Today, Roam co-founder YZ published the latest Roam token economic design through his personal X account. This is an exploratory discussion draft that analyzes Roams design concept and future development direction. Roams token economics aims to promote the expansion and sustainable growth of global wireless networks by introducing a unique flywheel model. In the context of globalization, Roams economic system not only solves the pain points of the traditional telecommunications industry, but also provides innovative solutions for the construction of the Web3 ecosystem. The following is the original content:

Over the past three years, @weRoamxyz @weRoamCN has gone through a transformation from #MetaBlox to #Roam . Although we have taken many detours along the way, we are still very grateful for the support of the community and the recognition of our industry colleagues. Many people think that Roam is a project with hardcore technology and real application scenarios. At least with Roam, we no longer have to worry about network problems. We sincerely thank the 2 million users for their love for our product.

Recently, Roam will soon complete the testing of the pre-burning pool and enter the airdrop and TGE formal burning stage. At this critical moment, I would like to share the design of Roams economic system. In my opinion, this is one of the most important tasks I have done in the past three years. In the current context where VC coins lack support and Meme PVP makes industry-savvy people feel desperate, I hope everyone can discuss together to see if Roams economic system has reference value and find room for improvement.

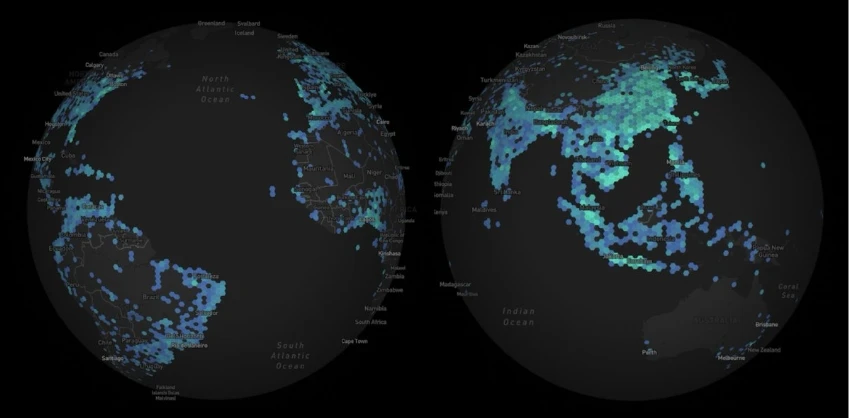

Before introducing the economic system, lets talk about our business model: Roams business model is an open global wireless network, focusing on building a network through DePIN to connect you and me. The core is to operate communication services with the Internets thinking, promote ecological development and user base expansion through the flywheel effect of Web3, and break data barriers through open networks to welcome the AI era.

At present, our business model has achieved two-wheel drive, and will achieve three-wheel drive in the future:

1.0 Roam’s Economic Flywheel Model

Roams economic system achieves sustainability and growth through three key flywheels: the user flywheel, the node flywheel, and the future AI data flywheel.

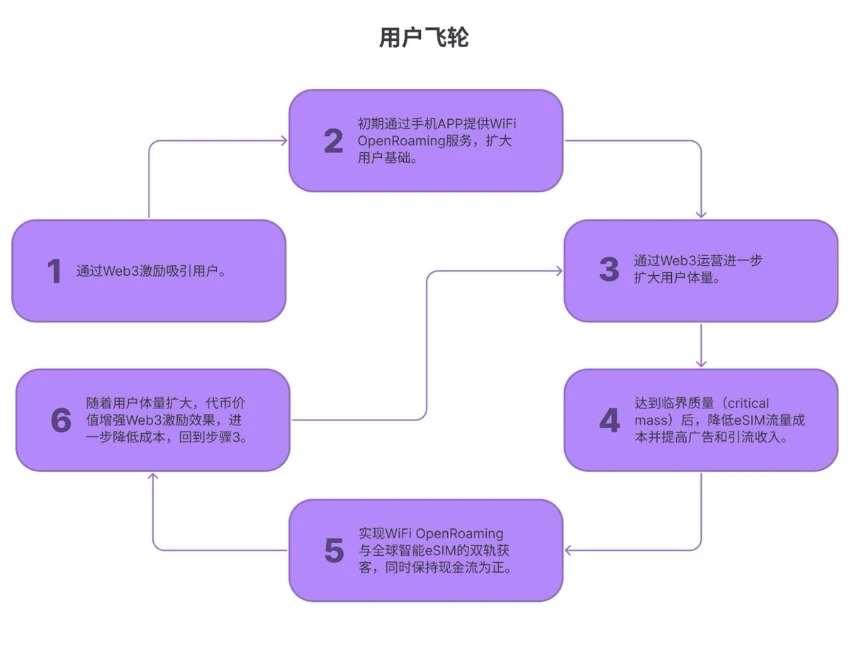

User Flywheel:

Attract users through Web3 incentives.

