Original - Odaily

Author - Nan Zhi

Generally speaking, for airdrops of popular large-scale projects, there is often a long period of time between the announcement of the airdrop and the actual distribution, such as the recent TIA, JUP and DYM. In order to lock in profits or earn pricing differences in advance, many users will choose to conduct OTC transactions in advance. However, through OTC platform transactions built by individuals or small organizations, users often face security issues - OTC transactions are usually made by both buyers and sellers to the middleman, and the funds are deposited with the middleman before the transaction is officially completed. There is a risk of the middleman running away. .

Whales Market solves this problem by launching a series of trading platforms,Support pre-market trading before popular tokens are listed on exchanges, and Solana ecological token OTC trading. Buyers and sellers execute peer-to-peer transactions on the chain, and the margin is locked in the smart contract and is only released to the parties after the transaction is successfully settled. This simplifies the transaction process and also significantly reduces the risk of financial losses due to fraudulent practices.

On the other hand, after Blast proved that the points mode can bring in a lot of TVL, the points system became popular. In popular areas of airdrops, such as Restaking, Solana Ecosystem, BTC L2 Ecosystem, etc., most projects have introduced a points system. However, how to price points and how to choose a points-based protocol are pain points for most users, and the pricing issue also applies to future projects. Tokens listed on exchanges. On the other hand, there is still a long way to go before the expected airdrop dates for these projects.Whale Market has launched a points trading market, which is also conducted in the form of pending orders + point-to-point transactions, providing a pricing venue while meeting users needs to lock in profits in advance.

Analysis of each transaction market mechanism and fees

pre-market

The pre-market of Whales Market allows users to trade popular tokens that will be listed on exchanges soon. For example, ALT, JUP, and MANTA have all been listed on the market, and DYM and AEVO can currently be traded.

Buying and selling process

Users can actively place orders or accept offers. In an active pending order, the user sets the token to be purchased or sold, the price, the quantity, and whether the transaction can be partially filled (Partial Fill), and then waits for the counterparty to accept the offer. If it is not a partial transaction but a complete transaction, it means that only one counterparty can directly take the entire pending order.

In the case of partial transaction, the placing order party can choose to end the order in advance and conduct subsequent transactions based on the completed part, and the margin for the uncompleted part will be refunded accordingly.

