Odaily Frontline | Report: The overall trading volume of the encryption market increased by 34% in Q3

This article comes fromDecrypt, original author: Robert Stevens

Odaily Translator |

, original author: Robert StevensReportOdaily Translator |

According to a report on the crypto market this summer by CoinGecko, a Singapore-based crypto data site,

, "The third quarter of 2020 is the summer of DeFi."

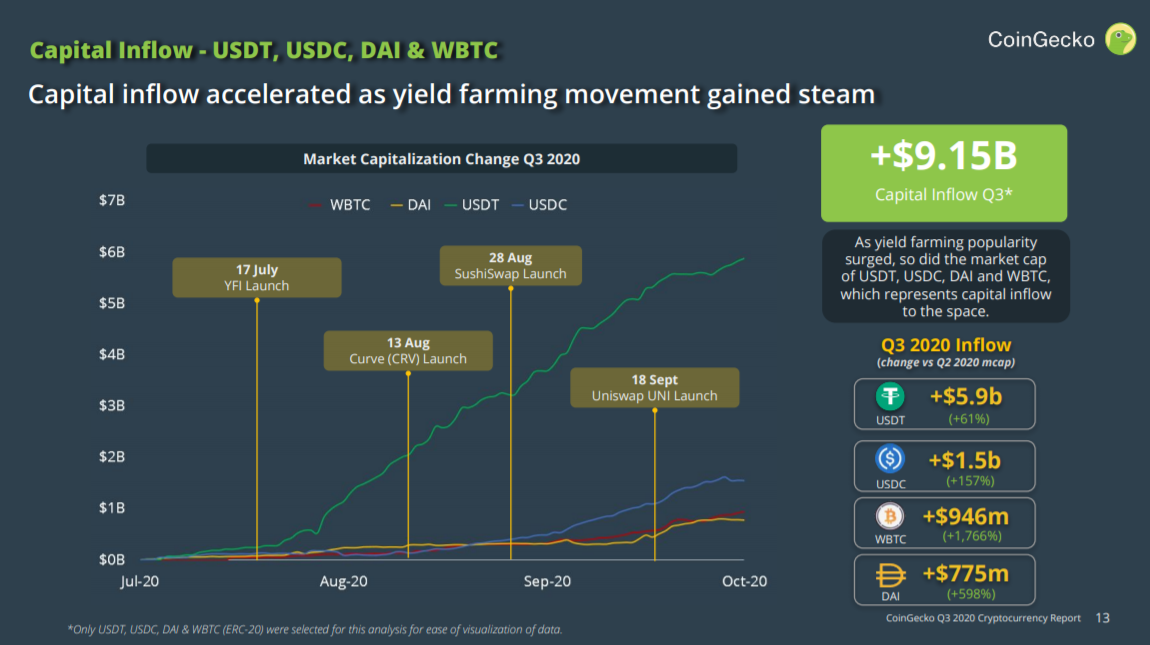

The numbers are stark: CoinGecko found that inflows into crypto markets increased by $9.15 billion in the third quarter, attributable to a surge in DeFi protocols.

secondary title

Rise of DEXs

First of all, the market value of Ethereum-based stablecoins USDT, USDC, DAI and wBTC soared. USD-pegged stablecoins are useful when navigating the highly volatile space of DeFi. The transaction volume of USDT increased by 61%, USDC increased by 157%, DAI increased by 598%, and wBTC increased by 1766%.