In the initial stage, WiFi OpenRoaming service will be provided through mobile phone APP to expand the user base.

Further expand the user base through Web3 operations.

Once critical mass is reached, eSIM traffic costs will be reduced and advertising and traffic revenue will be increased.

Achieve dual-track customer acquisition with WiFi OpenRoaming and global smart eSIM while maintaining positive cash flow.

As the user base expands, the value of tokens enhances the incentive effect of Web3, further reducing costs and returning to step 3.

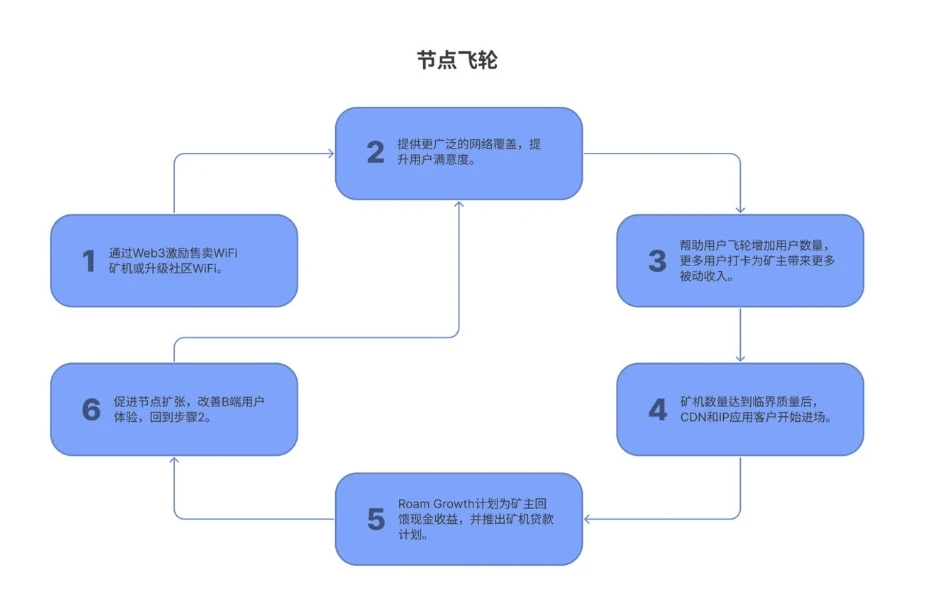

Node Flywheel:

Use Web3 incentives to sell WiFi mining machines or upgrade community WiFi.

Provide wider network coverage and improve user satisfaction.

Help users flywheel to increase the number of users, and more users checking in will bring more passive income to the miners.

After the number of mining machines reaches critical mass, CDN and IP application customers begin to enter the market.

Roam Growth plans to return cash benefits to miners and launch a mining machine loan program.

Promote node expansion, improve B-side user experience, and return to step 2.

