Original author: Weird thinking (X: @0x Logicrw )

Why Bittensor is a scam and $TAO is heading to zero

First of all, although Bittensor has always officially claimed to be a fair mining project, in fact, the underlying Subtensor is neither a PoW public chain nor a PoS public chain; it is a stand-alone chain managed by the Opentensor Foundation (Bittensors foundation), and its mechanism is very black box.

As for the so-called Big Three + Senate binary governance structure, the Big Three are three employees of the Opentensor Foundation, and the Senate is the top 12 verification nodes, all of whom are internal people or stakeholders.

Secondly, the release of Kusanagi on January 3, 2021, marked the activation of the Bittensor network, allowing miners and validators to start receiving the first batch of TAO rewards. From the activation of the network to the launch of the subnet on October 2, 2023, Bittensor has mined a total of 5.38 million TAOs in the 2 years and 9 months. However, there is no document or information to explain the distribution rules and final destination of the tokens generated from January 3, 2021 to the launch of the subnet on October 2, 2023.

It is reasonable to speculate that this part of the tokens was divided up by internal members and interest groups, because Bittensor, unlike Bitcoin, was incubated and invested by VC.

If this part of tokens is divided by the current issuance of 8.61 million, at least 62.5% of TAO is in the hands of internal members and interest groups. In addition, the Opentensor Foundation and some invested VCs also operate verification node businesses on Bittensor, so the proportion of chips in their hands will only be more than 62.5%.

Just like the OM avalanche a few days ago, all the projects whose market value you don’t know why is so high, their distorted market value is often caused by the pitiful circulation.

Billions marketcap backed by poor liquidity.

