4 Alpha Core Views (3.3-3.8)

1. Macroeconomic Review of This Week

1. Market Overview

Market sentiment is at a temporary low, with the U.S. stock SPX falling below its 200-day moving average, triggering a sell-off in CTA strategies, but the sell-off is nearing its end.

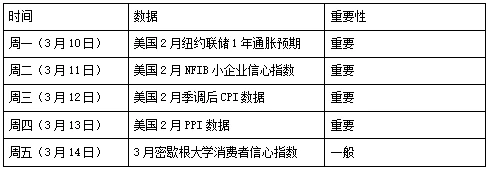

The VIX index remained above 20, the Put/Call ratio increased, and market panic sentiment was high.

The crypto market received limited stimulus from Trumps news on the national strategic reserve of crypto assets, as the policy details were not as expected and the overall risk appetite shrank.

2. Economic data analysis

Manufacturing PMI: The new orders index fell below the boom-bust line, the employment index was lower than expected, and the manufacturing industry became cautious due to the impact of tariffs.

Non-manufacturing PMI: Exceeding expectations, indicating that the US economy remains resilient and the service industry is generally stable, but expansion is slowing down.

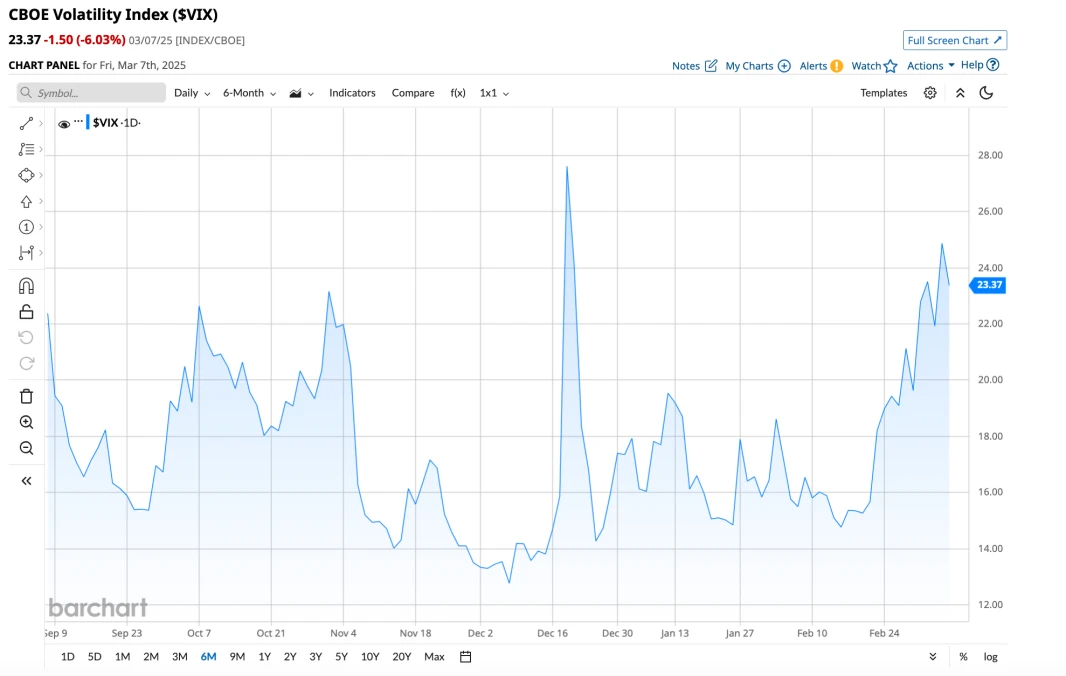

GDP forecast: The Atlanta Fed lowered its first-quarter GDP forecast to -2.4%, but the decline was mainly due to net exports, while consumer spending remained solid.

