Arthur Hayes is an African-American entrepreneur and banker born in 1985. He is also one of the co-founders of the cryptocurrency exchange BitMEX. BitMEX is one of the largest cryptocurrency derivative exchanges in the world, specializing in futures, options, and perpetual contracts for cryptocurrencies like Bitcoin. He, along with the founders of BitMEX, invented the groundbreaking perpetual contract that revolutionized crypto trading patterns.

Hayes graduated from the prestigious Wharton School of the University of Pennsylvania in 2008. After working as a trader in banks, he immersed himself in the forefront of the cryptocurrency revolution and founded an exchange. At one point, his net worth exceeded $1 billion, making him the youngest African-American billionaire in history. In 2022, Hayes was charged by the Department of Justice for violating the United States Bank Secrecy Act. He later pleaded guilty and was sentenced to six months of house arrest, two years of probation, and a $10 million fine. Having made enough money, experienced youthful recklessness, faced court trials, and spent time in prison, Hayes has now left behind the troubles of the United States and is deeply involved in Asia, finding a peaceful place to write some essays.

This article combines various materials and narrates the story of Hayes' career in a humorous tone. It is apparent that his excellent educational background, brave and meticulous thinking, value of pursuing high risks and high returns, and rebellious and adventurous personality have shaped the Hayes we see today.

Early Experiences of a Financial Prodigy

Although Hayes' family conditions were not affluent, they were far from impoverished. He was born into a middle-class American family, where both parents worked for General Motors. He was born in Detroit but was sent to a private school in neighboring Buffalo, New York, to attend a good school.

Hayes showed his athletic talents during his high school years. He was a member of the school's tennis team and also participated in the cross-country team (Cross country is a long-distance race conducted in natural outdoor environments, usually with a race distance of no more than 12 kilometers). Hayes used his athletic achievements to secure scholarships. During his college years, he even ranked in the Mr. Penn fitness competition.

His ambitions began to show during college. After being admitted to UPenn in 2004, Hayes would go to the university gym with his friends at 5:30 am every morning (it was located next to the Wharton School). According to an interview with NY magazine, Hayes said they used this early morning time to contemplate their future, daydream, and imagine becoming billionaires.

His friend who trained with him once said, "I think he saw himself as a financial wizard, a financier, more like Gordon Gekko than Mark Zuckerberg."

I don't want to be in Buffalo, I want to go to China

He never wanted to follow the conventional path. The rebellious Hayes believed that going to Manhattan or Wall Street after graduation would make him no different from other classmates, with no new and interesting prospects. So he decided to take a different route. In the summer of his junior year (2007), he finally secured an internship opportunity at Deutsche Bank in Hong Kong. Subsequently, Hayes boarded a flight to Hong Kong and embarked on his journey to Asia.

Hayes: "The old hats in Buffalo won't leave here, but I don't want to stay in Buffalo."

Reporter: "Then why not go to Manhattan?"

Hayes: "Why do the same thing as my classmates? I will get the same results as them."

As an intern who hadn't graduated yet, Hayes, who had just arrived in Hong Kong, had not only his own work but also the responsibility of buying lunch for his leaders. Interestingly, he mentioned this experience in one of his blog posts: "I receive a considerable amount of tips for every meal, earning hundreds of dollars in profit each week. To avoid making you think this behavior is improper, everyone in the trading department knows what I am doing and tacitly approves. They know it well."

Can going to nightclubs lead to a formal job? That's how Hayes did it. Approaching graduation season, Deutsche Bank appointed several recruitment officers to recruit at the University of Pennsylvania. During the interview, Hayes mentioned that he likes to party at nightclubs in Hong Kong, and one of the interviewers even asked him about the nightlife spots in Philadelphia, to which he recommended some. In the end, they all got drunk at Philly House in Philadelphia, and Hayes successfully got his first formal job after graduation as a trader at Deutsche Bank's Hong Kong branch.

Hayes's flamboyant personality was evident during his internship. In recent years, Hong Kong has popularized Casual Friday, which allows employees to dress casually on Fridays. Hayes's bank also adopted this practice at the time. According to his blog post, he was an intern analyst at the time. One Friday, a senior executive passed by his desk and asked his immediate supervisor, "Who the fuck is that?" His supervisor looked up and saw Hayes wearing a tight pink polo shirt, faded jeans, and bright yellow sneakers. Since then, the entire department abolished Casual Friday. This guy always pushes the boundaries.

