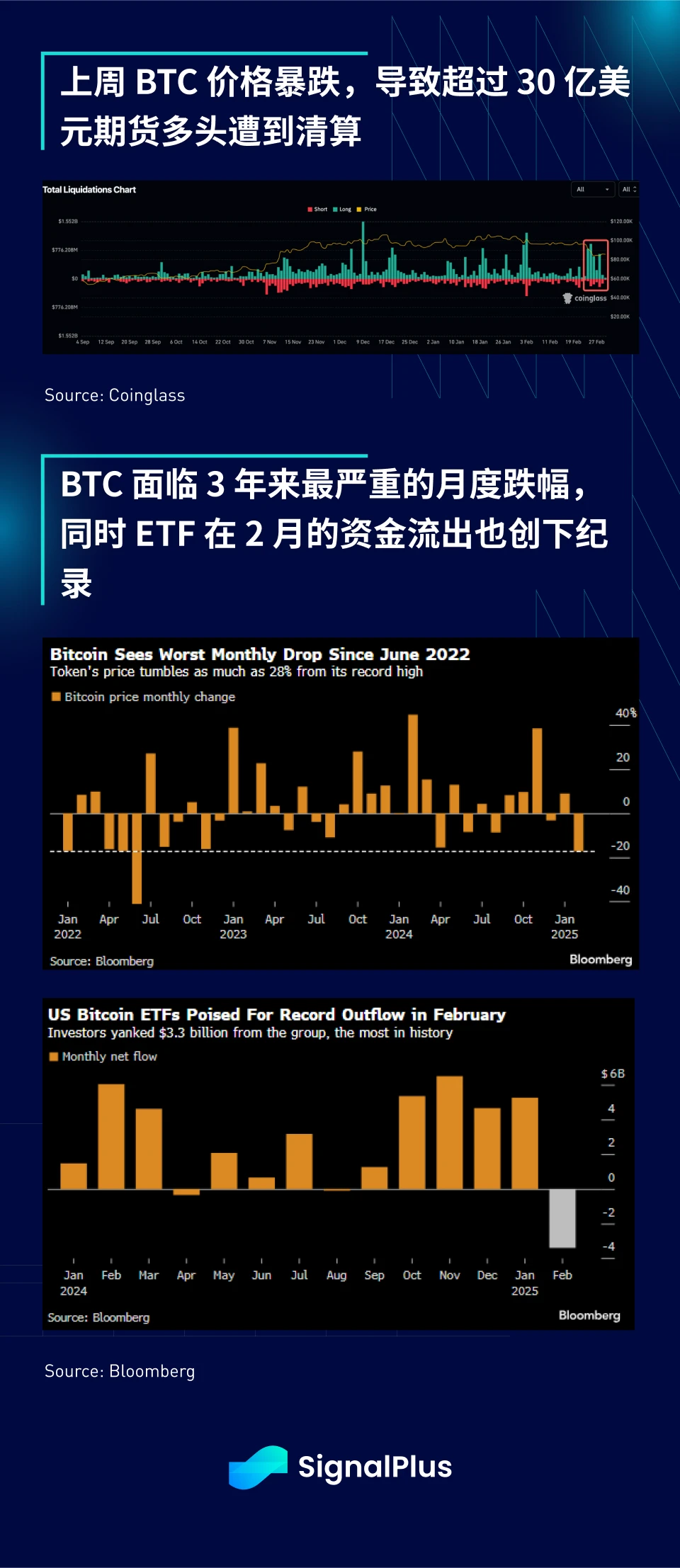

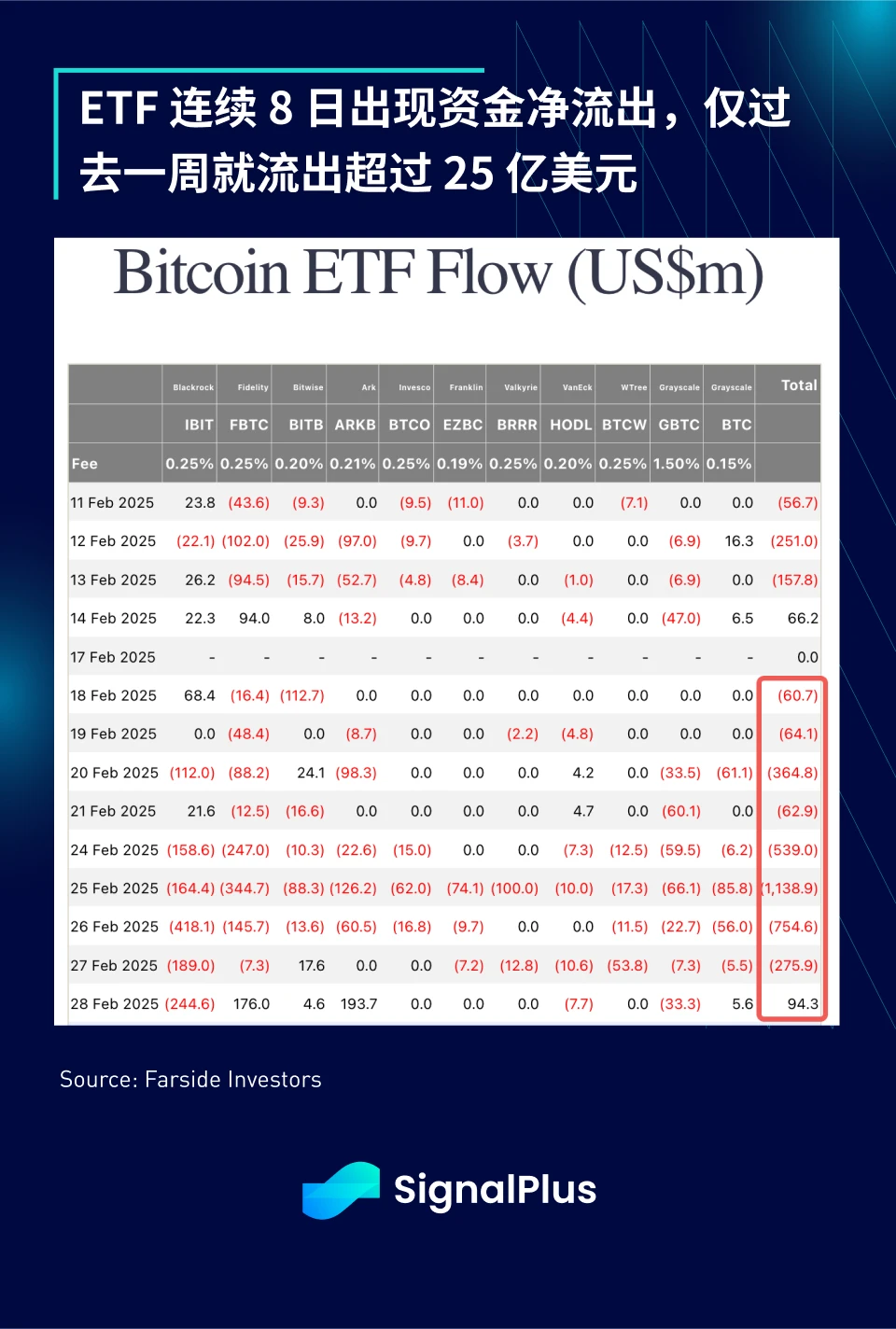

The market environment is full of mixed information, and I really don’t know where to start. First of all, let’s talk about cryptocurrencies. The price of BTC plummeted to $78,000 last week. According to Coinglass, more than $3 billion of futures longs were liquidated. BTC is about to usher in its worst single-month performance since June 2022. At the same time, ETFs also saw the largest single-month capital outflow in history ($2.5 billion outflow last week alone).