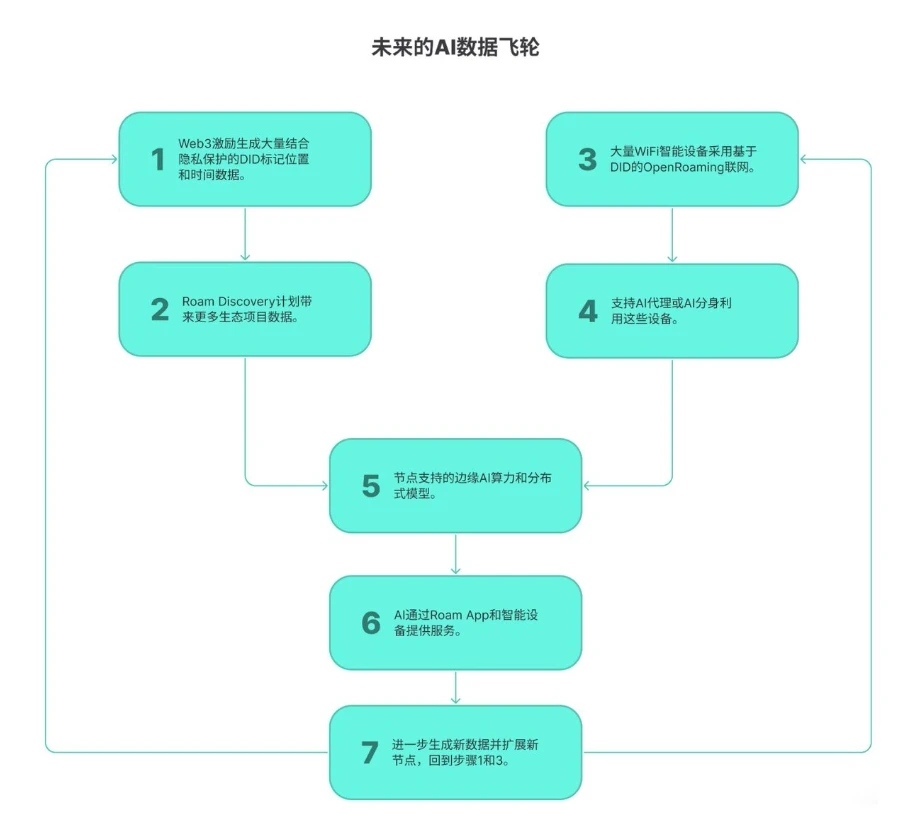

The AI Data Flywheel of the Future:

Web3 incentivizes the generation of large amounts of DID-tagged location and time data combined with privacy protection.

The Roam Discovery program will bring more ecological project data.

A large number of WiFi smart devices use DID-based OpenRoaming networking.

Enable AI agents or AI avatars to take advantage of these devices.

Edge AI computing power and distributed models supported by nodes.

AI provides services through the Roam App and smart devices.

Further generate new data and expand new nodes, returning to steps 1 and 3.

Through these flywheel models, Roam is committed to creating a sustainable ecosystem that drives innovation and growth in wireless networks around the world.

2.0 Roam Token Economics Analysis

2.1 Token Allocation:

The total supply is 1 billion (1 B) $ROAM tokens.

120 million (M) is reserved for the team and will be distributed over 6 years.

280 Million (280 M) is distributed to past and future investors, with airdrops also deducted from this.

The remaining 600 million (600 M) are generated through mining.

2.2 Design principles:

Drawing on the so-called impossible triangle principle, Roams token economics design only fixes two basic parameters and leaves everything else to the market to ensure the sustainable development of the system and maintain market stability.

integral:

The system uses points for settlement instead of using tokens directly. Points are only circulated within the system, similar to Tencent Q coins or airline points, with a constant value and no upper limit. Ecosystem sellers receive points instead of tokens when providing services, in order to avoid selling pressure caused by rising coin prices and maintain reasonable pricing.

Fixed point value is the first basic anchoring parameter.

Tokens:

The token release curve is similar to Bitcoins exponential decay. The initial monthly release is about 0.6%, which drops to 0.35% after 5 years, 0.2% after 10 years, 0.05% after 20 years, and 0.001% after 50 years.

The release curve is pre-fixed and is the second basic anchoring parameter

2.3 Core Mechanism:

Points and token conversion:

Points are converted into tokens through a “burning” process, with the conversion rate determined by the market.

Tokens can also be converted into points, a process that also involves token destruction.

Cycle mechanism:

The conversion process is performed based on cycles (virtual blocks), and each cycle is 1000 seconds.

Difficulty adjustment mechanism:

Paying homage to Bitcoin, Roam’s token generation also has a difficulty adjustment mechanism.

Adjust the token release curve according to network activity (number of check-ins) to ensure the stability of token value and avoid death spiral.

When the network activity decreases, the token release rate is adjusted to ensure the value of the token. This process helps to eliminate low-value nodes and increase the benefits of high-value nodes, similar to the computing power upgrade in Bitcoin mining.

Mining and TGE:

Roam’s TGE marks the official launch of the conversion of points to tokens. Mining always generates the same points before and after the TGE.

Through these mechanisms, Roam is committed to building a stable and sustainable economic ecosystem to support the long-term development of its global wireless network.

