Source: NGC Ventures

Author: Tudd Cai

When it comes to MEV (Maximal extractable value), most users despise it. When we trade Meme coin on Uniswap, we set a high slippage to ensure that we can buy and sell in volatile markets, but this gives MEV bots the opportunity to front-run our trades. For example, when we traded the popular MeMe coin PePe with ETH, when a searcher noticed the transaction, they used higher gas to front-run the purchase of PePe, causing the price of PePe to rise and resulting in us buying fewer PePe than expected. Subsequently, the searcher sells for a profit. This process is known as a sandwich attack. As a regular user, you can set a lower slippage, such as 0.1%, to prevent front-running bots from profiting. However, setting a low slippage may increase the chances of failed large transactions and still require transaction fees. Users can also choose to increase the gas fee, which will increase the attack cost for the bots. The downside is that it also increases the user's transaction cost.

It can be seen that users are easily at a disadvantage when facing MEV bots. However, for MEV bots, it does not mean easy profits and arbitrary harvesting of users. As all transactions are by default in the Ethereum public memory pool, each transaction is monitored, and MEV searchers check if they can take advantage of these transactions. When multiple searchers compete for the same transaction, the builder in MEV seizes the space in the next block through a priority fee, causing normal transactions to be blocked and increasing the cost of on-chain transactions. All transactions will be processed on-chain, but only one searcher can be successful, resulting in unnecessary losses for other unsuccessful searchers. To protect users, projects dedicated to optimizing the MEV problem provide private RPC for users and promise that transactions broadcasted through this RPC will not be front-run. For example, Flashbot Protect RPC and OpenMEV RPC (MEV-resistant service provider for Sushiswap). Taking the former as an example, Flashbots Protect is an RPC tool used to resist bots attempting to front-run user transactions for profit. Unlike other node providers, Flashbots Protect sends transactions to a private memory pool to avoid being seen by searchers before being processed on-chain, effectively reducing the occurrence of sandwich attacks.

When competition among searchers intensifies and users are also protected, searchers make a request to cooperate with users. Why should users agree to cooperate with searchers? Because MEV in the public memory pool can be avoided by searchers, but MEV in the private transaction pool is still easily captured, even if users use Flashbots Protect RPC, it can only prevent potential MEV from being captured by searchers in the public memory pool, and searchers in Flashbots Auction still have the opportunity to extract MEV from its transactions. Flashbots Auction provides a private transaction pool + a sealed block space auction mechanism, allowing block validators to outsource the work of finding the best block construction to searchers. In this private transaction pool, searchers can communicate privately. With Flashbots Auction, searchers no longer need to ensure that their transactions are prioritized by means of Gas War, nor do they need to pay for failed transactions.

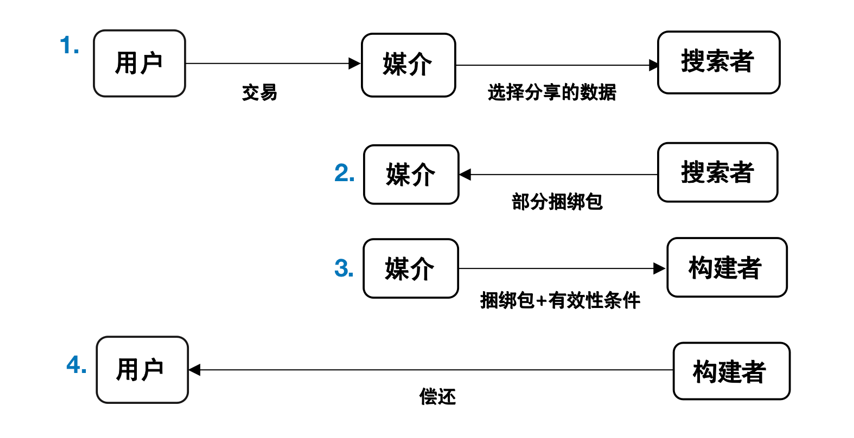

Users think that since they cannot completely avoid being extracted MEV, they might as well obtain some rebate from the searchers themselves. As a result, a win-win solution emerged, called MEV-Share. MEV-Share is a protocol proposed by Flashbots in February 2023, which realizes programmable privacy for users: users selectively share data about their transactions with searchers. This allows users to decide how, when, and by whom their transactions are executed. By default, users only share the hash of the transaction and the addresses of supported liquidity pools. Searchers search programmable private order flows (private order flows refer to non-publicly visible transaction activity and order information submitted to the Flashbots auction system) and bid in the order flow auction to obtain the right to execute users' private orders. This selective disclosure of transaction data by users helps searchers make better bids, optimizes competition among searchers, and users receive fees refunded by builders. So, who mediates the data exchange between users and searchers? MEV-Share introduces a new participant called Matchmaker to facilitate this exchange.

