Original author: Route 2 FI

Original translation: TechFlow

Gm, friends.

The crypto market is undergoing tremendous changes, and we must adjust our strategies and tactics because what worked in the past no longer applies.

The traditional “buy and hold (HODL)” strategy is gradually losing its effectiveness. As market volatility increases and new projects emerge one after another, the belief in long-term holding becomes more fragile.

Today, the rule of survival in the market is to trade flexibly, constantly adjust positions, and look for opportunities in a decentralized and uncertain environment.

Whether you can successfully adapt to this new situation will determine whether you survive or are eliminated by the market.

Let’s take a deeper look to see if there is any hope in this market.

Altcoin Casinos: How to Survive in a Fragmented Crypto Market

For those who have only entered the crypto market in the past year to year and a half, the market is undergoing a profound transformation.

What was once an easy path to profitability through centralized exchanges has become increasingly complex. The market operates more like a casino than a traditional trading market, requiring investors to be more flexible and agile than ever before.

The traditional “buy and hold” strategy, which worked in the early cycles, is no longer applicable. Holding periods are becoming shorter and shorter, from weeks to days (remember those old players who told us that we just needed to buy altcoins at low prices and sell them at high prices?).

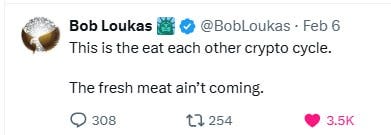

Behind this change is the continuous emergence of new coins and new projects. Each new project is competing for market attention and funds, constantly challenging the status of existing projects.

Even some events that are traditionally viewed as positive can have unintended consequences. For example, Trump’s introduction of a high-profile meme could attract a large number of new users to the crypto market, but at the same time could cause the value of many altcoins to plummet. Usually, the beneficiaries are limited to Bitcoin (BTC), Solana (SOL), and related meme coins.

Many investors learned a painful lesson from this - if the portfolio is not heavily invested in BTC and SOL, it may suffer huge losses.

A similar situation occurred with the launch of Berachain, which attracted a lot of attention and funding, but had a negative impact on the Abstract ecosystem.

In such a dynamic and unpredictable market, the wisest approach is to accept volatility as the norm and recognize that this volatility may increase further as new coins, chains, and projects continue to emerge.

As a result, many investors are re-adjusting their strategies, increasing their holdings of BTC and stablecoins while drastically reducing their long-term altcoin positions. The markets focus has also shifted from long-term investment in altcoins to tactical short-term trading operations.

The goal is to avoid being the “last believer” of those failed projects, watching their value evaporate into zero.

At the end of the current cycle, the risk-reward ratio of buying currencies other than BTC based on long-term investment logic may not be ideal. Although altcoins may be close to the bottom, the possibility of most currencies, NFTs or ecosystems hitting new highs at the same time is becoming increasingly low.

A large number of new coins are launched every day, which dilutes the markets attention and funds, making it more difficult for existing projects to rise again.

( Related Articles )

The current cryptocurrency cycle is full of unprecedented challenges because there is a greater sense of uncertainty than ever before in the market. This uncertainty mainly stems from the fact that even for popular altcoins, there is not enough confidence that they will rebound after experiencing a sharp drop.

Looking back at the cycles in 2017 and 2021, investors were generally confident in buying the dips in altcoins, as long as the market capitalization (mcap) of these projects was not too low (usually less than $100 million). The general view at the time was that these coins would recover their value during the cycle, at least not completely disappear in this cycle. Those coins that gained market attention early on tended to maintain their popularity and market position until the end of the cycle.

However, this cycle is completely different (yes, it is). The market is full of narratives and sub-narratives, each vying for investors’ attention, which is often fleeting. Investors are more cautious about “bottom-fishing” now because the entire narrative of a coin can collapse at any time, rendering the investment worthless.

Unlike past cycles that were centered around a single main story, the market now presents multiple narrative-driven mini-cycles, each with its own highs and lows. Bitcoin (BTC) and Solana (SOL) are widely considered relatively safe bets that may eventually recover their value, but their potential returns may not be attractive to investors who are looking for high multiples (after all, BTC has risen 6 times from its bottom, while SOL has risen 20 times). The question is whether to put money into areas such as AI cryptocurrencies. While these areas have received a lot of attention recently, they have fallen sharply from their all-time highs and there is no clear sign that they can return to their peak.

