Key technical indicators: (February 10, 4pm -> February 17, 4pm Hong Kong time)

BTC/USD fell 1.4% (97.5k USD -> 96.15k USD), ETH/USD rose 1.9% (2.64k USD -> 2.69k USD)

Spot technical indicators at a glance

The market has been very quiet this week, trading in a narrow channel (which was converted from the initial wedge pattern). Support is firmly held below $95.75k, extending to $94-95k; while selling continues to be seen at $98k and above. Given the strong support below, we still think that prices will move out of the current range in the next few trading days. But as realized volatility continues to move deep lower, it may take some time for implied volatility to move into the 40s. Resistance is currently between $98-99k, and higher above $100k; if the lower $94-95.7k is broken, stronger support will appear at $89-91k.

We remain optimistic about Bitcoin in the medium term and expect it to trade in the $120-130k range, but this is expected to happen later this year.

Market Theme

Overall, the macro market was relatively calm this week. Although CPI and PPI slightly exceeded expectations. The market seems to have found a balance with the Feds rate cuts/hikes. At the same time, the sensitivity to Trumps tariff news is gradually decreasing (the market reacted mildly to this weeks reciprocal tariff news).

Cryptocurrencies are again flat, with Bitcoin still firmly in the $94-99k range. After the strong CPI release, the price action bounced off the bottom of the range, indicating strong support here, but quickly retreated after soaring to $98k. Ethereum also continues to stay in the $2.55-2.85k range, but with greater local volatility. Other small coins have mixed gains and losses, with SOL being heavily sold before the supply lock in early March.

Cryptocurrency expert Sacks brought optimism to the market on Friday, claiming that cryptocurrencies are about to see very positive developments. The initial deadline for the first terms of the cryptocurrency working group is this Friday, the 22nd, so we expect to see some market excitement on some news or rumors later this week. But before a more tangible catalyst appears, the market generally seems reluctant to continue chasing higher.

