1. Bitcoin Market

From April 19 to April 25, 2025, the specific trend of Bitcoin is as follows:

April 19: The price of Bitcoin fluctuated relatively steadily on that day, fluctuating around $84,450 in the morning. In the afternoon, it showed a mild upward trend, reaching $85,383 and $85,465 respectively, indicating that market sentiment began to tend towards cautious optimism.

April 20: Bitcoin was under short-term pressure after the opening and quickly fell back to $84,744, but then buying gradually strengthened and the price rebounded to around $85,200 and consolidated in this range. The market weakened slightly in the afternoon and the price fell back to $84,028, but after gaining support at a low level, it rebounded to $84,623, indicating that there was strong buying in the market.

April 21: Bitcoin continued its rebound momentum from the previous day, opening at around $84,540, and then slightly up to $85,126. Market sentiment significantly strengthened in the afternoon, and Bitcoin started a rapid rise, breaking through from $85,047 to $87,472, forming a strong breakthrough pattern in the short term. After a brief consolidation around $87,420, the bullish sentiment was further released, and it rose again to $88,353. This strong rise means that Bitcoin has officially broken away from the downward channel in the previous few months, and has entered a new round of rising cycle in terms of technical form. On the macro level, the market generally pays attention to the increasingly tense relationship between US President Trump and Federal Reserve Chairman Powell, coupled with the uncertainty of the future policy path of the US dollar, making Bitcoin as a digital gold a safe-haven property favored by funds.

April 22: Due to the large increase in the previous trading day, Bitcoin experienced a technical correction in the early trading of the day, falling to a minimum of $86,696. Subsequently, it received buying support at the support level, and the price resumed the upward trend, breaking through the key resistance levels of $87,401 and $88,505 respectively. In the afternoon, after the market digested the good news that Trump announced a substantial reduction in tariffs on China, risk appetite rebounded, and Bitcoin quickly increased in volume, soaring from $88,719 to $91,297, successfully breaking through the psychological barrier of $90,000, showing the re-allocation of funds to risky assets.

April 23: Bitcoin fluctuated in a high range throughout the day. After a brief technical adjustment, the price quickly stabilized at $91,164, and then continued its strong rebound, breaking through $92,000 and rising to an intraday high of $93,152. Subsequently, the price remained at a high level, and the trend continued to be stable, reaching $93,715 and $94,381. There was a round of rapid correction during the midnight period, with the lowest price falling to $92,202, but the decline was quickly repaired, indicating that the markets buying support was still strong.

April 24: Bitcoin resumed its upward trend after the pullback the previous night, and the price rebounded to $94,133 and fluctuated in a narrow range around $93,530. As volatility gradually narrowed, the market direction gradually became clear, and the price fell from the high to $91,733 to complete a phased adjustment. Subsequently, the decline slowed down, and buying intervention led to a slow recovery in prices, indicating that short-term support has initially stabilized.

April 25: Bitcoin continued its rebound momentum from the previous trading day and is still running in the upward channel. The current trend shows a certain upward potential, but whether it can continue to rise in the future still needs to pay attention to the further expansion of trading volume and the breakthrough of key resistance levels.

Summarize

Bitcoin has been strong this week. Not only has it successfully broken through key resistance and restarted its upward channel on the technical side, it has also been driven by multiple changes in macro fundamentals. The market is focused on the increasingly tense relationship between US President Trump and Federal Reserve Chairman Powell, which has exacerbated the markets uncertain expectations about the future path of US dollar policy, thereby enhancing Bitcoins safe-haven appeal as a non-sovereign asset. At the same time, Trumps announcement of a sharp reduction in tariffs on China boosted global risk sentiment, and the rebound in US stocks and the recovery of risk appetite for funds provided support for further increases in Bitcoin prices. In addition, the existence of inflationary pressures and the vague outlook for the Federal Reserves policies have accelerated the allocation of Bitcoin by institutions and long-term funds to hedge against potential systemic risks.

Overall, Bitcoin has significantly escaped from the previous mid-term downward range, and the market structure has undergone positive changes. The subsequent trend needs to focus on whether the price can build effective support in the high area. At the same time, the continuity of trading volume and on-chain capital flow will become the key indicators to verify the continuation of the new round of bullish trend.

Bitcoin price trend (2025/04/19-2025/04/25)

2. Market dynamics and macro background

Fund Flows

1. The outflow of funds from exchanges continues, reflecting the increasing willingness to hold long-term positions

In the past 7 days, a total of about 10,467.8 BTC flowed out of centralized exchanges (CEX), indicating that investors tend to transfer assets to on-chain or cold wallets. Bitfinex outflowed 3,638.18 BTC; OKX outflowed 5,120.23 BTC. The trend of capital outflow is usually regarded as bullish, indicating that selling pressure is reduced and market bullish expectations are rising.

2. Dynamics of institutions and whales: Divergence intensifies, and large investors continue to build positions

CME position divergence: Institutional and retail investors showed obvious divergence in the futures market, with asset management institutions net long positions falling from a high of $6 billion to $2.5 billion. Other participants net long positions increased to $1.5 billion, a one-year high, indicating that retail sentiment turned bullish.

The number of whale wallets hit a four-month high: 2,107 wallets hold more than 1,000 BTC, an increase of more than 60 since early March. Bitcoin returned to $87,400 on April 21, breaking through the shock zone for the first time since March 28.

