first level title

Original compilation: BlockTurbo

Getting started with Filecoin

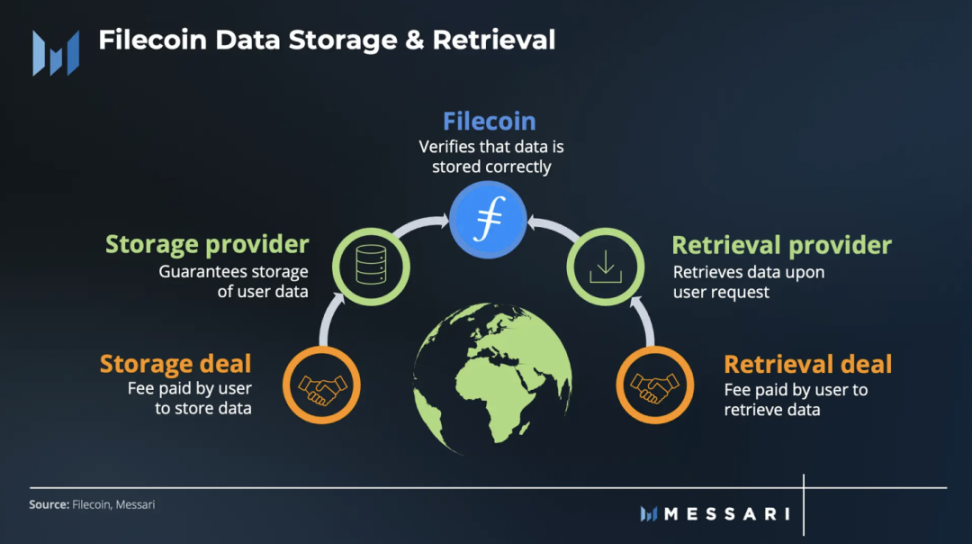

There is one big downside to relying on centralized data storage: it is difficult to systematically verify the integrity of stored data. As it stands, the Filecoin network is a peer-to-peer version of Amazon S3. It is built on top of the Interplanetary File System (IPFS), which serves as the distributed data storage and sharing layer for the Filecoin network. Filecoin verifies data storage on a regular basis and uses storage transactions that are dynamically priced based on supply and demand, rather than a fixed pricing structure.

A storage deal is like a contract with a service level agreement (SLA) - the user pays the storage provider to store data for a specified period. In order to ensure data security, Filecoin uses a cryptographic economic incentive model and regularly verifies storage using zero-knowledge proofs. To incentivize storage providers to participate in transactions, Filecoin rewards them with the networks native token, FIL. Storage providers can also be fined if data cannot be retrieved or storage fails.

performance analysis

Key indicators

performance analysis

income

income

Agreement income

Agreement income

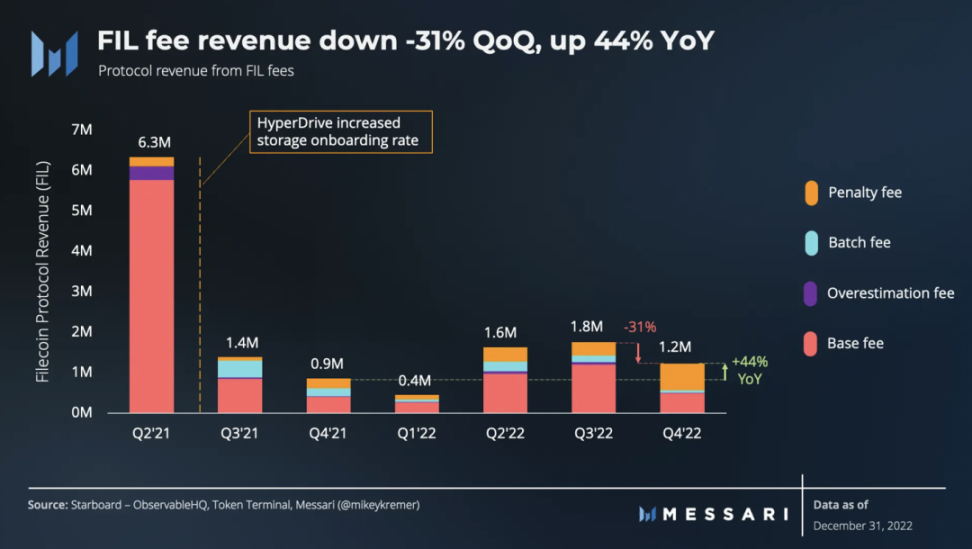

According to Messari’s revenue analysis, Filecoin’s protocol revenue represents the sum of:

Base fees - Required for any storage transactions or proofs; base fees are determined by message congestion.