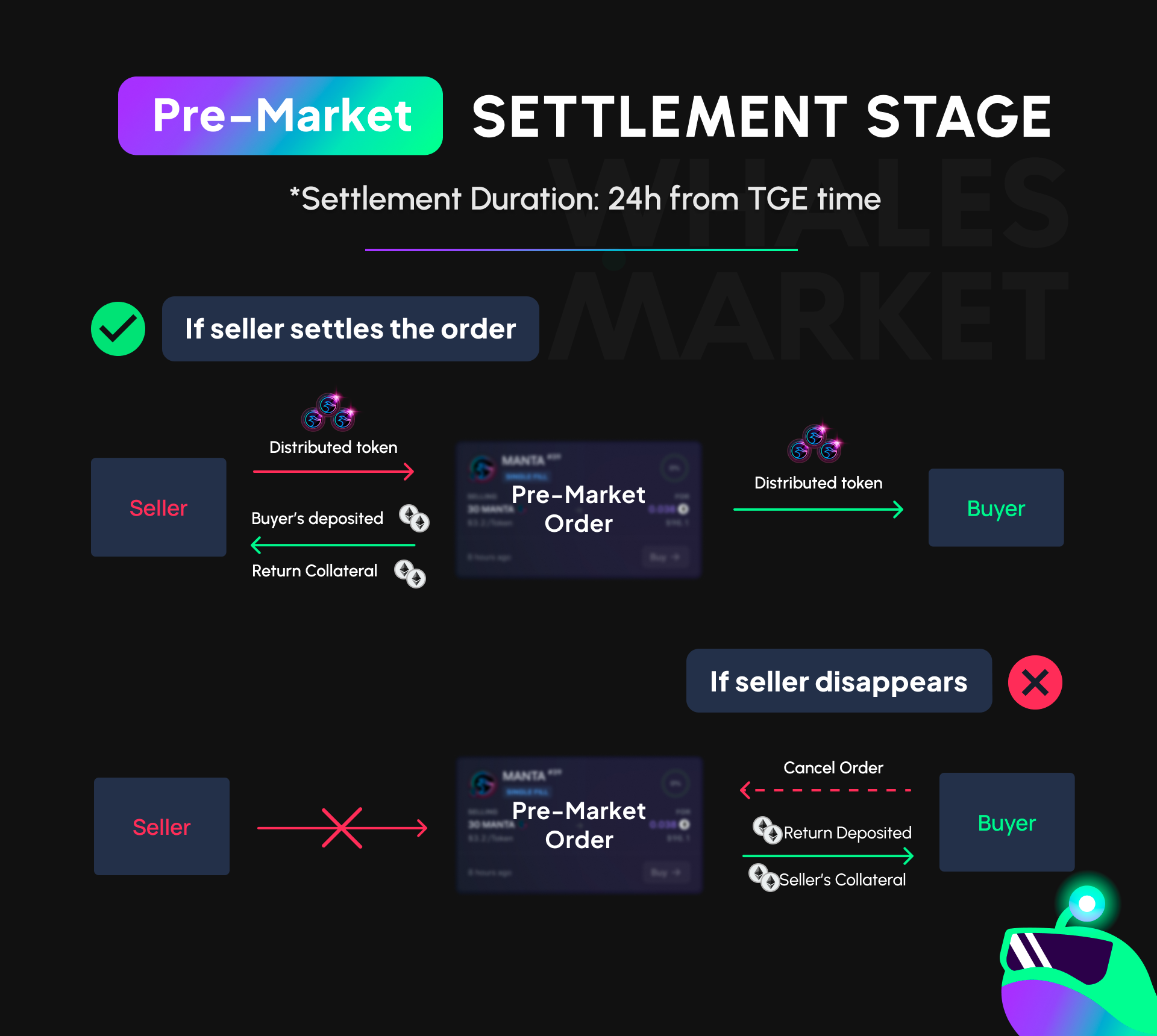

settlement mechanism

The mechanism of Whale Market requires that within 24 hours after the token TGE, the token seller must settle the transaction order and return the deposit after completing the settlement. If the seller refuses to honor the deposit, the deposit will be deducted and paid to the buyer.

transaction fee

When the order is successfully settled or the seller runs away, a transaction fee of 2.5% will be charged based on the order amount.

When a user cancels a pending order in advance, a 0.5% fee will be charged for the unfilled portion.

OTC market

For on-chain tokens, especially Meme coins, the LP pool added is usually not too large, and there is a gap of dozens of times from the market value. If large orders are traded directly through DEX, large slippage will occur.

In response, Whales Market launched the OTC market and selected a group of tokens with an LP pool of more than $300,000.Allow users to conduct peer-to-peer transactions through pending orders to avoid slippage problems caused by insufficient liquidity.

In the OTC market, the platform charges a 0.1% order fee and a 0.1% transaction fee.

points market

Based on the points trading needs mentioned above, Whales Market has launched a points trading market, and the transaction form is consistent with the pre-market market and OTC market.Currently, points transactions for four protocols including Magic Eden, HyperLiquid, EigenLayer, and friend.tech have been launched.According to the official announcement, subsequent agreements that will be launched includeDrift, MarginFi, Kamino, and Blast of the Solana ecosystem.

The points market is also conducted through pending order transactions. The market will list the average price of buying and selling pending orders for users reference and pricing. Although there is a list of completed orders, further price analysis tools are not yet provided.

In terms of fees, the points market is consistent with the pre-market market. When an order is successfully settled or the seller runs away, a transaction fee of 2.5% will be charged based on the order amount. When a user cancels a pending order in advance, a 0.5% fee will be charged for the unfilled portion.

But there is a point marketpotential problems, for unlisted tokens, there is a clear 1:1 redemption.However, the relationship between points and the actual tokens of the project is not necessarily linear., for example, a user purchased 100 points for a certain project, but during the actual airdrop, the project side set that no airdrop will be given if the points are less than 500 points. In this case, there is no conclusion or precedent as to who should bear the loss.