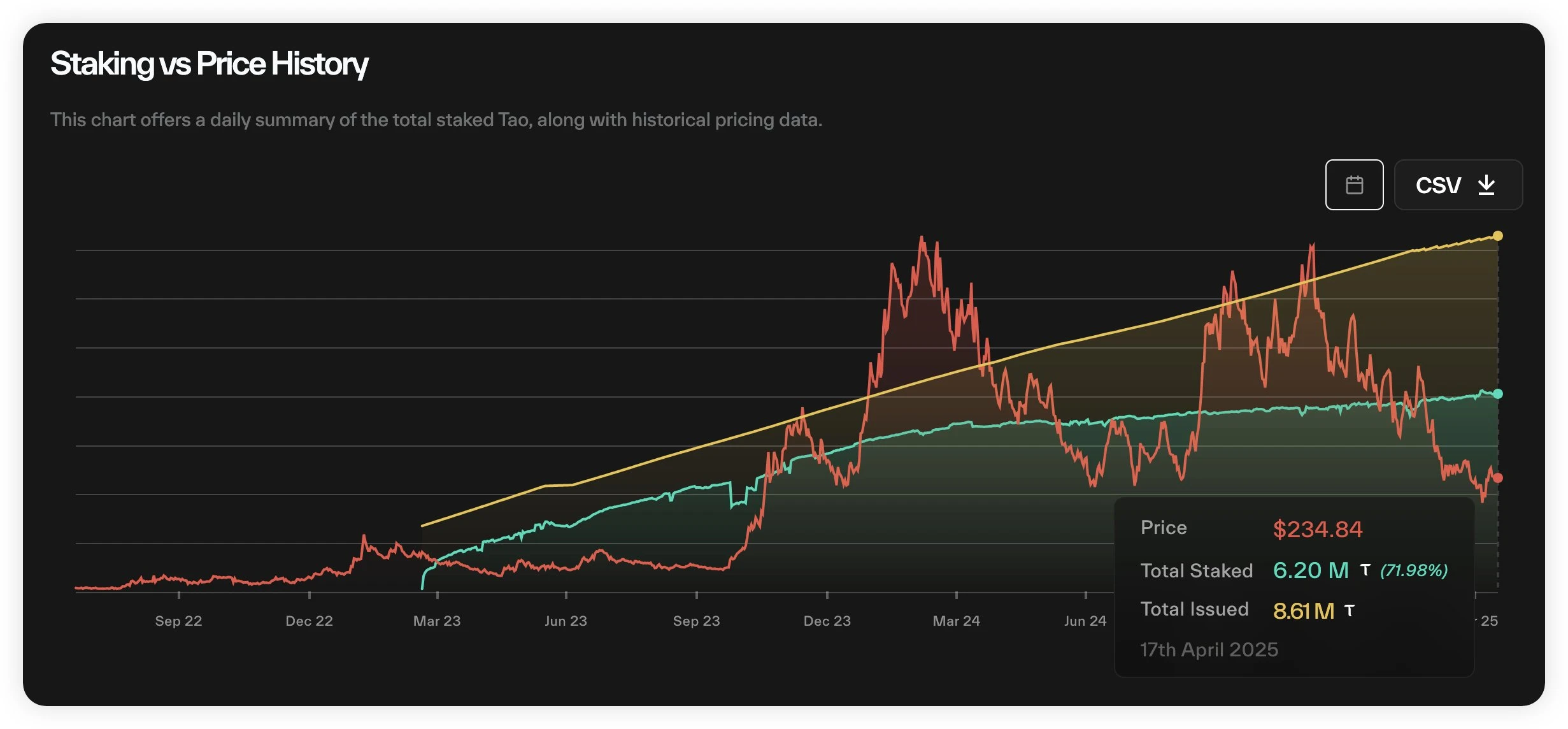

The following picture shows the historical pledge situation of TAO. Don’t be fooled by it and think that the pledge rate of TAO has gradually increased from low to high. The reason for this is that TAO is experiencing severe inflation.

In fact, TAO’s pledge rate has never been lower than 70%, and the highest was close to 90%. According to TAO’s current market value of $2 billion, at least $1.4 billion of TAO has never been involved in circulation. TAO’s actual market value is only $600 million, while the corresponding FDV is as high as $5 billion, a typical low-circulation, high-market-value project.

Please take a closer look at how the bubble of the so-called AI project with the largest market value was blown up by the main market makers.

Finally, the so-called dTAO upgrade is actually more like providing OGs with an opportunity to exit liquidity, allowing you to take over the TAO in the hands of interest groups in order to buy subnet tokens with high increases.