The high degree of market fragmentation makes it difficult for investors to accurately identify and seize emerging trends. Cryptocurrency has been a speculative market since its inception, although past cycles have tried to justify it by emphasizing peer-reviewed blockchain technology, solid fundamentals and real-world applications. However, this round of cycles seems to have abandoned this pretense and accepted a more realistic view: everything depends on how to attract and maintain the markets attention. This trend has led to a significant shortening of the attention cycle of investors in the market. The bull market cycle that once lasted one to two years is now compressed into just a few months, weeks, or even days.

The current market seems to be experiencing a meme super cycle (or has it ended?). However, even the most popular memes have experienced a sharp decline from their peak, making the rationale of investing in them even more questionable.

In the current crypto market, investors face a higher take-up risk than ever before. In past cycles, when currencies experienced similar declines, investors often viewed it as an opportunity to buy the bottom, as the probability that these currencies would eventually rebound was almost beyond doubt. However, the question now is whether these currencies can regain the market attention they once had. The current market tends to support those currencies that are in the lead rather than those projects that are lagging behind. Even if some projects have strong fundamentals, it is difficult to gain favor if they lack market enthusiasm.

Although meme coins and AI projects have performed well in the current market, investors remain cautious about these trends because the shift in market attention is often rapid and difficult to predict. This general uncertainty comes from the fact that investors are faced with too many choices. There are thousands of currencies and projects vying for attention in the crypto market, making it difficult for investors to judge which projects have real potential and which are just short-lived. The fragmentation and short-lived nature of market attention makes it difficult to form a long-term market consensus on a project. A question worth pondering is whether this phenomenon has become the new normal in the crypto market, or is it just a temporary phenomenon in the current market environment.

Typically, each market cycle goes through an initial phase of confusion and distraction, followed by a period of stabilization as clear winners emerge. However, it is also possible that the market has changed fundamentally, and investors attention spans have become shorter and shorter, making it impossible for a single narrative to dominate for long. At the same time, macroeconomic factors are also deeply affecting the current market landscape. In the past, loose monetary policy made investing relatively simple, as ample liquidity drove the formation of speculative bubbles. However, in the current environment of high interest rates and tight liquidity, the market has become more severe.

Investors’ weakening confidence in “bottom fishing” is likely to reflect broader economic realities. Investors’ risk appetite has dropped significantly amid an uncertain economic outlook. There has also been increasing debate about the traditional four-year cycle, with some predicting that the cycle may be extended. However, judging from the current market performance, the four-year cycle seems to still exist, but there have been some significant changes compared to the past. For example, the market performance in the current cycle is relatively sluggish: Bitcoin has only reached about 1.5 times its previous all-time high, while Ethereum has not even broken through a new all-time high. This market performance is largely driven by some specific events, such as Michael Saylor’s support for Bitcoin and the launch of a Bitcoin ETF, which have attracted the attention of institutional investors. However, capital inflows outside the Bitcoin ecosystem are very weak, and speculative capital has flocked more to Meme coins with extremely short life cycles.

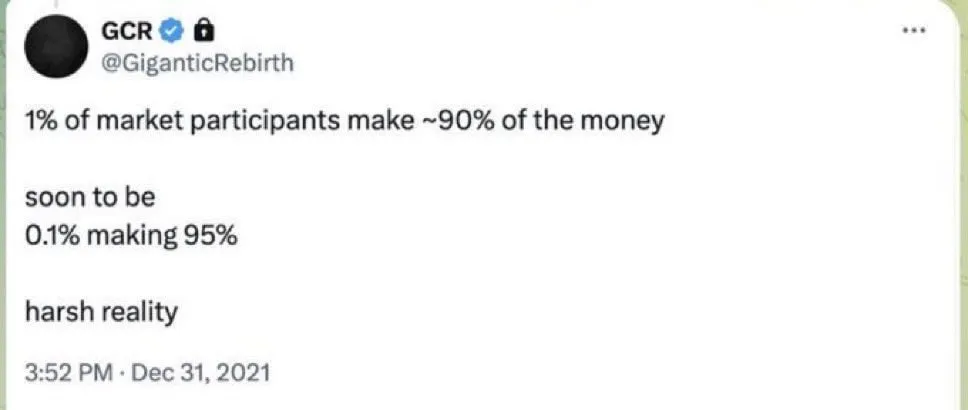

In the current market, widespread speculative funds have almost disappeared, and the market lacks sufficient momentum to break through the overall new high. Instead, funds are more likely to flow back and forth within the existing cryptocurrency field, presenting a net flat state. Due to the lack of major liquidity providers, these scattered hot spots are difficult to drive the overall flow of funds, and it is also difficult to attract a large amount of capital inflows from new investors.

