On March 20, MantleCN was honored to invite @YeruiZhang , @0x_Todd , @0x blockma and the former editor-in-chief of Foresight News to discuss in depth how Mantle breaks through the traditional L2 definition and achieves a strategic leap from an expansion solution to a comprehensive on-chain financial hub. The following is a full review of the AMA content.

1. Moderator’s question: How does Mantle break through the traditional L2 definition and achieve a strategic leap from an expansion solution to a comprehensive on-chain financial hub?

Wilson replied:

Mantle, as Ethereum L2, aims to solve the pain points of scalability and liquidity that hinder the wider adoption of cryptocurrencies. From this perspective, it has played a positive role. We are in the process of integrating zero-knowledge proof (ZK-proof) technology and aim to become a leader in this field.

However, during our development journey, we realized that the cryptocurrency native user base was still relatively small and we had to be more ambitious and strive to attract millions of users. This is where the story of on-chain finance began.

We are in the midst of the first pro-cryptocurrency U.S. administration in history, and never before have macroeconomic and regulatory conditions been so favorable for mass adoption, especially by traditional financial institutions that have been hesitant to accept cryptocurrencies due to previous regulatory uncertainty.

Mantles transformation has been possible because we have worked hard to build the necessary infrastructure and assets since our founding and have won the trust of the global community. Our vision is to make on-chain finance an indispensable part of everyones personal financial toolkit in the future.

2. Moderator’s question: In the process of building a unified financial ecosystem, how will Mantle integrate and bridge mETH, FBTC and other native or packaged assets to create a true on-chain value network?

Wilson replied:

We have developed institutional-grade assets such as mETH and Function FBTC, and are launching a cryptocurrency index fund that will provide passive returns in the crypto market to traditional and decentralized finance (DeFi) investors.

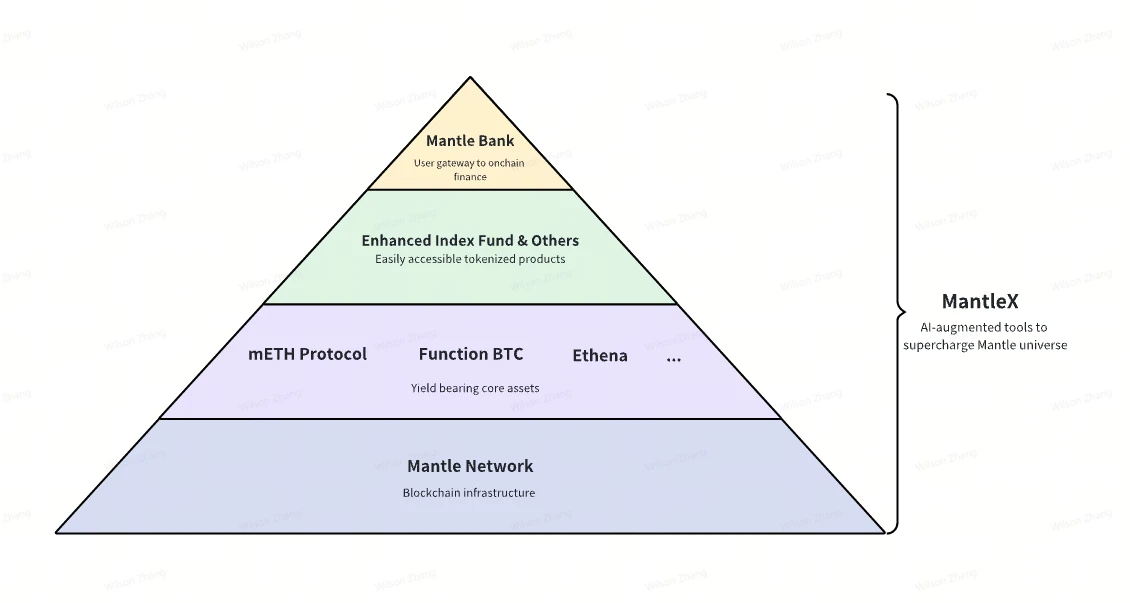

I imagine the Mantle ecosystem as a pyramid, with Mantle Network L2 as the key blockchain infrastructure layer, mETH and FBTC as the core assets that generate income, cryptocurrency index funds used to unlock liquidity for more investment institutional funds, and finally Mantle Bank as a portal interface for users to easily access the entire ecosystem. This is how the assets of the entire Mantle ecosystem are currently integrated with the platform.

3. Moderator’s question: For the current Crypto industry, which tracks can support long-term builds and have very high ceilings?

Block Horse replied:

First of all, I think the best and longest-lasting one is PayFi, which is similar to Mantle Bank and the Bybit Card I personally use. I have a very good experience with it, so the ceiling of the payment track is very high and the feasibility is also very high. The second is asset management, like Mantles banking business, which is a very large track that can absorb traditional financial funds for custody and then raise interest rates. These are the two areas at present.

Todd replied:

If you ask me this question in 2021, I might tell you about DeFi or NFT, but now it is 2025, I will probably divide it into two major parts. The first part is the completely decentralized MEME. I think MEME is a product that presents the simplest and most direct way of playing to everyone at this moment in the industry. It has always been a game that only requires funds on the market. Of course, if it can form a synergy with off-market funds, then there are still many opportunities in MEME, so there are direct development opportunities around the infrastructure of MEME, such as exchanges, snipers, and bots. This is a completely decentralized, on-chain, and retail track.