image description

Stablecoin capital inflows in the third quarter, picture from CoinGecko

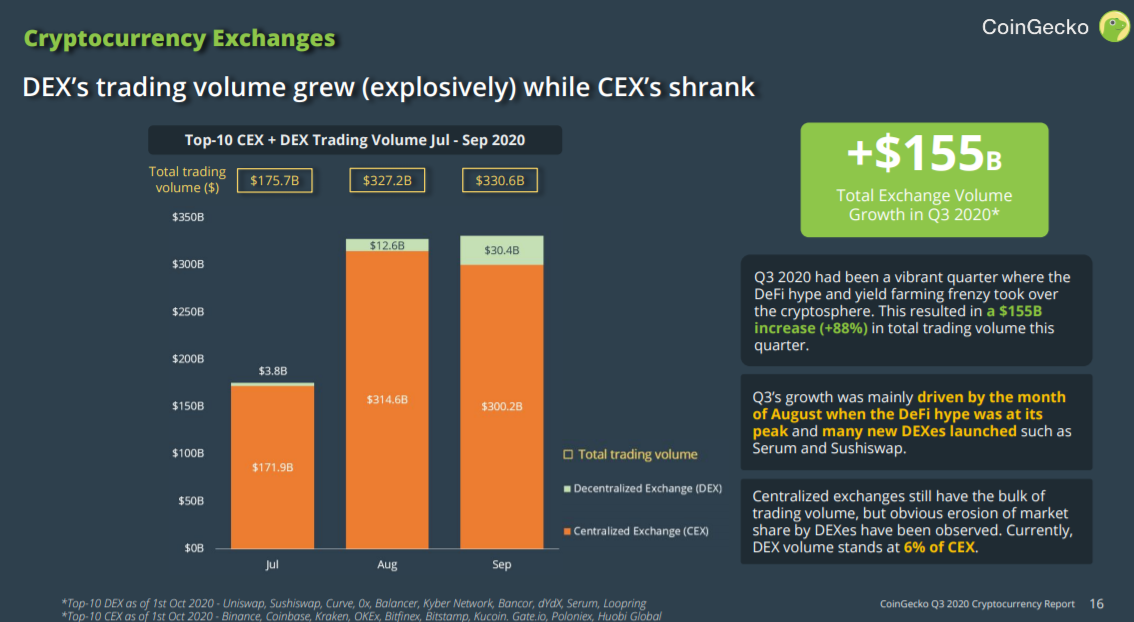

CoinGecko found that people do use DeFi protocols. Although the trading volume of DEXs (such as Uniswap) is only 6% of that of centralized exchanges (such as Binance), DEX trading volume increased by 700% in the third quarter.

(However, Sam Bankman-Fried, CEO of decentralized exchange FTX, said earlier this week that DEX volumes are unreliable because they are backed by yield farming profits.)

Reports show that monthly trading volume growth on decentralized exchanges has outpaced that on centralized exchanges. The average monthly trading volume growth of the top ten DEXs in the third quarter was 197%, while the figure for centralized exchanges was only 35%.

Jason Brown, business development manager at blockchain developer Komodo, agrees, saying high DEX volumes are likely to be the new norm: “The non-custodial nature of DEXs gives them a clear security advantage over centralized counterparties. The market may temporarily move away from DEXs as regulations come into effect, but those companies that find compliant solutions and focus on end-user self-sovereignty will thrive.”

image description

secondary title

How is Bitcoin doing?

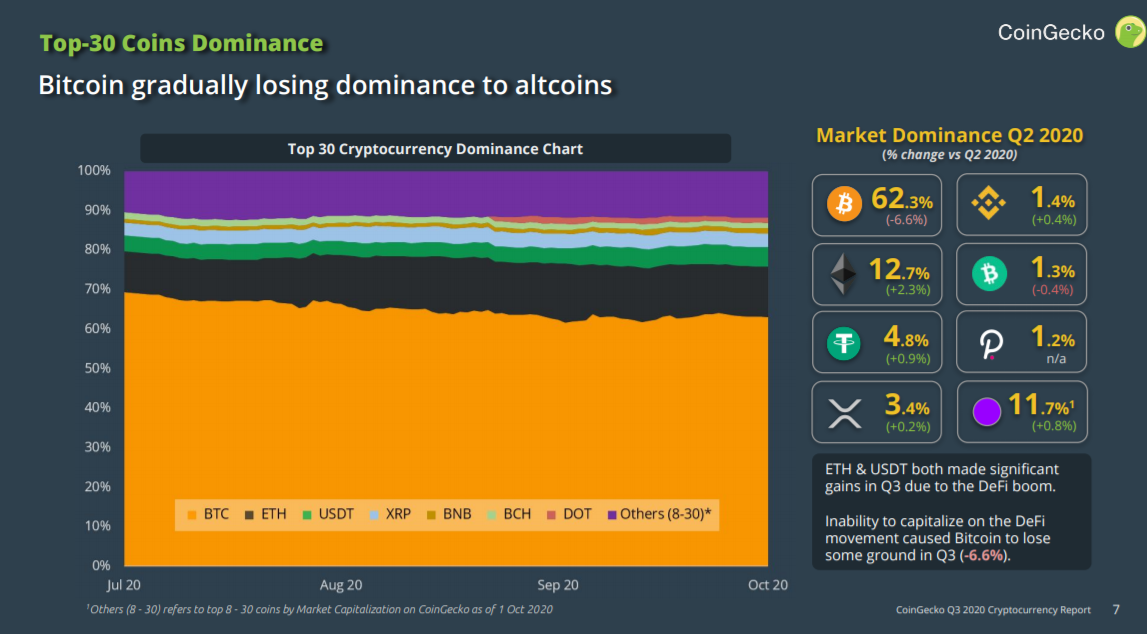

CoinGecko’s report also shows that Bitcoin is losing its dominance: Compared to the second quarter of this year, Bitcoin’s dominance has dropped by 6.6 percentage points, from 68.9% to 62.3%. During the same period, Ethereum’s dominance increased by 2.3 percentage points, from 10.4% to 12.7%. This may be because various top DeFi protocols are based on Ethereum.

image description

Bitcoin VS Altcoin Market Cap Percentage. Image via CoinGecko

According to Brown, “altcoins built on other blockchain networks generally offer more use cases.” As a result, he said, “Bitcoin’s lack of technical upgrades and a fee-based market-based mining system is not conducive to continued growth. That said, Bitcoin just retains its brand and first-mover advantage.”