ETH Weekly Report | PayPal launches Ethereum-based stablecoin PYUSD; Base mainnet officially goes live (8.7-8.13)

1. Overall overview

PayPal has announced the launch of PayPal USD (PYUSD), a U.S. dollar stablecoin for transfers and payments. The stablecoin is issued by Paxos Trust Co. on the Ethereum blockchain and is backed by U.S. dollars, short-term Treasury bills and cash equivalents. PYUSD will gradually become available to PayPal customers in the United States. Starting today and in the coming weeks, eligible U.S. PayPal customers who purchase PYUSD will be able to transfer PYUSD between PayPal and compatible external wallets; use PYUSD for peer-to-peer payments; choose to use PYUSD at checkout; Currency is exchanged with PYUSD.

The Base mainnet has officially opened to the public, with over 100 DApps and service providers as part of the Base ecosystem. According to Jesse Pollak, Head of Base Protocol, users can explore these DApps and benefit from lower transaction fees and faster transaction speeds (compared to Ethereum). Meanwhile, Coinbase has launched its “Onchain Summer” campaign. The event lasts for several weeks and focuses on promoting Base’s mainnet partner DApps in the fields of digital art, music, and games. It is worth mentioning that users will have the option to mint a unique Base, Day One NFT to celebrate the opening of the Base mainnet.

In the secondary market, the current ETH price may continue to consolidate in the short term, with support at $1,800 and resistance at $1,850.

2. Secondary market

1. Spot market

OKX market data shows that ETH closed at $1,848 last week, up 1.2% month-on-month.

ETH daily chart via OKX

The daily chart shows that the price is currently consolidating around $1,850, the lower support level is $1,800, and if it falls below, it may fall further to $1,750; the upper resistance level is $1,850.

2. Network operation status

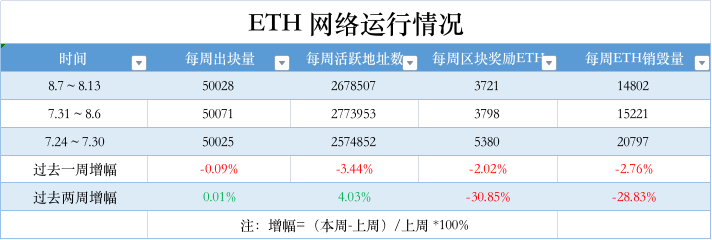

Etherscan The data shows that in the past week, the Ethereum network produced 50,028 blocks, down 0.1% month-on-month; the number of active addresses per week was 2,678,507, down 3.4% month-on-month; block reward income was 3,721 ETH, down 2% month-on-month; weekly ETH The number of items destroyed reached 14,802, a decrease of 2.7% from the previous month.

3. Large amount changes

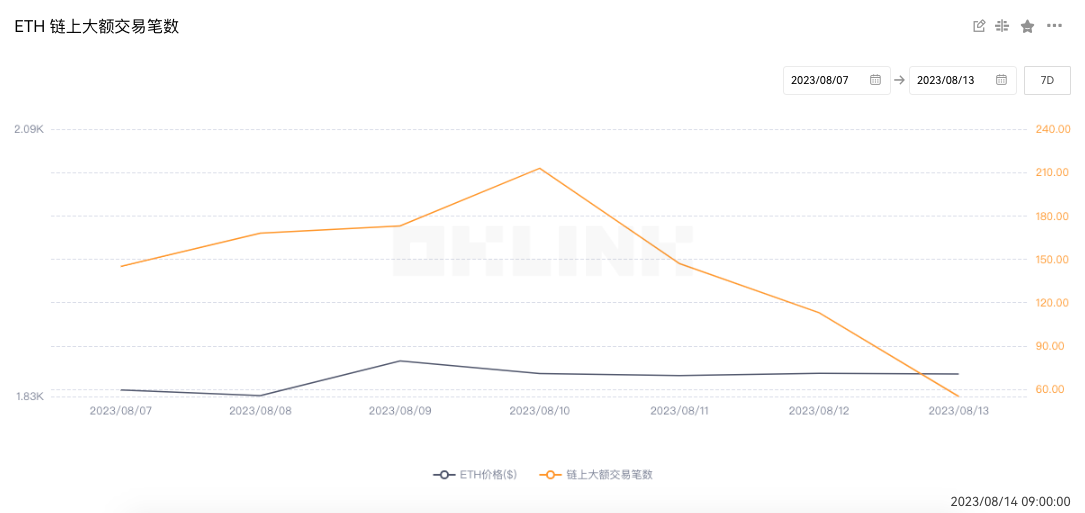

OKlink dataIt shows that the number of large-value transactions on the chain reached 1,015 last week, a decrease of 22.4% compared with the previous week (1,309). The trading enthusiasm of giant whales has dropped significantly.

