4 Alpha Core Views

1. Macroeconomic Review of This Week

1. Market Overview

Market sentiment weakened in the second half of the week due to Trumps tough stance on auto tariffs.

The crypto market momentum is weak, liquidity and macro uncertainties remain, and the market is waiting to see whether reciprocal tariffs will be implemented.

Gold continued its upward trend, while U.S. stocks, cryptocurrencies and commodity markets performed weakly.

2. Economic data analysis

GDPNow predicts that Q1 GDP will be -1.8%, indicating a weakening economic trend.

Labor market weakness was evident, with unemployment rising in 290 metropolitan areas and an increase in the number of people continuing to apply for unemployment benefits.

PCE in February exceeded expectations, while consumer spending declined, and the economy showed a combination of weak growth + high inflation.

3. Liquidity and interest rates

The Federal Reserves broad liquidity improved slightly and remained at 6 trillion.

The U.S. Treasury yield curve is bearish and steep, with long-term bond yields rising faster than the short end, and the market remains concerned about inflation.

Credit market pressure has increased, high-yield bond credit spreads have widened, the corporate financing environment has deteriorated, and recession risks have risen.

2. Macroeconomic Outlook for Next Week

1. The biggest variable in the market : Trump’s reciprocal tariffs will be implemented on April 2. If the tariffs exceed expectations or are retaliated, it will impact market sentiment.

2. Pay attention to the U.S. unemployment rate and non-farm payrolls data in March to verify recession risks.

3. Investment advice: Prioritize defense and avoid chasing ups and downs

Appropriately allocate arbitrage quantitative funds, gold, and US Treasuries as safe-haven assets.

High-valuation technology stocks and crypto assets are still under the dual pressure of interest rates and recession. It is recommended to reduce positions or move profit targets downward.

If the tariff impact is lower than expected, market risk appetite may pick up, but it does not mean a trend reversal and further macro-favorable support is still needed.

The market is still in a weak economy + high inflation + policy swings pattern, and risk assets are facing downward pressure. The future market direction depends on the impact of the implementation of equal tariffs and whether the US employment data confirms the risk of recession. In the short term, it is still necessary to focus on defense and remain patient to wait for clearer signals.

As market pressure increases, should we just wait for reciprocal tariffs to be implemented?

1. Macroeconomic Review of This Week

1. Market overview this week

As we analyzed last week, the market is still waiting for the implementation of reciprocal tariffs, and risk assets this week are still showing obvious volatility.

In addition to the continued rise in gold, the overall trend of the U.S. stock market, cryptocurrency and commodity market was quite weak. After Trump announced a tough attitude on auto tariffs, the market deteriorated significantly in the second half of the week.

