Last Thursday, Ethereum completed the Shanghai upgrade and opened the pledge withdrawal function. The expected selling pressure did not come, and the enthusiasm of the market to participate in ETH pledge became higher. according totoken.unlocks (click to jump)According to the data, since the upgrade, the new pledge amount of the Ethereum network has reached 468,000 ETH--before the upgrade, the average new addition per week was only about 100,000 ETH.

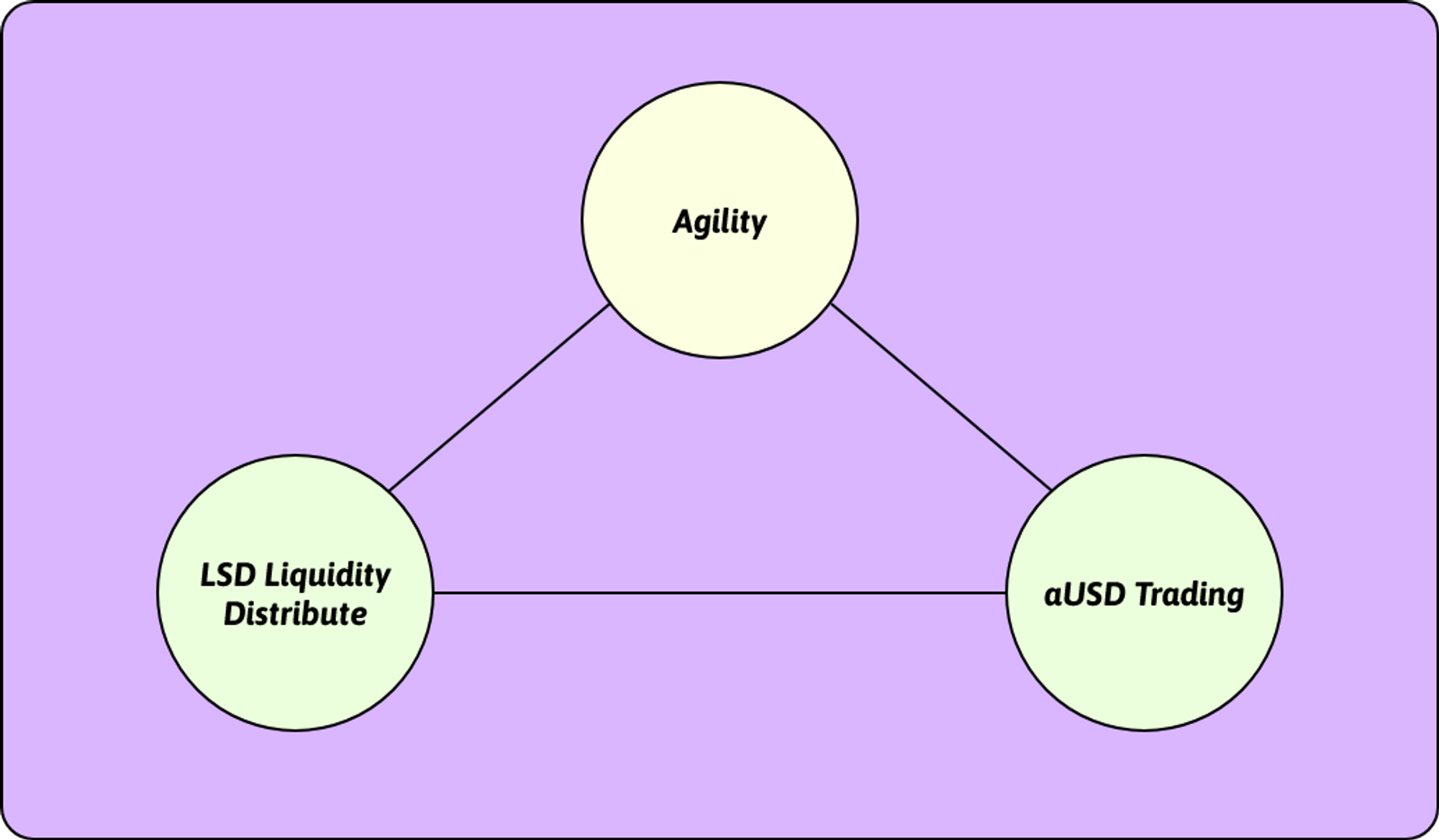

If this trend can continue, more LSD (Liquid Staking Derivatives) agreements will be born, driving the advent of LSD Summer. At this time, for the LSD Holder of the new agreement, there are two core requirements: one is the liquidity of LSD tokens; the other is the value-added scenarios of LSD tokens - pledge, loan, interest generation, etc. The Agility Protocol was born to solve these core problems.

