In-depth analysis of the development status, challenges and future thinking of the NFTfi field

Compilation of the original text: Bai Ze Research Institute

Compilation of the original text: Bai Ze Research Institute

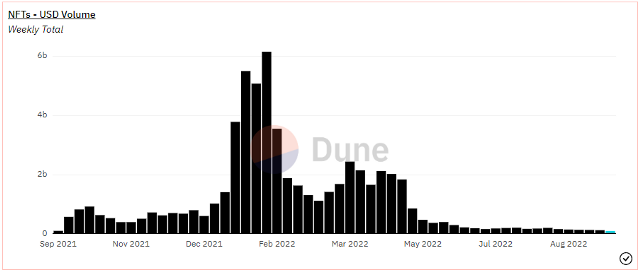

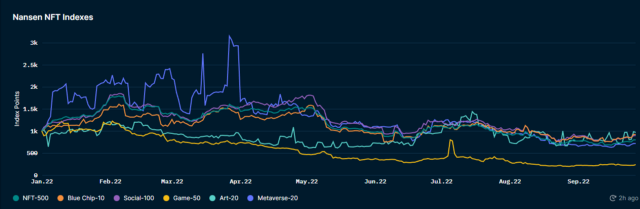

NFT has been described as one of the strongest catalysts for the next-generation art market and adoption of cryptocurrencies, with the industry seeing huge growth between September 2021 and January 2022. However, the sector's weekly trading volumes corrected quickly as growth slowed amid a downturn in global capital markets.

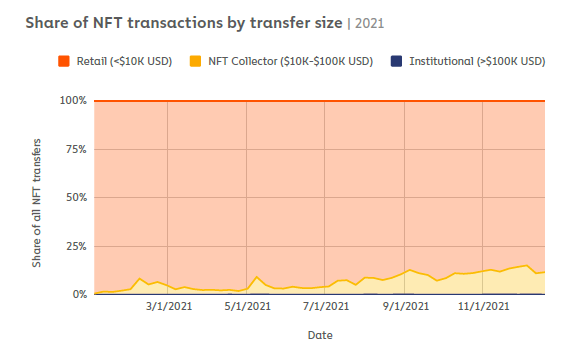

The NFT market is currently powered byless frequent but higher valuetransaction drivers.

image description

image description

Image: Share of NFT transactions by transaction volume and transaction value size

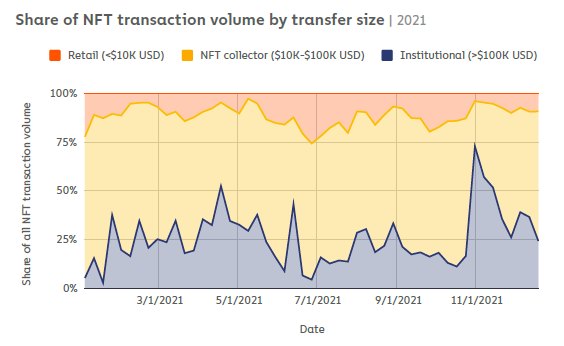

This difference is also reflected in the price performance of higher-tier (i.e. blue-chip projects, e.g. BAYC, CryptoPunks) NFT families compared to the broader market. Year-to-date, blue-chip projects have outperformed the broader NFT market by 12% (as of September 28, 2022).

image description

image description

first level title

NFT financialization pattern

secondary title

1) Insufficient market liquidity

There are three main reasons why NFTs generally lack market liquidity (besides their inherently small size):

Irreplaceability: Buyers need to spend more time distinguishing and buying NFTs of the same set, due to their unique characteristics and decentralized liquidity across the set

Affordability: Higher price barriers to buying leading NFTs, reducing user base for leading NFTs (fewer buyers means lower liquidity)

Lack of utility: Most of the current NFT projects have not yet developed meaningful practical applications, which is an important reason why NFT has not been widely adopted (low potential user base)