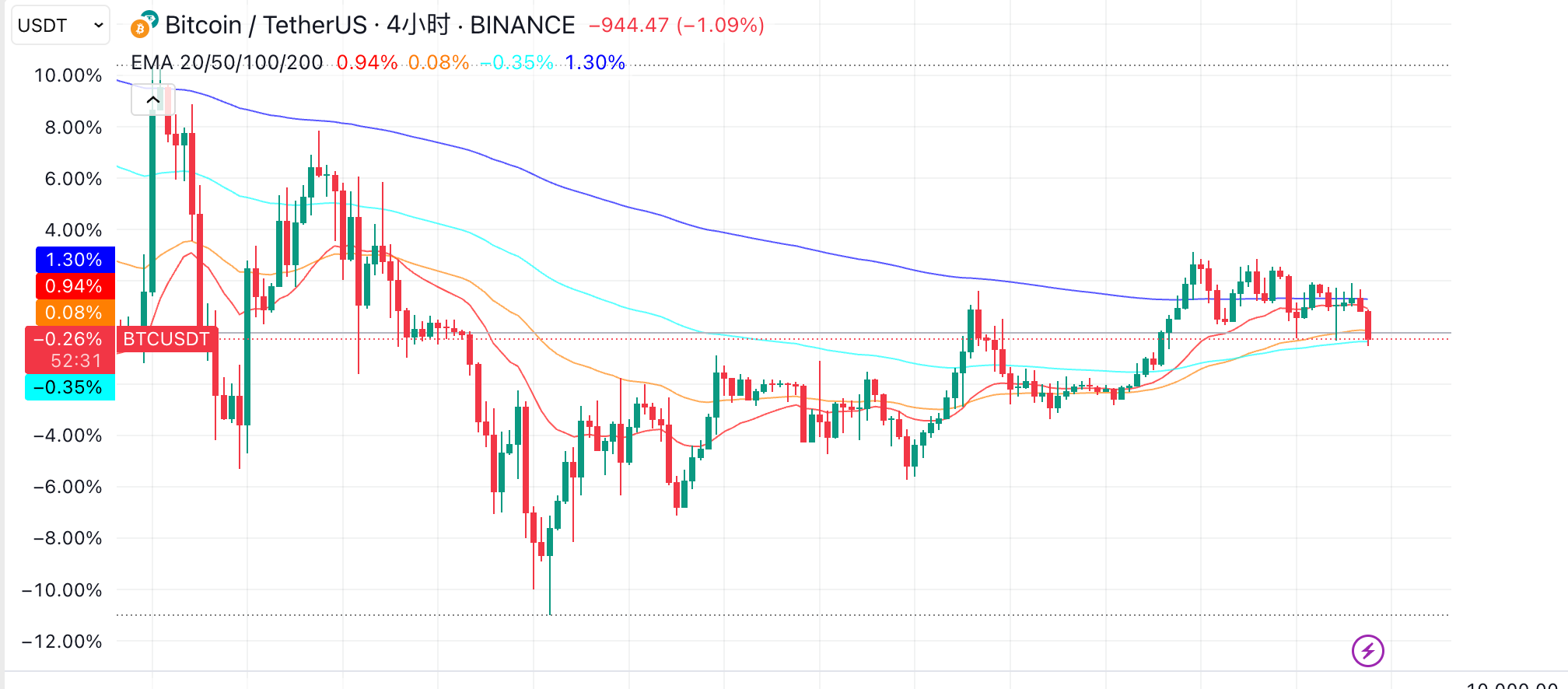

Chart 1: 4h level, BTC is still below EMA 200

Source: Tradingview

From the perspective of the cryptocurrency market, the market was generally calm this week, but the momentum was weak. The U.S. House of Representatives introduced the Stablecoin Transparency and Accountability to Promote the Ledger Economy Act, which aims to regulate payment stablecoins, establish a new compliance mechanism, expand regulatory powers, and clarify key definitions regarding the issuance and use of digital assets backed by the U.S. dollar. The continued easing of policy direction has not immediately reversed the market downturn. Against the backdrop of poor overall liquidity and continued macro uncertainties, consistent with our previous prediction, the market still needs to give a new direction after the implementation of reciprocal tariffs.

2. Economic data analysis

This weeks data focuses on the US labor market and PCE data, while also providing further analysis of forward-looking signals from the credit market.