Matchmaker can adjust three processes in the MEV-Share supply chain. It can receive users' transactions and selectively share the data of these transactions with searchers. It can also insert users' private transactions into bundles that searchers have not yet completed, creating complete bundles. Bundles are introduced in the Flashbots Auction and consist of multiple transactions to be executed. They can be sent by searchers to builders, who will select the most profitable ones from the received bundles and package them into complete blocks before sending them to relays, and finally to validators. In MEV-Share, Matchmaker can send complete bundles along with the validity terms that builders must comply with (e.g., returning fees to users) to the builders, who must adhere to the validity terms to participate in the MEV-Share supply chain. We know that MEV-Share is a collaboration between users and searchers, but why would builders also get involved? Here we need to introduce the various roles involved in the MEV process.

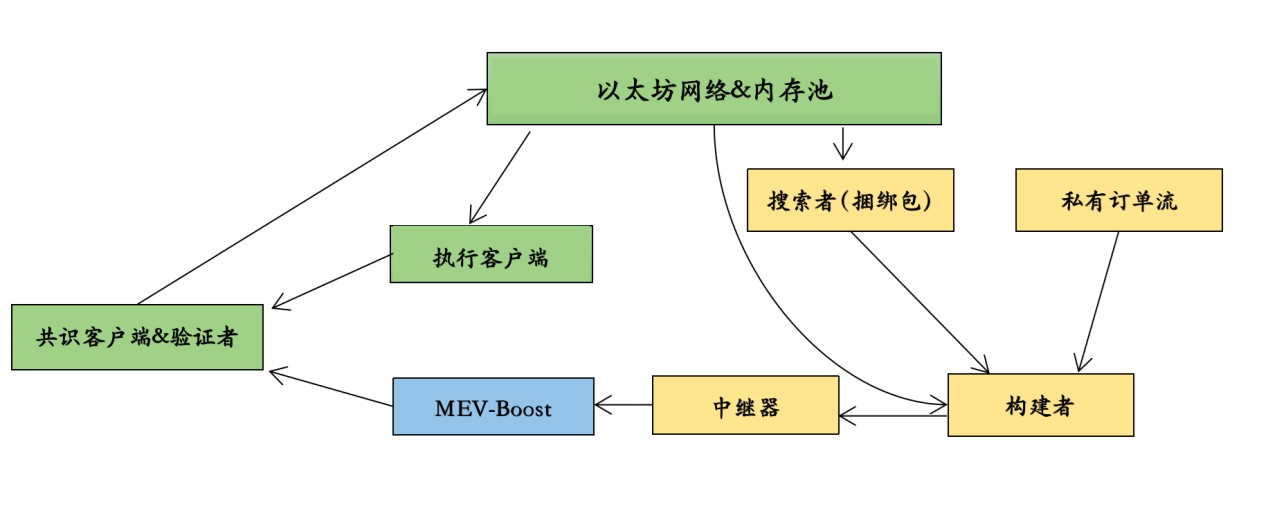

In the current transition of Ethereum to proof of stake, validators can either sort and package transactions in the mempool themselves, or they can choose to package blocks that have been sorted by builders and have higher MEV income, which are pushed by MEV-Boost. Through MEV-Boost, validators can greatly increase their income; therefore, the majority of validators will choose to integrate MEV-Boost instead of sorting themselves. In fact, according to mevboost.pics, the current percentage of validators integrating MEV-Boost has reached 90.7%.

