Original | Odaily Planet Daily ( @OdailyChina )

Author: Azuma ( @azuma_eth )

Last night, Polymarket, a prediction market that was popular during the US election, suffered the most serious oracle manipulation attack since the project was founded, causing a prediction pool with a betting scale of over 7 million US dollars to give an incorrect result. In the end, users who bet on the correct result suffered heavy losses, while users who bet on the wrong result took away all the funds in the prize pool.

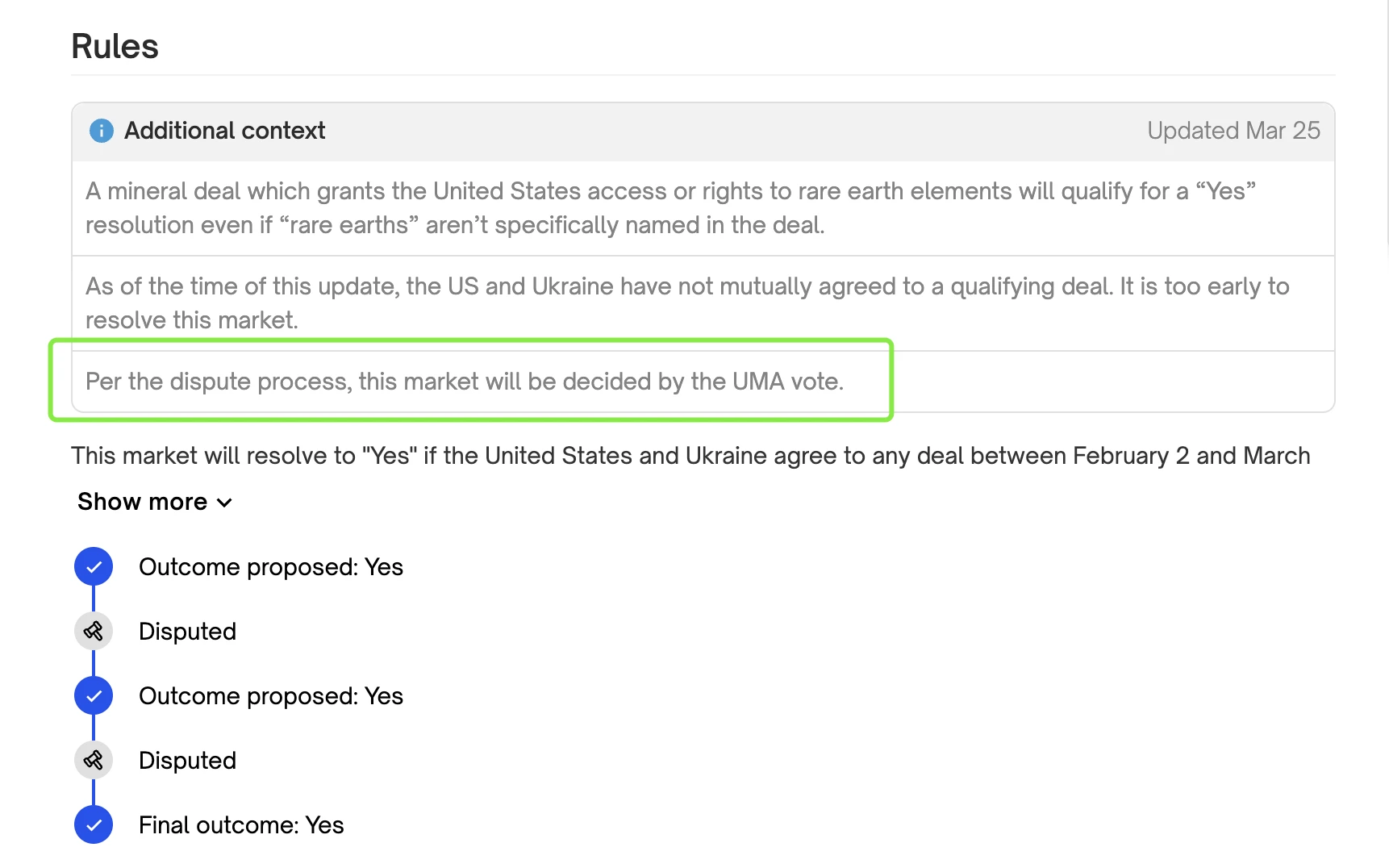

The prediction pool in question was whether Ukraine will reach a rare earth trade agreement with Trump before April . In the real world, the United States and Ukraine have not yet reached an agreement on the deal, so the prediction pools judgment result should be no. However, as shown in the figure below, the prediction pools judgment result unexpectedly turned to yes before settlement, ultimately causing this situation of right and wrong being reversed.

Why does this happen? The answer lies in Polymarket’s decision mechanism. Polymarket relies on the oracle UMA to determine the outcome of an event . The decision process is as follows:

Result reporting: After an event occurs, anyone can report the result to UMA.

Dispute window: There will be a dispute period after the report is submitted. Anyone who believes that the report is wrong can raise a dispute. If no one disputes, the report result will be accepted; if there is a dispute, UMAs dispute resolution mechanism will determine the final result.

