Key Takeaways

– Understanding Derivatives and Risks: Crypto derivatives such as futures, options, and swaps offer profit opportunities but come with high volatility, leverage risks, and liquidity challenges.

– Implement effective risk management: Reduce liquidation risk caused by market fluctuations through position control, stop-loss orders, hedging strategies and asset diversification.

– Ensure compliance and security: Pay attention to changes in regulatory policies, choose compliant exchanges, and use cold wallets and secure trading measures to protect assets.

– Keep your trading mentality stable: avoid making impulsive decisions due to FOMO (fear of missing out) or panic, follow your trading plan, and record your trades to optimize your strategy.

Cryptocurrency is rapidly entering the mainstream market, providing unique opportunities for investment, speculation and risk aversion. In this emerging field, cryptocurrency derivatives based on digital assets such as Bitcoin or Ethereum have become an important part of the market. These derivatives include futures, options, swaps and perpetual contracts, which traders can use to profit from market price fluctuations without holding actual assets.

However, high volatility, complex product structures, and unregulated markets can turn trading opportunities into huge risks. Therefore, effective risk management is essential for all crypto derivatives traders. This guide will provide:

– Overview of mainstream derivatives

– Analysis of main risk factors

– Practical risk management strategies

Help traders and investors to respond to market challenges prudently and improve transaction security and stability.

Table of contents

Understanding Crypto Derivatives

Key risks of crypto derivatives

– Position planning and leverage control

– Stop Loss Orders and Risk/Reward Ratio

– Hedging strategies (options and carry trading)

– Diversification of assets and trading strategies

– Collateral and margin management

– Continuous monitoring and adjustment

Legal and compliance considerations

Technical and operational risk prevention

Trading Psychology and Emotional Management

– Avoid FOMO (Fear of Missing Out)

– Overcoming loss aversion

– Maintain transaction records

– Stick to your trading plan

Understanding Crypto Derivatives

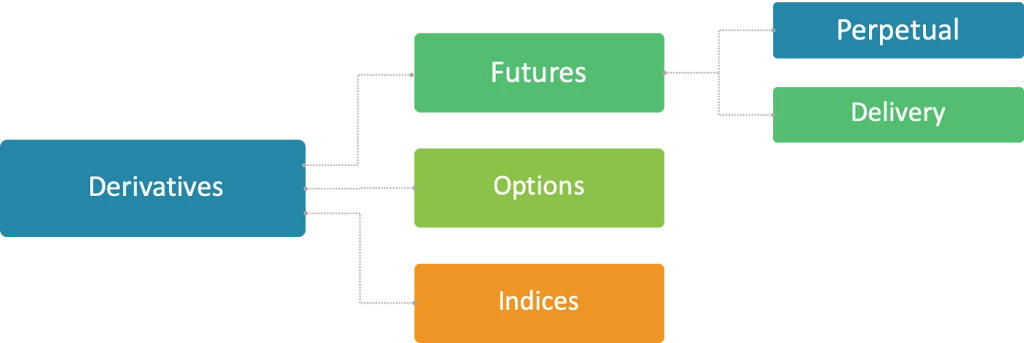

Cryptocurrency derivatives allow traders to gain market exposure or execute hedging strategies without directly holding Bitcoin or other digital assets. These instruments can amplify returns, but also come with higher risks. Here are the main categories:

Futures

Definition: Buyers and sellers must trade the underlying asset at an agreed price on a specific date in the future.

Trading platforms: regulated exchanges (such as CME) and crypto exchanges (such as Binance, XT.COM).

– No expiration date: The contract price is kept close to the spot market through the Funding Rate.

– Suitable for: traders who want to hold leveraged positions for a long time without the need to renew contracts.

– Fixed expiry date: When the contract expires, the position is settled in cryptocurrency or stablecoin.

– Suitable for: Institutional investors or traders who want to get a certain settlement time.

Stablecoin margin vs. coin-based contracts

– Stablecoin-Backed (e.g. BTC/USDT ): Use stablecoins such as USDT and USDC as margin to reduce the volatility risk of leveraged positions.

– Coin-Backed contracts (e.g. BTC/USD ): Using cryptocurrency as margin, the position profit and loss and margin value will change with market fluctuations.

