BTC Weekly | Bitcoin Shrinkage; Bakkt Bitcoin futures rose 17% during the trading week, implying that institutional investors are entering the market? (7.6-7.12)

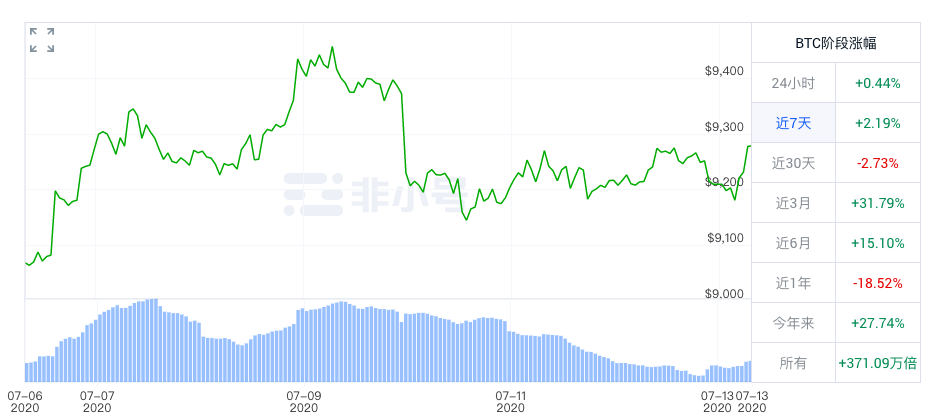

The shock of Bitcoin shrank, and the weekly line closed up 2%;

The share of Turkish Lira against Bitcoin rose to the top three;

Bitcoin net inflows are positive for the first time in 6 weeks;

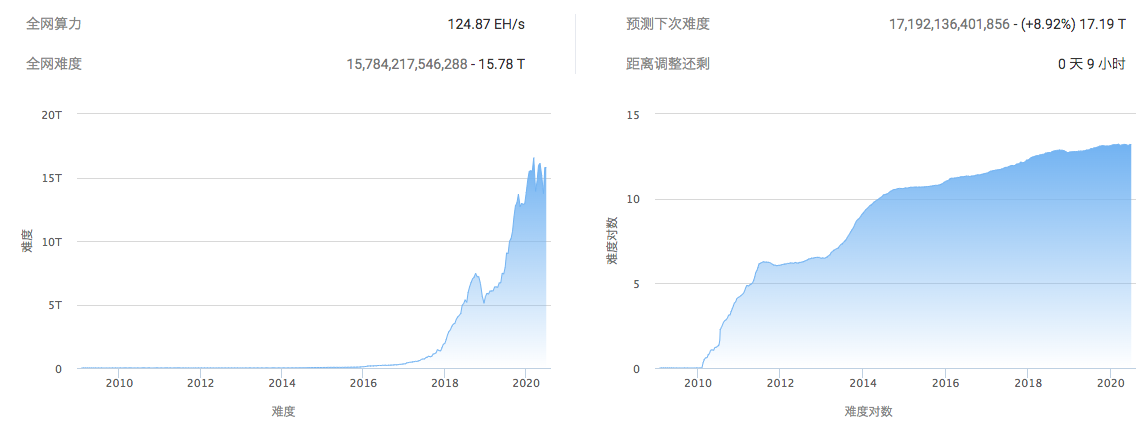

The computing power of the entire network continues to break record highs, and the difficulty is about to increase by 9%;

Secondary market

Secondary market

Bitcoin’s volatility shrinks, closing up 2% for the week

non trumpet

Gold diggers in the currency circleGold diggers in the currency circleIt pointed out that MACD is about to move towards the golden cross. Generally speaking, long and short positions will compete in this position, and there will be a needle wash; from the perspective of the one-hour level line, it has already formed the prototype of an upward channel. The army has the opportunity to lead.

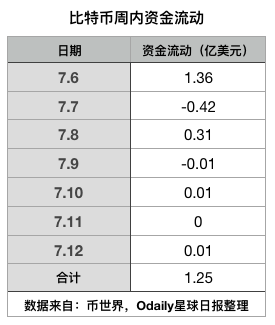

Bitcoin net inflows are positive for the first time in 6 weeks

Although the currency price has not yet come out of the consolidation trend, it finally got out of the 5-week net outflow phase and received a net inflow of 125 million US dollars this week.

Although the currency price has not yet come out of the consolidation trend, it finally got out of the 5-week net outflow phase and received a net inflow of 125 million US dollars this week.

