Produced | Odaily

Editor | Hao Fangzhou

Produced | Odaily

With the rise of encrypted finance, more and more traditional institutions have begun to pay attention to this emerging ecology.

Listed companies such as Tesla and MicroStrategy have begun to try to incorporate Bitcoin into their balance sheets, forming a good example. However, more traditional institutions are choosing to wait and see. One of the reasons behind this is that security (private key management) and compliance have become important factors that hinder the entry of giants.

Recently, we have paid attention to the digital asset management infrastructure and product suite called Qredo, which aims to lower the barriers to Web3 entry for institutional investors, while providing everyone with the most secure custody with rewards.

Qredo includes a new Layer2 protocol that allows users to seamlessly transfer and settle cryptocurrencies such as Bitcoin and Ethereum; in addition, Qredo provides institutional users with decentralized private key custody through decentralized multi-party computing (MPC), eliminating the need for Concerns about private key management; Qredo also cooperates with Hex Trust, MetaMask Institutional and other institutions to provide traditional users with complete custody solutions and support them to access various DeFi protocols. According to official data, Qredo currently manages nearly $8 billion, has about 50,000 wallets and more than 11,000 monthly active users.

first level title

1. Qredo lowers the threshold for institutions to participate in Crypto

In the past two years, encrypted finance has begun to go out of the small circle and attract the attention of the mainstream society. In particular, some listed companies have begun to use Bitcoin as an important asset reserve. According to CCTV financial statistics, more than 200 listed companies around the world have purchased Bitcoin.

In addition, decentralized finance (DeFi) has also successfully "out of the circle". Even U.S. regulators, which have always been cautious about encrypted assets, are optimistic about the prospects of DeFi. Heath Tarbert, chairman of the US CFTC, gave DeFi a high evaluation, saying that "the whole concept of DeFi is revolutionary."

However, under the wave of Web3, more traditional institutions still remain on the sidelines for cryptocurrencies and DeFi.There are many reasons that hinder the entry of institutions, the two most important of which are: asset security and compliance (Asset security and compliance).

Taking asset security as an example, there is a big difference between encrypted currency and traditional legal currency, which is mainly controlled by the private key: whoever has the private key owns the ownership of the encrypted currency; once the private key is lost, the control of the old account is lost. Although the concept of private keys is gradually becoming popular, it is still difficult for traditional institutions to be persuaded to "recognize" this set of rules, and they attach more importance to asset security. How to reduce the uncontrollable risks caused by the leakage of private keys is an unavoidable problem in realizing asset security.

In addition, from the perspective of asset compliance, how to reduce the trouble of traditional institutions from being exposed to "black money" in the process of participating in the encryption ecology? At present, regulatory agencies around the world have issued relevant bills on cryptocurrencies. The most representative one is the 16 recommendations of the Financial Action Task Force (FATF) on anti-money laundering (also known as the "travel rule"). Once violated, it will be included in the The FATF blacklist or gray list will undoubtedly increase the compliance burden on traditional institutions, causing them to hesitate to enter the market.

Only by effectively solving the above two problems can we further promote the pace of institutional users. Just imagine, traditional giants with a market capitalization of tens of billions of dollars, even if they invest only 1% of their assets in the encrypted market, will push encrypted finance to a new level.

This is where Qredo comes in.As a Web3 infrastructure project, Qredo provides a complete set of "out-of-the-box" solutions for traditional institutions, enabling them to hold assets in a form similar to traditional bank accounts - access rights can be set for encrypted assets And control money without exposing private keys.

“We provide them with an encrypted security protocol that enables institutions to reduce the risk of private keys and the risk that anyone can compromise or hack their escrow account,” said Josh Goodbody, COO, Qredo. “For some customers, they need a custodial solution. , needed someone to look after the assets for them, so we started working with custodians.”

Qredo has partnered with Hex Trust, one of the first regulated custodians in Singapore, to help Qredo custodian user assets; in addition, Qredo has partnered with options platform Deribit, Web 3 wallet, DeFi protocol Clearpool for institutional borrowers, DeFi lending protocol X-Margin and others have reached cooperation to enable institutions to securely access digital assets and DeFi.

Currently, Qredo has nearly $8 billion in assets under management, approximately 50,000 wallets and over 11,000 monthly active users.

