4 Alpha Core Views

1. Macroeconomic Review of This Week

1. Market Overview

U.S. stocks: rose slightly, but are still in a downward trend overall. Trading activity is not high and the Put/Call Ratio has declined, indicating that some funds have begun to bottom-fish.

Commodity market: Gold continued to rise after breaking through $3,000 per ounce, copper prices rose by 0.8%, and the cumulative increase in the past three months exceeded 11%; crude oil prices stabilized at $68 per barrel, and natural gas prices fell.

Crypto market: Overall trading was sluggish, BTC remained volatile at $84,000, lacking upward momentum, and altcoins followed BTC fluctuations.

2. Analysis of FOMC meeting

Strategic level: The Federal Reserve adheres to the principle of data dependence, avoids committing to a specific time for interest rate cuts, and maintains policy flexibility to deal with uncertainties.

Tactical adjustments (three key measures):

(1) Adjust inflation expectations management: Emphasize the New York Fed’s five-year inflation expectations data and downplay the University of Michigan’s consumer confidence index to reduce market noise.

(2) Re-emphasize “temporary inflation”: downplay the long-term impact of tariffs on inflation, provide policy space for interest rate cuts, and prevent the market from falling into a stagflation panic.

(3) Adjusting the pace of balance sheet reduction (QT): Although liquidity is sufficient, the Federal Reserve slowed down QT to hedge against the liquidity shock that may be caused by the debt ceiling issue.

3. Liquidity and interest rate market changes

Liquidity rebounded: Broad liquidity reached 6.1 trillion this week. TGA account outflows drove liquidity improvements, and the use of the Federal Reserves discount window declined, indicating that market funding pressures eased.

Interest rate market: Expectations for rate cuts remain stable, with a 67% probability of a rate cut in June and three rate cuts expected throughout the year.

Bond market: Short-term interest rates fell faster than long-term ones, and the yield curve steepened, reflecting that the market is more certain about rate cuts, but there are still concerns about inflation rebound.

Credit market: Investment-grade credit spreads widened, credit risk increased slightly, and market risk appetite declined, but no systemic risk signals have emerged yet.

2. Macroeconomic Outlook for Next Week

1. Reciprocal tariffs (effective April 2) are the focus of market attention

Tariff intensity: The level of tax rates and coverage will affect commodity prices, and thus inflation and corporate profits. If it exceeds expectations, it may push up import costs, put pressure on corporate profits, and put pressure on the stock and bond markets.

Global trade frictions: If they trigger retaliation from other countries, it will exacerbate supply chain tensions, push up inflation, threaten global economic growth, and may trigger panic selling in the market, reinforcing the logic of the stagflation trade.

2. The market is still in cautious mode, and there is a strong demand for tail risk hedging

VIX has fallen but risk signals in the credit market have strengthened. The market has not yet escaped from panic mode. Investors tend to reduce risk exposure and increase holdings of safe-haven assets (gold, government bonds, etc.).

Federal Reserve policy direction: If tariffs push up inflation, the Federal Reserve may tighten policy ahead of schedule, resulting in tighter market liquidity and increased volatility; if inflation is controllable, the Federal Reserve may continue its dovish stance and provide a market buffer.

3. Strategic recommendations

The market is still in an uncertain stage of policy and risk pricing. The short-term strategy should focus on defense + flexible offense to capture the markets periodic opportunities while avoiding tail risks.

4 Alpha Macro Weekly Report: After the FOMC meeting, before the implementation of the reciprocal tariffs

1. Macroeconomic Review of This Week

1. Market Overview

As we pointed out in last weeks weekly report, market sentiment is still cautious, but there are opportunities for periodic oversold rebounds. With the short-lived boost from the dovish signals of the FOMC meeting last week, the performance of various risk assets this week is slightly different.

US stocks: Small gains for the week, Dow Jones index rises better

Dow Jones Industrial Average (+1.2%)

Nasdaq (+0.2%)

SP Index (+0.6%)

Russell 2000 (+0.7%)

Although the US stock market rose slightly this week, it is still in a downward trend overall, and the market trading activity is not high. From the perspective of options, the Put/Call ratio is 0.86, which is lower than the high level last week, reflecting that some funds have already started to buy at the bottom.