Project Token Analysis

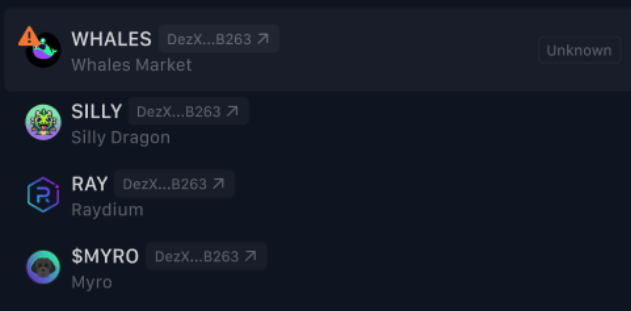

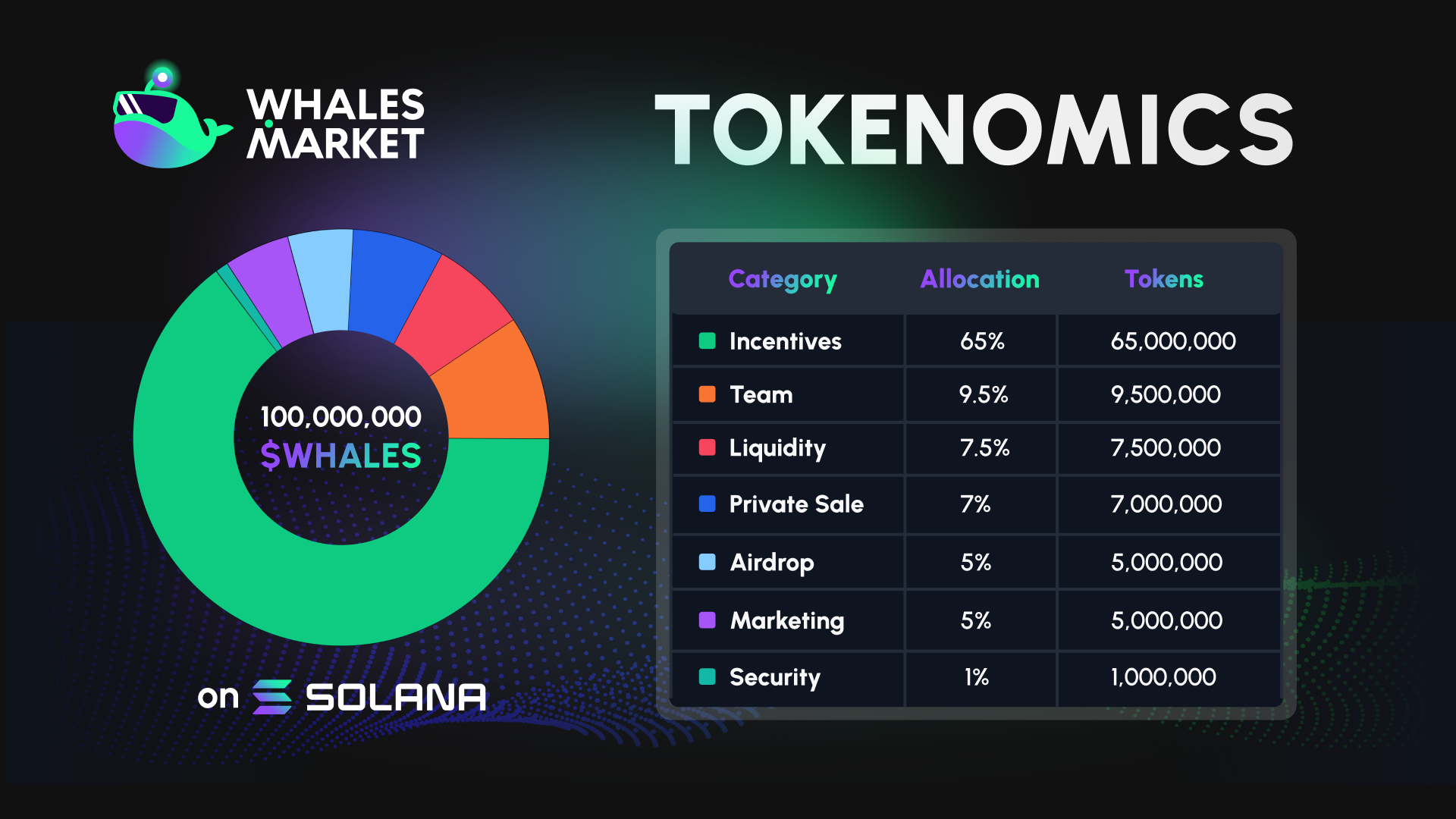

The total number of tokens in Whales Market is 100 million, including:

65% is used for incentives, linearly released in four years, and token governance is conducted by the DAO to ensure that income is greater than the inflation rate;

7.5% is used to provide liquidity, with 2.5% reserved for CEX listings;

The team accounts for 9.5%. After 9 months of locking, it will be linearly released for 36 months;

The remainder totals 18%.

Transaction fee distribution

Each transaction in each market is charged a fee, which is distributed in the following proportions:

60% allocated to WHALES token stakers;

20% is used to cover ongoing development costs;

10% is used to buy back and destroy tokens;

10% is allocated to LOOT token holders and xLOOT holders.

Data achievements and project prospects

In terms of tokens, according to Dune statistics, more than 10 million WHALES have been pledged, accounting for 62.7% of the circulating supply. Currently, WHALES has reached 3 USDT, which has increased approximately 100 times in a month, demonstrating investors’ long-term confidence in WHALES.

In terms of protocols, the total transaction volume of Whales Market reached US$33.3 million, fees captured on Solana were US$837,000, and fees captured on Ethereum were US$46,000. Compared with the current market value of the token of US$48.8 million, there is not much difference in magnitude. Considering The token has only been online for more than a month, and its profitability is considerable.

According to the roadmap disclosed by Whales Market, the Runes market and whitelist market will be launched in the future, and preparations for CEX listing are underway. Considering that the points market will continue to expand, Whales Market has a promising future.