As prices plummeted, market sentiment deteriorated significantly, with Alternative’s “Fear Greed” index falling to an extreme low last Friday. The Trump administration then intervened with two pieces of good news, announcing that a “Cryptocurrency Summit” would be held at the White House this week and proposing the inclusion of five tokens in the new strategic reserve (BTC, ETH, SOL, XRP, ADA).

Inspired, the price of the currency rebounded sharply, and the price of BTC rose straight up, but it was blocked at around 9.2-9.3 million, which corresponds to the long-term trend line resistance. If the government is learning how the Federal Reserve manipulates the asset market - oh no, it should be said that it verbally guides the market trend - then so far, their timing and technical control have been perfect. Does this mean that we are witnessing the gradual formation of the Trump Put in the cryptocurrency market?

However, the news of the “strategic reserve” has not been recognized by all market participants. Long-term supporters and opinion leaders of decentralization (such as Naval Ravikant) do not support it. It is expected that the discussion and controversy about the composition of reserve assets will likely continue to ferment for some time to come. It would be quite ironic if the Democratic Party finally chooses to embrace BTC and become BTC extremists in order to oppose the Trump administration.

Our intuition is that this rally may just be a corrective rebound within the trend, as the structural forces of the recent top are still in place (memecoin FUD sentiment, the impact of trading account losses, excessive market position leverage, risk aversion in the overall asset market, etc.), not to mention that the legislative process for establishing a strategic reserve of cryptocurrencies is still long and full of variables.

It should be emphasized that the US President does not have the power (or funds) to directly purchase cryptocurrency assets. Relevant measures still need to be approved by Congress and follow legislative procedures. Before any substantive action is taken, funds must be obtained through the issuance of debt by the Treasury Department.