3. ETFs continue to attract funds, and capital sentiment is rapidly heating up

April 21: Fidelity ETF net inflow of 306 BTC, total holdings of 194,578 BTC, market value of $17.17 billion. US Bitcoin spot ETF net inflow of $382 million

April 22: Net inflows of $912 million

April 23: Net inflows of $917 million

Technical indicator analysis

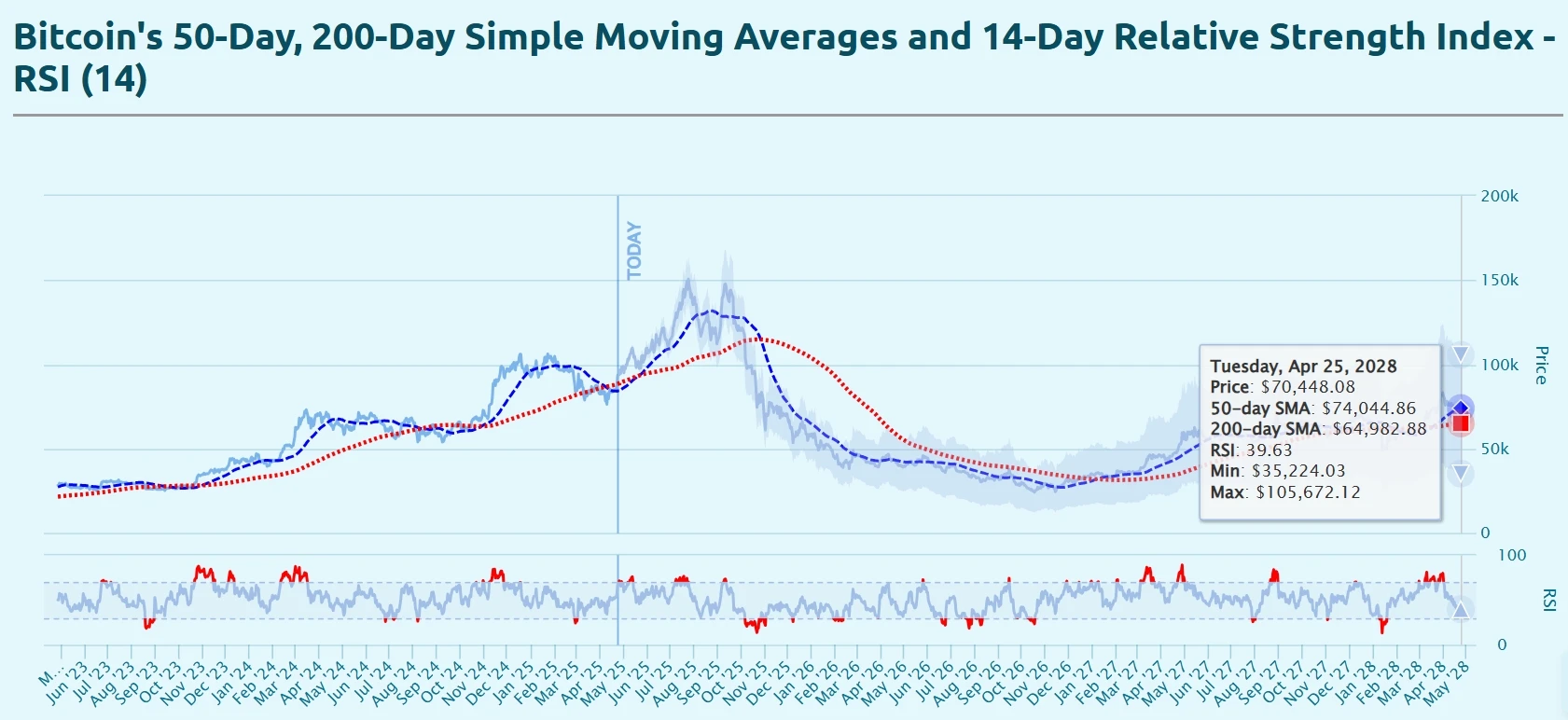

1. Relative Strength Index (RSI 14)

As of April 25, Bitcoins 14-day relative strength index (RSI) was about 39.63, which is in a weak range. This level indicates that buying momentum is still insufficient in the short term, and the market has not yet entered an oversold state, but it has fallen from its previous high, reflecting that the recent price has weakened in the process of repair after a rapid rise. If the RSI continues to drop to around 30, we need to be alert to short-term technical corrections; on the contrary, if it rises again and breaks above 50, it may provide signal support for the start of a new round of rises.

2. Moving Average (MA)

As of April 25, Bitcoin’s key moving averages are as follows:

50-day moving average (MA 50): $74,044.86

200-day moving average (MA 200): $64,982.88

The current price of Bitcoin continues to run above MA 50 and MA 200, indicating that the overall trend remains in a medium- to long-term bullish structure. MA 50 is significantly higher than MA 200, forming a golden cross pattern, which is a typical confirmation signal of a medium-term upward trend. In addition, as the current price deviates significantly from the above two moving averages, it is necessary to pay attention to whether there is a need for price deviation repair, or to conduct technical consolidation in a volatile manner to consolidate the foundation for a new round of gains.

RSI 14, 50-day SMA, 200-day SMA data chart

3. Key support and resistance levels

Support Levels: The current support levels are $92, 000 and $90, 000 respectively. If the price of Bitcoin drops to these levels, there is a possibility that it will find support and rebound.

