Original text - Grayscale

Compile - Odaily

Recently, Grayscale released Septembermarket report, the core points are as follows:

Bitcoin rallied in September while many traditional assets suffered significant losses, underscoring the diversified nature of cryptocurrencies. The pressure on global markets appears to stem from rising government bond yields and rising oil prices.

As Bitcoin on-chain metrics improved this month, strong fundamentals played a key role. As stablecoin market capitalization stabilizes after falling last year, the digital asset market remains focused on the development of Layer 2 blockchains and the potential for spot Bitcoin ETFs once they are approved in the U.S. market.

While there are encouraging signs for the cryptocurrency industry itself, the broader financial market backdrop is likely to remain challenging. However, Bitcoin’s recent stability suggests that its valuation may begin to recover once the macro backdrop improves.

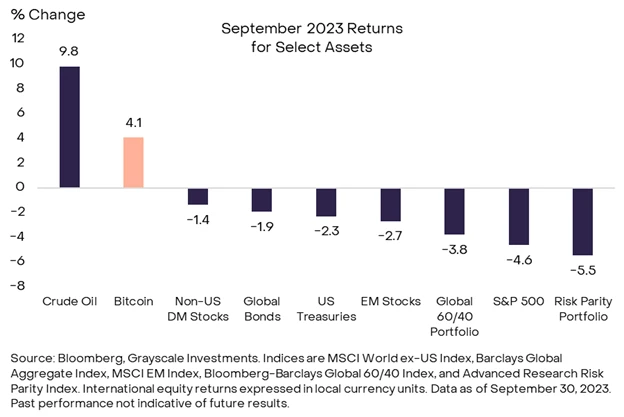

BTC gained 4% in September, contrasting with significant losses across many traditional assets this month (Table 1). Cryptocurrencies are now more correlated with other markets, but they continue to provide investors with a degree of diversification in this challenging market environment.

Bitcoin (BTC) gained 4% in September, a gain that contrasted with significant losses across many traditional assets during the month (Chart 1). Cryptocurrencies are now more correlated with other markets, but they continue to provide investors with a degree of diversification (gain) in this challenging market environment.

Chart 1: Bitcoin offers diversification benefits amid shrinking global markets

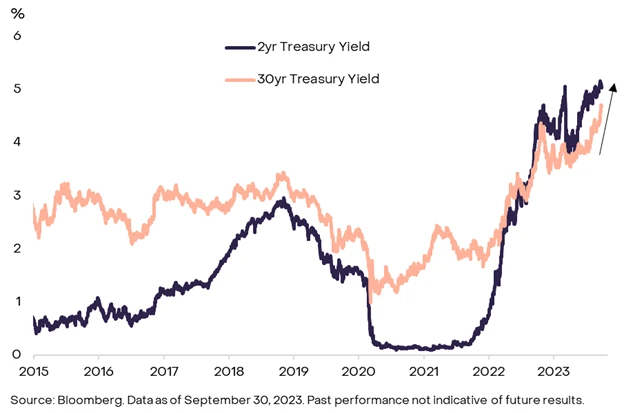

The latest pressure on global assets appears to be coming from the U.S. bond market (Chart 2), which may be related to related actions by the Federal Reserve. At its mid-September meeting, the Fed signaled it could raise interest rates again later this year and that it could cut rates more slowly next year than previously expected. The Feds new guidance could help push short-term bond yields higher and boost the value of the dollar.

Chart 2: Rising bond yields weigh on global markets

However, the bigger challenge facing fixed income markets may be the glut of long-dated government bonds. The 30-year Treasury yield rose nearly 50 basis points (bp) in September, reaching its highest level since 2011. Long-term bonds (such as those with remaining maturities of more than 10 years) are generally less sensitive to small changes in the Feds interest rate guidance.