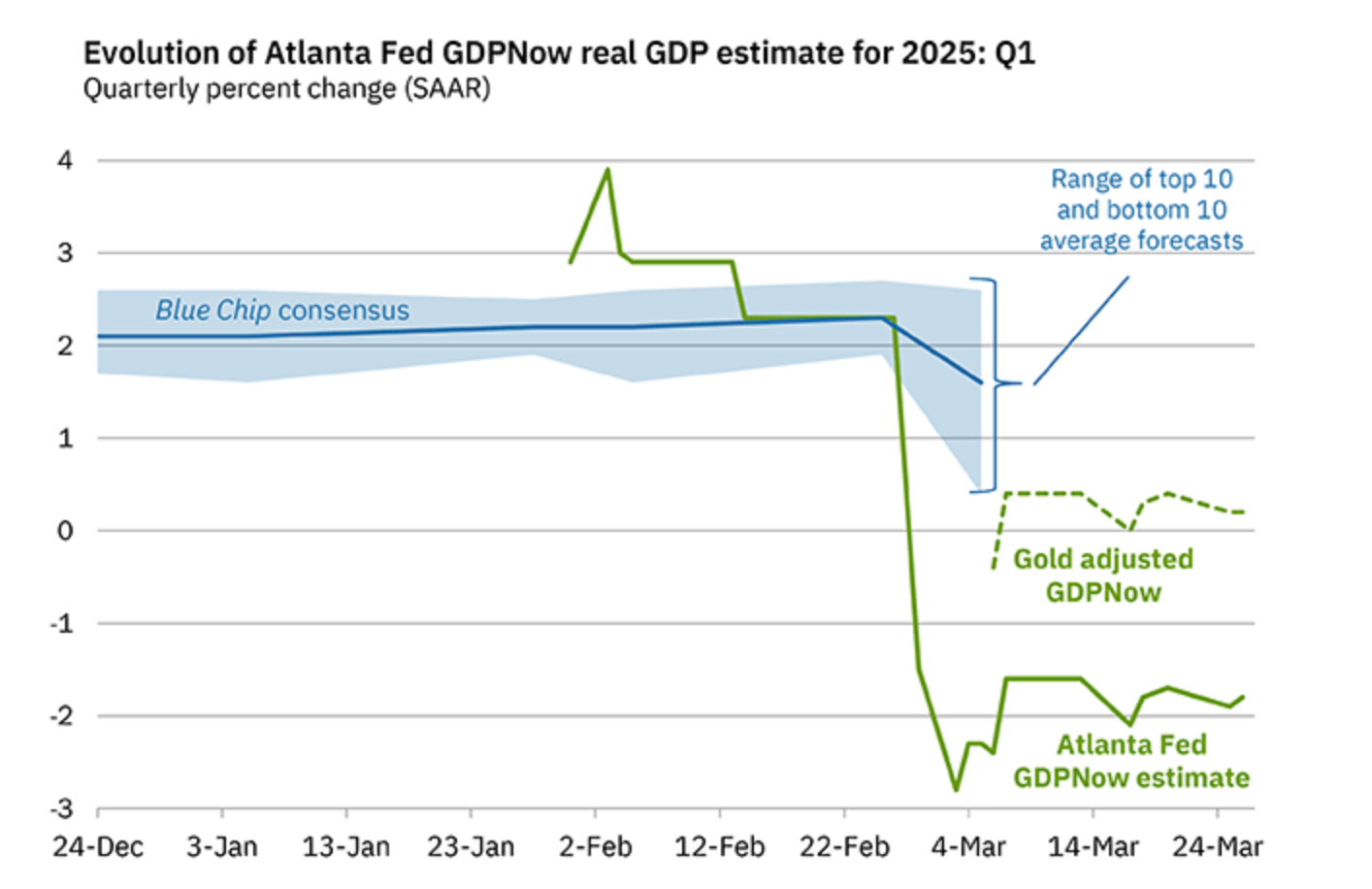

GDPNows latest first quarter GDP forecast is -1.8%, the same as last week. It is worth mentioning that the model has made an official adjustment, and the model takes into account the import and export of gold. According to the recent data released by the US Census Bureau and the National Association of Realtors, the forecast for the growth rate of real domestic private gross investment in the first quarter was reduced from 9.1% to 8.8%, and the adjusted model forecast is 0.2%.

Figure 2: Latest GDP forecast

Source: Atlanta Federal Reserve

Judging from the data, the weakening trend of the US economy is very obvious, but there is currently no hard data to give a clear signal of recession. However, based on the verification of multiple data from the labor market and credit market, the risk of recession has indeed increased.

From the perspective of the labor market, although the initial jobless claims data released this week was slightly lower than expected and lower than the previous value, if we look at it further over a longer period of time, the fatigue in the labor market is very obvious.

