Image credit: byDavid Duong。

Compilation of the original text: The Way of DeFi

Image credit: byCore point of view:tool generation

Core point of view:

We expect digital asset selection to shift towards higher quality ecosystems such as Bitcoin and Ethereum based on factors such as sustainable token economics, the maturity of their respective ecosystems, and relative market liquidity.

We believe that investors’ willingness to accumulate altcoins has been severely impacted by the 2022 deleveraging, which may take several months to fully recover.

We believe that the next market cycle for digital assets will largely depend on the development of standards and frameworks for regulated entities.

The drama of 2022 will shape the crypto landscape for years to come.

Despite the uncertainty surrounding the potential impact, there are still some important characteristics that distinguish this market from previous crypto winters. On the one hand, institutional adoption of crypto remains steadfast, with many investors taking the long view and recognizing the cyclical nature of these markets. Instead of retreating, they use this environment to hone their knowledge and build infrastructure for the future.

But no one would argue that digital assets haven't suffered major setbacks. The total market cap of the crypto market is currently around $835 billion, down 62% from $2.2 trillion at the end of 2021, though still high relative to the history of most asset classes. By comparison, the Nasdaq is down 30% since the end of 2021 and the S&P 500 is down 18%.

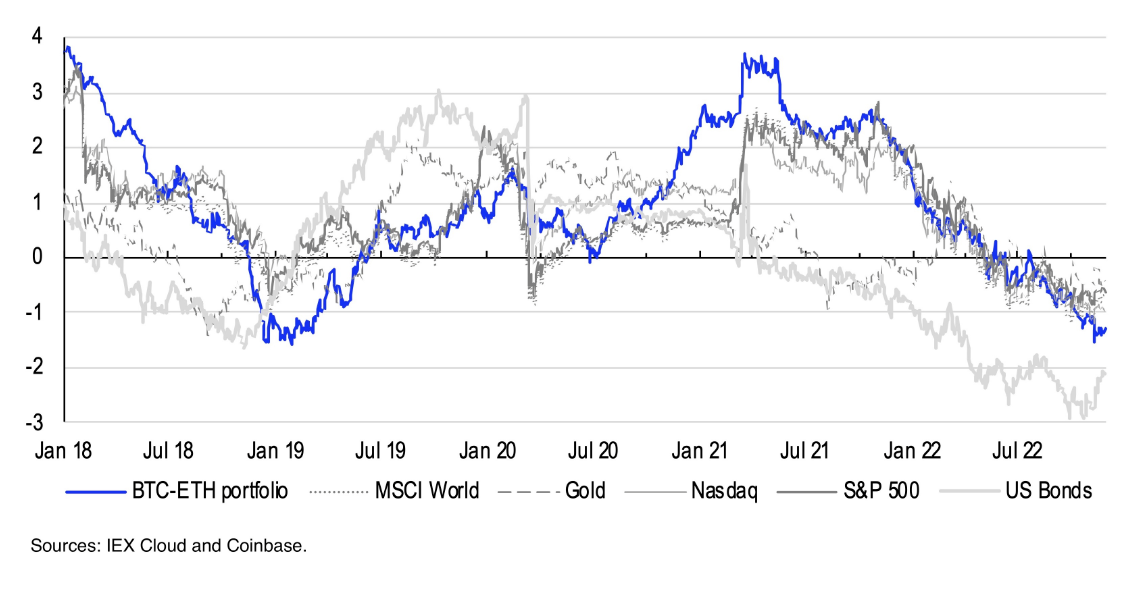

image description

Figure 1: Rolling 1-Year Sharpe Ratio

The difference between these periods can also be observed in the expected impact of the recent crypto downturn. For example, we expect to see more calls for regulatory clarity as institutional investors push for better governance and standards to help make this asset class more accessible, safer, and easier for all to navigate. However, this will take time as the industry learns the lessons of systemic flaws in the right context and applies the necessary risk controls to protect its customers.

Looking ahead, we believe that the evolution of the crypto ecosystem is putting topics like tokenization, permissioned DeFi, and Web3 front and center. Meanwhile, Bitcoin's core investment thesis remains intact, while Ethereum appears to outpace its L1 rivals in terms of network activity. We see a wider variety of use cases for NFTs outside of art, such as using NFTs to prove and verify real-world assets, or as ENS domains. Stablecoins are now one of the largest components in the crypto ecosystem, playing a huge role in storing and transferring wealth.

we are atattached reportThese trends and more are discussed in , starting with the key themes we expect to emerge in 2023.

