Markets have kicked off 2025 with a string of bad starts and unresolved price action, with risk assets struggling to find direction amid the DeepSeek narrative that has rocked the market and President Trump’s sporadic tariff threats.

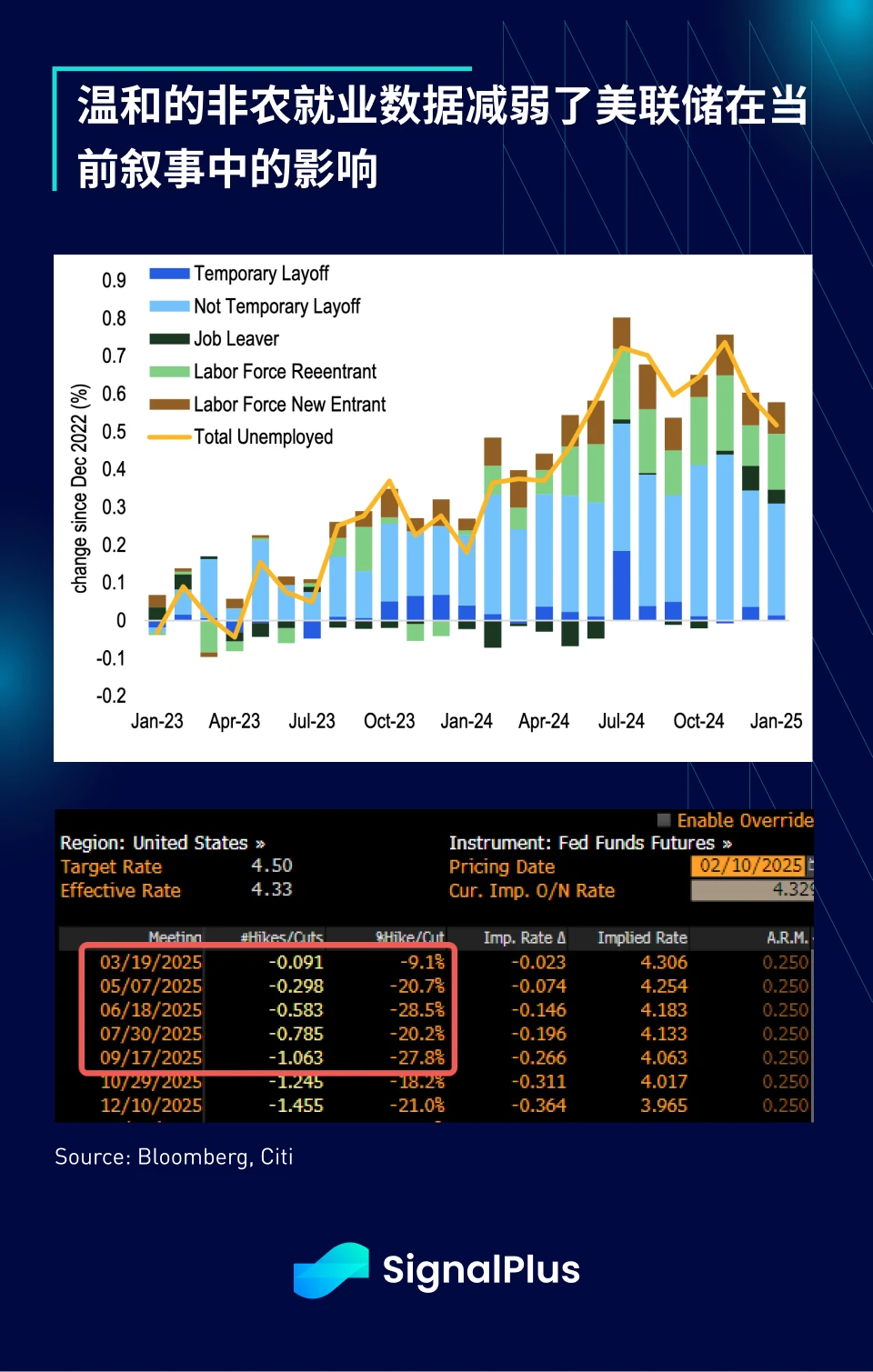

Economic data is currently taking a backseat, with January nonfarm payrolls slightly below expectations, though the unemployment rate also fell to 4%, leaving the market with a muted reaction. Fed Funds futures are currently pricing in only a 9% rate cut for the March FOMC meeting, with a full rate cut not priced in until September (five meetings later), muting the Fed’s influence in the current narrative.

On the other hand, the erratic nature of tariffs continues, with Trump announcing a 25% tariff on all steel and aluminum imports today (Monday) and implementing reciprocal tariffs immediately. U.S. stocks were under selling pressure late Friday as the market prepared for a challenging opening.

