February 21, 2025, is destined to be written into the history of cryptocurrencies.

That night, Bybit, a leading global exchange, suffered the largest hacker attack in history, with losses amounting to US$1.5 billion, or approximately RMB 10.8 billion, far exceeding any previous security incident.

In the following 24 hours, the price of Bitcoin plunged several times, once falling below $95,000 per coin, and panic spread in the market. According to incomplete statistics, more than 170,000 investors around the world were liquidated and suffered heavy losses.

“The money is not in the exchange”: the simplest truth

For cryptocurrency users, the exchange being hacked is the worst nightmare. Once assets are stored in an exchange, there is a risk of being wiped out. However, Ethenas approach is a little different. They have adhered to a principle from the beginning: assets supporting USDe are never stored in exchanges.

This seems like common sense, but it takes great courage in the pursuit of high returns and the decentralized crypto world. Ethena chose to hold its assets in the Copper third-party custodian, and only access exchange liquidity through Copper ClearLoop when trading is needed. The settlement process is completed within the custodian, and the funds do not leave the custodian. In laymans terms, it is as safe and efficient as paying with a digital wallet, the money is always in the bank account.

The beauty of this design is that even if something happens to the exchange, the users core assets will not be directly exposed to risk. This model helped a lot in the Bybit hacking incident. Ethenas supporting assets did not exist on Bybit at all, avoiding direct losses. More importantly, it can quickly transfer $30 million worth of hedge positions from Bybit to other platforms. The whole process is like changing the battlefield - the old position has fallen, and the new line of defense has been built, and the flexibility is eye-catching. This makes people wonder: If more projects can also use this method, can there be fewer days of anxiety?