Chart 3: U.S. weekly unemployment claims data

Source: Zerohedge

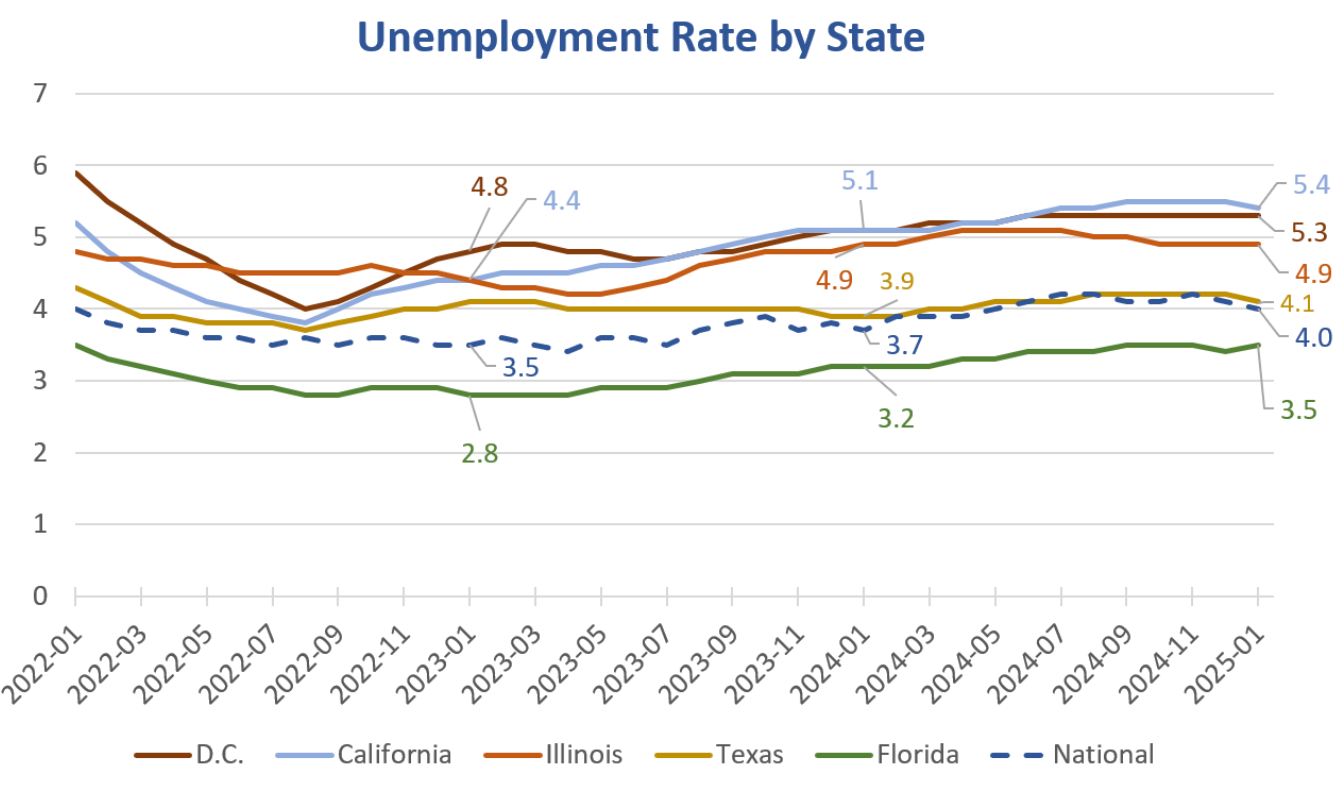

Looking further at the data for each state, unemployment rates are rising in 290 of the 387 metropolitan areas in the United States.

Figure 4: Unemployment rate data of some states in the United States (seasonally adjusted)

Source: U.S. Bureau of Labor Statistics, MishTalk

It is particularly noteworthy that the number of people continuing to apply for unemployment benefits in Washington, D.C. is currently at its highest level since 2021, but the initial application data has not changed significantly, which suggests that the DOGE departments layoffs and spending cuts plan led by Musk is not going very smoothly, perhaps because of the large number of lawsuits.