Options

Definition: Gives the holder the right, but not the obligation, to buy (call option) or sell (put option) a cryptocurrency at a specified price before the expiration date.

use:

– Hedging: Preventing the loss of large amounts of crypto assets due to market declines.

– Income Generation: Earn additional income by selling options (such as covered calls).

– Speculation: Using leverage to gain market direction without holding the underlying asset.

Swaps

Definition: A contract between two parties to exchange specific financial benefits or obligations.

Perpetual Swaps:

– No expiration date: Keep the price close to the spot market through funding rate.

– Popular Markets: Commonly found on exchanges such as Binance, OKX, Deribit, etc.

Structured Products

Structured products provide customized risk/return structures through a combination of derivatives and are widely favored by institutional investors.

Dual Investment (coming soon on XT.COM )

– No principal protection: When the market price does not reach the target at maturity, users can obtain higher returns.

– How it works: If the price is lower than the target, the investor receives the original asset plus additional interest; if the price exceeds the target, the investor’s position is converted to another asset (e.g. BTC → USDT), and the investor may miss out on additional gains.

– Partial capital protection: returns depend on prices remaining within a set range.

– Suitable for: Investors who want to obtain stable returns but are willing to bear certain risks.

Image Credit: Medium

Key Risks of Cryptocurrency Derivatives

The risks in the crypto derivatives market are interrelated, and understanding these risks can help traders build effective protection strategies.

Volatility Risk

– Cryptocurrency prices fluctuate wildly, and it is not uncommon for prices to rise or fall by more than 80% in a single day.

– The leverage effect amplifies market volatility. If the market conditions are unfavorable, it is easy to trigger forced liquidation (margin call).

Counterparty Risk

– Traders rely on the financial stability and security of the exchange.

– If the exchange is hacked or goes bankrupt, you may lose your deposit and unrealized profits.

Liquidity Risk

– Market liquidity is fragmented, especially for small-cap assets, and insufficient trading depth may lead to execution difficulties.

– Low liquidity can easily cause slippage. When the market fluctuates violently, it becomes more difficult to close a position, and may even lead to greater losses.

Regulatory and Legal Risk

– Global cryptocurrency regulations change frequently, and policies vary from region to region.

– Regulatory changes may affect leverage ratios, margin requirements, and even lead to trading restrictions or bans in certain regions.

Technology and Operational Risk

– The trading platform may be attacked by hackers, system failures or server overloads, affecting the trading experience and fund security.

– High-frequency trading strategies may fail due to API connection delays or failures, affecting trading execution efficiency and profitability.

Identifying these risks and their severity is key to developing an effective risk management strategy.

Image Credit: Insurance Risk Services

Risk Management Strategies

Effective risk management requires a combination of quantitative tools, a disciplined trading approach, and market research. The following are common strategies:

Position planning and leverage control

Position planning

– Invest only a portion of your capital on a single trade to hedge against market volatility and control your personal risk exposure.

– Over-allocation of funds can lead to rapid portfolio losses, especially in extreme market conditions.

Leverage Management

– High leverage (such as 20x, 50x) can magnify profits, but also increase the risk of loss.

– Experienced traders usually use low to medium leverage to reduce the risk of liquidation.

Stop Loss Orders and Risk/Reward Ratio

Stop Loss Order

– Set a stop loss point to ensure that the position is automatically closed when the market price reaches the preset level to control losses.

– A reasonable stop-loss mechanism helps traders maintain discipline and prevent losses from expanding.

Risk/Reward Ratio

– Maintain a healthy risk/reward ratio (e.g. 1:3) to ensure long-term profitability.

– Even if some of your trades fail, the winning trades can still make up for the losses.

Hedging strategies

Using Options

– When holding a large amount of crypto assets, you can buy put options to hedge against the risk of market crash.

– If you are bearish on the market but worried about price increases, you can buy a call option to reduce risk.

Arbitrage Trading

– Carry trading reduces risk by holding opposing positions (e.g., going long and short at the same time).

– This strategy reduces overall market impact and focuses on price differences between assets.

Diversification

Asset Diversification

– Hold different cryptocurrencies or stablecoins to reduce the impact of a single asset’s sharp drop.

– For example, if Bitcoin plummets while Ethereum remains stable, the overall losses will be reduced.