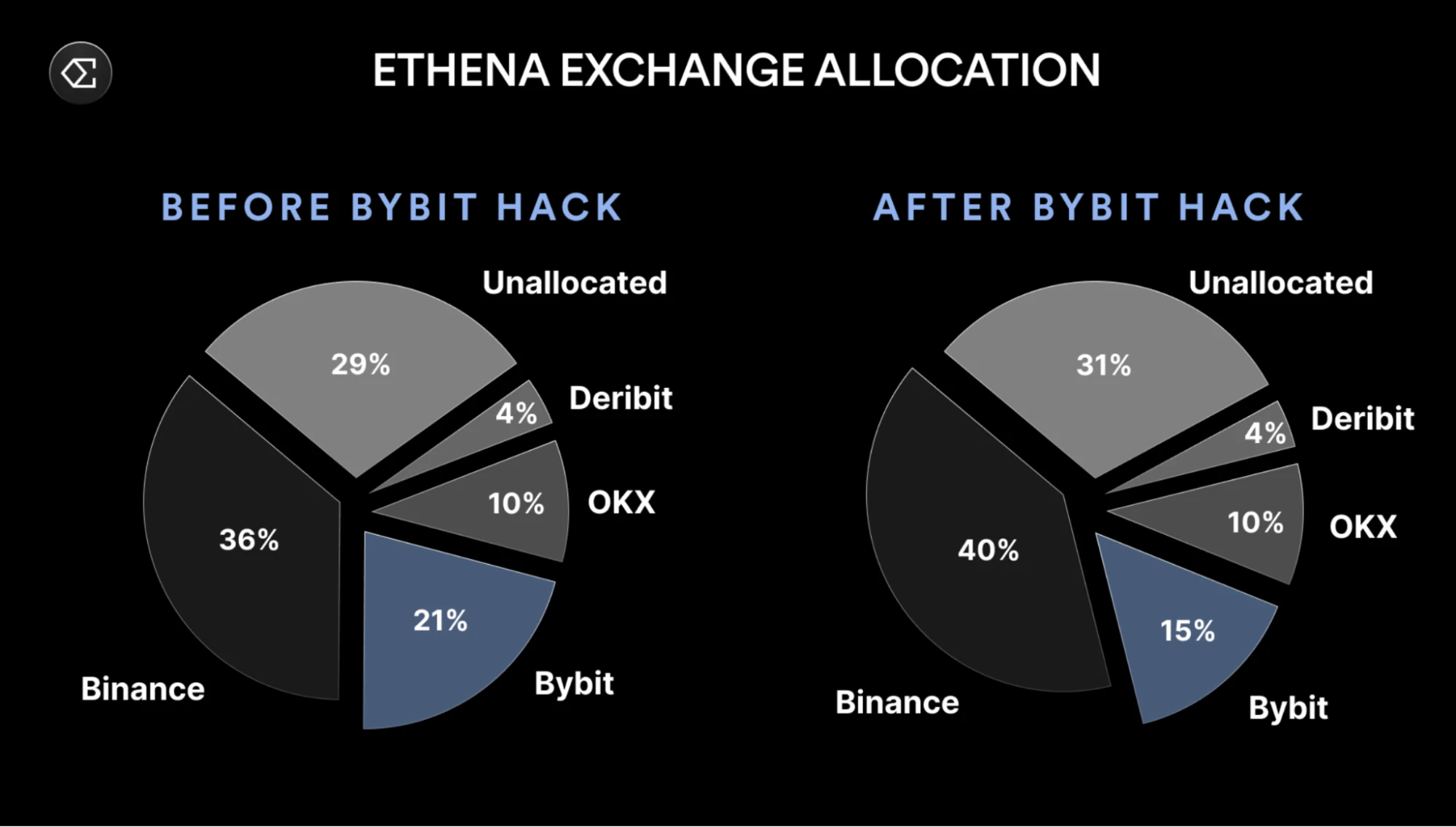

Ethena exchange’s allocation positions before and after Bybit was attacked

Redemption wave of $120 million per hour: the ultimate challenge of stress test

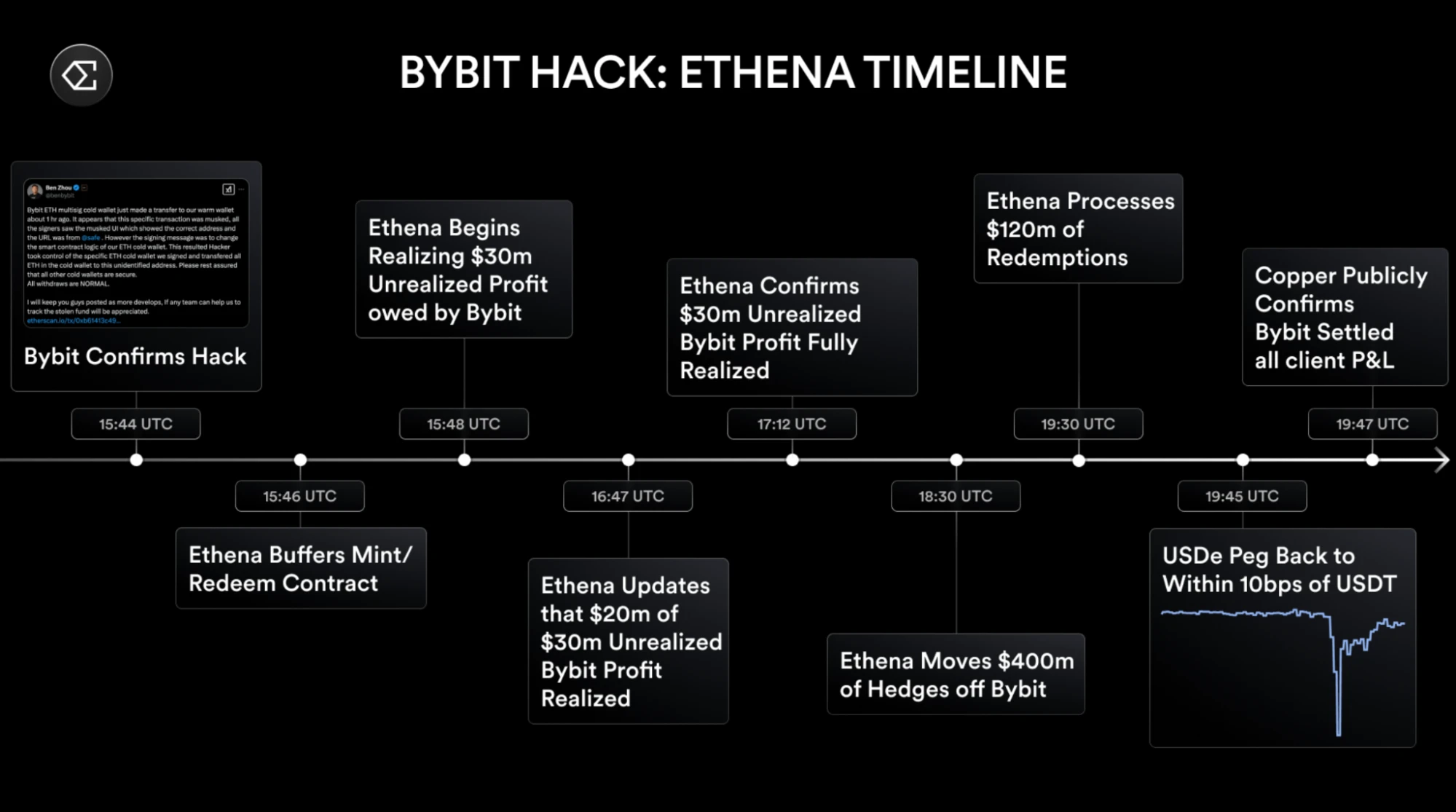

Ethena timeline after Bybit attack

Panic is contagious.