Exploring Bitcoin

In 2013, Hayes learned about Bitcoin for the first time. At that time, he had left Deutsche Bank and joined Citigroup, but was soon laid off. According to his own recollection, his first trade was buying BTC spot from the Mt Gox exchange, then depositing it into the ICBIT exchange (the exchange that invented the coin-based futures contract). He then sold a BTC/USD futures contract expiring in June of the same year at a premium, and his net profit skyrocketed to 200%. He made thousands of dollars in an instant. From then on, he couldn't be stopped.

At that time, the Chinese government had strict financial controls, and Bitcoin had a significant premium compared to Hong Kong's market. Hayes noticed this and started buying Bitcoin at a lower price from Hong Kong exchanges and selling it on Mainland exchanges. He would also withdraw his profits to a fake Mainland bank account, then take a minibus to cross the border to Shenzhen, withdraw a bag full of cash, and bring it back to Hong Kong. After experiencing this multiple times, it aroused the suspicion of Hong Kong authorities. One time, during transit, border personnel detained him on suspicion of suspicious Bitcoin transactions. Hayes had to claim that he was a victim in the transaction before he was released.

Rise of BitMEX

After the collapse of Mt. Gox, which once held 80% of the market share, the three major exchanges in China - Huobi, OKCoin, and BTC China - absorbed the majority of the market share. Overseas exchanges such as Bitfinex, ICBIT, and Bitstamp also took a share of the Chinese market. The market competition was fierce, and each had its own way of survival: Bitfinex relied on its peer-to-peer lending market and support from USDT, ICBIT invented reverse futures contracts (also known as coin-based contracts), and as for Bitstamp... let's not mention the 5 million stolen. Coinbase was more user-friendly and had just opened for a year, thriving as a new exchange.

In the face of such a market environment, Hayes still saw his own opportunity. In Deutsche Bank and Citigroup, his expertise was in futures contract trading. He believed that the existing exchanges in the market were not professional enough. He wanted to provide a similar bitcoin trading experience to the big traders who were used to trading stocks on Wall Street. So he came up with the idea of starting a bitcoin derivatives exchange. He imagined a platform that only accepted bitcoin, looked somewhat like Bloomberg terminals, and had similar functions. Trading bitcoin would be as professional as trading stocks on Wall Street. So he approached Ben Delo and Sam Reed, both coding geniuses passionate about crypto. In 2014, the three of them registered a company in Seychelles and officially established BitMEX, short for Bitcoin Mercantile Exchange (in homage to the Chicago Mercantile Exchange, CME). Hayes himself took on the role of CEO. On the first day of the exchange's official launch, it achieved a trading volume of $50 m. (source)

Although the business was not ideal for the first half of the year, it wasn't until spring 2015 that Hayes had the idea of giving up and proposed to his two partners: Hong Kong's second-hand electronic products are booming, why don't we start a business selling second-hand iPhones? The two partners did not agree. In the end, they decided to attract users by making high-risk and high-return their specialty. The reason why futures trading has super high profits is because of leverage, which means that after mortgaging certain assets, you can borrow some additional funds. The more you borrow, the greater the leverage, but also the greater the risk. Hayes and his team decided to increase BitMEX's leverage to 50 times, which means that a maximum position margin of 1 BTC can be opened to 50 BTC. Later, they increased the leverage to 100 times. At that time, this far exceeded the leverage levels of competitors, making BitMEX the gathering place for the most "loose" gamblers in the market, and miraculously turning BitMEX from loss to profit. Super high leverage thus became the core of BitMEX's brand, and even the name of the parent company was changed to 10 0x Group.

Inventing Perpetual Swaps

Hayes once said in a YouTube video, "Some competitors who make similar products as us focus on retail investors, why don't we go after retail investors?" But after all, not all retail investors have a formal financial background and lack solid financial knowledge. When a group of completely ignorant traders came to BitMEX to trade, they found themselves unable to understand the game and watched their money disappear inexplicably when the contract expired.

According to an interview with NY Magazine, there was an interesting example where many retail investors would email Hayes complaining that their contracts "suddenly disappeared." In fact, their contracts had expired. So these retail investors complained that Hayes and BitMEX were scammers.

Delo was the first to come up with an improvement for this product: could they create a futures contract that does not expire? This would solve the problem for retail investors. So, the several founders followed this inspiration and continued to explore. When their thoughts were flowing like a stream, they even wrote down their ideas on a noisy bar's napkin (link to the article).

