ARK Invest, one of the most famous investment companies in the US market, listed stablecoin protocols as one of the most important trends in the next few years in its latest forward-looking Big Ideas 2025 report. This prediction mentions the most rapidly developing example today: the Web3 project has pushed the market size of non-fully mortgaged stablecoin protocols to US$6 billion in just 12 months and has been listed as a key trend in 2025 by ARK Invest. But is this experiment a breakthrough for innovators or the beginning of another leverage game?

In this article, let us take an in-depth look at the ARK report’s predictions on the future impact of stablecoin protocols.

The rise of stablecoin protocols

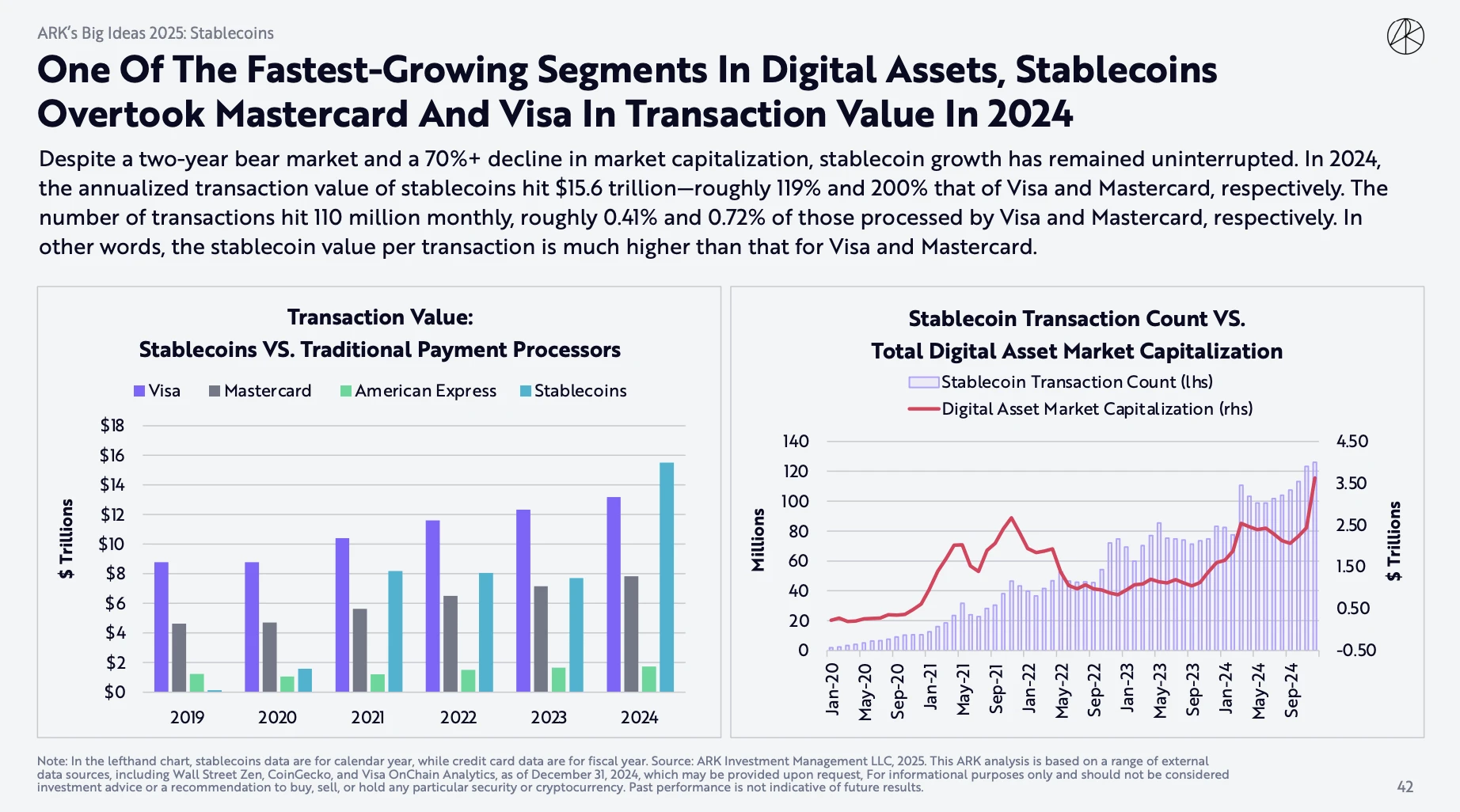

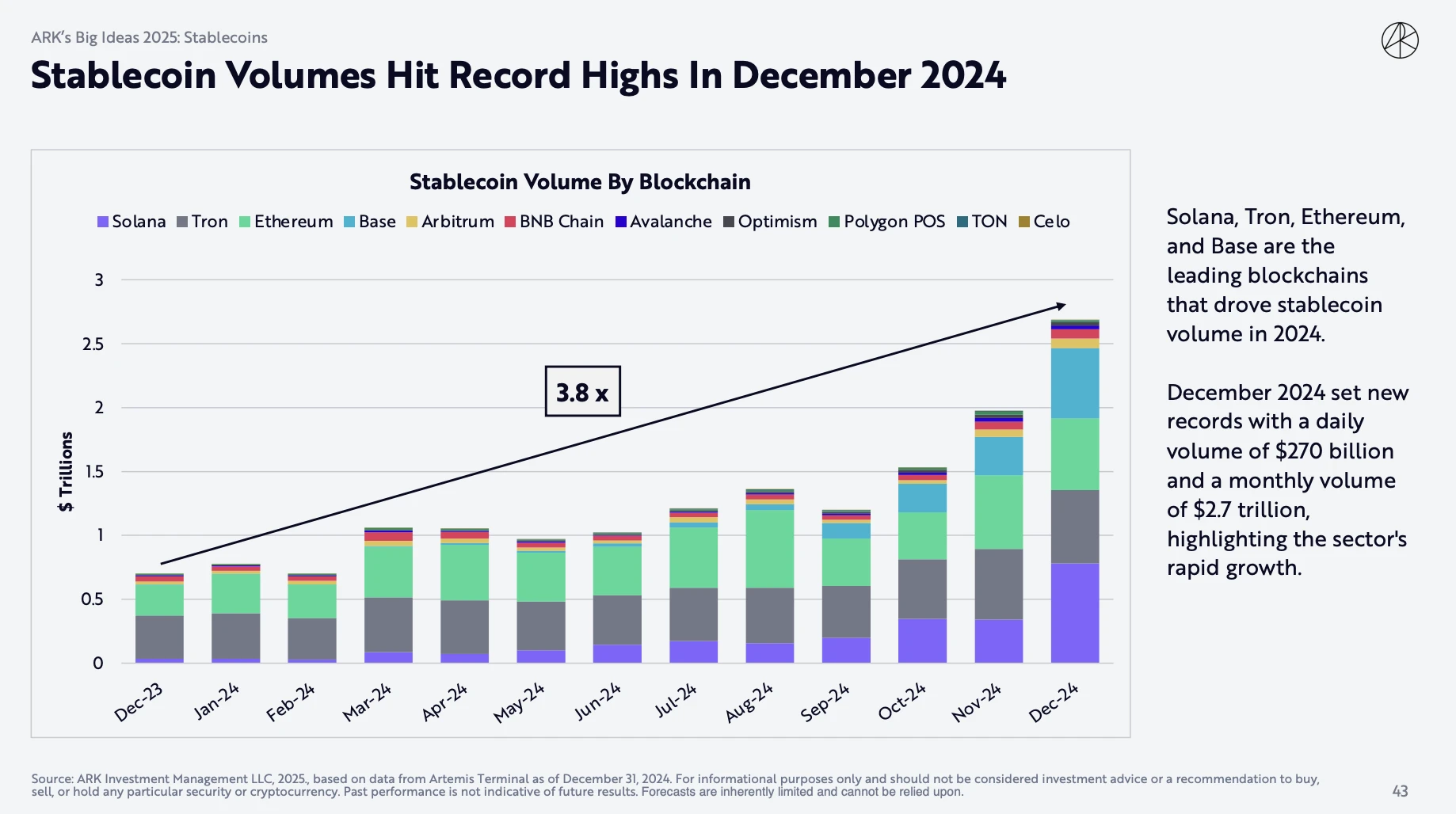

The report data shows that the annualized transaction value of stablecoins in 2024 reached an impressive $15.6 trillion, which is 119% and 200% higher than the annualized transaction value of Visa and Mastercard respectively. Even more surprising is that in December 2024, the daily transaction volume of stablecoins reached $270 billion, and the monthly transaction volume was as high as $2.7 trillion. These data strongly prove the rapid expansion of stablecoin protocols in the global payment and transaction fields, as well as their significant risk resistance in dealing with market fluctuations.