When Bybit users began to withdraw cash frantically, the stablecoin market also set off a huge wave.

Data shows that USDe’s redemption requests exceeded $120 million in one hour, which is 15 times the daily redemption volume of the protocol. But Ethena’s response speed was surprising.

Within 10 minutes after the incident was confirmed, its liquidity buffer pool was urgently expanded from US$30 million to US$250 million, as if building a dam in an instant before it burst.

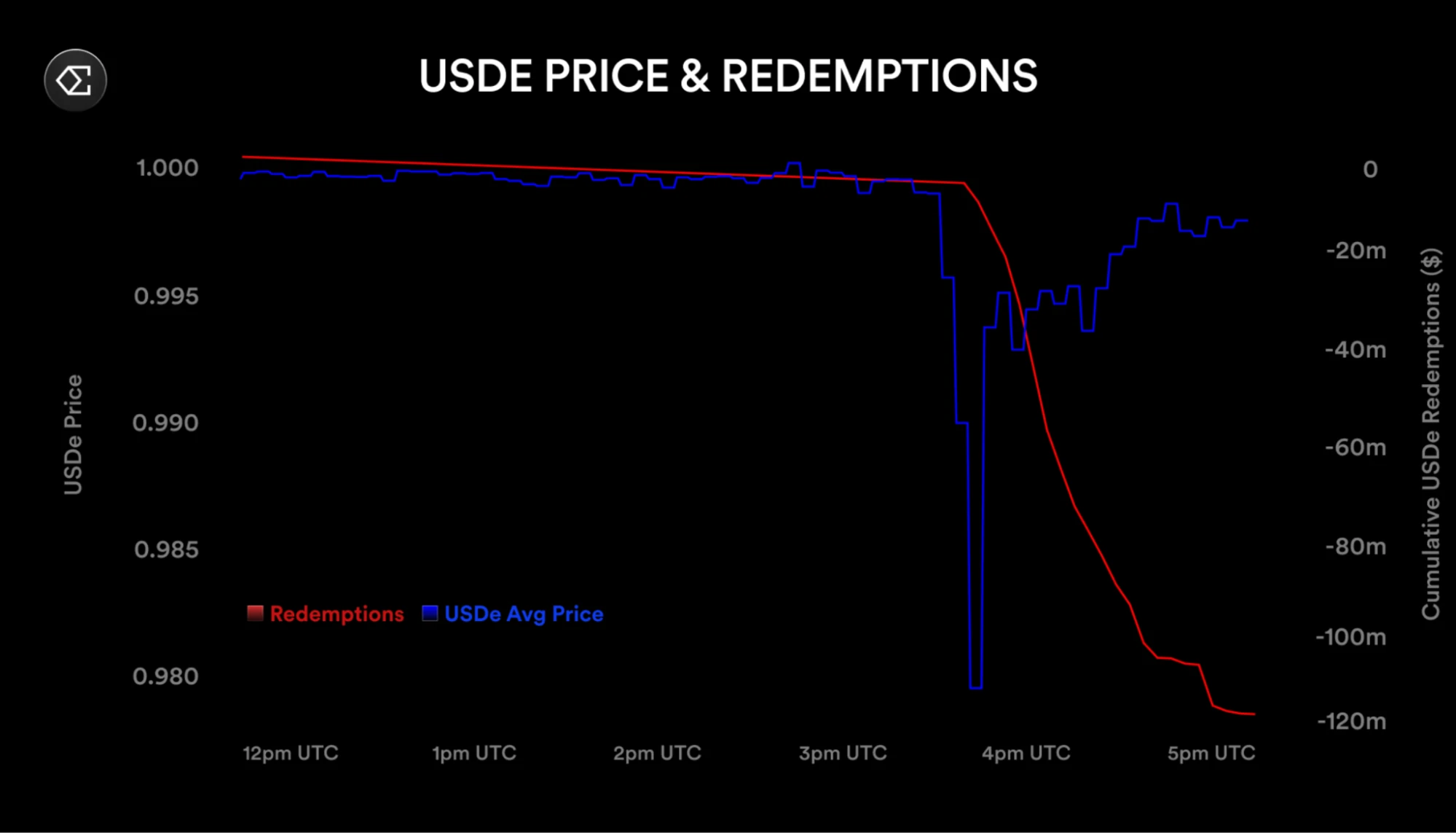

USDe daily currency price and redemption status

Behind this operation is a pre-set emergency mechanism: when market volatility exceeds the threshold, the system automatically triggers the mobilization of liquidity reserves.