The result was the most groundbreaking and iconic innovative product of BitMEX: Perpetual Swaps. It ingeniously avoids the traditional drawbacks of futures contracts that always have expiration dates (a 24x7 market always having expiration restrictions can be a big problem) while fulfilling the functions of traditional futures contracts: allowing long positions to profit when prices rise and allowing short positions to profit when prices fall.

Perpetual Swap, also known as Perp, is a type of futures contract trading without an expiration date. It cleverly utilizes funding fees to anchor the contract price to the spot price. This allows investors to enjoy the leverage convenience of contract trading while avoiding the hassle of expiration and switching positions. For more information about Perp, please refer to: What is a perpetual contract?

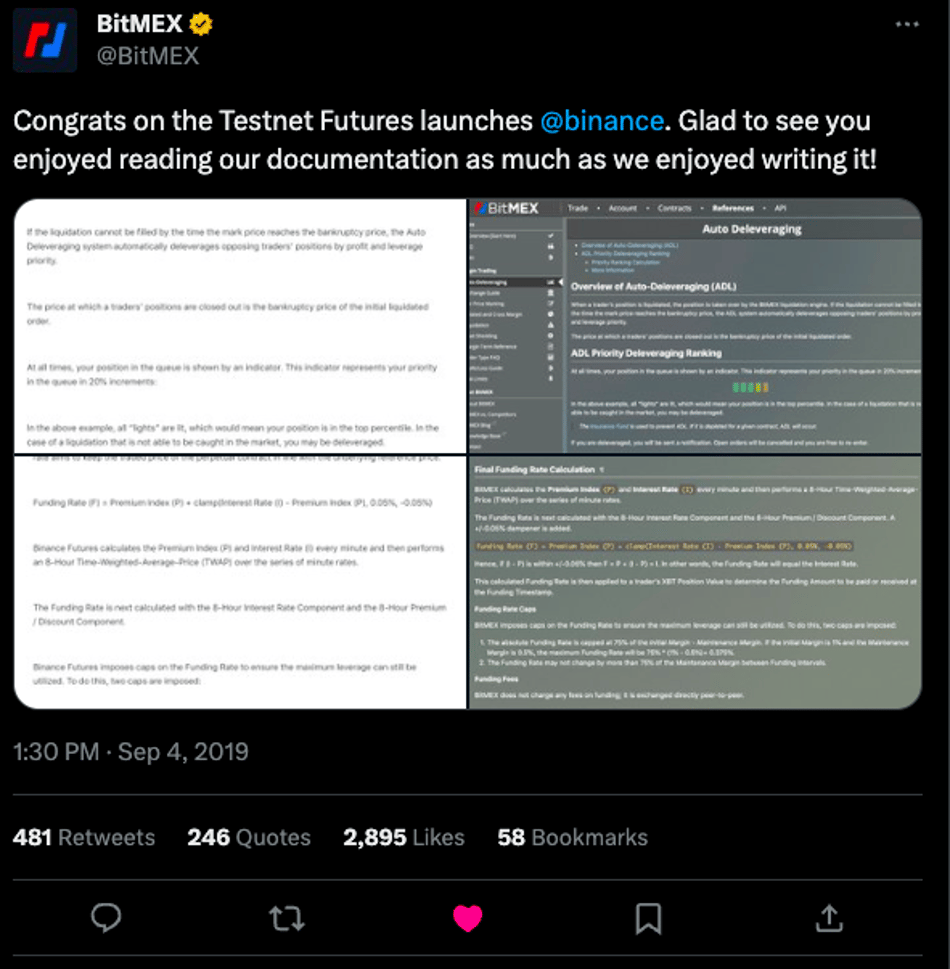

Since May 2016, when BitMEX launched the first perpetual contract product XBTUSD perp, more and more exchanges have followed in BitMEX's footsteps and successively launched perpetual products. Bybit and OKEx launched in December 2018, FTX and Binance launched in October and December 2019 respectively. Interestingly, when Binance launched its futures contract testnet, BitMEX even mocked them at one point: Congratulations to Binance for launching a futures contract testnet. It's nice to see you copying our documentation and having as much fun as we did writing it. We are genuinely happy for you!