Resistance: Bitcoin’s immediate upside resistance is at $94, 000 and if the price breaks above the resistance, it could drive further gains.

Market sentiment analysis

Prices recover, sentiment positive

This week, Bitcoin market sentiment shifted from cautious to optimistic. On April 22, Bitcoin price broke through the key psychological barrier of $90,000, reaching a high of $90,900, becoming an important signal of short-term market recovery. After that, it broke through $92,000 and $94,000 on April 23, reflecting a significant warming of capital sentiment and increased buying power, pushing prices further up. This round of rebound is closely related to the markets reassessment of safe-haven asset allocation, and is also driven by the expected fluctuations in the Feds policy and macro uncertainties, making Bitcoin the focus of capital attention again.

Key Sentiment Indicators (Fear and Greed Index)

According to CoinMarketCap data, as of April 25, the Fear Greed Index was 52, in the neutral zone, indicating that market sentiment has recovered from the previous panic. This week, the index showed a clear upward trend: April 21: 34 (fear); April 22: 38 (edge of fear); April 23: 52 (sentiment improved rapidly); April 24: 53 (close to the greed zone). The continued rise in sentiment indicators and the simultaneous strengthening of prices confirm each other, indicating that the market is gradually moving away from pessimistic expectations and may have the basis for continued rebound in the short term.

However, the current index has not yet entered an obvious greed zone. Although investor sentiment has recovered, it is still in a state of wait-and-see and cautious optimism. Whether the market can continue to form a sustained upward trend in the future depends on the further coordination of capital momentum and macro news.

Fear and Greed Index Data Picture

Macroeconomic Background

1. Controversy over the independence of the Federal Reserve

On April 21, President Trump criticized Federal Reserve Chairman Jerome Powell and hinted that he might remove him from his post, sparking market concerns about the Feds independence, causing the dollar to weaken, stocks to fall, gold prices to soar, and investors to turn to safe-haven assets.

However, on April 23, Trump withdrew his threat to fire Powell, saying he had no intention of removing him from office and calling for further interest rate cuts. This move eased market concerns about policy intervention, the US dollar exchange rate rebounded, and investor confidence recovered.

2. U.S.-China trade relations ease

The Trump administration announced on April 23 that it would substantially reduce tariffs on Chinese imports, with the original 145% tariff set to be significantly reduced. Finance Minister Scott Bessant said the current tariff level is unsustainable and expected the Sino-US trade conflict to cool down.

The move was interpreted by the market as a positive signal of easing Sino-US relations, which boosted global market sentiment and pushed up the prices of risky assets including Bitcoin.

3. Hash rate changes

Between April 19 and April 25, 2025, the Bitcoin network hash rate fluctuated as follows:

On April 18, the hash rate dropped from 888.05 EH/s to 794.95 EH/s, then quickly rebounded to 907.88 EH/s, but then fell back to around 860 EH/s. On April 19, the downward trend of the previous day continued, reaching a minimum of 748.20 EH/s, and then gradually fluctuated upward, reaching a maximum of 986.24 EH/s, followed by multiple rounds of declines, falling to 814.48 EH/s, 752.16 EH/s, and 692.90 EH/s respectively.

On April 21, the hash rate showed a trend of first decline and then rise, rising slightly to 813.43 EH/s during the day, and fluctuated around 800 EH/s, rising again in the evening, reaching a staged high of 982.94 EH/s. On April 23, the hash rate showed a unilateral downward trend as a whole, falling from 971.10 EH/s to 786.62 EH/s, and briefly consolidated in this area, and then further fell to 690.11 EH/s.

On April 24, the hash rate recovered. The Bitcoin network hash first rebounded to 789.24 EH/s, and then climbed again to 878.77 EH/s after a small correction, showing the gradual recovery of miners sentiment. As of April 25, as of the time of writing, the hash rate continued the rebound momentum of the previous day and climbed to 882.77 EH/s, indicating that miners have gradually regained confidence in the long-term growth of Bitcoin.

In summary, the overall hash rate of the Bitcoin network showed a wide range of fluctuations this week. Although there was a significant pullback in the medium term, the recovery in the short term shows that miners confidence has gradually recovered, market activity has rebounded, and network security has been guaranteed to a certain extent. The dynamics of miners computing power, especially the relationship with price fluctuations, will still be a key factor worth paying attention to in the coming weeks.

