introduction

Recently, Guatian often receives consultation requests from project parties, asking which public chain should be deployed, the performance differences of each public chain, what the ecological layout and platform traffic are like, and what the long-term and short-term impact will be on the project. Just this year, we have experienced the issuance of several popular public chain projects, including Arbitrium, Sui, and the long-awaited zkSync. Everyone is eager to popularize and analyze the basic knowledge of public chains. So we specially set up a public chain research team to prepare an overall review of the public chains that are very active and attract a lot of attention in the market. We will conduct a comprehensive analysis of the performance level, friendliness and support of these public chains for the GameFi project from the perspective of GameFi project parties and users.

The initial plan is to write 4 long research articles, with the main contents distributed as follows:

The first article starts from the development history of Ethereum, chain game ecology, and existing problems, and further extends to the Ethereum 2.0 upgrade roadmap;

The second article starts from the Optimistic Rollup track and analyzes the basic technical route of the OP series, as well as the differences between several representative projects (Arbitrium, Optimism, opBNB, etc.) in terms of technology, market and support for chain games;

The third article focuses on analyzing the technology of the zk Rollup track, as well as related information on representative projects such as zkSync, StarkNet, Polygon zkEVM, Linea, and Scroll;

The fourth article analyzes the technical features, chain game ecology and technical support of other popular Layer 1 public chains, such as Solana, Aptos, Sui, Near, Avalanche, etc.

I believe that through the above systematic analysis, both project parties and users will have a more comprehensive and in-depth understanding of the mainstream public chains in the market today, and can also better deploy and invest in projects based on different public chains. Relevant decisions provide a more solid theoretical foundation.

Beginning

In the wave of the digital age, Ethereum shines as a bright star at the top of the blockchain world. Since its inception, Ethereum has been a cutting-edge promoter of blockchain and smart contract technology, constantly creating new chapters of history. As the pioneer of blockchain games, Ethereum has been leading the development of the GameFi track. Guatian will lead you through the development and upgrade path of Ethereum, exploring how this ecosystem has evolved from a start-up project into the worlds most important public chain ecosystem.

1. The origin and development history of Ethereum

Ethereum has been an exciting story since its first day, full of challenges, innovations and struggles.

At the end of 2013, Ethereum Vitalik Buterin released the Ethereum white paper, which not only inherited some of the design concepts of Bitcoin, but also opened a new chapter in the development of blockchain. Then in 2014, Ethereum launched an ICO, raising approximately $18 million worth of Bitcoin in 42 days, shocking the entire blockchain community.

On July 30, 2015, Ethereum successfully released its first version, Frontier, and at the end of the year proposed a standard that had a profound impact on the industry - ERC 20.

However, not long after, 2016 became the most turbulent year for Ethereum. In March 2016, Ethereum launched the Homestead upgrade, a major network upgrade. This upgrade aims to improve the stability and security of Ethereum and marks Ethereum entering a more mature stage. The Homestead upgrade improves Ethereum’s virtual machine, smart contract development tools, and network protocols, attracting more developers and enterprises to participate. However, the good times did not last long. Between May and June 2016, the Ethereum community experienced a major crisis called The DAO incident. The DAO is a decentralized autonomous organization that had a vulnerability in its smart contract that allowed attackers to steal large amounts of ether. The incident sparked a divide in the community, with one party advocating a hard fork to recover stolen ether and the other insisting on the principle of not modifying the blockchain. Eventually, a hard fork occurred and Ethereum split into two different blockchains, Ethereum (ETH) and Ethereum Classic (ETC). Ethereum Classic adheres to the principle of non-interference in the code and continues to maintain the Ethereum genesis block unchanged.

If 2016 marked Ethereum’s evolution from a startup project to a more mature and sophisticated blockchain platform, 2017 was Ethereum’s real boom moment. In early 2017, the Ethereum Enterprise Alliance (EEA) was established to promote the application of the Ethereum blockchain in the enterprise world. The alliance has attracted many well-known companies, including Microsoft, IBM, Intel, etc., to jointly research and develop Ethereum technology.

