Original | Odaily Planet Daily ( @OdailyChina )

Author: Azuma ( @azuma_eth )

Last week, Uniswap released the long-awaited V4 version. Perhaps because it coincided with the Chinese New Year holiday, the response to Uniswap V4 in the Chinese-speaking region was not great. However, objectively speaking, this upgrade, which Uniswap calls the biggest upgrade in the history of the project, is still quite bright.

The core of Uniswap V4 lies in Hooks. Hooks can be understood as a smart plug-in that allows arbitrary logic to be run when the state of the liquidity pool changes (before and after transactions or adding or removing liquidity), allowing developers to customize trading functions with a high degree of freedom. With the release of V4, Uniswap can no longer be seen as a simple trading platform, but can be used as a backend protocol to unlock more use cases. Different developers can use Hooks to build applications of different types and characteristics according to different scenario requirements.

In the following, we will take stock of 10 projects that have begun to use Hooks for development, to give you a glimpse of the magic of Hooks.

ƒlaunch

ƒlaunch is deployed on the Base network and is a Meme token issuance and trading platform based on Uniswap V4.

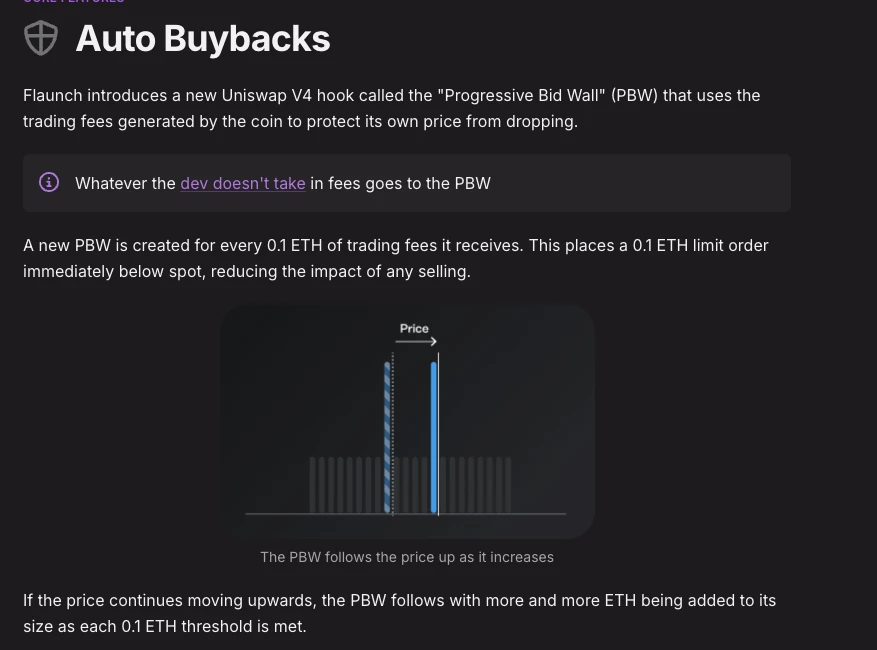

The feature of ƒlaunch is that it uses Hooks to provide customizable functions for token launch, such as custom fee settings, automatic repurchase, fee sharing, etc.

The so-called automatic buyback means that the transaction fees generated by all token trading activities on ƒlaunch will be automatically used to buy back the corresponding tokens. Specifically, every time the transaction fee accumulates to 0.1 ETH, the buyback function will be automatically triggered, that is, these funds will be added as limit buy orders through Hooks, thereby strengthening the price support of the token.

Bunni

Bunni is one of the first DEXs built on Uniswap V4. Currently, Bunni V2 has been launched on the Ethereum mainnet, Base, and Arbitrum.

Bunni is characterized by providing programmable liquidity functions, thereby helping LPs build yield-maximizing, dynamic and automated liquidity pools to maximize LP profits under different market conditions.

LIKWID

LIKWID is a leveraged trading platform powered by Uniswap V4.

LIKWID aims to completely change the classic AMM model from xy=k to (x+x)(y+y)=k, thereby realizing oracle-free and permissionless leveraged trading of any token, supporting both long and short directions.