Bitcoin network hash rate data

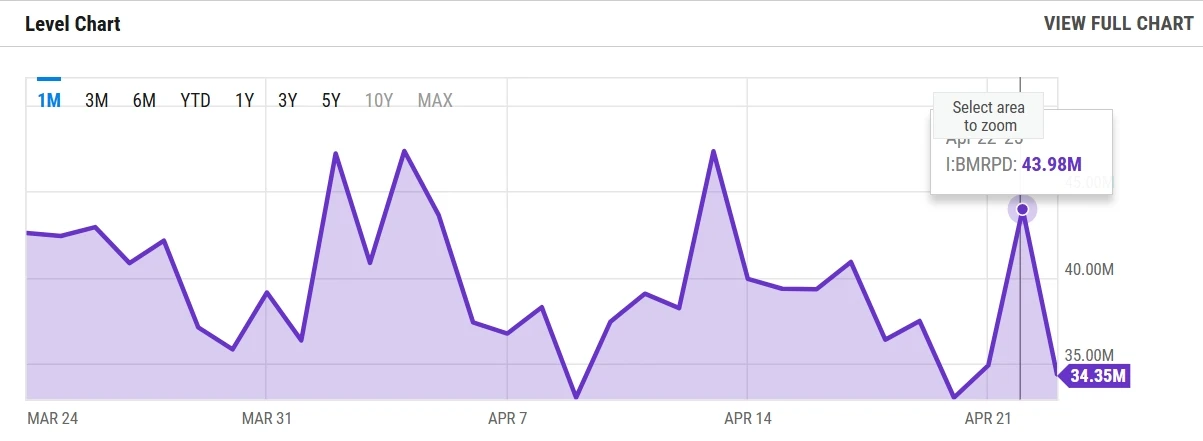

4. Mining income

According to YCharts data, the total daily income of Bitcoin miners this week (including block rewards and transaction fees) is as follows: April 19: 37.46 million US dollars; April 20: 33.00 million US dollars; April 21: 34.87 million US dollars; April 22: 43.98 million US dollars; April 23: 34.35 million US dollars. From the trend point of view, miners income briefly rose to 43.98 million US dollars on April 22, reaching a high point this week, but quickly fell back to 34.35 million US dollars on April 23, with a daily decline of 21.9%, indicating that the volatility of miners income has increased. In addition, compared with 65.64 million US dollars in the same period of 2024, the total income on April 23 fell by 47.7% year-on-year.

From the perspective of unit computing power income, the current hash price is about $48.52 per PH/s, which is at a relatively high level in recent times. This rebound is mainly supported by the recent rebound in Bitcoin prices, which are currently hovering around $93,000. But at the same time, the total network computing power continues to hit new highs, and the squeeze effect on unit computing power is still continuing, making small and medium-sized miners still face operating pressure on the margin of profit and loss even against the background of the recovery of hash prices.

It is worth noting that some miners who previously chose to hold on to their bitcoins when the price of bitcoin was low may realize additional income if they choose to sell their bitcoins during this round of price rebound, thereby alleviating cash flow pressure in the short term. Overall, whether miners income can achieve a sustainable recovery still depends on the continued performance of bitcoin prices and changes in on-chain transaction activity in the future.

Bitcoin miners daily income data

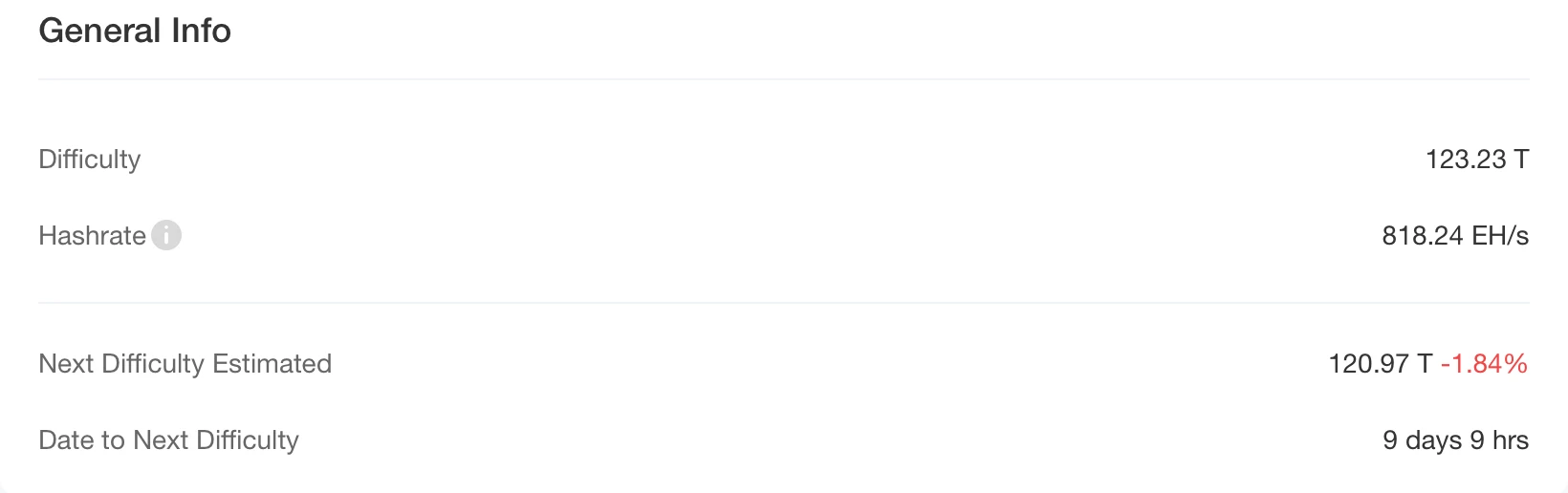

5. Energy costs and mining efficiency

The Bitcoin network completed the latest round of difficulty adjustment at 17:13:37 on April 19, 2025 (block height 893,088), with the difficulty increased by 1.42% to 123.23 T, setting a new historical peak. As of the time of writing on April 25, 2025, the total network hashrate is 818.24 EH/s, and the current total network mining difficulty is 123.23 T. The next round of difficulty adjustment is expected to take place on May 4, with an expected downward adjustment of about 1.84%, which will reduce the difficulty to 120.97 T. This trend shows that as the network hashrate increases and mining efficiency improves, Bitcoins mining difficulty will continue to fluctuate, and miners participation and the markets hashrate distribution may change.