Commodity market: Gold and copper prices continue to rise

This week, gold continued to rise above $3,000 per ounce, and fell back after the Federal Reserves interest rate meeting. Copper spot prices rose 0.8%, and have risen by more than 11% in the past three months. The energy market showed a differentiated performance: crude oil prices stabilized around $68 per barrel, and natural gas prices continued to fall.

Cryptocurrency market: Overall trading remains sluggish

There is no new catalyst in the market, and Bitcoin continues to fluctuate around 84,000, with no obvious upward momentum. At the altcoin level, follow the BTC trend step by step.

2. Analysis of FOMC meeting

Last week, the main focus of important macroeconomic events was on the Federal Reserves interest rate meeting and Powells speech. The specific analysis is as follows:

In the current complex macroeconomic environment, the Federal Reserve is facing multiple difficulties. The hidden crisis brought about by stagflation risks, political uncertainty and liquidity tightening of financial institutions has made policy decisions more delicate. At the same time, due to data lags, the impact of tariff shocks and supply chain changes will not be reflected in real time, and policy differences within the FOMC are also intensifying. Therefore, in his recent statements, Powell made a series of adjustments to the strategic and tactical aspects of the policy to balance market expectations and economic fundamentals.

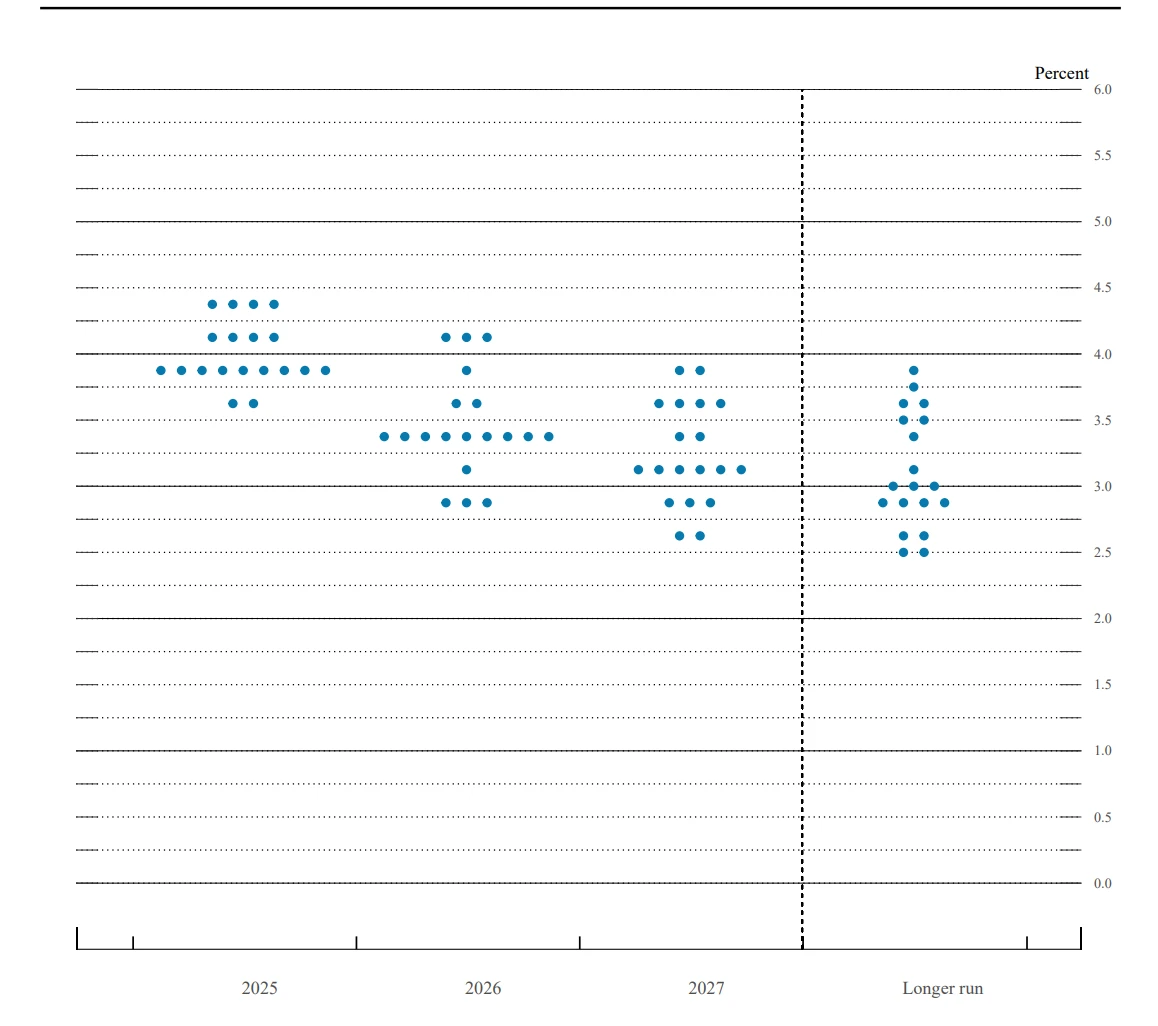

Figure 1: Changes in FOMC meeting dot plot Source: Federal Reserve

The Fed’s adjustments can be analyzed from two perspectives: strategic and tactical.

1) Strategy: Wait and see, without making a clear commitment to cut interest rates

The Fed still adheres to the principle of data dependence and avoids committing to a specific time or pace of interest rate cuts. Its core idea is to seek a balance between slowing economic growth and inflation risks, while ensuring policy flexibility to cope with future uncertainties.

2) Tactical Adjustment: Three Key Measures

At the tactical level, the Federal Reserve made three key adjustments to optimize the management of market expectations and hedge against uncertainties caused by external shocks.

(1) Emphasize the New York Fed’s 5-year inflation forecast and downplay the Michigan index

The Fed selectively uses data that is conducive to stabilizing expectations, emphasizing that the New York Feds five-year inflation expectations are relatively stable, and no longer overly relies on the University of Michigan Consumer Expectations Index, which is more volatile. The core purpose of this adjustment is to prevent the market from de-anchoring inflation, thereby reducing excessive market volatility caused by data noise. As we analyzed last week, the University of Michigan Consumer Index has obvious partisan differences, and the data is seriously distorted, and it has lost its guiding role.

