key points

key points

Bitcoin surged above a key resistance level. Trading volumes and futures open interest both hit new records after a plunge in March.

Bitcoin Continues Steady Rise Against Gold, Suggesting Wider Bitcoin Adoption

The Federal Reserve’s record balance sheet and widening U.S. fiscal deficit will continue to support the cryptocurrency market.

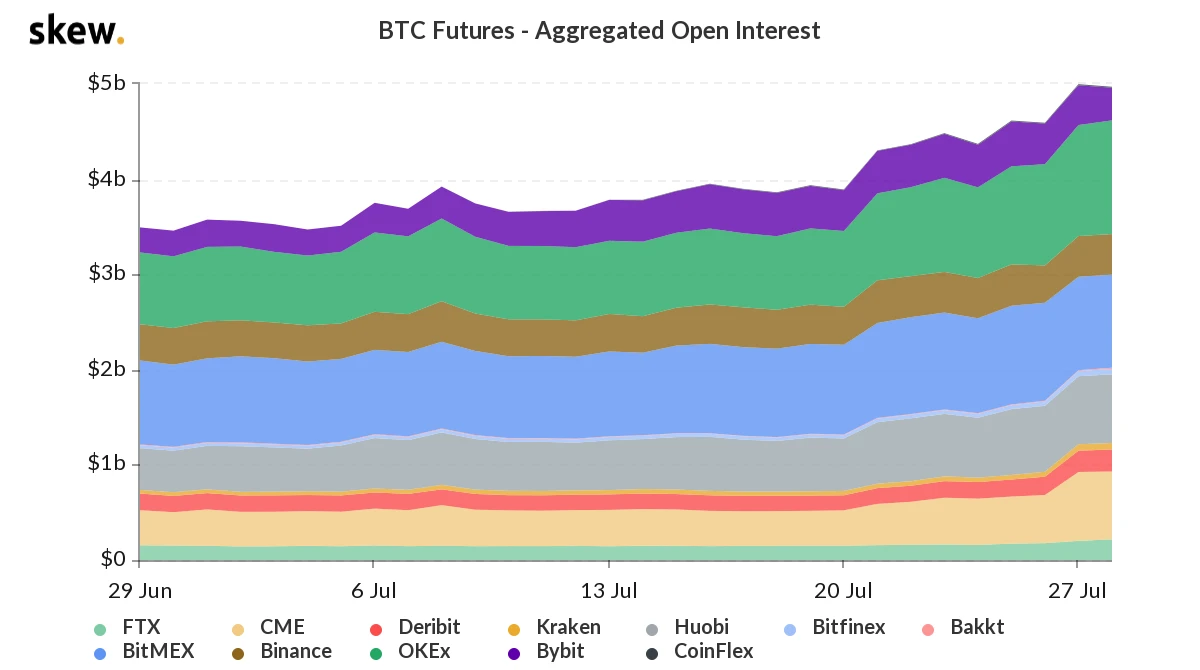

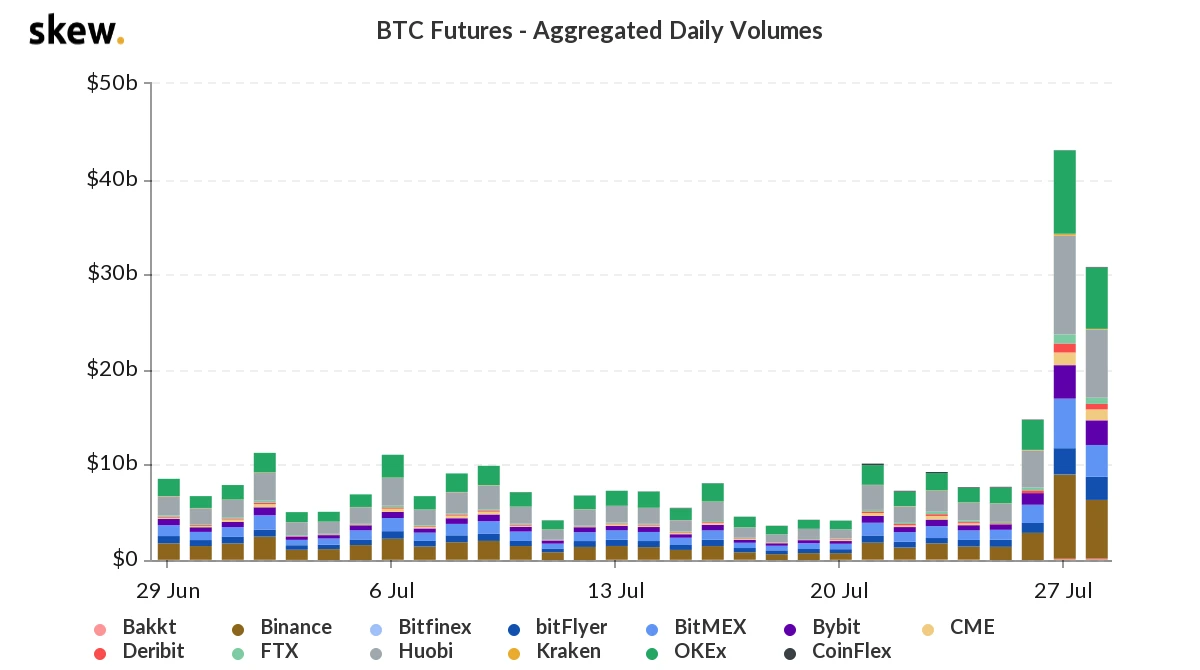

The excitement spread to the bitcoin derivatives market, with total futures volume across exchanges surging 186% to about $44 billion, the highest single-day high since the market crash on March 13. Also, the total amount of open interest rose to $4.95 billion as price volatility widened and expectations for further market gains increased.