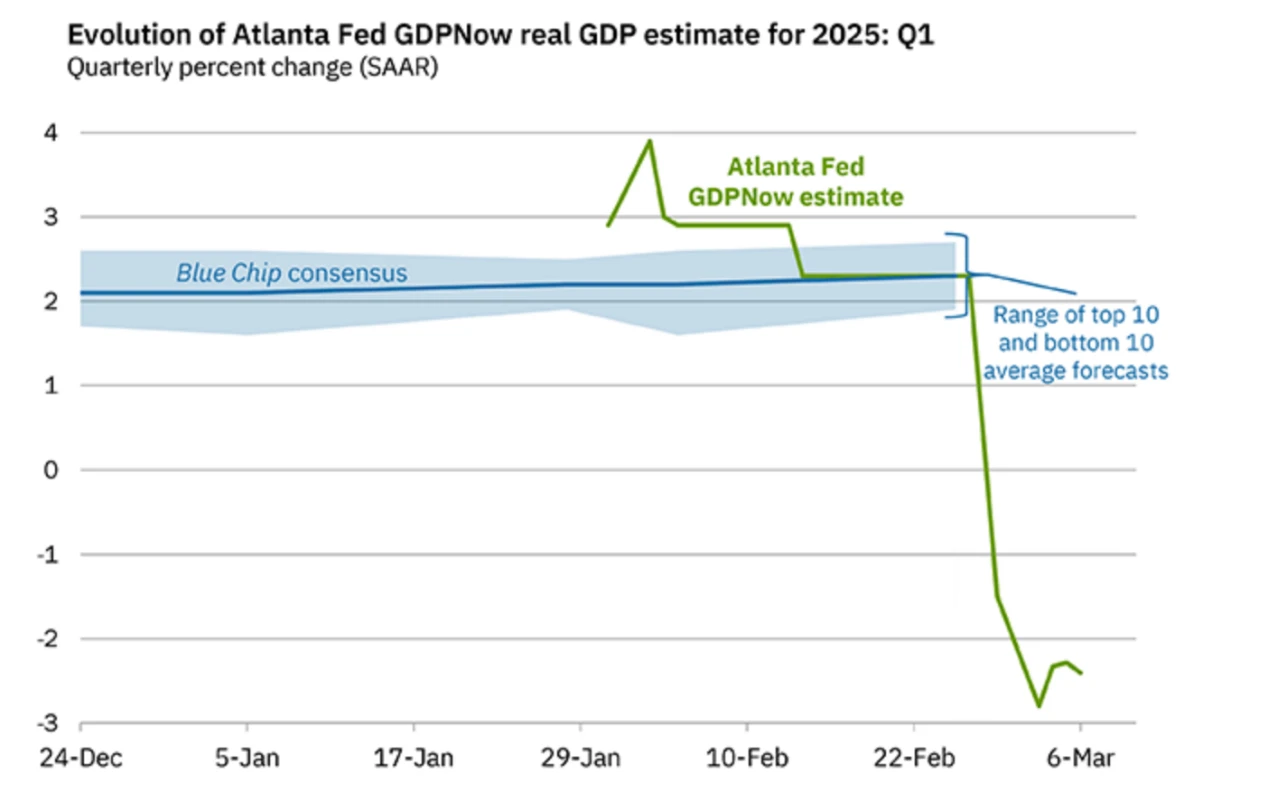

Non-farm payrolls data: Employment data was differentiated, with the unemployment rate rising slightly, job growth slowing down, and wage growth limited, indicating that companies prefer to extend working hours rather than create new jobs.

3. Federal Reserve Policy and Liquidity

1) Powell’s speech:

The Federal Reserve tends to wait and see cautiously until the tariff policy becomes clear.

The 2% inflation target remains the core, and a short-term rise in inflation will not prompt an interest rate hike.

Economic fundamentals remain stable, but if employment continues to slow, the likelihood of a rate cut increases.

2) Liquidity: The Federal Reserve’s broad liquidity has improved marginally, but market sentiment remains weak.

3) Interest rate market: Short-term financing rates fell, the market bet on interest rate cuts in the next 6 months, and the 10-year US Treasury yield turned upward, indicating that recession expectations have eased.