Key themes for 2023

The intermittent pattern in financial markets in recent months has made it difficult for investors to make meaningful capital allocations across most asset classes. For crypto in particular, bankruptcies and deleveraging events in 2022 culminated in a tightening of confidence, which we believe could prolong the down cycle for at least a few more months. Liquidity constraints could also disrupt normal market functioning in the short term, as the assets of many institutional entities have been locked up in FTX's bankruptcy proceedings.

However, it's not all bad news. This environment has helped crypto escape speculative enthusiasm and paved the way for new innovations in the asset class.

Against this backdrop, we expect three key themes to emerge in 2023:

Institutional investors have turned to high-quality assets;

Creative destruction ultimately leads to new opportunities;

Fundamental reforms lead the next cycle;

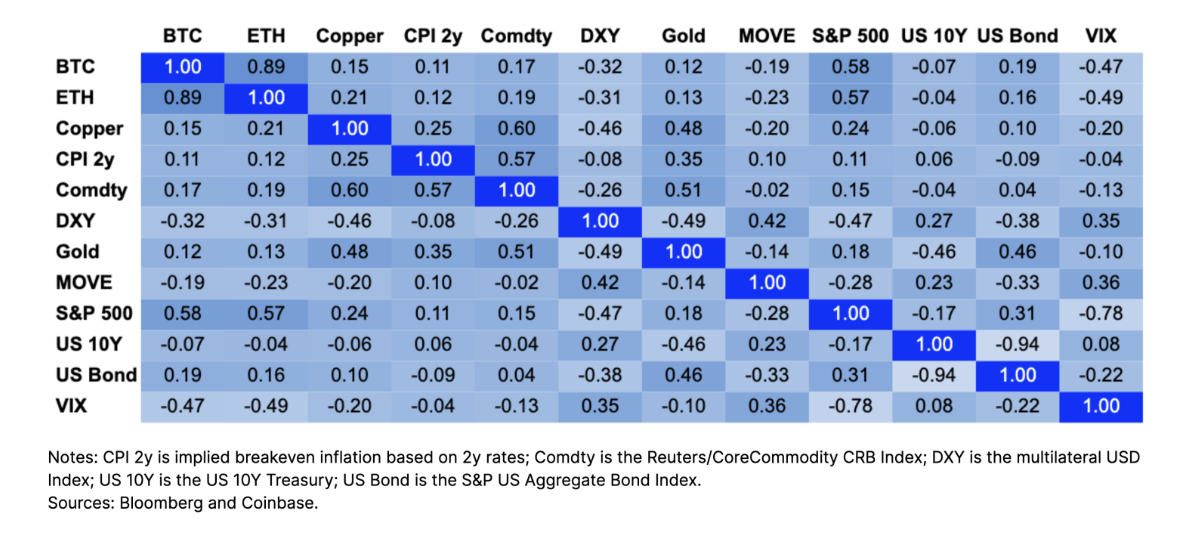

image description

Figure 2: Correlation matrix (1 year window)

Theme 1: Moving to Quality Assets

Regarding digital asset investment, investors are biased towards supporting higher quality tokens

Institutional investors have already scaled back capital allocations to most risky assets in the second half of 2022 due to rising interest rates, high inflation and weak equity returns. This tightening is happening even under the assumption that future U.S. recessions are likely to be mild. Expectations for the timing of the recession stretched from the beginning of the second quarter of 2023 to the first quarter of 2024, as economic data was strengthened by a reserve buffer backed by the stimulus package and still a sizable number of job vacancies.