(2) The concept of “temporary inflation” was re-introduced to pave the way for interest rate cuts

In response to the inflation shock brought about by Trump’s tariff policy, the Federal Reserve re-emphasized the “transient inflation” narrative to downplay market concerns about stagflation. Its main purpose is to:

l Provide the FOMC with room to maneuver, ease the divergence within the dot plot, and make policy more flexible.

l Hedge against stagflation signals by weakening the long-term impact of the combination of GDP reduction + CPI increase, suggesting to the market that the Federal Reserve will still cut interest rates when inflation is declining, rather than passively responding to stagflation.

l Stabilize inflation expectations by emphasizing that slower economic growth may offset some of the inflationary pressure caused by tariffs, and make it clear that even if tariffs rise, the Fed will not change its interest rate cut plan.

(3) Adjust the pace of balance sheet reduction (QT) to hedge liquidity risks

Powell specifically mentioned that although market liquidity is still sufficient, there are signs of tightening. Therefore, the Fed tactically adjusted the QT rhythm to alleviate the liquidity shock caused by issues such as the debt ceiling. This move shows that the Fed is willing to make flexible adjustments while maintaining a tight monetary policy to prevent unnecessary turbulence in the financial market.

In fact, judging from the reserve situation of US banks, the reserve level is already higher than the level when the Fed started quantitative tightening in June 2022, and recently, as the US broke through the debt ceiling, the Treasury used its account funds at the Fed, and the reserve level rebounded further; from the perspective of the short-term financing market, the recent SOFR interest rate has been stable and has not shown obvious pressure. Combining the Feds actions and actual conditions, it is highly likely that this is to cope with the impact of the Treasury rebuilding its balance sheet on market liquidity after the debt ceiling negotiations.

Overall, the Feds core goal is to respond to the impact of Trumps policies, ensure financial stability, and hedge against stagflation risks. This strategy not only continues Greenspans moderate tightening thinking, but also gains greater strategic adjustment space through tactical concessions.