Agility is a decentralized financial protocol based on Ethereum. Its vision is to unlock liquidity for LSD holders, explore more LSD trading scenarios, and provide deep liquidity for other LSD-related protocols. It is committed to becoming the leader of LSDFi and LSD Summer. Pioneers and core contributors.

secondary title

(1) LSD liquidity distribution platform + aUSD trading platform

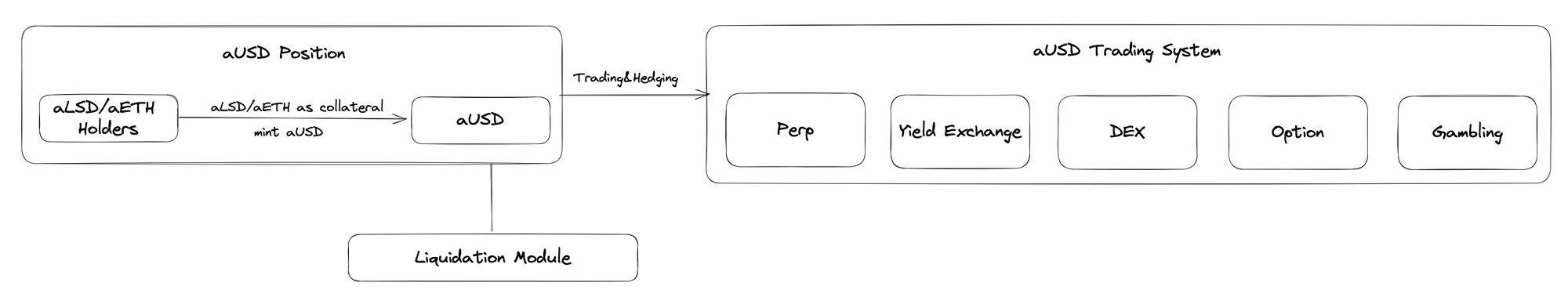

image description

(aLSD and aETH)