image descriptionSkew

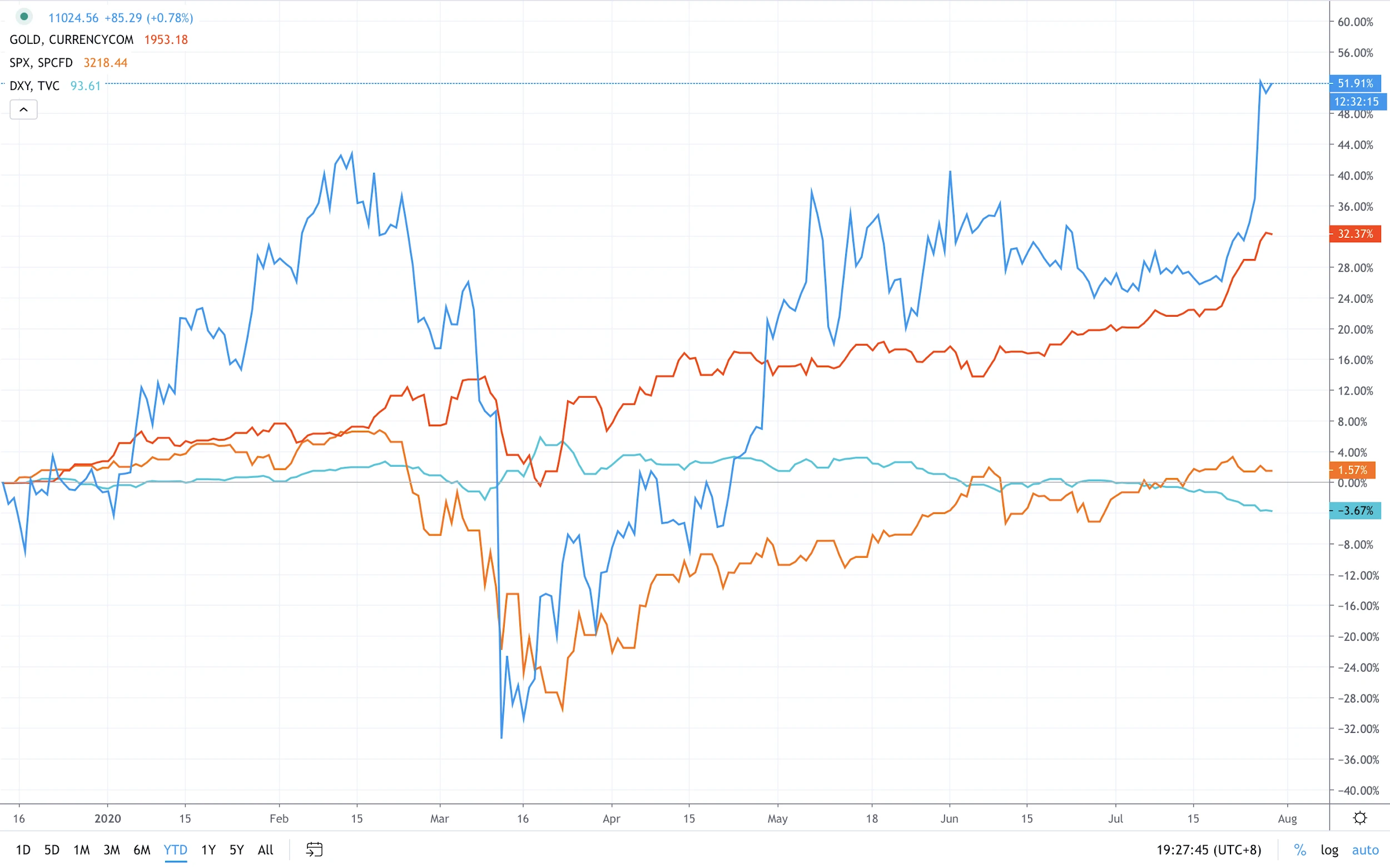

Gold is clearly leading the rally in so-called zero-coupon assets, including silver and bitcoin. Consistent with our previous analysis, Ethereum has led the new bullish momentum in the crypto market, with year-to-date returns outperforming Bitcoin.

image descriptionTrading View