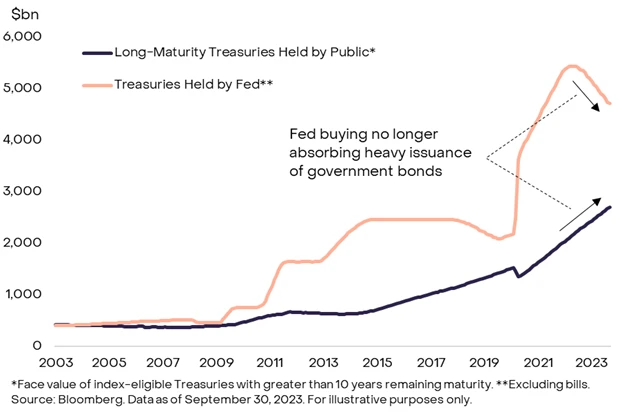

Instead, bond markets appear to be struggling to absorb the massive borrowing from the U.S. Treasury—the result of the government’s massive budget deficit. While the budget deficit has been large for some time, the Feds purchases (quantitative easing) have absorbed some of the bond supply in the past. Now that the Fed is shrinking its balance sheet (quantitative tightening), more government borrowing is hitting open markets, putting upward pressure on interest rates (Chart 3).

Chart 3: Without the Fed’s quantitative easing (QE), bond markets struggle to absorb U.S. government debt

Rising bond yields and higher oil prices appear to be weighing on stocks and most other risk assets. The SP 500 fell nearly 5% in September, led by losses related to the health of the U.S. economy — homebuilders, industrials and companies tied to retail performance.

Bitcoin is largely immune to drawdowns on traditional assets and has outperformed most other large cryptocurrencies.

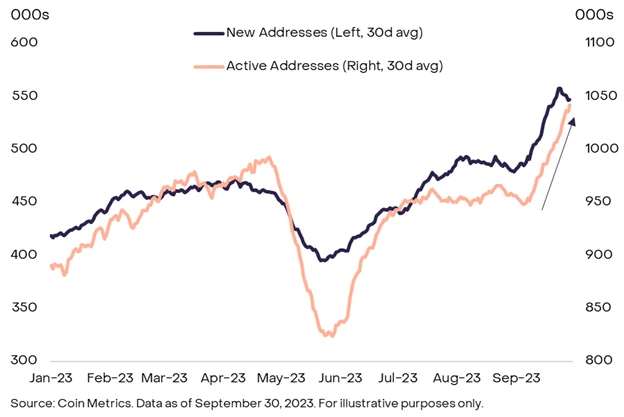

While transaction volume continues to decline this month, Bitcoin’s various on-chain metrics have improved: funding addresses, active addresses, and the number of transactions have all increased (Chart 4). Given the progress of the spot Bitcoin ETF in late August, the pick-up in on-chain activity may represent new investors entering the market ahead of possible regulatory approval.

Bitcoins price recovery may also be related to the news that the trustee of cryptocurrency exchange Mt Gox will defer creditor repayments until October 2024 - it currently holds about 138,000 Bitcoins, currently worth 37 billion, this decision may reduce market selling pressure expectations.

Chart 4: Bitcoin on-chain activity increased in September

Meanwhile, ETH token prices fell slightly from September, with the ETH/BTC ratio falling to a one-year low. ETH price volatility is also extremely low: As of September 30, ETH’s 30-day annualized price volatility was only 25%, which is lower than BTC’s volatility during the same period, while the average volatility since January 2022 is about 60% %.

Unlike Bitcoin, ETH’s on-chain fundamentals haven’t changed much. Later in September, the ETH/BTC ratio recovered slightly as market attention focused on potential ETH futures ETF approval.

In addition to BTC and ETH, a noteworthy fundamental change in September is that the market value of stablecoins has stabilized after a long period of decline. According to DeFiLlama data, the total market capitalization has stabilized at around $124 billion, with almost continuous decline over the past year; since mid-August, the circulation of DAI and True USD (TUSD) has increased significantly, while the supply of Tether (USDT) A slight increase since early September.