Dispute Resolution: UMA token holders need to vote to determine the correct outcome. UMA will incentivize honest behavior and punish evil behavior.

According to the process records of Polymarket, the prediction pool finally reached the third step of the process, which means that someone disputed the results of the original report, so a UMA vote was needed to decide the final result.

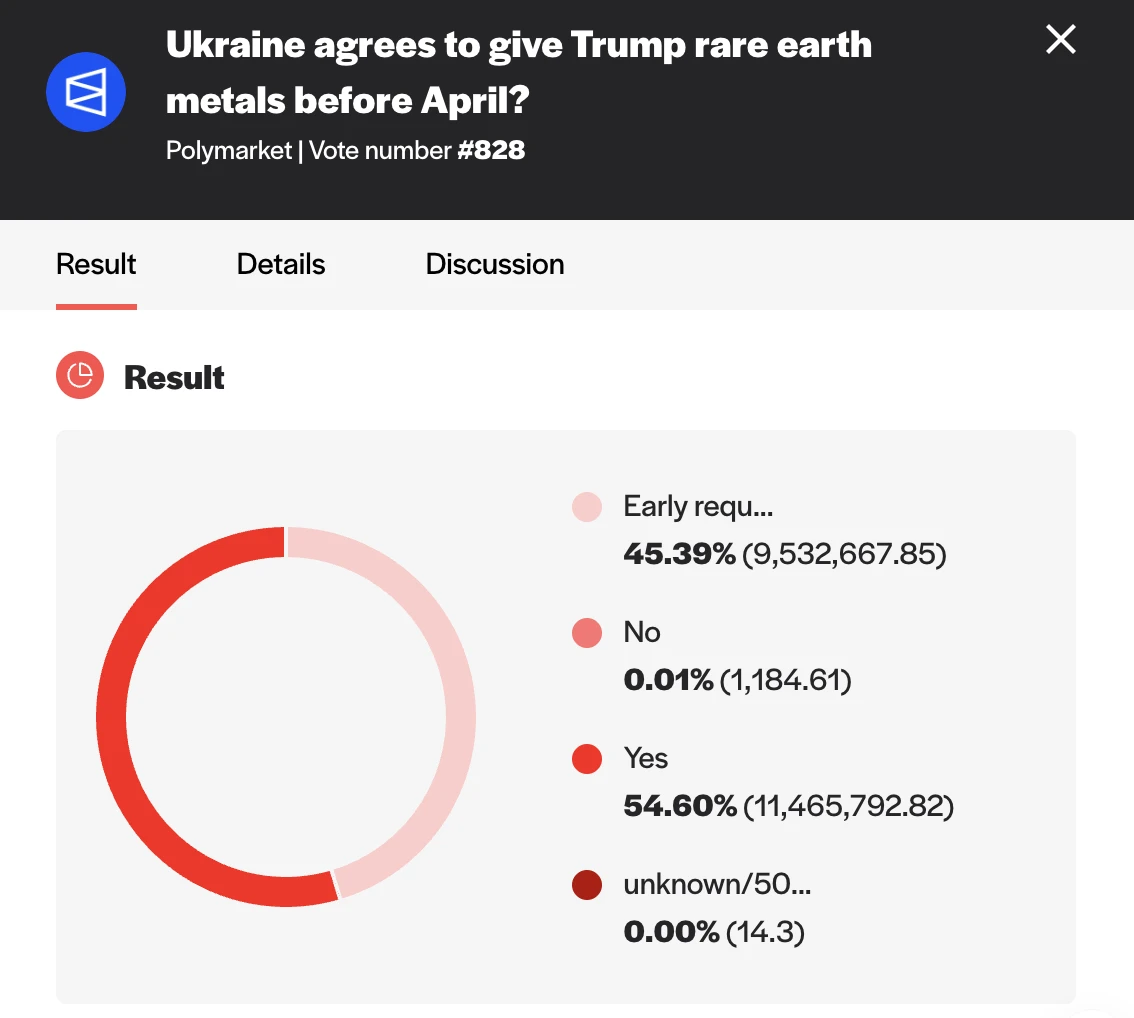

According to the final voting results from UMA, 54.6% of the votes chose yes regardless of the facts, forcing the prediction pool to determine the final result as yes.

According to the records of Reddit user @iamtheone, in the early stages of the UMA voting, another option Its too early to draw conclusions now was once dominant, but in the final stage, a mysterious force invested millions of UMAs in the yes option, forcibly changing the voting results.