2.4 Reward Mechanism

2.4.1 Points Generation

Roams economic system is centered around rewarding participants who contribute to three core flywheels: user flywheel, node flywheel, and AI data flywheel.

Mining machine owners are an important part of the system, and they can receive points as rewards every day. As the system develops, this reward method will gradually transition from the current even distribution to a differentiated distribution based on the service capabilities provided by the mining machine (such as CDN, IP address-based services, etc.), thereby further ensuring that the rewards come from real cash flow. In addition, the mining machine can also generate a small number of high-level stickers every day, and the miner can choose to give these stickers to other users or keep them for himself.

Community validators, i.e. APP users, receive points by verifying the operation of the mining machine. They need to link to the mining machine and perform network verification, punch in. After each punch in, the validator and the mining machine holder can get corresponding points and stickers. This punch in process is the core behavior that supports the development of the three flywheels.

For the future AI data flywheel, Roam plans to launch an incentive mechanism similar to points generation in the second half of 2025.

In addition to the above three points, Roam also encourages community users to add WiFi networks of third-party devices, especially those compatible with OpenRoaming. These users can receive points rewards similar to those of mining machines, but the reward amount is relatively small, and both the verifiers and device registrants who check in on these devices can receive rewards. In Roams ecological projects, such as blockchain games, users have the opportunity to receive additional points rewards by participating, which also increases the playability of the system. However, Roam and its Discovery ecological projects are designed not to change the number of overall points to ensure the stability of the system.

2.4.2 Analysis

Overall, Roams reward system is designed to encourage real labor and contribution. Users can earn considerable passive income by adding more mining machines or actively participating in activities. Many users have earned passive income after their first registration by adding community WiFi and helping them upgrade OpenRoaming. Top players can earn tens of thousands of points every day, which is equivalent to a considerable income, enough for many people to live a happy life.

Active network expansion is common in the Roam community. Some players compare Roam to StepN, earning income through daily walking and WiFi check-ins, while in Southeast Asia, there are players riding motorcycles hoping to achieve the goal of one person, one city. For those who don’t have time to participate in daily activities, investing in mining machines can also bring stable passive income.

Whether it is investing money or putting in effort, these actions are steadily building the Roam network, helping to drive the development of the three flywheels and generating income from the real world. This is in stark contrast to those crypto projects that only rely on on-chain TVL and have no real value.

2.5 Other assets

In addition to points and tokens, the Roam economic system has two important assets: NFTs and stickers.

First, NFT represents the ownership of cloud miners in Roam. Roams economic system prioritizes rewards for networks that actually provide WiFi OpenRoaming services. Therefore, it can be understood that miners deployed in places with high traffic will earn higher income. However, not everyone has the opportunity to deploy miners in these high-traffic locations. In response to this situation, Roam uses NFT cloud miners to help users deploy in these ideal places through Roams agent team, so that users can earn considerable income.

Secondly, stickers play an important role as network verification credentials in the Roam ecosystem. Network verification is a high-frequency use scenario and one of the core elements of the entire ecosystem. This function not only ensures the quality of network services, but also strengthens the connection between users, generates relevant data, and makes Roam a high-frequency APP. In the economic system, stickers determine the amount of users burning in the sticker pool. In the future, stickers can also be synthesized into pledge acceleration cards in a similar way to chain games, become props for ecological GameFi and SocialFi, and even serve as discount coupons in economic activities.

By introducing NFTs and stickers, Roam further enriches the diversity and innovation of its economic system, which not only provides users with more ways to participate, but also lays a solid foundation for the sustainable development of the entire ecosystem.

3.0 Points Burning

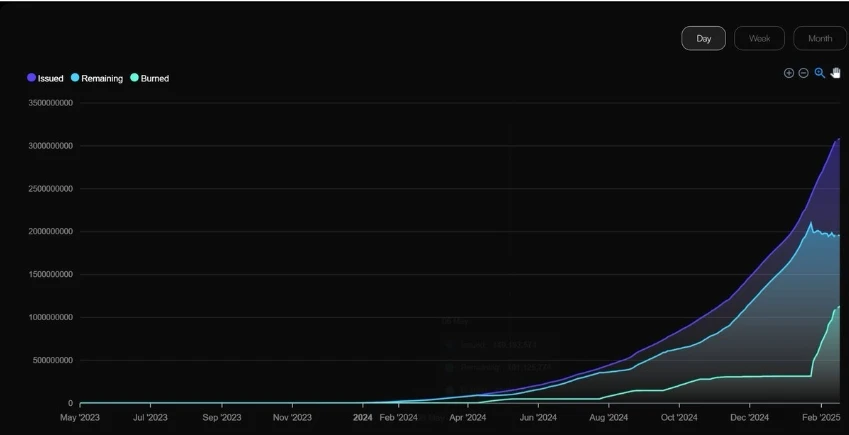

Starting from January 24, 2025, Roam started the pre-burn of points. The results far exceeded the teams expectations and provided a valuable data foundation for the improvement of the economic system.