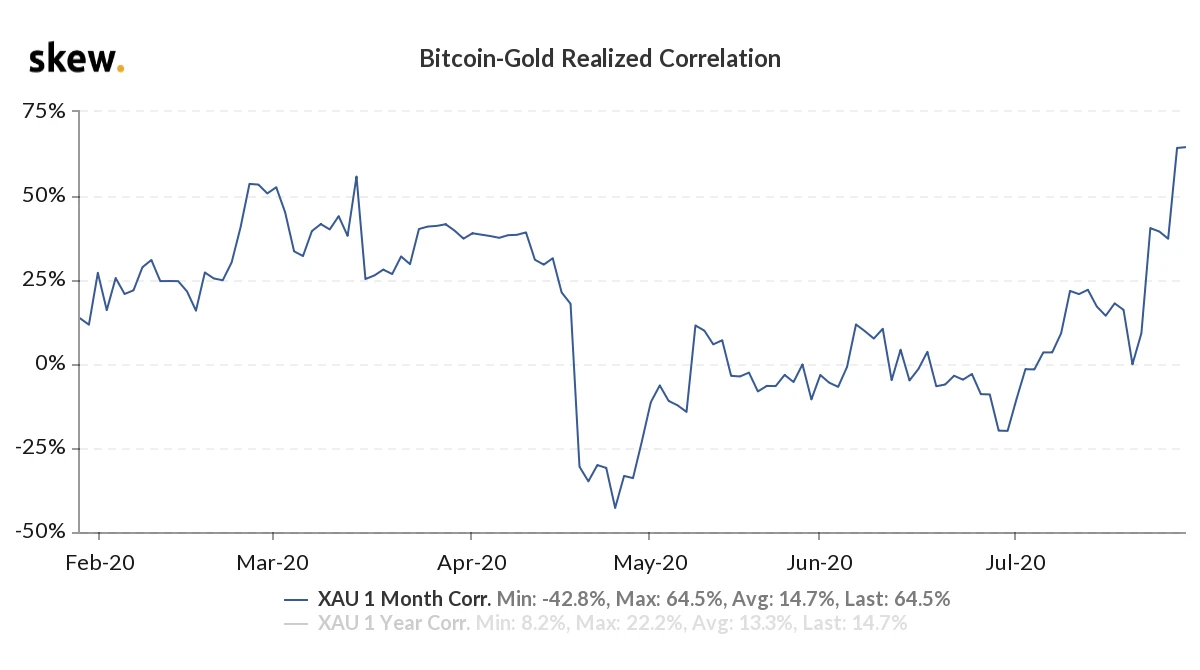

Despite the growing correlation between gold and Bitcoin, we observed a clear uptrend in the price of Bitcoin/Gold. Bitcoin mimics several key properties of gold and is touted by crypto enthusiasts as"digital gold"; so it is no surprise that Bitcoin is gradually being adopted as a modern safe haven.