According to the latest model data from MacroMicro, as of April 23, 2025, the unit production cost of Bitcoin is approximately $96,160.26, while the spot price on that day is $93,699.11, and the corresponding mining cost-to-price ratio is 1.03. Compared with the previous stage when the cost was higher than the price, the ratio has tended to balance as the price of Bitcoin has rebounded. This change shows that the profit and loss margin of miners is gradually improving, and profitability is being alleviated with the rebound of market prices, but the overall profit space is still relatively limited, and it is necessary to continue to pay attention to the dynamic changes in price trends and computing power input.

In addition, a report released by TheMinerMag on April 21, 2025 pointed out that due to the volatility of Bitcoin prices and structural cost increases, the economics of Bitcoin mining deteriorated overall from March to April, and both industry profit margins and valuations were squeezed. With the recent rebound in Bitcoin prices, market expectations may bring some improvements to the cost structure and profitability of miners, but the overall competitive situation remains severe.

Bitcoin mining difficulty data

6. Policy and regulatory news

Trump news:

1. Trump says he will reach an agreement with China within a month

On April 18, US President Trump said on the 17th local time that he was confident that China and the United States would reach an agreement. He believed that the two sides would reach an agreement in the next three to four weeks, and said that if an agreement could not be reached, goals would be set and adjustments would be made.

2. Trump: The cryptocurrency industry urgently needs clear regulatory policies

On April 23, US President Trump said that the cryptocurrency industry urgently needs clear regulatory policies.

3. Trump: No intention to fire Powell, calls on the Fed to cut interest rates

On April 23, Trump said at the swearing-in ceremony of SEC Chairman Atkins that he had no intention of firing Federal Reserve Chairman Powell and called on the Fed to cut interest rates. He was disappointed that the Fed did not cut interest rates faster and said that it was a perfect time to cut interest rates.

4. Trump: Tariffs on China will not be as high as 145%, they will drop significantly but will not be zero

On April 23, Trump said that tariffs on Chinese goods will not be as high as 145%, will be significantly reduced, but will not be zero.

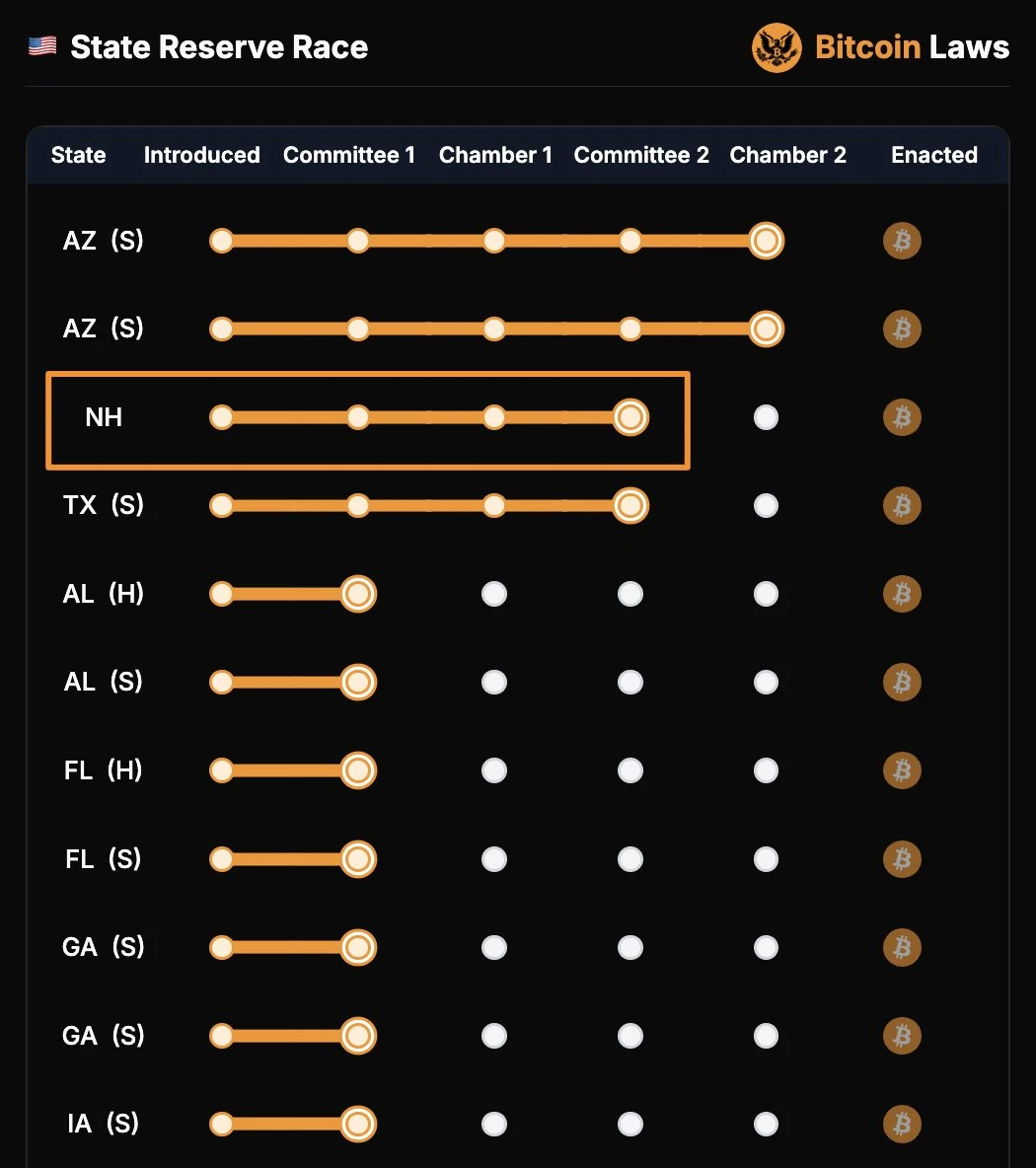

Related news on the bills advancement:

1. Texas House of Representatives holds public hearing on Bitcoin Reserve Bill SB 21

On April 24, the Texas House Government Efficiency Delivery Committee held a public hearing on the Bitcoin Reserve Bill SB 21. The bill is currently in the pending status, indicating that the committee has not yet held a final vote.

2. New Hampshire Senate Finance Committee votes to pass Bitcoin Reserve Bill

On April 24, the New Hampshire Bitcoin Reserve Act HB3 02 passed the Senate Finance Committee with 4 votes in favor and 1 vote against.

Related images

7. Mining News

UN report: Illegal cryptocurrency mining has become a powerful tool for transnational criminal gangs to launder money

On April 21, the United Nations Office on Drugs and Crime (UNODC) reported that transnational criminal gangs in Southeast Asia used illegal cryptocurrency mining, stablecoins and the Telegram black market to rapidly expand global money laundering and fraud activities involving billions of dollars, threatening global security.

LAPD seizes $2.7 million worth of stolen Bitcoin mining machines

On April 23, the Los Angeles Police Department cracked a theft case and seized Bitcoin mining machines worth $2.7 million. Other stolen items included tequila, pet food and coffee. Two suspects related to South American criminal gangs were arrested. It is reported that the investigation of the case is still ongoing and more suspects may be arrested in the future. The Los Angeles Police Department has not yet disclosed how to deal with these Bitcoin mining machines.

Related images

8. Bitcoin related news

Bitcoin holdings of global companies and countries (statistics for this week)

1. El Salvador once again slightly increased its Bitcoin holdings

El Salvador added 1 bitcoin on April 25, and his total holdings now stand at 6,157.18 bitcoins, with a total value of approximately $577 million.

2. Strategy increased its holdings by 6,556 bitcoins

Strategy purchased 6,556 bitcoins for approximately US$555.8 million last week and currently holds a total of 538,200 bitcoins, making it one of the worlds largest bitcoin holders.

3. BlackRock purchased nearly 955 more Bitcoins through ETFs

BlackRock increased its holdings of 954.535 bitcoins through its IBIT fund, worth approximately US$84.18 million, showing a continued bullish attitude.

4. Financial giant Fidelity once again increased its holdings of Bitcoin worth more than $123 million, and has increased its holdings for three consecutive days

On April 25, Fidelity increased its holdings of 1,331.15 bitcoins through its Bitcoin exchange-traded fund FBTC about 13 hours ago, with a value of $123.24 million. Fidelity has increased its holdings of bitcoin for three consecutive days this week, with a total increase of about 4,706 bitcoins.

5. Australias Monochrome spot Bitcoin ETF holdings increased to 343 BTC

As of April 24, Australias Monochrome Spot Bitcoin ETF (IBTC) had increased its holdings to 343 bitcoins, with a market value of approximately US$49.6851 million.

6. Multiple Wall Street institutions collectively increased their holdings of Bitcoin. As the price of Bitcoin returned to $90,000, large institutions such as Bitwise and ARK Invest increased their holdings today, and market confidence has significantly improved.

Economist: Bitcoin could rise to $138,000 in the next three months

On April 19, according to Cointelegraph, economist Timothy Peterson pointed out in his latest analysis that BTC may rise to $138,000 in the next three months. He believes that the current US High Yield Index Effective Yield is the key. The current value of this indicator has exceeded 8%. If it follows the historical trend, this is likely to make the price of Bitcoin reach $75,000 to $138,000 within 90 days.

Michael Saylor emphasizes Bitcoin has zero counterparty risk

On April 20, Michael Saylor, founder of Strategy (formerly MicroStrategy), posted on the X platform that Bitcoin does not have counterparty risk, does not rely on companies, countries, creditors, legal currencies, competitors or culture, and is not even afraid of chaos.

Related images

Standard Chartered: Concerns about Fed independence could push Bitcoin to all-time highs

On April 22, Jeff Kendrick, an analyst at Standard Chartered Bank, said that if concerns about the independence of the Federal Reserve continue, Bitcoin could rise to an all-time high. He said that due to its decentralized ledger, cryptocurrency is a hedge against the risks of the existing financial system. The risk of U.S. Treasuries was reflected after Trump hinted that he might remove Federal Reserve Chairman Powell because of his desire to cut interest rates. Kendrick said that the yield premium that investors pay for buying long-term Treasury bonds relative to short-term Treasury bonds has risen sharply, which has benefited Bitcoin. According to LSEG data, Bitcoin rose to a six-week high of $90,459. Standard Chartered Bank expects the price of Bitcoin to rise to $200,000 by the end of 2025.