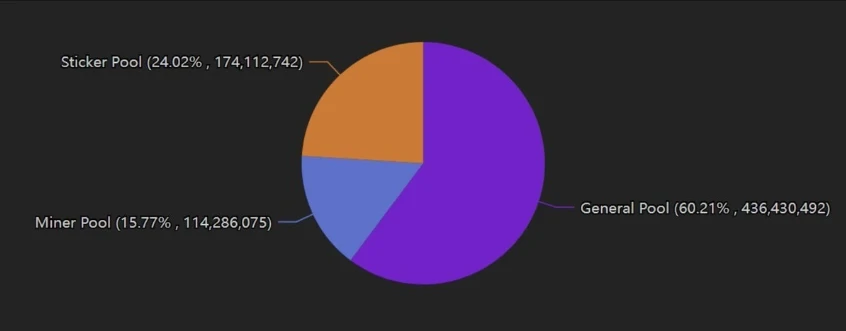

The burning mechanism is divided into three burning pools: mining pool, sticker pool and ordinary pool. The ratio of tokens generated by each pool is 5: 3: 2.

Among these pools, the mining pool is dedicated to burning points generated by mining machines. For example, if a user has 1 million points, 100,000 of which come from mining machines, and the remaining 900,000 points come from community mining and check-in activities, then the user only has 100,000 points to burn in the mining pool.

The burning mechanism of the sticker pool requires users to use stickers to build a burning quota. Roam provides four types of stickers: ordinary stickers (can burn 50 points), rare stickers (can burn 100 points), rare stickers (can burn 250 points), and legendary stickers (can burn 1000 points). A maximum of 50 stickers can be used at a time, but please note that stickers can only be used once.

The remaining points are burned in the general pool.

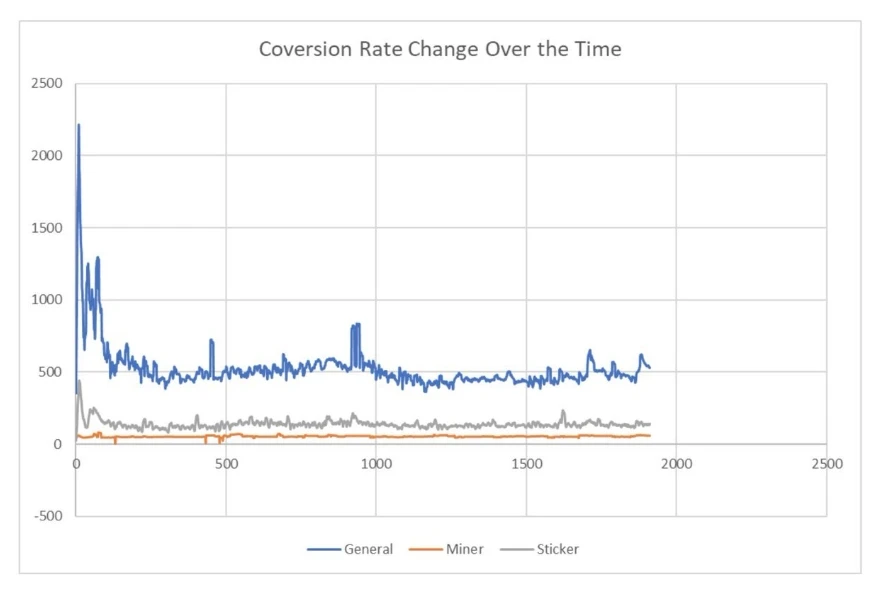

In each cycle, the number of tokens that can be obtained after each point is burned depends entirely on the total number of points involved in the burn in that cycle. If the point pool can generate 648 tokens in a cycle and 10,000 points are burned at the same time, then each point can get 0.0648 tokens.

