LD Capital Macro Weekly Report (10.30): A-shares start, China and the United States make positive progress; ground war begins, this week’s market changes

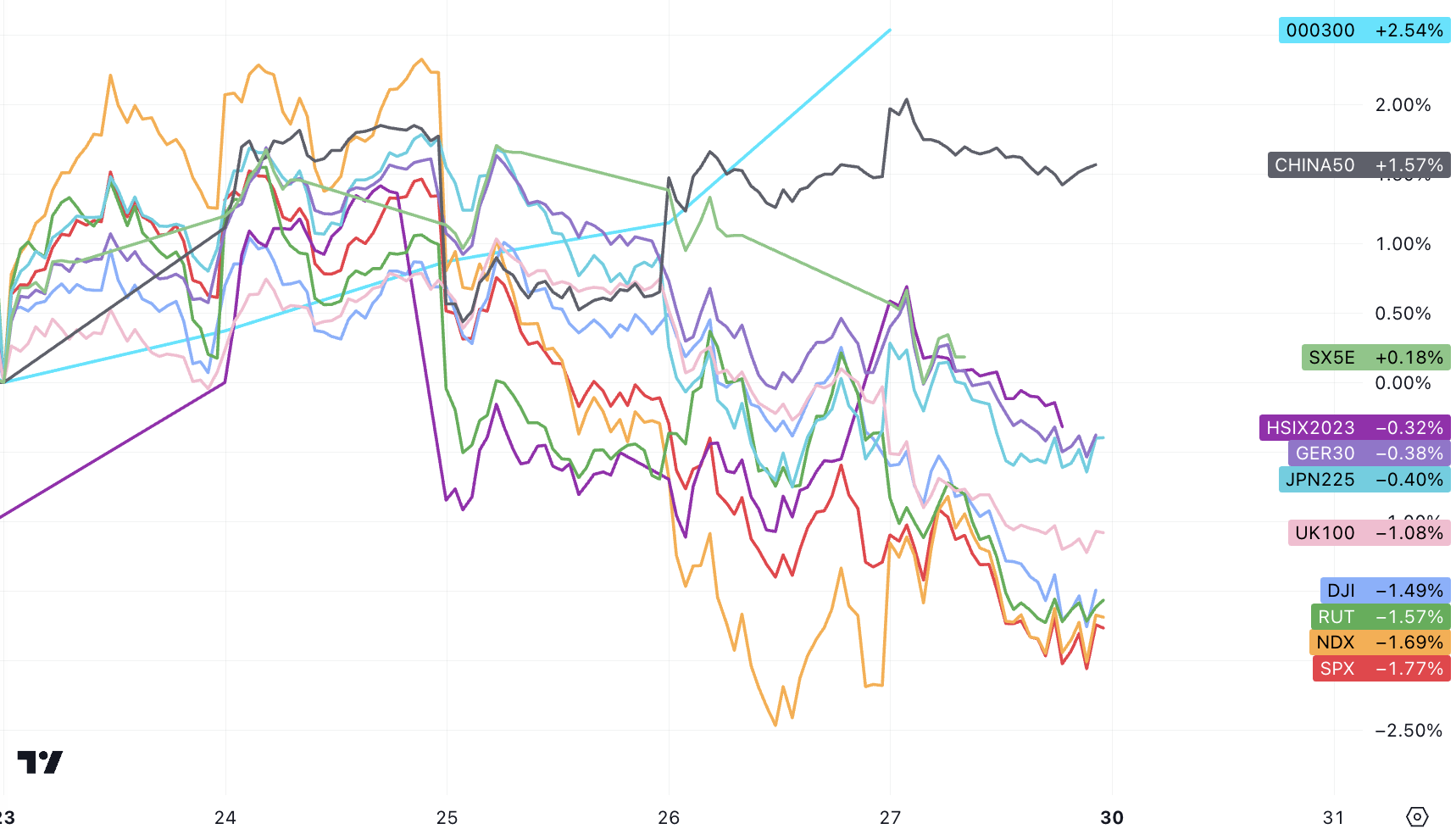

Developed country stock markets fell after a brief rebound last week, with U.S. stocks falling particularly sharply. Chinas stock market finally rebounded (the largest in three months). The main events affecting the market include Chinas breakthrough of the fiscal budget red line (the markets long-awaited central government leverage), strong US third-quarter GDP growth report, mild PCE inflation release, still high 10-year Treasury yields, earnings reports from large-cap technology stocks (especially Google and META) that were interpreted as not good enough, dovish ECB meeting, Israel officially began ground operations.

Crypto-assets continue to rise along with gold, although there is no new progress in ETFs, which confirms our previous view that this bull market is not only good for ETFs, but also the need for diversified allocation of alternative assets when uncertainty accumulates to a certain extent. ETFs Even if it doesnt happen, it wont have much impact.

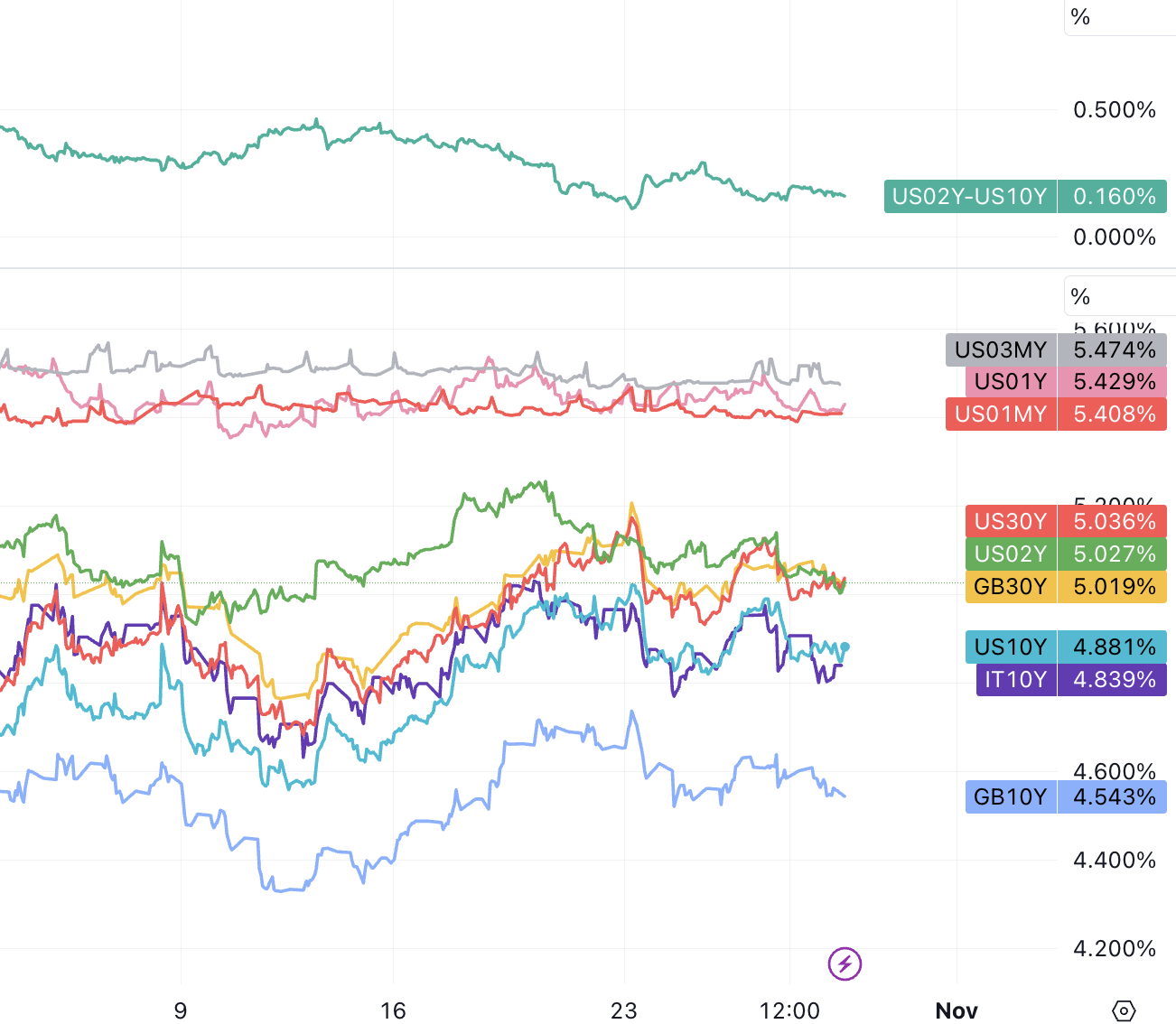

The U.S. long-term bond yield fell significantly, with 30 yr falling by 15 bp, 10 yr failing to stabilize at 5%, falling 13 bp and returning to below 4.9%, and 02 yr falling by 8 bp to the 5% mark:

U.S. stocks diverge

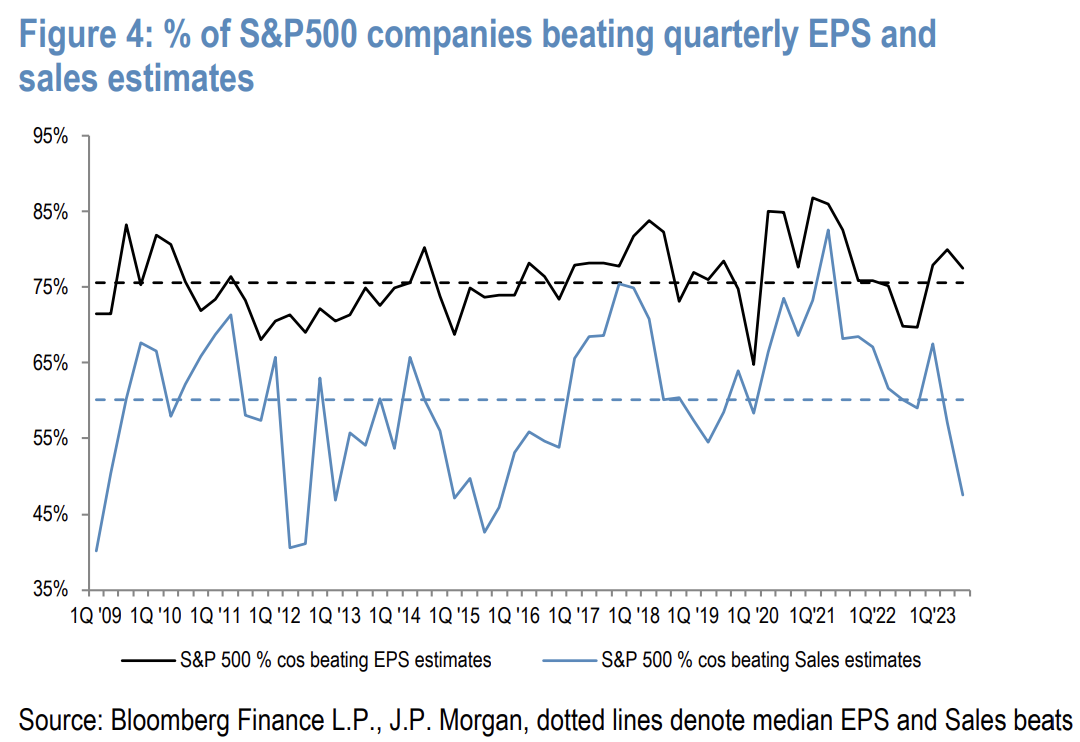

The earnings season is nearly halfway through. The stock market has been falling for most of this earnings season, and it is very cruel to any company whose performance falls short of expectations: Judging from the price performance on the first day of earnings release, the stock prices of companies that fall short of expectations lag behind their benchmarks on average. The SP 500 lost 5.7%, its worst performance in a year and the second-worst performance in Bloomberg Intelligence data dating back to 2017.

Last week we got 4 major earnings reports from big tech companies: Google, Microsoft, Amazon and META. The top 3 companies with public cloud businesses have had mixed results. Reports from Microsoft and Amazon suggest their cloud businesses are accelerating or at least holding steady. Google, on the other hand, failed to meet expectations, with its cloud growth and margins negatively impacted by customer optimization and upfront investments. Shares of Amazon and Microsoft are up 2 – 3% this week, while Google is down more than 10%, underscoring that fundamentals continue to matter in today’s market.

In the past, the seven largest technology stocks masked the overall weakness under the surface. Now the valuation of the vast majority of stocks in the SP 500 Index (493 out of 500 stocks) is no longer a cause for concern. The valuation is at 16 times earnings, slightly lower than 10-year median. Of course, the top seven stocks in the index are still trading at very high earnings multiples, pushing the entire index to a P/E ratio of 18x, which is still high by historical standards. Therefore, for investors with strong stock picking skills, valuation does not appear to be a negative factor for most stocks at the moment, except for Big Tech.