Batch fees - used to increase storage capacity.

Overestimation fees - Overestimation fees required to optimize gas usage.

Penalty fees - Charges against storage provider failures.

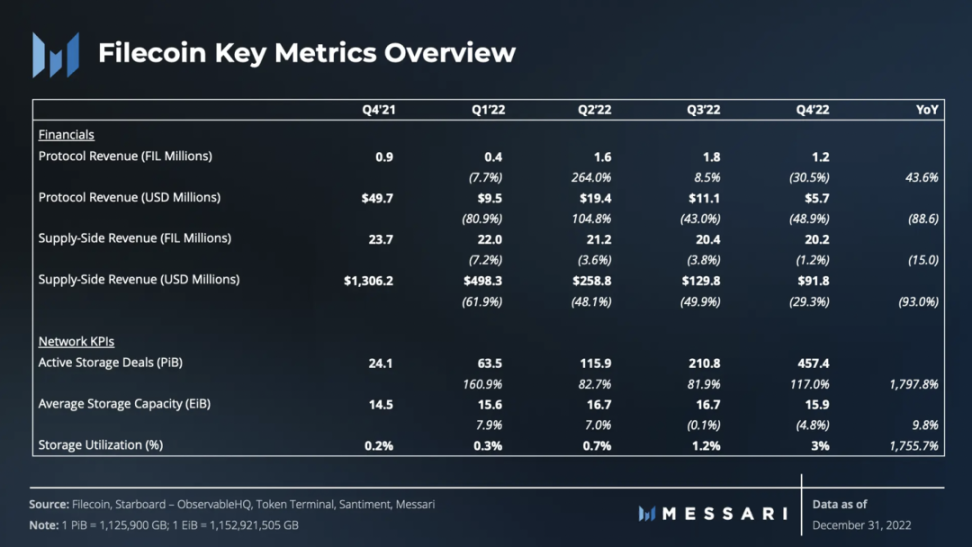

Protocol revenue fell 31% to 1.2 million FIL in 4Q22. Compared with the same period last year, it increased by 44% from nearly 0.9 million FIL in 4Q21. Notably, Q422 brought two notable changes to the composition of accruals:

While active storage transactions are up 10% (according to the Filecoin Key Metrics Overview table), base fees are down 60%.

Penalties increased by 100% to an all-time high as storage providers went offline for more days.

FIL protocol revenue continues to be relatively low in Q422 compared to pre-HyperDrive network upgrade in July 2021. Proven with aggregated storage, HyperDrive increases storage availability by 10-25x. While the HyperDrive upgrade benefits network participants — by reducing congestion and freeing up block space — it also results in lower overall transaction fees. As a result, the HyperDrive upgrade has led to a decline in protocol revenue over the past four quarters.