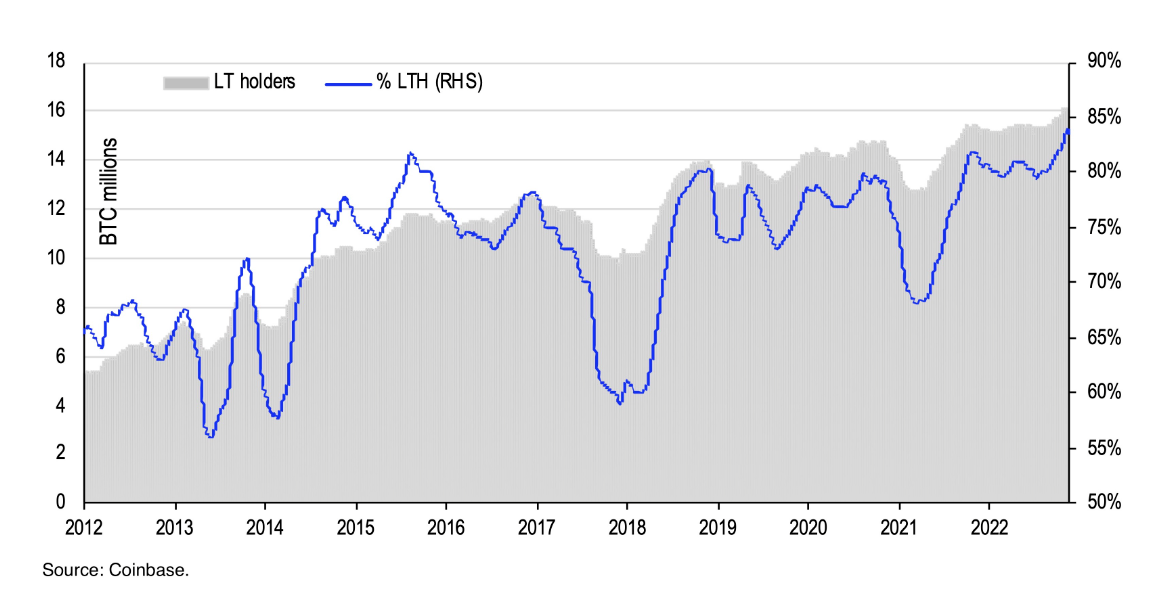

image description

Figure 3: BTC long-term holders accounted for 85% of their holdings

Strengthening ETH's Narrative

With the recent proliferation of competing L1 blockchains, the market for L1 has become saturated, leading many in the crypto community to question the need for additional block space. Ethereum's successful merger of its consensus and execution layers in September 2022 also strengthens the case for ambitious future upgrades, despite the long-term trend towards core protocol ossification. In our opinion, this supports the fundamental narrative of Ethereum as a multi-chain world leader, especially since nearly all networks compete for the same pool of users as well as capital. Some chains/ecosystems do better than others, and we believe user and developer activity will be clustered on a smaller number of chains in 2023 than in 2022. However, Ethereum’s dominance could still be challenged in other ways, as the network relies on L2 scaling solutions to expand its block space, which also has its own risks. This includes things like centralized orderers, lack of fraud proofs, and lack of L2 interoperability.