Bitcoins market share once reached 64.67%, but now falls back to 64.30%

According to TradingView data, Bitcoins market share (BTC.D) rose to 64.67% this morning, a new high since February 2021, and has now fallen back to 64.30%. The high market share of Bitcoin shows the silence of the cottage market, but it may also mean that a bottoming out rebound is coming.

According to previous historical data, when Bitcoins market share reached 60% in November last year, altcoins started a small bull market. In 2019 and 2021, Bitcoins market share reached a high of 70%, followed by a magnificent general rise.

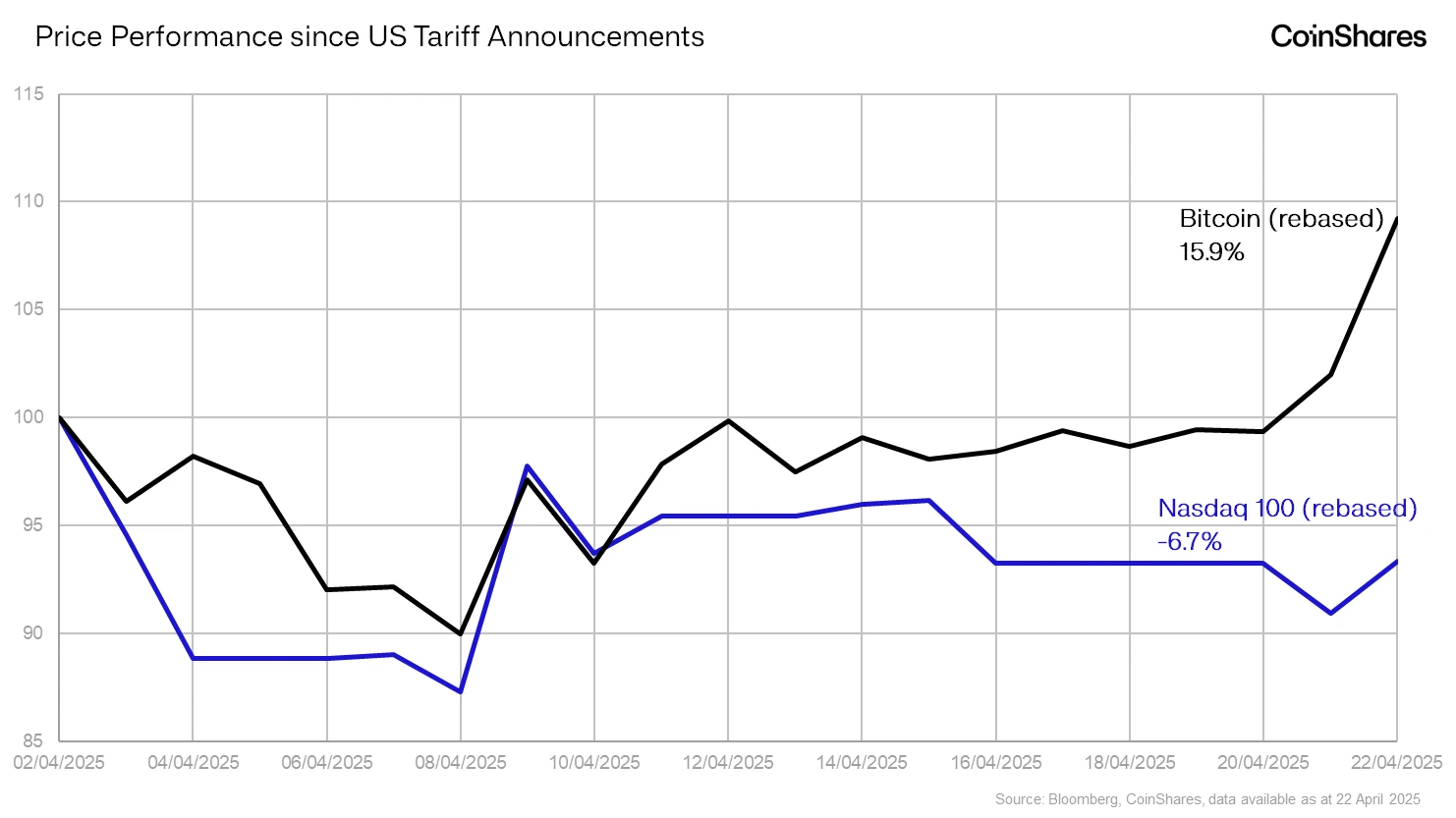

CoinShares Research Director: Bitcoin has outperformed the Nasdaq by 15.9% since the US tariff announcement

On April 23, CoinShares research director James Butterfill wrote on the X platform that since the U.S. Liberation Day tariff announcement on February 2, Bitcoin has outperformed the Nasdaq 100 Index by 15.9%, highlighting its advantages as a decentralized investment asset.

Related images

Survey: Most Hedge Funds Expect Bitcoin Dominance to Continue to Rise

According to a survey conducted by Crypto Insights Group on 50 hedge funds with more than $5 billion in assets under management on April 23, 70% of respondents expect Bitcoins dominance in the crypto market to further increase in the next six months, three times the same period last year. This trend may delay the arrival of the alt season. The report pointed out that the three major factors driving the rise in Bitcoins dominance include: Against the backdrop of increasing macroeconomic uncertainty, Bitcoin has shown strong resistance to declines, attracting more safe-haven funds; The launch of Bitcoin ETFs and the establishment of the US Strategic Bitcoin Reserve provide institutional investors with a clearer regulatory framework; Most altcoins have performed poorly, and investors are more inclined to choose Bitcoin with higher liquidity and lower risks.

