Original article from Four Pillars

Compiled by Odaily Planet Daily Golem ( @web3_golem )

Editors note: As the meme market on the Solana chain continues to fade, the strategy of many players has changed from looking for gold dogs to looking for gold mines. Among them , the attention of Solanas liquidity re-pledge protocol Fragmetric, which completed a $7 million seed round of financing in early February, has gradually increased, and the current TVL exceeds $85 million. In this research report written by 100 y, not only is the working principle of Fragmetric and the on-chain reward distribution mechanism introduced in detail, but also the advantages of Fragmetric compared to the Ethereum re-pledge protocol EigenLayer are pointed out. It can use Solanas excellent scalability and unique Token-2022 standard to solve the problems of the existing Ethereum re-pledge system.

The first chapter of the research report mainly introduces the concept of re-staking and the two core problems faced by the re-staking ecosystem in the Ethereum ecosystem, namely, the excessive reliance of EigenLayer reward distribution on off-chain calculations and the inability of the liquidity re-staking protocol to distribute rewards to LRT holders in real time due to operating costs and operational complexity, which leads to huge selling pressure when AVS token rewards are distributed. However, in order to save readers precious attention, the first chapter has been deleted in this article, and the focus is on the introduction of the Fragmetric protocol itself. Readers who are not familiar with the concept and history of re-staking can read the original text.

Core conclusions:

Although it is a relatively new ecosystem, the restaking ecosystem has grown at an astonishing pace and has become a core pillar of DeFi. However, the Ethereum restaking ecosystem faces challenges such as low Ethereum scalability and selling pressure from AVS token rewards.

Fragmetric is a liquidity re-staking protocol in the Solana ecosystem that efficiently tracks LRT holders and calculates on-chain contributions through a solution only possible with Solana. This approach successfully solves problems in the Ethereum re-staking ecosystem, such as the selling pressure on AVS tokens.

Fragmetric’s TVL is growing rapidly, Jito Tiprouter is now live, and various protocols such as Switchboard Oracle and Sonic’s Hypergrid are expected to join soon.

Fragmetric Overview

Fragmetric is a native liquid restaking protocol on Solana, built on top of Jito restaking. Users deposit SOL and Solana LST into Fragmetric and receive fragSOL, a token that can be used in various DeFi protocols. Deposited SOL and LST are re-staked through Jito, improving network security.

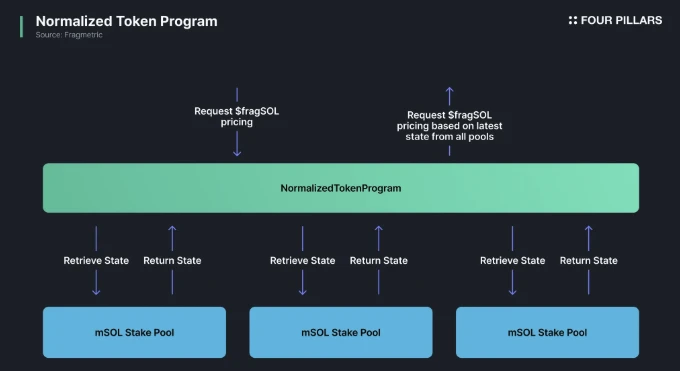

Standardized Token Procedures

While Fragmetric operates similarly to other liquidity staking protocols, accepting SOL and LST in exchange for fragSOL, one of its unique advantages is its “standardized token process” that supports re-staking across multiple LSTs.

LST in the Solana ecosystem (such as mSOL, bSOL, and jitoSOL) have different values, so it is crucial to issue fragSOL at an equivalent exchange rate when users deposit. One way is to use an oracle to adjust the exchange rate before minting. However, despite the high security and reliability of modern oracle protocols, the involvement of its third-party infrastructure always introduces additional fragility to the system.

Fragmetric directly accesses on-chain staking pool data, enabling it to accurately assess the value of SOL-based LST and calculate the correct fragSOL issuance rate. By ensuring that the total value of deposited LST is equal to the market value of fragSOL, Fragmetric maintains a fair and transparent minting process.

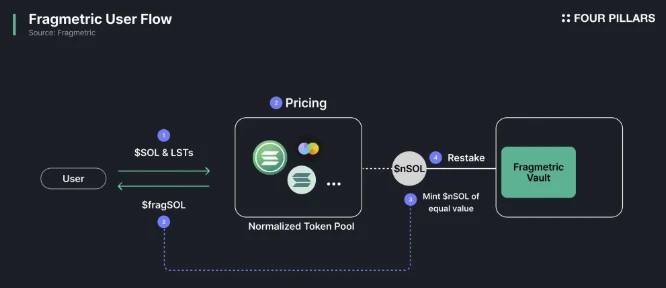

How Fragmetric works

The complete user flow (including the standardized token procedure) is as follows:

Users deposit SOL and LST into the protocol;

Fragmetric’s proprietary normalized token program calculates a normalized price based on the value and quantity of deposited tokens to mint nSOL and fragSOL. The supply of nSOL and fragSOL remains constant;

fragSOL is issued to users, while nSOL is re-staken through Jito and used to protect various NCNs (node consensus networks);

If a Slasher successfully executes a slashing, they will receive nSOL as a reward and can destroy it to claim the corresponding SOL and LST deposits.