In 2022, Qredo announced the completion of an $80 million Series A round at a valuation of $460 million, led by 10T Holdings, an encryption investment firm managed by investors Dan Tapiero, Stan Miroshnik, and Michael Dubilier. This round of financing includes diversified strategic investors Coinbase Ventures, Avalanche, Terra, Kingsway Capital, HOF Capital, Raptor Group, GoldenTree Asset Management; in 2021, Qredo will raise a total of 120 million US dollars.

"We've won the backing of some of the biggest and brightest investors in the crypto space, which is a clear testament to Qredo's long-term focus and mission," said Qredo CEO Anthony Foy, "The Qredo solution provides institutions with a secure A cost-effective and compliant way to get the most out of digital assets and DeFi. We are now in an excellent position to seize the opportunity, capture market share, and demonstrate the strong value of decentralized custody.”

first level title

2. Why do institutions favor Qredo?

Looking at the current encryption market, there are many projects that choose the To B direction, and "attracting traditional institutions to enter the market" is also a time-tested story template.

Why do institutional users favor Qredo? A very important reason lies in its transformation of infrastructure.

"Infrastructure is a key battleground for expanding crypto adoption," said Dan Tapiero, founder and CEO of 10T Holdings, "Qredo's distributed architecture and unique implementation of MPC is a game-changer for the secure custody and settlement of crypto assets. Qredo is a project with the drive, resources and technical strength to support the complex and changing needs of its users now and in the future."

In general, Qredo's unique advantages are reflected in two aspects: at the technical level, the core is decentralized multi-party computing (MPC), which eliminates vendor risks and single points of failure associated with centralized hosting solutions and traditional private key management ; At the policy level, the governance and compliance of the organization can be flexibly controlled.

(1) Decentralized MPC eliminates single point of failure

Nowadays, with repeated hacker attacks and various security incidents, multi-signature has become popular and has become the first choice of many organizations. In simple terms, it achieves asset security by assigning each wallet a number of individual private keys (N) and a set of signatures (M) required to authorize transactions.

However, this method still has problems such as subjective evil by insiders and leakage of private keys; and for institutional users, frequent authorization also increases transaction costs. How to achieve fine-grained control over accounts under the premise of security has become a difficult problem.

The solution proposed by Qredo is to decentralize private key custody and completely remove trusted third parties from the digital asset custody business. But it is easier said than done, and finally after research, Qredo chose decentralized multi-party computing (MPC). Decentralized MPC is Qredo's unique implementation of multi-party computation, which uses BLS (Boneh-Lynn-Shacham) digital signatures to build a threshold approval scheme guaranteed by Qredo's own layer2 blockchain; using this escrow method, private keys Distributed in an independent blockchain network. Since the single point of failure of the private key is eliminated, offline storage, hardware isolation and cumbersome signing procedures are no longer required.

In June 2020, the Qredo team launched the consensus-driven multi-party computing network v1.0 test network; in September of that year, launched the main network v1.0 supporting BTC and instant transfers, and then supported ETH and BTC-to-ETH atomic swap; 2021 In May, the flagship wallet of the Qredo network came out, bringing the institutional-level security and fine-grained governance control of decentralized MPC to the market; in November, the Qredo network supported more ERC-20 standard tokens.

(2) Compliance can go further

Today, global regulators have implemented stricter policies on cryptocurrencies, representative of which is the "travel rule". In simple terms, the Travel Rule requires all virtual asset service providers (VASPs) to share the identity information of originators and beneficiaries of digital asset transfers, including names, physical addresses, and national identification numbers.

For companies that provide encryption services, how to cater to regulations and meet compliance requirements has become a major difficulty. Qredo is one of the few crypto businesses currently compliant with the “travel rule.”