Turkish lira rises to top 3 by bitcoin trading share

Data on the chain

Data on the chain

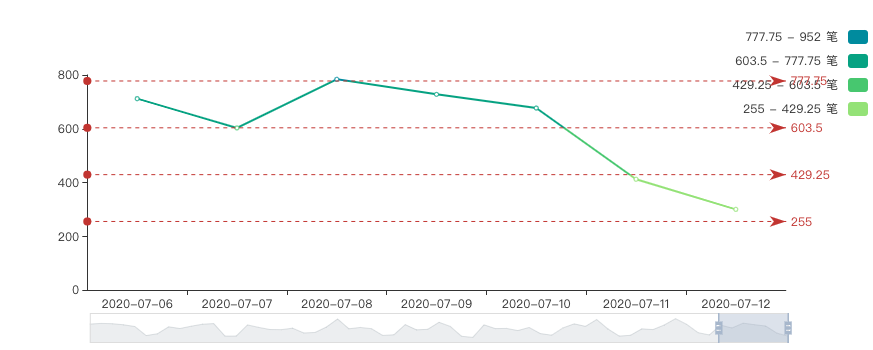

Large transfers drop slightly

image description

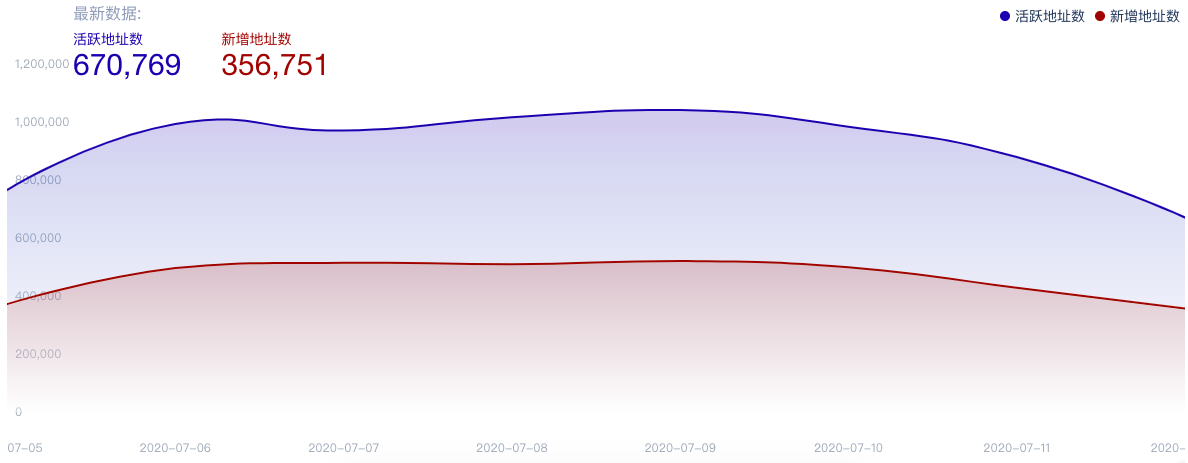

Active addresses increased by 4%

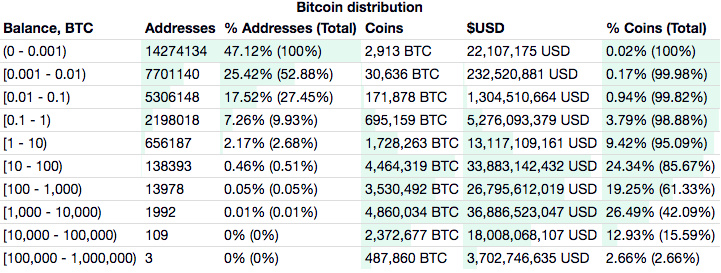

Small amount of currency holding addresses accounted for nearly 50%

Small amount of currency holding addresses accounted for nearly 50%

mining

mining

according to

according toBTC.comAccording to data, Bitcoin computing power continued to rise this week, reaching a record high of 124.8EH/s (judging from the weekly average computing power indicator). With the launch of new mining machines, Bitcoin once again ushered in a cycle of rising computing power. Today, the difficulty of the entire network is expected to increase by 9%.