Still, Andy Martinez, CEO of Crypto Insights Group, said the alt season is not completely over and funds are shifting to projects with real revenue, transparent financials and reasonable token issuance plans.

Coinbase executive: Sovereign wealth funds are buying Bitcoin in large quantities

On April 24, John DAgostino, head of strategy for Coinbases institutional department, said that in April 2025, sovereign wealth funds and other institutions were accumulating Bitcoin in large quantities, while retail investors were exiting the market through ETFs and spot transactions.

In a recent interview, the Coinbase executive compared Bitcoin to gold and said that many institutional investors buy Bitcoin as a hedge against monetary inflation and macroeconomic uncertainty.

“Bitcoin trades based on its core characteristics, which are similar to gold, scarcity, immutability and portability as a non-sovereign asset,” the executive said. “So it trades the way those who believe in Bitcoin want it to trade.”

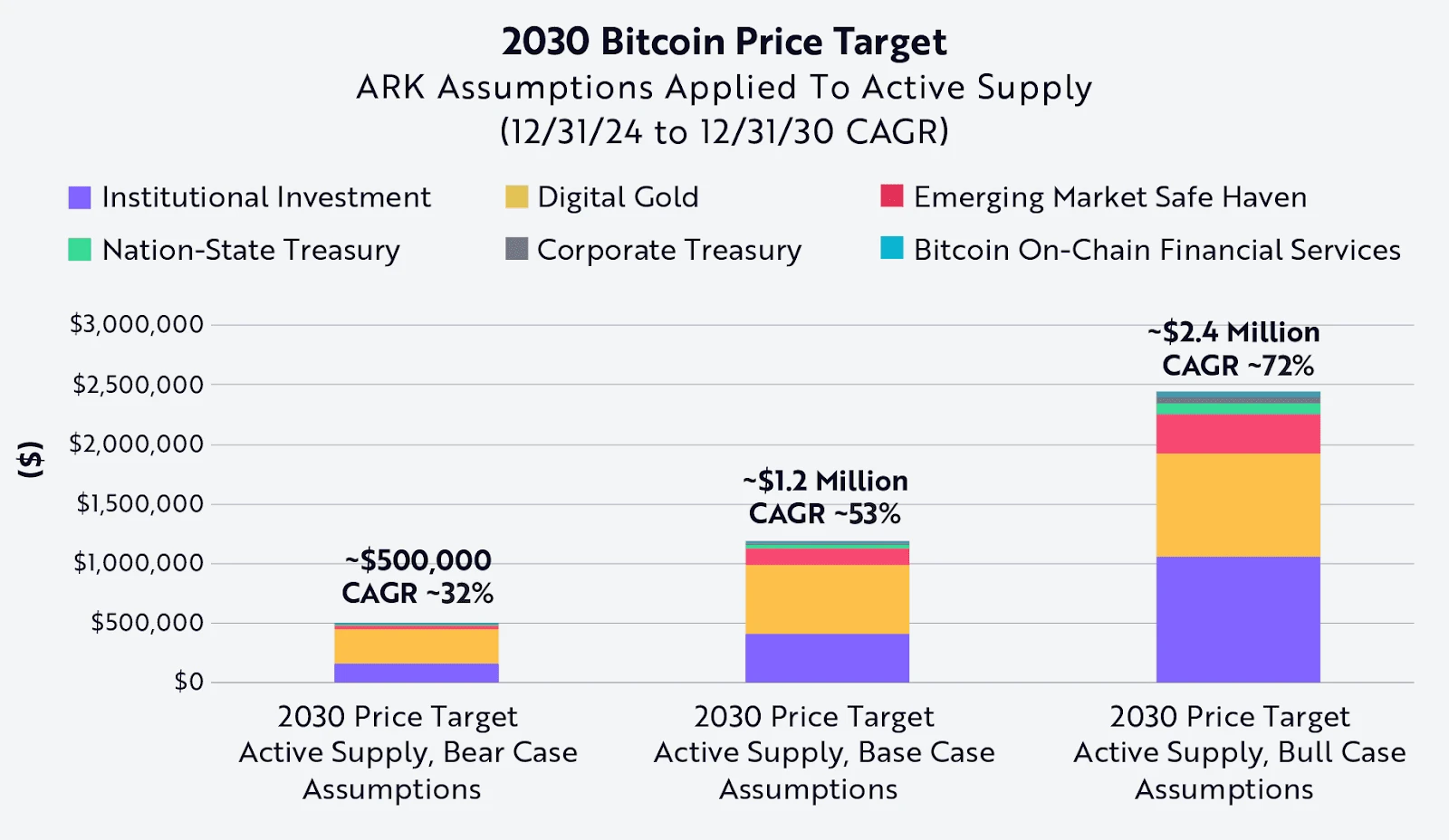

ARK raises its 2030 Bitcoin bull market forecast to $2.4 million, citing institutional investment as the main reason

On April 25, ARK Invest raised its price target for Bitcoin in the bull market scenario in 2030 to about $2.4 million in its latest report, with a base scenario of $1.2 million and a bear market scenario of $500,000. The report pointed out that institutional investment contributes the most to the bull market scenario. ARK said that Bitcoin is increasingly accepted as a more flexible and transparent means of storing value.

Related images