In October 2017, Ethereum completed the first phase of the Metropolis upgrade, called “Metropolis Byzantium.” This upgrade introduces a series of improvements, including better privacy protection, improved smart contract security, and reduced transaction costs. Metropolis Byzantium further enhances Ethereum’s functionality and paves the way for future growth.

Along with the mainnet upgrade, the ICO (Initial Coin Offering) craze has swept the entire blockchain world. In 2017, Ethereum’s smart contract platform became the first choice for many new projects, and many new cryptocurrency and blockchain projects raised funds through ICOs. This craze led to a rapid increase in the price of Ethereum and attracted a large number of investors and developers. The price of Ethereum rose from a few dollars at the beginning of 2017 to hundreds of dollars by the end of the year. This sparked global attention and pushed Ethereum to the well-deserved second-largest market capitalization currency in the cryptocurrency market. But the flip side of the boom, due to the proliferation of transactions and smart contracts, has brought about Ethereum’s increasingly serious problems of transaction congestion and high gas fees. This has caused the Ethereum community to start paying attention to network expansion and performance improvement issues, and has also paved the way for the subsequent continuous upgrade of Ethereum.

By 2018, Ethereum faced serious challenges. In early 2018, Ethereum and other cryptocurrencies experienced a huge price crash, causing the price of Ethereum to plummet. This sparked market volatility and investor concerns, reflecting the instability of the crypto market. In the winter of cryptocurrencies, Ethereum’s upgrades have not stopped. The development of Ethereum 2.0 has made important progress and determined the overall route of switching from Proof of Work (PoW) to Proof of Stake (PoS) to improve scalability and energy efficiency. Meanwhile, the Ethereum network continued to face congestion and high transaction fees in 2018 due to increased transaction volume. This has led to increased focus on network performance and scalability, and many discussions on how to address these issues.

In 2018, regulators around the world began to adopt stricter regulations on cryptocurrencies and ICOs. This has resulted in some ICO projects being investigated and sanctioned, and the crypto industry has begun to focus on legal compliance issues. Despite market volatility, 2018 saw the rise of the decentralized finance (DeFi) ecosystem. DeFi projects are rapidly growing on Ethereum, including decentralized exchanges, lending platforms, and stablecoins, bringing new opportunities and innovation to the Ethereum ecosystem.

2019 is a year of innovation for Ethereum. The Ethereum 2.0 project made important progress in 2019, including the release of the Beacon Chain, marking Ethereums gradual move towards a more scalable and energy-efficient network. 2019 was also the year that the DeFi ecosystem exploded. A large number of DeFi projects have emerged on Ethereum, including lending platforms, decentralized exchanges, stablecoins, etc. These projects have attracted billions of dollars in capital inflows, bringing decentralized innovation to the financial sector.

With the rise of DeFi, regulators have begun to focus on the compliance of Ethereum and other blockchain projects. This has resulted in some projects being required to take steps to comply with laws and regulations, which has also led to discussions about the balance between decentralized nature and compliance. Stablecoins on Ethereum, such as USDT, DAI, and USDC, have become important assets in the crypto world, providing stability and liquidity for crypto transactions. 2019 also witnessed the rise of blockchain games, with some games on Ethereum starting to attract large numbers of users. These games often use NFTs (non-fungible tokens) to give players true ownership and interoperability.

From its inception, to its development and maturity, until it reaches its peak, Ethereum has experienced constant changes and challenges, which has fully proved its huge potential as a smart contract platform. From the initial Homestead upgrade to hard forks, from the craziness of ICOs to the increase in regulation, and the initial rise of DeFi and chain games, the Ethereum community continues to work hard to promote technological progress and create infinite possibilities for the future of the blockchain. Below we will focus on elaborating on the development history of Ethereum’s chain games.