2. Macroeconomic Outlook for Next Week

The market is still in the stage of expectation game, the trend is unclear, institutional funds are more inclined to wait and see, and it is difficult for the market to form a clear direction in the short term.

Pay attention to the micro-changes in economic data from March to April. The impacts of tariffs, government layoffs, interest rates, etc. have a lag, and confirmation of market trends requires more data support.

The market should not be overly pessimistic. The economy has not deteriorated significantly. Investors should manage their positions, maintain a balance between offense and defense, and wait for clearer trend signals.

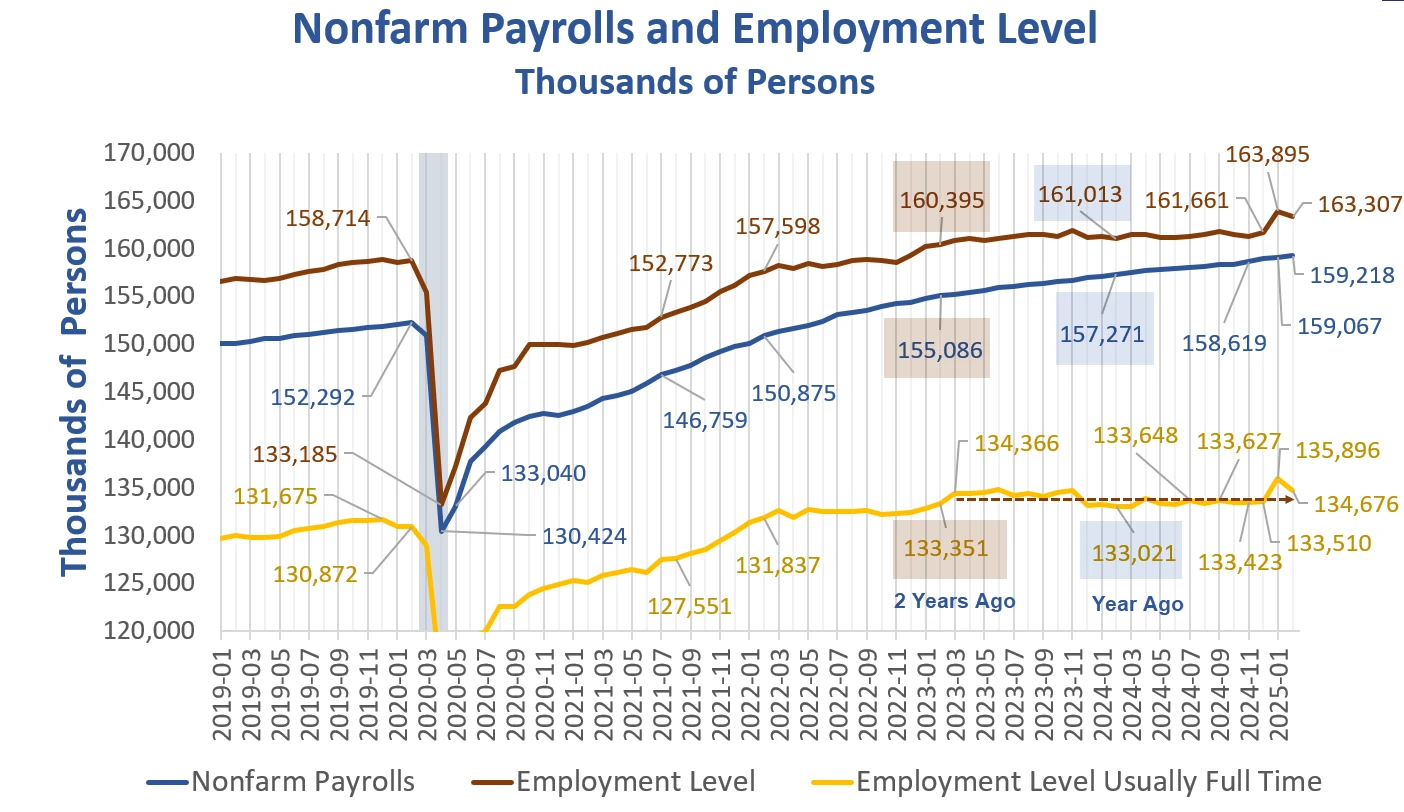

Key data next week: Pay attention to key data such as CPI, PPI, and Consumer Confidence Index to judge changes in inflation and consumption trends.

