Weekly Editors Picks is a functional column of Odaily Planet Daily. In addition to covering a large amount of real-time information every week, Planet Daily also publishes a lot of high-quality in-depth analysis content, but they may be hidden in the information flow and hot news, and pass you by.

Therefore, every Saturday, our editorial department will select some high-quality articles that are worth spending time reading and collecting from the content published in the past 7 days, and bring new inspiration to you in the crypto world from the perspectives of data analysis, industry judgment, and opinion output.

Now, come and read with us:

Investment and Entrepreneurship

Understanding Crypto Market Cycles: Why This Cycle Is Different

The biggest difference in this cycle is the role of institutional capital, with institutional adoption driving Bitcoin’s strength.

Market dilution: The number of altcoins has surged, leaving less room for gains.

Retail liquidity is attracted to new mechanisms (on-chain) outside of traditional spot trading.

Is it time to sell off the crypto market? Nearly 20% of indicators have peaked and are falling

Biteye analyzed 15 commonly used escape top indicators and found that one-fifth of the indicators have reached the escape top range in 24 years, namely: Bitcoin Rhodl ratio, USDT current financial management, and altcoin seasonal index.

Crypto market analysis: Is the bull still there? Will there be a day for altcoins to “break free”?

How to find your own card table in a fake casino?

Today, Bitcoins capital flow has been completely disconnected from other cryptocurrencies, forming an independent ecosystem.

Comparing the Shanzhai market to a casino, only when there is sufficient capital flow in the casino (i.e., high net capital inflow) is it a good time to participate. Choosing the right gaming table (i.e., investment target) is equally important.

The sources of capital inflows in the copycat market include new capital inflows, token buybacks and destruction. The outflows of casino funds include large-scale capital withdrawal events, tool-driven continuous capital withdrawals, Cabal withdrawal and pre-sale models, VC token unlocking, and deleveraging.

Frequently used L1s (like SOL and ETH) and products that generate high revenue (like HYPE) have the potential to create positive-sum games.

The situation in 2025: too many tables, but too few players. In the future, the market of altcoins may be triggered by some unexpected events.

From HODL to disposable memes, how to find a way to survive in a highly fragmented market?

The traditional “buy and hold” strategy, which worked in the early cycles, is no longer applicable. Holding periods are becoming shorter and shorter, from weeks to days. If a portfolio is not heavily invested in BTC and SOL, it may suffer huge losses.

The market now exhibits multiple narrative-driven mini-cycles, each with its own highs and lows.

Key factors that have driven bull markets in the past, such as loose monetary policy and retail investor enthusiasm, no longer seem to be as significant in the current environment. Funds are more likely to circulate within the crypto ecosystem.

Most agencies have difficulty truly understanding the core of the project and are suitable for short-term execution rather than brand building. In contrast, excellent internal marketing talents have more long-term value, can go deep into the industry, actively learn and establish real industry connections. Ultimately, the success or failure of marketing depends on the initiative of the project itself, not the commitment of the agency.

Airdrop Opportunities and Interaction Guide

5 AI projects with zero-cost interaction (with detailed guide)

Sahara AI, O XYZ, ChainOpera, Fraction AI, Singularity.

Meme

Arthur Hayes: The Future of Political Memecoin

As technology develops, information can be disseminated faster and cheaper to a wider audience, and politicians have a more direct connection with the people they rule. As rulers become more human, they must adapt the way they communicate their policies to the public. Humanization does not always work in the politicians favor, as the public quickly realizes that they are as weak-minded as fools.

Political Memecoin provides zero-knowledge proof of political popularity. Specifically, as an individual, you can now privately support politicians by purchasing their memecoin. Politicians can understand the real opinions of the people. The rise of Polymarket embodies this phenomenon. If the goal is a popularity indicator that is globally accessible, easy to understand, and impossible to ban, then political memecoins traded on DEX are the perfect tool, with the three properties of being globally accessible, easy to understand, and impossible to ban.

Memecoin is the best political engagement tool ever created. They tie financial gain directly to voting support from every voter, not just large campaign donors.

Ethereum and Scaling

A Deep Dive into Ethereum Issuance and Destruction: The Cat-and-Mouse Game

BTC and ETH are expected to win the battle for Internet currency, and the decisive factors are credible neutrality, security, and scarcity. Since the merger with Ethereum, ETH is scarcer than BTC.