2. The rise of Ethereum on-chain games

If you want to sort out the development history of blockchain games, the first place to look is the Ethereum ecosystem. From 2017 to the present, Ethereum has flourished, and many phenomenal chain games have appeared. We have selected several representative projects to talk about their development history and existing problems.

When it comes to the originator of blockchain games, most people would think of it as CryptoKitties in 2017. Although it is not strictly the first blockchain game, it is indeed the first to become popular on Ethereum and be widely used. A phenomenal game that most people are familiar with. It is a game based on collecting and breeding digital cats. The game combines ERC-721 for the first time and becomes the earliest NFT project. Each digital cat is a unique NFT. The adoption, breeding and trading of kittens has successfully ignited the FOMO sentiment in the crypto community. The price of a crypto kitten, which is as high as one million, has also shocked most ordinary players. The success of CryptoKitties has aroused the interest of a large number of players/project parties in NFT. Due to the popularity of the game, transaction congestion and high fees have become the norm, which has also exposed the scalability problem of the Ethereum network.

Now in 2018, Gods Unchained has entered everyone’s attention. It is a Hearthstone card game on Ethereum. Players can collect, trade and fight cards with different attributes. The game ensures the security of cards by using NFT on Ethereum, thus launching a deep honeymoon period between chain games and card games, and ushering in an era where everything can be Fi. However, due to limitations of the Ethereum network, the game still suffers from transaction delays and high fees during peak periods.

The last wave of blockchain gaming projects that truly reached its peak is undoubtedly Axie Infinity. Axie is a collection and combat game based on Ethereum. Players can earn tokens by collecting, cultivating and trading Axie, the virtual creature in the game. When it came out in 2018, it had been tepid because it was in a deep bear market. It was not until a big bull market in 2021 that it rose rapidly, which not only greatly increased the playability of the game and the enthusiasm of players, but also brought about A new wave of popularity of P2E chain games has emerged, and a large number of game unions and gold farming studios have been born. At its peak, Axies monthly revenue exceeded $300 million, surpassing Honor of Kings to become the most profitable game in the world. The rise of the P2E model also represents the true arrival of the GameFi era. Through the DeFi+NFT model, it promotes the development and transactions of game assets based on blockchain technology. In addition to Axie Infinity, a number of games with similar models have also appeared on the market, such as Alien Worlds, Cryptoblades, Sorare, Zed Run, etc. However, due to the congestion and high transaction fees of the Ethereum network, the entry threshold and transaction costs of the game are too high, which also limits the participation of many players.