according to

according to

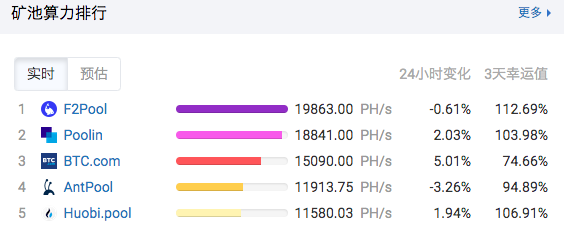

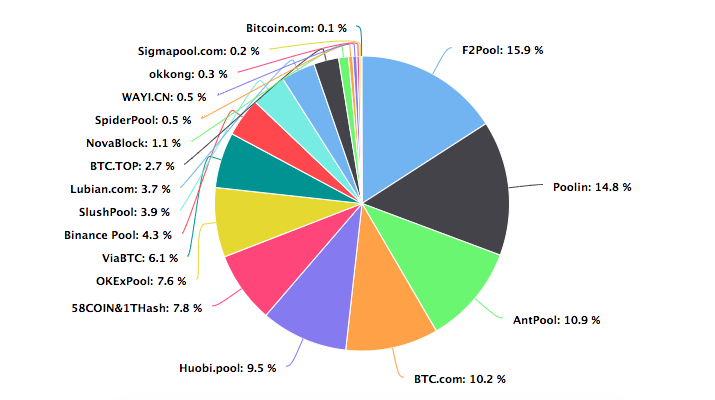

according toBTC.comAccording to the data, the real-time computing power of F2pool is 19.9EH/s, which is a slight drop compared to last Monday; the percentage of computing power (block generation share) in the past week has dropped slightly, but it still maintains the first place at 15.9%;

Coinprint Mining Pool announced that the real-time computing power is 18.8EH/s, which is slightly lower than last Monday; the computing power accounted for 14.8%;

AntPool has announced that its real-time computing power is 11.9EH/s, a slight drop of 15% from last Monday, and the proportion of computing power has dropped to 10.9% in the past week.

related news

related news

Iran to Reward Those Who Report Illegal Bitcoin Miners

On July 6, Iranian Vice President Eshaq Jahangiri announced that cryptocurrency miners in the country must register with government agencies such as the Ministry of Industry, Mines and Trade to curb activities such as smuggling of mining machines by illegal miners.

As of July 7, according to Iran's "Financial Tribune" report, the executive chairman of Iran's National Power Generation, Distribution, and Transmission Corporation (Tavanir) stated that the government will provide rewards to whistleblowers to encourage the reporting of illegal Bitcoin mining activities . Incentives include rewards worth 100 million riyals ($480) to those who cooperate with energy officials in cracking down on illegal mining. Tavanir is authorized by the government to investigate and deal with illegal mining activities. It is reported that there are currently about 1,100 illegal mining centers operating in Iran. (Official website of the Ministry of Commerce of China)

Skew data: Short-term Bitcoin options quickly pulled back this week

Encrypted data provider Skew tweeted that this week, short-term Bitcoin options quickly pulled back.

According to previous reports, Bakkt Volume Bot statistics show that last week (June 29 to July 5) the total transaction volume of Bitcoin monthly futures was 80 million US dollars, an increase of 17% from the previous week; It was 9.3 million US dollars, an increase of 18% from the previous week. At the same time, the price of CME futures has also been rising, and its premium indicates that institutional investors are adopting a "buy and hold" investment strategy for digital currencies at this stage. In addition, the latest Bloomberg report states that over the past month, BTC futures have averaged a 1% premium. “Steady premiums on Bitcoin futures are supporting market functioning, indicating increasing institutional interest in buying and holding BTC.” (Cryptoslate)

Ex-Goldman Sachs executive: ETH/BTC is experiencing a bull breakout

Raoul Pal, former head of Goldman Sachs' stock derivatives business and founder of Global Macro Investor, recently tweeted that in the upcoming Bitcoin bull market cycle, ETH is likely to "become (the first) cryptocurrency that outperforms BTC." The chart shared by Pal shows that ETH/BTC is experiencing a bullish breakout after a two-year bear market. It is worth mentioning that Pal stated that he does not hold ETH, but may establish a position in the near future. (CryptoSlate)

Recently, the procuratorial organ in Sichuan reviewed a huge telecommunications network fraud case according to law and approved the arrest of more than 400 suspects. Since 2018, the criminal gang has successively set up criminal dens in Cambodia, the Philippines, Guangzhou, China, and other places, and carried out telecommunications and network fraud against the domestic public in the name of investing in "Bitcoin" and "Myth Coin". The amount involved is particularly huge. (Sichuan Prosecutor's WeChat)