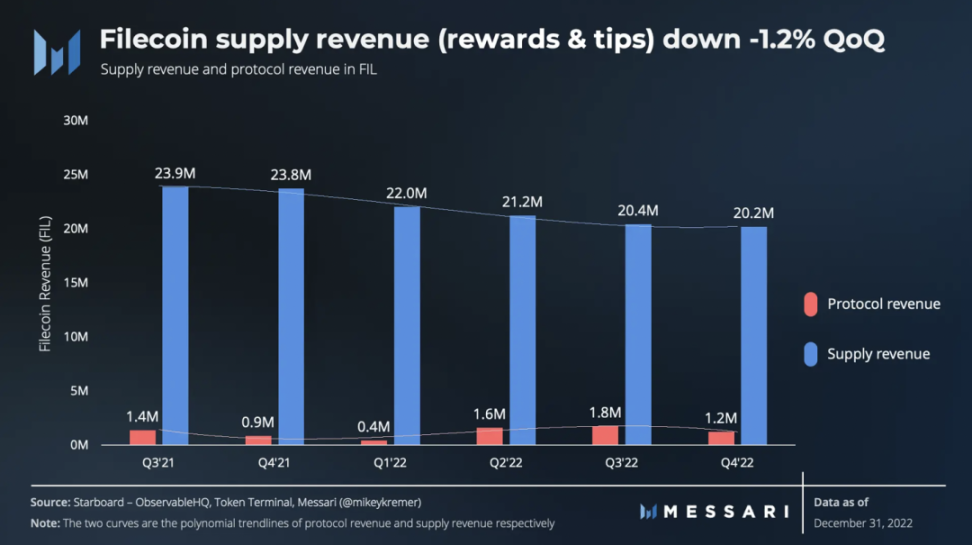

The only portion of Filecoin fees that is not burned by the protocol is the “tips” collected by block miners to speed up transactions on the network’s supply side. Therefore, this tip counts as supplier income. Filecoins supply-side revenue includes token rewards paid to storage providers (over 99.97% of Q422 supply-side revenue), while tips make up a small fraction.

supply side revenue

Supply-side revenue consists of block rewards paid by the network to supply-side participants. The minting mechanism for new FIL tokens relies on:

Exponential decay model (30% of tokens): Block rewards are initially highest to incentivize participation and decrease exponentially over time.

Baseline model (70% of tokens): block reward increases with storage capacity.

The purpose of the combination of these two models is to avoid the decline in participation after the distribution of block rewards in the early stages of the network (see exponential decay), and to continuously reward the additional value created for the network by increasing storage capacity (see baseline model).

Supply-side revenue declined 1.2% to 20.2 million FIL in 4Q22, impacted by an overall reduction in incentive payouts. While the baseline growth target was met in 4Q22, mintage decreased overall due to the aforementioned exponential decay. It is worth noting that while the growth rate of built-in storage capacity has declined quarter-over-quarter since 4Q21 (according to the Filecoin Key Metrics Overview table), so has supply-side revenue.

Dosage

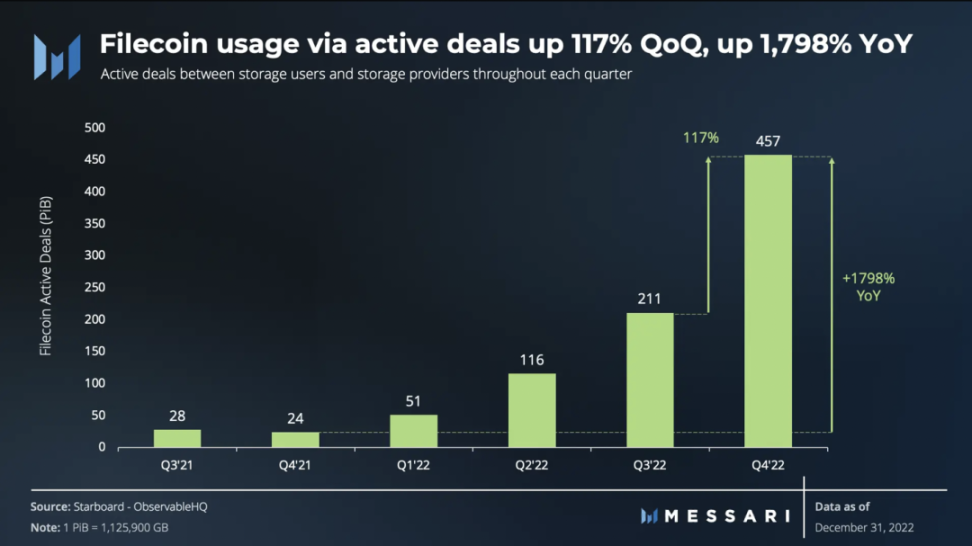

The amount of data stored in active transactions between storage users and storage providers measures the demand for Filecoin services. Demand for Filecoin storage comes from storage transactions specific to Web2 and Web3.

storage transaction

Near-zero storage fees may further encourage increased data storage through transactions. By the end of 4Q22, more than 231 PiB were stored on the Filecoin network through active transactions - a 10% increase from the previous quarter. This positive growth trend has continued since 4Q21, as Filecoins active transactions increased by 850% year-over-year.