The trend is uncertain, non-farm payrolls are differentiated, will it rebound or further bottom out?

1. Macroeconomic Review of This Week

1. Market overview this week

Judging from the volatility of major asset classes, market sentiment is still at a stage low this week. Although Fridays non-farm data and Powells speech have eased the markets pricing of the recession trade, the uncertainty of the tariff outlook offsets the boost to the market from the data.

From the perspective of US stocks, SPX fell below the 200-day moving average for the first time in 16 months. The market decline triggered the selling of US stock CTA strategies. According to statistics from Goldman Sachs trading department, a total of $47 billion was sold in the past week, but fortunately the selling is nearing its end. From the perspective of volatility, the VIX index continued to maintain a high level of more than 20, much higher than the level of around 15 at the beginning of the year. At the same time, the Put/Call Ratio rose again and broke through 0.9. These data corroborate each other, reflecting that the markets panic and bearish sentiment are still high.

Chart 1: This week, the VIX index continued to remain above 20 Source: Barchart

From the perspective of the cryptocurrency market, despite the positive stimulus of Trump signing the national strategic reserve of crypto assets this week, the improvement in the market is not obvious. On the one hand, the main form of strategic reserves is the confiscated assets of the United States, and there is no hint of new purchases, which is lower than market expectations; on the other hand, due to the callback of major risk assets such as US stocks, the risk appetite has obviously shrunk, the overall liquidity is poor, and BTC has been unable to rebound.

As we pointed out last week, the market has not formed stable trading expectations at present, and concerns about macro policy uncertainty have suppressed the improvement of market sentiment.

2. Economic data analysis

The focus of this weeks data analysis is still on the US economy. A number of data released this week further prove that the US economy is indeed slowing down, but from the microstructure of the data, we believe that the markets recession concerns are exaggerated.

The February ISM manufacturing index released on Monday continued the expansion trend in January, but the pace slowed down, with a composite index of 50.3, which was lower than market expectations. It is worth noting that the new order index was below the boom-bust line, the first contraction since October last year, the employment index was significantly lower than expected, and the price index was higher than expected. The structural data diverged, indicating that under the influence of Trumps tariffs, manufacturers have become more cautious in production and recruitment, and the demand side may slow down further; however, the non-manufacturing PMI released on Wednesday gave the opposite data, with the reading exceeding market expectations. The two data point to two facts about the current US economy:

Trump’s tariff policy has indeed caused great disturbance to US importers/manufacturers and continues to exert negative impact.

The momentum of the US economy has indeed slowed down, but it should be noted that the US GDP mainly relies on the service industry. The overall situation of the service industry is still relatively stable, but it has slowed down from the past aggressive expansion to a slow growth trend, which shows that the fundamentals of the US economy have not yet shown clear signs of deterioration.

The Atlanta Fed updated its latest GDP forecast on Thursday, with data showing that the latest forecast for first-quarter GDP is -2.4%, slightly higher than the -2.8% forecast on March 3.

Chart 2: As of March 6, GDP forecasts continue to decline

Source: Atlanta Federal Reserve

The market is concerned about the continued negative GDP forecast, but structurally, US personal consumption expenditures and private investment did not decline in the first quarter, but the contribution of net exports to GDP fell sharply due to the surge in imports caused by tariffs, which is the core reason for the lower GDP forecast. This also shows that as long as consumer spending maintains a stable growth rate, concerns about fundamentals may be overly pessimistic for the US economy, which is mainly driven by consumption.