The performance of this round of crypto market cycle is significantly different from previous bull markets. This has triggered deep thinking about the nature of crypto market cycles. The current market lacks a broad speculative boom, earnings are concentrated in Bitcoin, and funds are more circulated within the crypto ecosystem. These phenomena indicate that the market is trying to adapt to a completely new operating model. The key factors that drove the bull market in the past, such as loose monetary policy and the enthusiasm of retail investors, no longer seem to be so significant in the current environment. And the long-awaited alt season (alt SZN), a period when almost all altcoins experience rapid growth, has not yet really arrived.

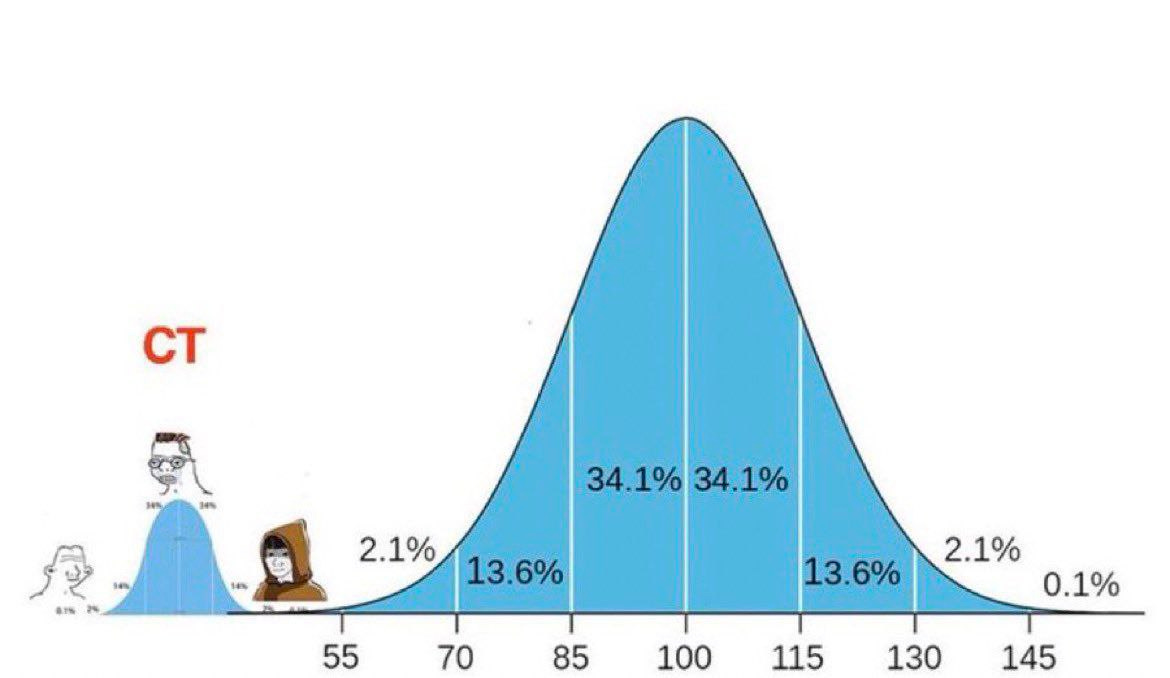

Since the launch of the Bitcoin ETF, the gap between Bitcoins market value and the total market value of other cryptocurrencies (i.e., the BTC-TOTA L2 indicator) has continued to widen. In the past alt season, a large amount of speculative funds poured into the market, and almost all currencies rose indiscriminately. However, Bitcoin now seems to have become an independent existence, and its price trend is more affected by ETFs, Microstrategys strategic layout, the macroeconomic environment, and political factors. In contrast, the alt market is more like a high-risk casino. Only when there is a large net inflow of funds in the market and you are able to choose the right investment direction, it is possible to get a return.

However, for every winner in this casino, there is a loser. Compared with previous cycles, the crypto market in 2025 is more complex and difficult to grasp. There are too many investment tracks (i.e. different altcoins and niches) in the market at the same time, and new tokens are emerging every day, competing for investors attention and funds. Too many choices make it difficult for investors to quickly identify projects with real potential, and also increase the risk of mistakenly entering failed projects. In such a fast-changing market, success requires extremely high insight, keen market awareness, and flexible response capabilities.

Despite this, there are still some people who are confident about the future of the copycat season, and I sincerely hope that their predictions will come true.

That’s all for today’s sharing.

Have a great weekend everyone, and see you next week!