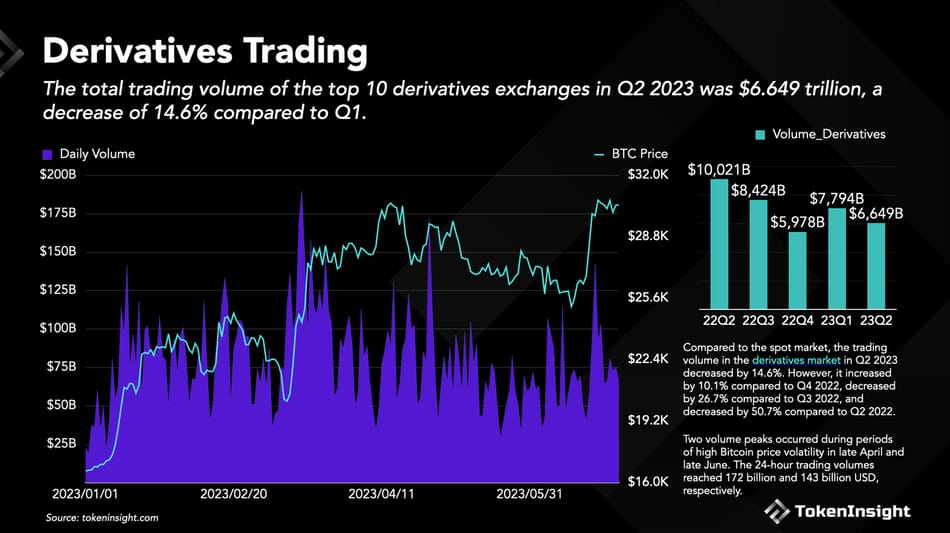

Although Perpetual Swap didn't become popular overnight, this excellent product eventually sparked a market revolution. The quarterly trading volume in the derivative market has exceeded 660 billion USD, with perpetual contracts accounting for over 90%.

Making a Splash

2017, BitMEX had a smooth sailing, and they made a lot of money, so someone wanted to buy them. Hayes and the founders of BitMEX rejected a venture capital acquisition proposal. "With a valuation of $600 million, it's too little," thought Hayes. When BitMEX was just founded, the founders struggled to raise money. Now, of course, they choose to retain all their equity. The following year entered a bear market, but this made people trade more frequently on their platform. That summer, BitMEX had a daily trading volume of up to $8 billion, which brought in $4 million in revenue for BitMEX that day. Their ability to attract money is outstanding.

2018, Hayes transformed into a promising youth and returned to his hometown to show off his wealth. In May, Hayes went to New York to attend the crypto conference Consensus and became the center of attention before entering the venue: BitMEX's three Lamborghinis parked illegally outside the Midtown venue in Manhattan. Hayes self-deprecatingly called this a marketing strategy "guerrilla marketing" and openly admitted that it might be a little bit gauche. Interestingly, these luxury cars were actually rented and incurred a fine of about $1,000 for illegal parking. Okay, this fits Hayes' flamboyant and rich personality.

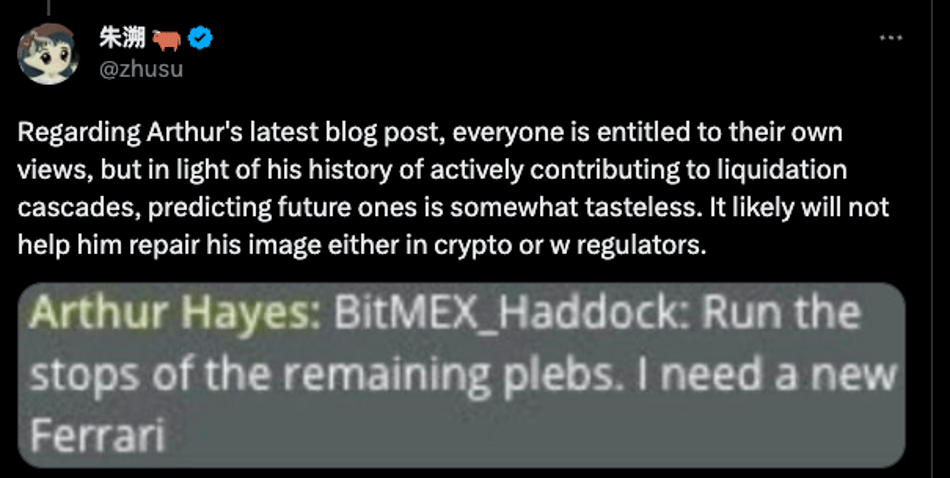

Overnight wealth made Hayes a target in the crypto community, making countless people envy how easy it seemed for him to make money. At the time, there was a joke circulating in the crypto industry: when others make money, Hayes makes money; when others lose money, Hayes still makes money. There's also an interesting meme, a seemingly message Hayes sent to his own company employees: "Stop loss for all the dumb money, I want to buy a Ferrari." It mocks Hayes for manipulating the market and being an adversary to the users.