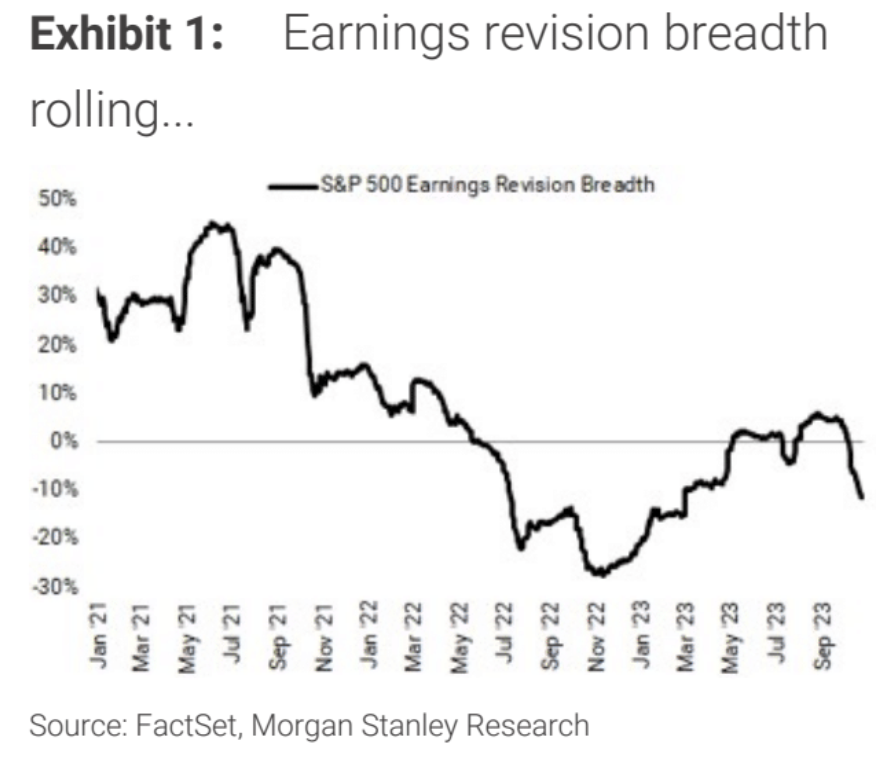

Since the current financial reporting season, although there are more companies than expected, profit expectations have been continuously revised downwards. Combined with declining consumer confidence and expected expenditures to slow down, the fundamentals are hardly optimistic.

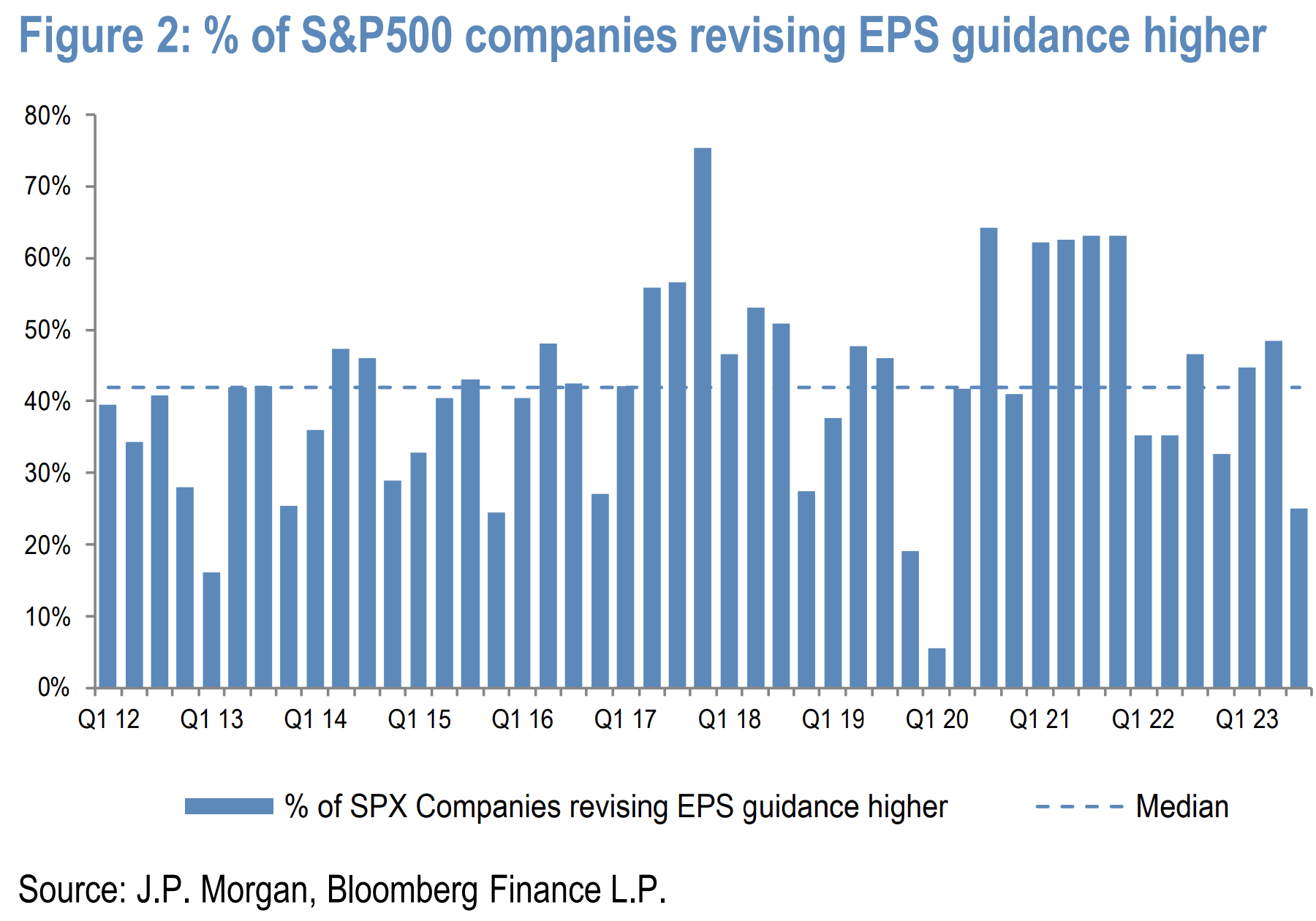

An above-average number of companies warned of falling profits, pointing to weaker sales/demand, deteriorating macro conditions and inflationary pressures, with the lowest share of companies raising EPS guidance for next year since 2020.

On the other hand, falling bond market prices mean that high-quality collateral will also face discounts. When a large loss occurs in the market value assessment of bond m 2 m, institutions holding bonds will also be forced to sell stocks in order to control risks. Therefore, rising interest rates put pressure on stock indexes by forcing institutions to deleverage and sell stocks. This is the second transmission mechanism of rising interest rates to the stock market that we often see.

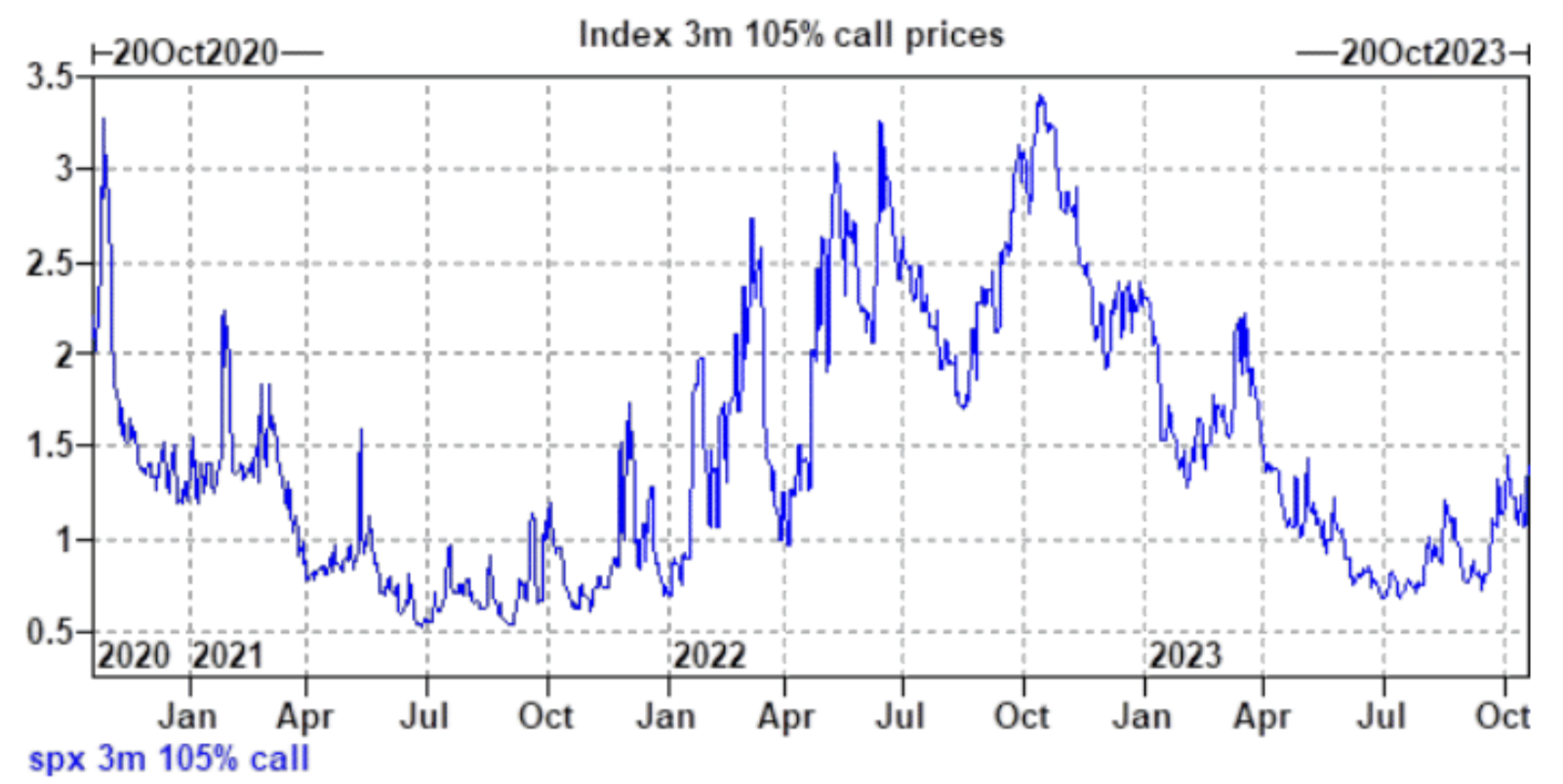

Goldman Sachs expects headwinds to persist, “but we would view further material downgrades to the growth outlook as a buying opportunity”… The absolute cost of buying 3-month 105% strike calls now is 1.4% and very well priced Attractive, as long as the SPX can recoup Fridays losses it will cover costs. Goldman Sachs still maintains the SPX year-end forecast of 4,500 points vs. the current level of 4,137 points.

However, Morgan Stanley holds a different view. The institution expects the end-of-year level to be only 3,900. MS Michael Wilson believes that the market now has high expectations for corporate Q4 earnings, and market breadth usually leads prices, but now the breadth is still very narrow (no more stocks participating in the rally), with no signs of a rebound in sight.

Happy GDP and lower yields

Last week also saw US third-quarter GDP growth hit +4.9%, the fastest pace since the peak in Q4 2021. Even after all the rate hikes by the Federal Reserve and the accompanying rise in bond yields, the U.S. economy is still moving at a strong post-pandemic pace.

But its important to know that 4.9% is an inflation-adjusted figure, where the price index is 3.5%, meaning that nominal GDP grew by 8.4%, which is a pretty high number (the opposite of China).

Looking ahead, economists predict growth will slow sharply to 0.8% in the fourth quarter. It can be seen that this GDP data is understood as the end of the good news for the U.S. economy, and U.S. bond yields even fell back somewhat, which is contrary to the previous market reaction that should have occurred.

Currently, U.S. GDP and 10-y U.S. Treasury yields are almost the same. This 5% + 5% combination is very rare for the U.S. economy: the last time this happened was in the first quarter of 2006, and then the risk of the subprime mortgage crisis surfaced. ; The last time was in the second quarter of 2000, on the eve of the bursting of the Internet bubble, so it is understandable that the market is worried. However, as the economic momentum is expected to slow down very strongly, there is a demand for interest rates in the secondary market to fall, which will create tension with macro narratives such as excessive fiscal borrowing in the United States, civil strife in the government, and geopolitical conflicts. The worst-case scenario is that the two parties resonate and the safety of U.S. debt is challenged.