3. Changes in liquidity and interest rate markets

The Feds balance sheet currently stands at 6.7 trillion, and the tightening trend has further slowed down. From the perspective of broad liquidity, liquidity continued to rebound, reaching 6.1 trillion this week, still due to the outflow of the US Treasurys TGA account. The use of the Feds discount window continued to decline this week, indicating that the current macro liquidity is generally positive.

Chart 2: Changes in USD base liquidity Source: Gurufocus

From the perspective of the interest rate market, after the Federal Reserves interest rate meeting, the interest rate market priced in the first rate cut expectations in June, with a probability of about 67%, and about three times throughout the year.

Figure 3: Interest rate market pricing for 2025 rate cut expectations Source: CME

From the perspective of the bond market, the downward slope of short-term interest rates is significantly faster than that of long-term yields, and the overall treasury yield curve is steeper. This reflects that although the market has become more certain about the path of interest rate cuts, there are still major doubts about the inflation rebound or even stagflation narrative.

Figure 4: US Treasuries Yield Curve Source: US Treasury

This week, we will continue to follow the forward-looking signals of the credit market. From the perspective of the default swap index, the US investment-grade credit default swap index (CDX IG) continued to rise and the credit spread widened, indicating that the credit risk pricing of investment-grade corporate debt has increased slightly and the market risk appetite has decreased. However, combined with liquidity indicators, although risks have begun to accumulate, no malicious warning signals have yet appeared.

2. Macroeconomic Outlook for Next Week

Under the influence of the Federal Reserves dovish signals last week, the temporary inflation narrative was used to hedge the expected risks brought by tariffs, but market concerns did not dissipate, and the market began to pull back near the end of last week.

The current focus is on the reciprocal tariffs that started on April 2, with two main focuses:

Tariff intensity: The level of tax rates and coverage will directly affect the prices of imported and exported goods, and in turn affect inflation and corporate profits. If the intensity of tariffs exceeds expectations, import prices may rise sharply, corporate costs will increase, and profit margins will be under pressure, which will have a negative impact on the stock and bond markets.

Retaliatory measures from other countries: If tariffs trigger retaliation from other countries, it will intensify global trade tensions, further disrupt supply chains, increase inflationary pressures, and threaten global economic growth. If retaliatory measures escalate, it may trigger panic selling in the market, and risky assets will face significant downward pressure, reinforcing the logic of the stagflation trade.

Looking at the past week, although VIX has fallen back, risk signals in the credit market have strengthened, which shows that the market has not completely escaped from panic mode and funds still have strong demand for hedging against tail risks.

Before the tariff policy becomes clear, the market may continue to wait and see. Investors may adopt a defensive strategy: reduce risk exposure and reduce allocation to high-risk assets such as stocks; increase demand for safe-haven assets such as gold and government bonds to hedge against uncertainty.

In addition, the impact of reciprocal tariffs on the Feds attitude is also very important. If tariffs lead to continued inflationary pressure, the Fed may be forced to tighten monetary policy ahead of schedule, which will tighten market liquidity and increase volatility. On the contrary, if inflationary pressure is controllable, the Fed may continue its dovish stance and provide a buffer for the market.

In short, the market is still in an uncertain stage of policy and risk pricing. The short-term strategy should focus on defense + flexible offense to capture the markets periodic opportunities while avoiding tail risks.

Key macro data for next week:

--------------------------------------------------------------------------------------------------------------------------------------------------

Disclaimer

This document is based on 4 Alphas independent research, analysis and interpretation of available data. The information contained in this document is not investment advice and does not constitute an offer or invitation to buy, sell or subscribe for any financial instrument, security or investment product to residents of the Hong Kong Special Administrative Region, the United States, Singapore or other countries or regions where such offers are prohibited. Readers should conduct their own due diligence and seek professional advice before contacting us or making any investment decision.

This content is protected by copyright and may not be reproduced, distributed or transmitted in any form or by any means without the prior written consent of 4 Alpha. While we endeavour to ensure the accuracy and reliability of the information provided, we do not guarantee its completeness or currency and accept no liability for any loss or damage arising from reliance on this document.

By accessing this document, you acknowledge and agree to the terms of this Disclaimer.