However, Hayes did not stop showing off. At the end of 2018, Hayes tweeted a photo of himself donating an ambulance to Seychelles on BitMEX. The photo showed Hayes wearing sunglasses, which was quite annoying. The highlight of this photo was the sticker at the bottom, which said, "My other car is a Lamborghini."

The debate at the 2019 Tangle in Taipei is another highlight that cannot be ignored when talking about Hayes. From a few classic quotes from this debate, you can get a sense of what it's like when someone goes crazy to a certain extent. At that time, Hayes and renowned economist and anti-cryptocurrency writer Nouriel Roubini engaged in a heated debate about Bitcoin and BitMEX on the show.

The two of them were diametrically opposed in their attire: Roubini wore a suit, representing the traditional conservative camp, while Hayes wore tight jeans with large holes at the knees, representing the rebellious vanguard. Less than 10 minutes into the debate, the arrogant Hayes made a shocking statement. When asked why the company was registered in Seychelles, Hayes replied, "I didn't want to bow down and take an ass-fucking from the U.S. government just because it's regulated."

Later, when asked about the difference between regulatory agencies in the United States and Seychelles, Hayes went even further, saying, "They (the United States) are just more expensive to bribe." And what about Seychelles? "Just a coconut."

Playing with Fire

There is an old saying among Chinese people, "Stay silent and make a fortune." Excessive flaunting and constantly pushing boundaries have made Hayes numerous enemies. After the 2019 Tangle Taipei debate, he gradually faced backlash from his adversaries, including the US government.

On July 19, 2019, just a week after the show, the CFTC (Commodity Futures Trading Commission) initiated an investigation into BitMEX, suspecting the exchange of providing trading services to US users. According to US law, BitMEX, which is registered in Seychelles, is not allowed to serve US customers. The US government naturally despised this "clownish" threat to its own authority and disregard for the law, similar to how Ant Group lost its chance to go public after Jack Ma's controversial remarks at a summit.

Within a day of this incident, the Bitcoin net outflows from BitMEX reached an astonishing $7.3 million, and throughout July, BitMEX's Bitcoin net outflows exceeded $500 million, setting a new record (previously never surpassing $100 million in a single month).