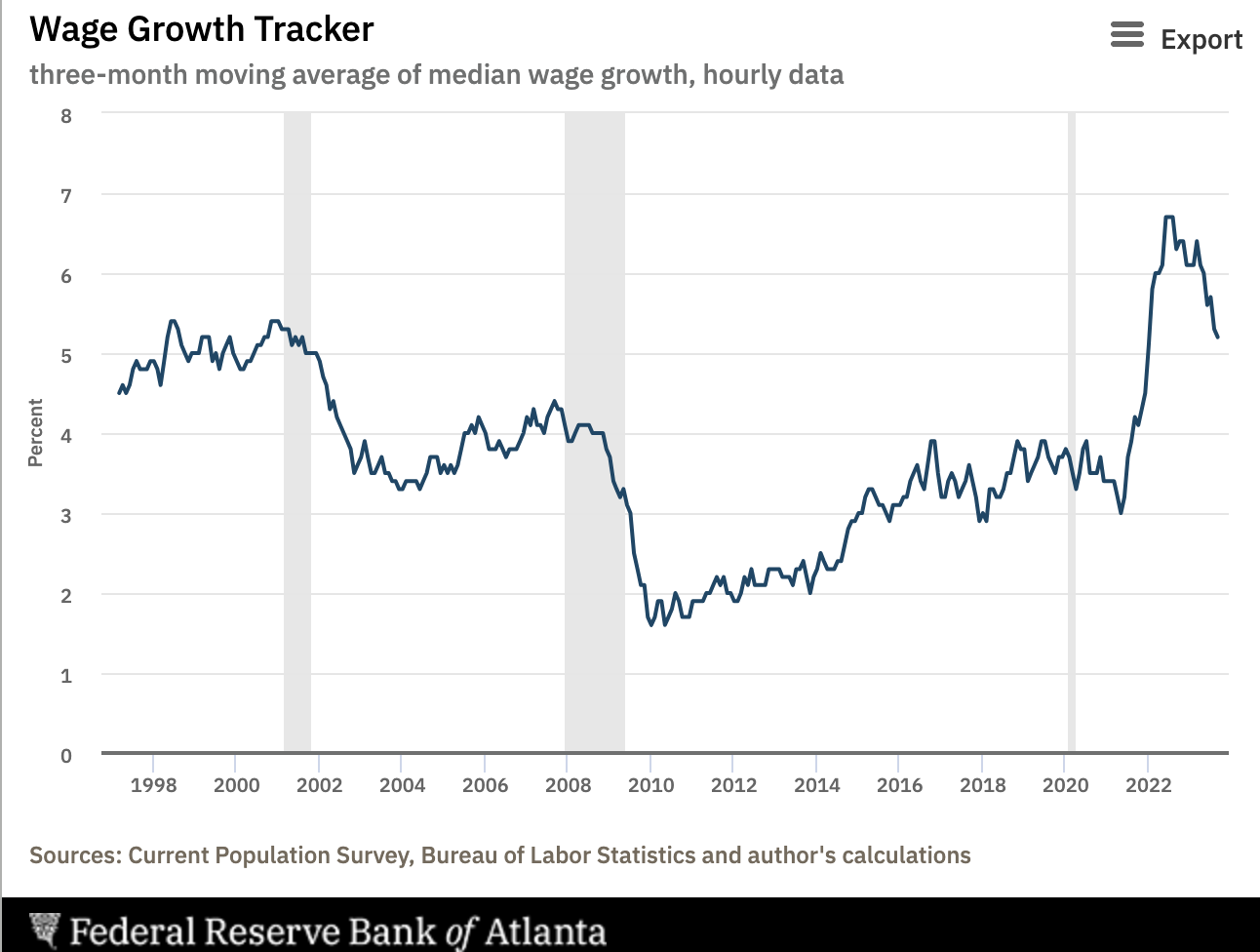

This week’s inflation data was largely in line with expectations. Core commodity inflation has actually turned negative, supporting the claim of transitional inflation. Some people have even begun to discuss that deflation may be a bigger problem than inflation. Their evidence, for example, after the rent data reflected, wages did not spiral together with prices, indicating that the cause of inflation was a one-off; in addition, even in the face of a very expansionary fiscal policy, inflation fell rapidly this year, indicating that the fiscal It will have little impact on prices and there is a risk that the Fed will tighten too much.

In any case, the economic data that have been released so far are generally strong. If the trend can be maintained, recession expectations may also be weakened in Q4.

Credit spreads may be accelerating

As can be seen from the figure below, the white line Bloomberg statistics of U.S. corporate high-yield bond yields are 9.3%, corresponding to the blue line U.S. 10 yr is 4.9%, and the spread between the two is 4.4% green line.

Its a long way from the spreads peak of about 6.1% in October 2022, and has seen little expansion in the last two months of the bond bear market. Unless markets now view Treasuries as riskier than junk bonds, high-yield bond yields should continue to price upward.

This means that the credit crunch on the corporate side seems to have not yet been fully reflected. Generally speaking, the larger the credit spread, the higher the profitability requirements of the company, otherwise the price-to-earnings ratio should fall.

Republicans unite

The new Speaker of the House of Representatives, Mike Johnson, was elected, and the civil strife in the Republican Party has temporarily passed a major milestone. He is a Trump ally, and his election sent the Trump faction into raptures. Bannon tweeted a direct x, praising him as a key thought leader and architect among Republicans who opposed certifying Biden as the winner.

Currently, Mike expresses his support for a temporary spending law to avoid a government shutdown on November 7, and he did actively negotiate with Biden after being elected. The market thus lowered expectations for shutdown. But it is expected that the dispute between the two parties over the formal fiscal spending plan will be more fierce, at least when the more moderate McCarthy is in office.

Israel officially launches ground operation

Late last Friday, after Israel officially began its ground invasion of Gaza, U.S. bond yields and U.S. stocks fell, while gold and crude oil rose after the news. But on the second day of the ground operation, Middle East markets opened on Sunday showing few signs of panic.

Middle East stock markets see a lower likelihood of a wider regional war. Middle East markets showed few signs of panic as they opened on Sunday, a day after Israel began its ground invasion of Gaza. Israels TA-35 stock index closed up 1.3% in Tel Aviv, its first gain in three sessions. The index has fallen 11% since Israel declared war on Oct. 7 following Hamas infiltration.

Hamas announced a voluntary ceasefire in mid-week, which made the market happy for a time. This time Hamass military operation is different from the past. Not only the equipment has been significantly improved, but the strategy has also been improved. Including focusing on quality rather than quantity, instantly paralyzing the Iron Dome defense system, treating hostages kindly, proactive publicity, etc.

The market currently believes that the possibility of the fighting between Israel and Hamas escalating into a wider Middle East war remains low. All other actors in the region have clear incentives to avoid wider conflict. Among them is Hezbollah, which has so far been restrained although it has launched missiles into Israeli-controlled territory.

But on the other hand, the prices of gold and crude oil are still rising/maintaining high levels. Crude oil prices rose 3.2% on Friday, trading above $85 a barrel as Israel stepped up its ground campaign, although still below its highest since the conflict began (just over $90). Gold prices rose 1% on Friday, topping the $2,000 mark.

Although global supply has not been really affected so far, the crude oil market is mainly worried about the future direction of the following two points:

The United States imposes sanctions on Irans crude oil exports (but the impact of most of Irans crude oil exports to China may be limited)

The Strait of Hormuz is disrupted, and tankers transport nearly 17 million barrels of crude oil through the waterway every day. Iran and Iraq frequently attacked each others oil tankers in 1984, and in recent times Iran has stepped up its campaign to seize ships and harass commercial vessels.

Positive progress in Sino-US relations

The U.S. Department of Transportation announced that starting from November 9, the number of round-trip flights between China and the United States operated by Chinese airlines will increase from 24 pairs per week to 35 pairs per week. In 2019, the number of round-trip flights between China and the United States reached over 300 per week.

The additional flights came hours after Chinese Foreign Minister Wang Yi concluded two days of talks in Washington with Secretary of State Antony Blinken and national security adviser Sullivan and met with Biden.

U.S. President Joe Biden and Chinese President Xi Jinping are expected to meet on the sidelines of the Asia-Pacific Economic Cooperation summit in San Francisco next month, according to two U.S. officials familiar with the plans.

Meanwhile, just last week, President Xi Jinping unexpectedly met with California Governor Gavin Newsom, who was on a trip to China in recent weeks, visiting Shenzhen and Beijing. Although Newsom is only the leader of a U.S. state, China seems to treat him as a representative of the U.S. government. Western media commented that this is a signal of Chinas friendship to the West.

In addition, last week China also signed an agreement of intent to purchase U.S. agricultural products (mainly soybeans) worth billions of dollars. This is the first time that China and the United States have signed such a large agreement since 2017.

According to Reuters, the U.S. Soybean Export Council said on Tuesday (October 24) that a delegation of Chinese commodity importers signed an agreement on Monday (October 23) at the China-U.S. Sustainable Agriculture Trade Forum in Iowa. Purchase agreements worth billions of dollars, mainly for agricultural products such as soybeans.