The five major non-farm payroll data this week slightly reversed the markets pessimism and also partially weakened the markets expectations of a recession. From the unemployment rate in February, the published data was slightly higher than market expectations, at 4.1%; the seasonally adjusted non-farm payrolls were 151,000, lower than the markets expectations of 160,000; in terms of wages, the annual growth rate was lower than expected, while the monthly rate was in line with expectations, but lower than the previous value. At the same time, further analysis of the sub-data provided has the following key conclusions:

Although net employment has increased, the underemployment rate and the number of newly unemployed people have increased rapidly, reflecting that the overall employment situation is obviously weak, but it does not point to a deterioration.

Limited wage growth and longer working hours indicate that companies are currently more willing to increase the working hours of existing employees rather than recruit new employees; limited wage growth reflects the slowdown in demand and the increased demand for companies to control costs.

Figure 3: Changes in US non-agricultural employment from 2019 to 2025 Source: Mish Talk

This Friday, Federal Reserve Chairman Powells speech at the 18th Monetary Policy Forum attracted much attention from the market. The market was generally stable after his speech. Powells speech actually gave several key guiding information:

It implies that the Federal Reserve tends to be cautious and wait-and-see until Trumps tariff policy becomes clear. The original words are: The cost of being cautious is very low.

The 2% inflation target was reiterated again; at the same time, it was specifically hinted that the Fed is more concerned about long-term inflation expectations, and if short-term inflation expectations rise, it will not lead the Fed to restart interest rate hikes.

The Federal Reserve is relatively optimistic about the current economic situation, believing that although consumer spending has slowed down, economic growth is relatively stable and the labor market is generally sound.

If more data points to a slowdown in the labor market, it will be possible that the Fed will resume cutting interest rates.

These four points combined actually conveyed to the market expectations of a relatively loose monetary policy. In other words, Powells speech gave the current decision-making path of the Federal Reserve: first, under the stable long-term inflation expectations, the Federal Reserve has no pressure to raise interest rates; against the backdrop of continued slowdown in employment data, the Federal Reserve may tolerate short-term inflation above the target and continue to maintain an easing stance.

3. Liquidity and interest rates

In terms of the Feds balance sheet, the Feds broad liquidity margin continued to improve this week, and as of March 6, it returned to 6 trillion, but the scale of the improvement was not enough to offset the decline in market sentiment.