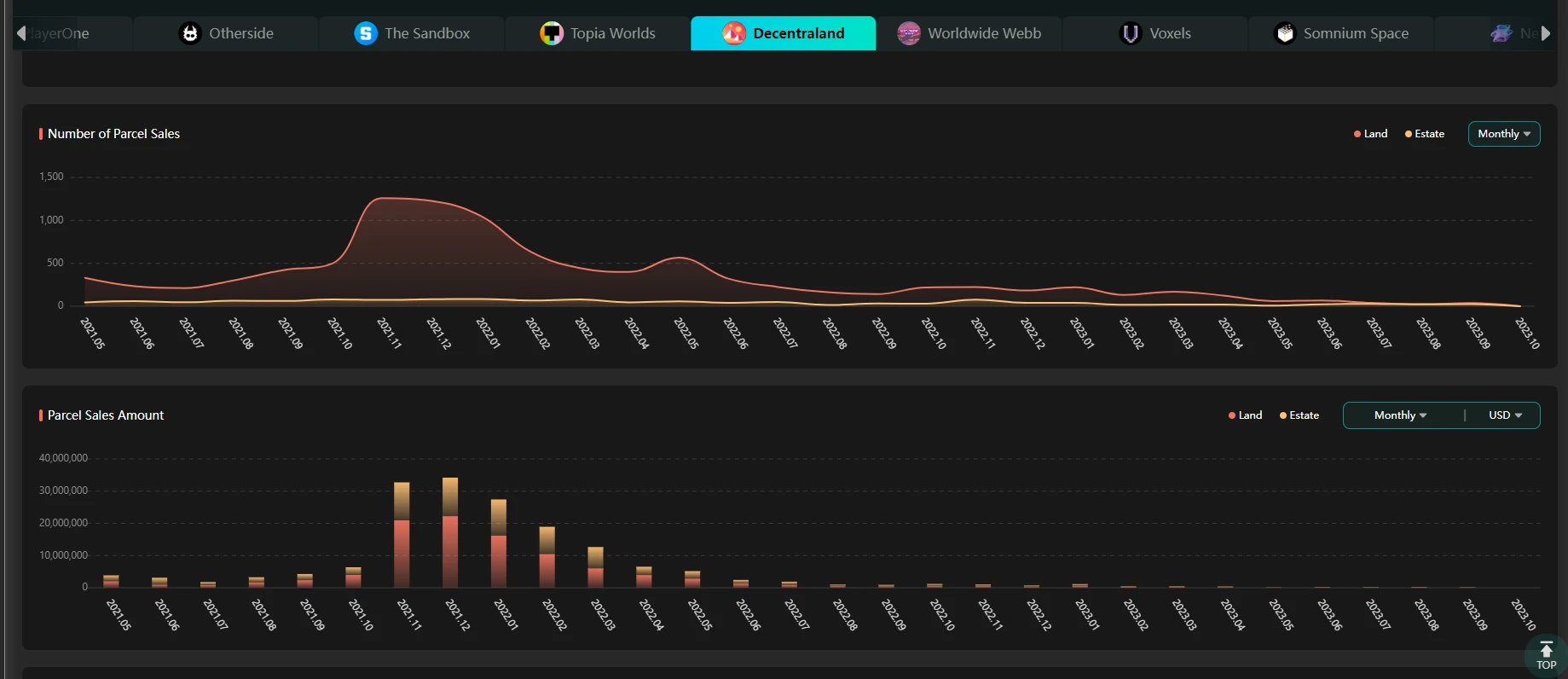

Another major branch of chain games is the so-called Metaverse faction, represented by Sandbox and Decentraland, Metaverse games that use Metaverse elements and land sales as the main economic model. Take Decentraland as an example, it is a virtual trading platform based on Ethereum where users can buy, collect and trade virtual land and assets in the game. Decentraland uses NFT to ensure the true ownership of virtual assets. However, the games insufficient optimization, poor experience, and performance limitations of the Ethereum network also hinder the further development of the game. As you can see in the chart below, the transaction amount and quantity of Decentraland land has continued to decline since peaking at the end of 2021 (about $34 million), and is now less than 1% of the peak.

1. Some pioneering achievements in Ethereum’s on-chain games

Ownership and Scarcity:Blockchain technology enables virtual assets in games to have real ownership and scarcity. Players can truly own and control their own game assets, and the supply of these assets is limited, giving virtual assets higher value and tradability.

Economic ecosystem:Ethereum on-chain gaming creates a real economic ecosystem for players. Players can earn virtual asset gains through their efforts and investment in the game, and trade, sell or lease them to other players. This economic model provides players with the opportunity to earn real value and provides greater motivation for game development.

2. Ethereum’s on-chain games face some problems and challenges

The biggest problem of Ethereum is its scalability. Due to the limited architecture, the expansion capability is insufficient and the transaction speed is slow. At the same time, the limited throughput also leads to high gas fees, especially in the centralized sale stage of project NFT and Token. Try to It may cause Gas War, paralyze the network, and push transaction fees to extremely high levels in an instant, which greatly affects the user experience.

3. Ethereum 2.0 upgrade

Ethereum launched the ETH 2.0 testnet at the end of April 2020, and after half a year of testing, it officially launched its 2.0 mainnet in December, marking the arrival of the Ethereum 2.0 era. Ethereum 2.0 is a major upgrade to the 1.0 mainnet, aiming to improve the performance, scalability, security, and sustainability of Ethereum to accelerate the use and application of Ethereum.

Why upgrade to 2.0?