Fund flows and positions

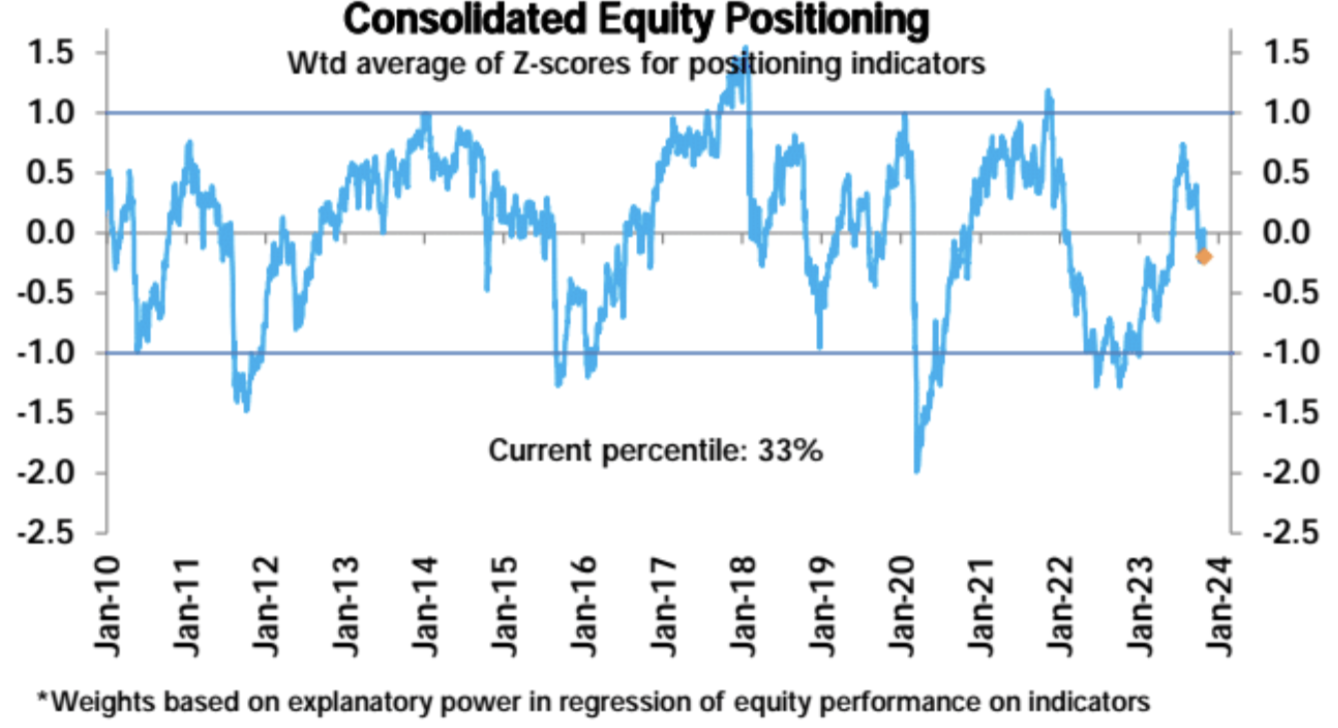

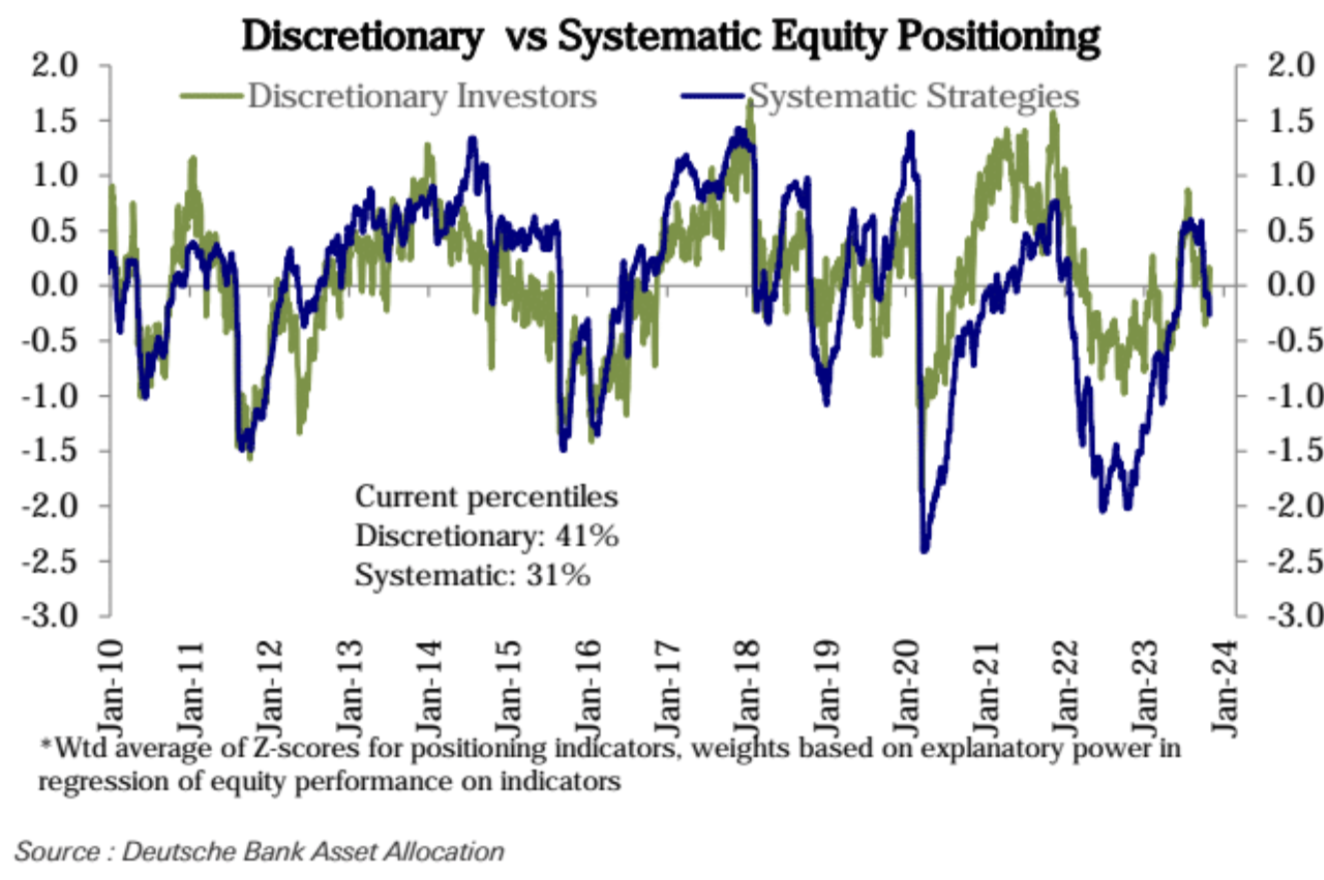

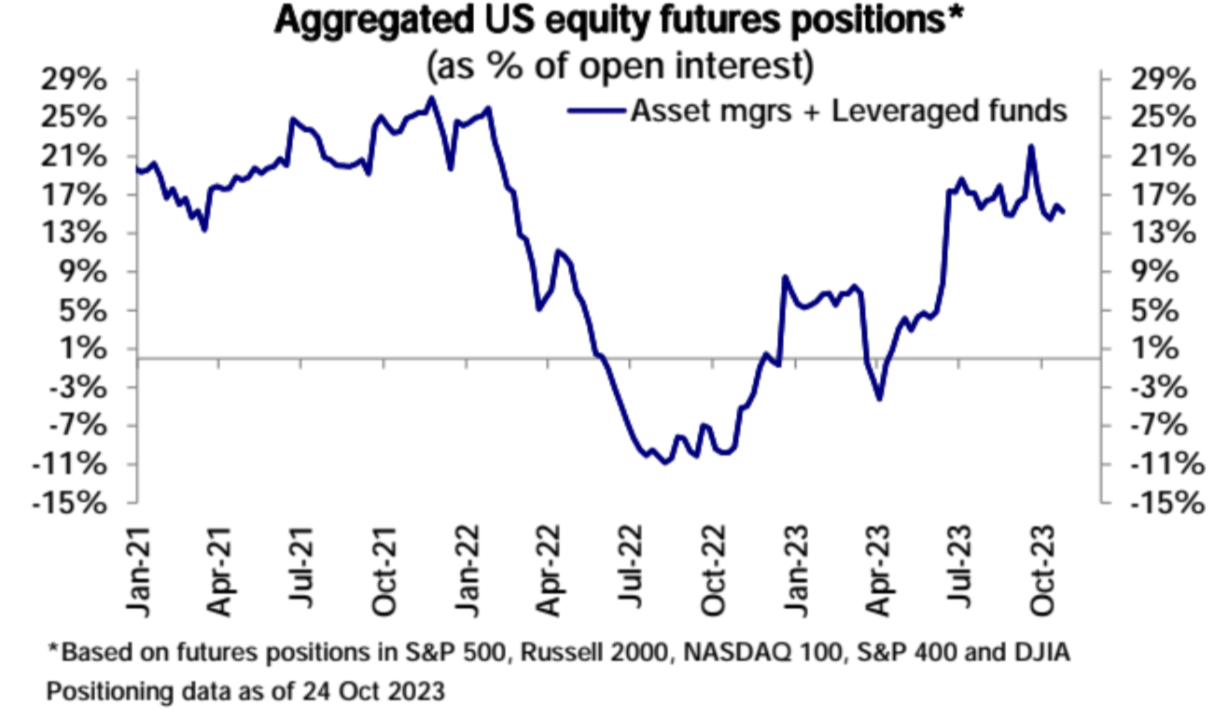

Last week, the comprehensive position of U.S. stocks dropped slightly to the 33rd percentile of history, subjective investor positions increased slightly from the 37th – 41st percentile, and systematic strategy positions fell sharply to a lower level of the 36th – 31st percentile.

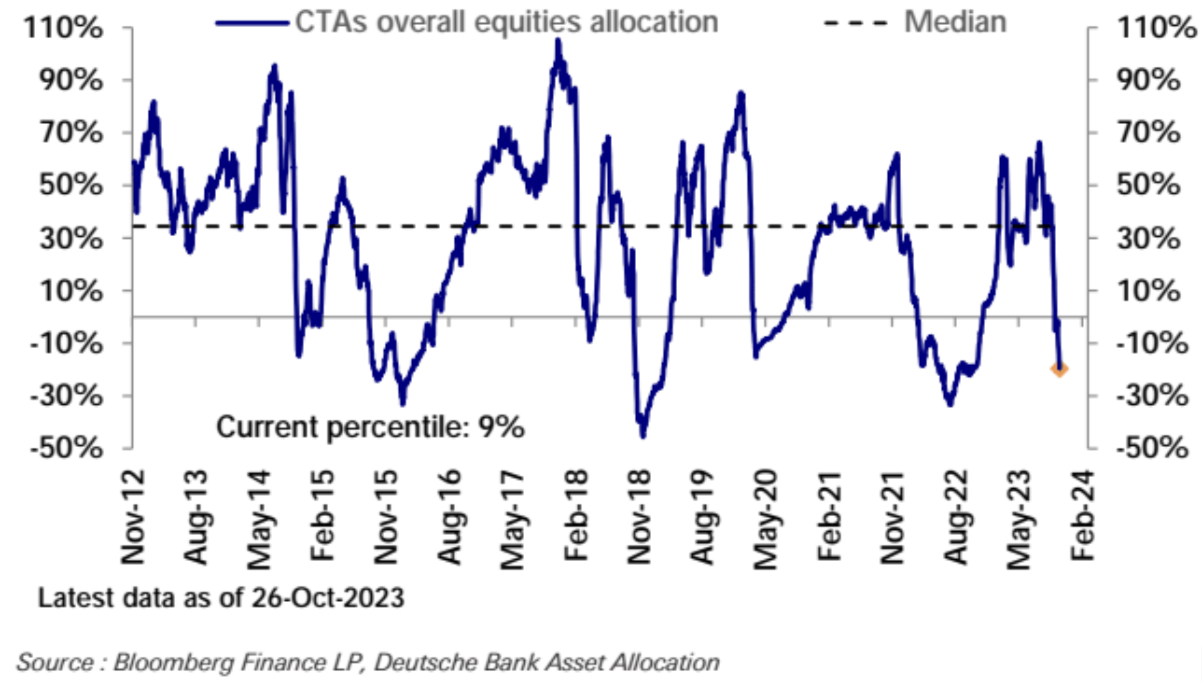

Positioning in the CTA strategy dropped to the historically bearish 9th percentile:

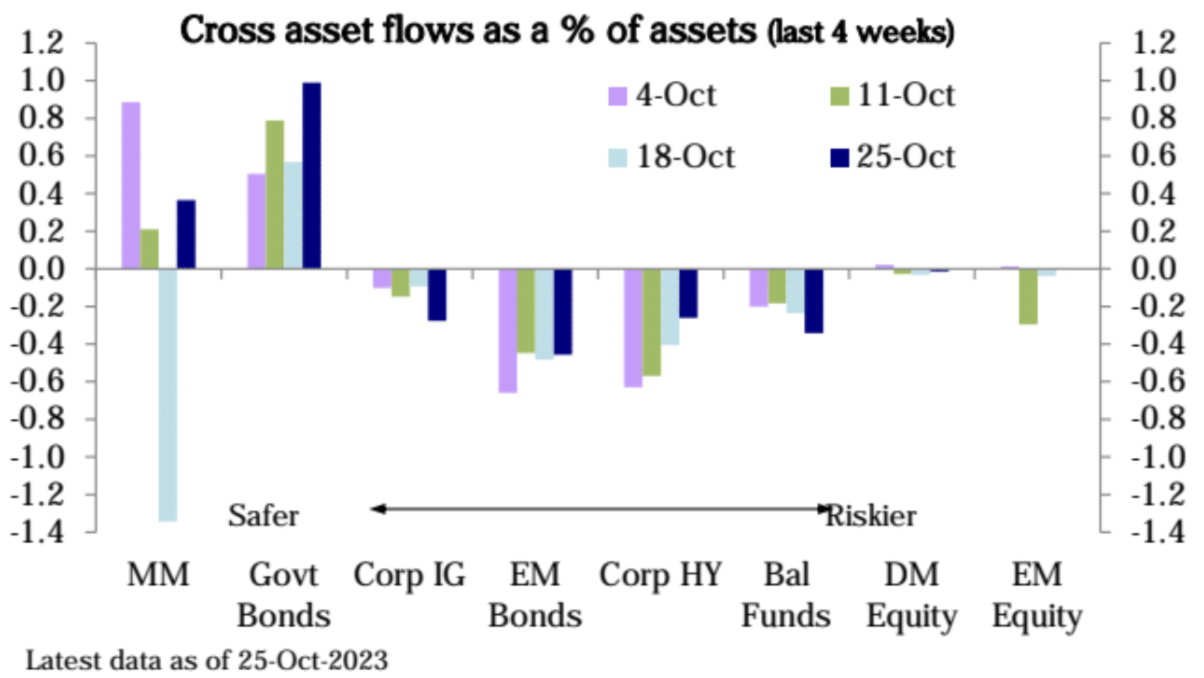

Equity funds saw a third straight week of outflows, mostly from European and global funds; Bond funds saw a third straight week of inflows, mostly into government bonds; Money market funds turned to moderate inflows ($29 billion). It looks like the previous weeks record outflows were Caused by one-time factors:

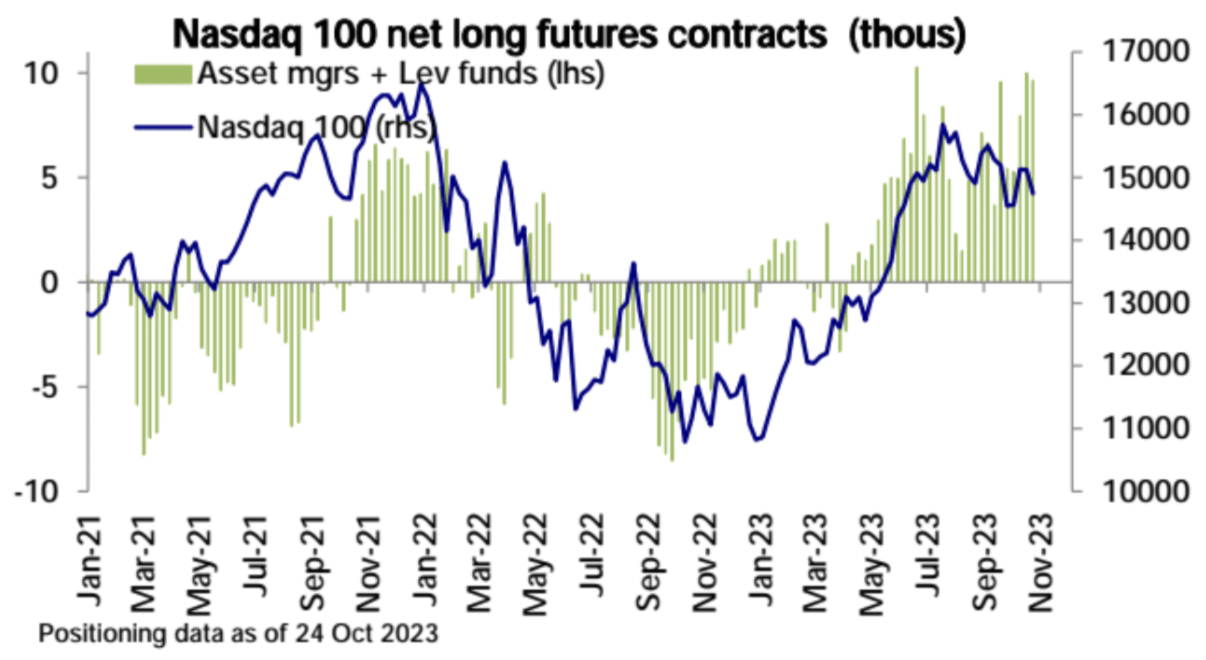

Nasdaq 100 long sentiment remains high:

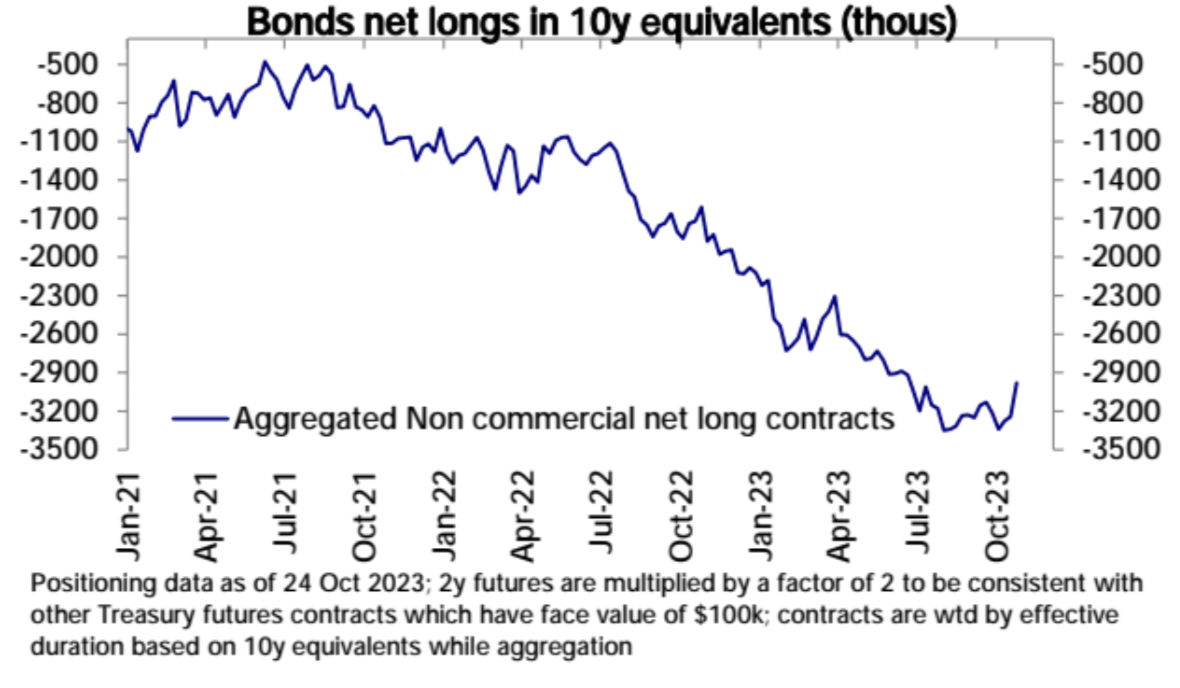

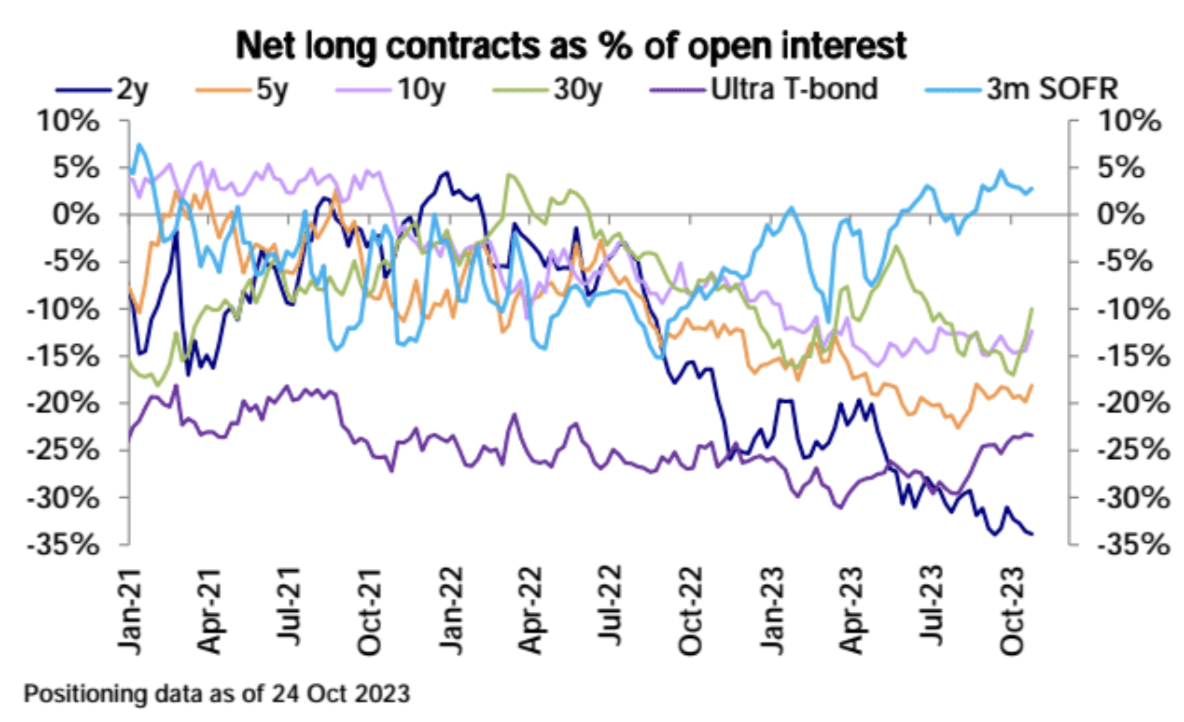

Short positions in U.S. Treasury futures were liquidated on a large scale last week:

In particular, the 30-year Treasury bond may be affected by Ackman’s order call:

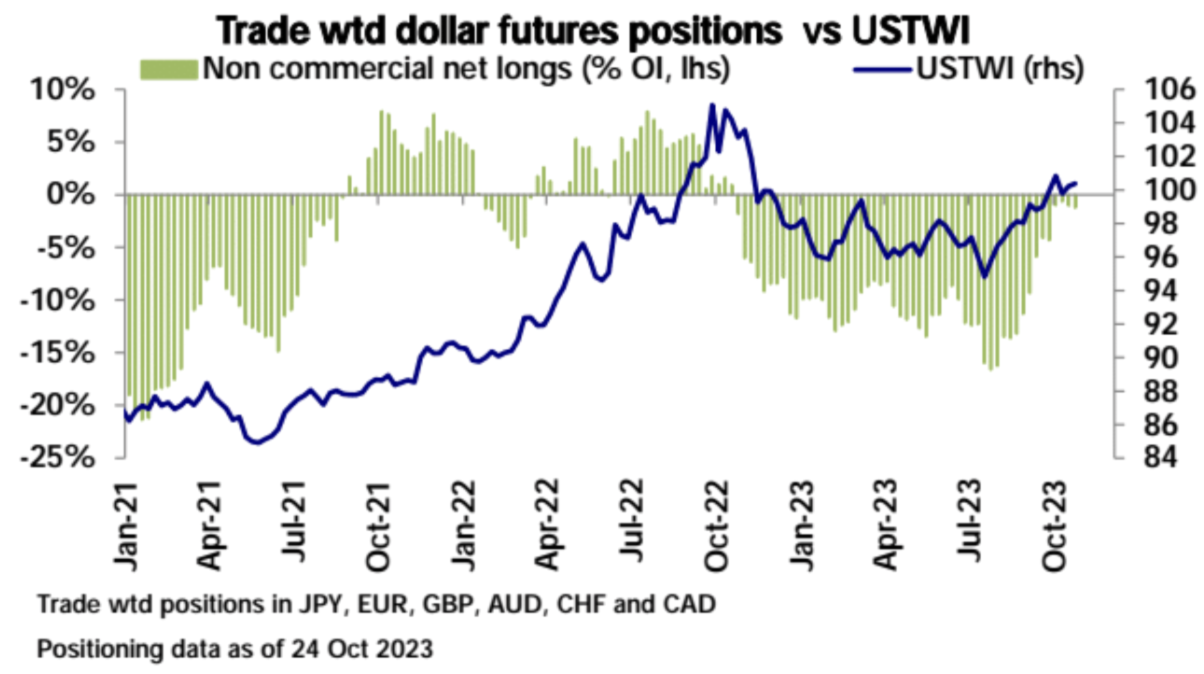

The U.S. dollar maintains a slight net short position:

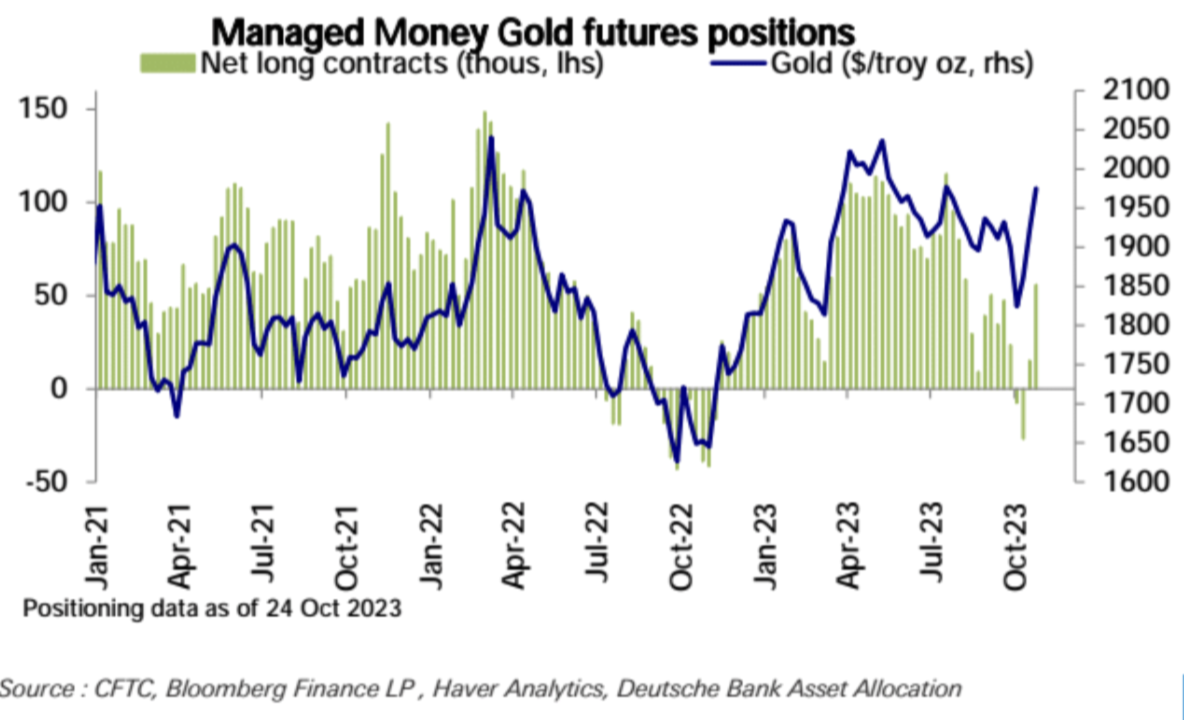

Gold net longs jump the most since March:

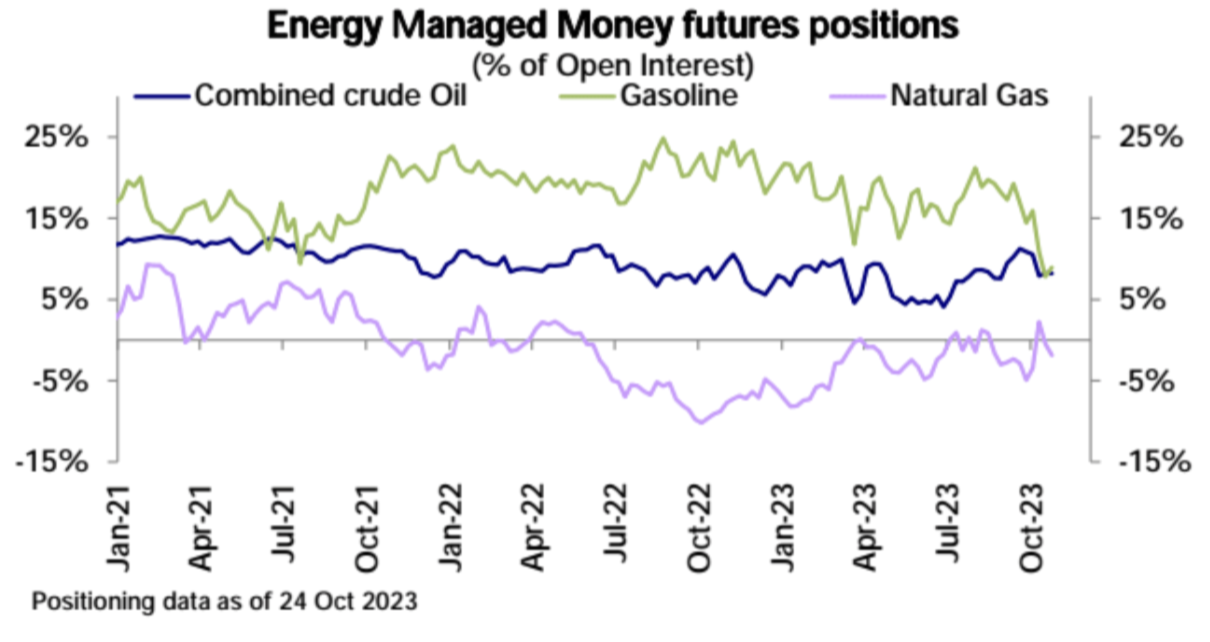

There was little change in the net long position of crude oil and gasoline, but the net long position of natural gas turned into a net short position:

sentiment indicator

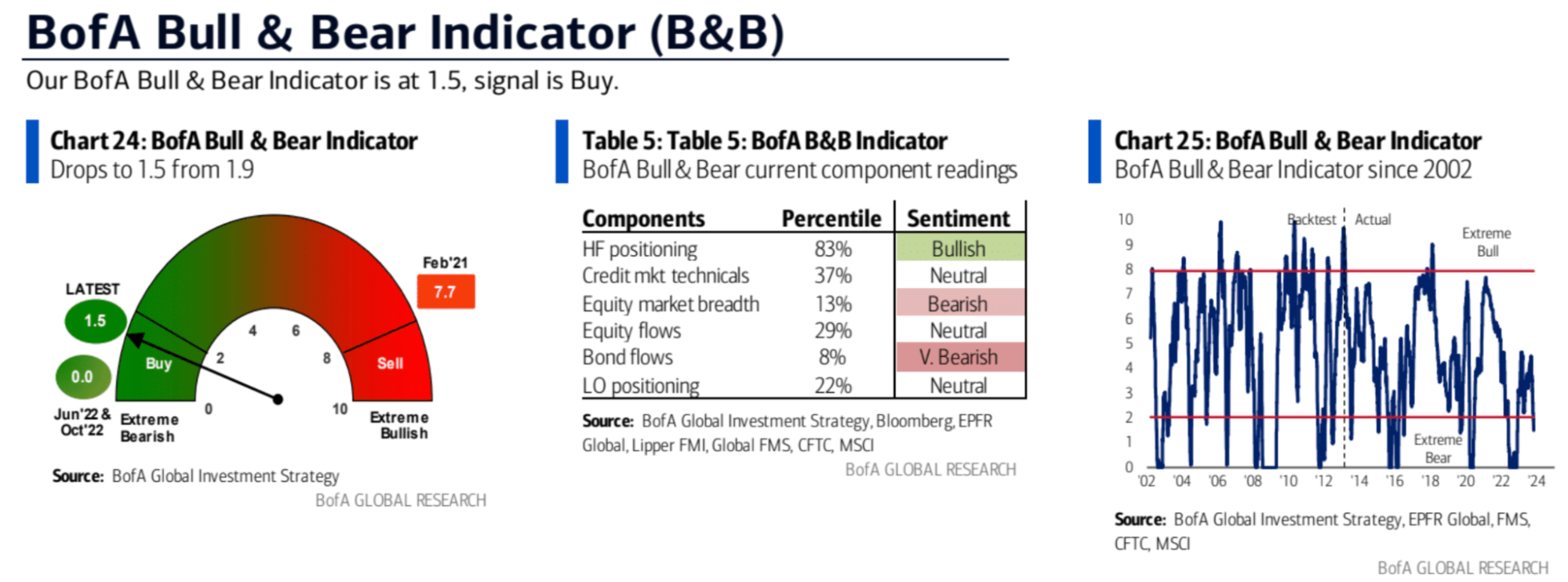

Bank of America Merrill Lynch’s bull and bear indicator continues to fall from 1.9 – 1.5, which is in the buying range:

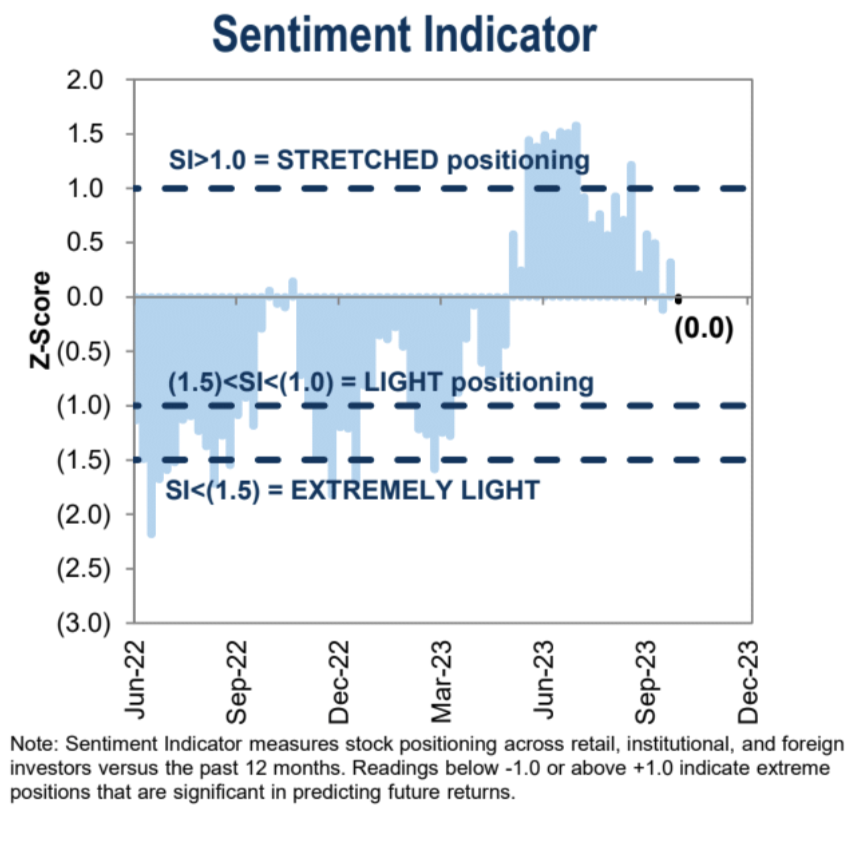

The Goldman Sachs institutional positioning sentiment indicator fell back to neutral:

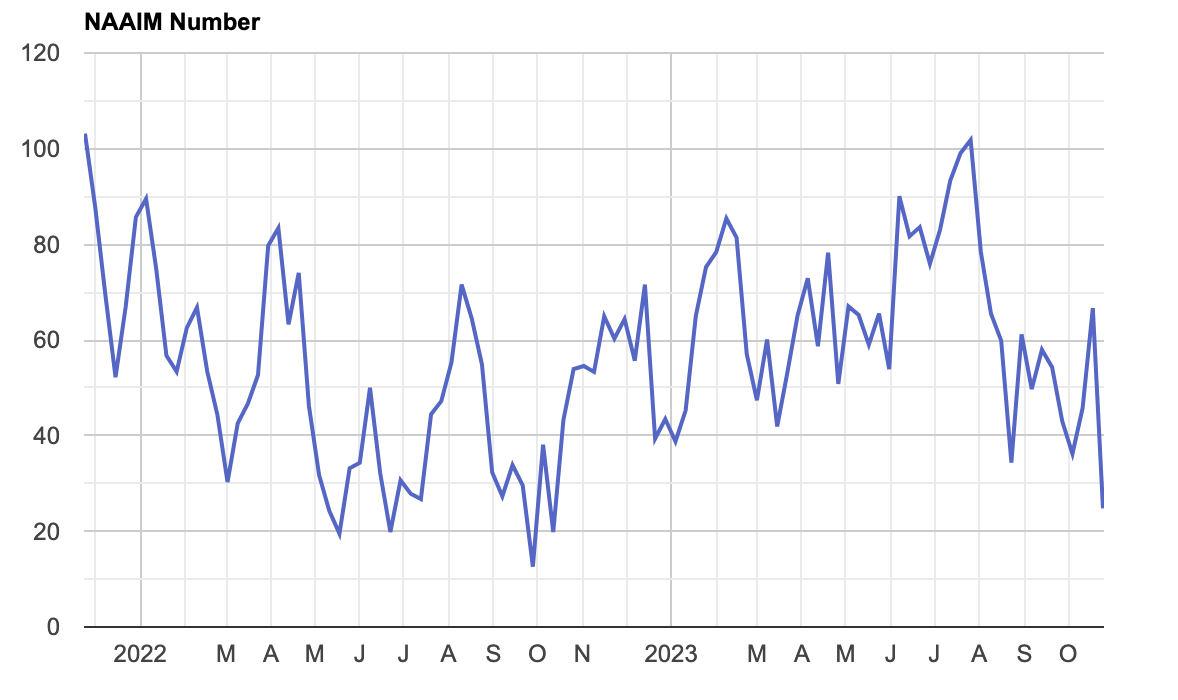

The National Association of Active Investment Managers Exposure Index represents the average exposure to the U.S. stock market reported by its members. A sharp plunge last week (67% -25%) to the lowest level since October last year

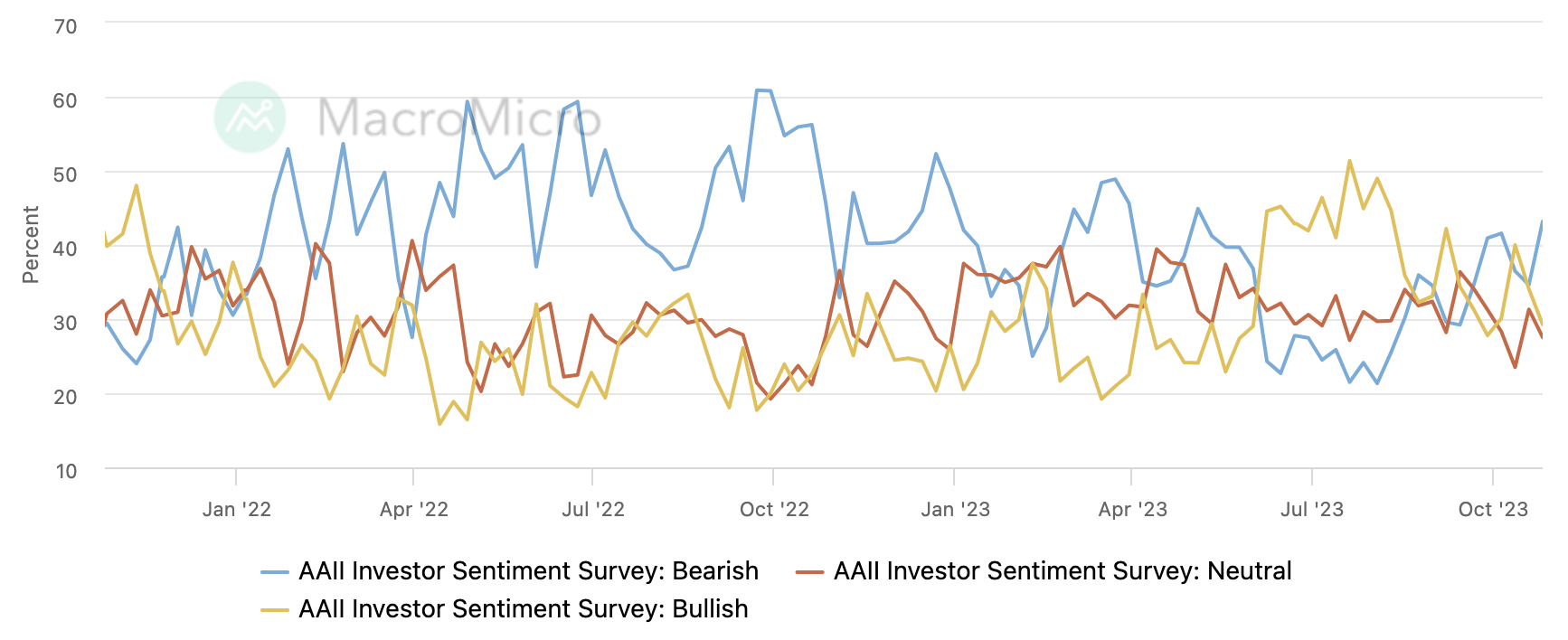

According to the AAII investor survey, the proportion of shorts has increased (35% -43%) to the highest level since May this year:

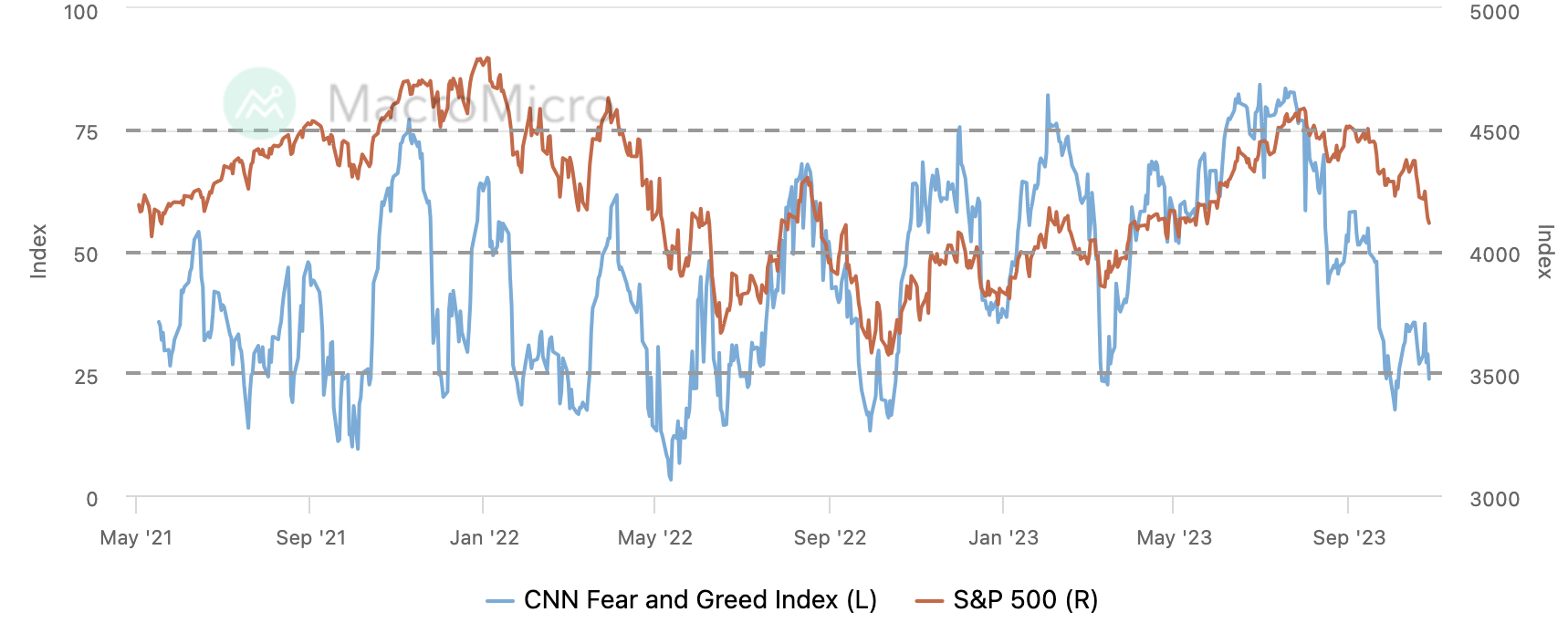

CNN Fear and Greed Index fell back to the extreme panic range:

institutional perspective

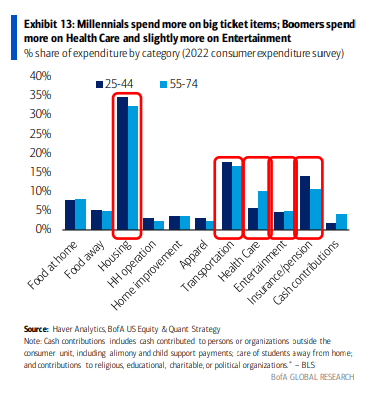

Bank of America: Buy Boomers, Sell Millennials (long the post-50s, short the post-80s)

High interest rates are paying for seniors with savings and squeezing young people without savings, so be long seniors stocks. Avoid those whose wealth depends on cash-strapped Millennials.

Sectors that benefit include health care, entertainment, insurance and other industries where the elderly consume more. Home improvement stocks may also do well as baby boomers are living longer than previous generations and are increasingly reluctant to sell homes with lower mortgage rates.

In terms of millennials, Bank of America pointed out that industries such as clothing and e-commerce retail will be hardest hit.