The future of decentralization

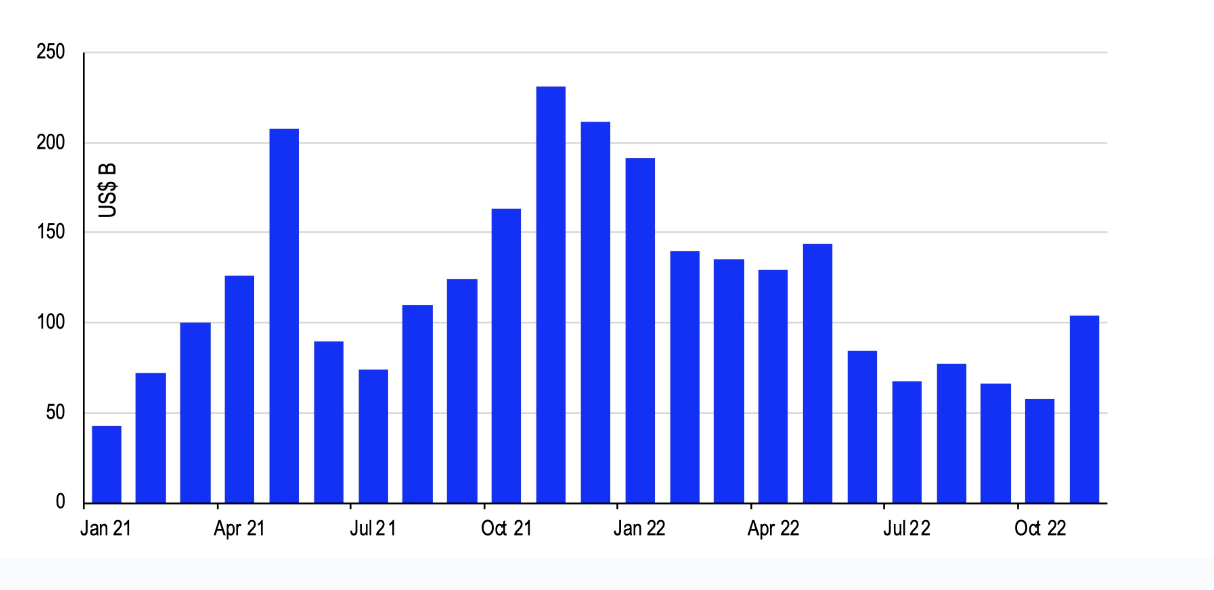

image description

Figure 4. Monthly trading volume of all DEXs

More focus on permissioned DeFi

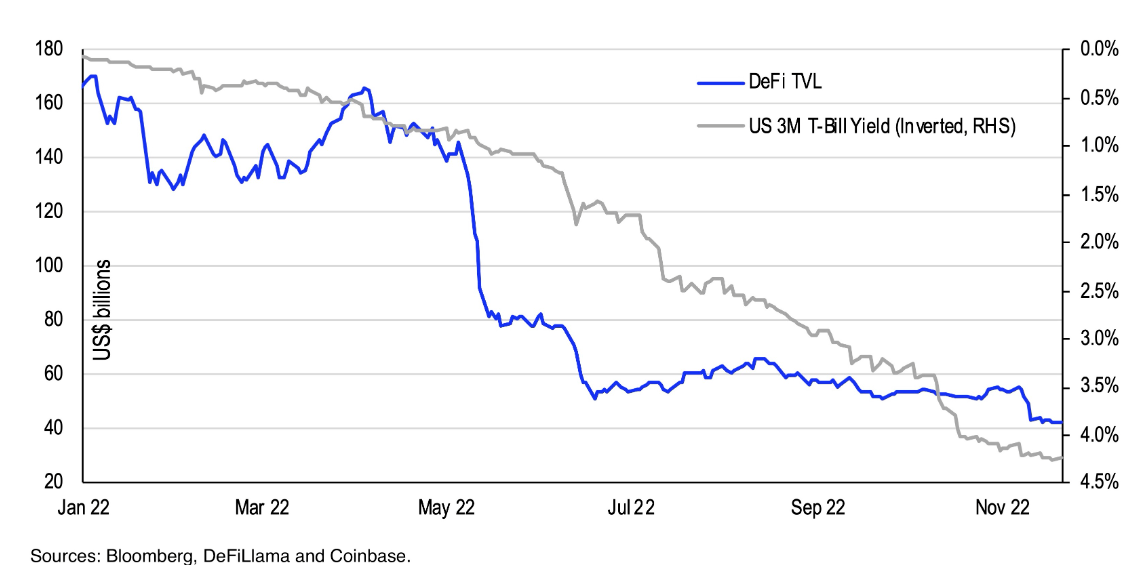

Overall DeFi activity, from a peak TVL of $180 billion in December 2021, has fallen back to $42 billion by the end of November 2022, although this is largely related to deleveraging and the collapse of centralized crypto lenders such as Celsius, DeFi lending The relative yields of interest rates have lagged behind the ostensibly risk-free rates in traditional finance such as U.S. Treasuries. Thus, we may have seen the end of hyper-optimization of yield-seeking behavior by crypto-native users, at least for now. In our view, this could be a precursor to seeing more decentralized applications (dapps) adapt their platforms for permissioned DeFi activity as regulated institutional entities seek to become more involved in the space.

image description

Figure 5: TVL in DeFi vs. US 3-month Treasury yield

Tokenization vs Tokens

While the concept of tokenizing real-world assets (RWAs) is not new, it has gained enormous traction among financial service providers in recent months as a means of addressing the inefficiencies inherent in traditional securities settlements. s concern. For some institutions, tokenization is a less risky way of gaining crypto exposure than directly investing in tokens. Whatever the reason, it is important to note that tokenization lacked similar support among these entities during the previous 2018-2019 crypto winter. Instead, banks currently use tokenized versions of financial instruments across multiple institutional DeFi use cases, often via public blockchains.