4. Rich list address

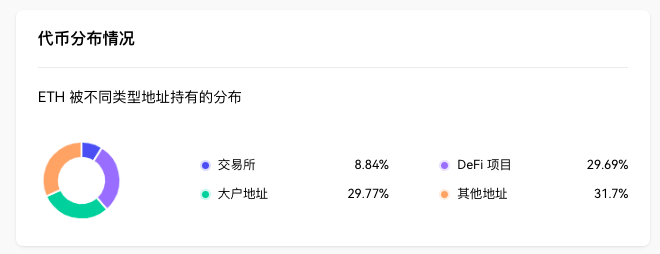

OKLink dataIt shows that from the perspective of the distribution of ETH holding addresses, exchanges accounted for 8.84%, a decrease of 0.06% month-on-month; DeFi projects accounted for 29.69%, an increase of 0.25% month-on-month; large addresses (top 1000 addresses excluding exchanges and DeFi projects) Accounting for 29.77%, a month-on-month decrease of 0.07%; other addresses accounted for 31.7%, a month-on-month decrease of 0.12%.

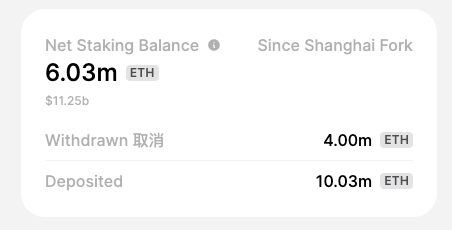

token.unlocksIt shows that the total amount of pledged ETH in the entire ETH network is currently 23.27 million ETH, and the pledge rate is 19.09%. , last weeks data was 3.94 million; the total net pledge volume increased by 6.03 million, compared with the previous weeks data of 5.74 million, an increase of 290,000 over the previous week.

5. Lockup data

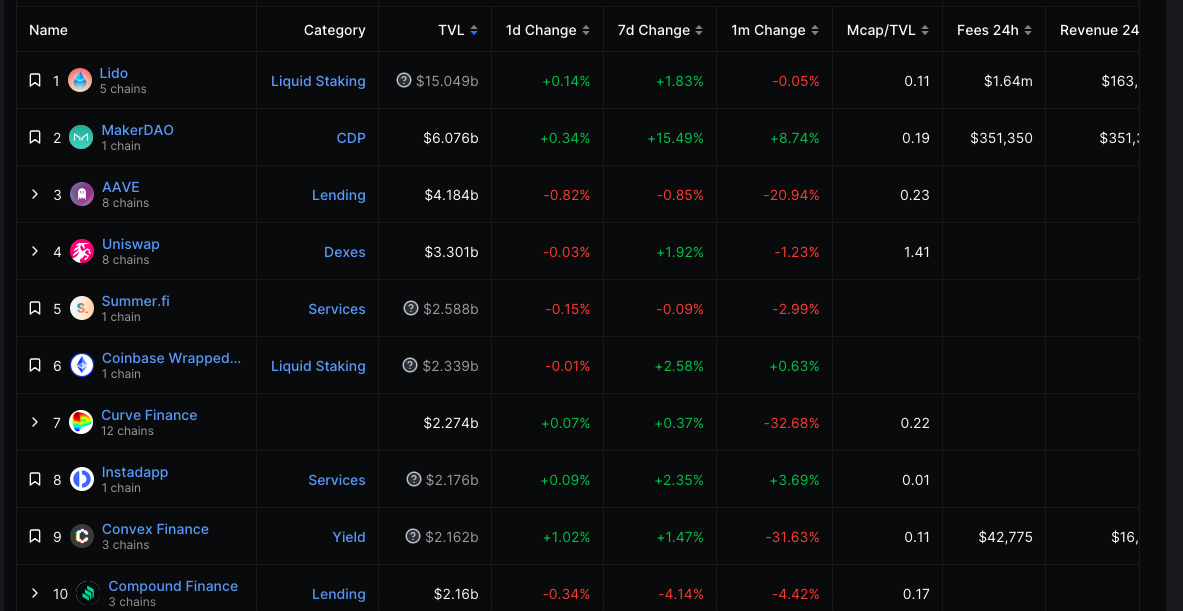

DeFiLlamaThe data shows that the value of locked collateral on the chain rose from $23.37 billion to $24.5 billion last week, a month-on-month increase of 4.8%. Looking at individual projects, the top three lock-up values are: Lido at US$15.04 billion; MakerDAO at US$6.07 billion; Aave at US$4.18 billion;