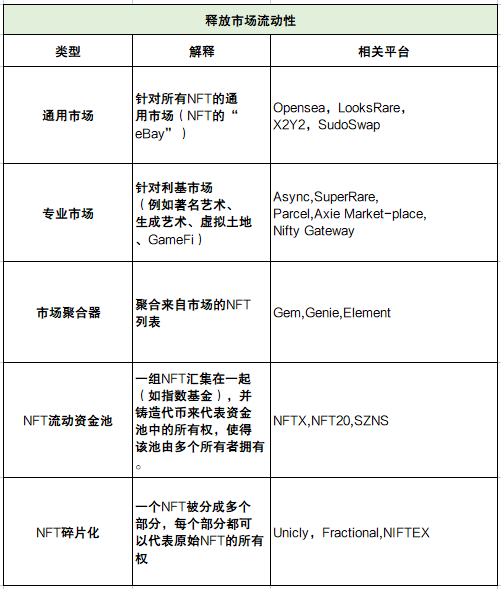

Here are the main protocols aimed at increasing liquidity in the NFT market:

A. General market

They are relatively mature, applicable to all types of NFTs, and are a general solution that can facilitate NFT sales.

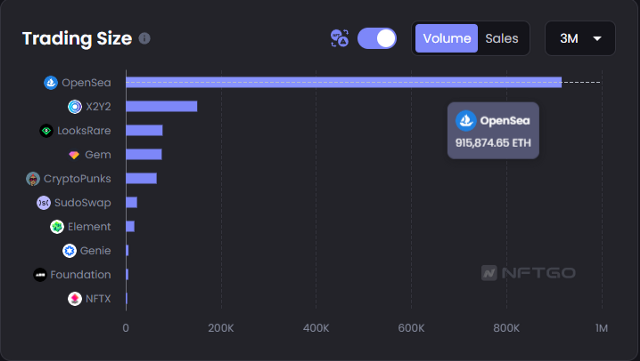

OpenSea currently dominates the space by around 75% by volume, although different platforms with different mechanisms (token issuance, proprietary pricing models, lower fee rates) have been slowly eroding OpenSea's dominance.

B. Professional market

They are still in their early stages, but as the overall NFT industry develops further, demand may increase.

Currently, use cases for these specialized marketplaces are still limited to facilitating NFT transactions in niche industries (e.g., virtual land), rare collectibles in NFT collections, and exclusive marketplaces for specific dApps.

C. Market aggregators

Best suited to capture the growth of different markets and the fact of their distribution.

By aggregating listings for NFT transactions across multiple marketplaces, aggregators provide a great user experience and even better prices for newer (and more innovative) marketplaces.

D&E. NFT liquidity pool and NFT fragmentation

NFT fragmentation protocols focus more on splitting individual NFTs, while NFT liquidity pools usually split NFT pools with similar prices and can be further expanded to form collective investment networks (community venture capital groups). Given the overlap, NFT liquidity pools and NFT fragmentation are often lumped together.

The main problem with NFT fragmentation protocols is that they are (yet) unsuitable for utility NFT collections, which is the ideal direction for the NFT marketplace. This is because most fragmented NFTs are difficult to recombine into original assets. It deprives NFTs of their potential social utility, even though investors can still profit from price changes. This is similar to investing in derivatives that track changes in the price of an underlying asset, but forgoing the other non-financial benefits of holding the underlying asset directly.

secondary title

2) Capital inefficiency

As you may recall, the initial development of DeFi revolved around swaps and lending protocols. And because of this, different DeFi protocols can now provide investors with various ways to take leveraged positions so that they can maximize capital efficiency more easily than before.

The NFT industry is still behind in this regard, as NFTs are not yet universally accepted as collateral. Now, we’re also starting to see more protocols aiming to improve on this, using NFTs as collateral.

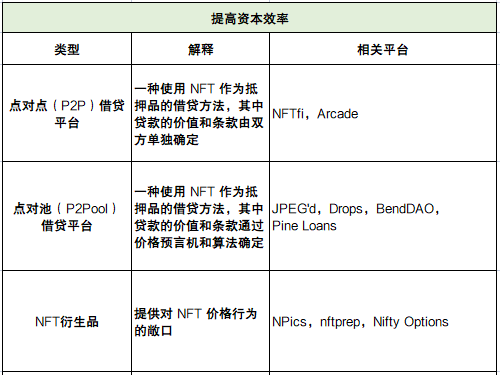

The following are protocols aimed at increasing the capital efficiency of NFTs:

A. P2P lending platform

These platforms have created an open market for NFTs to be used as collateral.

On the one hand, the core advantage of these P2P lending platforms is that they operate without oracles since the price and terms are negotiated by each lender and borrower. On the other hand, due to this semi-manual nature, P2P NFT lending cannot be executed instantly and is only most effective for long-tail assets.