Societe Generale issued OFH tokens based on AAA-rated French home loans that can be used as collateral to borrow up to 30 million DAI, while JP Morgan, DBS Bank, and SBI Digital Asset Holdings traded tokens via Polygon in early November 2022. Monetized currencies and sovereign bonds. Other similar entities have also piloted tokenizing wealth management products and other securities. However, we think it is unlikely that the scope of these efforts will expand beyond financial instruments for the time being, as the total value of RWA locked on Ethereum has declined to the current level of 612 million after peaking at $1.75 billion in Q2 2022 Dollar. This is partly because while issuers are addressing financial and legal hurdles to tokenize other less liquid real-world assets such as real estate, the markets for these assets are currently underdeveloped.

Theme 2. Creative destruction ultimately leads to new opportunities

Liquidity downward spiral

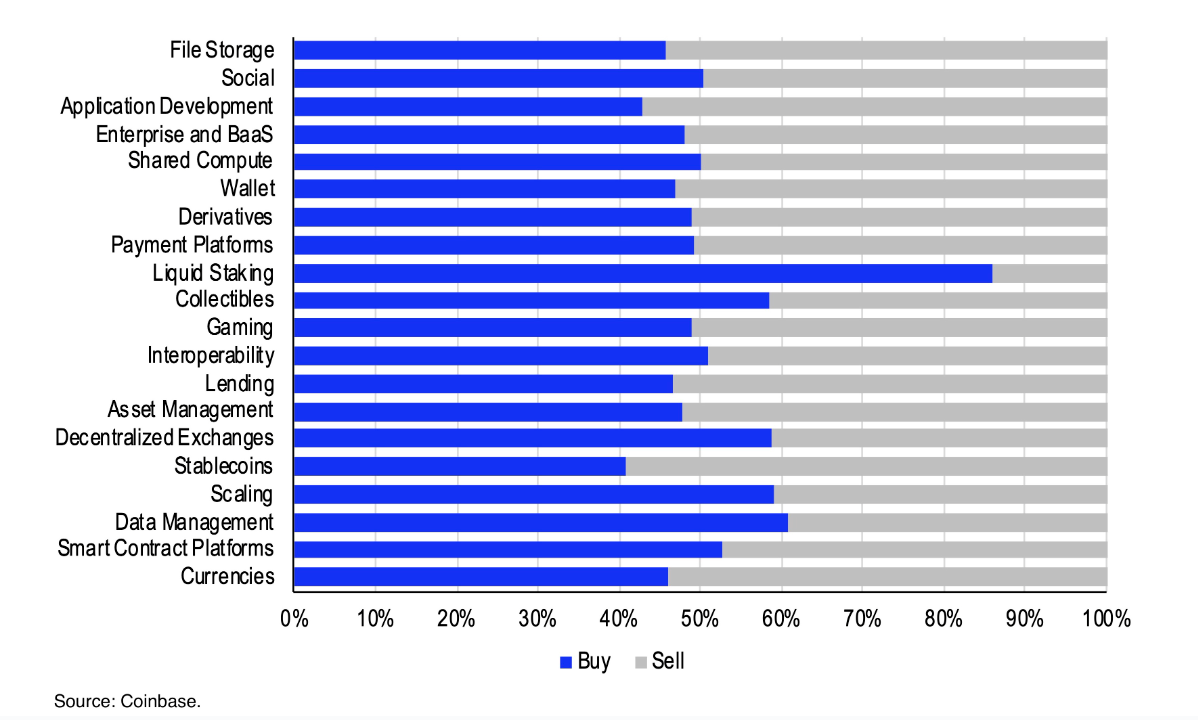

image description

Figure 6: The flow of assets in various fields on the Coinbasse platform

The capitulation of bitcoin miners

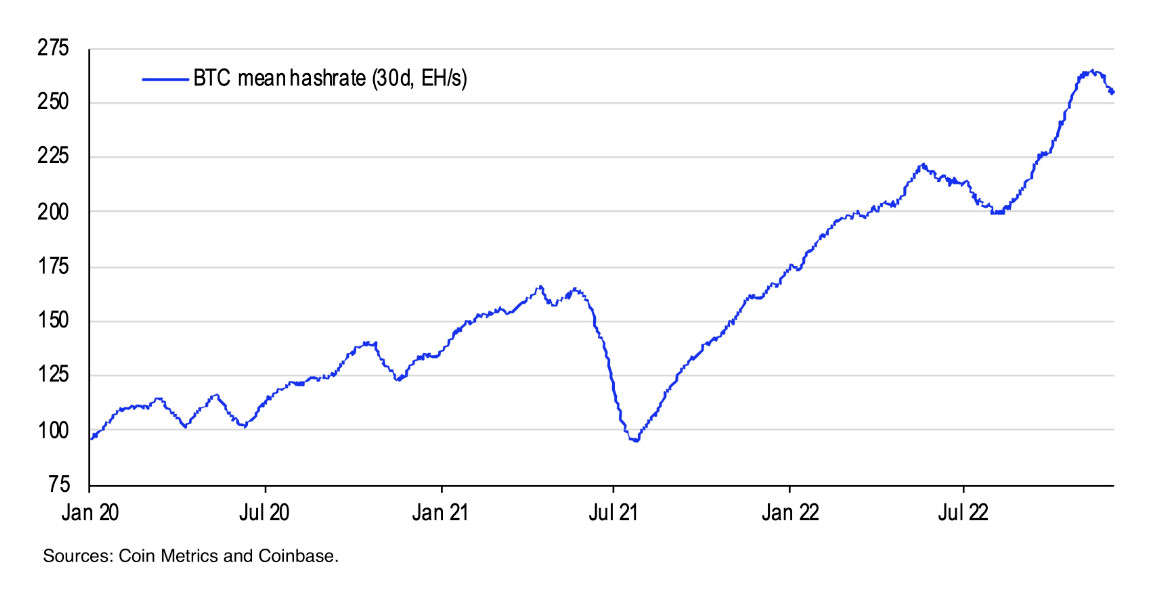

Amid continued weakness in the broader crypto market, the precarious economics of bitcoin miners seems unlikely to improve anytime soon. Recent Glassnode data (November 18, 2022) shows that Bitcoin miners are selling 135% of their daily output of BTC per day, which means miners are liquidating all newly mined BTC as well as some of their BTC reserves. The events of early November prompted Bitcoin miners to sell more than 8,000 BTC in a week, and the total BTC reserves of miners returned to the level of early 2022 (about 78,000 BTC). In addition to the continued pressure on the price of Bitcoin, the increase in the computing power of the Bitcoin network, and the resulting increase in the difficulty of mining, has made things more complicated for miners.

image description

Figure 7: Bitcoin average computing power (30 days, EH/s)

Explore new use cases for NFTs