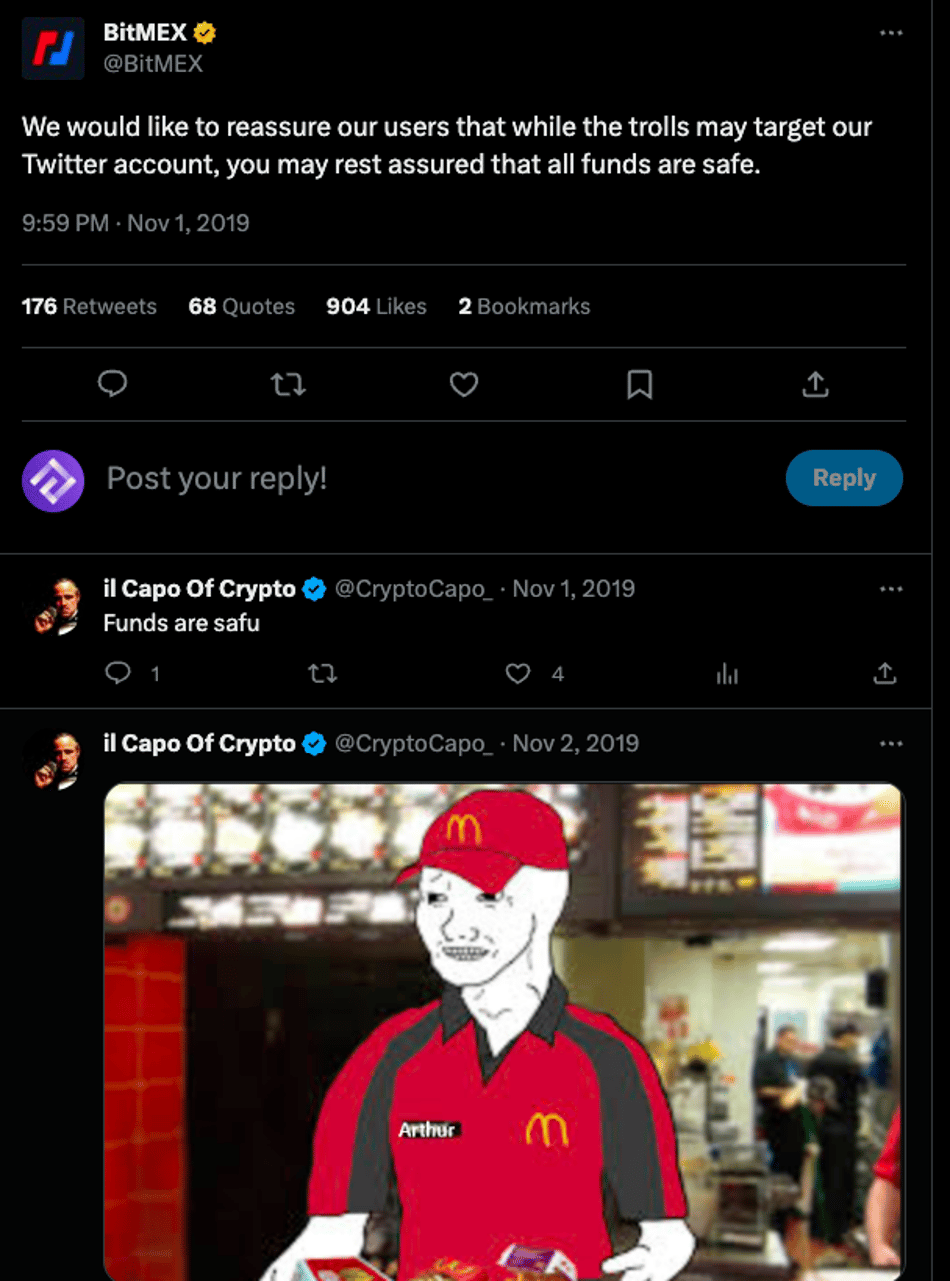

Immediately afterwards, there were various thorny issues: On November 1st, BitMEX accidentally leaked a large number of user email addresses, causing the situation to gradually spiral out of control. Shortly after, hackers breached the BitMEX Twitter account and playfully tweeted "Take your BTC and run. Last day for withdrawals" and "Hacked." but quickly deleted them. Furthermore, they created a new Twitter account, @Bitmexdatabase1, and began continuously leaking user IDs and emails. However, BitMEX could only claim with grandeur: Funds are safe.

Lawsuits as mountains collapse

After entering 2020, BitMEX has not recovered from the 312 incident and has encountered another problem. On May 16th, BitMEX received a lawsuit from BMA LLC (Bitcoin Manipulation Abatement) in California, accusing BitMEX and executives including Arthur Hayes of money laundering, fraud, and operating an unlicensed cryptocurrency exchange. The plaintiff also emphasized that in 2019, about 15% of BitMEX's trading volume, approximately $138 billion, came from U.S. users, claiming that this is the "highest record of illegal transactions in the United States." As the saying goes, when you're unlucky, even drinking water can get stuck in your teeth. When BitMEX got entangled in this lawsuit, it had already experienced a series of troubles such as closing its Japan service and server downtime and crashes.