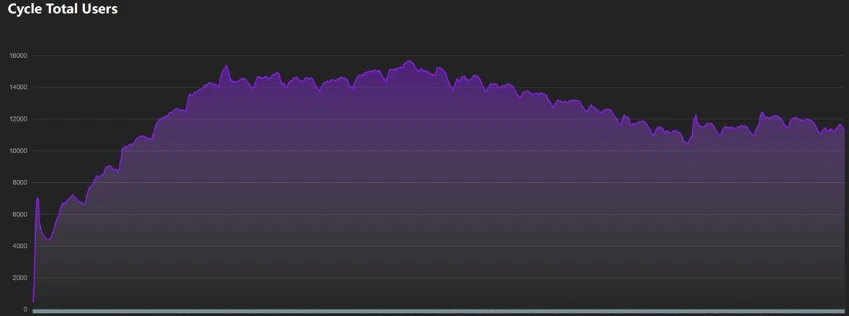

After 1930 cycles, the combustion results are as follows:

In just over ten days, Roam has burned a quarter of the points generated in the past year and a half. The popularity of the entire burning process is evident: after the first few cycles, the number of people participating in the burning online at any time has steadily exceeded 10,000.

The average conversion rate of the mining pool is 54.5 points to one token, the sticker pool is 139.1 points, and the general pool is 523.3 points. The high conversion rate of the mining pool ensures the stability of mining machine income. The relatively high conversion rate of the sticker pool further rewards users who check in more often.

4.0 Value support of Roam tokens and points

The ultimate success of an economic system often stems from the stability and growth of the currency price. So where does the support for Roam tokens come from? The answer is nothing more than two aspects: the increase in intrinsic value brought about by the expansion of the network scale, and the increase in the value of individual tokens by the token deflation mechanism.

4.1 Enhancement of intrinsic value:

The growth of the Roam network has been fully demonstrated through the data from Roam Explorer - Real-Time Updates on Roam Networks Expansion , so there is no need to elaborate here.

4.2 Token Consumption and Deflation Mechanism:

4.2.1 Absolute Deflation: Token Burning and Disappearance

Tokens are permanently withdrawn from circulation through a burning mechanism, which directly reduces the total amount in circulation and increases the value of individual tokens.

4.2.1.1 Arbitrage-driven tokens are converted back into points

After TGE, Roam will start the reverse conversion mechanism. Users can convert tokens into points in any cycle using the weighted average value of the sticker pool and the regular pool. Assuming the average value of the past 1900 cycles is used, one token will be able to be converted into 292.78 points. The converted tokens will be burned and withdrawn from circulation.

This process provides arbitrage opportunities for users who have enough stickers, incentivizing them to convert one token into points and then earn more tokens through reburning. (Current sticker pool 139.1 points converted to one token)

The reason why the number of points pool burned is much smaller than that of the ordinary pool is that the number of stickers is the bottleneck of burning, and stickers can only be obtained through the core behavior of punching in.

Although this process may reduce the conversion rate of the sticker pool, since the number of stickers rather than the number of points is the burning bottleneck, generating more points after the reverse conversion of tokens will not change the high conversion rate of the sticker pool, it still helps to promote token burning.

This mechanism will greatly stimulate further user interaction with the App, amplify the value of data, advertising, and traffic, and thus stimulate more cash revenue.

4.2.1.2 Points application drives token reverse conversion

All applications in the Roam ecosystem, including games, social networking, AI, etc., require points. Whether it is the BitBang game that is popular in the Indonesian community, or the MojoGogo AI agent managing Twitter, various AI assistants, accelerated synthesis cards, buying stickers in the trading market, medal system, etc., points are indispensable. If you don’t have enough points and don’t want to get them through mining, then buying tokens to burn points is the only option.

4.2.1.3 Direct burning of tokens

Currently, the Roam ecosystem has generated 3 billion points, of which more than 1 billion points have been burned. This includes 700 million points consumed in pre-burning, and 300 million points recovered and burned through Roams own network revenue. After the TGE, Roam can also choose to use part of the revenue to directly purchase tokens on the market and burn them, further reducing the amount of tokens in circulation.

4.2.2 Relative Deflation: Imbalance in Supply and Demand of Tokens

In the market, when the demand for a token exceeds the supply, the price of the token will generally increase.

