In the cryptocurrency market, competition between exchanges is not only reflected in liquidity and trading volume, but also in the speed of listing. For traders and investors, whether they can get a head start in the early listing stage of tokens is often an important consideration in choosing a trading platform, especially in the case of highly volatile markets.

A report previously released by crypto data research company TokenInsight analyzed the listing activities of major global crypto exchanges from November 1, 2024 to February 15, 2025. The report shows that Gate.io is in a leading position in terms of the number and speed of new coin listings.

During this period, Gate.io launched a total of 317 spot trading pairs, far higher than the 24 and 19 spot trading pairs of its major competitors.

In addition, in this round of bull market cycle in the crypto market, decentralized finance (DeFi), infrastructure and memecoin have become the three major themes of market attention and dominate the spot trading pairs of major exchanges.

Among them, more than one-third of the new spot listings are concentrated in the Meme track. This trend is very obvious on Gate.io, where 23.97% of the new coins belong to the Meme category. In contrast, OKX, Bybit and Bitget are more focused on infrastructure projects, which account for 31.58%, 26.23% and 21.57% of their new spot listings respectively. Binance is more focused on the DeFi track, with 33% of new projects belonging to the DeFi field.

It is worth noting that Gate.io also provides users with a special on-chain asset spot trading area called Pilot. This area covers on-chain projects in multiple different tracks. On-chain asset spot trading area Meme+ of MEXC mainly focuses on the Meme coin track.