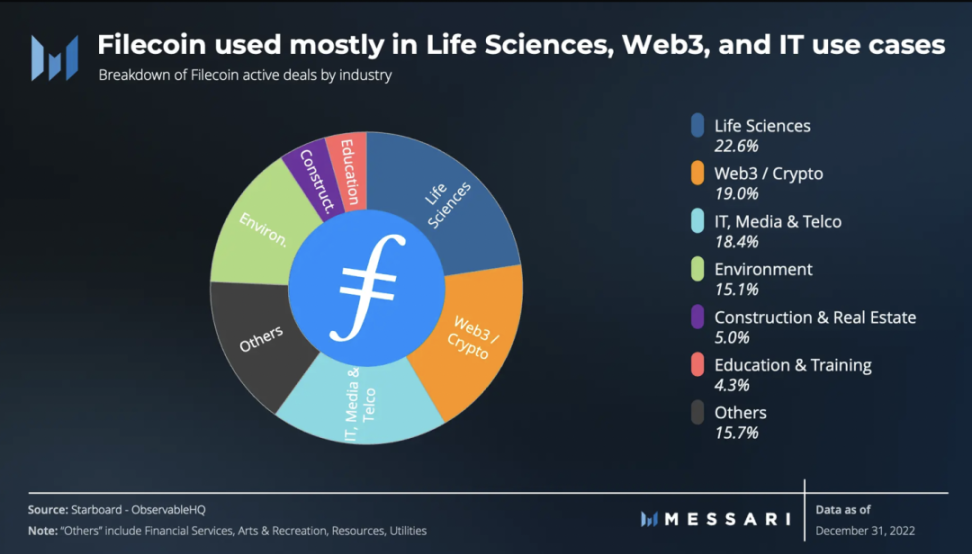

A breakdown of active storage transactions by industry use case reveals the industries utilizing Filecoin the most:

Life Sciences (23%)

Web3/Encryption (19%)

Information Technology (18%)

To incentivize the use of real data for these storage transactions and prevent a network rewards game, the Filecoin Plus (Fil+) program was introduced. Fil+ provides more rewards for participating in verified transactions by increasing the likelihood that storage providers will win block rewards. This has led to storage vendors cutting fees from competing vendors. So in 4Q22, storage was almost costless.

Since Q4 2021, there has been a shift from regular transactions (unverified data transactions) to dominated by Fil+ transactions (verified data transactions). This shift corresponds to a continued upward trend in Fil+ deals, which accounted for 99.5% of all new deals in 4Q22. The flipping of Fil+ transactions to regular transactions, combined with the increase in new transactions, shows that Fil+ incentives and onboarding programs are successfully driving storage utilization.

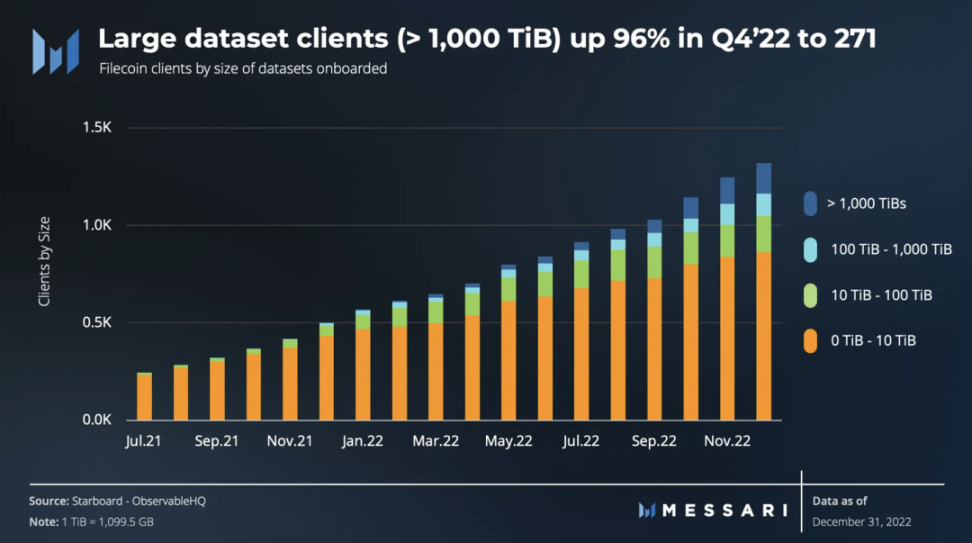

client

According to Messaris recent guide to decentralized storage networks, Filecoin is primarily aimed at businesses and developers as a cold storage solution. Its competitive pricing and easy access make it an attractive choice for Web2 customers looking for a cost-effective alternative to storing large amounts of archival data.