Additionally, Fragmetric aims to support other SPL tokens beyond SOL-based assets, such as JTO. Unlike native staking, re-staking relies on cryptoeconomic security, which means that a variety of tokens can be used, not just native tokens. This suggests that Fragmetric could facilitate re-staking of multiple asset types in the future.

Solana Token-2022 Standard Advantages

While Fragmetric’s standardized token program is an advantage, the most important difference between it and other liquidity re-staking protocols is that it uses Solana’s Token-2022 standard (specifically the Transfer Hook function) to implement an on-chain reward distribution mechanism. This allows rewards to be distributed transparently without having to sell them for SOL, ensuring that users receive rewards directly and fairly while maintaining the integrity of the AVS token.

Token-2022 is Solana’s enhanced token standard that expands the functionality of the original SPL token program. It allows developers to design tokens with greater flexibility and implement additional features more easily. One notable feature added in Token-2022 is “interest-bearing tokens,” which automatically accrue interest on tokens.

Prior to Token-2022, implementing such functionality required custom smart contract development, which resulted in greater code complexity and additional audit requirements. However, with native support on the Solana network, developers can now save time and costs while improving token security.

Developers can use Token-2022 to introduce additional features on top of the basic SPL token program including:

Transfer Fees: Transaction fees are automatically charged when transferring tokens. For example, in creator tokens, artists can automatically receive royalties when their tokens are transferred.

Close Minting: Allows you to close a minting account when it is no longer needed. For example, after releasing a limited edition NFT series, you can close the minting account to prevent further minting.

Interest-bearing tokens: allow interest to accumulate automatically over time, similar to Compound’s cTokens.

Non-transferable tokens: Create tokens that cannot be transferred after issuance. This could be used as an NFT for university degree certificates, ensuring they remain in the recipient’s wallet.

Permanent proxy : Grants permanent control of a specific token to a designated account, allowing actions such as destroying or revoking tokens. For example, in a gaming ecosystem, administrators can revoke in-game items from players who violate the rules.

Transfer Hook: Allows custom procedures to be automatically executed during token transfers (described in detail below).

Metadata Pointer: Provides pointers to external metadata accounts, allowing for more dynamic metadata management.

Metadata storage: enables tokens to store additional information, such as names, symbols, and logos. For example, a music NFT can contain details such as the song title, artist name, and release date.

Transfer Hook

Transfer Hook is one of the most powerful features of Token-2022, which can execute custom logic when a token transfer occurs. This feature allows developers to build advanced token mechanisms such as:

Verify KYC compliance before allowing token transfers.

Apply dynamic royalties based on transaction amount.

Update metadata, such as NFT ownership records, when tokens are transferred.

The main advantage of Transfer Hook is that it is automatically executed along with the token transfer. This means that if the Transfer Hook logic fails, the token transfer will not be successful. For example, in a KYC-enforced token, if the sender or receiver fails the KYC check, the transaction will automatically fail, ensuring compliance and security at the protocol level.

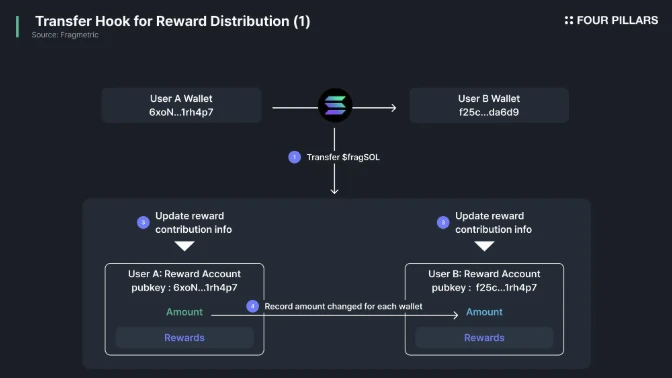

Fragmetric’s on-chain reward distribution mechanism

Fragmetric distributes the accumulated NCN/AVS rewards to users through its reward module. The system uses the Transfer Hook function in Solanas Token-2022 standard to allow the protocol to detect changes in the fragSOL balance in the users wallet and automatically calculate the reward contribution information on the chain.