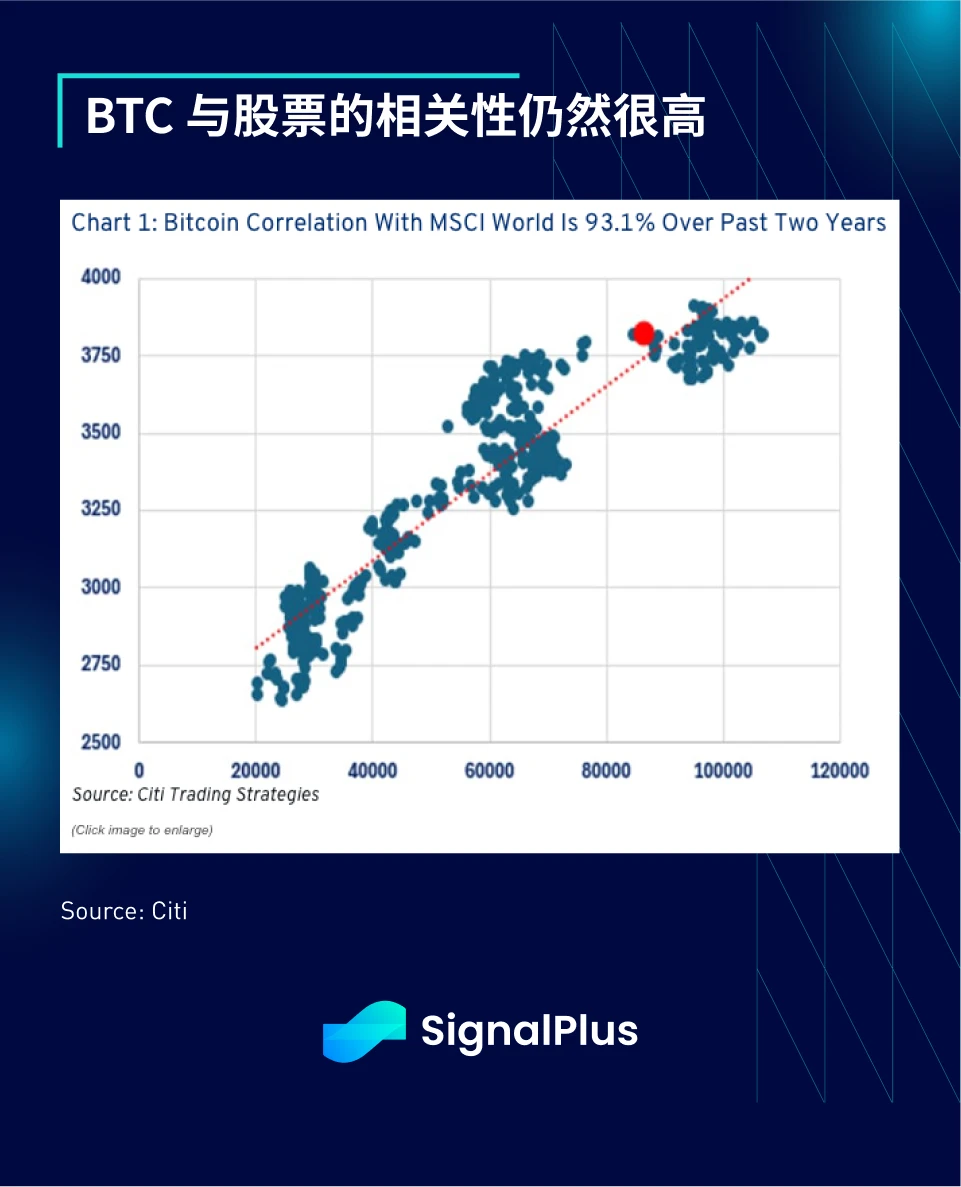

While we are positive about the long-term direction of the market narrative, we must also remind the market not to have overly optimistic expectations for short-term progress, and that cryptocurrency prices will remain closely tied to the risk appetite/risk aversion sentiment of the macro market for the foreseeable future.