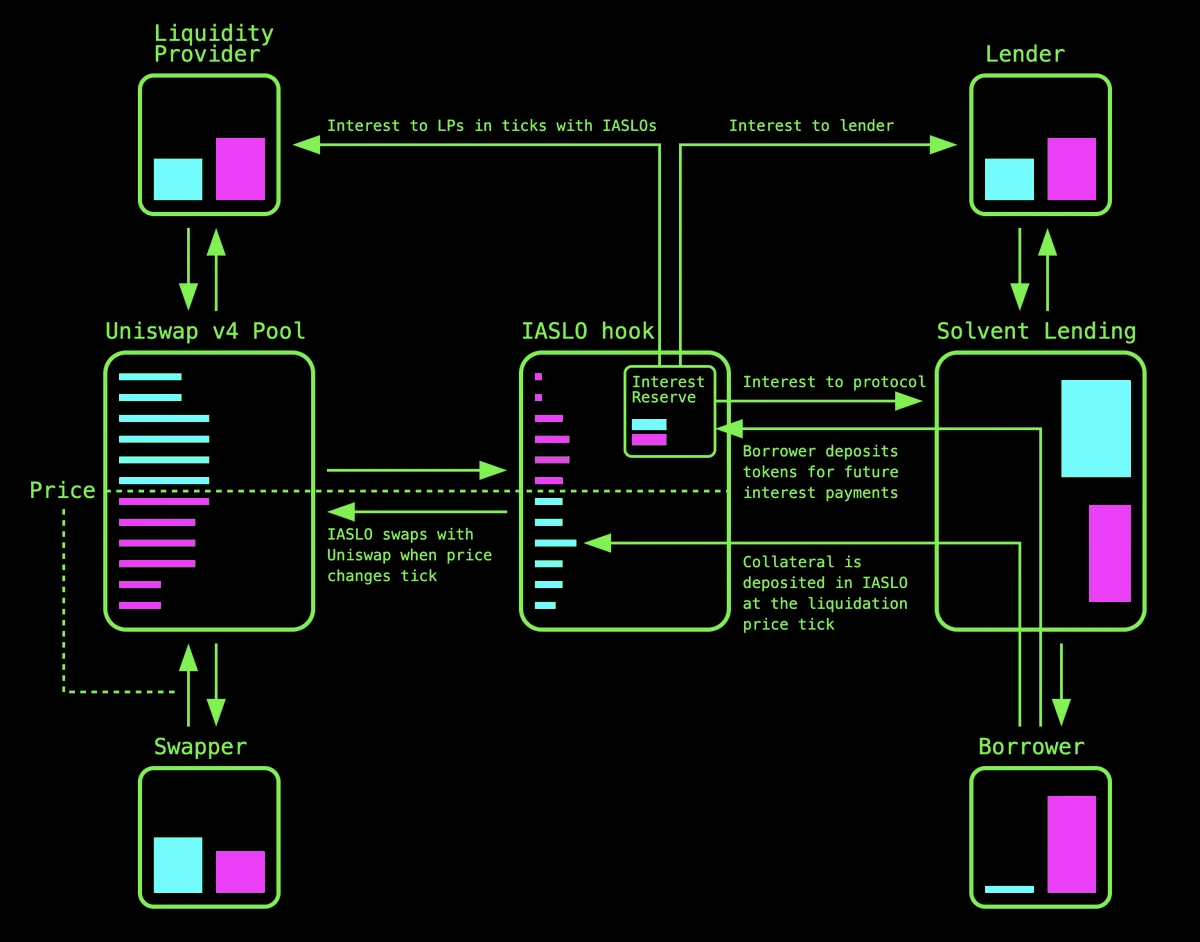

Solvent Network

Solvent Network is positioned as a lending protocol. Its main feature is that it will use Uniswap V4s Hooks to ensure that liquidations can be executed in a timely manner at any level of price volatility, thereby enhancing the robustness of the protocol.

Tenor Finance

Tenor Finance is positioned as a non-custodial fixed-rate lending protocol. With the help of Uniswap V4s Hooks, Tenor Finance allows users to use a fully on-chain interest rate AMM to lend and borrow ERC 20 tokens at a fixed rate.

Cork Protocol

Cork Protocol is building an on-chain credit default swap (CDS) market using Uniswap V4’s Hooks. The protocol aims to set custom fees and liquidity concentration based on the expiration time of swap tokens.

According to official announcement, Cork Protocol is expected to be launched on the mainnet soon.

Doppler

Doppler is a liquidity bootstrapping protocol developed by Whetstone Research that aims to solve the problems associated with Uniswap V4 integration by executing the entire liquidity bootstrapping auction within the Hooks contract.

Semantic Layer

Semantic Layer focuses on building the next generation of MEV solutions for Uniswap V4. The project aims to use Hooks to create a new generation of DeFi applications that can reduce MEV risks.

A51 Finance

A51 Finance aims to build an intent-based liquidity automation engine on Uniswap V4. Users can now use the project to perform multiple intentional operations such as position transfer, automatic rebalancing, dynamic fee adjustment, and automatic withdrawal.

HookRank

HookRank is a platform that tracks and evaluates the security and maturity of various Hooks in Uniswap V4. It aims to provide developers and users with a reliable resource to find safe and effective Hooks.