Odaily Frontline | The market value of Bitcoin breaks through trillions of dollars and hits a new high

This article comes fromReutersReuters

Odaily Translator | Nian Yin Si Tang

, original author: Gertrude Chavez-Dreyfuss & Tom Wilson

Odaily Translator | Nian Yin Si Tang

With the price of Bitcoin reaching new highs, its market value has successfully exceeded 1 trillion US dollars. The strong performance seems to be a bit of a "face" to JPMorgan analysts - they warned in an assessment report that Bitcoin is an "economic side show (economic side show)" and is not effective as a hedge against falling stock prices. good.

At press time, bitcoin, the world's most popular cryptocurrency, jumped to an all-time high of $56,399.99, up 14% for the week and nearly 70% so far this month. According to the latest OKEx quotes, BTC has risen as high as 56,600 USDT today, setting a new record high.

Signs that bitcoin is gaining acceptance among mainstream investors and companies, from Tesla Inc. and Mastercard Inc. to BNY Mellon rise.

According to CoinMarketCap data, the current total market value of digital currencies is about 1.7 trillion US dollars.

"If you really believe that bitcoin is a store of value, then it still has a lot of room to grow," said John Wu, president of AVA Labs. AVA Labs is an open-source platform for creating financial applications using blockchain technology.

“If you look at gold, its market cap is $9 or 10 trillion. Even if Bitcoin were half the market cap of gold, it would be 4 times the current price, which is $200,000. So I don’t know it When will it stop rising," he said.

Jacob Skaaning, portfolio manager at crypto hedge fund ARK36, said the next milestone in bitcoin's market capitalization will be surpassing Alphabet Inc, which currently has a market capitalization of $1.431 trillion.

"There may be some big volatility along the way, but I'm still very bullish and I believe this uptrend will continue for the time being," he added.

Still, many analysts and investors remain skeptical of the poorly regulated, highly volatile digital asset, which is rarely used for commerce.

According to analysts at JP Morgan, the current price of Bitcoin is well above fair value estimates. The investment bank said in a memo that mainstream adoption would increase Bitcoin’s correlation with cyclical assets that rise and fall with economic changes, reducing the benefits of diversification into the crypto space.

“Crypto assets continue to be ranked as the worst hedge against sharp equity drawdowns, diversification benefits at prices well above production costs are questionable, and correlations with cyclical assets are rising as crypto ownership becomes mainstream ,” JPMorgan said.

Other investors said this week that bitcoin's volatility is preventing it from becoming a widespread means of payment.

On Thursday, Tesla CEO Elon Musk, who has recently tweeted about Bitcoin several times, said that owning Bitcoin is only slightly better than holding cash. He also defended Tesla’s recent purchase of $1.5 billion in bitcoin — a move by Tesla that sparked mainstream interest in bitcoin.

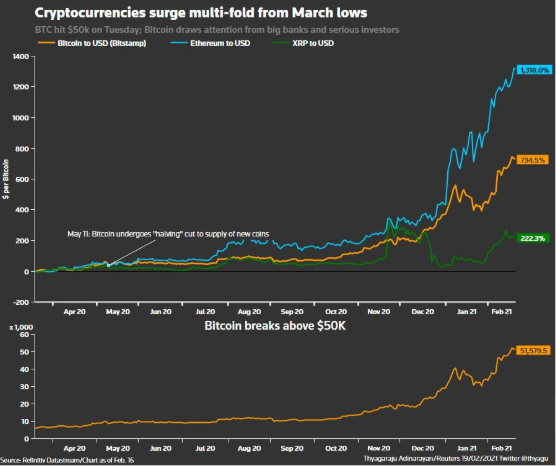

image description

Bitcoin has grown exponentially from March 2020 lows

Bitcoin proponents believe that Bitcoin is "digital gold" that can hedge against the risk of inflation caused by the massive stimulus programs of central banks and governments aimed at combating COVID-19.

However, according to JP Morgan, Bitcoin would need to rise to $146,000 in the long run to match the total private sector investment in gold through exchange-traded funds (ETFs) or bars and coins.

Rival cryptocurrency ethereum (ETH) also breached its all-time high of $2,000 today.