By the end of 4Q22, a total of 1,320 customers used datasets on Filecoin, of which 271 customers used large datasets (e.g., datasets with a storage size greater than 1,000 TiB), an increase from Q3 138 customers, a 96% increase 22. Filecoins customers range from New York City and the USC Shoah Foundation, to Web3 platforms like OpenSea. Other notable use cases for onboarding data to the Filecoin network include:

UC Berkeley and Seal Storage Collaborate on Storage Physics Research

GenRAIT Leverages Estuary to Store Critical Genomic Data on Filecoin

Starling Labs Research Center Stores Sensitive Digital Records of Human History

Chinas Fastest Growing Digital Content Host Eweison Uses Filecoin for Data Storage

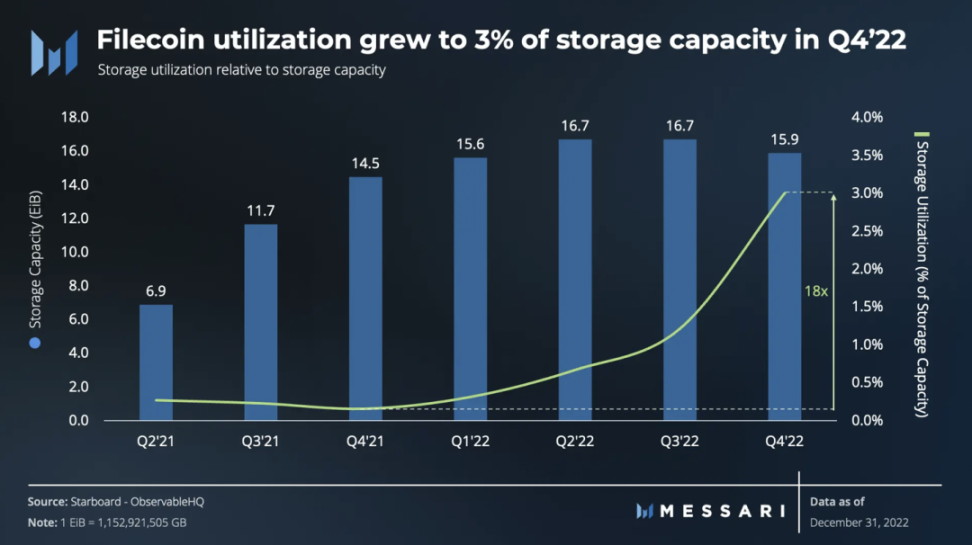

Utilization and Capacity

Despite the overall market downturn, Filecoins committed storage capacity has grown to 16.7 EiB over the past five quarters. This growth is partly attributable to the increase in storage providers. The number of Filecoin storage providers surged by roughly 300% to 3,030—corresponding to peak network capacity. However, after reaching an all-time high in Q222 and stabilizing in Q322, storage capacity declined in Q422.

Meanwhile, storage utilization relative to total available storage capacity has steadily increased over the past few quarters to 3% in 4Q22, compared to just 0.2% in 4Q21. That said, usage has grown 18 times faster than capacity over the past year, despite starting from a low base.

Because of the Fil+ programs ability to acquire new users and introduce valuable datasets, it can serve as the basis for future profitable use cases around the data. Essentially, Filecoins strategy seems to be to acquire data at close to zero cost in order to monetize data retrieval or data computation in the future.

