Original author: BitMEX Alpha

Quick Facts

Despite negative macro factors such as poor inflation data and continued ETF outflows, market prices have not fallen, indicating that the market may have bottomed.

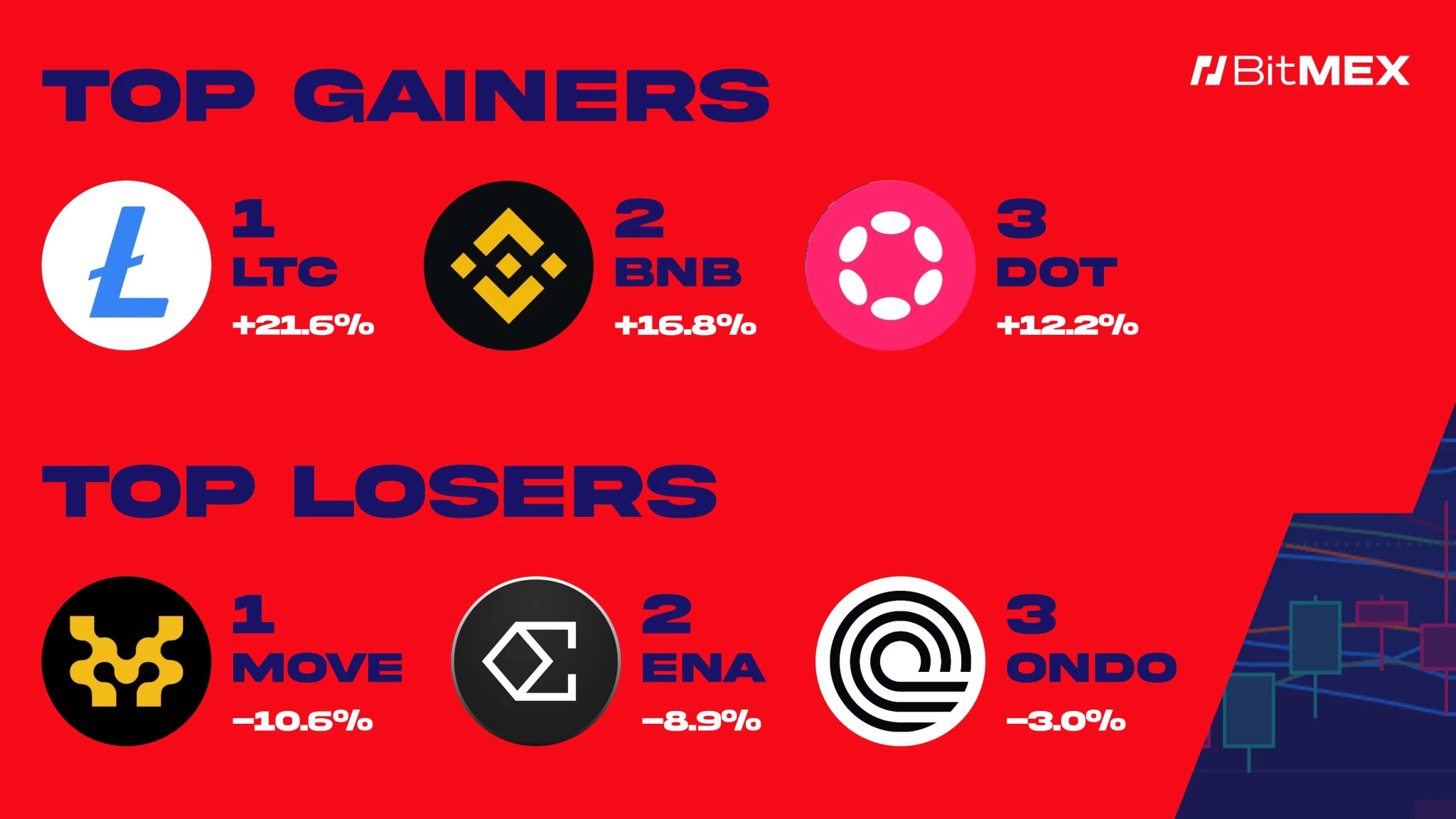

Litecoin (LTC), BNB and Polkadot (DOT) performed outstandingly, with increases of 21.6%, 16.28% and 12.2% respectively; while MOVE, ENA and ONDO performed poorly, with declines ranging from -3% to -10.6%.