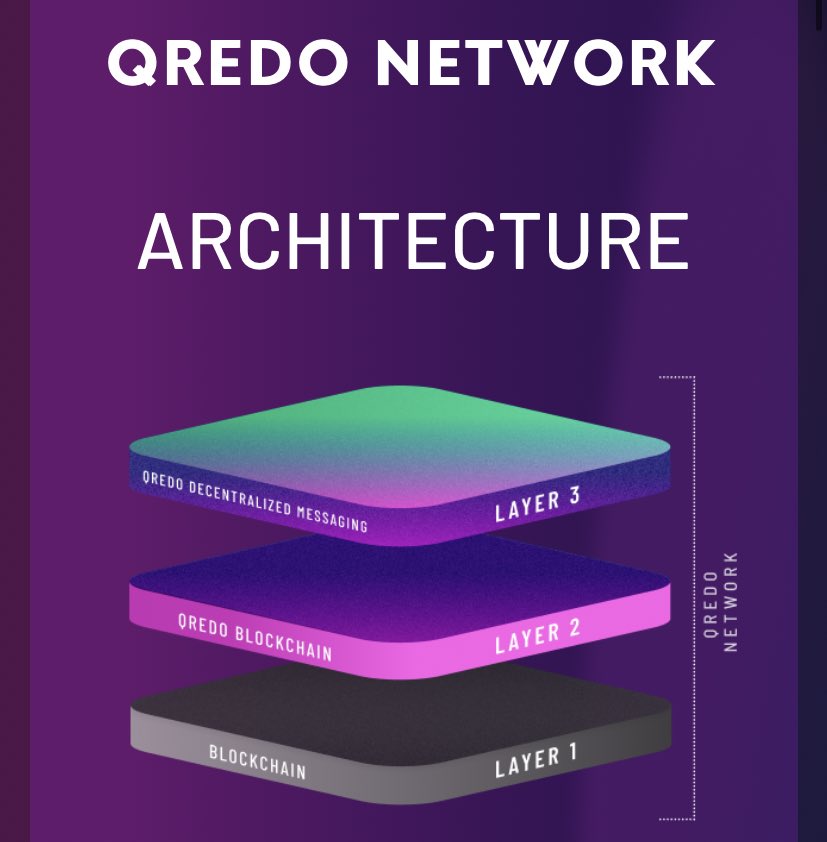

The Qredo network consists of the MPC protocol working with Layer2, topped with a layer3 messaging network based on the decentralized communication protocol Matrix. Essentially, Qredo is a general-purpose messaging system for sharing transaction data when dealing with crypto assets.

When a VASP on Qredo sends a digital asset over a layer 2 blockchain, a cryptographically bound data packet is simultaneously sent on a layer 3 network. The package ties compliance data, including originator and beneficiary information, to digital asset transactions, linking otherwise anonymous activity to real-world identities.

Through this mechanism, registered VASPs can send digital assets to other approved registered VASPs on the Qredo network; newly registered VASPs have been automatically vetted for compliance. When receiving a transaction, the packet data Travel Rule information can be used to accept, reject or quarantine (vet) incoming digital assets in a process that can be managed programmatically through Qredo's combined Python library.

This elegant solution enables VASPs seeking "travel rule" compliance to overcome key challenges around privacy, identifying other VASPs, and managing transaction flow.

In addition, Qredo will protect customer privacy while meeting compliance requirements. Each VASP on Qredo then stores the encrypted data on their own communication server (Matrix home server) within their own infrastructure. Information is still available in real time, but only decrypted into clear text for processing by cryptographically authorized parties for auditing and suspicious activity reporting purposes.

first level title

3. Why do individual users choose Qredo wallet?

In addition to serving institutional users, Qredo can provide institutional-level encryption services to ordinary Web3 users (family members, friends, etc.). Below, we will help you understand the relevant use cases of Qredo:

Xiao Zhang and Xiao Wang are a couple. They want to set up a husband and wife account to jointly manage encrypted assets. However, the traditional solution may face the leakage and loss of the private key (the controller dies), resulting in loss of control over the account.

At this point, they can open a "joint digital asset account" in their Qredo account, mainly by setting up two funds: the first fund will be a petty cash wallet with a simple signature scheme, where the signature of either party can Authorize the transaction (one of the two parties); the second fund will be a joint savings account for large transactions, which will require the signatures of Xiao Zhang and Xiao Wang to authorize the transaction (both parties).

Xiao Zhang and Xiao Wang have a child, and they want to set up an encrypted account for the child—this account needs to be consumed with the consent of the guardian. At this point, they can create a "shared wallet" for the child on Qredo, which requires two family members to approve transactions (2 out of 3), meaning the child needs approval from one of his parents to use cryptocurrency .