Gold prices are on track to reach new highs this week amid tariff risks and continued buying by global central banks. The People’s Bank of China has increased its gold reserves for the third consecutive month since Trump took office. Notably, gold’s gains have continued even as terminal rates have risen and cryptocurrency momentum has weakened, suggesting that structural changes in demand are no longer just a pure effect of central bank liquidity.

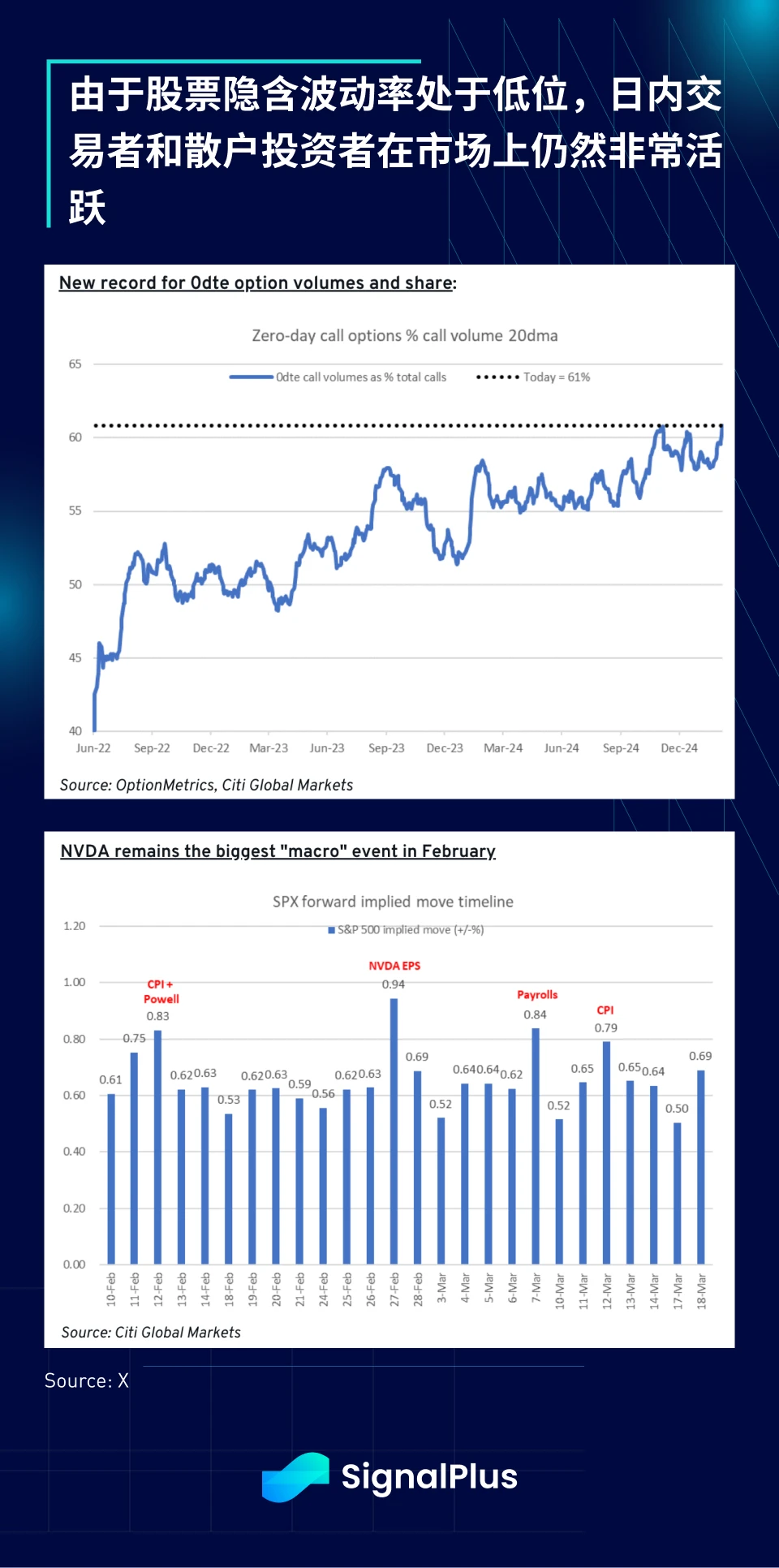

Despite a volatile start to the year, US retail and day traders remain actively engaged in the equity market, with day-expiring options volume rebounding to a record high, while equity implied volatility remains low, save for events such as CPI/Powell and Nvidia earnings releases.