The other part is to focus on compliance, attach great importance to the traditional market, and hope that practitioners and funds of traditional institutions can enter the crypto industry. PayFi mentioned by Block Ma just now is very meaningful, because many people in the traditional world first imagine whether these things can be like Alipay, such as paying for coffee, so payment is undoubtedly a long-term track. At the same time, the second part is Web3 Bank, which we will discuss in detail later. It is not a parallel relationship with PayFi. Web3 Bank actually includes more, such as Web3 insurance, financial management, payment, wealth management, etc. Therefore, traditional financial people are very interested in this concept, which is their comfort zone. In addition, now that countries around the world, even the US president, publicly support cryptocurrencies, they are very eager to move. The cryptocurrency industry provides them with ideas and assets, and they provide Crypto with traditional compliance architecture, talents and funds. So I think this track is likely to form a joint force for development, and I am personally quite optimistic about Web3 Bank.

Rui answered:

In my opinion, the best business must be to simplify complex things and then present them to the general public. In the past, each cycle of encryption had its own slogan. The DeFi period in 2020 is focusing on the yield and mechanism of DeFi; the public chain cycle in 2022 is focusing on the technology of the chain, such as stability, TPS, expansion, Ethereum upgrade, etc. In this cycle, I call it the IQ 50 cycle, that is, people don’t want to understand these things, because they are used to fragmented information input and have no intention to really read these technical and mechanism articles. Therefore, if there is a protocol that can open some potential arbitrage opportunities, or these income opportunities generated by information asymmetry and asymmetric understanding to the public, then this protocol can attract many users. The first to do this was Pendle, who made PT and YT of EigenLayer; for example, Memecoin was very popular at the end of last year, but those who really made a lot of money relied on becoming LPs to mine Memecoin. In summary, in addition to being a Kol, the other most enduring benefit in Crypto is to make complex things simple so that more users can adopt and benefit from them.

4. Host’s question: A few days ago, WLFI, a DeFi project supported by the Trump family, purchased 2 million $MNT. Will everyone pay for this signal?

Rui answered:

I think this cycle is about uniting around projects with strong financial strength. Mantle may be one of the richest projects in Ethereum Layer 2, so we should unite around Mantle.

5. Host’s question: I would like to ask Wilson one more question. Can you introduce to us the banking business that Mantle wants to do?

Wilson replied:

I would like to emphasize what Professor RUI said just now. Making complex things simple is exactly a problem that we at Mantle Bank want to solve. Mantle Bank is at the forefront of the development plan, and we see it as a one-stop bank that solves all the on-chain financial needs of users. Relying on the support of the Swiss banking system and on-chain infrastructure, our goal is to provide key on-chain applications such as capital inflows and outflows, transactions, savings and payments (including unlimited payments and credit products).

When users onboard Mantle Bank, it becomes the financial operating system, enabling them to interact directly with the rest of the cryptocurrency ecosystem as well as Mantle native products.

The group of truly savvy cryptocurrency native users is still small, and our goal is to onboard tens of millions of users around the world who need reliable on-chain financial products.

Mantle Bank development timeline:

Currently, there is a prototype of the product, which is being improved/optimized

Hopefully the public beta will be available in Q2 this year

Next, we will proceed to the guest question session

1. Rui asked: How does Mantle optimize capital efficiency and create a higher-yield on-chain financial model? For example, will new product plans such as Mantle Banking and MantleX introduce AI trading agents in the future to optimize on-chain transactions and asset management?

Wilson replied:

Going back to the concept of the Mantle ecosystem pyramid, MantleX can be seen as an AI enhancement tool that will enhance the user experience at each layer.

The AI story is still in its infancy, but potential application scenarios may include financial management, community engagement, on-chain research, and other Decentralized Financial AI (DeFAI) applications that will enhance user experience.

We look forward to unlocking the potential of AI and integrating it into crypto applications.

2.0X TODD asked: Regarding EOS’ transformation into a Web3 bank, what are the advantages and differentiations of Mantle banking?

Wilson replied:

I’m sure you’ve all heard about EOS’s transition to Vaulta, and it seems natural to connect this transition to what Mantle is pursuing.

Of course, their new products are still in development, but I can talk about what we are doing at Mantle.

Mantle Banks biggest competitive advantage lies in its seamless integration with the compliant Swiss banking system, which will provide reliable services worldwide and is supported by Mantles entire ecosystem, including high-quality assets such as mETH and Function FBTC.

Everything we’ve built over the past few years ensures we have the right infrastructure, liquidity, and distribution channels to welcome tens of millions of new cryptocurrency users in the future.

3. Block Ma asked: What is the vision and mission of Mantle Banking? What empowerment and benefits can it directly bring to $MNT Holders? Does it support offline withdrawal and consumption?

Wilson replied:

As mentioned above, Mantle Bank’s ultimate goal is to serve as a one-stop bank that meets all on-chain financial needs and attracts the general public, not just native cryptocurrency users.

$MNT is clearly the cornerstone token that drives the entire Mantle ecosystem. In addition to governance rights, holders will benefit from additional rewards such as more favorable spending rates and on-chain yield opportunities.

Mantle Ecological Pyramid