In the end, the secondary market price of USDe only briefly deviated from the anchor rate by less than 0.5%, and soon returned to around $1. During the same period, other stablecoins generally experienced a discount of 1%-3%.

Its like when a plane hits turbulence and passengers find their oxygen masks pop out automatically.

Transparent communication: let users know the bottom line

There is an unspoken rule in the cryptocurrency world: when something goes wrong, the project owner either remains silent or gives vague statements, leaving people guessing for a long time. This time, Ethena did the opposite. Within the golden hour after the attack, it issued three announcements in a row.

Confirm that core assets have zero risk exposure;

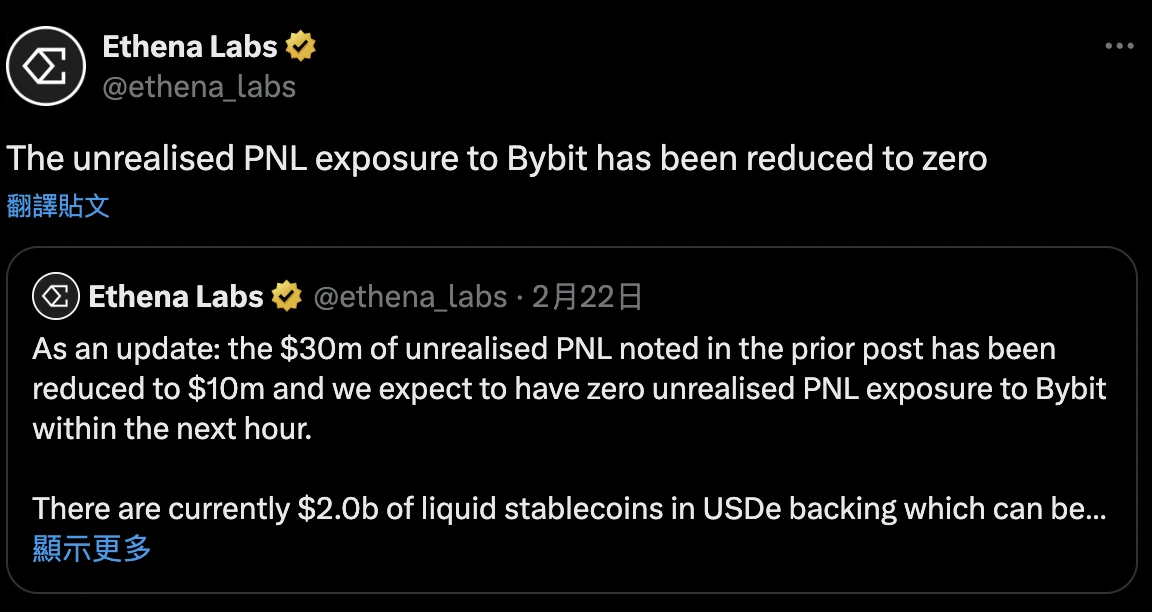

Disclosure of $30 million in unsettled profits with Bybit affected;

Real-time updates on position migration progress.

After that, we kept updating the progress until this part of the risk was cleared, and even Copper came out to confirm that there was no problem with the settlement.

This transparent approach, though simple, is very effective. When users see the custodian Copper personally verifying the security of assets, and when the on-chain data shows the progress of position transfers in real time, panic is quickly replaced by rationality. In comparison, Bybits crisis communication this time is also good, and the two sides sing the same tune, which makes this storm less scary. This also makes people cant help but think: I always thought that information disclosure would expose weaknesses, but now I find that sincerity is the biggest moat.

The truth under stress testing: Design is more important than you think

This attack exposed a cruel reality: the risk in the crypto world is not “if it will happen” but “when it will happen”.