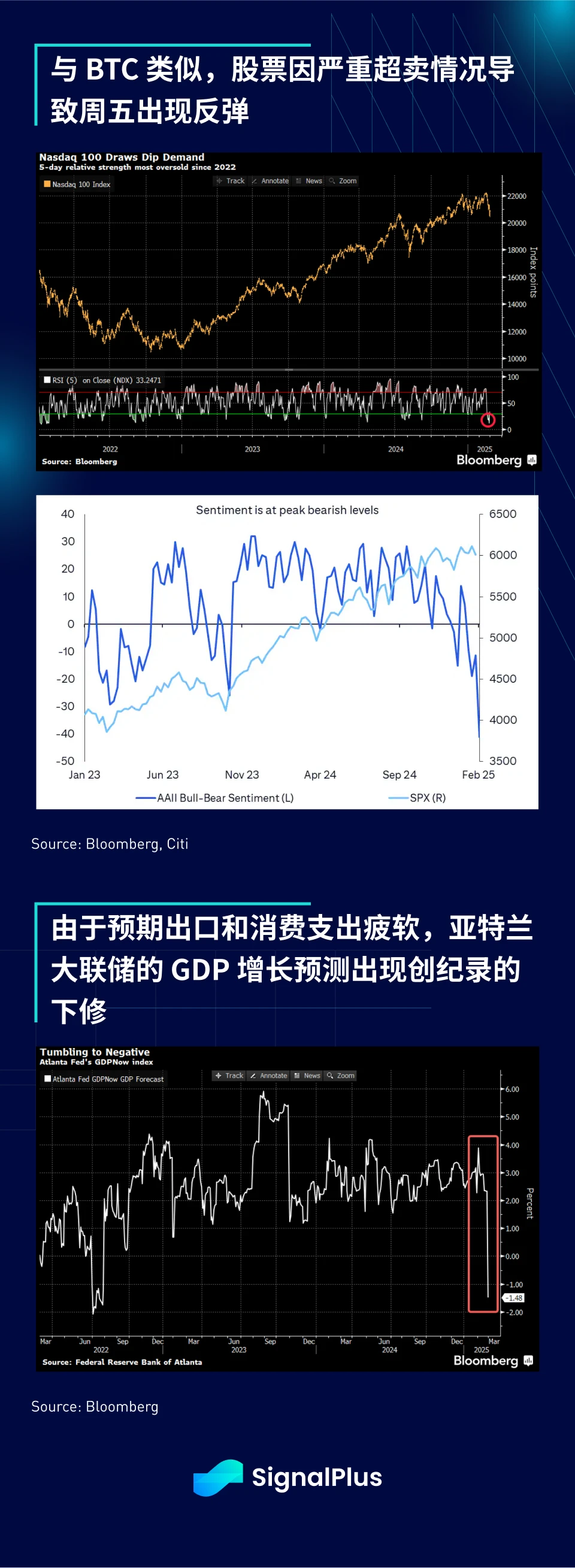

Back to the macro market, despite a rebound in stocks at the close on Friday, stocks most exposed to Trumps policies have fallen about 80% from their election highs, and his uncertain stance on tariffs and DOGE spending cuts has begun to negatively affect market sentiment.

Although the US stock market rebounded from oversold conditions last Friday (+1%), slightly converging the trend in February, the overall macro market sentiment has clearly become more negative, and most economic surprise indexes have turned negative.

Most notably, the Atlanta Fed’s first-quarter GDP growth forecast took a record drop last week, from +2.2% to -1.3%, driven by sharp weakness in exports (from -$29 billion to -$250 billion) and consumer spending (from +2.2% to +1.3%).