Xiao Zhang, an encryption practitioner, has formed a decentralized autonomous organization (DAO), and she will need a tool to manage the shared custody of funds among members. On Qredo, Zhang can build a treasury contract secured by multi-signatures, where any transaction must be approved by at least 4 of the 7 total signers (4 out of 7). Additionally, assets held in funds can be securely traded on centralized exchanges on the Qredo network and easily deployed in DeFi - enabling DAOs to easily diversify their holdings and allocate assets to invest and earn yield Opportunity.

Xiao Wang receives many cryptocurrencies every month and has multiple crypto accounts - these cryptocurrencies may be taxable and have different requirements. At this point, Xiao Wang can use Qredo to merge all encrypted sub-accounts into one Qredo wallet, which can be easily managed with the control panel. Then, when tax time comes, he can instantly export the individual records; in addition, he can set up sub-account permissions to give accountants instant access.

Through the above introduction, I believe that everyone has a clear understanding of the use cases of Qredo.

In addition, compared with the current mainstream multi-signature schemes in the market, Qredo has the following advantages:

Flexible governance changes. Unlike other on-chain multisigs, Qredo organizational accounts can be adjusted at any time. So if group membership changes, new approvers can be added and the quorum size can be changed without sending the full balance to the new account.

Unlimited scalability. On-chain multi-signature solutions allow only basic approval schemes with a limited number of participants. A Qredo organizational account allows assigning an unlimited number of transaction approvers, in addition to other roles with different permission levels.

Zero handling fee. Setting up a multisig scheme with a third-party provider can mean paying expensive fees, and each on-chain transaction costs even more than usual due to the additional complexity. And Qredo offers zero-fee hosting, and even complex governance plans can be set up and executed for free.

Multi-asset support. Most multi-signature schemes only support assets on one blockchain, while Qredo's cross-chain MPC supports assets on multiple chains. At present, users can host more than 30 kinds of assets in the Qredo wallet, and enjoy various benefits such as pledge, zero handling fee, and liquidity center.

It is these features that make individual users favor Qredo.

first level title

4. Qredo's next plan

In October last year, Qredo integrated with MetaMask Institutional. As of the release of this article, the official version of the integration has been launched for several days, and users have responded well. The integration enables users to safely participate in new DeFi innovations, such as accessing cross-chain liquidity pools and trading collateralized derivatives across multiple chains; a few weeks later, Qredo is one of the few selected to launch the next generation of Bitcoin and blockchain in El Salvador One of the technology partners for related applications.

Regarding future planning, Qredo said that it will launch the Qredo wallet v2 version in the near future to support more Layer1 public chains. Qredo plans to be fully compatible with EVM-based chains this year; in addition, Qredo wallet will support WalletConnect, and any user can Using Web3 and DeFi with Qredo.

In Qredo V2, the Qredo team is not involved and nodes are controlled by independent parties - eliminating counterparty risk and enabling all users to trade and store assets on a truly trustless network. It will also be managed by a decentralized autonomous organization (DAO), "with the evolution to a fully decentralized form, Qredo V2 releases a series of new innovative technical advantages".

In decentralized autonomy, Qredo's native token, QRDO, will be the governance token. According to the official website, Qredo has designed a "user-centric" incentive mechanism, and each participant (verifier, liquidity provider, trader, and custodian user) on the network can receive token rewards to maintain network stability and increase adoption.

In July last year, QRDO conducted a public offering on Coinlist, and finally raised 35 million US dollars, and then launched Crypto.com, Gate and other trading platforms. Although QRDO is an inflation model, the official plan is to add a "burn mechanism" according to user needs in the future, such as a validator token repurchase program.

official websiteofficial website)。

“Qredo is a brand new infrastructure, and we haven’t found any other decentralized protocol to compete with it in terms of innovation and utility, nor does Qredo compete with other blockchains.” Josh Goodbody said, “Instead, Qredo acts as a The key is interoperable middleware that provides a secure way to transfer ownership of digital assets across different chains. We look forward to providing the broadest possible support for other blockchain projects to meet community needs."

We will continue to pay attention to what achievements Qredo will achieve in the future.