In the MEV-Boost supply chain, there are five different roles: Users, Searchers, Builders, Relays, and Validators. Their relationships can be referenced in the diagram below. Users initiate the order flow, and when a user submits a transaction on the blockchain, it generally first enters the transaction pool of the memory pool. Searchers (arbitrage and liquidation bots, DeFi traders, Ethereum Dapps) begin searching the memory pool for extractable value and then bundle the transactions together to provide to the builders. Builders (usually professional institutions) are responsible for packaging transactions from searchers as well as transactions from the public mempool and private transaction order flow into blocks. Relays connect builders and validators, verify the validity and bidding of the blocks submitted by builders, and submit the valid highest bid to the validators. Validators are the miners of Ethereum after it transitions to proof-of-stake, they also referred to as proposers and are responsible for proposing blocks to the network and adding them to the chain. Currently, the competition pattern of validators is stable, with Lido occupying the largest market share. Validators can receive both consensus rewards (block rewards) and execution rewards (MEV+Tips).

It can be seen that builders are an important component in the MEV supply chain. Although MEV-Share regulates the relationship between users and searchers, if builders behave improperly and have a negative impact on the order flow, users have little possibility of recourse. Therefore, it is necessary to establish a method for sharing the order flow with trusted builders. Flashbots is building such a method, where builders must adhere to the principles of fair markets in order to receive the order flow from the Matchmaker. In this principle, builders need to ensure that they act in a market-neutral manner and do not exploit their privileged position to manipulate auctions, thus harming the interests of users. Therefore, MEV-Share also plays a role in reducing the centralization of the order flow.

So how do users, searchers, and builders use MEV-Share? The MEV-Share protocol is included in Flashbots Protect. Users can connect to Flashbots Matchmaker through Flashbots Protect. Users can also configure their RPC requests to choose whether to share their order flow with registered block builders. Searchers can subscribe to Flashbots Matchmaker to search for programmable private order flow, while builders can receive the order flow through MEV-Share.

If we were to describe the role of MEV-Share in one sentence, how would we describe it? My understanding is that it achieves collaboration and optimization within the MEV supply chain through programmable transaction data sharing. As we know, MEV-Boost is committed to optimizing collaboration between builders and validators, and MEV-Share does the same for users and searchers. In the near future, there may also be collaboration between searchers and builders.

Furthermore, let's consider why we need members of the MEV supply chain to share and collaborate. Why does Flashbots strive to propose these small yet significant solutions? I believe that fundamentally, this is a decentralized value proposition. It is well known that the MEV market is highly specialized and fiercely competitive dark forest, and Flashbots prefers to encourage community cooperation. Their ideal is to create a decentralized MEV ecosystem that is permissionless, transparent, and fair.

1) For blockchain, they hope to achieve maximum decentralization of ordering. For validators, they hope to achieve maximum revenue for block space.

2) For searchers and builders, they hope to achieve open access to transactions for users and searchers, expressive complexity of preferences, and cross-chain coordination.

3) For users, they hope to achieve the best order flow execution path and the lowest fees. "Preferences, privacy, coordination," and other keywords are concrete expressions of decentralization.

If MEV-Share is dedicated to the research at the starting end of the MEV supply chain, another proposal called MEV-Burn is dedicated to the research at the end of the MEV supply chain. In the current MEV-Boost system, MEV is captured by the searcher and flows to the block builder, validators, and the Ethereum network itself in the form of gas fees. Part of the gas fee paid by the searcher is burned according to the EIP-1559 protocol, while the other part flows to the block builder as a tip. The builder pays the fee to the validator to propose a block to the network. For builders, MEV profit is reflected as "transaction fee (Gas) + fees paid by the searcher - burned gas fees - fees paid by the builder to the validator." For validators, MEV profit is reflected as the fees paid by the builder. And for the Ethereum network, MEV profit is reflected as the ETH burned according to EIP-1559.

EIP-1559 is designed to address the problem of low efficiency caused by congestion in Ethereum transactions. It can dynamically adjust the upper limit of Gas fees to cope with short-term transaction peaks and avoid network congestion caused by excessive transaction volume. It changes the payment structure and flow of fees, thereby ensuring the utilization of blocks. In the MEV process, the block network also faces similar congestion issues, known as competition fees. Arbitragers are willing to pay a large amount of gas fees for faster transaction execution, and the resulting competition fees are the target of MEV-Burn.