In the trading strategy section, we will analyze the valuation gap between decentralized exchanges (DEX) and centralized exchanges listed in the United States - will undervalued tokens become one of the best trading opportunities in this bull run?

Data at a Glance

Best performers of the week

$LTC (+21.6%): Litecoin surges on ETF expectations, about to break through key levels

$BNB (+16.28%): As the fourth largest cryptocurrency by market capitalization, Binance Coin has seen a rare surge of 15%. CZ expressed support for meme coins on BSC, driving a surge in demand for BNB

$DOT (+12.2%): As Ethereum comes under pressure, traders turn their attention to the Polkadot ecosystem developed by ETH’s former CTO

Worst performer of the week

$MOVE (-10.6%): Compared with emerging public chains such as Berachain, MOVE is overvalued and its price is under pressure to fall.

$ENA (-8.9%): ENA continues to fall and shows no signs of stabilization

$ONDO (-3%): ONDO entered a mild adjustment phase, with a slight drop of 3% this week

Market News

Macro dynamics

Ethereum ETF saw $50 million outflow this week

Bitcoin ETFs saw net outflows of $677 million this week

U.S. inflation rises at fastest pace in 18 months in January

Barclays Holds $131 Million in Bitcoin via BlackRock ETF

Coinbases fourth-quarter revenue is $2.3 billion, and regulatory compliance has made progress

Robinhoods crypto trading revenue grew 8-fold in the fourth quarter, creating competitive pressure on Coinbase

Trumps World Liberty Fi increases MOVE holdings and pledges Ethereum

SEC reviews more Solana ETF applications, chances of approval rise

North Carolina becomes 20th US state to propose Bitcoin reserve legislation

Fed Chairman Powell keeps interest rates unchanged, supports stablecoin regulation, and opposes de-financialization of the banking industry

Project Progress

Jupiter DEX will start JUP token buyback next Monday

Former Binance CEO Changpeng Zhao hints at launching memecoin

Grayscale submits spot Cardano ETF application to SEC

SEC confirms acceptance of Grayscale XRP ETF proposal, entering federal review stage

MyShell snapshot completed, $SHELL tokens to be released soon

ZkLend suffered a $9.5 million hack, offering a 10% bounty to recover funds

OpenSea Confirms Imminent Token Airdrop and Expansion into Cryptocurrency Trading

Trading strategies

Disclaimer: The following does not constitute investment advice. This is just a summary of market news, and it is recommended that you do your own research before making any trades. The content in this article does not represent any guarantee of returns, and BitMEX is not responsible for your trading performance.

Tokens with real income may become the most undervalued investment opportunity in the market

The rise of decentralized exchanges (DEXs) is one of the most transformative developments in the cryptocurrency space. Despite these DEXs generating billions of dollars in real revenue each year and implementing aggressive token buyback programs, DEX tokens are still significantly undervalued compared to traditional exchanges such as Coinbase (COIN) or Robinhood (HOOD). Even in a volatile market environment, stock performance of cryptocurrency exchanges and brokerage platforms such as Robinhood has remained strong, and their latest earnings reports highlight the continued growth trend of cryptocurrency trading.

Take Robinhood as an example. Its trading revenue increased by 200% year-on-year, mainly due to the booming cryptocurrency business. The companys total revenue increased by 115% year-on-year to US$1.01 billion. It is worth noting that trading revenue surged 200% year-on-year to US$672 million, of which cryptocurrency revenue accounted for a significant share, reaching US$358 million, a year-on-year increase of 700%. In addition, option trading revenue increased by 83% and stock trading revenue increased by 144%.

With such impressive performance and the explosive growth of cryptocurrency trading, we cant help but ask: If Robinhoods stock price rises due to its growing cryptocurrency revenue, how should we evaluate the value of existing crypto projects that are also generating hundreds of millions of dollars in revenue? These projects, especially DEX, are not only thriving in the industry, but also implementing mechanisms such as token buybacks that Robinhood does not have. Would it be a wiser choice to invest in DEX tokens with real income and capital return promises than simply investing in traditional exchanges?

Price-to-income ratio analysis: DEX valuations are only a fraction of traditional exchanges

Traditional exchanges are overvalued relative to their revenues. For example, Coinbase (COIN) has a market cap of $74 billion, which is 11.2 times its $6.6 billion annualized revenue. Similarly, Robinhood (HOOD) has a market cap of $56 billion, which is 18.6 times its $3 billion annualized revenue.