1. Ethereum’s own high rates and congestion issues

We have also mentioned above that in chain game-related transactions, Ethereum’s high gas rate, slow confirmation speed, low efficiency and other issues have been criticized by users. Although some teams have optimized transaction efficiency and reduced fees to a certain extent by developing external applications (such as Flashbots), it is a drop in the bucket in the face of rising transaction demand. To fundamentally improve this problem, we must start from within the Ethereum public chain and upgrade its underlying architecture, so that the network can achieve a substantial performance leap.

2. The rise of competitive public chains

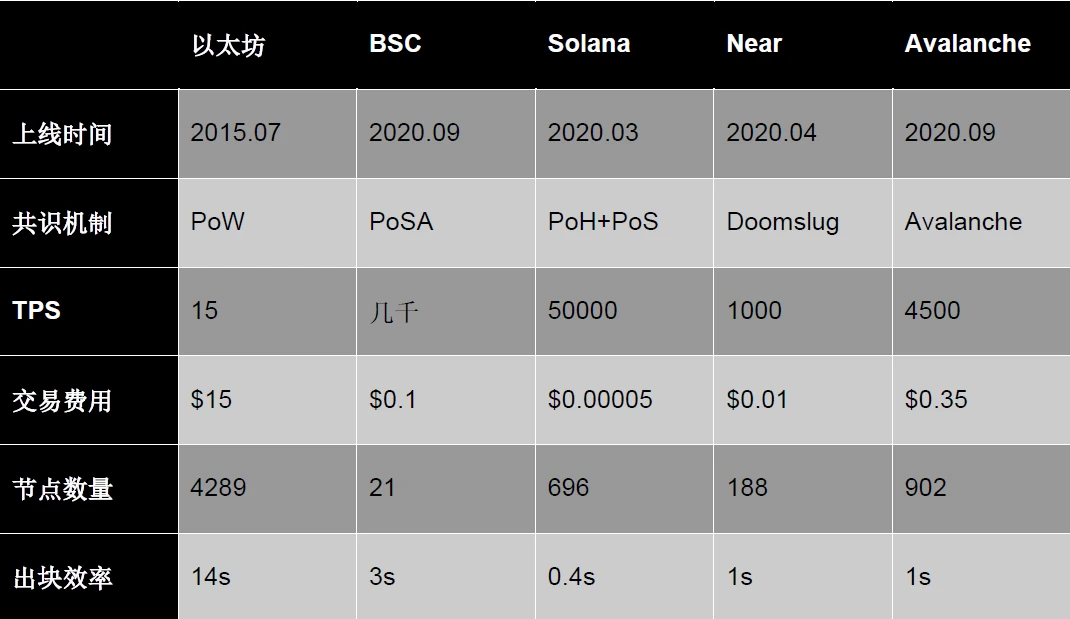

Although Ethereum still occupies an absolute leadership position in the current public chain market, latecomers continue to join, especially in terms of performance and architecture, constantly surpassing and innovating, which has shaken Ethereums market share to a certain extent. Rate. The following is a comparison of the performance and data of several major public chains before 2020 (before the Ethereum 2.0 upgrade). Ethereum does not have an advantage in any data (TPS, transaction fees, block production efficiency, etc.). If it continues to develop unchecked , it can be foreseen that it will be easily surpassed in terms of market share and market value in the near future.

Public chains represented by BSC and Solana are not only compatible with Ethereum EVM, but also have huge ecological blessings, and are supported by investors such as Binance and FTX. They naturally have user dividends and financial advantages, allowing them to grow rapidly and lead to Ethereum traffic flows. The congestion and high fees of Ethereum itself have given these public chains excellent development opportunities. All these forces Ethereum to upgrade as soon as possible in order to continue to maintain its position as the king of public chains.

3. Users’ new needs for public chain security and privacy

From its inception to the present, Ethereum’s transactions have increased thousands of times, from a daily transaction volume of several thousand to basically stable at the million level. Rapid growth is accompanied by the influx of large amounts of funds into the cryptocurrency field, which has also brought more high-quality applications and a large number of users. At the same time, users requirements for the security and privacy protection of blockchain technology are also constantly increasing.

