Original source: Cointelegraph Chinese

This week, Gate.io officially launched the 7th World Cryptocurrency Trading Competition (WCTC S 7) . This years competition is themed around F1 and is dedicated to interpreting the platforms extremely fast, accurate, and stable trading philosophy. According to the latest data from Gate.io, within 48 hours of the registration opening on April 15, the number of participating users exceeded 10,000, unlocking a prize pool of $140,000.

Since its first launch in 2019, WCTC has rapidly grown into one of the largest and longest-running trading competitions in the crypto industry. In 2024, WCTC S 6 attracted more than 90,000 participants from around the world, setting a record high, competing for a prize pool of up to $5 million. From just over 4,000 registrants in the first session to over 90,000 registrants, the exponential growth in the number of registrants for the six events highlights the crypto communitys strong interest in platforms that combine high rewards and a spirit of collaboration.

Gate.io hopes to further ignite global trading enthusiasm in the S 7 season in 2025, promising a prize pool of up to 5 million US dollars, plus rewards such as red envelope rain, sports cars, etc.

Trading competition, an “accelerator” for platform growth

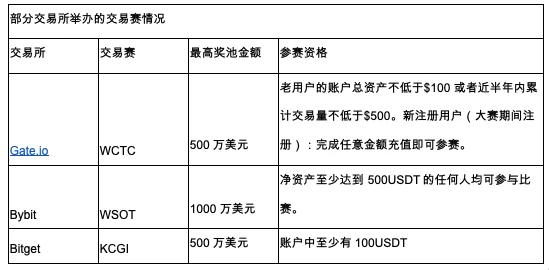

From Gate.ios WCTC , to Bybits WSOT, to various contract competitions launched from time to time by OKX and Bitget, the trading competition craze on cryptocurrency trading platforms is heating up.

On the surface, the trading competition is a technology competition. In fact, it is a catalyst for the platform to increase activity and trading volume. Unlike daily natural growth, trading competitions often increase the frequency of user transactions in a short period of time, especially contract transactions and high-leverage products, becoming a tool to pull up user activity in a short period of time.

The natural trigger point of community operation

Some platforms have introduced team battles, points battles and other mechanisms during trading competitions to encourage users to form teams, invite each other and expand the scope of communication. This also makes the trading competition itself have a strong social communication attribute and become a lever for user growth.

In addition to the trading behavior itself, trading competitions are often accompanied by strong operational investment. Whether it is Telegram groups, KOL team building, team PK... all kinds of social communication methods are on the scene. For the platform, trading competitions are an opportunity to build a sense of community belonging and a concentrated explosion of brand voice.

From short-term new customer acquisition to long-term brand equity

As the crypto industry gradually matures from the grassroots, the positioning of trading competitions is also changing. From the initial operation activities that simply pursued traffic and trading volume, it has gradually evolved into a part of the platforms brand strategy. Whether it is Gate.ios WCTC or Bybits WSOT, they have been held for many years in a row and have gradually built their own IP characteristics, no longer just playing a game.

Behind the trading competition is the competition of platform ecology

Trading competitions are about competing for trading volume, which is actually a comprehensive competition between exchanges for user attention, brand loyalty and ecosystem construction. As trading tools tend to be homogenized and product functions are increasingly similar, how to activate users in a more diverse and immersive way has become the core proposition of the next stage of trading platforms.

Trading competitions are becoming one of the most interesting ways to play this game.

Related recommendation: Gate.io changed its Chinese name to “大门” — When exchanges “roll up” Chinese names, what is Web3 fighting for?