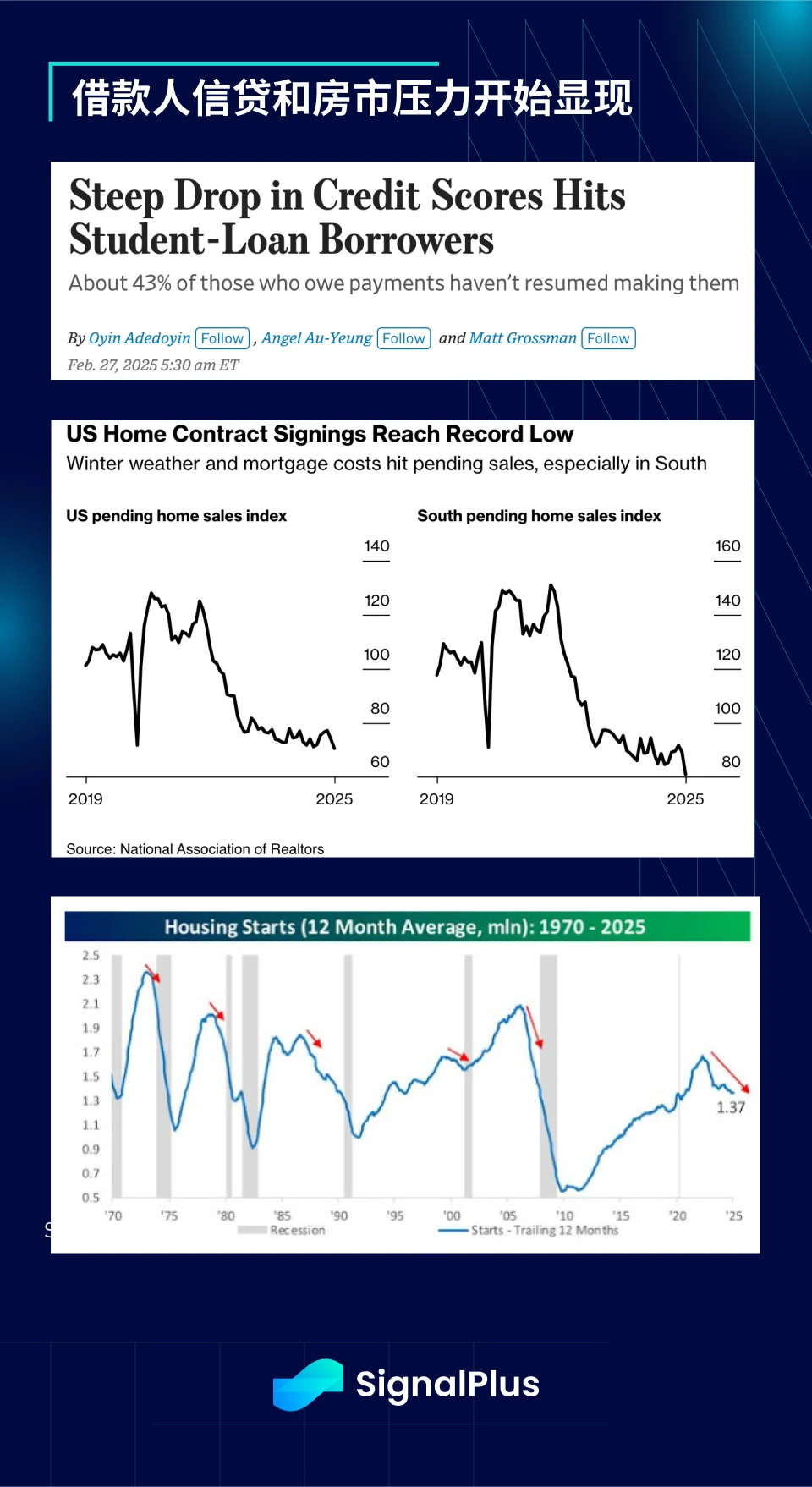

Consumer credit and housing data continued to fall sharply, further fueling expectations of weak economic growth, with new home sales hitting a record low and housing starts falling after a post-pandemic boom.

Meanwhile, Treasury Secretary Bessent seems unfazed by the current economic slowdown, blaming the economic pressure on Bidenflation and the policies of the previous administration. More interestingly, he explicitly stated that the real Trump economy will only come 6-12 months from now, which sounds like the government is not eager to deal with the current economic downturn, and also means that the Trump put option in the stock market may not start to work until a year from now.

If the Trump put in crypto is currently just rhetoric, and the Trump put in equities isn’t in effect until next year, where exactly is the real Trump put? We believe the macro (and crypto) community is missing the point, and the real Trump put has been in play in fixed income markets all along.

Here are some observations from the past month:

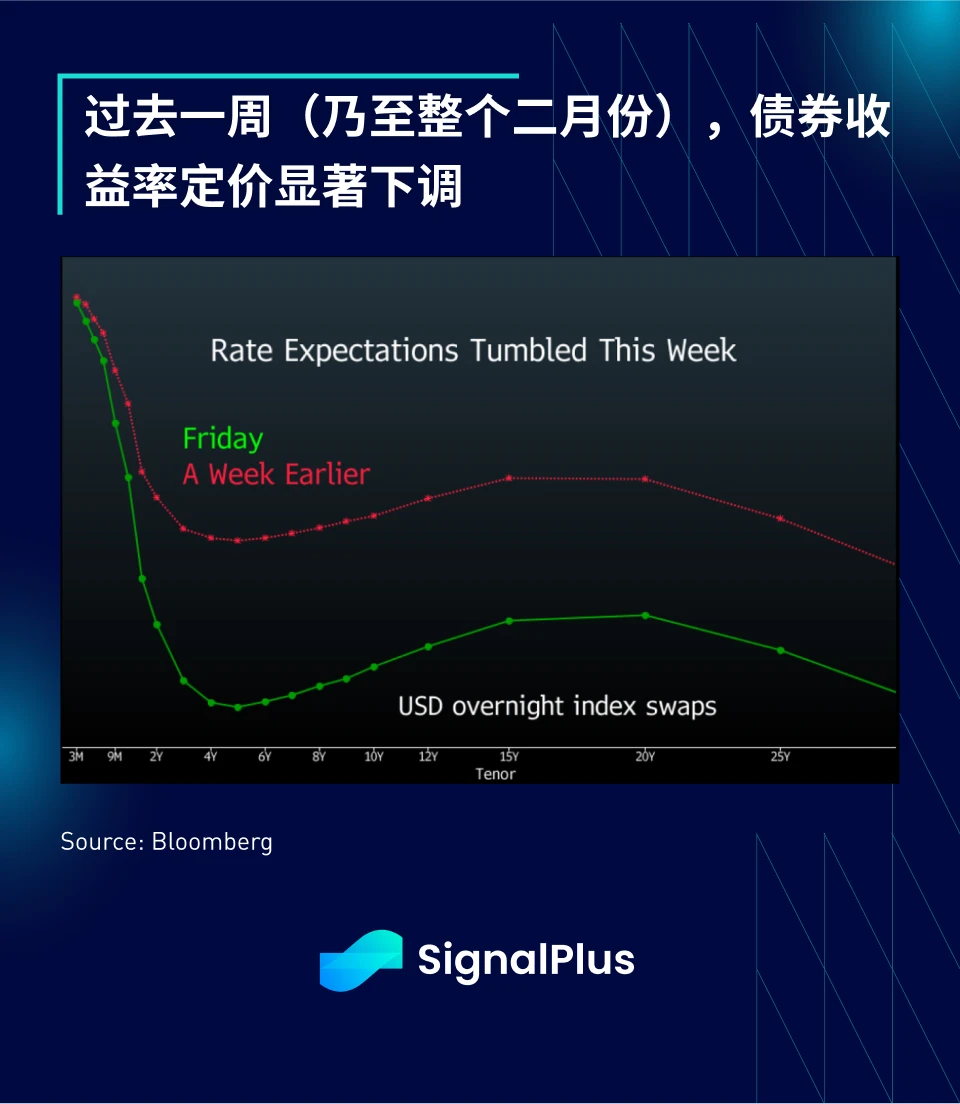

Bond yields have fallen significantly, and expectations for the first rate cut this year have been brought forward from the end of the year to early summer.

Super core PCE has quietly moved lower, having fallen to its lowest level since March 2021 (3.096%).