In applications in the financial field, users have strong demands for address privacy, etc. The excessive transparency of the blockchain world will obviously become an important constraint on the development of limiters. How to achieve privacy protection while ensuring security is also one of the important issues that need to be solved for the future development of Ethereum.

Upgrade main content

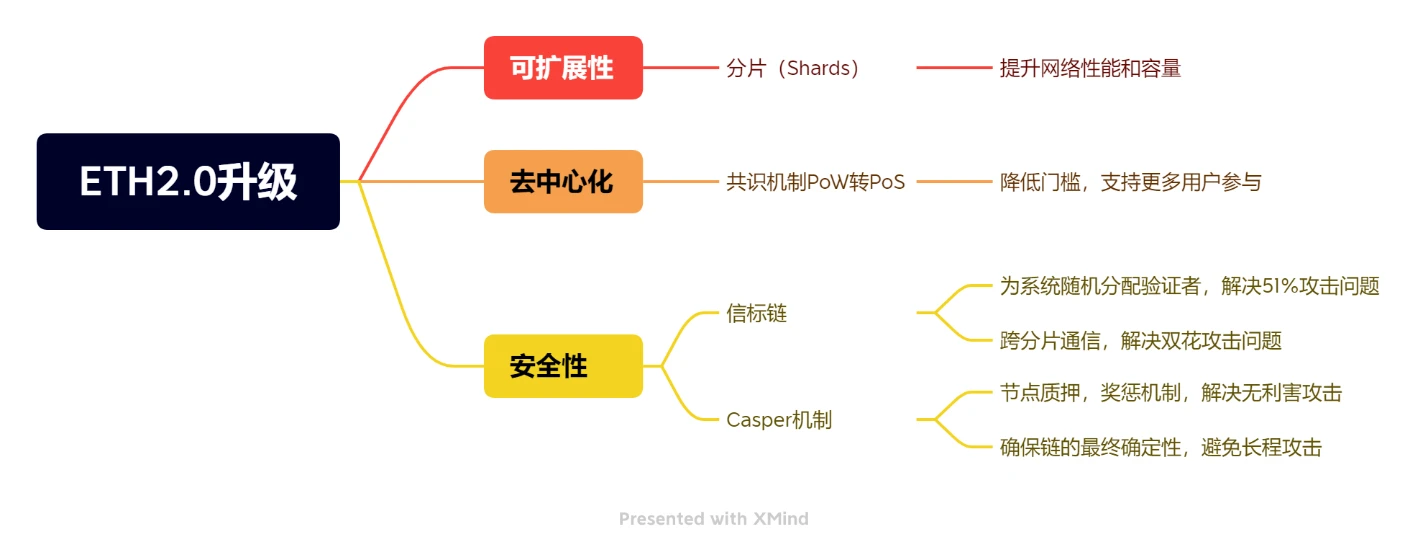

Everyone may have heard of the impossible triangle of blockchain, that is, decentralization, security and scalability, and the Ethereum 2.0 upgrade proposed solutions for the three aspects of this triangle, and then built this Upgrade the main content of the main line.

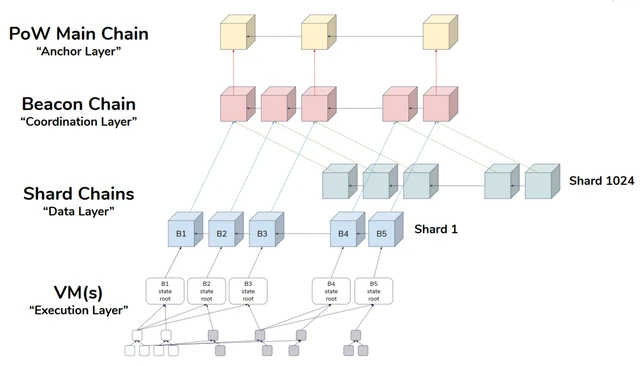

1. Shard Chains-solve scalability issues

Sharding chain is an architectural mechanism that can greatly improve the transaction efficiency and scalability of Ethereum. In Ethereum’s latest sharding solution (Sharding 2.0), all network resources will be divided into different shards. Each shard can be understood as a new chain and connected to the beacon chain (hub chain) respectively. In this way, each shard can be Each node does not have to process all transactions, but only needs to run one shard and only need to store a small part of the data, thus greatly improving work efficiency and greatly alleviating the scalability problem of Ethereum.