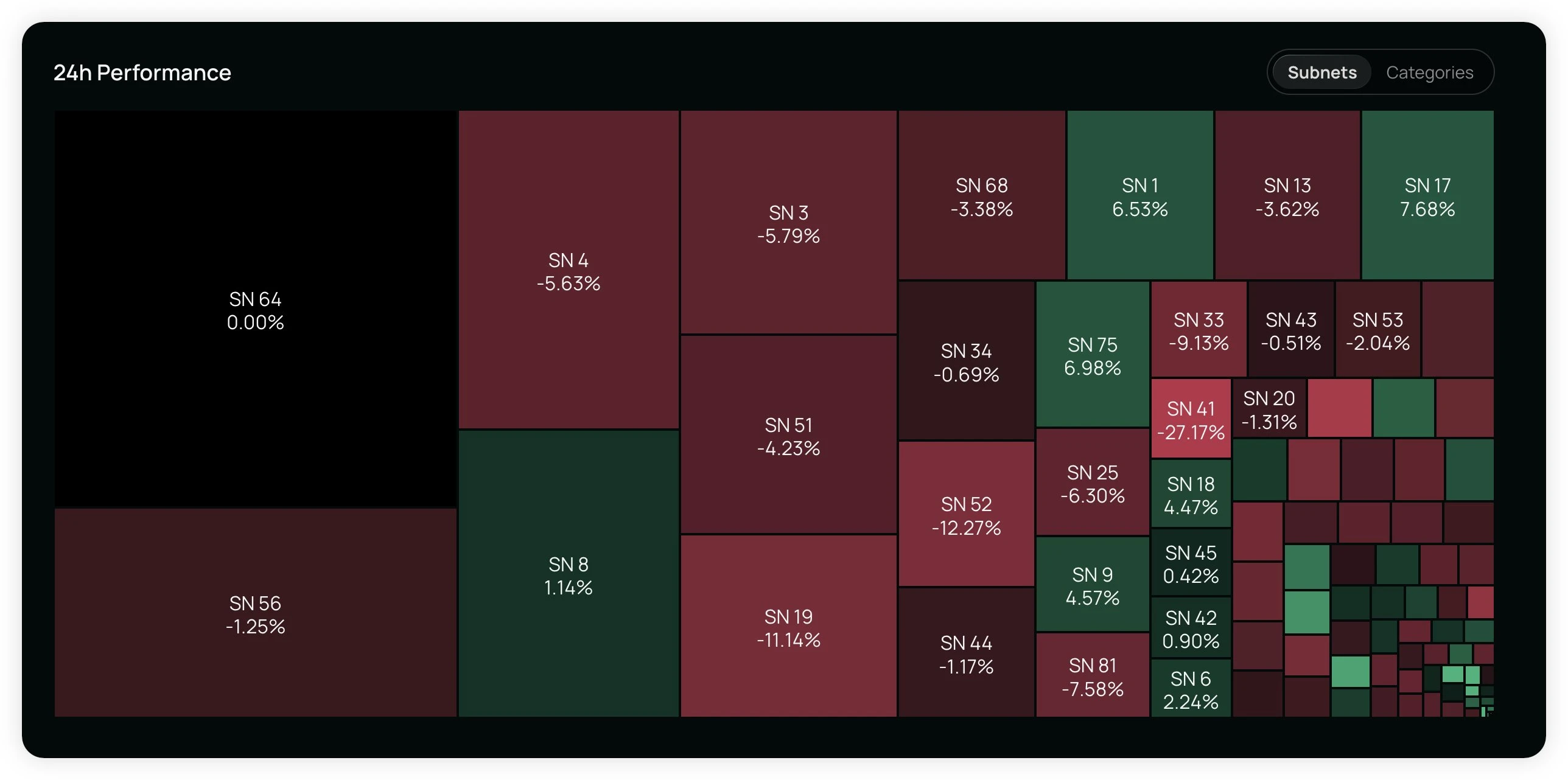

According to the three-disk theory, Bittensors dTAO upgrade in February this year was due to the fact that the dividend plate was unsustainable, and it had to introduce new Ponzi scheme models splitting plate and mutual aid plate to deleverage. The core purpose is to fabricate a new narrative to attract new external liquidity to continue to squeeze when the old narrative is weakening and external liquidity is about to be squeezed out.

The first is the “splitting”: by allowing all subnets to issue tokens, TAO has successfully positioned itself as the base currency for all Bittensor subnet tokens, with its value supported by the tokens of dozens (and more and more) subnets.

Due to the poor depth of the trading pool, subnet tokens often have amazing increases. In this way, Bittensor presents a disguised mask to the outside world that the ecosystem can provide high ROI opportunities. The exaggerated nominal ROI provided by the subnet Alpha token artificially creates huge buying pressure for TAO and covers up the selling of TAO by the root network verification nodes.

Unfortunately, Bittensor’s closed ecosystem, coupled with the market environment turning from bull to bear, resulted in the dTAO upgrade failing to attract enough external liquidity, and even internal liquidity (those TAOs staked on the root network) was not sufficiently mobilized and activated.

At the same time, the entry threshold of subnets has been lowered and there is no upper limit on the number, resulting in excessive and rapid issuance of coins, diluting the overall liquidity of the Bittensor ecosystem, which is already limited.

The second is mutual assistance. Unfortunately, Bittensors subnet token issuance cannot establish a mutual assistance model where funds can be highly circulated like Solanas http://Pump.fun , because Bittensors network infrastructure is very poor, and even tokens from different subnets cannot be exchanged, making it difficult for participants in subnet tokens to migrate liquidity between different subnets. This further exacerbates the liquidity dilution problem caused by the high split rate, and it is impossible to keep funds in the market and continue to participate in speculation like Solana.

Once the major stakers of the Root Network begin to flee en masse, liquidity both on and off the exchange will quickly dry up.

The moment you sell, game over.

So are the big investors fleeing? The answer is “They are fleeing”!