In contrast, leading decentralized exchanges (DEXs) have significantly lower valuation multiples despite their faster growth and unique advantages:

Raydium: 5-6x price/revenue

Market value $1.5 billion, annual revenue $250 million-300 million

Jupiter: 6x price/revenue

Market value $2 billion, annual revenue $300-400 million

Metaplex: 5x Price/Revenue

Market value $230 million, annual revenue $40-50 million

Hyperliquid: Price/Revenue Ratio ~12x

Market value $8-9 billion, annual revenue $500-700 million

While Hyperliquids price/revenue ratio (12.7x) is slightly higher than Coinbases (11.2x), its aggressive buyback policy (over 50% of fees spent on buybacks) and dominance in the perpetual futures space make it an attractive investment opportunity. The key difference is that Hyperliquid is not only growing rapidly, but also conducting large buybacks, while traditional exchanges such as Coinbase do not have a buyback program, which further highlights the inefficiency of the market pricing of DEX tokens.

Buybacks: A catalyst for increasing value for token holders

An important feature of these projects is to reward holders through active buyback programs. Unlike Robinhood and Coinbase, these crypto projects implement token destruction mechanisms, increasing scarcity and hopefully driving up token value.

Compared with traditional exchanges, DEX is creating a deflationary token economic model through active token buybacks and destruction:

Raydium: 12% of the transaction fee will be used for repurchase

Hyperliquid: Over 50% of fees ($684 million) are spent on buybacks each year, reducing supply faster than any competitor, and is expected to reduce supply by about 10% per year

Jupiter: As Solana’s largest DEX, it promises to use 50% of its fees ($150-200 million per year) for buybacks

Metaplex: $2-3 million per month ($24-36 million per year), 50% of $40-50 million in fees

Risk: Cyclicality and sustainability of the crypto market

Although DEX tokens appear undervalued based on current price/revenue ratios and strong growth potential, we also need to carefully consider the risks of investing in such projects. The most important risk is cyclicality - the crypto market is inherently cyclical and often enters a long period of adjustment after experiencing explosive growth. This cyclicality can significantly affect the revenue and trading volume of decentralized exchanges, making their profit forecasts more uncertain than traditional markets.

Another key challenge facing DEXs is the sustainability of growth. Raydium and Jupiter, for example, are both vulnerable to external shocks despite their current momentum. The recent surge in BNB on-chain trading volume is a typical example, which stems from Zhao Changpeng’s promotion of the meme coin on Binance’s native chain. This has led to a significant drop in trading volume on the Solana chain, which in turn has affected the revenue of Solana-based DEXs such as Raydium and Jupiter.

This situation highlights the fierce competition among the first layer (L1) blockchains. As new trends emerge, certain ecosystems may quickly attract attention and liquidity, while the user base of other ecosystems may shrink. For example, when the BNB chain attracted much attention due to the meme coin craze, Solanas market share was temporarily weakened, which directly affected the revenue of Solana ecosystem projects such as Raydium and Jupiter. This continuous fluctuation in trading volume will lead to instability in DEX token prices and revenue.

In addition, the rise and fall of specific ecosystems or tokens, especially those driven by speculative trends or sudden changes in user preferences, further increases the unpredictability of DEX token performance. Although the long-term development prospects of DEX remain promising, the risks of cyclical crypto markets and sudden changes in the competitive landscape must be fully considered when evaluating the sustainability of their revenue growth.

Conclusion: Investment opportunities in DEX tokens

Overall, despite the risks that DEX tokens face, such as market cyclicality and fierce competition across blockchain ecosystems, they still offer investors a very attractive opportunity. These tokens are noteworthy for their current market low valuations (reflected in low price/revenue ratios and strong revenue growth). More importantly, their active buyback programs (which are not available on traditional exchanges such as Robinhood) provide an additional value creation mechanism that helps mitigate the impact of market volatility. As DeFi grows faster than traditional exchanges and DEXs continue to innovate and expand, investors willing to look beyond short-term volatility will have significant opportunities. As the market matures, the gap between DEX fundamentals and their token valuations will likely gradually narrow, leading to significant long-term gains. Now is the time to recognize the true value of these tokens - they are undervalued gems in a rapidly developing market.