In addition to the substantial increase in trading volume, the number of active users of the stablecoin protocol has also hit a record high. The report shows that the number of active stablecoin addresses has reached 23 million. The application scope of the stablecoin protocol has far exceeded the scope of cryptocurrency trading and has begun to penetrate into the broader financial field, attracting more and more ordinary users to participate. At the same time, the total supply of stablecoins has also reached 203 billion US dollars, equivalent to 0.97% of the US M2 money supply. Although this proportion may not seem high, considering that the stablecoin protocol market is still in its early stages of development and its potential for global application, this figure indicates that the stablecoin protocol may have a profound impact on the global financial system in the future.

In terms of market share, USDT and USDC continue to dominate, accounting for more than 90% of the market share. However, the booming multi-chain ecosystem has also brought new growth momentum. Blockchains such as Solana, Tron, Ethereum, and Base have become the main force driving the growth of stablecoin protocol transaction volume.

200 billion forecast

ARK Invest boldly predicts that the stablecoin protocol market size will exceed US$200 billion by 2025.

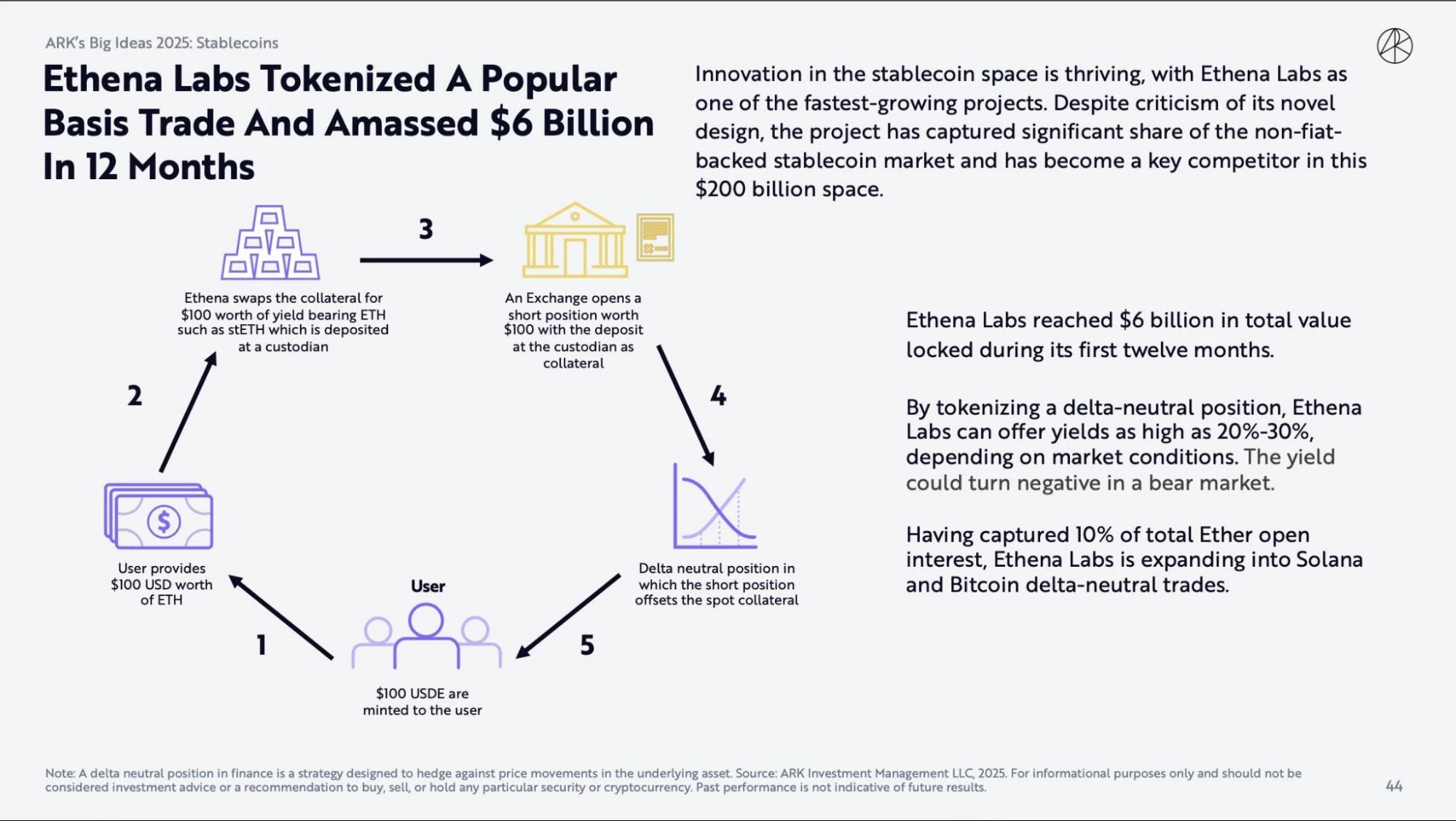

The report mentioned that the rise of Ethena Labs is a strong proof of ARK Invests prediction.