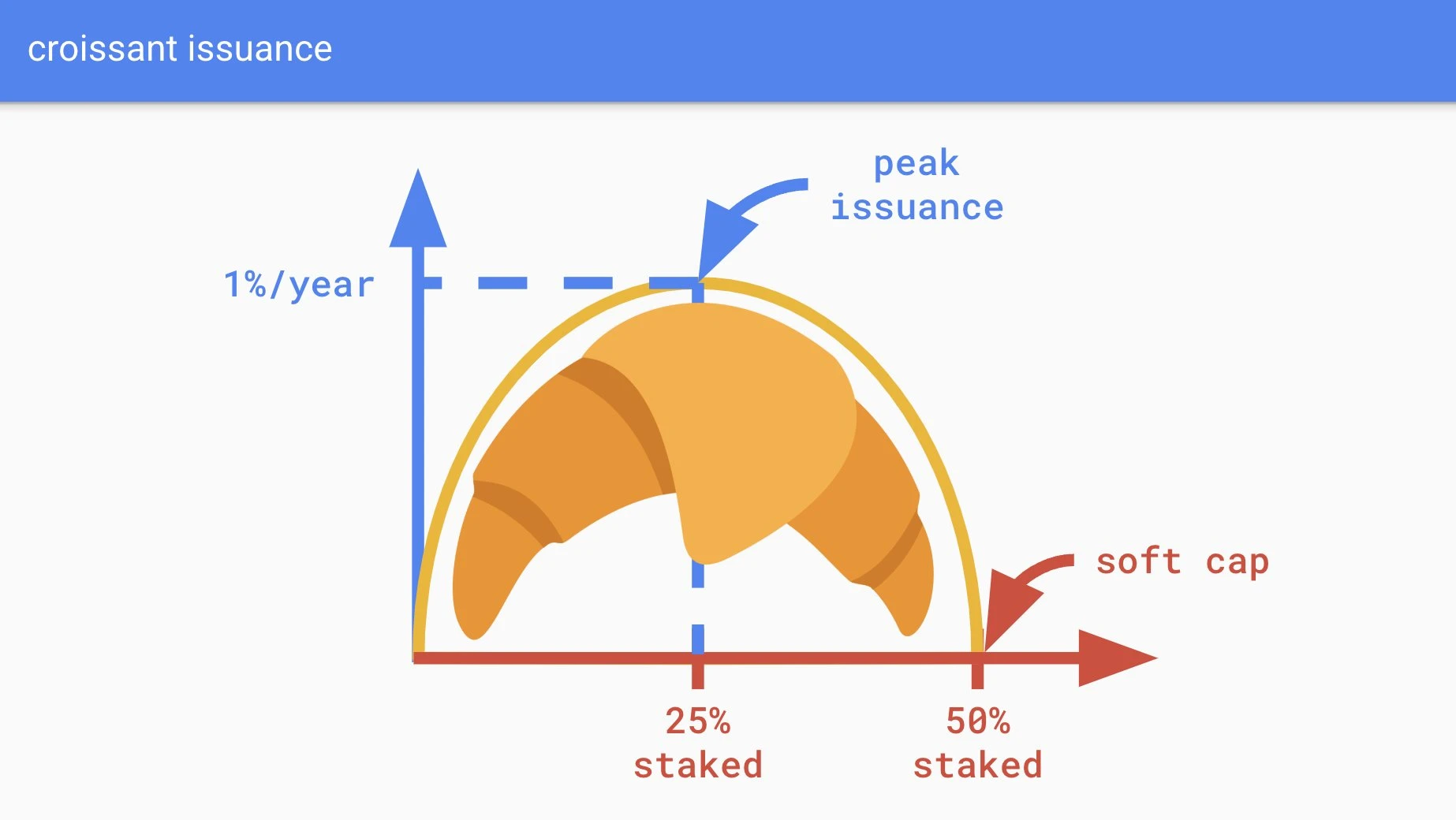

The current issuance curve of ETH is a trap. When most ETH is staked, it will face losses.

The issuance curve should drive the discovery of a fair issuance rate through staker competition — rather than an arbitrary 2% floor. This means that as ETH staked increases, the issuance curve must eventually decline and return to zero.

Croissant Release

The sustainable way to destroy a large amount of ETH is to expand data availability. In the next few years, there will be a cat-and-mouse game between supply and demand until the full Danksharding deployment is completed.

No one is buying ETH at the bottom? A list of whales buying at the bottom

The article compiled 0xScopes data on the Ethereum chain from February 3 to 10, with a single swap of more than $200,000, and found that whales made large purchases of multiple tokens.

These data suggest that despite overall market volatility, whales are still actively deploying specific tokens, which may indicate their confidence in these projects or their expectations for future market trends.

Multi-ecology and cross-chain

Discussing Solana’s re-staking market opportunities: perhaps with greater potential than Ethereum

Restaking allows staked assets to be reused across multiple decentralized services, or as Jito calls them, Node Consensus Networks (NCNs). It enhances the security and integrity of decentralized services, allowing them to leverage the economic security of L1 without having to spend a lot of resources designing their own security models (which are often more fragile). For stakers, it also improves capital efficiency, as a single asset can provide security for multiple decentralized services at the same time, thereby potentially earning a higher return on capital.

Solana is mature enough to support re-staking; re-staking on Solana has greater potential than Ethereum; re-staking can drive innovation in the Solana network and optimize the capital efficiency of DeFi users.

Dismantling the SVM arms race: Insight into the competition among Solayer, SOON, and Sonic SVM

The article analyzes the deep logic of this SVM arms race from three dimensions: underlying architecture, ecological strategy and market positioning.