4.2.2.1 Metcalfe’s Law and Exponentially Decaying Token Release Curve

As a typical network that connects people, the value of Roam is proportional to the square of the number of network nodes, which is a manifestation of Metcalfes law. However, Roams token release curve is similar to Bitcoin, which is exponential decay. As the number of network participants and nodes increases, the supply growth of tokens is lower than the demand growth. This natural mismatch results in an increase in token value.

4.2.2.2 Demands from the increase in token usage scenarios

Even if the number of tokens remains the same, when the use cases of tokens increase, it will lead to deflation. Assuming that 100 tokens can only be used in two scenarios at first, when the use cases increase to ten, the number of tokens available for each scenario will be greatly reduced. If the circulation velocity of tokens cannot be increased, deflation will occur. After Roams TGE, tokens can be used in multiple scenarios outside the ecosystem. For example, tokens can be used to top up credit cards for consumption, exchange for other tokens in the Discovery project, purchase phone numbers and eSIM traffic, etc. Every additional use case is actually causing deflation.

4.2.2.3 Reduce the circulation speed of tokens

Reducing the circulation speed of tokens will also create a deflationary effect. By locking Roam tokens to get free Internet access, participating in staking pools, etc., the number of tokens in circulation in the market can be effectively reduced, thereby increasing the value of tokens.

4.2.3 Summary

Through these mechanisms, Roam can not only maintain the relative scarcity of tokens, but also increase the demand for tokens in a variety of application scenarios, thereby promoting the healthy development of the overall economic system. This relative deflationary strategy helps to ensure the long-term value of Roam tokens.

4.3 Roam Points

Because Roam points only circulate within the system, their relatively stable value is easy to establish. After the pre-burn phase, we found that although the total amount is not limited, it has entered a state of slight deflation. In this case, we only need to adjust the speed of point generation to ensure the constancy of its value.

5.0 Roam Airdrop Strategy

For many projects without actual products, on-chain interactive airdrops are often a technical exchange behavior. This type of airdrop cannot retain users because users will quickly sell after receiving the airdrop, resulting in increased selling pressure on tokens. Therefore, many project parties tend to secretly reduce the number of tokens actually distributed during distribution, which has also caused many online controversies about rat warehouses.

However, for Roam, airdrops are a more cost-effective customer acquisition channel to compete with Web2 eSIM and WiFi providers, and have obvious advantages over traditional means such as SEO and SMM. Roam not only airdrops tokens, but also airdrops traffic! Roams airdrop activities are all carried out within the App, with clear targets for valuable users and new users to ensure that no resources are wasted. This strategy not only improves the quality of users, but also maintains the harmonious atmosphere of the Roam community.

Through this precisely targeted airdrop approach, Roam is able to effectively attract and retain truly valuable users, laying the foundation for the long-term development of the product.

6.0 If the bear market comes...

In a bear market environment, token prices are often under pressure and market liquidity may be lacking. However, Roam’s economic system has multiple ways to deal with this challenge and keep the value of the token stable.

Path 1: Difficulty Adjustment and Deflation Acceleration

In the case of a decrease in the number of participants and a decline in network activity, Roams difficulty adjustment mechanism will kick in, causing the rate of token generation to decrease. This accelerates the deflation process and provides support for token prices.

Path 2: Token/points arbitrage accelerates burning

As network activity decreases, the number of stickers will also decrease, making arbitrage easier. As arbitrage activity increases, token burns faster, supporting token prices.

Path 3: Token Sedimentation and Stable Income

Users can obtain APY by staking tokens, or obtain free communication services by locking up tokens. In this way, the circulation speed of tokens is reduced, forming relative deflation, thereby supporting the token price.

Path 4: Bear market is good for low-priced services

Bear markets often prompt more users to seek low-cost services, which may lead to more users switching from traditional operators to Roam. This shift not only increases Roam’s profits, but also provides the possibility for token repurchase and destruction, or treasury replenishment, further supporting token prices.

Through these paths, Roam can not only maintain its stability in the bear market, but also ensure the value growth of the token in the long run by optimizing the economic mechanism. Roam is also actively exploring more paths to face future currency price and liquidity challenges.

7.0 Summary

Crypto has entered an inflection point. For teams accustomed to the past business model, this is simply hell. But I believe that for teams that have been involved in the web2 Internet field for a long time, this is simply heaven.