3. Ecology and Technology

1.Technological progress

Parithosh Jayathi, an engineer at the Ethereum Foundation, tweeted that the Holešovice (Holesky) testnet is expected to be launched around September 15th, and developers have made two coordination calls for this. The testnet is intended to give client teams a larger scale than the mainnet to test clients and allow home stakers to test their setups without risk. Jayathi also added that at present, Goerli is the largest test network with about 500,000 validators, but it is about to be deprecated due to supply issues, so there is an urgent need to launch a new network, otherwise it may directly encounter the main network. to large-scale unknown problems.

Ethereum Go language client Go Ethereum has released Geth v1.12.1 of its Ethereum client, possibly its largest maintenance release ever, containing security-related fixes and recommending that all users upgrade.

Development work around the upcoming Cancun hard fork has been the focus of this release cycle, but Geth v1.12.1 is not yet ready for Cancun. However, this version already includes basic type definitions and state transition logic for EIP-4844 Shard Blob Transactions, and also implements a new mempool blobpool for EIP-4844 transactions. The new pool is backed by an on-disk database and has a simpler overall design than txpool for regular transactions. The blobpool is not yet used by p2p networks and is still being tested in the Cancun development network. Additionally, Geth no longer supports the Rinkeby testnet.

2. Voice of the community

(1) 115th Ethereum ACDC Conference: Devnet 8 will be launched early next week

Christine Kim, Vice President of Galaxy Research, posted a summary of the 115th Ethereum Core Developers Consensus Conference (ACDC), saying that Devnet 8 will be launched early next week. This will be the first dedicated testnet containing all completed EIPs for the Cancun/Deneb upgrade. In addition, the Holesky testnet will be launched at the end of September with 1.4 million validators, twice the size of the mainnet. The developers also reiterated their decision to rewrite EIP 4788 as a normal contract.

Ethereum co-founder Vitalik Buterin commented on advances in artificial intelligence, especially systems like ChatGPT. He expressed optimism about the potential of artificial intelligence, arguing that it could enhance human creativity, rather than just replace human roles. Vitalik believes that at its current stage, AI is more about empowering individuals than replacing them. He envisions a future in which artificial intelligence tools allow individual creators to produce films and other works of art without the high costs associated with traditional Hollywood productions.

Vitaliks vision for artificial intelligence in the entertainment industry is that the cost of film creation will be greatly reduced, so that a single individual can produce film content with the creativity and artificial intelligence platform. He sees this as an opportunity to move away from repetitive and overused storylines, such as the numerous remakes in popular culture, and toward unique narratives that reflect diverse values.

In addition, Vitalik believes that the transition from human intelligence to superhuman AI is one of the most important transitions in Earths history. He compared its importance to several other major transitions in Earths history. However, he also acknowledged the challenges and potential risks of advanced AI. While he believes research is needed, and possibly some targeted regulation, he warns against imposing broad restrictions that could stifle innovation. (Cryptoglobe)

3.Project trends

DEX ZigZag on zkSync announced that the privacy-friendly ZK-Rollup DEX Invisible has been launched on the test network. Invisible is an order book trading platform that allows users to trade funds privately. Users do not need Goerli ETH to access the test network, they only need to sign a message to participate in the test. Users can apply for ETH, USDC and BTC for testing on the Deposit/Withdrawal Page without confirming wallet transactions. According to previous news, the founder of Ethereum’s second-layer ZK Rollup order book DEX ZigZag plans to raise $500,000 for its new Perp DEX Invisible at a valuation of $10 million. Invisible will be released as an independent project, and part of its platform tokens ( at least 20%) to release the final unlock to ZZ holders.

(2) PayPal launched the US dollar stablecoin PYUSD, issued by Paxos and open to US customers

PayPal has announced the launch of PayPal USD (PYUSD), a USD stablecoin for transfers and payments. The stablecoin is issued by Paxos Trust Co. and is backed by U.S. dollars, short-term Treasury bills and cash equivalents. PYUSD will gradually be available to PayPal customers in the US. Starting today and in the coming weeks, eligible U.S. PayPal customers who purchase PYUSD will be able to transfer PYUSD between PayPal and compatible external wallets; use PYUSD for peer-to-peer payments; choose to use PYUSD at checkout; Currency is exchanged with PYUSD.

