Original | Odaily Planet Daily ( @OdailyChina )

Author|Nan Zhi ( @Assassin_Malvo )

In the bleak market conditions, the bold and open-and-close Liang Xi and the Hyperliquid 50x leverage trading whale have become the focus of market attention. Many people regard them as short-term market indicators. The Hyperliquid whale, with its previous extremely high leverage trading and precise opening prices, is considered to be insider funds, which has attracted countless followers.

Reference reading: Review of the Hyperliquid contract insiders cool operations, precise opening and closing of long and short positions .

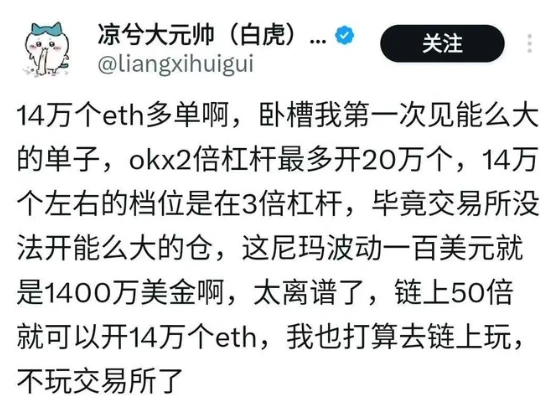

Today, the Hyperliquid 50x leveraged trading whale started trading again, opening a long order of ETH worth about $300 million with 50x leverage , with a maximum floating profit of $8 million . But soon after, he chose to withdraw most of the principal and profits, actively raising the liquidation price, resulting in his long position of 160,234.18 ETH being actively liquidated, totaling $306 million.

The most classic question in the community is: Why can it open such a large position? Who is the counterparty (who is losing money)? Below, Odaily Planet Daily will give a brief explanation of Hyperliquid and HLP mechanisms to answer this question.

Conventional matching mechanism

Readers must be familiar with order book trading models such as Binance and OKX. In this trading model, the counterparties are long and short users.

There are two other types of models on the chain - AMM and GMX-style perp DEX.

AMM is popular for its permissionless nature and ease of use and calculation, but for mainstream, high-market-cap currencies, on the one hand, trading is not intuitive enough, and on the other hand, it is difficult to use leverage.

The perp DEX represented by GMX uses GLP as the counterparty of the trader . The special thing about it is that the opening price is calculated using the mark price provided by the oracle. Simply put, if the user is trading BTC, the oracle will obtain data sources from exchanges such as Binance, OKX, and Bybit, calculate a mark price, and then open a contract according to this mark price. For example, if the current BTC mark price is 82000 USDT, the users opening price is this price, without having to eat up the sell orders of 82001 USDT and 82002 USDT in turn, and finally calculate the average price.

Under the GMX model, GLP is a passive liquidity strategy. Without taking into account various fees, the users profit = GLPs loss, and vice versa .

What about HLP?

Back to Hyperliquid, HLP is also a strategy of raising funds and acting as counterparties to traders , but unlike GLP, HLP is an active strategy in which Hyperliquid actively makes markets and earns profits through market making, collecting funding fees and liquidation. All users can provide liquidity for HLP and share profits and losses.

Why can such a large position be opened?

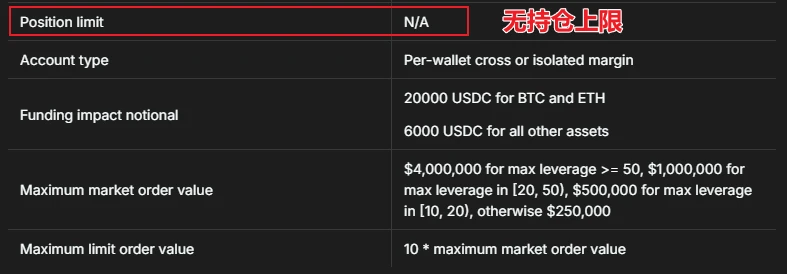

The most special thing about Hyperliquid is that before this incident, it had no position limit and only limited the amount of market orders and pending orders.

As a result, the whale conducted hundreds of transactions within 2 hours and opened long orders for ultra-high leverage contracts worth US$300 million, successfully attracting even Liang Xi.

What are the benefits of malicious liquidation?

Why did the whale choose to transfer margin and raise the liquidation price to close the position? There are two mainstream views:

The whale took advantage of Hyperliquids position loophole. It may have opened short orders on other platforms. This method can create a sharp drop and provide it with two-way profit opportunities.

If the whale chooses to use manual, multiple closing methods, since it is now a secondary leader and is closely watched by the market, it may cause ETH to fall rapidly and profits to shrink rapidly during the closing process. Therefore, a one-time, fast closing method is chosen.

How do other exchanges handle massive amounts of highly leveraged contracts?

In fact, this is not the first time that this scenario has happened. In order to deal with the risk of liquidation, CEXs such as Binance and OKX have also introduced mechanisms such as automatic liquidation (ADL) and margin ladders to prevent it.

Automatic Deleveraging: Taking OKX as an example, in the case where the OKX risk reserve cannot absorb further losses from liquidating losing positions , ADL will be triggered to limit further losses of the risk reserve. Essentially, a losing position is matched with an opposite profitable or highly leveraged position (the decreased position), and the two positions offset each other and close. Due to ADL, a profitable position may be closed , so the future profit potential of the position is limited.

Tiered margin: As the size of the position increases, the corresponding margin ratio will also increase in a ladder-like manner. Through the tiered margin mechanism, large position traders need to invest more margin, thereby reducing the risk of liquidation or loss of positions due to market fluctuations. This means that users cannot open large-volume contracts that can greatly affect the market with low margins.

How does Hyperliquid respond?

Hyperliquid Vault data showed that after the whale proactively triggered the liquidation mechanism, HLP lost a total of US$3.45 million .

Hyperliquid officially responded that this incident was not a protocol vulnerability or hacker attack, but was caused by the users withdrawal of unrealized profits (PNL), which led to a drop in margin and triggered liquidation. Hyperliquid said that the user still made a profit of $1.8 million in the end, while HLP lost about $4 million in the past 24 hours . Despite this, HLPs historical cumulative PNL remained at about $60 million .

In response, Hyperliquid announced that it will adjust leverage limits to optimize liquidation management and enhance market buffer capacity during large-scale liquidations. The maximum leverage of BTC will be adjusted to 40 times, and the maximum leverage of ETH will be adjusted to 25 times.