Diversification of trading strategies

– Use different trading strategies (such as trend trading, mean reversion, volatility arbitrage) to adapt to market changes.

– Certain strategies are effective in a one-sided rising market, but may fail in a volatile market, so a multi-strategy combination can help to achieve stable profits in the long term.

Margin Management

Overcollateralization

– Depositing additional margin can prevent forced liquidation during volatile market conditions.

– But keeping too much money on a single exchange may increase the risk of the exchange going bankrupt or being hacked.

Stablecoin margin

– Using stablecoins (such as USDT , USDC , DAI ) as margin can reduce the additional risk caused by fluctuations in the value of the margin.

– This strategy ensures that traders’ risk is only related to their open positions, without affecting the value of their margin due to market volatility.

Continuous monitoring and adjustment

Dynamic Risk Adjustment

– Market conditions are constantly changing and leverage and stop-loss levels should be adjusted based on current volatility.

– For example, during periods of extreme volatility, lowering leverage and narrowing stop-loss ranges can reduce potential losses.

Risk analysis and stress testing

– Use simulation tools to conduct stress testing to assess the impact of a worst-case market crash or exchange failure.

– Adjust position sizing, hedging strategies and margin management plans based on testing results.

These strategies provide traders with a basic risk management framework, but true success depends on disciplined execution and the ability to flexibly adjust strategies as the market changes.

Regulatory and compliance considerations

The regulatory environment for cryptocurrency derivatives is constantly changing, affecting how they are traded and compliance. The United States allows regulated Bitcoin futures (CFTC regulation), but places strict limits on retail leverage, while some countries completely ban or significantly restrict crypto derivatives trading.

Trading region compliance

– Understand the legal regulations of the country where the exchange is located to avoid fines, asset freezes or legal proceedings due to violations.

– Different countries have different regulations on crypto derivatives, and we should continue to pay attention to policy changes.

Exchange Due Diligence

– Confirm whether the exchange holds a legal license and is supervised by regulatory authorities.

– Assess the financial soundness of the exchange and ensure it has adequate liquidity and capital security measures.

– Check the security of the exchange to see if it has ever been hacked or had any asset loss incidents.

Tax and transaction records

– Keep complete trading records (including entry price, exit price, profit and loss).

– Many countries consider cryptocurrency gains to be taxable income, and accurate reporting can help avoid potential legal issues.

KYC and AML regulations

– Compliant exchanges usually require identity verification (KYC) and transaction records to prevent illegal transactions.

– Comply with KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations to help avoid account freezes or regulatory investigations.

Through proactive compliance management, traders can reduce legal risks and ensure trading stability and long-term sustainable development.

Image Credit: Financial Crime Academy

Technical and operational security precautions

Cryptocurrency transactions rely on strong security measures and sound operational management to ensure the safety of funds and the stability of transactions.

Fund security

– Mainstream exchanges store most user funds in cold wallets to prevent hacker attacks.

– Multi-Signature mechanism can improve security and requires multiple parties’ authorization to execute large withdrawals.

Platform stability

– The exchange should be equipped with backup servers and failover mechanisms to ensure stable operation of the system.

– Traders using automated trading tools should check the stability of the API to avoid trade failures due to system delays or glitches.

Operational risk management

– An exchange with sound risk control should be able to respond quickly to hacker attacks or system crashes and resume operations as quickly as possible.

– Exchanges with high transparency usually provide Proof of Reserves and accept third-party audits to enhance user trust.

Understanding the security and operational mechanisms of the trading platform is as important as understanding your trading strategy, as a hacker attack or system failure can result in devastating losses.