In the current system, validators can monopolize slots (each slot is 12 seconds in Ethereum PoS) for profit through MEV bribery. Validators have complete control over which transactions occur in which slot. Even if other members of the MEV supply chain do a lot of work, validators always enjoy more profits in comparison. When controlling more validators leads to more profits, it brings about centralization issues, where a single validator has a monopoly on proposing blocks. In order to make validators compete and strive for block proposal rewards, the MEV-Burn proposal has emerged. The core idea of this proposal is to auction the "block proposal right" at the protocol level. Once the winners among the validators are selected, the execution blocks they propose will be burned with at least the same amount of competition fees as their bids. This idea will prompt validators to bid closer to the maximum extractable value in the block, thereby able to destroy some MEV.

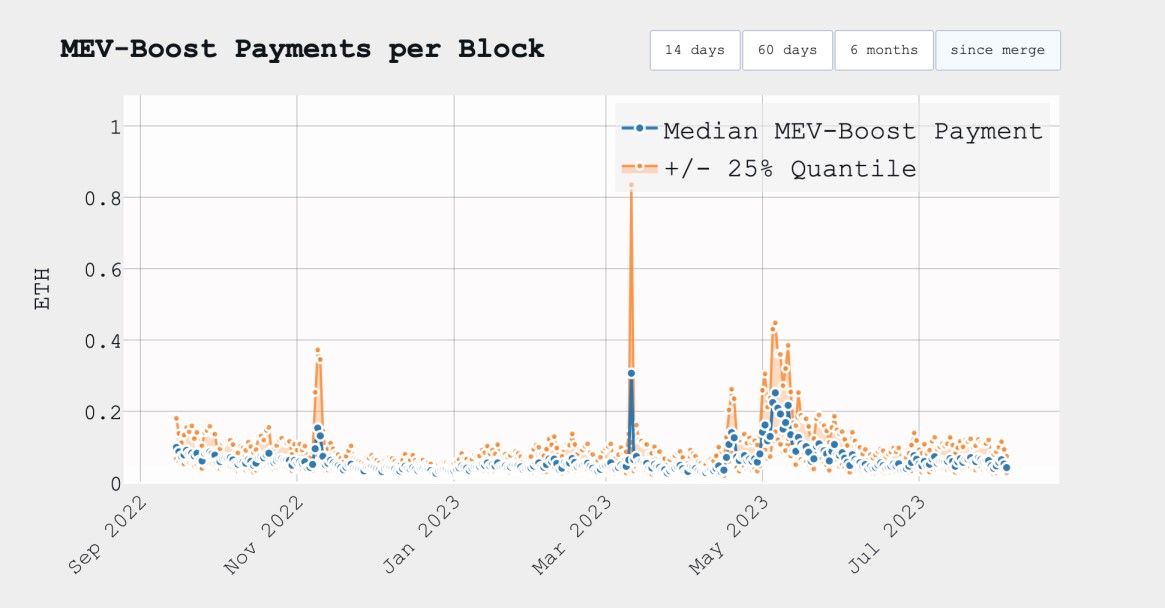

So why burn MEV? What are the benefits of doing so? Firstly, burning MEV can reduce the peak effects of MEV. As shown in the figure below, the average MEV payment (the image only describes the blocks created by Flashbots through MEV Boost) is about 0.05 ETH per block. However, sometimes it may surge violently to an average of 1 ETH per block. During these periods of market turmoil, lucky validators have extracted over 100 ETH from a single block.

Burning MEV can smooth out these peaks, enhancing consensus stability. Smoothing out the peaks reduces the motivation for individual proposers to steal MEV through short-chain reorganization, P2P attacks, and other means. Extreme MEV peaks can pose systemic risks to Ethereum, and MEV-Burn can enhance network security.