source:Skew

image descriptionTradingView

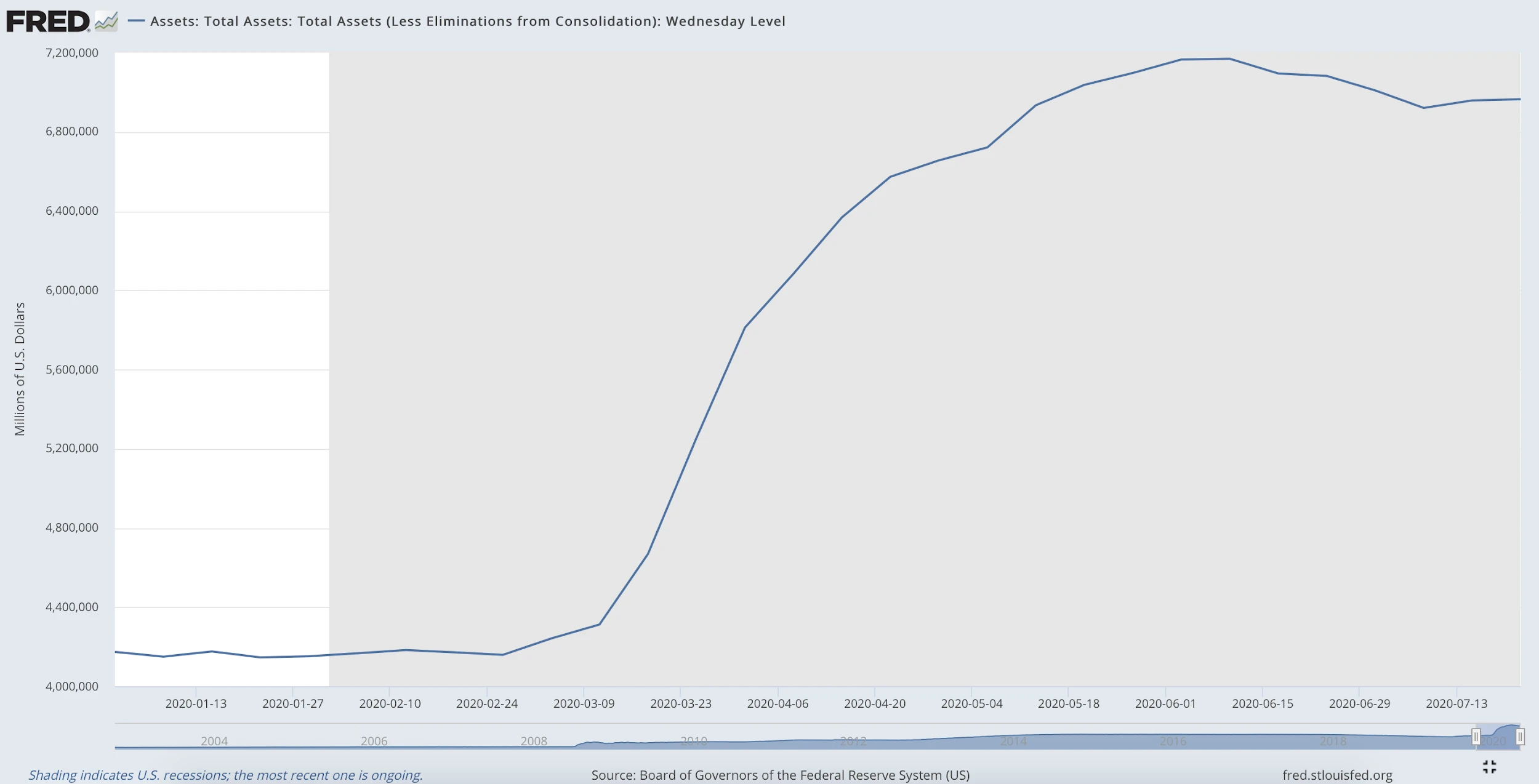

The “synchronized” bullish momentum in gold and bitcoin could be linked to accelerated dollar weakness against the backdrop of a weak global economic recovery. The dollar index fell to 94. The dollars depreciation is due in part to the Feds expanding balance sheet and growing public deficits. Last week, the Feds total assets rallied back to the $7 trillion level after a massive weekly purchase of $37 billion in mortgage-backed securities.

