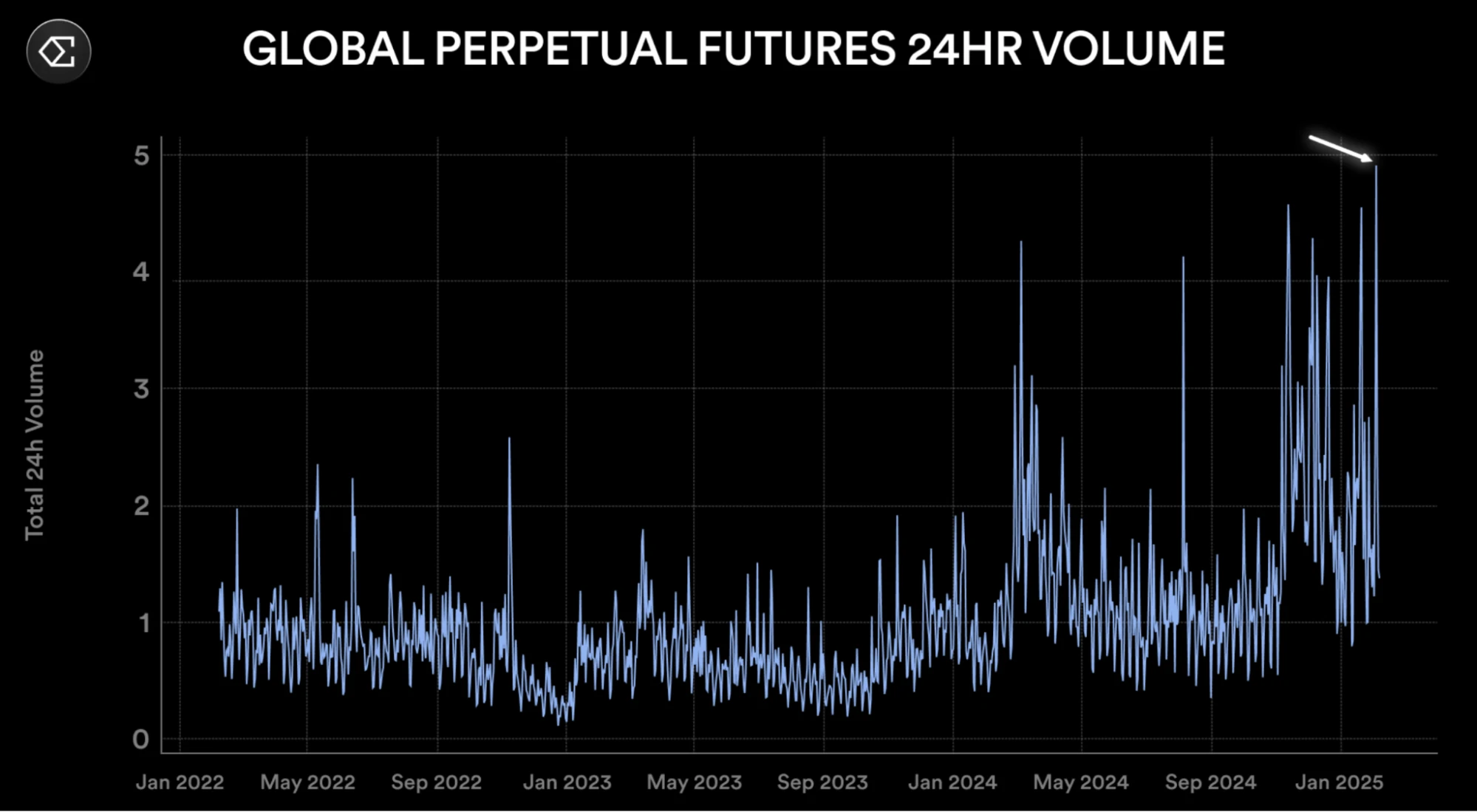

The stress test of the crypto derivatives market came unexpectedly. Last week, a black swan-level liquidation event once again brought the fragility of the derivatives market to the fore:

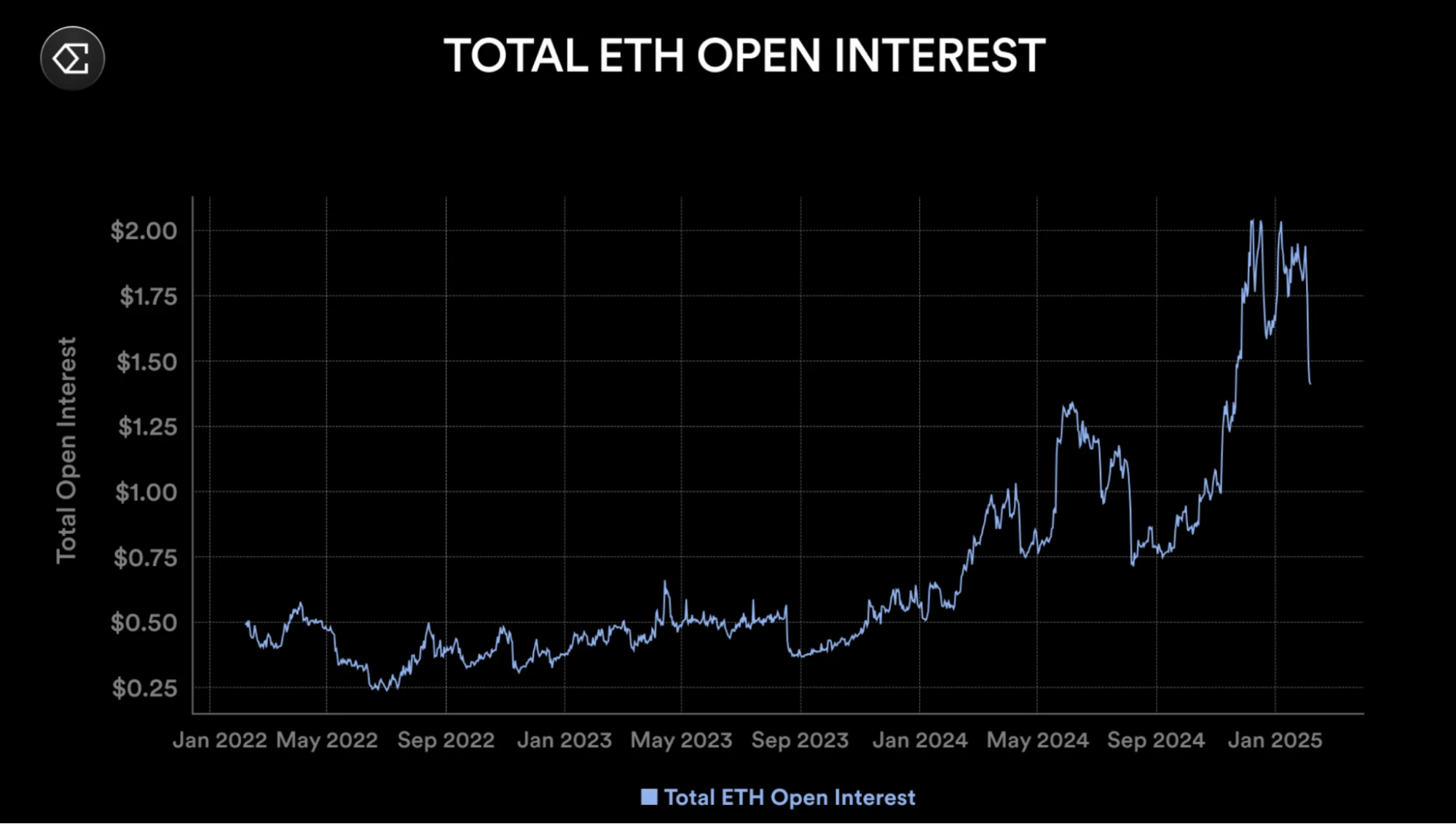

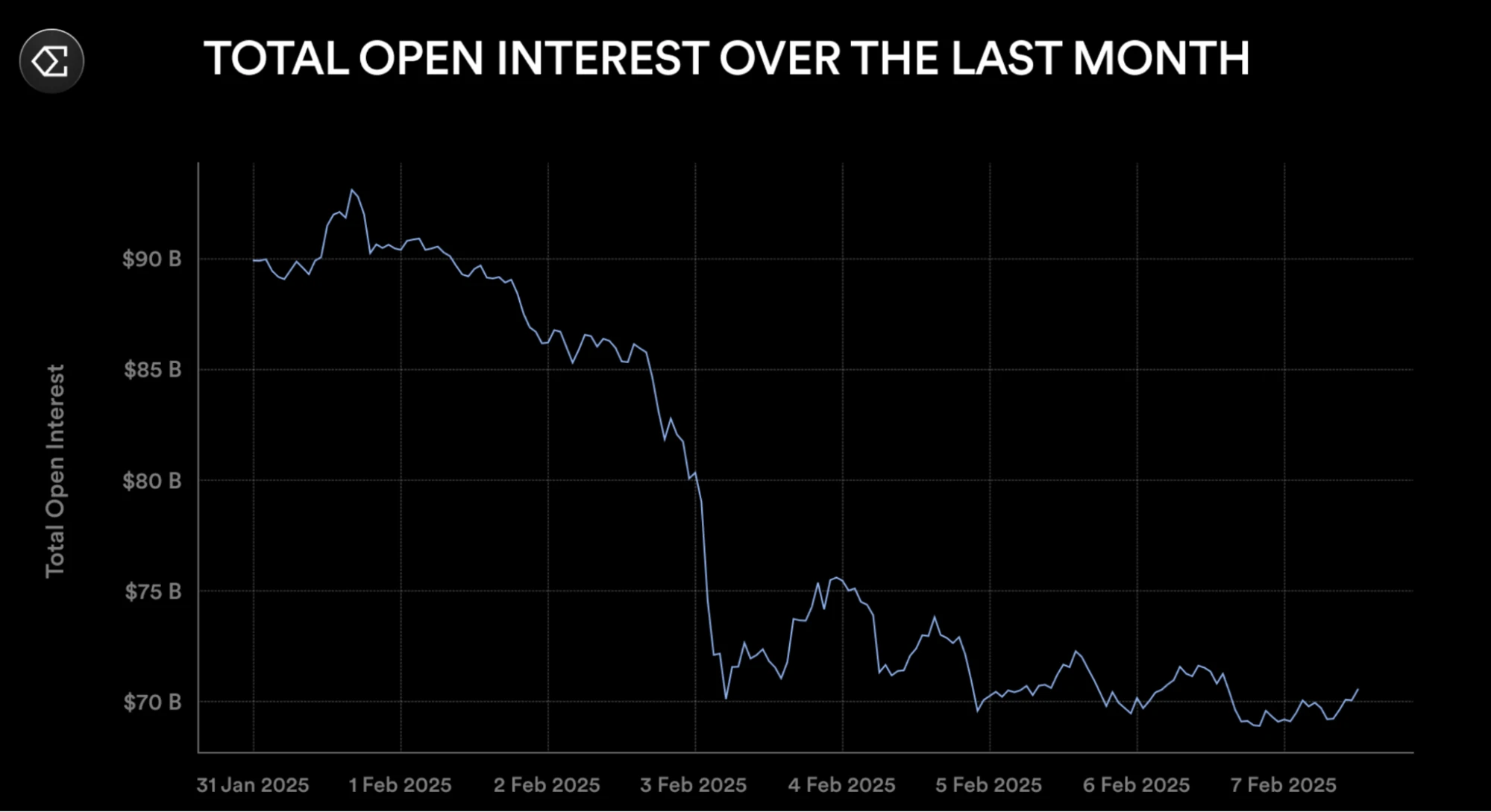

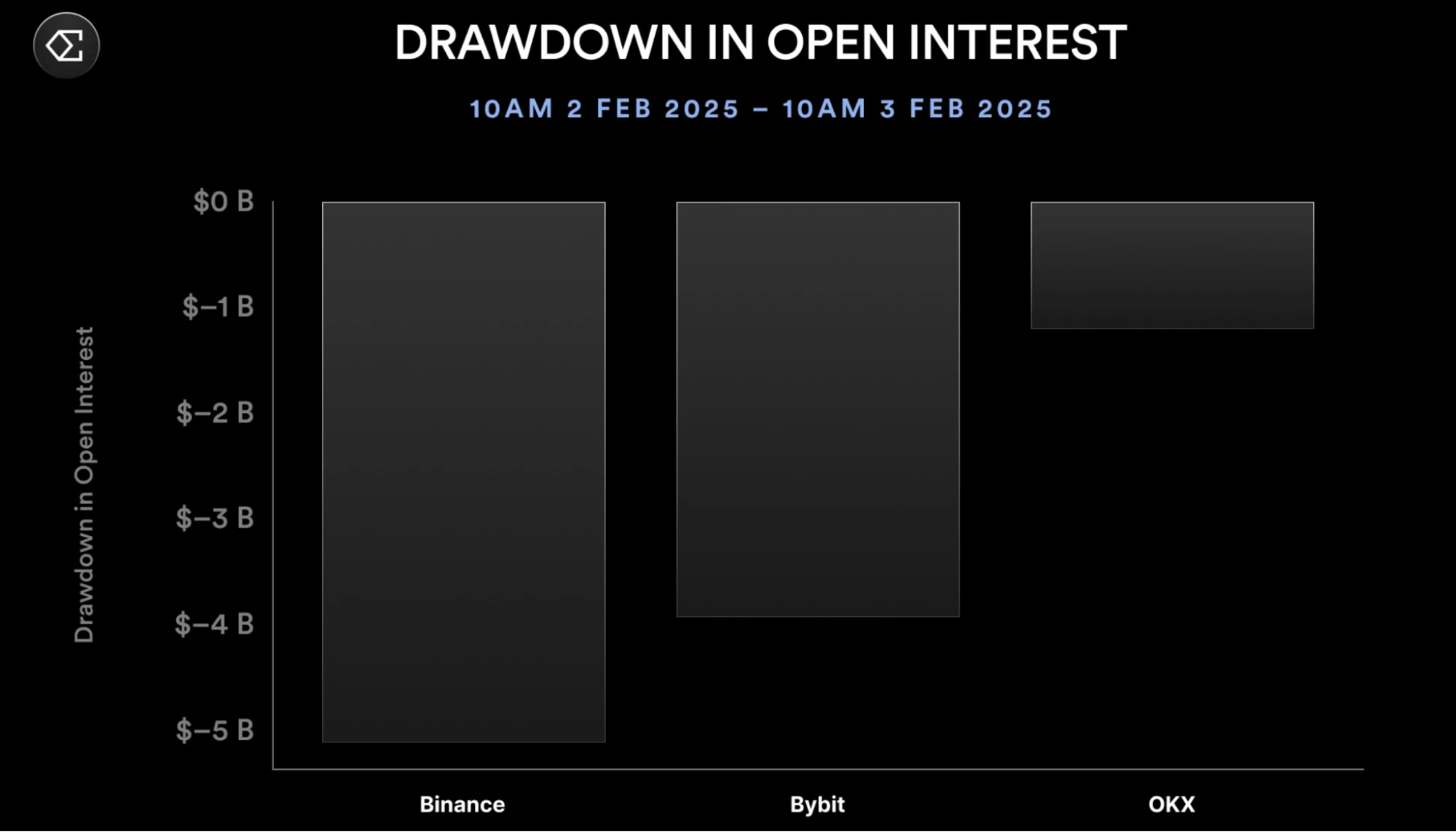

ETH open interest dropped by $2.3 billion in a single day, and the total contract position on the entire network evaporated by more than $14 billion, setting a record for the largest single-day drop in history.

This extreme market situation unexpectedly became the best testing ground for testing the hedging stablecoin model.

Market circuit breaker: ETH contract becomes the center of the storm

This liquidation event presents distinct structural characteristics: although the BTC contract market size is twice that of ETH, the weekly decline in ETH open interest reached 25% (a decrease of US$5 billion), far exceeding the loss ratio of BTC. From February 2 to 3 alone, ETH contract positions decreased by US$2.3 billion in a single day, accounting for 16.4% of the decline in the entire network. On-chain data shows that this asymmetric selling pressure may be caused by the concentrated liquidation of nested leverage in the Ethereum ecosystem (such as LST re-staking, DeFi protocol margin positions, etc.).

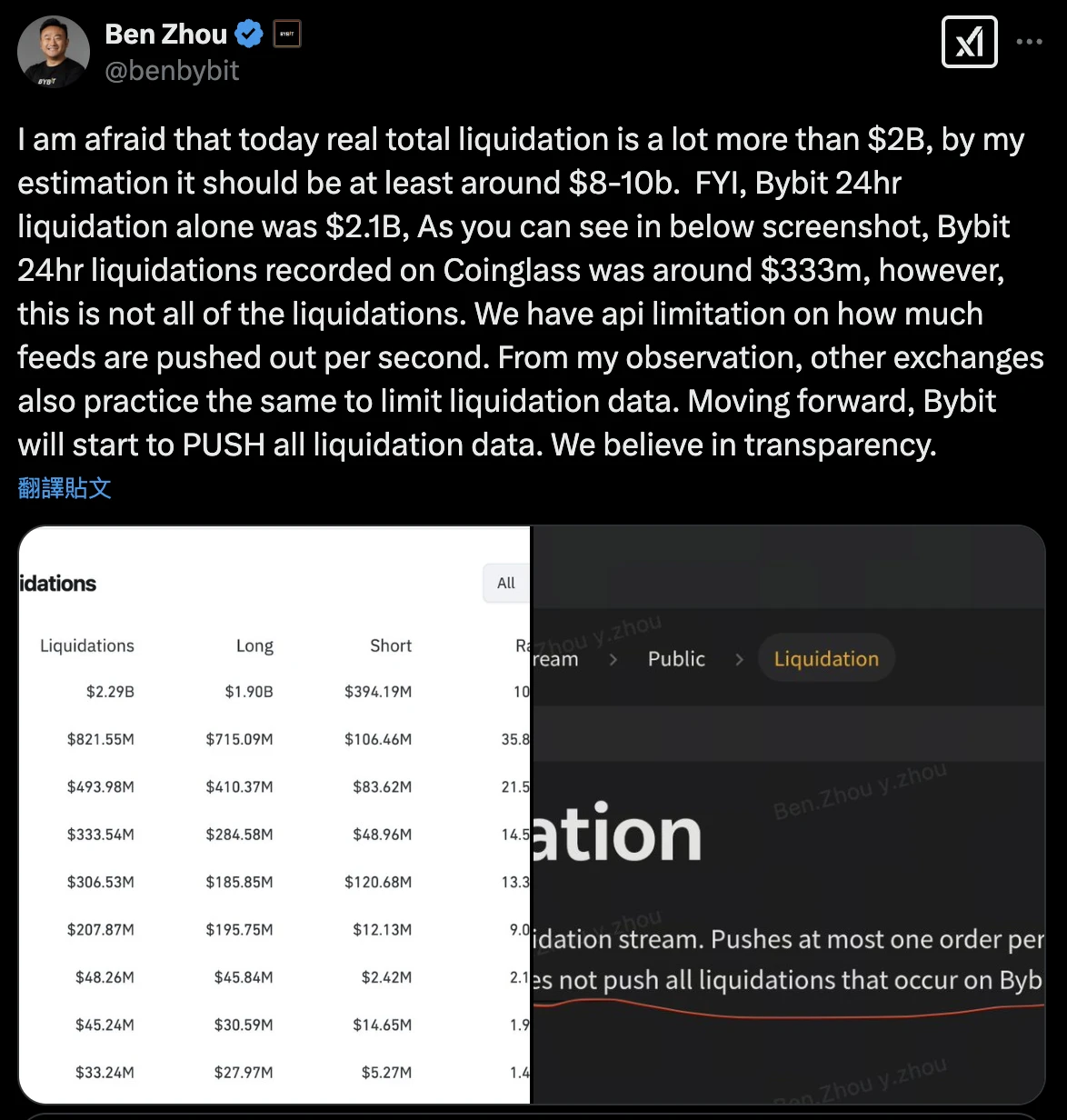

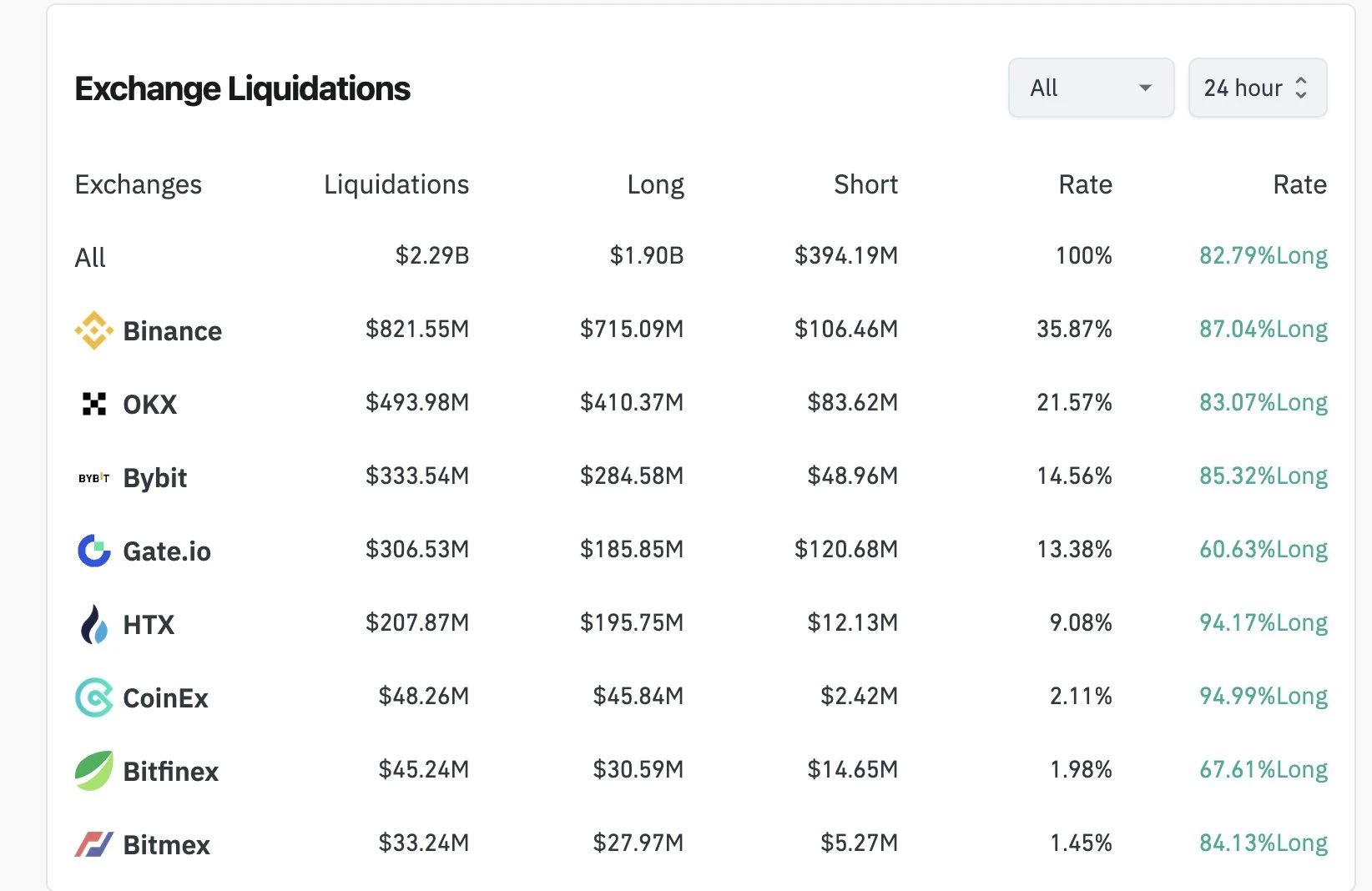

Exchange data shows that there is an obvious statistical deviation in the scale of this round of liquidation. The liquidation amount reported by third-party platforms such as Coinglass is only US$2.3 billion, but the founder of the leading exchange speculates that the actual loss may reach US$8-10 billion through internal data. This difference may be due to the data push restrictions of the exchange API, resulting in some forced liquidations not being captured in real time. Taking Bybit as an example, its officially disclosed liquidation amount (US$2.1 billion) far exceeds the US$333 million recorded by Coinglass. If calculated according to this logic, this incident may be the derivative crisis with the largest actual liquidation scale in the history of encryption.

Does the anchoring feature of stablecoins rely on mechanism or luck?

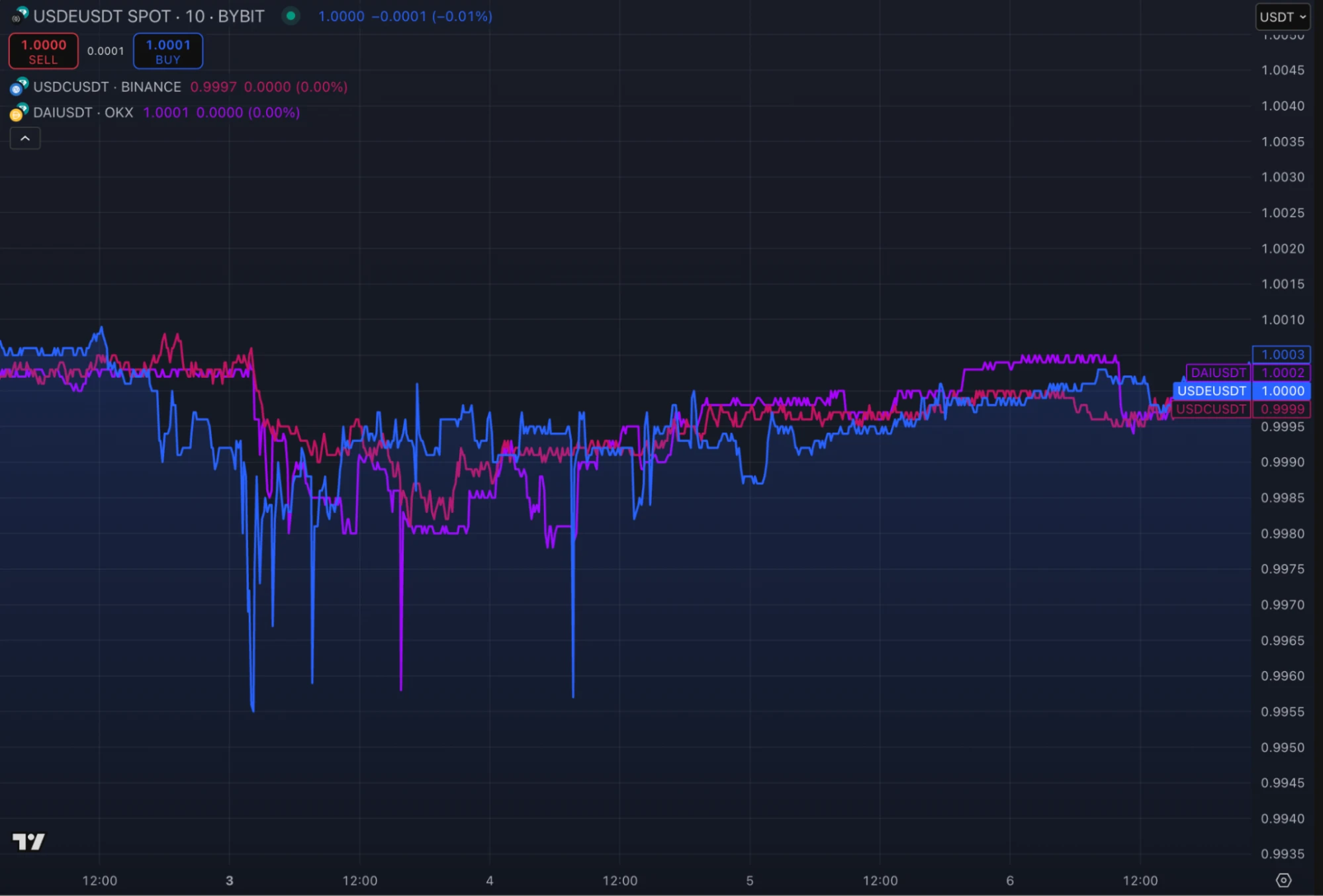

Against the backdrop of a sharp contraction in market liquidity, users have to turn their attention to the performance of stablecoin protocol anchoring. To my surprise, some protocols have gained additional benefits during the market sell-off through clever strategies. While most leveraged players fell in the liquidation wave, Ethenas synthetic USD stablecoin USDe completed a headwind operation: its 24-hour redemption volume reached US$50 million, and the secondary market transaction volume exceeded US$350 million, and the price difference with USDT was always anchored in the ± 0.1% range. The price curve shows that USDe is highly synchronized with fiat stablecoins such as USDC and DAI, and the synergy between CEX market makers and on-chain arbitrageurs effectively offsets short-term liquidity shocks.

USDe price vs USDC (red) vs DAI (purple)

Theoretically, when the price of ETH perpetual contracts is deeply discounted compared to the spot price (the maximum discount of Binance contracts this time is 5.8%), the unrealized gains generated by short positions form a natural buffer. The protocol converts part of the gains into realized profits through an automatic liquidation mechanism, thereby providing holders with additional APY bonuses. Ethena is one of the cases: data shows that it captured $500,000 in profits through this strategy last week, contributing a 50 basis point weekly APY increase to sUSDe holders.

The core mechanism that supports this stability lies in its unique spot + perpetual contract short hedging combination.

The double-edged sword effect of perpetual contract strategy

By reviewing this incident, we can see that the key bottleneck of the perpetual contract strategy was exposed: when the ETH funding rate continued to decline (lower than the BTC contract during some periods), the profit model that relies solely on the funding rate faced challenges.