Today, games that simply copy the EVM architecture + TPS numbers can no longer meet the needs of Web3 evolution. The blockchain war has shifted from a narrative battle to an execution environment revolution, especially after Solana Virtual Machine (SVM) has completed architecture upgrades and new developers have flocked to it. In essence, it is not to replace a public chain, but to reconstruct the technical paradigm of the entire smart contract execution layer. SVM supports parallel processing of transactions, which is an extension of Solanas influence.

After Solayer, where can we move idle SOL to make the most money?

Meteora, Fragmetric, Sanctum, Perena.

The secondary market includes BNX, CAKE, and BAKE.

Binance Alpha has BOB, KOMA, BANANA, CGPT, and MONKY.

Four.meme came from Queen YI, CZ, binancedog, and cakedog.

The reasons why AO was ignored may be: the token issuance did not bring much expectations to the market; the network activity did increase, but it still remained at a low level overall.

However, the AO ecosystem is still in its very early stages.

Also recommended: Inventory of 32 BNB Chain ecosystem projects listed on Binance: the average increase is nearly 26% Interpretation of BNB Chain 2025 roadmap: anti-MEV protection, AI priority, Meme coin support .

DeFi

The current status of DeFi sub-track development: an overall oligopolistic structure

At its core, DeFi is about providing a more innovative and efficient system that solves TradFi inefficiencies through proven PMF (Point of Market Fit). DeFi also consists of multiple key areas that typically follow an oligopolistic structure.

As DeFi enters its next phase of expansion, we will see more new verticals introduced into untapped markets and even integrated into CeFi.

Hot Topics of the Week

In the past week, the president of the Central African Republic issued a coin; CZ released a photo of his pet dog Broccoli ( previous story ), and a large number of memes with the same name started fighting;

In addition, in terms of policy and macro market, the Federal Reserves monetary policy report: plans to stop shrinking the balance sheet at the right time; Federal Reserve Chairman Powell: The Federal Reserve does not need to rush to cut interest rates; Trump has instructed Musk to review the spending of the US Department of Defense ; Market news: US states have filed lawsuits to prevent Musks government efficiency reform (DOGE) from accessing the government payment system ; Uniswap, Kraken and other crypto companies are recruiting Washington lobbyists or policy experts with extensive connections; the US SEC has accepted Solana spot ETF applications from 21 Shares, Bitwise, Canary and VanEck; the SEC has received DOGE ETF applications submitted by Grayscale and NYSE; Binance and the SEC submitted a joint motion to suspend the lawsuit for 60 days because the SEC cryptocurrency working group may intervene in the case; Hong Kong investment immigrants recognized Bitcoin and Ethereum as proof of assets for the first time; the former deputy director of the Beijing Financial Bureau was suspected of Bitcoin money laundering and sentenced to 11 years in prison;

In terms of opinions and voices, Bloomberg: Wall Street banks are betting on the IPO boom in the crypto industry and are expanding related businesses; Dragonfly partner: Bitcoin is dominant, altcoins are sluggish, but the Meme cycle is not over yet ; Bitwise Chief Investment Officer: Low retail investor sentiment may indicate huge opportunities for altcoins ; Analysis: Powell said the Fed does not need to rush to cut interest rates, and the altcoin market reacted calmly, which may indicate that it has bottomed out ; CZ: TST has nothing to do with BNB Chain or any Binance-related team , and involves infringement of the Binance Logo; CZ: Users need to manage their own risks. If you cannot withstand downward fluctuations, please do not touch Meme ; Coinbase Chief Policy Officer talks about the process of launching Meme coins: try not to involve token narratives, and use strict standards to maintain rigor; StarkWare co-founder: Starknet is about to become the first network to settle on both Bitcoin and Ethereum ; Kanye : Someone offered me $2 million to launch Meme coins, but I have refused; the law firm that sued Pump Fun claims that it faces threats of violence and human flesh searches;

In terms of institutions, large companies and leading projects, WLFI launched the strategic token reserve Macro Strategy to support crypto projects such as Bitcoin and Ethereum; OpenSea Foundation: SEA tokens will be launched soon ; Solayer opens LAYER airdrop applications ; Storys initial incentive plan is announced: accounting for 10% of the total IP, and strict anti-witch measures will be implemented from the first day of the mainnet launch; Story mainnet is launched , and IP airdrop applications are opened simultaneously; Pi Network will be launched on the mainnet on February 20; Arweave computing platform AO mainnet is launched and native tokens are launched, of which 36% will be allocated to AR holders; Crypto KOL: It is rumored that pump.fun intends to adopt the Dutch auction model to publicly raise Doodles on multiple exchanges and officially announce the issuance of coins and land on Solana;

In terms of security, SlowMist Yusine: The Central African Presidential Token CAR is at high risk , so beware of the virus on the official website; four.meme : It is currently under malicious attack, the team has suspended token trading on DEX, and internal funds are safe... Well, another abstract week.

Attached is a portal to the “Weekly Editor’s Picks” series.

See you next time~