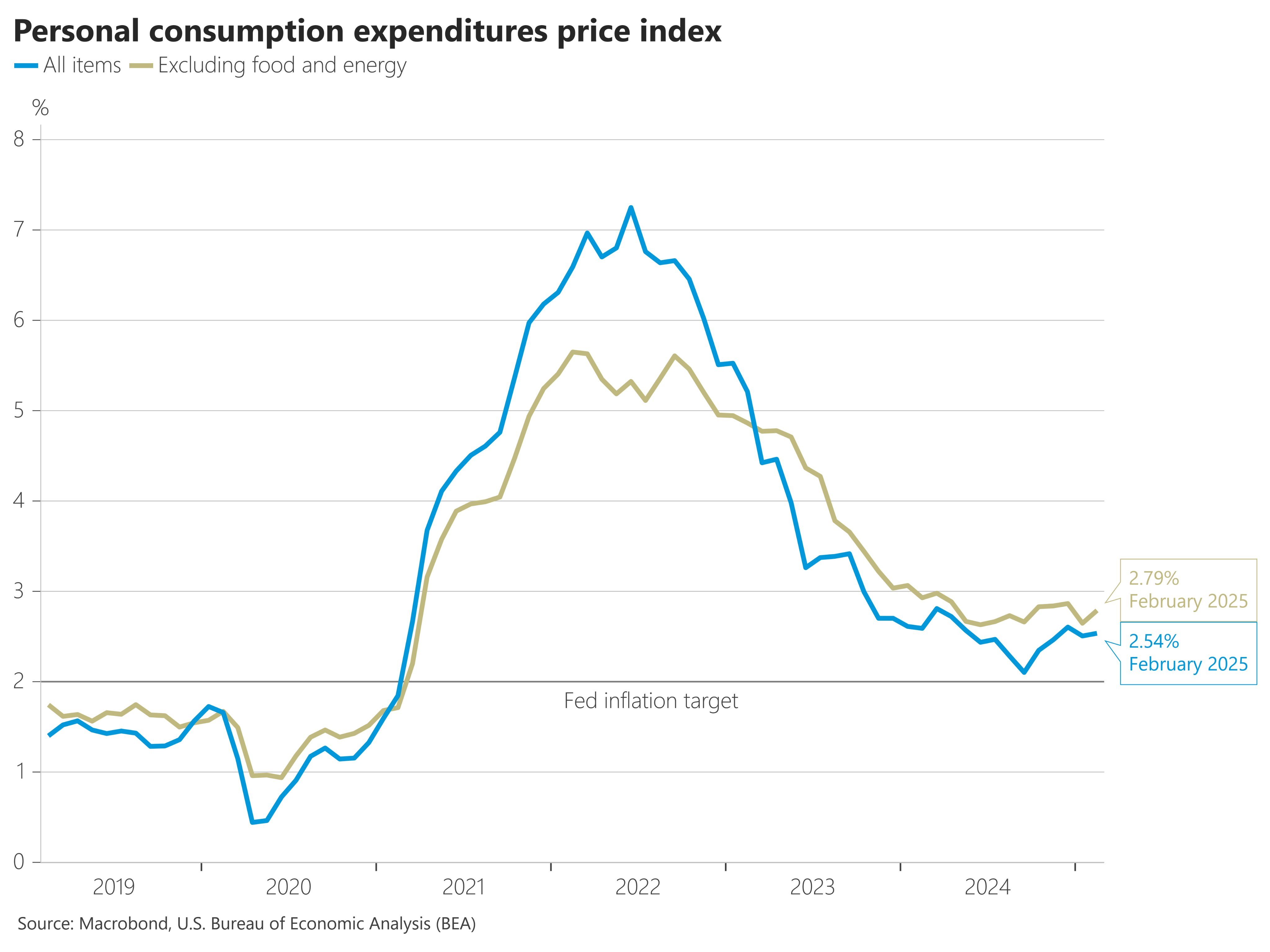

The PCE data was released on Friday evening. This data is the inflation data that the Federal Reserve pays the most attention to. Both the annual and monthly PCE rates in February exceeded expectations. After the data was released, risky assets turned from rising to falling.

In addition, there is no tariff-driven impact in the PCE data, and the main factor behind this rebound is service costs. In addition, the monthly rate of personal spending in the United States in February was 0.4%, lower than expected. The two data reflect that on the one hand, the economy is weak and consumer spending is declining, and on the other hand, inflation is still high, and it is difficult to reduce the last mile.

