When value becomes a bubble and the market is influenced by politics, encryption is no longer completely decentralized encryption.

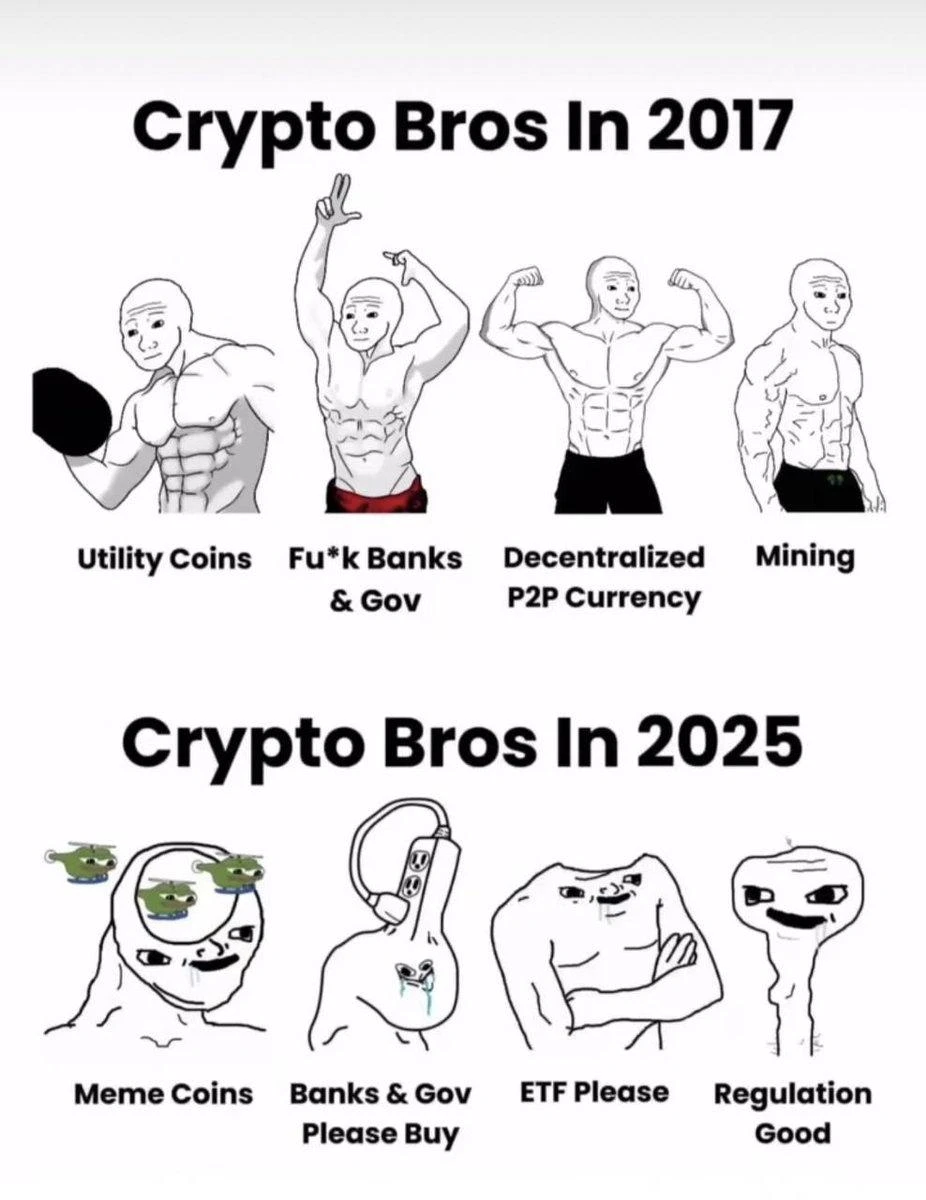

It was not until March 2025, when the U.S. stock market crashed and Bitcoin collapsed, and mainstream altcoins fell into zombie coins, that I finally realized that the essence of the crypto market is not technological innovation, but a large-scale reality show. Those meme coins with absurd names are the real protagonists. The exchanges coin listing announcement is more valuable than the white paper, and the KOLs emoticons are more useful than technical analysis.

So, I decided to perform a thorough trading performance art: I took out 1,000 U and invested it in all the incomprehensible Meme coins and hot coins on LBank, and used two weeks to verify a wild theory - in this magical market, the lower the IQ, the easier it is to make money. At present, the total profit of my account is 191,151 USDT. But the process is far more absurd than the ending...