The core innovation of Ethena Labs is to tokenize the Delta neutral strategy. Its process essentially converts the arbitrage opportunities unique to the crypto market into fuel for the minting of stablecoin protocols: by going long on spot + shorting contracts, using the spread between the funding rate and the spot price to generate income. The income is packaged in a structured manner. The basis income is packaged into an annualized 20%-30% interest-bearing asset to attract arbitrage capital inflows. Risk hedging is automated. The collateral is used by the custodian to achieve real-time hedging of on-chain/off-chain positions and maintain a 1:1 anchor.

This mechanism no longer relies on fiat currency reserves, but instead transforms market arbitrage opportunities into the intrinsic value support of the stablecoin protocol. This innovative value anchoring mechanism greatly improves the capital efficiency of the stablecoin protocol and provides a broader space for its scale expansion.

Stablecoin protocol transformation

ARK Invests report points out that the rise of stablecoin protocols will profoundly change the cryptocurrency market and push it into a new era of income rights revolution. This revolution is not a simple technological innovation, but a comprehensive reshaping of the crypto-financial system. The core is to create, distribute and trade income rights as a new financial asset. This transformation is mainly reflected in the following three key shifts:

Turn 1: Securitization of income rights - integrating the essence of DeFi with traditional finance

ARK Invests report emphasizes that Ethena Labs has successfully introduced the thinking mode of structured products in traditional finance into the DeFi field, realizing the gorgeous transformation of stablecoin protocols from a simple payment tool to a yield-generating tool. This means that stablecoin protocols are no longer just a medium for storing and transferring value, but have become a financial asset that can generate sustainable returns.

Ethena Labs USDe stablecoin protocol can essentially be understood as a call option on basis income. By cleverly utilizing the basis (the difference between the spot price and the perpetual contract price) and the difference in funding rates in the cryptocurrency derivatives market, USDe can continuously generate income for holders. It brings a new financial product design idea to the DeFi field and lays the foundation for the innovation of more complex income rights products in the future.

Turn 2: Capital efficiency upgrade - the efficiency advantage of stablecoin protocols

Compared with the traditional over-collateralized stablecoin protocol model, the Delta neutral strategy adopted by Ethena Labs demonstrates significant capital efficiency advantages.

The traditional over-collateralization model requires holding a large amount of fiat currency or crypto assets as collateral, which not only increases the cost of funds but also reduces capital utilization. The stablecoin protocol can achieve the same level of risk control with lower capital occupation by cleverly using derivative hedging strategies. Ethena Labs uses its expertise and technical advantages in the derivatives market to accurately hedge market risks, thereby minimizing the need for over-collateralization and achieving a significant improvement in capital efficiency. This higher capital efficiency not only reduces the issuance cost of the stablecoin protocol, but also provides greater room for the scale expansion of the stablecoin protocol.

Turn 3: The institutionalization process is accelerating - stablecoin protocols become the new favorite of institutional investors

ARK Invests report predicts that the rise of stablecoin protocols will accelerate the institutionalization of the cryptocurrency market. Since stablecoin protocols can generate stable returns and have higher capital efficiency, hedge funds and asset management institutions have begun to incorporate stablecoin protocols into their cash management strategies. This marks that institutional investors acceptance and participation in the cryptocurrency market has reached a new level.

The massive influx of institutional funds will further drive the exponential growth of the stablecoin protocol market and make it an indispensable part of the cryptocurrency ecosystem. This institutionalization trend not only brings greater financial support to the stablecoin protocol market, but also provides stronger stability for its long-term development.

The confirmation of ARK Invests prediction is an important experiment for the stablecoin protocol market to mature. However, historical experience shows that all financial innovations need to undergo a complete bull-bear test. Perhaps only when the next black swan event comes, we can truly see whether this revolution is the cornerstone of the reconstruction of the financial order or another castle in the air.