Organize - Odaily

Author - Qin Xiaofeng

1. Overall overview

Recently, a number of companies have submitted Ethereum ETF applications, namely: (1) Bitwise has submitted an updated prospectus for an equal-weighted Bitcoin and Ethereum futures ETF. This ETF may be launched together with VanEcks ETF, and its expense ratio is 0.85%, trading code is BTOP; (2) Kelly ETFs cooperated with HashKey to apply for Ethereum strategy ETF, code is EX, and the fee rate is 0.98%; (3) Asset management giant Invesco (Invesco) has submitted Ethereum to the US SEC Spot ETF application, named Invesco Galaxy Ethereum ETF, Galaxy Digital Funds LLC will serve as the execution agent of the ETF to promote its Ethereum sales; (4) Grayscale has joined forces with NYSE Arca to apply for the Grayscale Ethereum Trust (Grayscale Ethereum Trust) into an Ethereum spot ETF.

Glassnode data shows that the exchange’s Ethereum balance is 14,551,400.379 ETH, continuing to hit a five-year low. Dune statistics show that the median gas of Ethereum hit a new low in a year, falling to 8.15 gwei on October 1. The previous low was 5.83 gwei on October 2, 2022.

In the secondary market, the current ETH price may continue to consolidate in the short term, with support at $1,600 and resistance at $1,650.

2. Secondary market

1. Spot market

OKX QuotesData shows that ETH once rose to 1,780 USDT last week and closed at 1,632 USDT during the week, a month-on-month decrease of 3%.

ETH daily chart via OKX

The daily chart shows that the price is currently consolidating below $1,650. The lower support is $1,600. If it falls below, it may fall further to $1,550; the upper resistance is $1,650.

2. Network operation status

EtherscanData shows that the number of blocks produced by the Ethereum network in the past week was 50,080, a month-on-month increase of 0.1%; the number of weekly active addresses was 2,644,663, a month-on-month decrease of 3.1%; the block reward income was 2,664 ETH, a month-on-month increase of 10.7%; the weekly ETH The number of items destroyed reached 7,250, a decrease of 10.9% from the previous month.

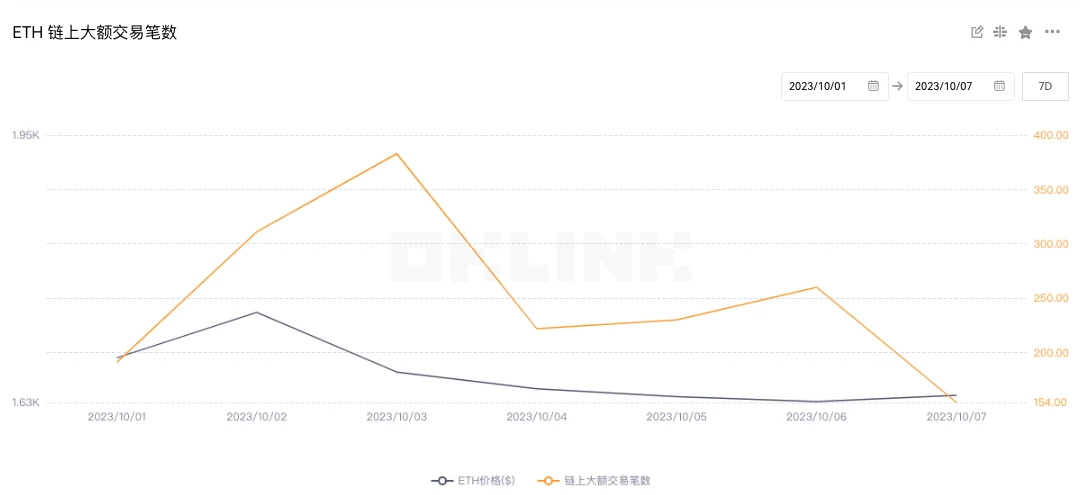

3. Large amount changes

OKlink dataIt shows that the number of large-value transactions on the chain reached 1,751 last week, an increase of 78.3% compared with the previous week (982). The trading enthusiasm of giant whales has increased significantly.

4. Rich list address

OKLink dataIt shows that the current total deposits of ETH 2.0 have reached 27.51 million ETH, with a pledge rate of 22.88%. Since the Shanghai upgrade, the net inflow has exceeded 7.5 million ETH; from the perspective of the distribution of ETH holding addresses, exchanges accounted for 8.46%, a month-on-month decrease of 0.05% ; DeFi projects accounted for 31.39%, a month-on-month increase of 0.35%; large addresses (top 1,000 addresses excluding exchanges and DeFi projects) accounted for 29.28%, a month-on-month decrease of 0.07%; other addresses accounted for 30.87%, a month-on-month decrease of 0.23% .

5. Lockup data

DeFiLlamaData shows that the value of locked-up collateral on the chain rose from US$20.63 billion to US$20.91 billion last week, a month-on-month increase of 1.3%; from a single project perspective, the top three lock-up values are: Lido US$14.41 billion; MakerDAO 4.44 billion USD; Aave USD 4.14 billion;

3. Ecology and Technology

1.Technological progress

Christine Kim, Vice President of Galaxy Research, posted a summary of the 171st Ethereum Core Developer Execution (ACDE) conference call. On September 28, developers discussed the progress of Dencun upgrade testing, EIP-4788 early audit results, and the beacon block root in the EVM. , Holesky testnet launch, EIP-7503, preliminary feedback on zero-knowledge wormholes, only changing the EIP-6780 and SELFDESTRUCT specifications in the same transaction.

Regarding the Dencun test, the Devnet-9 release has been delayed again, and the developers plan to launch Devnet-9 at the end of September or this week. The developer also stated that after the launch of Devnet-9, the 10th Devnet needs to be launched for Dencun upgrade, and the life cycle of Devnet-10 will be relatively short. Developers will also test the validator workflow to obtain MEV using MEV-Boost software on Devnet-9 and 10.

Regarding EIP-4788, the developers stated that they have completed three audits conducted by Chainsecurity, Trail of Bits, and Dedaub. One of the most important findings from the audit is that users can query smart contract addresses with a zero timestamp, even if no value is set for the zero timestamp. Before this meeting, the Holosky testnet was launched.

The developers also discussed EIP-7503, which proposes a new privacy solution for Ethereum based on zero-knowledge cryptography technology that will provide users with more robust transactions than cryptocurrency mixers like Tornado Cash privacy guarantee. It will also provide users with a way to prove that the funds in their accounts have not been obfuscated by the privacy protocols supported by EIP-7503, effectively allowing users to submit a proof of innocence for their accounts for regulatory and compliance purposes. -of-innocence).

Guillaume Ballet from the Geth client team raised a small issue in the EIP-6780 specification. Ballet noted that the EIP specifies the behavior of SELFDESTRUCT in a post-Verkle environment.

Christine Kim, Vice President of Galaxy Research, published a document summarizing the 119th Ethereum Core Developer Consensus Conference (ACDC). This meeting mainly discussed the Cancun/Deneb test, including the latest developer-centered test network Devnet-9. Status and health, and Devnet-10 startup time. Developers will re-evaluate the progress of testing of the Cancun/Deneb upgrade during the next ACD call and revisit the testing schedule.

In addition, she said that regarding the launch time of Devnet-10, not all developers are confident that the next devnet will be launched within the next two weeks, especially considering that customer teams are still discovering and solving bugs on Devnet-9; nor All developers participating in the call were confident in their commitment to upgrade the public Ethereum testnet Goerli ahead of the start of Devconnect in mid-November.

2. Voice of the Community

(1) Ethereum core developers: Lido’s market share of 33% does not mean that Ethereum is in trouble

Ethereum core developer eric.eth posted on the Multiple nodes must collude and destroy their cause. eric.eth further stated that even then, the social layer can step in and fork malicious Lido node operators and move to a new chain.

Ethereum co-founder Vitalik Buterin wrote about changes to the protocol and staking pools that may increase decentralization and reduce consensus overhead. The article points out that there are currently two types of Ethereum pledges, one is the node operator and the other is the client. Vitalik believes both have flaws: centralization risks for node operators, and unnecessary burden on the consensus layer.

Vitalik believes that decentralization can be increased by expanding representation options. Representatives can choose which node operators to delegate their interests to. Node operators will have a weight in the consensus that is proportional to the total stake delegated to them; delegators can choose to play a role in the consensus, which will be lighter than staking in full, and Not affected by long withdrawals and substantial risks, but will still act as a check on node operators.

Additionally, there is value in splitting staking into a slashable tier of higher complexity that functions every session but may only have 10,000 participants, while the lower complexity tier is only called in occasionally Come and participate. Lower complexity tiers may be completely exempt from cuts, or may randomly offer their participants the chance to deposit temporarily (i.e. for several periods) and be subject to cuts. In practice, this could be achieved by raising the validator balance cap and then implementing a balance threshold (e.g. 2048 ETH) to determine which existing validators move into higher or lower complexity tiers.

3.Project trends

(1) Blocknative will suspend its MEV-Boost Relay and related Ethereum block builders

Blocknative said on September 27: After extensive internal debate and consultation with our board of directors, it will suspend its MEV-Boost Relay and related Ethereum block builders. The measure will be suspended on September 27, ET It takes effect at 11 a.m. and the Relay Data API will continue to provide data downloads until October 4. Blocknative said the change does not affect Validator, Builder, Searcher or other network operations. In addition, Blocknative also stated: We are making these changes to focus our efforts on economically viable opportunities that are consistent with our values, interests and capabilities. (The Block) Previous news, Blocknative completed a $15 million A- 1 round of financing, led by Blockchain Capital and others.

(2) Aave initiated a vote to add FXS to Ethereum V3 temperature check

The governance platform shows that Aave initiated a temperature check vote to add FXS, the governance token and utility token of Frax Finance, to the Ethereum V3 liquidity pool. The proposal states that Aave could promote diversification of GHO collateral by adding FXS. In addition, FXS obtained from the Aave V3 pool can be used as a new strategic asset for GHO or new aToken. The addition of FXS will make it an important lending and staking asset in the Aave ecosystem, similar to tokens such as BAL, SNX, and CRV. The current proposal has a support rate of 99.99% and has not yet reached the quorum. Voting will end on October 10.

(3) OP Labs has launched fault proof on the OP Goerli test network

OP Labs has launched fault-proofing on the OP Goerli Testnet network, aiming to address critical flaws in OP Labs software. Proof-of-failure, sometimes called proof-of-fraud, is at the heart of Optimistic Rollup technology, a system that connects a Layer 2 blockchain, or Rollup, to a primary Layer 1 blockchain such as Ethereum; This technology is used to prove whether certain data in Rollup can be trusted. Deploying proof-of-failure on testnet is the first step in implementing proof-of-failure on the OP stack. OP Labs said the second phase will focus on achieving decentralization and should eventually also be able to accommodate so-called zero-knowledge proofs, relying on a promising cryptographic technology that can be used as an alternative to failure proofs. (CoinDesk)

(4) DeFi protocol Composable Finance has been launched on the Ethereum IBC test network

Composable Finance, the DeFi protocol of the Polkadot ecosystem, announced that it has officially launched the Ethereum IBC test network. Users can link the test network through MetaMask and Keplr wallets, and allow users to transfer Picassos native token PICA between Ethereum and Cosmos through IBC.

(5) Immutable plans to launch the zkEVM mainnet from December this year to January next year

Immutable officially released the mainnet launch roadmap. Immutable zkEVM will receive technical upgrades in the next few months in preparation for the mainnet launch. In November 2023, it is planned to rebuild the Immutable zkEVM test network and upgrade its first EVM client from Polygon Edge to Geth to ensure that Immutable zKEVM is as close to Ethereum as possible while being fully compatible with the entire Ethereum tool ecosystem; from December to The zkEVM mainnet will be launched in January next year, and developers will be invited to join in batches before being opened to the public.

In 2024, Immutable will offer a dedicated application chain with the same technology stack and functionality as Immutable zkEVM, but with a unique level of customization; a key future milestone for Immutable zkEVM will be the introduction of zk-prover, which will truly make it zk ”EVM moment and provides a trustless Ethereum and Immutable zkEVM cross-chain bridge.

(6) Multiple companies submitted Ethereum ETF applications

Recently, a number of companies have submitted Ethereum ETF applications, namely: (1) Bitwise has submitted an updated prospectus for an equal-weighted Bitcoin and Ethereum futures ETF. This ETF may be launched together with VanEcks ETF, and its expense ratio is 0.85%, trading code is BTOP; (2) Kelly ETFs cooperated with HashKey to apply for Ethereum strategy ETF, code is EX, and the fee rate is 0.98%; (3) Asset management giant Invesco (Invesco) has submitted Ethereum to the US SEC Spot ETF application, named Invesco Galaxy Ethereum ETF, Galaxy Digital Funds LLC will serve as the execution agent of the ETF to promote its Ethereum sales; (4) Grayscale has joined forces with NYSE Arca to apply for the Grayscale Ethereum Trust (Grayscale Ethereum Trust) into an Ethereum spot ETF.

Meanwhile, Volatility Shares withdrew its Ethereum futures ETF application. Justin Young, co-founder of Volatility Shares, said: “We don’t see an opportunity at this point in time.” When asked whether the company still plans to launch an Ethereum futures ETF at a later date, Young said that it will continue to apply, but The program application time is yet to be re-determined.

(7) UBS conducts money market fund tokenization pilot on Ethereum

UBS Asset Management (UBS) has conducted a pilot tokenization of money market funds on the Ethereum chain as one of the pilots of the Monetary Authority of Singapore (MAS)’s “Guardian Plan”. A key advantage of fund tokenization is that by expanding coverage to increase liquidity and expand the investor base, high net worth individuals may be able to invest in funds that were previously only available to institutions. In the first pilot transaction, UBS Asset Management executed the tokenized subscription and redemption of the fund in the form of a smart contract, and plans to work with more partners to explore other investment strategies in further pilots.

Thomas Kaegi, head of asset management for Singapore and Southeast Asia at UBS, said: “This is an important milestone in understanding the tokenization of funds and builds on UBS’s expertise in the tokenization of bonds and structured products. Through this exploration In this initiative, we will work with traditional financial institutions and fintech providers to help understand how to improve market liquidity and market access for customers. (ledgerinsights)

4. Data Pivot

(1)Glassnode: Exchange ETH balance hits 5-year low

Glassnode data shows that the exchange’s Ethereum balance is 14,551,400.379 ETH, continuing to hit a five-year low.

According to Cryptoslam data, NFT sales on Ethereum in September were approximately $141,409,363.10, the lowest since February 2021. The data also shows that the total transaction volume of NFT sales on Ethereum in September was approximately 756,000 (including 115,561 independent buyers and 98,751 independent sellers), the lowest record since August 2021.

(3) Ethereum Gas median hit a new low in a year

Dune statistics show that the median gas of Ethereum hit a new low in a year, falling to 8.15 gwei on October 1. The previous low was 5.83 gwei on October 2, 2022.