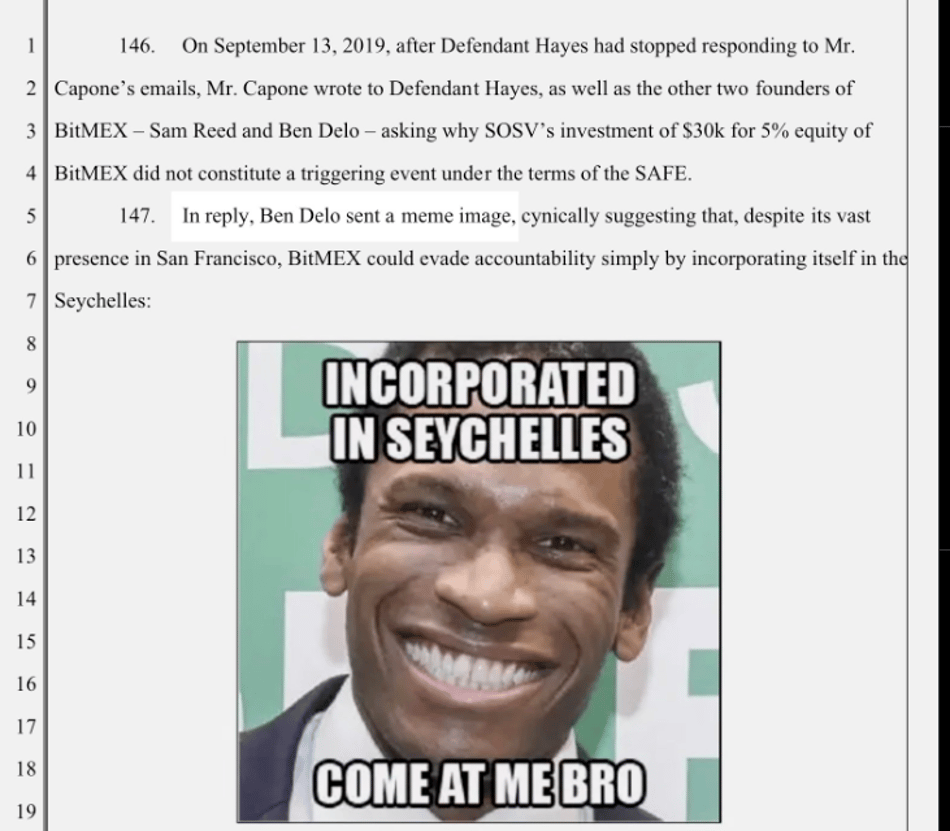

However, the plaintiff doesn't have much leverage against BitMEX since it purposely registered in Seychelles to evade U.S. regulation. BMA can only indirectly prove BitMEX's operational activities in the U.S. through customer email information, and this trivial evidence was later used by people from BitMEX to mock them: "I registered in Seychelles, come and get me!" They're still arrogant.

Unfortunately, the government is cracking down. Since the 2008 financial crisis, the emergence of Bitcoin has clearly caused concerns for governments around the world. Whenever Bitcoin's bull market arrives, central banks in various countries fear that Bitcoin will disrupt their control. This was especially true in the year 2020 during the pandemic. From MicroStrategy's crazy increase in BTC holdings, to the Nigerian government's fear of losing control after seeing its people invest $140 million in Bitcoin and subsequently banning transactions, to Musk selling Tesla stocks to buy Bitcoin, this series of signals has made the Federal Reserve feel the urgency to take action. At this very moment, BitMEX and Hayes became the perfect scapegoats: young, flamboyant, overnight fortunes, ill-gotten wealth, and to top it all off, Hayes is Black. It's like walking right into the line of fire.

In October 2020, at the beginning of a new bull market, Hayes and two other founders of BitMEX received a joint accusation from the US Department of Justice and the CFTC. The accusation was similar to previous ones: BitMEX had a large number of US customers without being registered in the US and was suspected of engaging in illegal money laundering activities, thereby violating the Bank Secrecy Act of 1970, also known as the Currency and Foreign Transaction Reporting Act. As a result, BitMEX became the first cryptocurrency exchange to be sued for violating the Bank Secrecy Act. The reason Hayes was targeted was because, earlier, when he was dealing with the CFTC, he failed to submit his customers' information to the CFTC, and the CFTC also had some retaliatory intentions. According to reports, within 48 hours of the CFTC's lawsuit, more than 45,000 BTC were withdrawn and flowed to other exchanges.

When this happened, Hayes reacted quickly, he directly stepped down as CEO and, together with Reed and Delo, created a new entity, 10 0x Group, to manage BitMEX more securely. The newly appointed CEO, Alexander Hoptner, has also expressed readiness for the lawsuit. According to reports, on the day Hayes resigned, BitMEX directly lost approximately $400 million of user deposits, seeming to indicate the end of an era.

Surrendering in Honolulu

On April 6, 2021, a private plane from Singapore landed slowly in Honolulu, Hawaii. Hayes, wearing a casual T-shirt, was arrested at the airport. FBI agents boarded the plane directly, verified his fingerprints and saliva. Then, agents wearing bulletproof vests handcuffed Hayes and escorted him to court. This was Hayes' first visit to the United States since 2018, but it was quite different from the time when he was driving a Lamborghini in New York.

Although surrendered, Hayes did not plead guilty in court. This is also the optimal decision after adopting the lawyer's advice: Hayes is still resisting. As early as March, another founder, Ben Delo, surrendered to the Supreme Court in New York and did not plead guilty either. After Hayes' team paid a $10 million bail, followed by more than ten days of detention and isolation, after a series of discussions, Hayes boarded a flight back to Singapore. During the pandemic period, Hayes has been staying in Singapore. After several months, in August, BitMEX finally reached a settlement with the CFTC, agreeing to pay a fine of $100 million, seemingly escaping from danger.