B. P 2 Pool lending platform

These platforms utilize pricing methods (oracles; see more solutions in Challenge 4) to set different parameters for originating loans (collateral value, minimum collateral value, maximum loan term, and interest rate). This process is automated, thus providing instant liquidity to borrowers.

The P 2 Pool lending platform is best suited for the "underlying" assets in liquid assets, because oracles rely heavily on historical data that is lacking in illiquid assets.

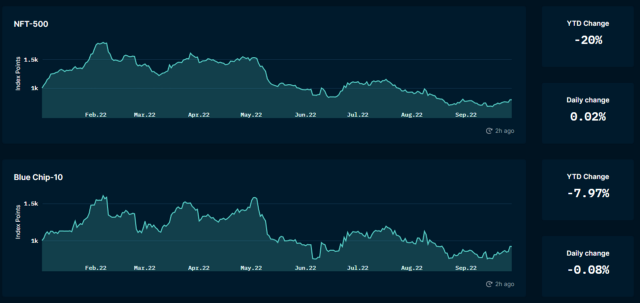

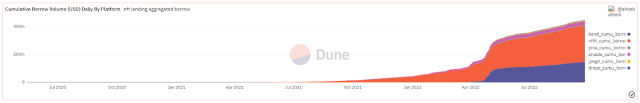

image description

Picture: Total loan volume of NFT lending platforms (P 2 P and P 2 Pool)

C. NFT Derivatives

This space remains underexplored as the low transaction volume (compared to alternative cryptocurrencies or traditional financial markets) and unique characteristics of NFTs pose a significant barrier to the seamless implementation of derivatives.

However, developments in this field will allow for more comprehensive trading strategies. Derivatives will allow investors to take the risk of price fluctuations with less (leverage and) capital requirements. Just like cryptocurrencies and traditional financial markets, derivatives can overwhelm spot markets in volume. It's also not impossible to see a robustly growing NFT derivatives market.

However, given the huge fundamental requirements of the derivatives market (high liquidity and accurate prices), I don't think NFT derivatives can flourish in the near future. In order to make a compromise with the current infrastructure, most platforms only list highly liquid NFTs, ignoring detailed feature groups (separating them into bottom, mid, top, etc.) or tracking bottom prices for the entire collection.

secondary title

3) Fully dependent on rising asset prices

The growth of the NFT market in 2021 will be a blessing for many. This is a turning point where people see NFT not just as a JPEG, but as a possible investment vehicle. However, it is highly unlikely that the NFT market will experience similar growth rates in the future, at least not in the short term.This means that people should rely less on rising asset prices and seek more sustainable income strategies.This is the argument for a protocol that allows NFT holders continuous access to cash flow.

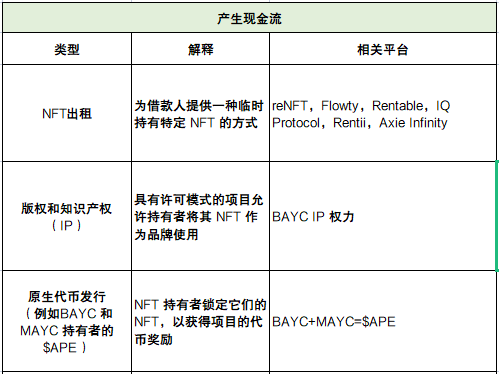

Similar to traditional financial markets, NFT has also developed in the field of leasing. Due to their lack of utility, NFTs are currently rented out for exhibitions (e.g. museums rent them for exhibitions) or their (limited) utility (e.g. unlocking exclusive events, special benefits in DeFi protocols, etc.).

Another way NFT investors can generate cash flow is by commercializing their IP ownership. An example is the development of a BAYC NFT-themed restaurant brand. Some NFT series also employ a model that rewards their NFT holders with fungible tokens.

Here are the protocols/mechanisms that provide cash flow to NFT holders:

A. NFT Leasing

NFT leasing depends heavily on its infrastructure. With the market currently dominated by PFP NFTs (lacking a clear practical use case), the NFT rental space has yet to gain a “push”. However, if the NFT market eventually moves toward tokenizing real-world assets (e.g., NFTs to represent property), then there may be a better development in the rental space.

B. Copyright and Intellectual Property (IP)

NFTs are often advertised as collectibles, but as regulations around digital assets remain unclear, collectibles face formidable hurdles in granting full copyright and intellectual property rights to their owners.