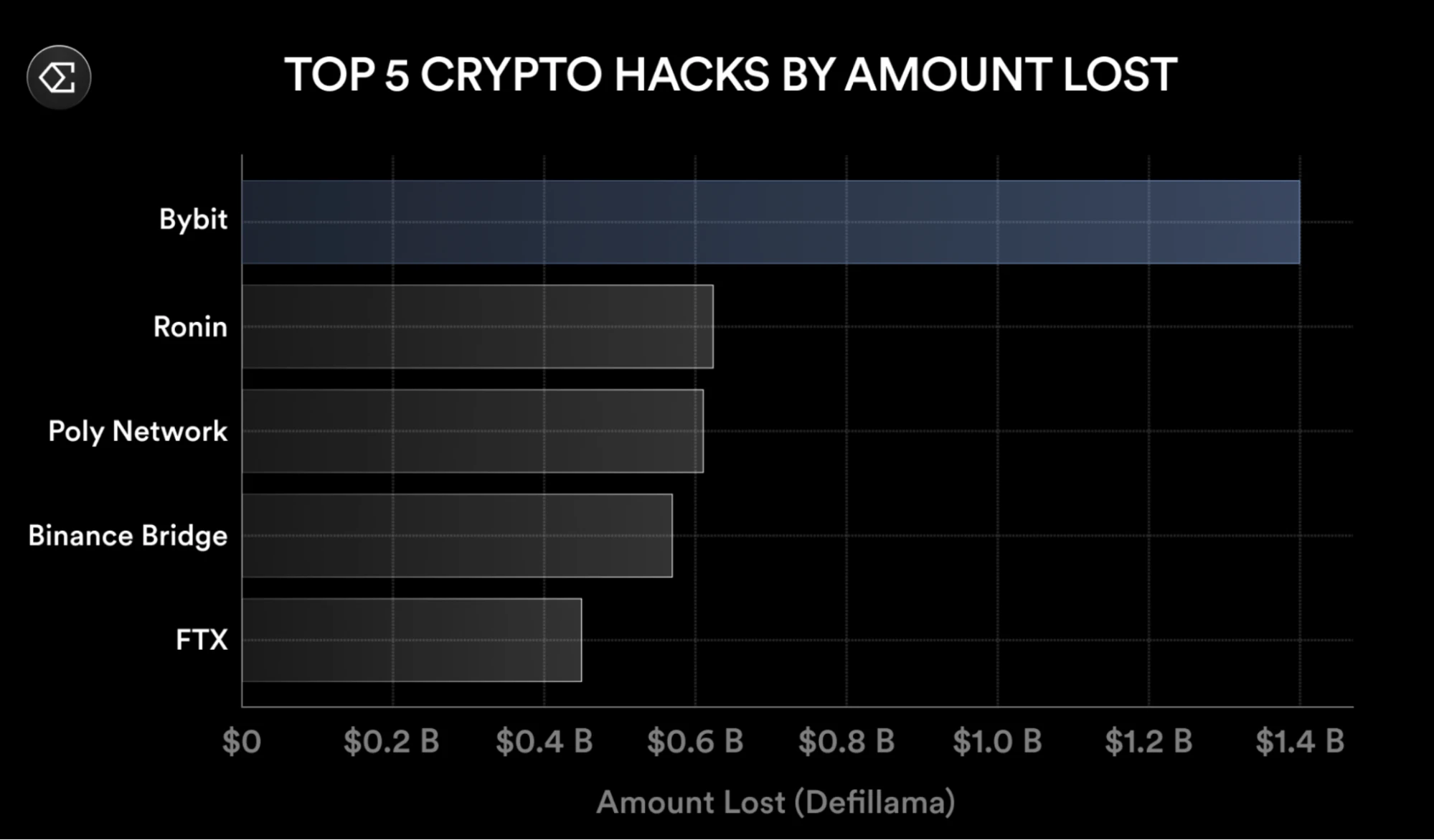

According to DeFiLlama statistics, the amount lost by Bybit this time is the largest cryptocurrency theft to date, surpassing the previous hacking incidents of Ronin Network and Poly Network, which lost $624 million and $611 million respectively.

The top five losses in the history of cryptocurrency, data source: Deflama

But for Ethena, this disaster has become a perfect scenario to verify its design philosophy. Those decisions that were once questioned as overly conservative - such as giving up the custody income in the exchange and presetting the liquidity plan for extreme situations - suddenly showed their foresight in the crisis. This reminds us that when choosing a project, in addition to looking at the income, the underlying design may be the key.

Postscript: Survival rules in the crypto world

The Bybit incident will eventually pass, but the lessons it left behind are far more important than the amount of loss:

Leaving the custody of the exchange is not a sign of cowardice, but a sign of respect for user assets;

Liquidity buffer pools should not be a decoration, but an oxygen mask in a crisis;

The cost-effectiveness of transparent communication is far higher than that of post-event remedy public relations rhetoric.

The story of Ethena may not dramatically change the stablecoin market, but it at least proves one thing: in the crypto world, the best defense is not an indestructible wall, but a design mindset that anticipates storms. When the next black swan comes, those projects that put on life jackets in advance may be the real long-termists.