image descriptionsource:

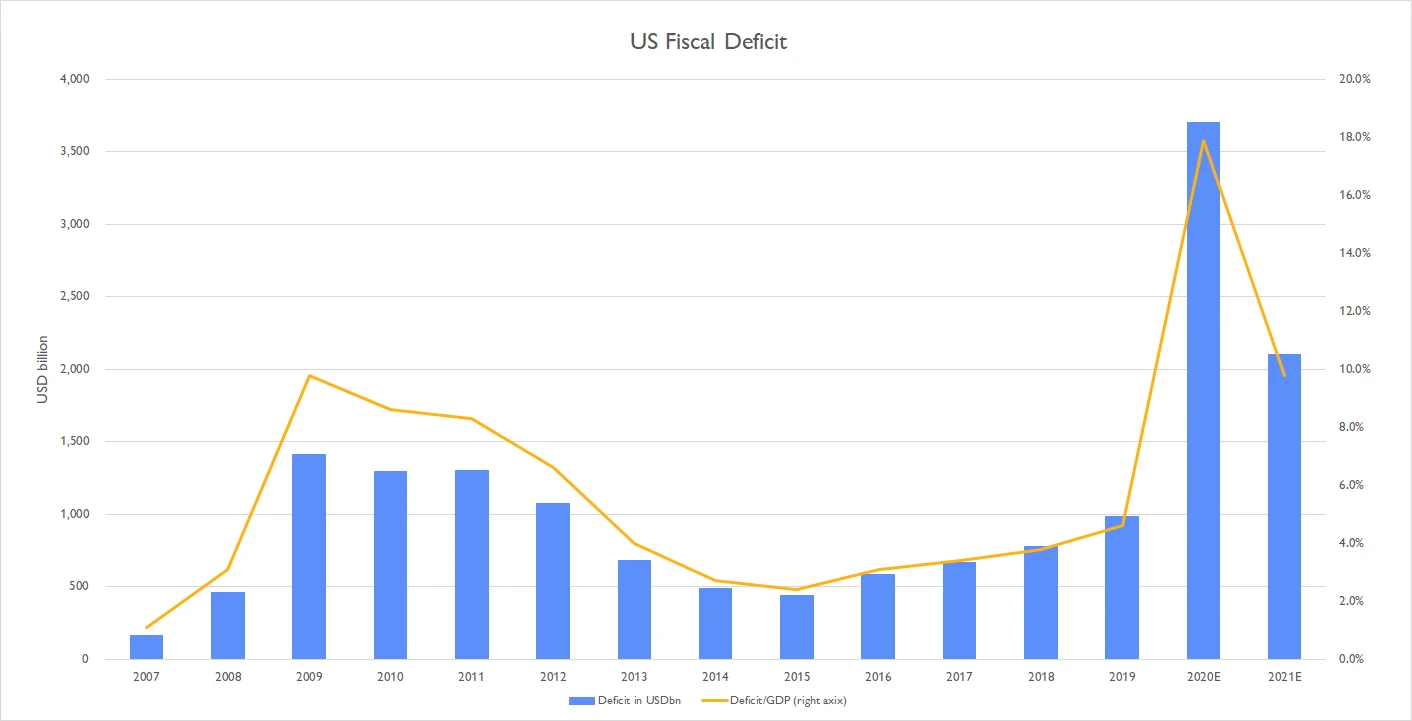

Federal policy will continue to support the U.S. economy as the Congressional Budget Office forecasts that an output gap will remain in the coming years. This means that unless the economy rebounds quickly, monetary policy in the United States will not be tightened. This years fiscal deficit is expected to rise to around 18% of GDP, close to the wartime record. As explored in previous insight articles, expansionary monetary policy will most likely continue to support the prices of real assets, including digital assets.

image descriptionThe Balance