C. Native Token Issuance

Some NFT projects have also issued native tokens, and NFT holders will receive token rewards for locking or not selling their NFTs.

However, without a complete use case, token sale by holders is inevitable. Selling pressure could trigger a negative flywheel effect, further depressing token prices and making yields even more unsustainable.

secondary title

4) Insufficient price discovery

How should NFT be priced?

This is the first problem to be solved in order to truly solve the above three challenges. However, I'm putting it last because it's one of the slowest/least innovative areas we've seen so far.

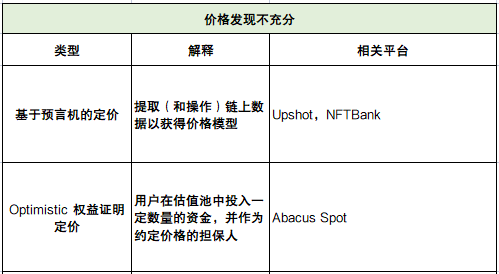

Currently, pricing mechanisms can be roughly divided into two categories:

A. Oracle-Based Pricing

The current status quo relies on oracle-based pricing methods to value NFTs listed in other NFT financial protocols.

These oracles usually extract key parameters of various markets to determine the fair value of NFT, such as reserve price, time-weighted average price (TWAP), volume-weighted average price (VWAP), historical price, etc. More comprehensive solutions on the market may implement machine learning algorithms to infer price trends and group similar feature levels.

Oracle-based pricing works best for highly liquid collections or collections with tight distributions. But given the volatility of NFTs, there should be a lot of error.

Protocols with various risk tolerances and mechanisms must customize their parameters to accommodate these errors. Also, relying on historical price data means not pricing in the news/roadmap.

B. Optimistic Proof-of-Stake Pricing

One of the most anticipated approaches to further improve NFT pricing is Abacus Spot’s Optimistic proof-of-stake pricing mechanism.

Inspired by Optimistic Rollups and Proof of Stake consensus mechanisms, this pricing model relies on users' collective valuations to price NFTs, rather than using historical data. Therefore, it is best suited for long-tail assets (lack of historical data) and those with low expected future sales.

Users value NFTs by co-depositing $ETH (within a defined period; at least 1 week) into the NFT valuation pool. NFT holders can use the corresponding valuation pool as proof of "collateral" or proof of valuation for the lending agreement.

In the event of a default, the underlying NFT is auctioned, and if the sale price exceeds the valuation pool size (total $ETH locked), the sale proceeds will be distributed proportionally to the valuer. If the auction price is lower than the valuation pool, the auction proceeds will be distributed to the valuers in the order of "first in, first out" (the latest valuer bears the risk of misvaluation).

The model is optimistic because it assumes that the price agreed upon by the valuers is correct. It derives from a proof-of-stake consensus mechanism, as valuers back their valuations with their funds (and their stake can be lost in misvaluations).

The downside of this pricing model is capital inefficiency, as it requires collateralized assets to guarantee the value of the NFT.

first level title

the way of the future

Financialization of NFTs aims to add (financial) utility to NFTs. Without proper financial conduct, NFTs can hardly be considered collectibles with an immutable record of ownership. The financialization of NFTs expands the scope (and market size) of how far and how wide NFTs can go. The author believes that the development of this industry may help NFT to be recognized as an investment class comparable to traditional financial markets.

The current landscape of NFTs (especially PFP NFTs) is closely related to the project's branding and marketing capabilities. As the NFT financial space becomes more important, project creators will have no choice but to adapt. They can take advantage of this by considering financialization as another feature of their collection of NFTs. An example of this adoption would be project creators allocating a certain amount of sales proceeds or funds to non-market liquidity protocols (e.g., lending platforms and liquidity pools).

The convenience of NFT financialization can act as a moat. When existing projects are brought into financialization, the barriers to success will increase little by little. This could indirectly force newer projects to innovate in order to compete, pushing the NFT space on the right track.

According to the "Notice on Further Preventing and Dealing with the Risk of Hype in Virtual Currency Transactions" issued by the central bank and other departments, the content of this article is only for information sharing, and does not promote or endorse any operation and investment behavior. Participate in any illegal financial practice.

risk warning:

According to the "Notice on Further Preventing and Dealing with the Risk of Hype in Virtual Currency Transactions" issued by the central bank and other departments, the content of this article is only for information sharing, and does not promote or endorse any operation and investment behavior. Participate in any illegal financial practice.