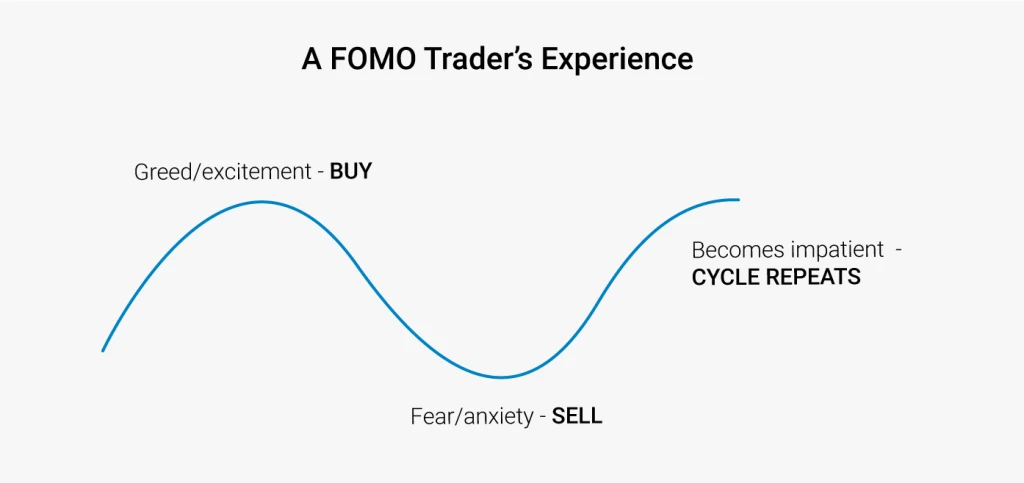

Managing Emotions in Trading

Even with good technical skills and trading strategies, you can still suffer serious losses if you are affected by emotions. The cryptocurrency market is often driven by market hype and panic, which can easily lead to wrong trading decisions based on fear or greed. Maintaining emotional discipline can ensure that traders execute trades according to plan rather than being driven by impulse.

Avoid FOMO

– When prices surge, traders may enter the market impulsively, ignoring risk control, and even continue to buy heavily after the best buying point has passed.

– Adhere to established trading rules and position limits to avoid over-leverage or missing out on good entry points due to FOMO.

Overcoming loss aversion

– Many traders are reluctant to admit losses, which causes them to hold on to their positions for too long and miss out on better trading opportunities.

– Controlling small losses early on helps preserve funds for more profitable trades later on.

Keep a trading journal

– Recording the decision-making process for each trade (entry/exit price, reason for the trade, emotions at the time) can help identify erroneous patterns.

– Reviewing your trading journal regularly can help you optimize your trading strategy and improve your discipline.

Stick to your trading plan

– Before entering the market, clearly set profit targets and stop loss ranges to ensure that each transaction has a clear risk management strategy.

– Avoid impulsive adjustments to trading strategies due to short-term market fluctuations. Adjustments when necessary should be based on rational analysis rather than emotional reactions.

Emotional control is what separates the consistently profitable traders from the losing ones. Staying calm, following your trading plan, and overcoming your psychological barriers are the keys to long-term survival and profitability in the cryptocurrency market.

Image Credit: Carl Fajardo

in conclusion

Cryptocurrency derivatives offer the opportunity for high returns, but also come with high volatility and complexity. Successful traders need to effectively manage risk in the following key areas:

– Product Knowledge: Learn how futures, options and swaps work before trading.

– Risk control: Use stop-loss orders, appropriate leverage and hedging strategies to reduce potential losses.

– Transaction security: Ensure the security of exchanges and trading platforms to reduce counterparty risk.

– Regulatory compliance: Keep an eye on KYC (Know Your Customer), AML (Anti-Money Laundering) and tax compliance requirements.

– Emotional management: Strictly implement the trading plan and avoid making impulsive decisions due to market emotions.

As the market continues to evolve, traders must continue to learn and adjust their strategies. Although no strategy can completely eliminate risk, a robust approach and strict execution discipline can greatly increase the likelihood of long-term success in the crypto derivatives market.

Quick Links

– When Crypto Meets Music: XT.COM x Rolling Stone China VIP Night at Consensus Hong Kong 2025

– Monad vs. Ethereum: Can this emerging L1 disrupt the market?

– Nine Cryptocurrency Trends in 2025: AI, DeFi, Tokenization, and More Innovations

About XT.COM

Founded in 2018, XT.COM currently has more than 7.8 million registered users, more than 1 million monthly active users, and more than 40 million user traffic within the ecosystem. We are a comprehensive trading platform that supports 800+ high-quality currencies and 1,000+ trading pairs. XT.COM cryptocurrency trading platform supports a variety of trading products such as spot trading , leveraged trading , and contract trading . XT.COM also has a safe and reliable NFT trading platform . We are committed to providing users with the safest, most efficient, and most professional digital asset investment services.