Extremely bullish market sentiment appears to be close to triggering a “sell” signal in various sell-side trading models, and in fact, SPX index earnings are trending downward in both the fourth quarter of 2024 and the 2025 forecast, and we are also cautious about the near-term outlook for stocks.

On the crypto front, price action has been disappointing. While the market remains excited about developments such as BTC’s potential inclusion in reserve assets and mainstream institutional participation, major altcoins have fallen 15-20% since the beginning of the year. We have previously expressed concerns about the launch of the $TRUMP Memecoin and the negative impact it could have on the crypto industry, and so far, these concerns have been borne out, with cryptocurrency trading volumes falling significantly since the new year and recent large-scale liquidations causing severe damage to the PL of trading accounts.

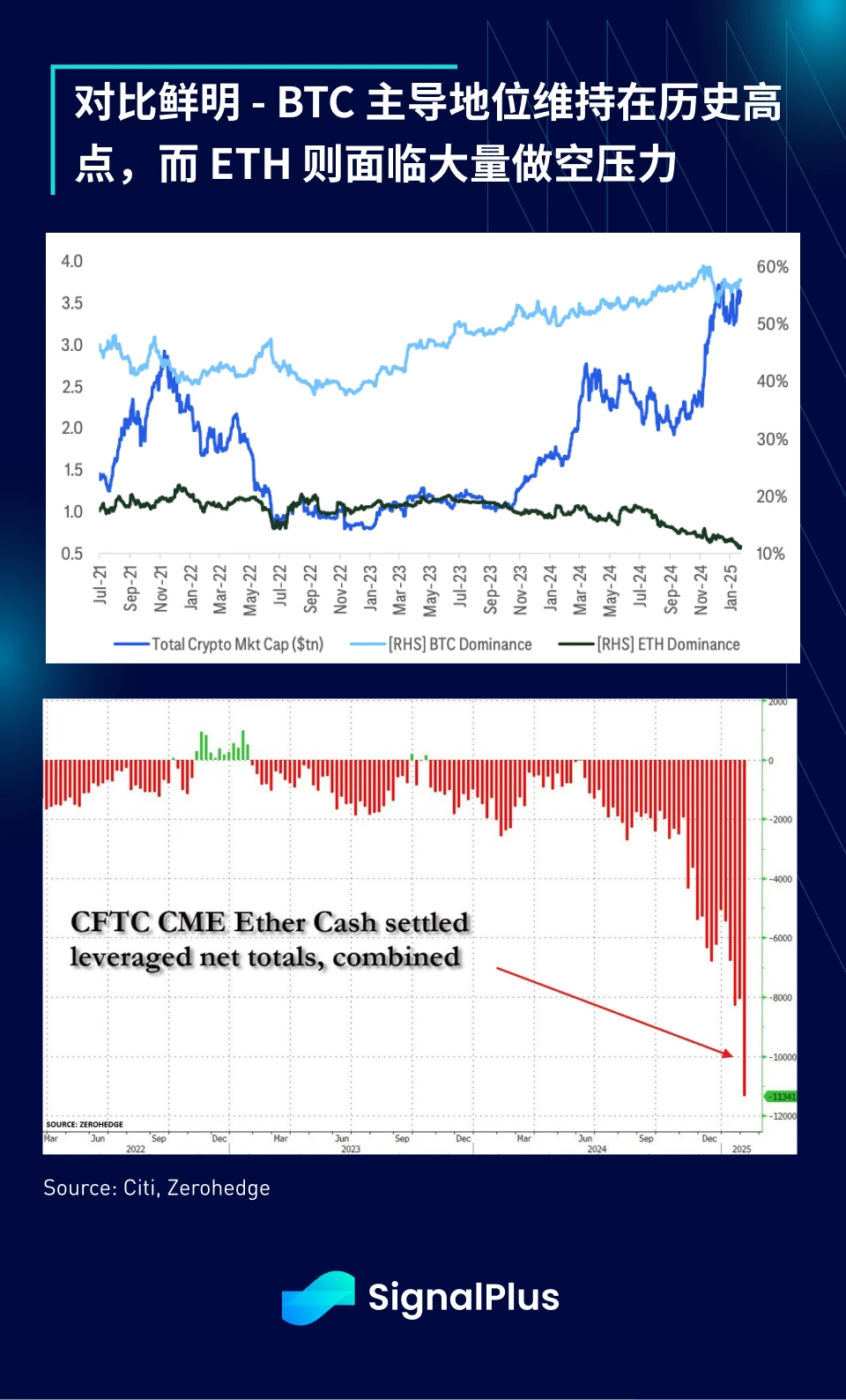

BTC’s strong performance relative to other assets is most evident when compared to ETH, which is currently facing record short pressure and strong FUD sentiment, with the second-largest token down 23% since the beginning of the year, far behind BTC’s +2.5%. The lack of L1 catalysts and narrative dominance may continue to put pressure on Ethereum.