Gate.io is one step ahead

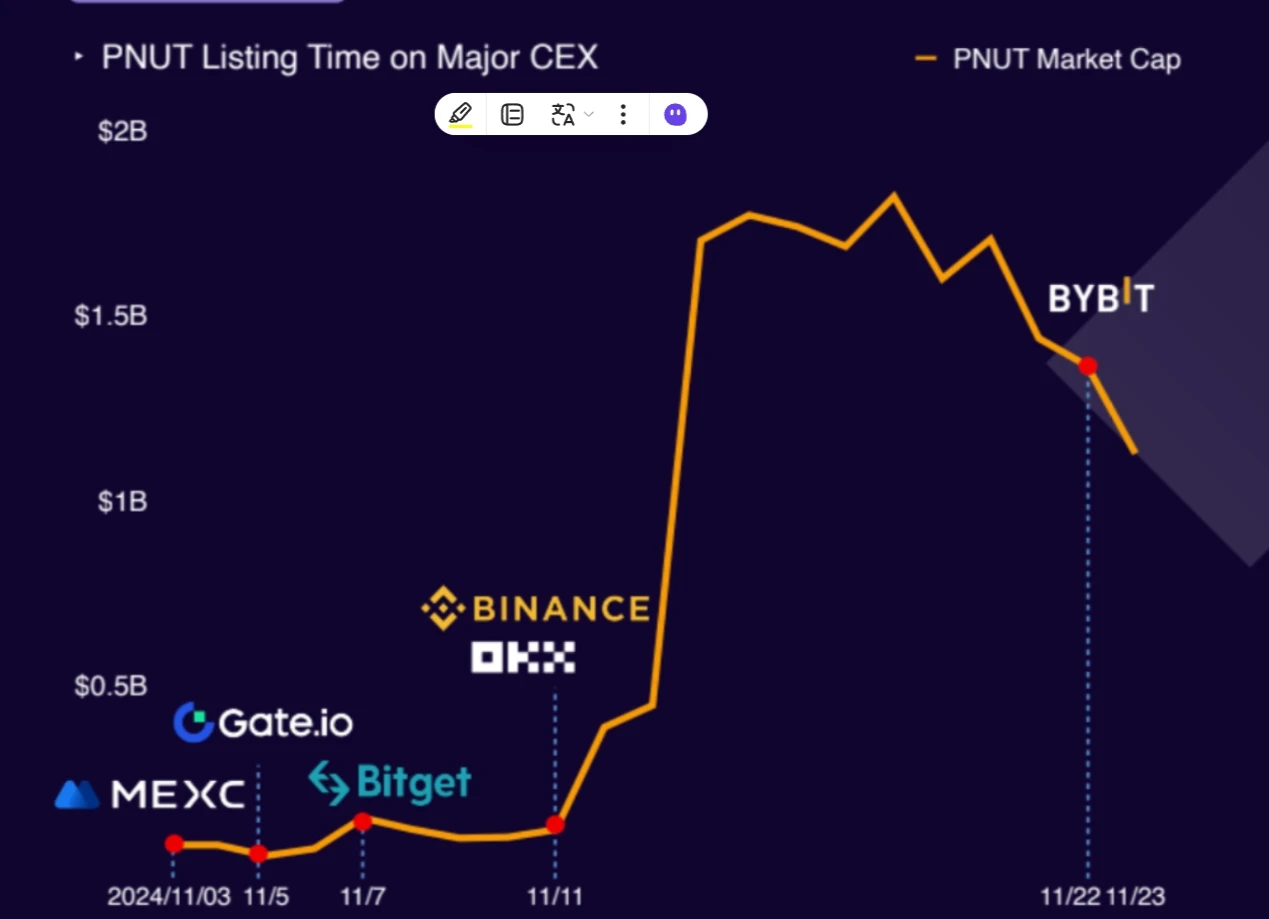

Last year, the Solana-based meme coin “Peanut” (PNUT) attracted market attention due to its unique background story. Before its price soared on November 13, the token had been listed on Gate.io and MEXC for nearly a week.

When Gate.io launched PNUT, the market value of the token was about $47 million, and now the market value of PNUT has fallen from its peak to about $200 million. In other words, even if investors did not sell at the high point, but continued to hold it from the time of listing to the present, they can still get a profit of about 326%.

The launch time of PNUT coins on major exchanges. Source: TokenInsight

In addition, in the launch process of artificial intelligence (AI) tokens such as AIXBT and AI16Z, Gate.io also has a clear advantage in getting ahead.

The launch time of AIXBT and AI16Z coins on major exchanges. Source: TokenInsight

While other exchanges were still preparing for the review meeting for the listing of Mubarak, which had just become popular at the beginning of this year, Gate.io had already been launched in the Innovation Zone for the first time, with the highest increase reaching 7,400%. Data shows that Mubaraks daily trading volume in the Gate.io spot market exceeded US$470 million, accounting for 63% of the total trading volume of CMC. Only three days later, Mubarak perpetual contracts were launched on Gate.io, supporting 1 to 50 times leverage, making it the first platform to provide high-leverage contracts for this currency.

Of the 236 new tokens listed on Gate.io in 2024, 191 (81%) were subsequently listed on Binance, and 73% of the currencies were already profitable for Gate.io users when they were listed on Binance.

It is reported that this extreme speed is inseparable from the three technological innovations behind it:

Prophet Coin Listing Engine: Integrates 380 data dimensions such as GitHub code updates, development community discussion volume, and on-chain whale movements to predict potential projects in advance;

Zero manual channel: Compliance projects can be listed in seconds through the KYC green channel;

Liquidity Sandbox: The Innovation Zone is equipped with a USD 30 million market maker reserve pool to ensure that new coins have depth as soon as they are launched.

Data shows that in the first quarter of this year, it took an average of only 3.2 hours to list coins on the Gate.io Innovation Zone, 47 times faster than the industry average. Among them, 87% of the coins had generated considerable wealth effects before being listed on Binance.

The review mechanism behind the rapid listing of coins: both security and compliance

Fast listing does not mean that the audit standards will be relaxed. On the contrary, many platforms still adhere to strict audit processes while ensuring the speed of listing, focusing on the compliance, technical security and market potential of the project. Taking Gate.io as an example, its token listing process is divided into 6 stages, namely:

Project Submission

Before a token is considered, the Gate.io project team must submit a detailed application that includes information about the project, the development team, the technology behind the token, its utility, token distribution, etc. This helps Gate.io understand the basics of the project, assess its potential, and determine if it aligns with the platform’s goals.

Initial review

Once the project submits the necessary documents, Gate.io ’s listing team conducts a preliminary review to assess the project’s eligibility. During this phase, the team evaluates the project based on multiple factors, including the project’s concept, market demand, token utility, and the credibility of the development team.

In-depth analysis

Projects that pass the initial review phase will enter a more in-depth analysis phase, where the Gate.io listing team will review the project’s white paper, development progress, token economic model, etc. This phase is critical to understanding the long-term viability of the project and its contribution to the entire cryptocurrency ecosystem.

Technology Assessment

Gate.io pays great attention to the technical aspects of the project. The platforms technical team will conduct a comprehensive assessment of the projects code, smart contract security, and overall technical infrastructure to ensure the project is safe and reliable.

Legal Compliance

Before a token is listed, it must comply with the platform’s legal and regulatory requirements. Gate.io works closely with legal counsel to assess the legal status of tokens, compliance with relevant regulations, and compliance with international law.

Final Approval

After all stages of the evaluation process are complete, the listing team compiles their findings and presents them to Gate.io’s executive team. The executive team then makes the final decision on whether to list the token on the platform. If the token is approved, Gate.io announces the listing and provides details about the token, trading pairs, and when trading will begin.

Conclusion:

In this crypto world where information flows rapidly and changes unpredictably, having the ability to respond quickly often means having the initiative in wealth distribution.