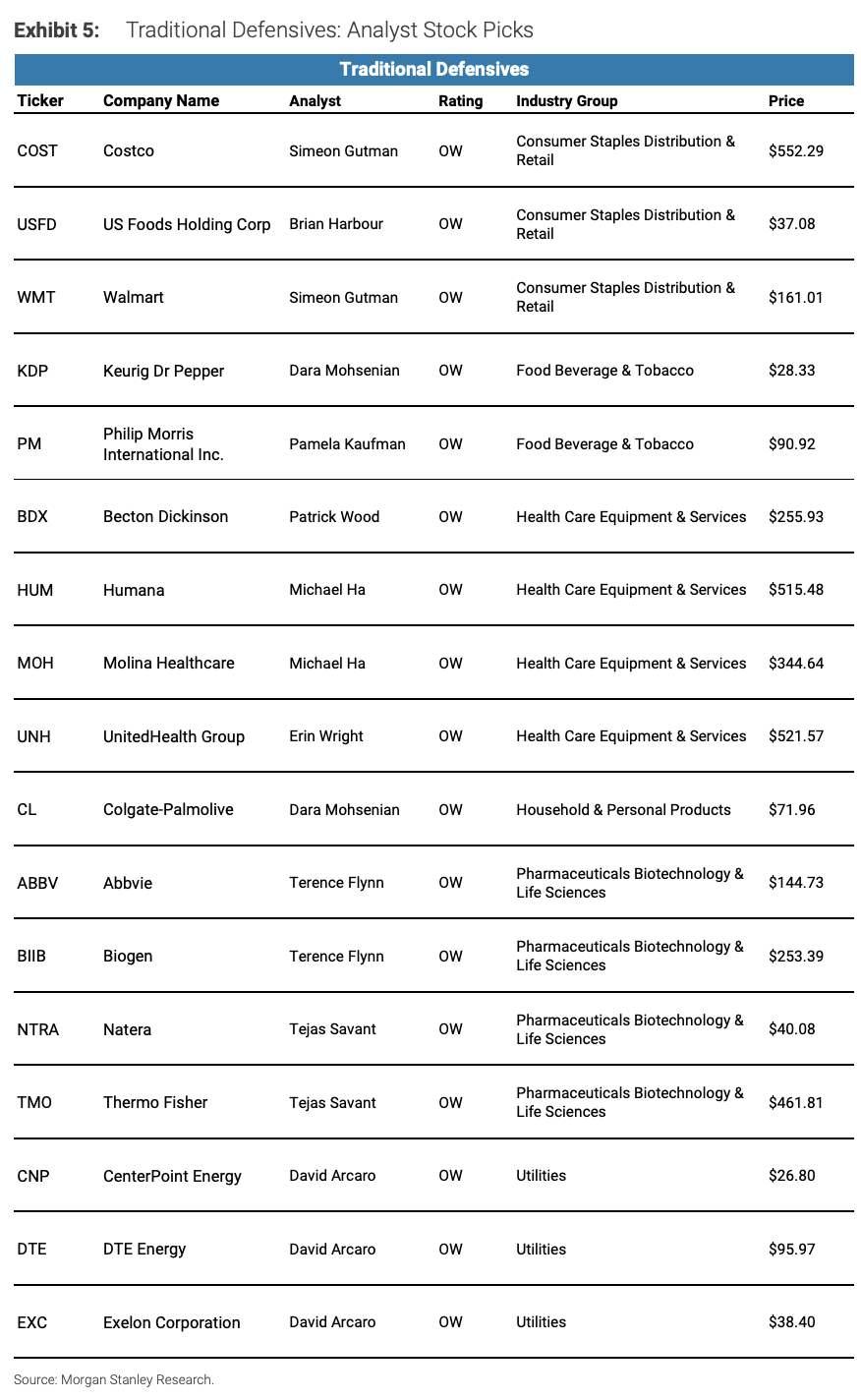

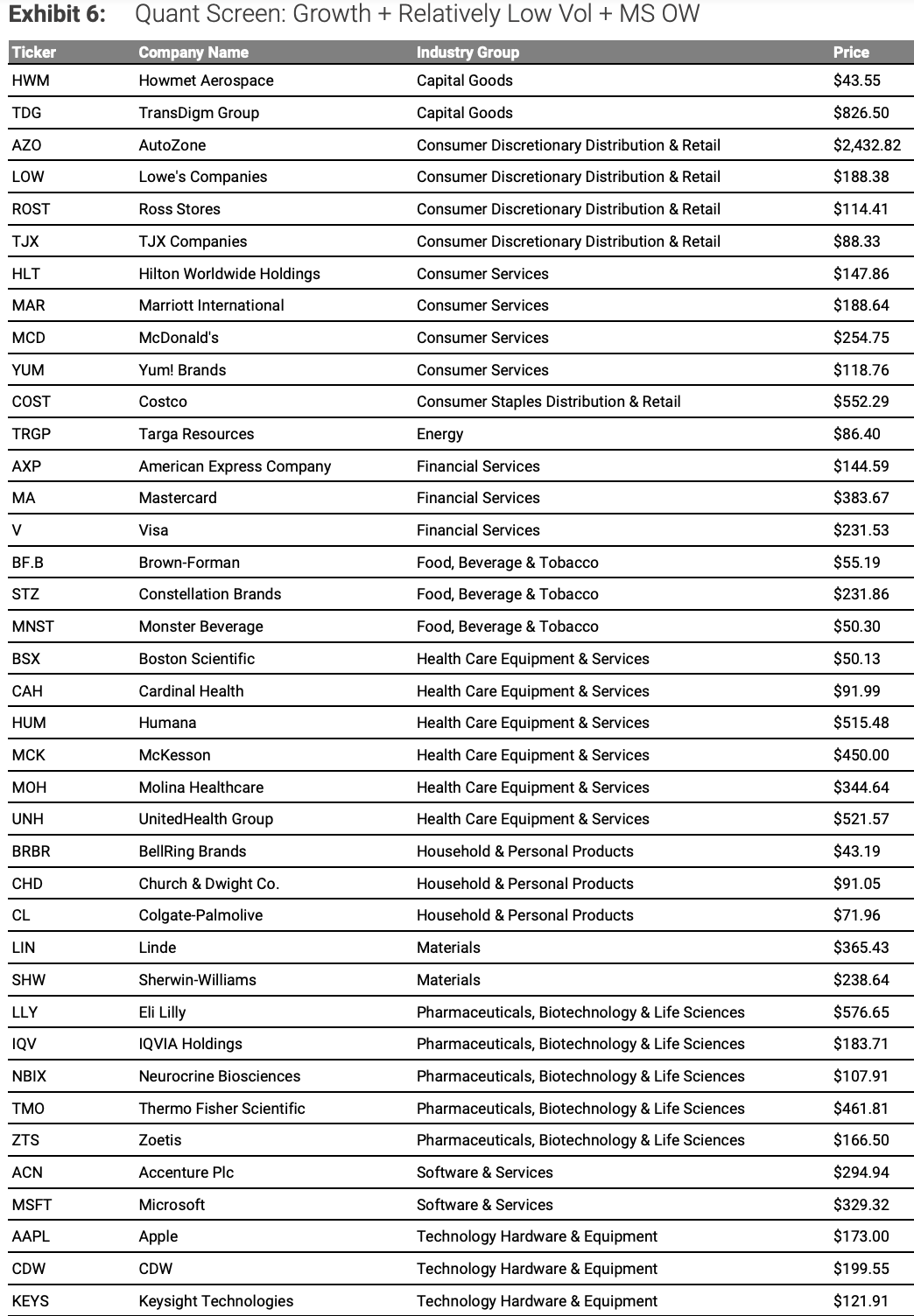

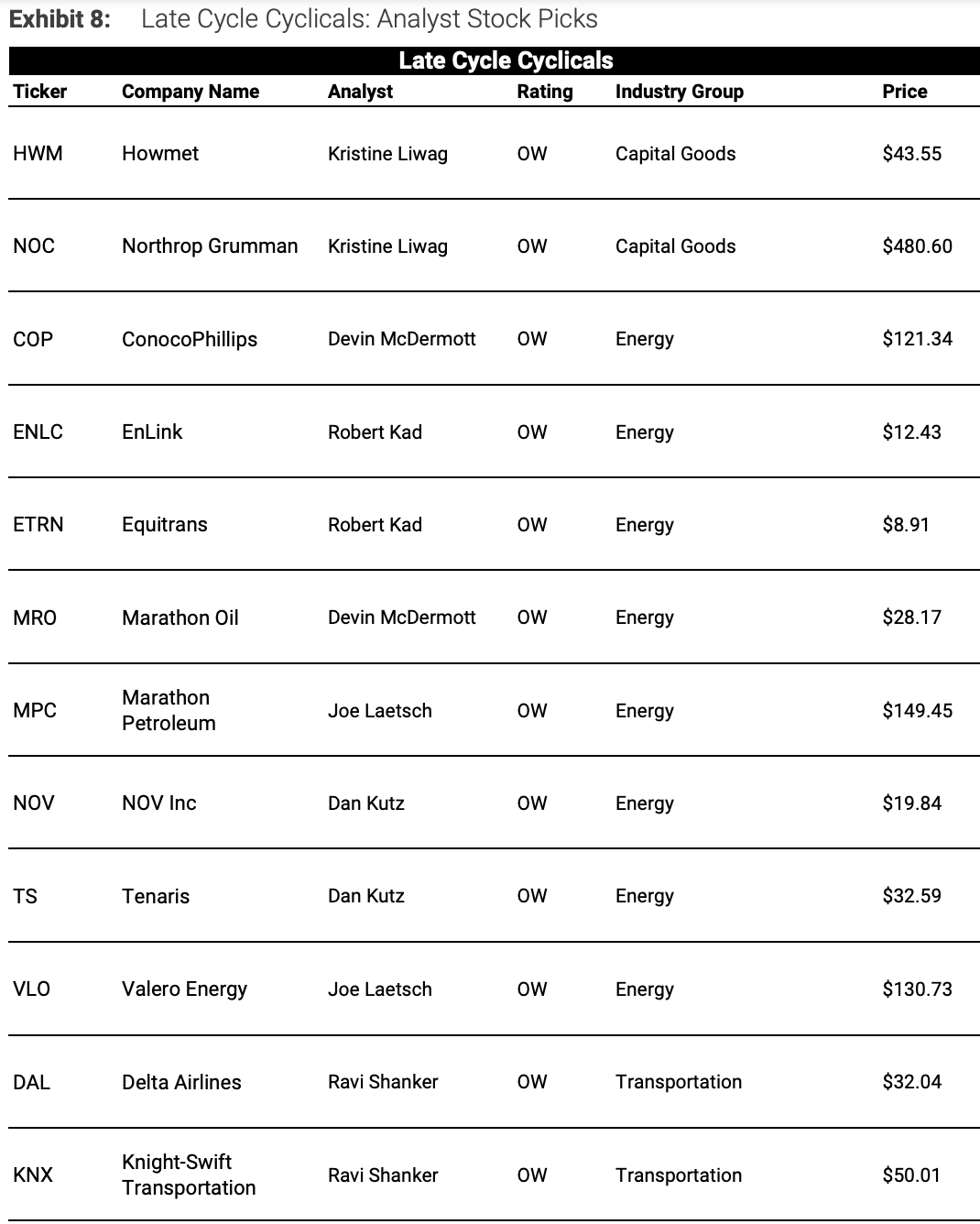

Morgan Stanley: Post-cycle allocation ideas

We are in a late-cycle environment (economic indicators such as GDP growth and corporate profit growth are close to their peaks and growth is slowing; monetary policy is tight; asset volatility is increasing). Historically, this has provided favorable performance support for companies in the following three directions: (1) traditional defensive stocks (health care, consumer staples and utilities), (2) selective growth opportunities (especially volatility Lower growth stocks, and those that can overcome cyclical risks such as AI), (3) post-cyclical cyclical stocks (industrials and energy)

The report lists the following areas and individual stock ideas:

(1) Healthcare sector: Large insurance companies such as Humana and UnitedHealth, as well as large equipment companies such as Thermo Fisher, these companies have solid performance and abundant cash flow.

(2) Consumer staples: Costco, Colgate and other consumer staples stocks are not affected by the economic cycle and consumption decline.

(3) Utilities sector: stocks such as CenterPoint Energy, supported by capacity gaps and environmental policies.

(4) Low volatility growth: Well-known technology stocks such as Microsoft and Apple, as well as stocks that research institutions believe will benefit from the artificial intelligence trend.

(5) Post-cyclical cyclical sectors: industrial products such as Howmet, and energy stocks such as Marathon Oil and Valero Energy.

Judging from market performance, the counterattack of defensive targets has begun Via GS:

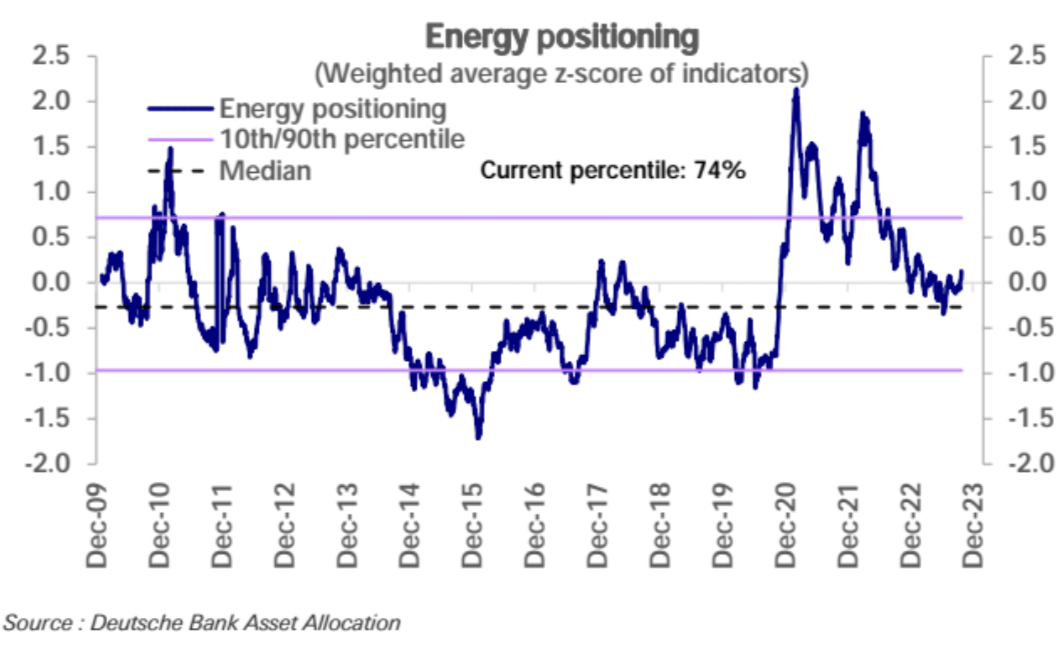

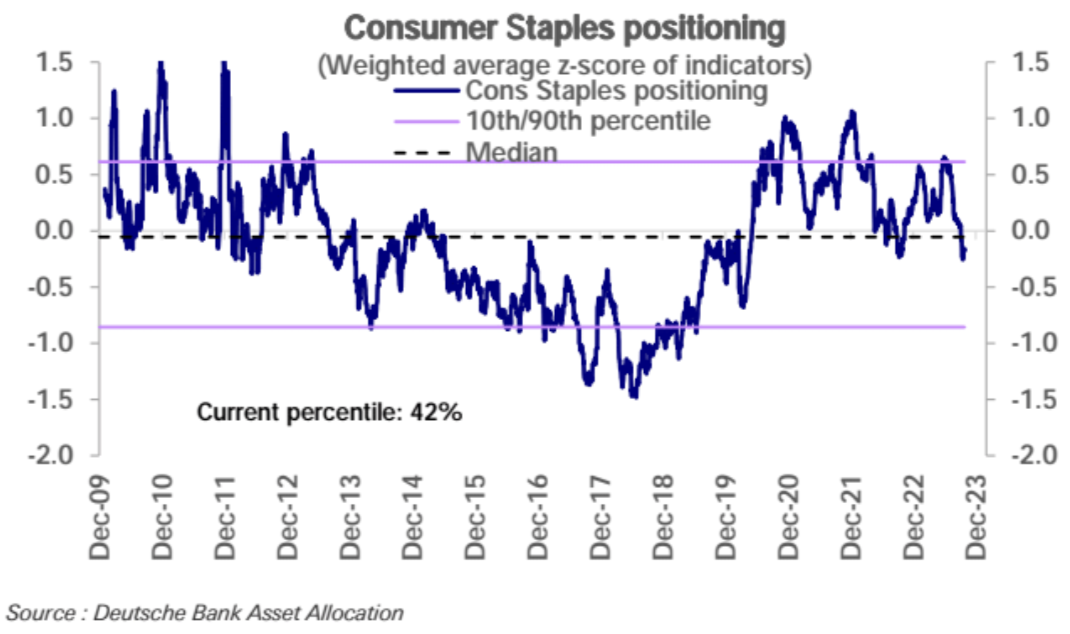

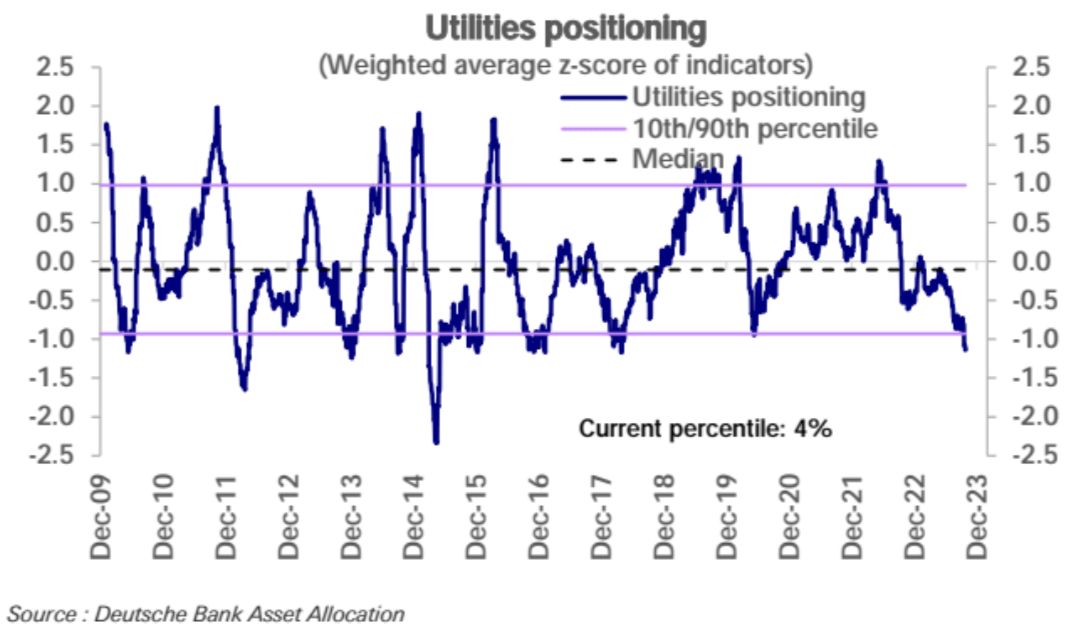

In addition to energy, the current position levels of several sectors mentioned by MS are also relatively low, especially the public utility Via DB:

Follow this week

Quarterly Treasury bond sales plan is key

The most important event this week occurs at 8:30 am New York time on November 1, when the Treasury Department will announce its bond sales plan for the next few months. Long-term yields rose in the market in early August after the Treasury Department announced an increase in quarterly debt sales for the first time in more than two years. Treasury Secretary Janet Yellen has publicly dismissed the idea that the need to finance ballooning deficits is pushing up yields, a comment that may be hard to find with markets. And the market generally believes that this weeks government bond auction plan may increase across the board. If this comes true, it will most likely stimulate market yields to rise.

Bank of Japan announces interest rate decision

Pay close attention to whether the Bank of Japan will raid again on October 31st. If yield curve control is removed, it will have a bearish impact on Treasury bonds and is the last unresolved issue for the major sources of global liquidity (the United States, Europe, and Japan). Given that the benchmark JGB yield is currently close to 0.9%, the highest in a decade, the Bank of Japan will either further expand the fluctuation limit on yields or completely abolish YCC in the future. Maintaining the YCC could force the Bank of Japan to step up bond purchases and expand its already large balance sheet. If yields in Japans domestic market become more competitive, Japanese investors may begin to withdraw overseas investments. This could have a huge impact on global financial markets. Last week, Nikkei reported that the BOJ may raise its inflation target for FY24 and said that the YCC may be adjusted again at this interest rate meeting.

October FOMC

At 2 pm on the 1st, the Federal Reserve FOMC is expected to announce its decision to stabilize interest rates at 5.5%. After Fed Chairman Powell recently said that rising long-term yields reduce the need for further tightening of policy at the margin, the market may use this meeting to bet that the Feds interest rate hikes may be over. For example, the interest rate futures market currently expects to raise interest rates again this year. The probability is only 19%, compared with 20% a week ago and 31% a month ago.

No new economic forecasts will be released this time, and the statement is unlikely to change much from Septembers, so attention will be on the press conference. It is expected that Powell will once again mention that the tightening of financial conditions (higher market interest rates) is the reason why monetary policy remains unchanged (information that doves like). That is to say, there is a high probability that Powell will not release higher marginal information, but we should pay attention to whether Powell Relenting to longer, that is, whether the time point at which the policy conveyed by the September dot chart will remain restrictive until the end of next year may be advanced.

lower expected non-farm payrolls

The market for November 3 nonfarm payrolls is expected to slow to 168,000, less than half of Septembers 336,000, mainly due to a slowdown in temporary hiring in the leisure and hospitality industry and a strike by U.S. auto workers.

More financial reports

Apple, Novo Nordisk, Eli Lilly, AMD, Pfizer, Qualcomm, Berkshire Hathaway (possibly)

LD Capital

As a global blockchain investment firm, we have built a portfolio of over 250 investments since 2016, spanning across various sectors, including infrastructure, DeFi, GameFi, AI, and the Ethereum ecosystem. We focus on investing in projects with disruptive innovations, actively taking on the role of primary investors, and providing comprehensive post-investment services to these projects. We employ a combination of direct investment from our own funds and a distributed fund model to cover all-stages of investment.

Trend Research

Trend Research division specializes in crypto hedge funds focusing on secondary areas within the crypto market. Our team members come from top platforms and institutions like Binance and CITIC. We excel in macroeconomics, industry trends, and project data analysis, with trend, hedge, and liquidity funds.

Cycle Trading

We specialize in Web3 project investment and service, with a strong emphasis on Infra, applications, and AI. We have a team of nearly 20 senior engineers and dozens of crypto experts as advisors, assisting projects in strategic design, capital platform relations, and liquidity enhancement.