The NFT market is still in its early stages, and it has had its fair share of market volatility. The current trading volume in the NFT market is well below the peak we saw in early 2022. But we believe that the technical underpinnings of NFTs represent an important archetype of how ownership and identity should function in the digital economy. In fact, the community of builders, artists, collectors, gamers, and digital native consumers has begun expanding their reach to accommodate the growing utility of NFTs. We believe that the recent downtrend can be seen as part of a healthy correction in the context of a broader cyclical adoption trajectory.

Looking ahead to 2023, the pressing question is how the next wave of NFTs will manifest. There is no easy answer to this question. It could be a resurgence of the cultural relevance trends we saw in 2021, or it could be a build-up of excess global liquidity. More specifically, future engagement may also be driven by new forms of utility beyond art/collectibles, including digital identity, ticketing, membership/subscriptions, tokenization of real-world assets, and supply chain logistics. Of course, investing in NFTs has its own risks. The debate around enforcing royalties at the token level may also begin in 2023, as this is a hot issue in the creator community. If royalties are increasingly ignored by market players, we believe this could threaten broader technology adoption.

Theme Three: Infrastructure reforms that spark optimism

Regulatory clarity is more urgent

We believe that the next market cycle for digital assets will depend heavily on the development of standards and frameworks for regulated entities. Clear guidance is necessary to avoid pushing innovation into regions where regulatory requirements are weaker and customers may be at greater risk. In the U.S., we expect the new Congress to proceed with one or more legislative proposals that currently enjoy bipartisan support, such as the Digital Commodities Consumer Protection Act (DCCPA), which would authorize the CFTC to regulate spot markets for digital assets, and /or the draft McHenry-Waters bill on stablecoins.