Chart 5: Stablecoin market capitalization has stabilized after falling

The adoption of stablecoins seems to be driving the Tron token to outperform other large-cap tokens. In September, TRX price increased by 15%; the total value locked (TVL) of stablecoins hosted on Tron is higher than any other blockchain, even more than Ethereum. A large portion of TVL comes from Tether (USDT), which is primarily hosted on Tron and currently accounts for an average of 35-40% of the networks daily transactions.

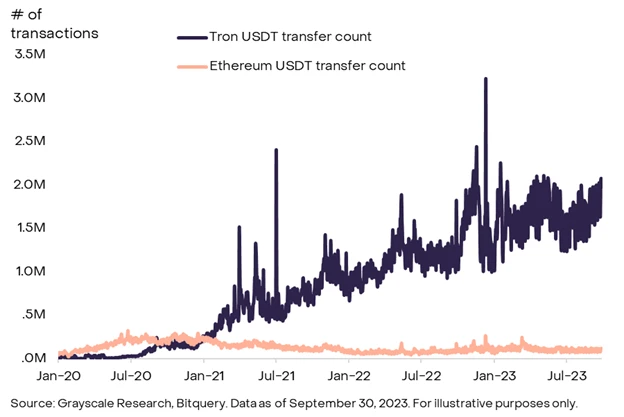

Tron leads in terms of TVL, largely due to lower transaction fees. The number of TRC-USDT transfers far exceeds that of ERC-USDT, and the average daily trading volume is about 15 times higher (Chart 6). USDT’s strong adoption on Tron demonstrates the stablecoin’s product-market fit and highlights its growing importance in the contemporary cryptocurrency ecosystem.

The symbiotic relationship between USDT’s success on Tron and TRX’s recent price rise may indicate that stablecoins are becoming an increasingly important part of the modern cryptocurrency market mechanism.

Chart 6: Tether activity on Tron is much higher than Ethereum

Beyond stablecoins, the cryptocurrency market remains focused on the continued development of Layer 2 blockchains – something Grayscale Research discussed in a recent report.

Notably, social media app friend.tech on BASE collected more total fees than decentralized exchange Uniswap in September. Other DeFi tokens that are performing strongly from a price perspective are AAVE, CRV and MKR, as well as the oracle protocol token LINK – which we believe is mainly due to recent collaborations with Swift and BASE.

Finally, Toncoin (TON) briefly surpassed TRX to become the tenth largest crypto asset by market capitalization. The project announced its integration with messaging application Telegram at the Token 2049 conference in Singapore (the TON project was originally launched by the founders of Telegram). While we are optimistic about the prospects for cryptocurrency integration with messaging applications, investors should consider factors such as the assets liquidity when assessing its valuation. It’s worth noting that the majority of TON’s supply is owned by a handful of whales, and the token’s trading volume is extremely low compared to its market capitalization. For example, according to data from The Tie, TON’s market capitalization is more than 200 times its monthly trading volume.

In our view, Bitcoins resilience, coupled with significant losses in traditional assets, illustrates the diversification benefits of digital assets and the steady improvement of industry fundamentals. The next major catalyst for Bitcoin prices could come from the approval of a spot ETF. In the previous legal dispute with Grayscale, the SEC lost the case and needed to appeal before October 13 to seek retrial; if the SEC abandons the appeal, then it will reconsider Grayscale’s pending application (to convert the Grayscale Bitcoin Trust GBTC to Spot Bitcoin ETF), as well as other spot Bitcoin ETF applications currently under consideration.

Despite these encouraging signs, the broader financial market backdrop may remain challenging for the time being: the Federal Reserve is still tightening policy, government bond yields may still be finding a new equilibrium, and a soft landing for the U.S. economy is unlikely. uncertain. However, Bitcoin’s recent stability suggests that its valuation may start to recover once the macro backdrop improves.