Figure 5: US PCE data for February

Source: U.S. Department of Commerce

3. Liquidity and interest rates

The Federal Reserves broad liquidity margin continued to improve this week, and as of March 19, it was still around 6 trillion.

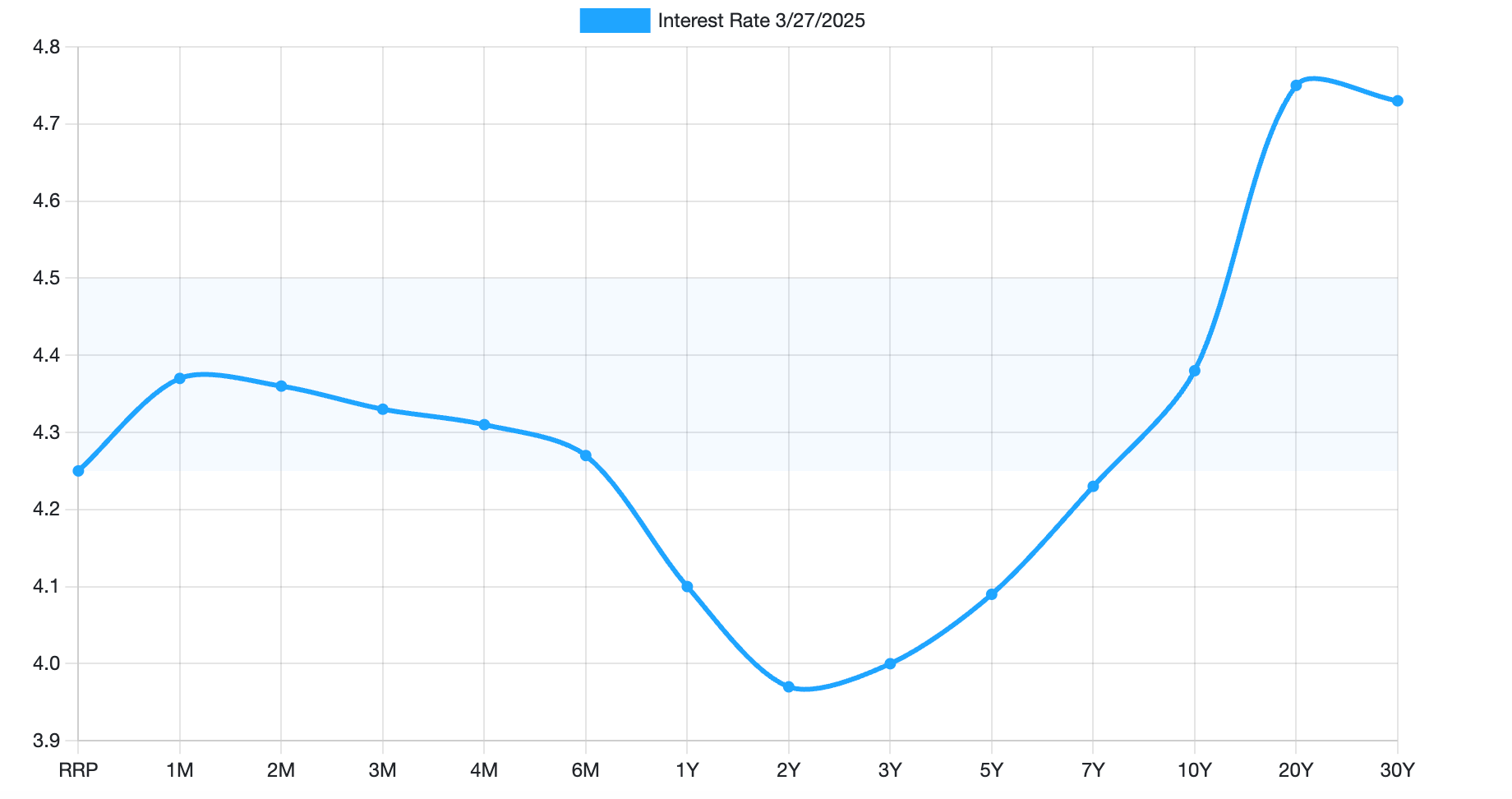

From the perspective of the interest rate market, the yield curve of government bonds showed a significant bearish steepness, with the upward slope of long bonds significantly higher than that of short bonds. From the perspective of interest rate expectations, according to the latest interest rate derivatives trading results, the probability of a rate cut in June is lower than last week, while the spread of 10-year inflation-protected bonds has slightly increased, indicating that the market is still concerned about inflation.