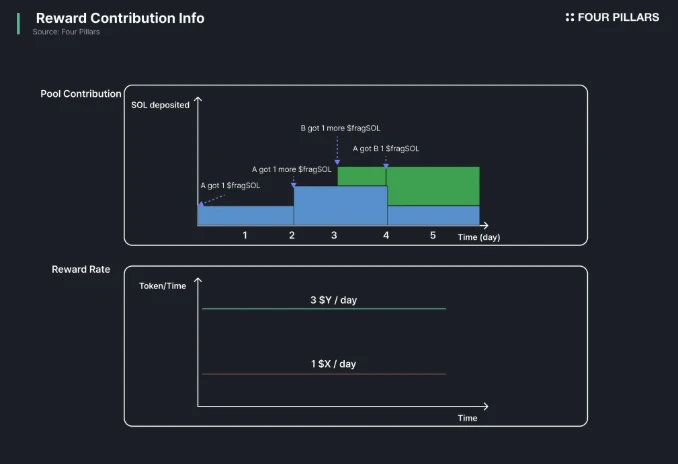

For example, as shown in the figure above, if Alice transfers 10 $fragSOL to Bob, the Transfer Hook will be executed during the transaction, automatically updating their on-chain contribution records. Alices contribution stops increasing after the transfer, and Bobs contribution starts accumulating after receiving fragSOL.

Contribution is proportional to the amount and time of assets re-staked. When claiming NCN/AVS rewards, the system calculates each users share based on their cumulative contribution. These rewards are stored in Fragmetrics reward pool reserve account, and users can claim them in proportion to their total contribution relative to all users.

Assume that Fragmetric supports two AVS protocols, X and Y, and provides 1 $X token and 3 $Y tokens as rewards every day.

Assume that Fragmetric supports two AVS protocols, X and Y, and provides 1 $X token and 3 $Y tokens as rewards every day.

User A: deposits 1 $fragSOL on day 0, increases to 2 $fragSOL on day 2, and then transfers 1 $fragSOL to user B on day 4.

User B: starts holding 1 $fragSOL on the 3rd day, and receives an additional 1 $fragSOL from A on the 4th day, for a total of 2 $fragSOL.

If 1 SOL * 1 DAY equals 1 contribution unit, their rewards at different time points are distributed as follows:

The rewards that B can receive on the 4th day: The total NCN/AVS rewards are 4 $X and 12 $Y, the total cumulative contribution is 7 units, and Bs contribution is 1 unit. B can receive rewards of 4/7 $X and 12/7 $Y.

As available rewards when he collects again on the 2nd and 5th days: On the 2nd day, only A holds fragSOL, so A can collect 2 $X and 6 $Y. Between the 2nd and 5th days, the total rewards accumulated are 3 $X and 9 $Y, and As contribution is 5 out of 8 units, so the rewards A can collect are 15/8 $X and 45/8 $Y.

In summary, Fragmetric leverages Solana’s unique Token-2022 standard and its Transfer Hook feature to intuitively track users’ re-staking contributions on-chain. This allows users to later claim NCN/AVS rewards based on their recorded contributions without relying on off-chain calculations.

In addition, Solana has significantly lower transaction fees compared to Ethereum, enabling users to easily claim various rewards in real time based on their contributions. Since the reward distribution mechanism eliminates the need to sell NCN/AVS rewards, it reduces selling pressure and has a positive impact on the entire ecosystem.

Setting a new standard for the re-staking ecosystem

Fragmetric leverages Solana’s high scalability and unique capabilities to solve key challenges in the Ethereum-based restaking ecosystem:

Implement on-chain contribution calculation: In protocols such as EigenLayer, reward calculations occur off-chain, requiring a trusted third party to submit results on-chain. Fragmetric eliminates this dependency by using Token-2022s Transfer Hook, enabling real-time on-chain contribution tracking. This improves the transparency and trust of the protocol.

Eases Reward Token Sale Pressure : Liquidity re-staking protocols based on Ethereum face operational challenges that force them to sell accumulated AVS rewards for ETH before distribution. However, Fragmetric stores NCN/AVS rewards in a reward pool reserve account, allowing users to directly claim rewards based on their on-chain contributions. Due to Solana’s high scalability and low operating costs, there is no need to sell AVS rewards in exchange for SOL, ensuring a healthier ecosystem without unnecessary selling pressure.

For the NCN/AVS protocol, Fragmetric’s transparent on-chain reward distribution and elimination of forced selling make it an attractive re-staking solution . This advantage has been recognized by the industry. For example, Switchboard Oracle has selected Fragmetric as its exclusive LRT provider, proving that Fragmetric’s reward distribution model is beneficial to the AVS ecosystem.

Currently, Fragmetric’s TVL exceeds $85 million and is growing rapidly. In addition to Switchboard Oracle, other protocols such as Sonic’s HyperGrid are also preparing to join. As the Solana restaking ecosystem expands, can Fragmetric become a new industry standard?