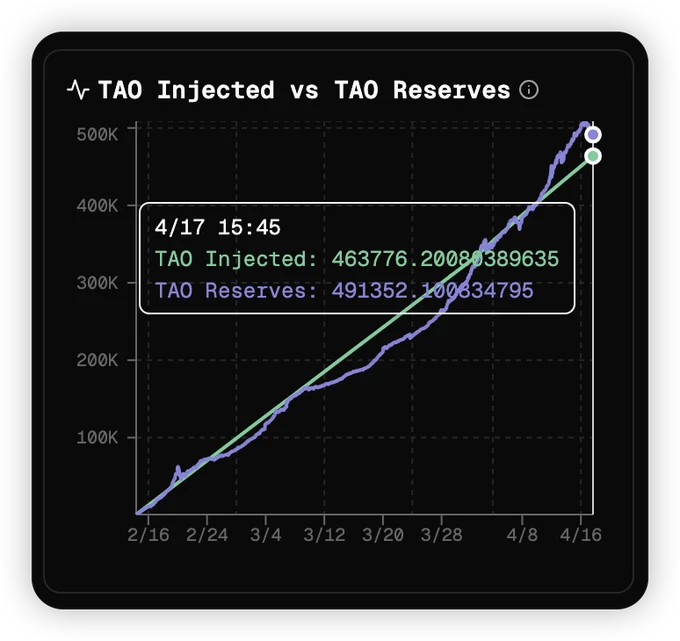

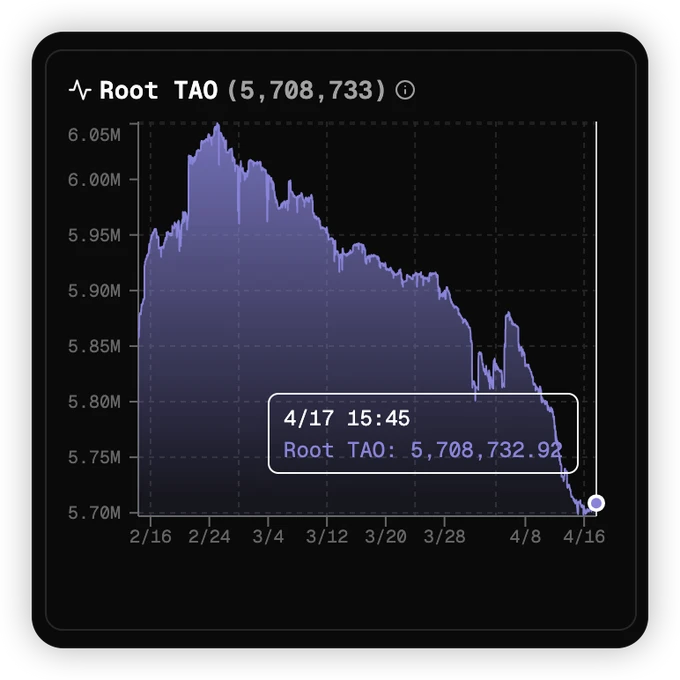

Since dTAO went live:

Bittensor Protocol injects 450,000 TAO into the subnet pool

150,000 TAO (33%) flow to the root network verification node through the automatic sell mechanism

The root network stake (τ₀) decreased by 150,000 (5.86 million → 5.71 million)

This means:

300,000 TAO (≈ $70 million) successfully escaped from the root network and may have been liquidated in the CEX.

Moreover, Bittensor’s foundation before was subnets and miners. Bittensor’s previous model was like VC, giving money to projects to let them focus on building valuable business models first, without having to worry about how to make money and ensure a balance between income and expenditure. This is the core reason for attracting projects to build subnets on Bittensor.

The project has attracted miners who provide computing power (or intelligence in Bittensors words) to Bittensor. This you are good, I am good, and everyone is good situation is the core reason why Bittensor has become the largest encrypted AI project by market value.

However, after the dTAO upgrade, the interests of subnet project owners, miners, and verification nodes are no longer aligned, and the original “you are good, I am good, everyone is good” no longer exists. The dTAO model does not bring any benefits to subnet project owners, and the collapse of the economic model is currently Bittensor’s biggest and most fundamental problem.

In Bittensors dTAO model, the subnet Alpha token is a kind of warrant we obtain by staking TAO in the subnet, and it is not a token that can be circulated in the general sense.

This makes it difficult for subnet project owners to invent effective Tokenomics for these tokens. These Alpha tokens are of no use to retail investors except for generating more Alpha tokens.

According to my observation, in order to increase the price of the coin, the most common way for subnet project parties to do so is to announce that they will use project revenue to repurchase Alpha tokens, such as Chutes (SN 64).

But if the Subnet Owner can only empower Alpha tokens in this way, then something funny will happen. The 18% Alpha tokens that dTAO distributes to the subnet project will always remain in the hands of the project. After all, you have announced that you will use the project revenue to repurchase, so why sell your own tokens?

Selling and buying back are contradictory.

Therefore, not only do subnet owners not receive any revenue from the dTAO model, they even have to subsidize it: create external revenue and inject it into their subnet Alpha tokens.

This means that subnet project owners and miners are essentially working for verification nodes.

As a privileged class in the Bittensor network, validator nodes cannot do anything of value, and can continuously sell subnet Alpha tokens from the beginning of the dTAO upgrade. TAO flowing to the root network accounts for up to 1/3 of daily emissions.

The reason why Bittensor is able to attract other projects to build subnets on them is essentially because the previous TAO emissions are a good subsidy mechanism for emerging projects with no income, allowing these projects to only focus on the business model that needs to be run.

If this subsidy mechanism not only disappears but even reverses, why would the subnet project party still want to build a subnet on Bittensor?

Just work on your own and keep all the income for yourself, isn’t that great?

Therefore, the dTAO model, as a means for interest groups to sell their products, is damaging the foundation on which Bittensor has developed to date.

Although the business models of most subnets in the Bittensor ecosystem are shitty, without them, Bittensor will lose its last fig leaf.

References for this article:

Bittensor official documentation: https://docs.bittensor.com

@harry_xymeng s research report Bittensor: When will the music stop

@thecryptoskanda s Three-Disk Theory: The Ultimate Guide to Ponzi Scheme Construction