From the perspective of the entire curve shape, the slope of the curve in the middle part is more obvious, which may indicate that the market believes that the Fed will still be data-dependent and cannot prevent interest rate cuts in the face of high inflation and tariffs.

Chart 6: Changes in the U.S. Treasury yield curve

Source: U.S. Treasury Department

In addition, in the weekly reports of the previous two weeks, we have pointed out the pressure in the credit market. The follow-up data this week showed that the credit spreads of high-yield bonds are still widening, which is different from the facts reflected by the U.S. Treasury yields. This shows that investors are putting more pressure on the micro-environment of enterprises. If the credit spreads widen further, it may further squeeze the refinancing costs and profits of enterprises. This is an extremely unfavorable forward-looking signal, which shows that the risk of recession in the U.S. economy has not only not retreated, but may be increasing.

2. Macroeconomic Outlook for Next Week

The current market focus is still on the reciprocal tariffs announced by Trump on April 2, which will be the biggest variable in the risk market in the near future. If the tariffs exceed expectations or the countries subject to tariffs take retaliatory measures, it will have a greater impact on the already fragile market. In addition, it is necessary to observe the US unemployment rate and non-farm employment next week to further assess the risk of recession.

In this case, arbitrage-type quantitative fund products may serve as a potential stable component of the overall asset allocation strategy of high-net-worth individuals. The current market direction is still unclear, the upward momentum is not sufficient, and external uncertainties may impact the market at any time.

Our overall view is:

Defense is the priority. The current macro environment presents a combination of weak economy + sticky inflation + policy swings. Risk assets (US stocks, cryptocurrencies, and highly valued technology stocks) are facing the dual pressure of interest rate pressure and recession expectations. For active positions, it is recommended to build positions or move profit targets downward.

From an allocation perspective, in addition to crypto quantitative arbitrage funds, you can still moderately allocate safe-haven assets such as gold and U.S. Treasuries.

If the reciprocal tariffs next week are lower than expected or the retaliation intensity of the countries subject to tariffs is lower than market expectations, the market risk appetite may be reversed, but it will not directly generate upward momentum. A greater macro-positive stimulus is still needed.

The market is extremely fragile this week. Avoid chasing ups and downs and strictly observe discipline.

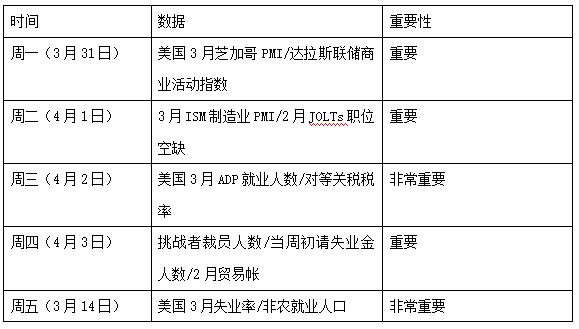

The key macro data for next week are as follows:

Disclaimer

This document is for internal reference only and is based on 4 Alpha Groups independent research, analysis and interpretation of available data. The information contained in this document is not investment advice and does not constitute an offer or invitation to buy, sell or subscribe for any financial instrument, security or investment product to residents of the Hong Kong Special Administrative Region, the United States, Singapore or other countries or regions where such offers are prohibited. Readers should conduct their own due diligence and seek professional advice before contacting us or making any investment decision.

This content is protected by copyright and may not be reproduced, distributed or transmitted in any form or by any means without the prior written consent of 4 Alpha Group. While we endeavour to ensure the accuracy and reliability of the information provided, we do not guarantee its completeness or currency and accept no liability for any loss or damage arising from reliance on this document.

By accessing this document, you acknowledge and agree to the terms of this Disclaimer.