1. New choice for red envelope financial management: in-depth interpretation of DeFi lending

In addition to buying new clothes and eating delicious food, have you ever thought about putting the red envelopes and year-end bonuses you received during the Spring Festival to work during the Spring Festival? DeFi lending, a concept that sounds a bit high-sounding, is actually a decentralized financial service based on blockchain technology. It allows users to lend or borrow digital assets to earn interest income or use leverage for investment.

Compared with traditional centralized finance, Web3's DeFi lending has the following advantages:

Decentralization: No single point of control, more secure and reliable.

High transparency: All transaction records are recorded on the blockchain and are open and transparent.

High efficiency: Automated processes lead to faster transactions.

Globalization: Not restricted by geographical location, users all over the world can participate.

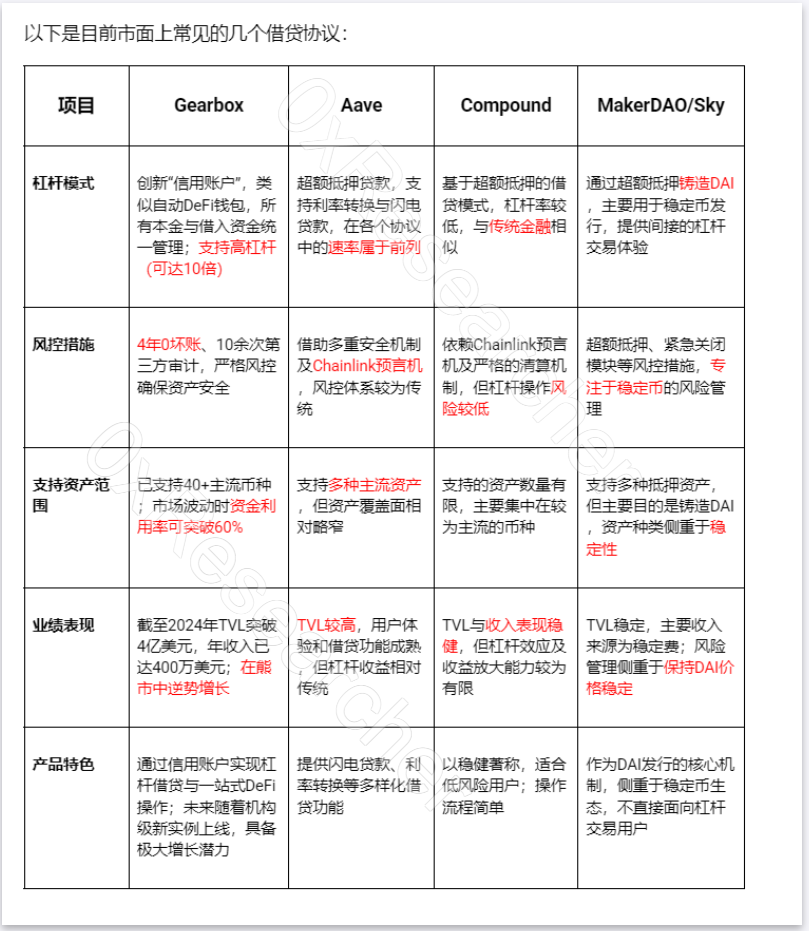

However, high returns often come with high risks. The DeFi lending market is highly volatile, and smart contract vulnerabilities, hacker attacks, and market risks can all lead to capital losses. Therefore, choosing the right platform and strategy is crucial. At present, some DeFi platforms have proven that security and reliability can be achieved with high returns. For example, Gearbox Protocol, a general-purpose leveraged lending protocol on Ethereum, is about to launch 2 institutional-level instances, further promoting the scale growth of funds, even in the recent market volatility. Through its innovative design, it integrates functions such as deposits, borrowing, leveraged trading, and yield mining into one account. The continuous influx of institutional funds has verified the reliability of its risk control model, and users can participate in high-yield, low-risk lending strategies with one click.

2. How to choose a reliable DeFi lending platform? ——Safety first

In the DeFi world, choosing a safe and reliable platform is a crucial first step. How to judge whether a platform is safe and reliable? You can check it through the following key features:

Historical risk control records: Priority will be given to protocols with a long operating time, zero bad debt records, and continuous institutional funding.

Capital utilization: A high capital utilization rate usually means that the protocol is more capital efficient and can generate more stable returns. However, too high a capital utilization rate may also mean higher risks and needs to be carefully evaluated.

User experience: A good platform should provide a user-friendly interface and simple operation process to reduce the learning threshold for novice users. Supporting multi-chain operations, providing multi-language support and complete help documents are all important components of user experience.

Risk control mechanism: A strong risk control mechanism is an important means to ensure the safety of user funds. This includes but is not limited to: AI risk control assistant, liquidation protection fund, insurance mechanism, mortgage rate management, etc. A complete risk control system can effectively reduce risks and ensure the safety of users' assets.

Transparency and auditing: Choose platforms that conduct regular security audits and make the audit results public. A transparent operating model can enhance user trust.

3. Choose the right financial strategy based on your risk appetite - do what you can

The flexibility of DeFi lending allows you to choose different financial strategies based on your risk tolerance:

Conservative type: Suitable for risk-averse investors, who can choose stablecoin deposits to obtain stable returns. Stablecoin is a cryptocurrency pegged to fiat currency, with relatively stable prices and low risks.

Balanced: Part of the funds are used for stablecoin deposits, and part of them are used for low-risk lending or yield mining, pursuing a balance between returns and risks. This requires you to have a certain understanding of the market and be able to adjust your investment strategy according to market conditions.

Aggressive: Suitable for investors with high risk tolerance, who can try leveraged trading to pursue higher returns. However, leveraged trading also comes with higher risks, which requires you to have rich investment experience and risk management capabilities. Remember, high returns are often accompanied by high risks!

No matter which strategy you choose, you must conduct a full risk assessment and set stop-loss points to control potential losses.

4. Tips for financial management during the Spring Festival: Steady appreciation and prevent problems before they occur

Diversify your investments: Don’t put all your eggs in one basket. Diversifying your investments can effectively reduce risk.

Set a stop loss point: In case of market fluctuations, stop loss in time to avoid greater losses.

Pay attention to gas fees: When performing cross-chain operations, pay attention to gas fees and choose the appropriate network to reduce transaction costs.

Invest rationally: Don’t be blinded by high returns. Analyze risks and benefits rationally and make a reasonable investment plan.

Continuous learning: The DeFi field is developing rapidly, and continuous learning of the latest knowledge and technologies can better respond to market changes.

This guide is designed to help Web3 novices understand the basic principles of DeFi lending and risk management methods. Before engaging in DeFi financial management, please be sure to conduct sufficient research and risk assessment. DYOR, invest carefully, and make rational decisions to navigate the world of DeFi with ease! I wish you a happy new year and a prosperous future!