Opening: When the US stock market plummeted and KOLs shouted orders, I smelled an opportunity

Since March 2025, the US stock market has been experiencing a continuous Black Friday - the Nasdaq has continued to plummet, Wall Street analysts are crying liquidity crisis, but the crypto circle is undercurrent. At three oclock in the morning one day, I saw a KOLs tweet: Bitcoin fell below 60,000? Dont panic! Meme season is here! The picture is some well-known tokens first launched in the LBank list: ACT, MOODENG, GOAT... These names are very much like crypto jargon, but my adrenaline is soaring - the rebound after the plunge has always been a carnival for local dogs.

Sure enough, the next day (March 3), LBank announced the launch of STAR 10, with an opening price of 0.085 U. Because it is the eponymous token of the football elf Ronaldinho, and as one of the representatives of Brazilian football, Ronaldinho, who has his own popularity, not only won the Golden Ball Award, but also won the unique title of Prisoner King, I decisively exited the market and went all-in for 1,000 U. Later, CZ led the order in disguise, and the K-line rose all the way, but later the community spread information such as signed trading, so I decisively left the market and made a profit of 3,700 U. Later, STAR 10 really fell all the way.

Operation: From scientific smart money to industrial money grabbing

Principle 1: Specialize in “not understanding”

On March 4, LBank launched PWEASE. When I saw the profile picture, my first reaction was: What the hell is this? But the data doesnt lie - the on-chain holdings are dispersed, Twitter emojis are fighting, and the #PWEASE topic has soared 300% in 24 hours. I decisively bought 800 U at 0.005 U, and sold it at 0.035 U on March 9, with a return rate of 600% and a profit of 4,800 U.

Principle 2: Be Faster Than the Dealer

On March 6, ROAM was launched. It opened at 0.05 U. I searched through the data and only found some scattered information. But the trading volume of LBank suddenly surged, and the price instantly rushed to 0.8 U. I immediately placed a 15x take-profit order, and it was triggered 15 minutes later. Later I learned that this was a blitzkrieg by a market maker and KOL to kill hesitant retail investors.

Principle 3: Use platform mechanisms to counter harvesting

On March 9, I bought 10,000 U of DRB. In addition, LBanks compensation mechanism became a life-saving talisman - even if the price plummeted, the platform would compensate according to the market average price. As a result, DRB continued to rise after the opening, and I easily made a profit of 433.33%, a profit of 43,333 U. It turns out that when the market is not good, the exchanges MEME coin is the strongest Alpha!

Market revelation: Meme has evolved into an “assembly line”

1. New script for market makers: DEX launch → create FOMO → launch CEX

Today’s memes are no longer “community-initiated” but an industrial assembly line: project owners pull up the price on DEX to attract attention; KOLs simultaneously call for “the next Pepe”; and exchanges such as LBank are quickly launched.

2. Survival rules for retail investors: turn yourself into a “quantitative robot”

Heat Scanner: Use TG bot to monitor the Twitter interaction of LBank new coins;

Automatic stop-profit: set a psychological price, place orders in time, and let the mechanism make decisions for you;

Guerrilla warfare of funds: the total position is divided into multiple parts, and the investment in a single currency does not exceed 30% to prevent being killed three times by local dogs.

Staying sane in the absurdity

Admitting the absurdity: I used to firmly believe in technical analysis until I saw ROAM soar 22 times because Musk casually mentioned interstellar travel - the crypto market does not need logic, it only needs stories.

Rejection of faith: On March 11, a superstar project TIA announced a partnership with Apple, but the price plummeted by 15%. I silently changed my computer wallpaper to a large font: Memes dont care about fundamentals.

Taking advantage of human nature: When the whole network was wailing about the U.S. stock market crash, I looked for coins with absurd names and bizarre icons in the LBank new coin list - the more panic the market is, the more local dogs need a carnival to survive.

In two weeks, my account went from 1,000 U to 190,000 U. But I know that this is not ability, but luck - just like ROAM, which was launched on March 6, the 22-fold increase may be the result of 200 projects that went to zero.

In LBank, people get rich every day, and people cancel their accounts every day. The only certainty is that when the market is quiet, when you open the list of new coins, there will always be more absurd memes waiting to be buried or deified.

(Risk warning: The currencies mentioned in this article are all case studies and do not constitute investment advice.)