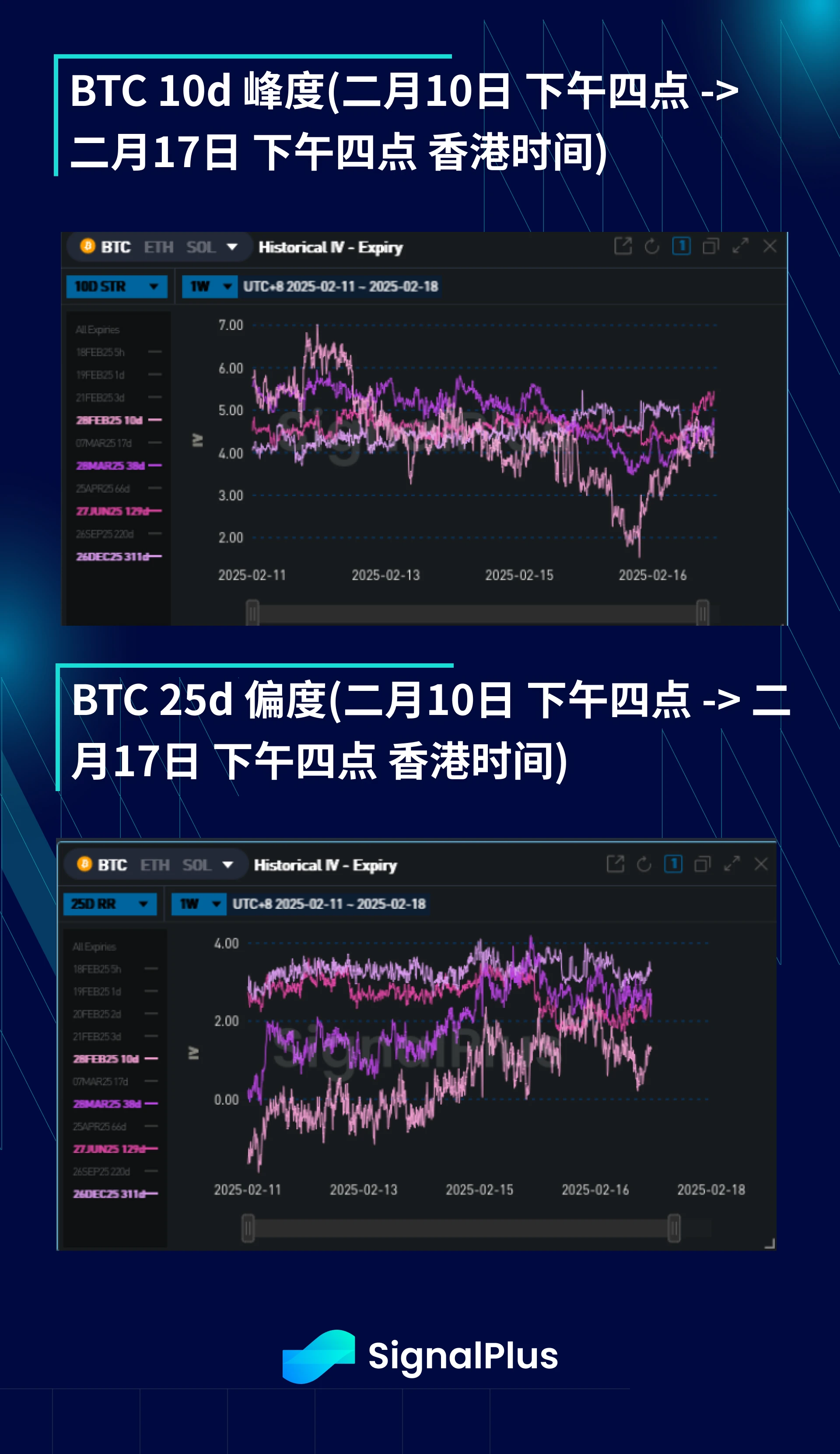

BTC ATM Implied Volatility

Implied volatility levels fell slightly in a sideways trend this week and gradually found support because their absolute levels were lower than previously visible. But this masks the fact that the term structure is quite steep. As trading days with lower volatility gradually expire, the expiration dates of the forwards should be gradually raised. But in fact, they have not been raised (sideways or falling), which essentially means that the volatility of the forward days is gradually falling. Combined with the recent low realized volatility, it means that the cost of holding long forward positions is quite high.

If the price of the currency continues to stay within the range of 94-100k USD, we expect the ATM implied volatility to continue to decline, and coupled with the fairly steep term structure, we believe that the optimal trading strategy is to partially hold a short position with a March expiration. At the same time, holding a wing long protection outside the range in the shorter term can provide sufficient protection in the event of a price breakout.

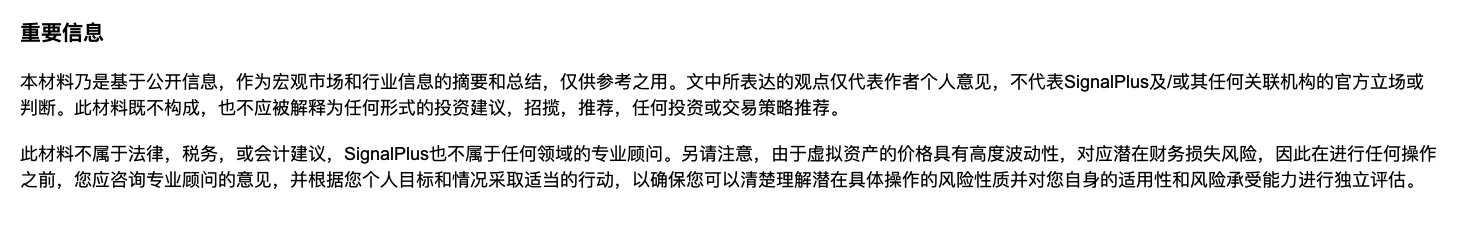

BTC Skewness/Kurtosis

The skewness has gradually shifted upwards this week as several attempts to break through the strong support level of $94-95k have failed. It is also because the market is quite cautious about holding shorts outside this range, considering the current low level of implied volatility and the possibility that both realized and implied volatility will rise rapidly if the price breaks through either side.

Kurtosis was quite quiet this week outside of the short-term horizon. The shrinking price range confirms that the market has low demand for local strikes between $95k-100k, while being cautious about holding shorts outside of this range due to low volatility levels.

Good luck to everyone trading this week/month!

You can use the SignalPlus trading vane function at t.signalplus.com to get more real-time crypto information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlusCN, or join our WeChat group (add the assistant WeChat, please delete the space between English and numbers: SignalPlus 123), Telegram group and Discord community to communicate and interact with more friends. SignalPlus Official Website: https://www.signalplus.com