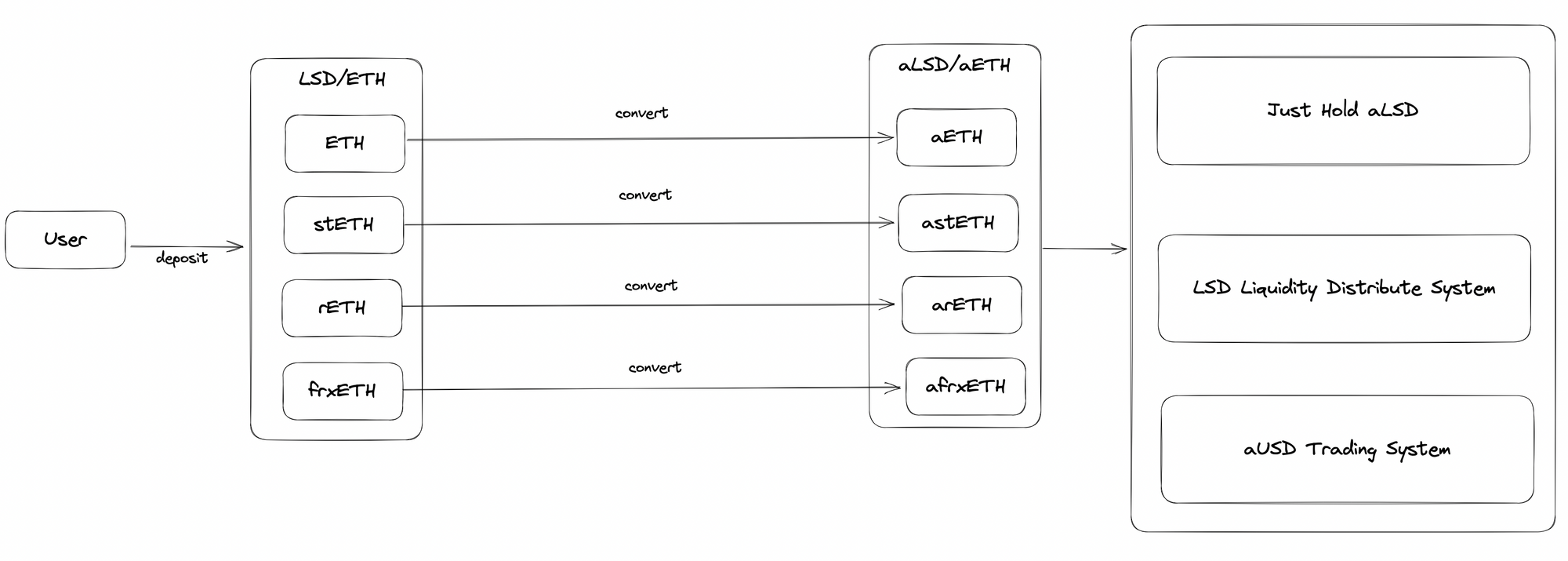

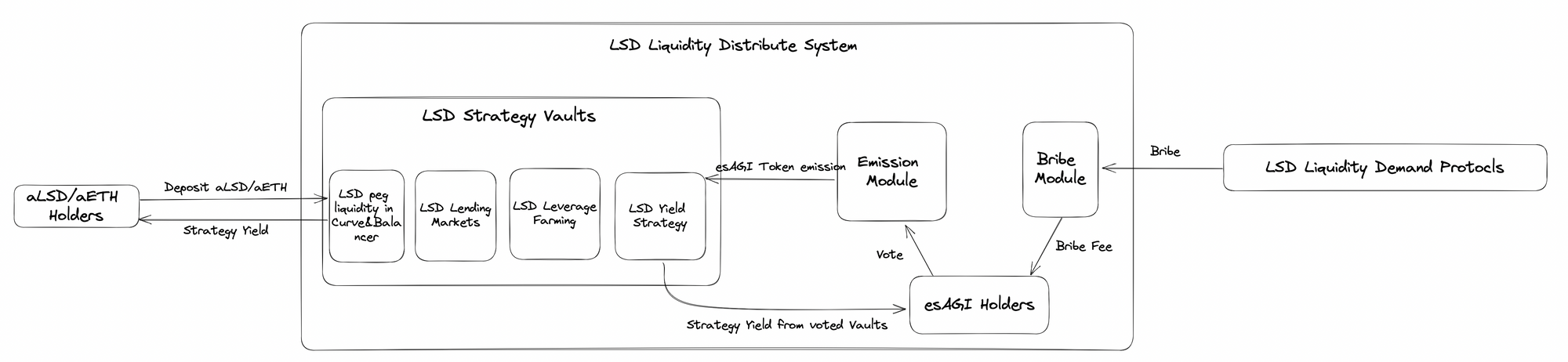

Agility also supports ETH pledge and generates aETH; in addition, it also accepts three LSD pledges of stETH, rETH and frxETH, and generates aLSD (astETH, arETH and afrxETH). After users obtain aETH and aLSD, they can choose: (1) directly hold aLSD to obtain corresponding LSD pledge income; (2) use aLSD or aETH to participate in the LSD liquidity distribution system, provide liquidity for the selected treasury and obtain income ; (3) Pledge aLSD or aETH to mint aUSD for trading or hedging risks.

image description

(LSD dispensing system)

What is esAGI token? The Agility protocol uses esAGI tokens as rewards to be distributed to each treasury, which is generated by the governance token AGI token mortgage and has voting rights. Users can vote to determine the number of rewards each vault can get in each period; more esAGI rewards will attract more LPs to provide liquidity for the vault.

So, for those protocols that have liquidity needs for LSD or ETH, they can bribe esAGI token holders to vote for their own treasury - esAGI token holders can get 70% of the selected strategy treasury returns and bribery fee. (Odaily Note: This method is actually borrowed from Curve’s veCRV voting bribery.)

image description

(aUSD generation and usage scenarios)

After the user obtains aUSD, they can trade or hedge, such as long/short ETH, GMX, GNS, Pendle, Gear and other assets on the Agility protocol, long/short LSD yield, option trading, gambling games, etc. According to the plan, Agility will build its own aUSD trading ecosystem or attract developers to participate in order to increase the application scenarios of aUSD.

secondary title

(2) Token AGI fair start

AGI is a token issued for the protocol, which has functions such as governance, rewards, and liquidity guidance. The total supply is 1 billion, of which 500 million have been destroyed in the proposal on April 15; of the remaining tokens, 88% For liquidity incentives, 10% enters the treasury, 1% is used for initial liquidity, 1% is used for marketing, and the team share is 0. The marketing fee is deposited in the Agility Treasury address supported by Safe: 0x11c0b36a6d5DB7AD79e8E19Ad9734f74006023AB, which is mainly used for cooperation with CEX (including liquidity and market makers), smart contract design, and vulnerability maintenance.

On April 7th, AGI was officially launched on 1inch/airswap, with a sales volume of 3 million units and a unit price of US$0.04; in the past 10 days, the price of AGI once rose from US$0.04 to the current US$0.96, an increase of 2300%, and the circulating market value is 15.47 million Dollar.

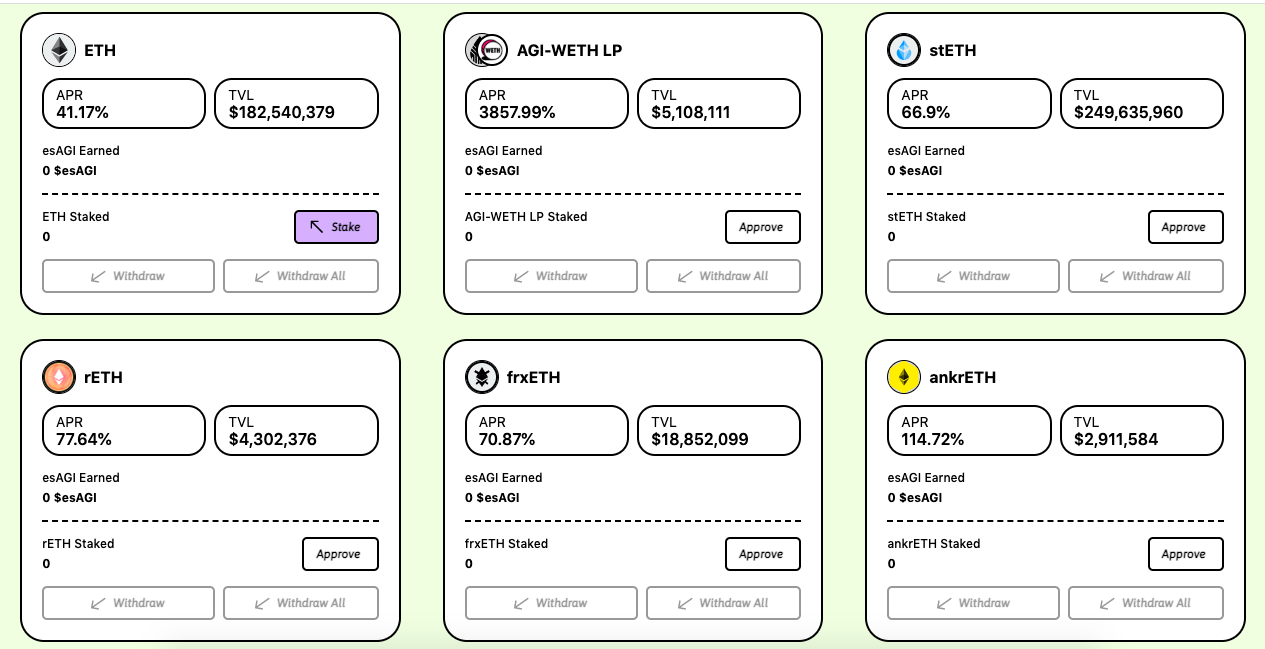

On April 10th, Agility launched "Fair Launch" to distribute AGI tokens among participants in the Agility ecosystem, attracting nearly $500 million in deposits within a week. Specifically, Agility has opened five mining pools for liquidity mining, including: ETH, stETH, rETH, frxETH four single-currency mining pools and AGI-WETH LP mining pool, and subsequently added ankrETH mining pool. Of course, the AGI-WETH LP mining pool distributes the most rewards, and its rate of return is also the highest—annualized 3,800%. The benefits of other mining pools are as follows:

According to the project roadmap, Agility plans to complete the construction through three phases: the first phase, Genesis Liquidity Farming - accumulate LSD and ETH liquidity; launch the aUSD module and stimulate aUSD-USDC liquidity; the second phase, start the LSD strategy vault, Start the Perp and Yield Exchange of the aUSD trading ecosystem; start the LSD liquidity distribution ecosystem; the third stage, improve the aUSD trading ecosystem, attract external developers to build more trading scenarios, improve the LSD liquidity distribution ecosystem and launch Bribe ( bribery) function.

Odaily's [New Projects] column aims to help early Web3 projects gain market exposure opportunities. If you are also a Web3 entrepreneur, please follow the official Twitter @OdailyChina, private message [seeking reports], send your project introduction and contact information, we Will communicate with you as soon as possible.