Since then, both founders have surrendered to the authorities, while Reed from Wisconsin suffered more: Reed was actually arrested in October. At that time, he was living in the suburbs of South Boston with his wife and three-month-old baby. According to media reports, at six o'clock in the morning, more than a dozen FBI agents and police officers kicked in the door with guns, and directly tied him to a chair. Subsequently, Reed was taken to a mysterious federal agency building and detained in a dark and damp basement for ten hours, and even had ankle cuffs.

I don't know if it was the horror of prison life or for some other reason, but Hayes eventually surrendered and admitted guilt in February 2022, along with two other co-founders. They admitted to "contempt" for the Bank Secrecy Act and failure to enforce anti-money laundering provisions, and agreed to pay a fine of $10 million each.

The federal prosecutor in the Southern District of New York told the court that BitMEX was a "tool for money laundering and criminal activity" and conducted over $200 million in suspicious transactions without reporting any of them to the government. The prosecutor claimed that at one point Hayes unfroze an account belonging to a suspected hacker, allowing them to withdraw assets believed to be stolen bitcoins. The prosecutor wrote that due to the company's failure to require traders to provide account identification details, "the full extent of BitMEX's criminal activity will never be known."

Department of Justice lawyer Damian Williams said, "Arthur Hayes and Benjamin Delo created a platform that openly flouted legal provisions, and they willingly ignored the most basic anti-money laundering requirements."

With various pieces of evidence presented, the prosecutor naturally sought a heavy punishment from the court. Hayes himself attempted to show some remorse, saying, "Although I am indeed proud of BitMEX's achievements, I deeply regret my involvement in these criminal activities." There were also friends speaking up for him, such as Mike Novogratz, the current head of Galaxy Investment Partnership, who said, "Let's not forget that Arthur is a young, successful black man. Our country and industry need more black individuals like him."

In May 2022, under pressure from public opinion, including racial tensions, the judge chose to impose a lenient punishment, allowing Hayes to avoid imprisonment but placing him under house arrest for six months.

Let the past miseries remain in the past

According to media reports, Hayes is being held in a luxurious white three-bedroom suite in South Beach, Miami (indeed his own property), with a huge balcony overlooking the entire Biscayne Bay. From here, Hayes can gaze at Miami's skyline, enjoy the sea breeze, and either do yoga or go out to play sports and swim every day (according to his own description, he is allowed to exercise outdoors for a few hours each day). He even gets recognized by fans when he goes out to buy coffee. Hayes loves writing, so he rented a nearby WeWork office to meet his office and writing needs. He even occasionally dines out and interacts with members of the local crypto native community.

However, Hayes' aversion to the United States can be seen from many aspects of his life. On the surface, being under house arrest here is like being on vacation, but he is particularly nervous. "In the United States, I am very concerned about my personal safety because people can carry guns." He is even sensitive enough to take out his anger on tiny bugs. He feels that the ground-floor swimming pool is completely unusable due to too many mosquitoes, and complains, "In Singapore, they would do mosquito control." In the report, he also complains about many shortcomings of the United States: too much time difference with other countries, the food in the United States is disgusting, and so on. All aspects show his aversion to the United States, which has reached the point of cultural disdain. "I don't plan to return to the United States again, and I probably will never come back."

Fast forward to early 2023, and Hayes has been playing in Hokkaido for a while. According to his own account, we can feel that he has indeed laid back a lot: "I don't have any visions now, so let's just protect our customers' money and not lose their bitcoins."

Closing Thoughts

Once upon a time, there was a young man who was smart and received higher education. After working as a trader in traditional finance for a few years and feeling dissatisfied, he started his own exchange. He became rich overnight, became a Twitter celebrity, attracted everyone's attention, and then led the crypto movement to success. He defiantly challenged the U.S. government and became a rebellious entrepreneur, attracting outsiders to watch. He was arrogant and eventually faced consequences when the U.S. government launched a counterattack. He did try to resist, but in the end, he was defeated. He also changed Crypto.

This story sounds familiar. SBF: It's not me. User: It is you. Hayes: It is clearly me.

Of course, despite having similar experiences, their differences are also obvious: one was late, the other was early. One is whiter, the other is darker. One comes from a wealthy family, the other from a car repair worker. One is a dead fat otaku, the other is a big muscleman. And, of course, there is a very important difference: one took customers' money with conclusive evidence, while the other, although facing multiple charges, has never been accused of misappropriating user deposits.