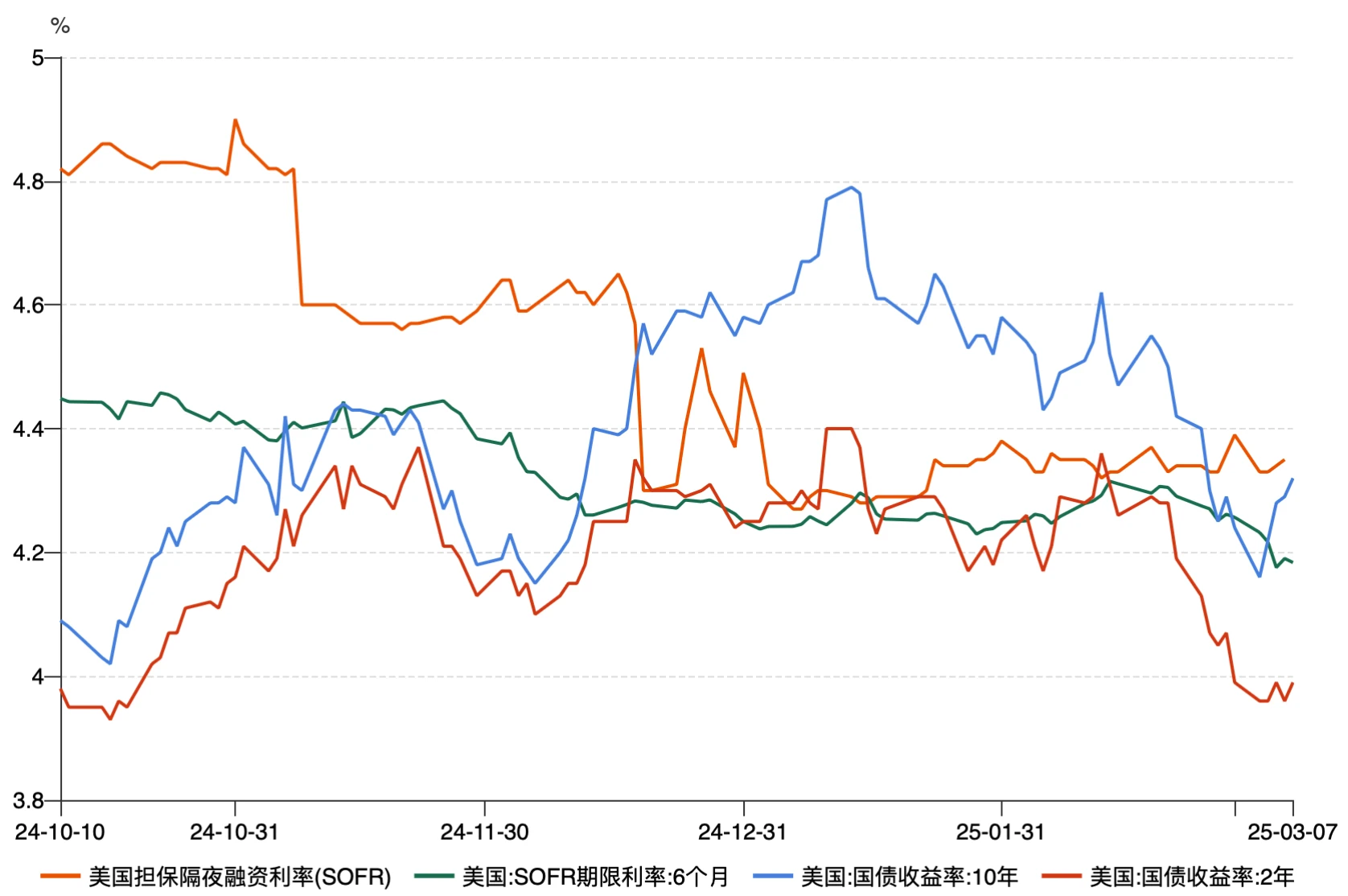

From the perspective of the interest rate market, measured by the short-term financing rate, the interest rate derivatives market is clearly betting on a rate cut in the next six months, and the downward slope of the SOFR 6-month term rate is significant. From the perspective of Treasury yields, the market is pricing in three rate cuts in the future, each of 25 BP, but at the same time, the 10-year Treasury yield turned upward, indicating that the markets recession concerns have dissipated in Powells speech.

Figure 4: Changes in U.S. overnight financing rates and Treasury yields Source: Wind

2. Macroeconomic Outlook for Next Week

Based on the conclusions from the interest rate market, risk market and economic data, we believe that the market is still in a critical period of digesting risk expectations. The risks of re-inflation and recession brought about by tariffs cannot be falsified by existing data, which means that the trend confirmation of the market still requires more real data to calibrate. In other words, for mainstream institutional funds, based on risk aversion considerations, they will not build large positions, but are more likely to adopt a cautious wait-and-see attitude.

Based on the above analysis, our overall view is:

The current main line of the market is still expectation game rather than trend confirmation. Therefore, from the perspective of risk logic, the market cannot give a clear direction in the short term. For investors, either waiting or making decisions when the market pulls back to a reasonable position will have a higher profit and loss ratio.

Since factors such as tariffs, US government layoffs, and interest rates have a lagging impact on the market, investors should focus on the micro changes in various economic data from March to April. Macroeconomic variables will also gradually become clear in the next two months. Once interest rates confirm a market turning point, the crypto markets rebound potential will be greater.

Micro data do not point to a significant deterioration in the economy, and we should not be overly pessimistic. The market always accumulates risks when it rises and releases risks when it falls. Investors are still advised to manage the position risks of their investment portfolios, increase defensive allocations, and strike a balance between offense and defense amid drastic market fluctuations.

The key macro data for next week are as follows: