SignalPlus Daily Review (20230419)

Dear friends, welcome to SignalPlus Daily Morning News. SignalPlus Morning News updates macro market information for you every day, and shares our observations and opinions on macro trends. Welcome to track and subscribe, and follow the latest market trends with us.

Dear friends, welcome to SignalPlus Daily Morning News. SignalPlus Morning News updates macro market information for you every day, and shares our observations and opinions on macro trends. Welcome to track and subscribe, and follow the latest market trends with us.

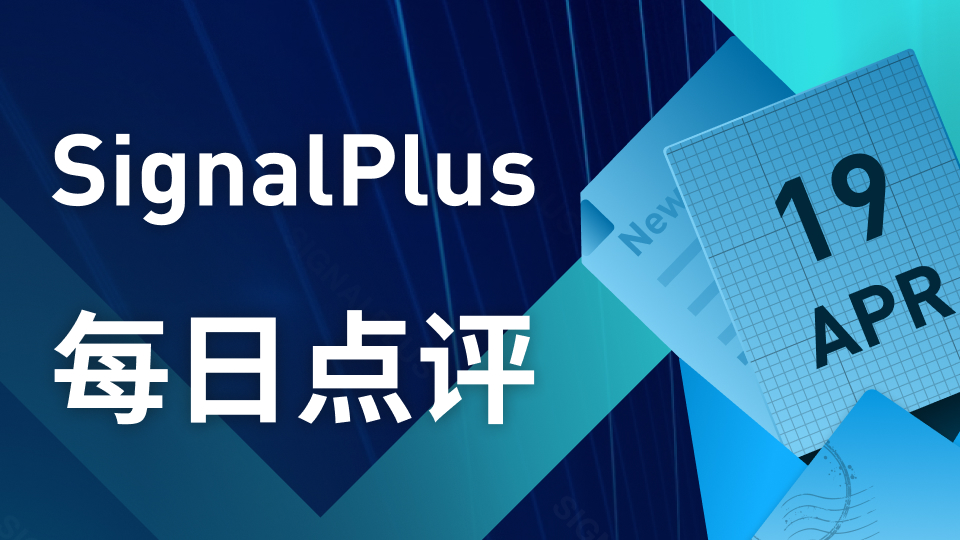

China's economic data beat expectations, leading to increased risk sentiment in early Asian trading hours, SPX futures rose to close to the 4200 mark, and bond yields also rose in early trading. European bond yields have continued to move higher since the market turmoil in early March, with 2-year gilts up 8 basis points on the back of strong wages data, adding to recent data that the global economy was "strong enough".

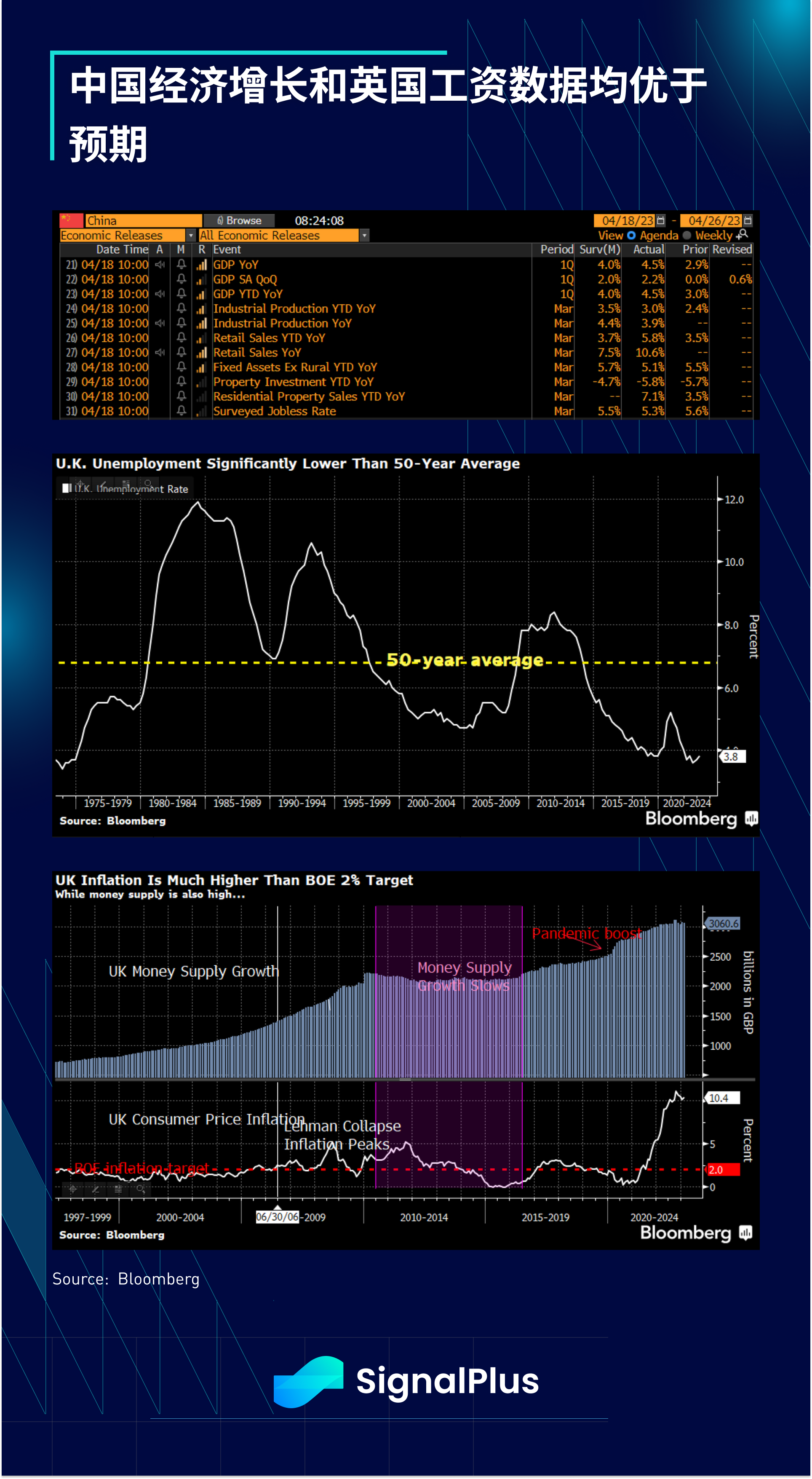

Developed market bond yields have given back most of the SVB-induced decline, with UK and European bond yields having retraced roughly 50% of their overall moves, while US Treasuries have been more muted. In terms of central bank policy expectations, markets still expect a string of U.S. rate cuts in the second half of the year, but with cost pressures remaining uncomfortably high, markets expect the European Central Bank and Bank of England to remain hawkish. The current economic environment is very different from before the global financial crisis, when slowdowns in different economies were more synchronized, and today policymaking across countries is more divergent and risk spillovers are better contained.

Earnings results from US banks were a bit mixed yesterday, with Bank of America (BoA) reporting surprisingly strong trading results, with the CFO calling the first quarter "one of [their] best quarters for sales and trading"; Earnings in Goldman's fixed-income business have not been as strong as those of its peers, its FICC sales and trading revenue have missed expectations, and its consumer push has so far failed to pay off. The turmoil from the SVB event still appears to be contained in the earnings results so far, with the banking sector one of the best-performing sectors for the month (+8%) despite lingering investor negativity.

Fears of an impending recession remain, and the Fed remains hawkish (Bullard: "Wall Street seems pretty convinced a recession is six months or so away, but that's not the way to read the current expansion"), and a few weeks Just had a banking crisis that had the potential to turn into a catastrophe, but the dramatic improvement in risk sentiment and the subsequent decline in risk asset volatility (VIX is now below 17%) has given systematic funds the ability to re-engage in the market and capitalize on the upside , pushing the S&P 500 index up 1% for the month. While the Fed Funds curve is still pricing in market expectations of cumulative rate cuts of around 50 basis points by December, indicators of financial conditions have (again) pre-empted that financial conditions have eased to their most accommodative levels since the start of the year.

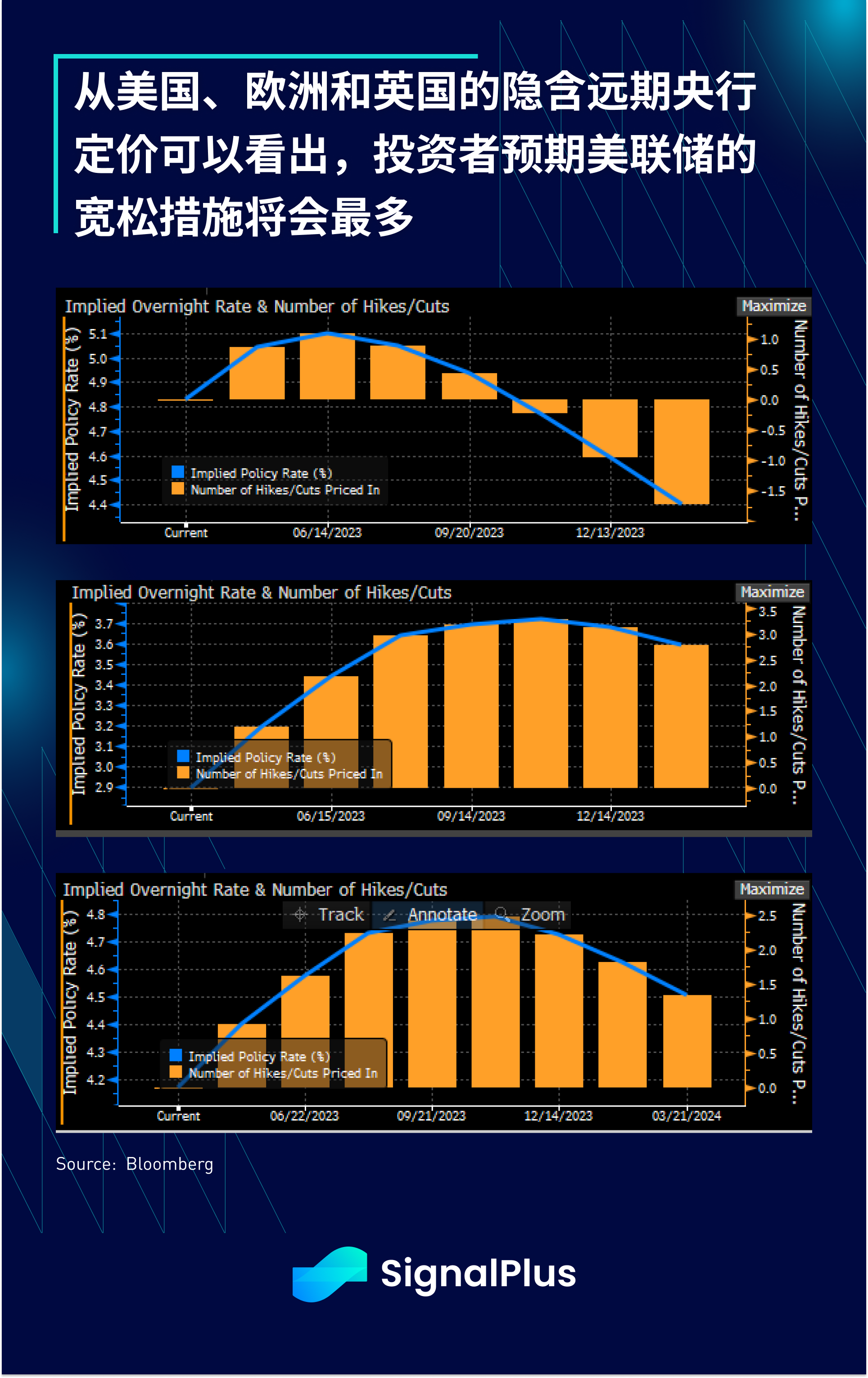

Sumitomo Mitsui has just announced the issuance of about US$1 billion of AT 1 bonds. This is the first AT 1 bond issue after the CS crash, and the price of CoCos has rebounded to the level before the CS crash. The market is really forgetful.