The turmoil in the crypto market in 2022 has created a sense of urgency among lawmakers to clarify which government agencies oversee what and identify a path forward for fundamental risk controls on crypto asset activity. This may help address prominent concerns about issues such as less objectionable collateral transparency following the FTX crash. That said, we think policymakers should recognize that the problems facing this year are driven by humans, not because of any unique aspects of crypto or blockchain technology. Regulatory frameworks should balance the need to set reasonable standards for centralized entities with the need to protect the freedom to innovate at the grassroots level.

Crypto Lending Practice Reform

Borrowing and lending in the crypto space has become incredibly challenging in 2022 as all credit has been withdrawn from the system. Some of the largest digital asset lenders in history have gone bankrupt or gone out of business because they would face solvency risks if they did not accept the bailout. We have previously commented on what we believe to be the right approach to crypto funding, including first principles for managing credit risk. But at the same time, many lenders are already damaged following the collapse of Celsius and 3 AC in June 2022, so what happens in the post-FTX environment appears to be more a continuation of this consolidation than a new strain on these entities.

More likely, we will see the maturation of lending practices in the crypto space, including underwriting standards, proper collateral, and asset/liability management. We expect banks to conduct more rigorous due diligence and stress-test potential exposures to prepare for a less volatile market ahead. Another theme for 2023 may be that the source of inventory in this sector will shift from the historical retail base to institutional investors. We believe it may take several months for agency credit to return to previous levels of activity, but borrowing may not be a challenge for creditworthy, responsible borrowers. Notably, DeFi lending protocols like Compound and Aave remained fully operational under these conditions, with defaulting institutions like Celsius and 3 AC repaying DeFi loans ahead of all other creditors to withdraw their deposited collateral.

Pathways used by institutions

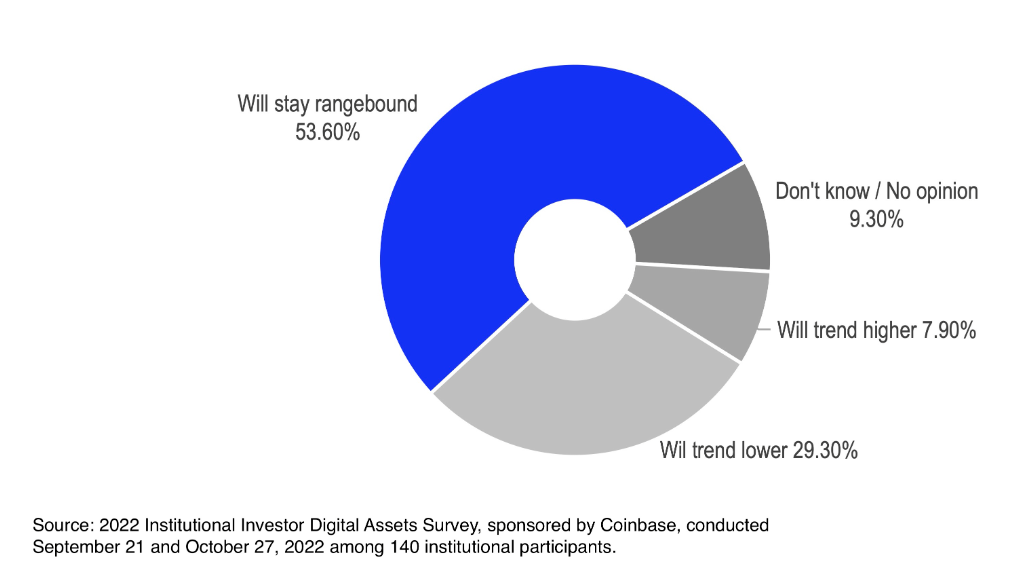

investigationinvestigation(Sponsored by Coinbase) shows that regardless of short term price action or the unfortunate actions of some bad actors, investors believe crypto is here to stay.

image description

Figure 8: Institutional investors' price forecasts for the next 12 months

herehere。