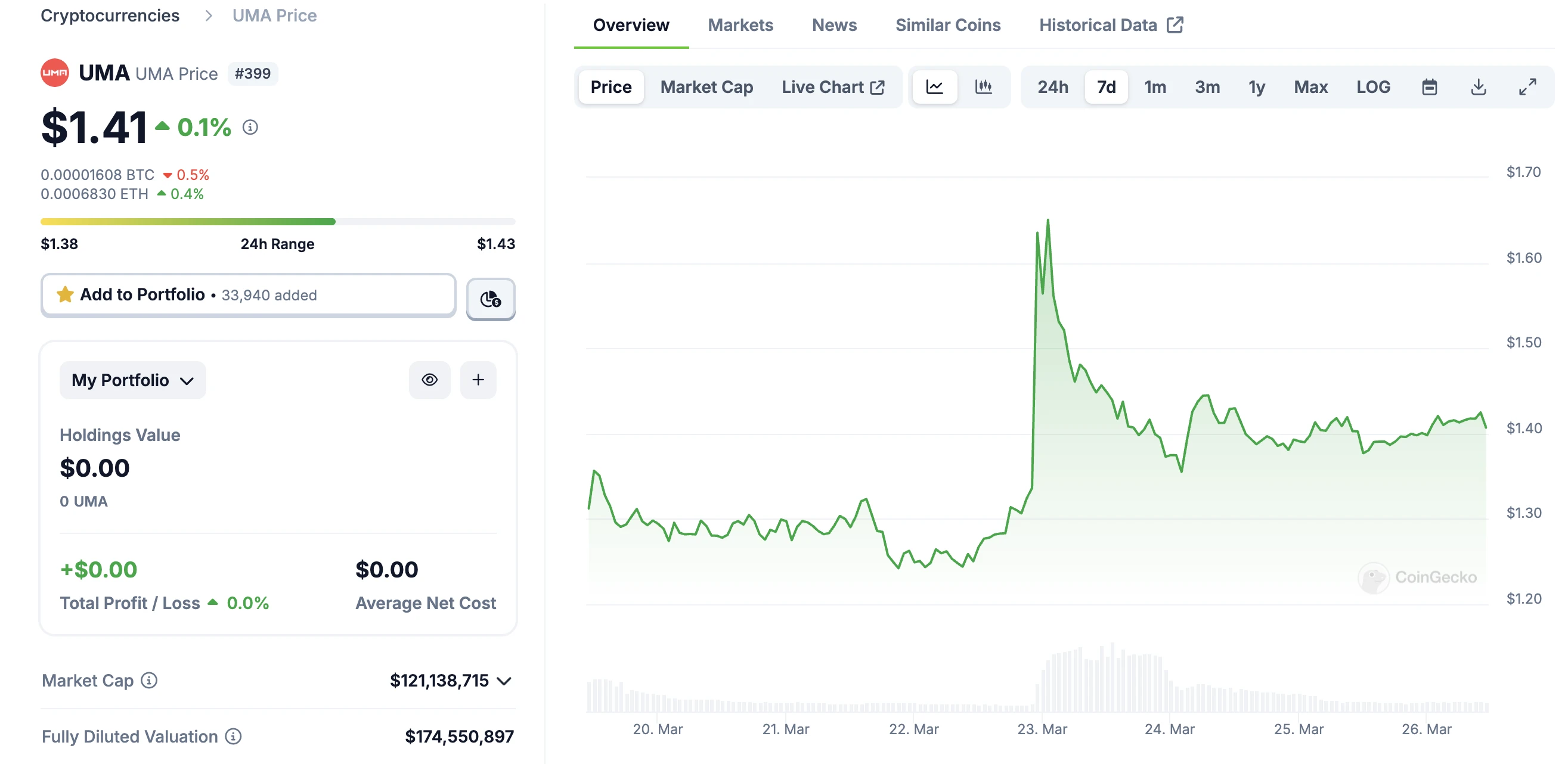

At the same time, the price of UMA soared 24% for no reason on March 22, and then gradually fell back, which may mean that the mysterious force had already prepared the plan several days ago.

The Reddit user added that this is not the first case of oracle manipulation on Polymarket. The platform has previously experienced many small-scale market manipulations (such as identifying the Venezuelan president as Edmundo González and claiming that Trump audited Fort Knox), but the amount involved in this case is the largest, with the total amount of bets in the prediction pool involved exceeding US$7 million.

The key reason for this incident is that the UMA voting mechanism on which Polymarket relies to make final decisions only sets a 0.05% penalty for incorrect voting, which makes the cost of doing evil extremely low. In the face of potential profits from reversing the facts, scammers have ample motivation to implement oracle manipulation.

What is even more shocking is that Polymarket officials released an announcement in Discord this morning saying that they had learned about the unexpected situation but were unable to refund users.

We have been informed of the anomaly in the Ukrainian rare earth agreement forecast market. The settlement results of this market are contrary to user expectations and our previous clarifications. As this incident does not constitute a system failure, we are unable to provide a refund . The current situation is unprecedented. We have held emergency meetings with the UMA team around the clock to ensure that this incident does not happen again. This is definitely not the future we want to build - we will establish a more complete system monitoring mechanism, develop a clearer rule framework, and optimize a more timely clarification process. Specific measures will be announced in succession after a comprehensive evaluation.

As you can imagine, Polymarket’s response was quickly criticized by the community. The comment section below the original prediction pool has now accumulated 5,554 comments, with a large number of users criticizing Polymarket’s mechanism and response.

As one of the most amazing projects in the entire cryptocurrency market last year, Polymarket obviously has no shortage of money to pay full compensation. Such a response is bound to damage its market reputation and community sentiment. Considering the current heated community sentiment, whether there is room for subsequent changes, Odaily Planet Daily will continue to follow up in real time.