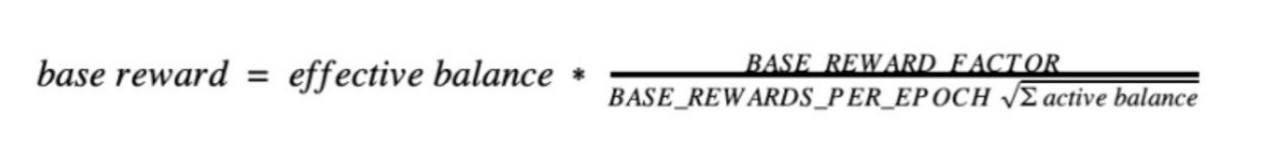

On the other hand, MEV-Burn can produce the same economic benefits as EIP-1559. Under the mechanism of Ethereum's proof-of-stake, the rewards for validators are mainly reflected in the base reward, which represents the average reward for each validator under the best conditions in each time period. This is calculated based on the validator's effective balance (up to 32) and the total number of active validators.

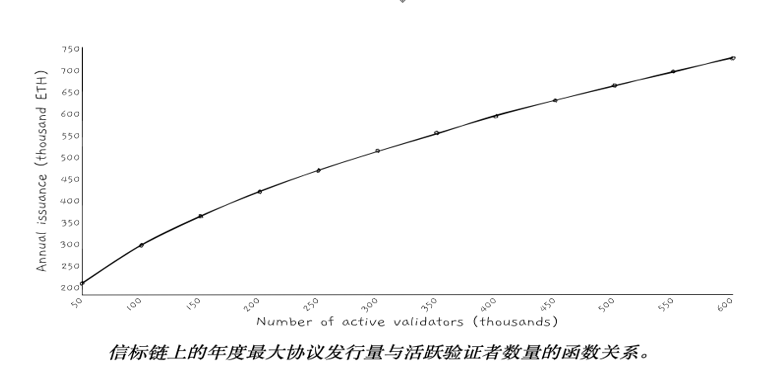

As for the issuance of ETH, it is directly proportional to the square root of the number of validators. The burning of MEV reduces the income of validators, thereby reducing the total reward for ETH staking, which will also result in a decrease in the amount of ETH staked. With the decrease in the amount of ETH staked, the total supply of ETH will also decrease. Since the beacon chain is designed to ensure security only through issuance, EIP-1559 and MEV burning can reduce excessive investment in economic security and improve economic efficiency, and a decrease in the number of validators can alleviate the pressure on beacon nodes. The burning of MEV can also achieve the effect of increasing the scarcity of ETH. If MEV-Burn is successfully implemented, the rate of decrease in the supply of ETH will be accelerated by about 2.5 times.

Another interesting point is taxation. In traditional business, when a company wants to distribute profits to shareholders, there are often two options. The first option is to pay dividends to shareholders, and the second option is to buy back shares like Apple does. Share buybacks are often subject to Capital Gains Tax, while dividends are subject to Income Tax. The model of MEV burning is similar to share buybacks. In most jurisdictions, Income Tax is significantly higher than Capital Gains Tax. In the UK, Income Tax is 50% and Capital Gains Tax is 20%. EIP-1559 and MEV burning can convert the income tax that users should pay into capital gains tax, significantly improving the tax efficiency for cryptocurrencies in certain jurisdictions. EIP-1559 has already prevented the selling pressure of approximately 1 million ETH, and MEV burning can also prevent the selling pressure of millions of ETH.

A series of solutions regarding MEV are aimed at creating a fair, transparent, and secure trading environment. In the exploration of MEV redistribution paths, we have observed the cooperation between users and searchers, as well as fiercer competition among validators. However, MEV still faces challenges of centralization and insufficient fairness in distribution. During the research process, organizations like Flashbots have expressed their commitment to maintaining decentralization, respecting the preferences of each user and domain involved in MEV, and look forward to more participation, research, and discussion. Looking ahead, we anticipate deeper research and innovation, pushing towards more decentralization!

References:

https://collective.flashbots.net/t/announcing-mev-share-beta/1650

https://writings.flashbots.net/searching-on-mev-share

https://docs.flashbots.net/flashbots-protect/rpc/mev-share

https://ethresear.ch/t/mev-burn-a-simple-design/15590

https://ethresear.ch/t/burning-mev-through-block-proposer-auctions/14029

https://www.youtube.com/watch?v=jlGc0npwkeU&pp=ygUIbWV2 IGJ 1 cm 4% 3D

https://ethereum.org/en/developers/docs/consensus-mechanisms/pos/rewards-and-penalties