PayPal stated that PayPal USD is the only supported stablecoin in the PayPal network. As an ERC-20 token issued on the Ethereum blockchain, PayPal USD will be available to the already large and growing community of external developers, wallets and Web3 applications, can be easily adopted by exchanges, and will be Deployed to enhance experiences within the PayPal ecosystem. Most current stablecoins are used in Web3-specific environments - PayPal USD will be compatible with this ecosystem from day one and will be available on Venmo soon.

(3) Aaves proposal to reduce CRV LT, LTV and debt ceiling on Ethereum and Polygon has been passed

The governance page shows that Aaves proposal to reduce CRV LT, LTV and debt ceiling on Ethereum and Polygon has passed with a 100% approval rate. According to the proposal, the changes are as follows: on Ethereum, CRV LT is reduced from 61% to 41%, LTV is reduced from 55% to 35%, and the debt ceiling is reduced from 20 million US dollars to 5 million US dollars. On Polygon, CRV LT has been reduced from 75% to 65%, and LTV has been reduced from 70% to 35%.

LSD protocol Puffer Finance announced the completion of a $5.5 million seed round of financing, led by Lemniscap and Lightspeed Faction. It is reported that the new financing will be used to further develop Puffer Finances open source project Secure-Signer (Secure-Signer), which aims to prevent verifiers from Possible penalties during the verification process. The project has been funded by the Ethereum Foundation for $120,000, and core researcher Justin Drake himself participated in the advisory. Additionally, Puffer Finance is creating a permissionless staking pool that lowers the participation threshold for independent validators from 32 ETH to 2 ETH to improve capital efficiency. In addition, Puffer Finance received US$650,000 in pre-seed funding last June, led by Jump Crypto, with participation from Arcanum Capital and IoTeX. (CoinDesk)

(5) The Hope.money lending agreement HopeLend mainnet is online, and the rewards for the first week of community activities are as high as 200 million LT

The distributed stablecoin project Hope.money announced that HopeLend has been launched on the Ethereum mainnet. As an important part of the HOPE ecosystem, HopeLend is a decentralized lending protocol that provides rewards for depositors, borrowers and liquidators, redefining the way assets are used in the HOPE ecosystem. It is understood that to celebrate the official launch of HopeLend, Hope.money has launched a series of airdrop reward activities to encourage users to actively use HopeLend to participate in lending. The event will last for two weeks, and the total rewards in the first week are up to 200 million LT (worth about 10,000 U).

(6) Gas consumption in the NFT market on Ethereum dropped to a two-year low

Gas consumption in the NFT market based on the Ethereum network is decreasing significantly, falling to June 2021 levels. Specifically, transaction activity on OpenSea, Blur, LooksRare, Rarible, and SuperRare currently accounts for approximately 1.85% of the total gas consumption of the Ethereum network. This figure is down significantly from the previous high on January 9, 2022, when NFT transactions on OpenSea alone accounted for 28.69% of Ethereum’s total gas consumption. (CryptoSlate)

(7) Scroll: There are currently no tokens and airdrops, please beware of false information

Scroll, the Ethereum Layer 2 solution, reminded on Twitter: Recently, there has been an increase in accounts impersonating Scroll on Twitter, Discord and Telegram. We want to reiterate that there are no Scroll tokens yet, and Scroll has not carried out any form. Airdrop activity. Users are requested to remain vigilant.”

The Base mainnet has officially opened to the public, with over 100 DApps and service providers as part of the Base ecosystem. According to Jesse Pollak, Head of Base Protocol, users can explore these DApps and benefit from lower transaction fees and faster transaction speeds (compared to Ethereum). Meanwhile, Coinbase has launched its “Onchain Summer” campaign. The event lasts for several weeks and focuses on promoting Base’s mainnet partner DApps in the fields of digital art, music, and games. It is worth mentioning that users will have the option to mint a unique Base, Day One NFT to celebrate the opening of the Base mainnet.

Ethereum re-pledge association EigenLayer officially announced that it plans to increase the liquidity re-pledge limit of stETH, rETH, and cbETH again on August 22. The specific standard is that when the re-pledge amount of any of the three assets reaches 100,000, protocol deposits will be suspended again.

Virtune, a Swedish digital asset management company, listed Virtune Staked Ethereum ETP SEK on Nasdaq Stockholm. This exchange-traded product (ETP) tracks the price of Ethereum on the one hand and will provide an additional annualized rate of return of up to 5% on the other. ; 100% physically backed and fully collateralized; Virtune uses non-custodial staking and does not transfer Ethereum to a third party.