retrieve

retrieve

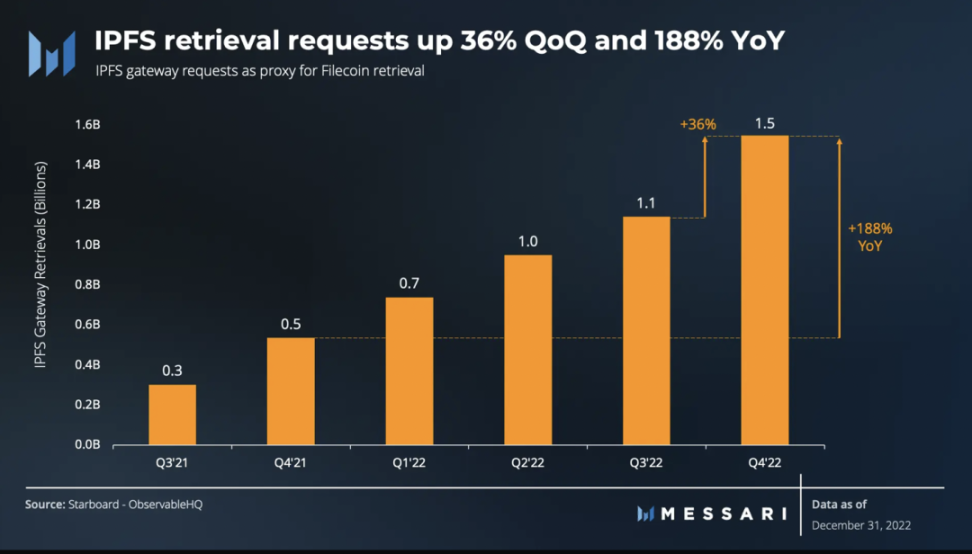

IPFS gateway requests can act as a proxy for Filecoin retrieval, since most of Filecoins developer storage tools make data retrieval accessible to the entire IPFS network.

Q422 saw a 36% increase in the number of retrieval requests compared to Q322. Search requests increased by 188% compared to the same period last year. This positive trend is a reasonable proxy for capturing the increased usage of popular storage developer tools that rely on IPFS for storage and retrieval, such as NFT.storage and Web3.storage. As the retrieval market continues to evolve, new metrics will become available to track beyond the IPFS gateway.

Ecosystem overview

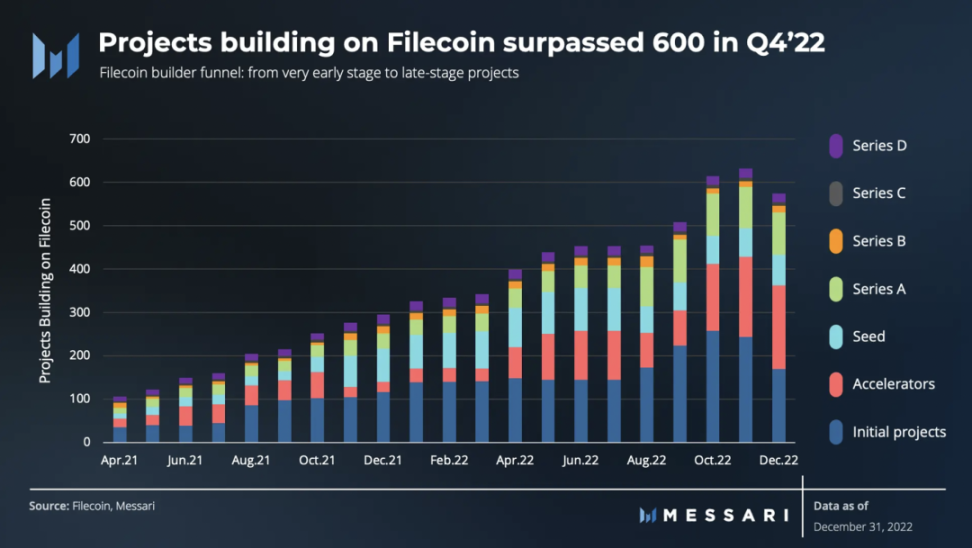

The Filecoin ecosystem has been actively developing a funnel of developers and builders through events such as hackathons, accelerators, grants, mentoring, and growth support. The funnel is designed to help early stage projects and teams grow enough to receive funding and investment. Funding provided by Protocol Labs or affiliated entities.

There are currently over 600 known projects under development on the Filecoin, IPFS, and Protocol Labs network ecosystems, up from nearly 500 in 3Q22. These projects utilize IPFS, Filecoin, lib p2p protocols or services built on top of these protocols. A large part of the growth came from accelerators, which increased from 82 in 3Q22 to 194 in 4Q22. Additionally, projects like NFT.Storage and Web3.Storage enable other projects to leverage Filecoin/IPFS.