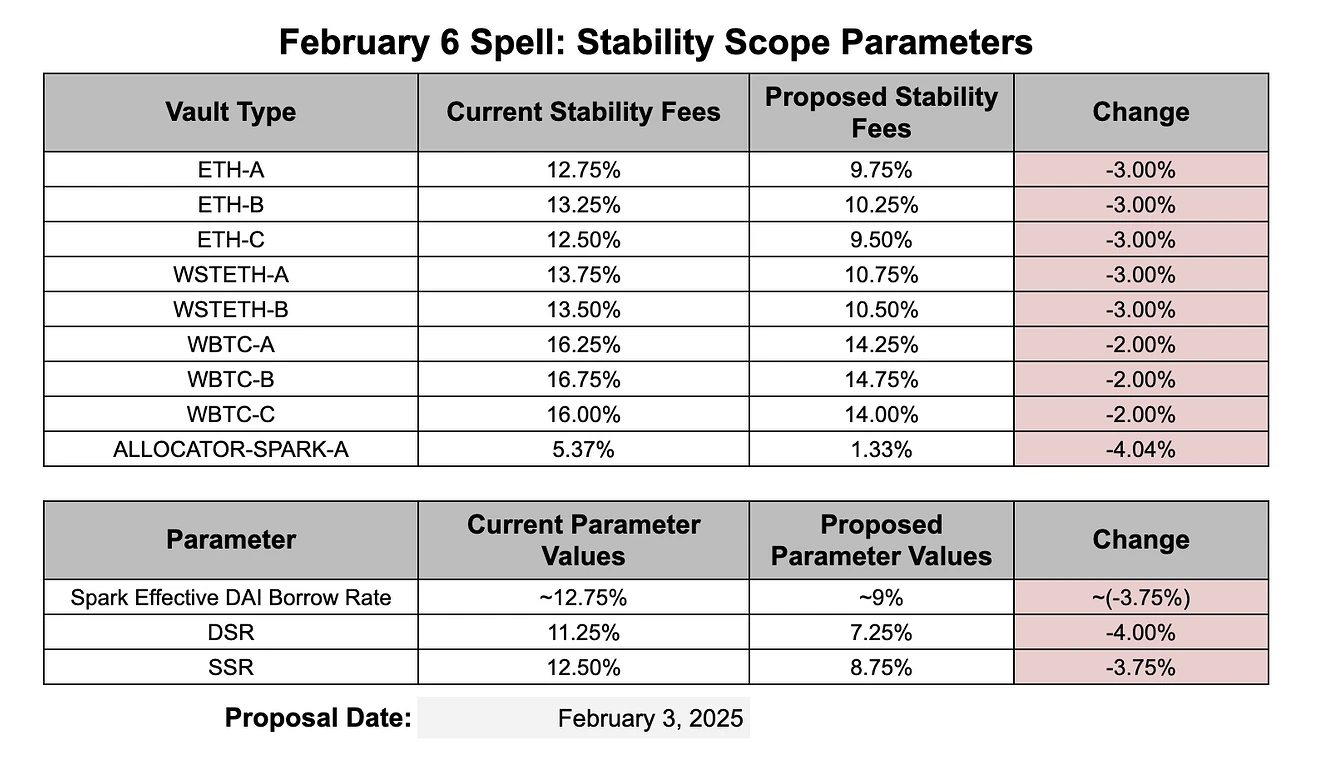

In response to this, Ethenas solution is to initiate dynamic rebalancing, transferring more than $1 billion in collateral from perpetual contracts to on-chain stablecoin interest-bearing markets such as Morpho and Aave (some pools have an annualized rate of 8.75%). This yield radar model enables it to maintain its base yield during periods of low funding rates. However, the sustainability of this strategy remains to be seen. When the market turns into a deep bear market, stablecoin yields may shrink as lending demand declines, and the negative funding rate losses of perpetual contracts may intensify. At this time, how can the protocol maintain its yield attractiveness?

Another controversial point is the risk of cross-exchange execution. The discount of Binance ETH contract (5.8%) far exceeds that of Bybit, OKX and other platforms (about 1%), resulting in Ethenas short profits being highly concentrated in a single exchange. Although its automated system claims to be able to capture cross-platform price differences, in extreme market conditions, issues such as exchange API speed limits and withdrawal delays may still erode arbitrage space.

The “Impossible Trinity” of Derivative Stablecoins?

In any case, Ethenas experiment provides new ideas for the algorithmic stablecoin track: hedging spot fluctuations through perpetual contracts may create an anchoring mechanism that is more capital efficient than excess collateral; and the dynamic collateral library design attempts to find a balance between yield, liquidity and security.

But this stress test also revealed potential risks:

1. Liquidity coupling risk: When multiple exchanges experience deep discounts at the same time, the concentrated liquidation of short positions may exacerbate spread fluctuations;

2. Dependence on income sources: Current income comes from perpetual contract spreads and interest on stablecoins on the chain, both of which are positively correlated with market risk appetite;

3. Black swan tolerance: If liquidity dries up across exchanges and asset classes (such as the March 2020-style crash), hedge portfolios may face the risk of cross-collateral contagion.

There is no final test

In this historic liquidation event, stablecoins such as UDSe have shown unexpected stability, but their true test may not yet come. Once the market falls into a death spiral of long-term low volatility and negative funding rates, can this model that relies on derivative hedging continue to generate blood? The answer may need to wait for the arrival of the next crypto winter.

At least, this test proves one thing: in the death valley of algorithmic stablecoins, what can survive the bull and bear markets may not be the most perfect design, but the most adaptable survival strategy.