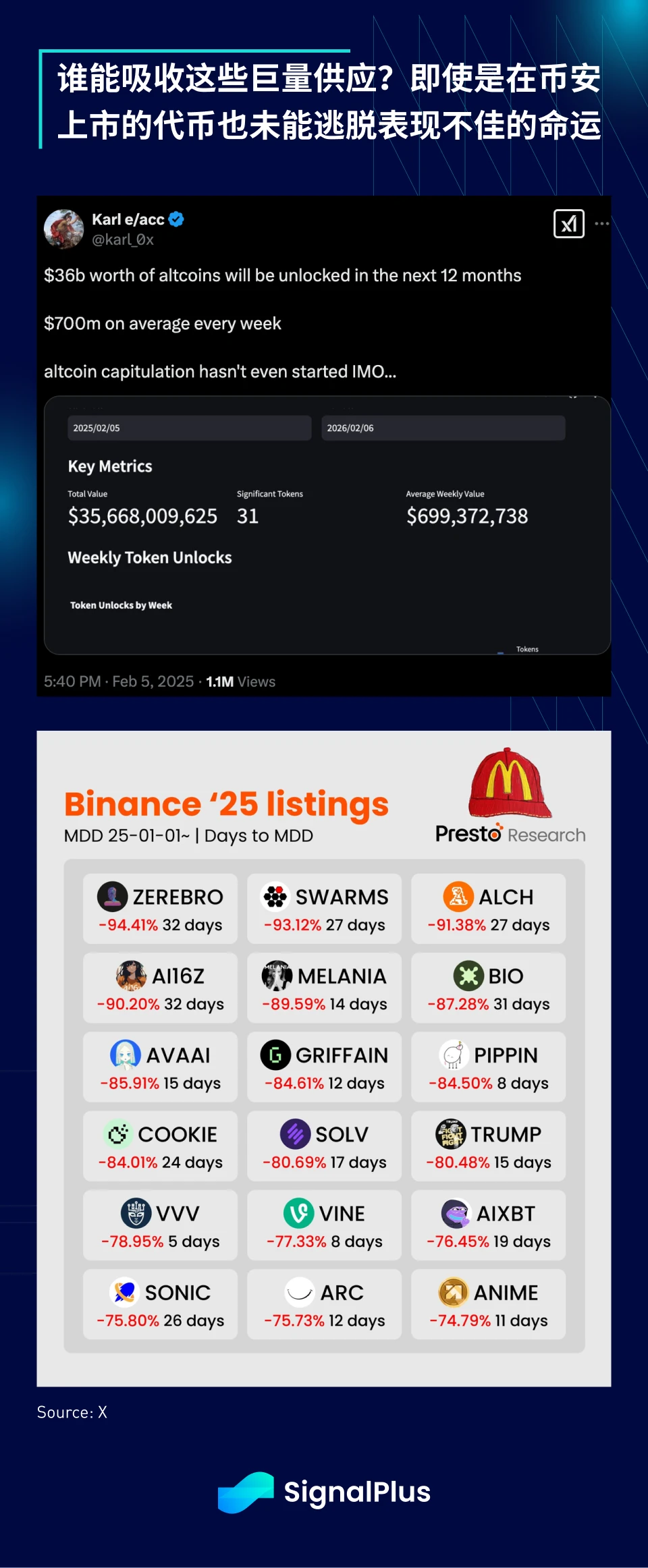

Worse still, analysts have pointed out that more than $30 billion in altcoin supply will be released in the next 12 months, and these unlocked tokens will flow to markets with limited demand and severe wallet losses. However, the TradFi funds entering the market may only focus on BTC or the top three tokens and are unlikely to spill over into the altcoin market. This weak market state is also reflected in the performance of new tokens after listing, even on Binance. For the current cycle that is moving towards maturity, this time seems to be really different.

Finally, let’s talk about a lighter topic. After the release of $TRUMP, will more countries issue their own memecoins to raise budget funds? I sincerely hope that this is just a joke and not a normal phenomenon in the coming year!

You can use the SignalPlus trading vane function at t.signalplus.com to get more real-time crypto information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlusCN, or join our WeChat group (add assistant WeChat: SignalPlus 123), Telegram group and Discord community to communicate and interact with more friends.

SignalPlus Official Website: https://www.signalplus.com