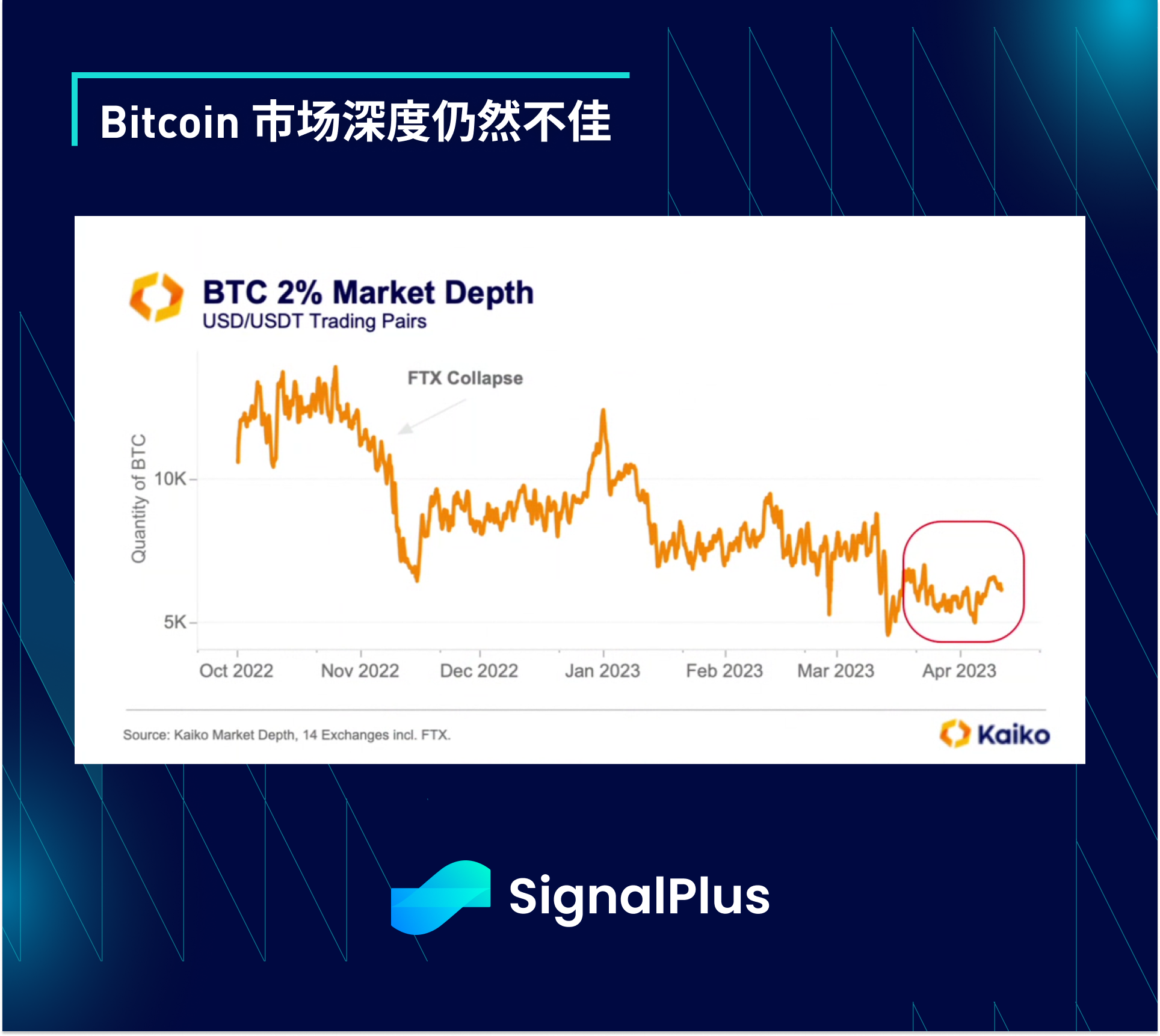

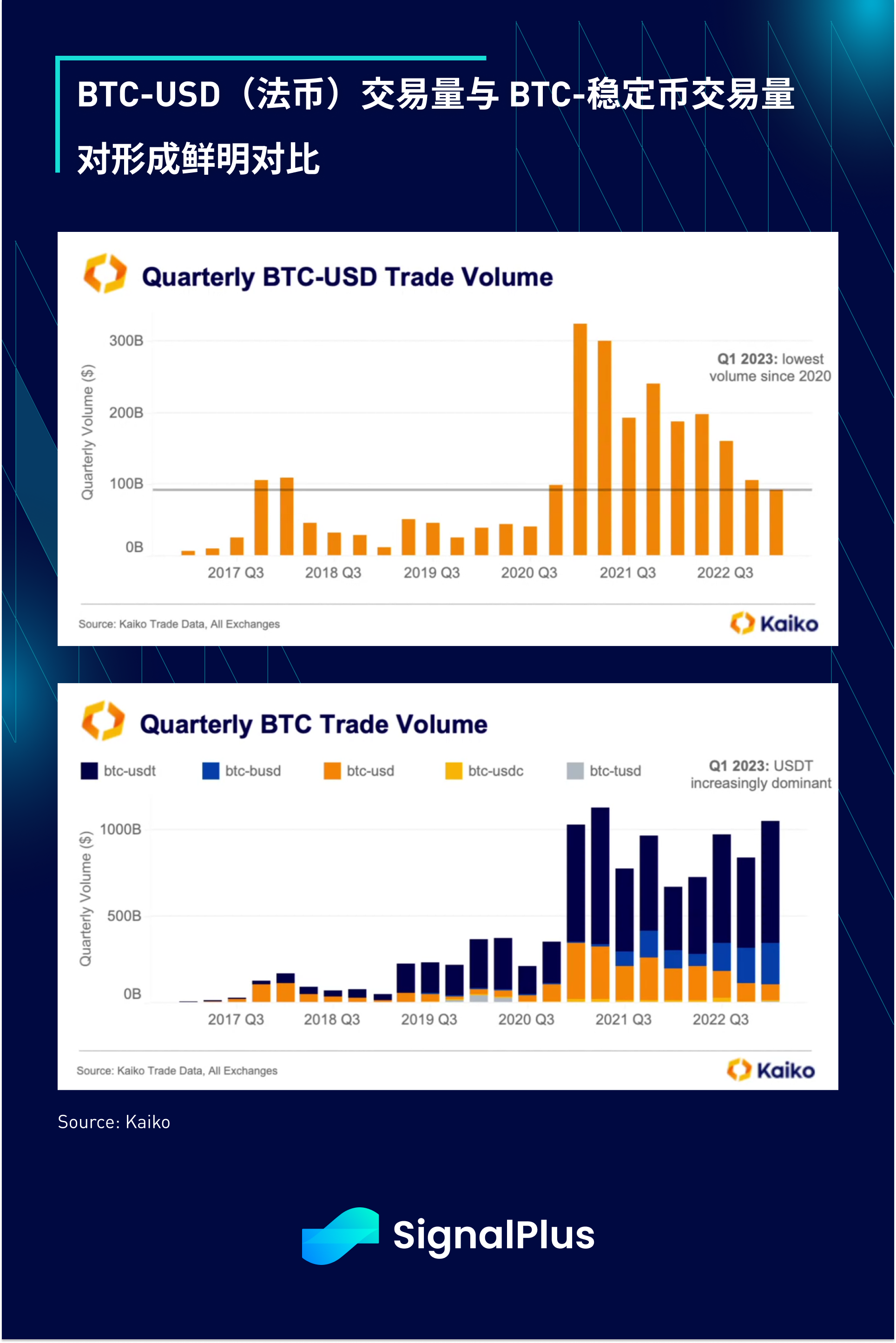

In terms of the market, although the price has rebounded recently, due to the lack of payment entry channels and regulatory pressures continue to affect the participation of market makers and the depth of transactions, even for Bitcoin, the depth of liquidity in the secondary market is still very poor. Additionally, according to Kaiko research, the BTC/USD (fiat currency) volume metric, which primarily reflects trading activity on regulated exchanges such as Coinbase/Gemini, saw its lowest quarterly level since 2020, confirming that mainstream interest in the U.S. continues to decline, which In stark contrast to the overall trading volume including overseas exchanges, the overall quarterly trading volume is still close to recent highs, showing that trading activities are increasingly concentrated on native cryptocurrency users, and this group naturally tends to "only long" position, This may help explain the sharp rally in most coins year-to-date.

If you want to receive our updates immediately, welcome to follow our Twitter account @SignalPlus_Web 3 , or join our WeChat group (add a small assistant WeChat: chillywzq), Telegram group and Discord community to communicate and interact with more friends.

SignalPlus Official Website: https://www.signalplus.com/