The ecosystem is used for a ton of different use cases: data infrastructure, media streaming, metaverse, and gaming. Most applications and protocols utilizing Filecoin offer services focused on data services:

Ocean Protocol: Developer tools and platforms for data marketplaces

Lighthouse: A permanent data storage service with a one-time payment pricing model

Slate: A search engine for processing and sharing personal data

Berty: Secure Messaging and Social Media App

Dether: Cash in/out and diversified financial transactions

Another broad category is media and entertainment; examples include:

MoNA: A 3D Art Gallery in the Metaverse

NFTwitch: NFT minting platform for Twitch content

Huddle 01: Decentralized Video Conferencing

Curio: NFT Marketplace for Entertainment Brands to Profit from Intellectual Property

OPGames: Minting NFTs from Games

qualitative analysis

qualitative analysis

product update

Saturn

Saturn is a fully decentralized Filecoin content retrieval and delivery network (CDN) designed to accelerate web content delivery. Saturn also seeks to increase Filecoins appeal to Web3 developers by reducing the cost of running a Filecoin node and speeding up decentralized data retrieval. Saturns long-term goal is to take a large percentage of applications to retrieve information, thereby achieving the coveted Web3 killer app.

V1 7 Shark Upgrade

Filecoins November 2022 v1 7 Shark upgrade includes improvements to its smart contract programmability for Fil+ transactions. This upgrade is available from March 2022 and introduces programmable storage. The goal is to improve the integration between on-chain smart contracts and off-chain data providers. However, transaction initiation is expected to become more expensive due to the increased gas consumption of on-chain validation.

Enterprise-level partnerships

CME Adds Filecoin to Price Index

CME will start publishing FIL reference rate and price benchmarks in October 2022. While this development did not directly translate to the creation of tradable FIL-backed futures contracts, the inclusion of the FIL token could increase Filecoins popularity in traditional financial markets. This may further lead to better funding opportunities and partnerships for Filecoin, as well as enhance the roadmap and potential collaborations.

Protocol Labs partnership with Ernst Young and Seagate

key event

key event

ETHBogota & ETHIndia

Filecoin and IPFS sponsored the Ethereum-based hackathon ETHBogota in October 2022 and ETHIndia in early December 2022. Filecoin and IPFS together provided $20,000, while ETHIndia provided a total prize pool of over $350,000. Filecoin and IPFS contributed $20,000 from ETHBogotas $500,000+ prize pool.

Sustainable Blockchain Summit

Filecoin Green, a branch of Filecoin focused on promoting data transparency in the energy sector, participated in the Sustainable Blockchain Summit in October 2022. Several energy experts from Filecoin delivered keynotes, including:

A cornerstone of the regenerative economy

Unlocking carbon market interoperability

FIL Lisbon

Filecoin hosted FIL in Lisbon in November 2022, bringing together over 65 speakers including developers, storage providers, ecosystem participants and users. The conference hosted working groups, hackathons, IPFS camps and other learning opportunities, side events, networking events, and more. Among the conferences many highlights were presentations emphasizing the value of data security and transparency, including:

From the CIA to Amazon: How MuckRock Made Data Transparent

Opening the Doors of the Democratic Library

Unreliable Evidence: Starling Lab Documents Ukraine War

FEVM Hackathon

Held in December 2022, the hackathon aims to leverage Filecoins infrastructure for highly specific and unique data needs, such as:

Koios: No-code data DAO platform

ZKsig NFTs: Access Control to the Marketplace

2022 Year in Review

route map

2022 Year in Review

In 2022, Filecoin rolled out a series of updates to increase the storage capacity of the network. The increased capacity makes data easier to retrieve, enabling more real-world use cases for its core product. While not yet live on mainnet, the 2022 update lays the groundwork for smart contracts to interact with Filecoins data functionality.

Outlook to 2023

Summarize

Summarize

4Q22 marked an uptick in Filecoin usage as active storage transactions increased by 10% quarter-over-quarter. While storage capacity is down 5 percent from an all-time high, storage utilization is growing 18 times faster than storage capacity year-over-year. While decentralized storage is still in its early stages, the Filecoin ecosystem is still thriving, with more than 600 projects currently building on Filecoin.

The successful launch of the Filecoin Virtual Machine can enable next-generation applications beyond storage. Prominent examples include permanent storage (similar to Arweave), undercollateralized loans to storage providers, and decentralized computing.

If Filecoin continues to meet demand, it has the opportunity to become a major provider of decentralized storage and cloud services for Web3 and traditional applications. Filecoin must continue to prove its reliability as a storage provider and potentially an enabler of various data-intensive services.