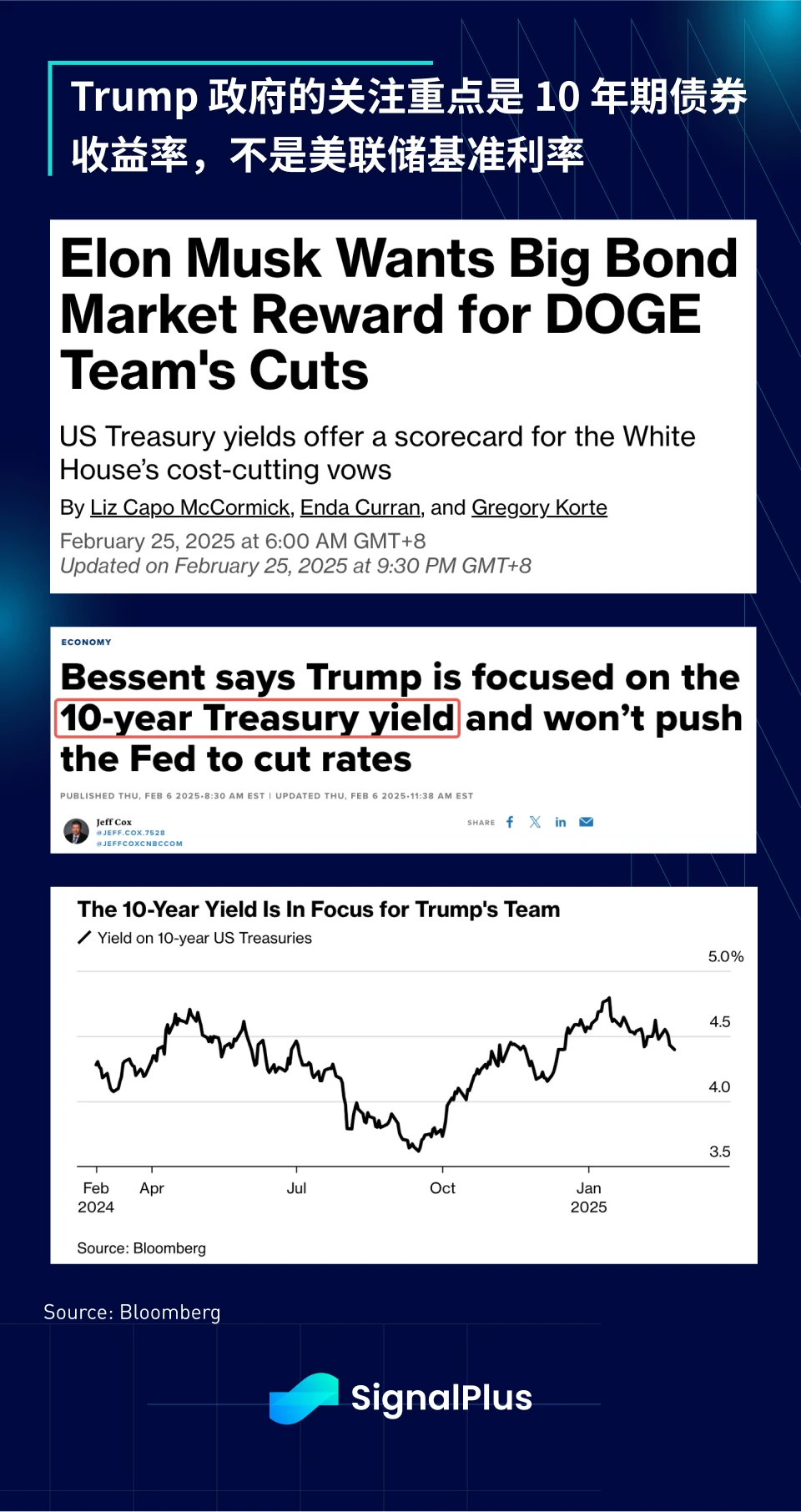

Elon Musk made it clear that the bond market should thank the government for DOGE’s spending cuts.

In a January X conference call, Elon Musk said:

“If you’re short bonds, I think you’re on the wrong side.”

In a public interview with Bloomberg TV, Treasury Secretary Bessent said:

“We are not concerned about whether the Fed cuts interest rates… After the Fed made a large-scale rate cut, the 10-year bond yield rose, and the market reaction raised questions about whether monetary policy can effectively affect the overall economy.”

Bessent further emphasized:

The president wants to see lower interest rates... In our conversations, were primarily focused on the 10-year bond yield.

The president has not asked the Fed to cut rates. He believes that if we deregulate the economy, push through the tax bill, lower energy costs, and so on, then interest rates and the dollar will adjust themselves.

It is clear that the Trump administration has a deep understanding of how financial markets work and how falling long-term interest rates can benefit the economy. In fact, the focus on long-term interest rates rather than overnight rates is exactly the same logic as the Feds QE (quantitative easing) or Operation Twist, but it is expressed in a different way.

In other words, the Trump administration’s current strategy is to lower long-term interest rates, allowing the benefits of lower funding costs to naturally spill over to the U.S. dollar, stock market, and cryptocurrency markets. Therefore, we believe that the real “Trump put option” in the market is in the bond market, not the stock market, and investors can adjust their investment strategies accordingly. (Disclaimer: Please do your own research, not investment advice)

The focus of the market this week will be on whether the United States will impose a 25% tariff on Mexico and Canada as scheduled, followed by the European Central Bank meeting and Fridays non-farm payrolls report. After the market experienced violent fluctuations last week, risk assets may take a breather and may maintain a shock consolidation pattern in the near term, and the upside may be limited.

I wish you all a smooth transaction!

You can use the SignalPlus trading vane function at t.signalplus.com to get more real-time crypto information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlusCN, or join our WeChat group (add the assistant WeChat, please delete the space between the English and the number: SignalPlus 123), Telegram group and Discord community to communicate and interact with more friends. SignalPlus Official Website: https://www.signalplus.com