The Sharding 2.0 solution is tailor-made for the Rollup solution (we will further elaborate on the Rollup solution and the Layer 2 project in subsequent articles), and the Rollup solution is an extension of the sharding solution. Through Rollups, all exchange processes and executions occur off-chain, while the Ethereum main chain only stores transaction data. The hybrid implementation of data sharding and Rollups can theoretically allow Ethereum to process more than 100,000 transactions per second, and Rollups are also considered to be the most ideal expansion solution at present.

2. Proof of Stake-solve the problem of decentralization

Another important upgrade of Ethereum 2.0 is the introduction of the Proof of Stake (PoS) consensus mechanism. In the past, the operation of Ethereum was based on Proof of Work (PoW), which required a lot of computing power and energy. The transition from PoW to PoS will reduce the energy consumption of Ethereum by more than 99%.

In the PoW consensus mechanism of Ethereum 1.0, miners obtain ETH by processing package redemptions. In the PoS mechanism in ETH 2.0, users only need to mortgage ETH to become a verifier on the network to obtain a proof of equity representing the share. Under the PoW mechanism, becoming a verification node requires purchasing expensive mining machines and generating sufficient computing power to be competitive. Under the PoS mechanism, the entry threshold for verification nodes can be effectively lowered. Any user who pledges 32 ETH will have the opportunity to join the verifier committee, which selects block verifiers and block proposers by the beacon chain random algorithm. The block proposer packages the transaction to propose a new block, and the other blocks are verified. They test the new block and finally collaborate to complete the block generation process. The lowering of entry barriers allows more nodes to participate in verification and makes the entire network more dispersed and decentralized.

3. Beacon chain and Casper mechanism-solve security issues

The introduction of sharding and PoS consensus mechanisms solves the problems of scalability and decentralization, but also brings new security challenges. For example, there are 51% attack problems caused by sharding, double-spending attacks between shards, and disinterested attacks, long-range attacks, and simple attacks caused by the PoS consensus mechanism. Ethereum bridges these two types of risks and solves security issues through the beacon chain and consensus mechanism Casper.

In order to solve the 51% attack problem, the beacon chain will provide randomness to make each verifier unpredictable, and after each verification task, all verification nodes will be reshuffled and a new verification committee will be selected. The tradition of collusion between verification nodes is avoided and security is improved. At the same time, cross-shard communication is achieved through the beacon chain, and the status and information of all shards are recorded to avoid double-spending problems.

Casper is the core consensus protocol of Ethereum 2.0, responsible for managing system nodes and implementing rewards and penalties for validators. Validators need to pass the pledge and apply to the beacon chain to become a node before they can run the protocol. If a validator fails to complete the assigned tasks, there is a risk of losing the pledged Tokens, or even being kicked out of the node pool and unable to continue to participate in the verification work. This forces validators to act honestly and abide by consensus rules through a reward and punishment system, which largely solves the problem of PoS disinterested attacks.

Long-range attacks refer to starting from the genesis block, creating a chain longer than the original main chain, and tampering with the transaction history to replace the original main chain. A simple attack refers to an attack in which the forked chain creates as many blocks as possible per unit of time to exceed the length of the original main chain. The upgraded Ethereum sets the first Slot block in each Epoch as a checkpoint, and achieves the finality of the chain through voting, making the block unchangeable and avoiding such risks.

4. ETH 2.0 upgrade roadmap

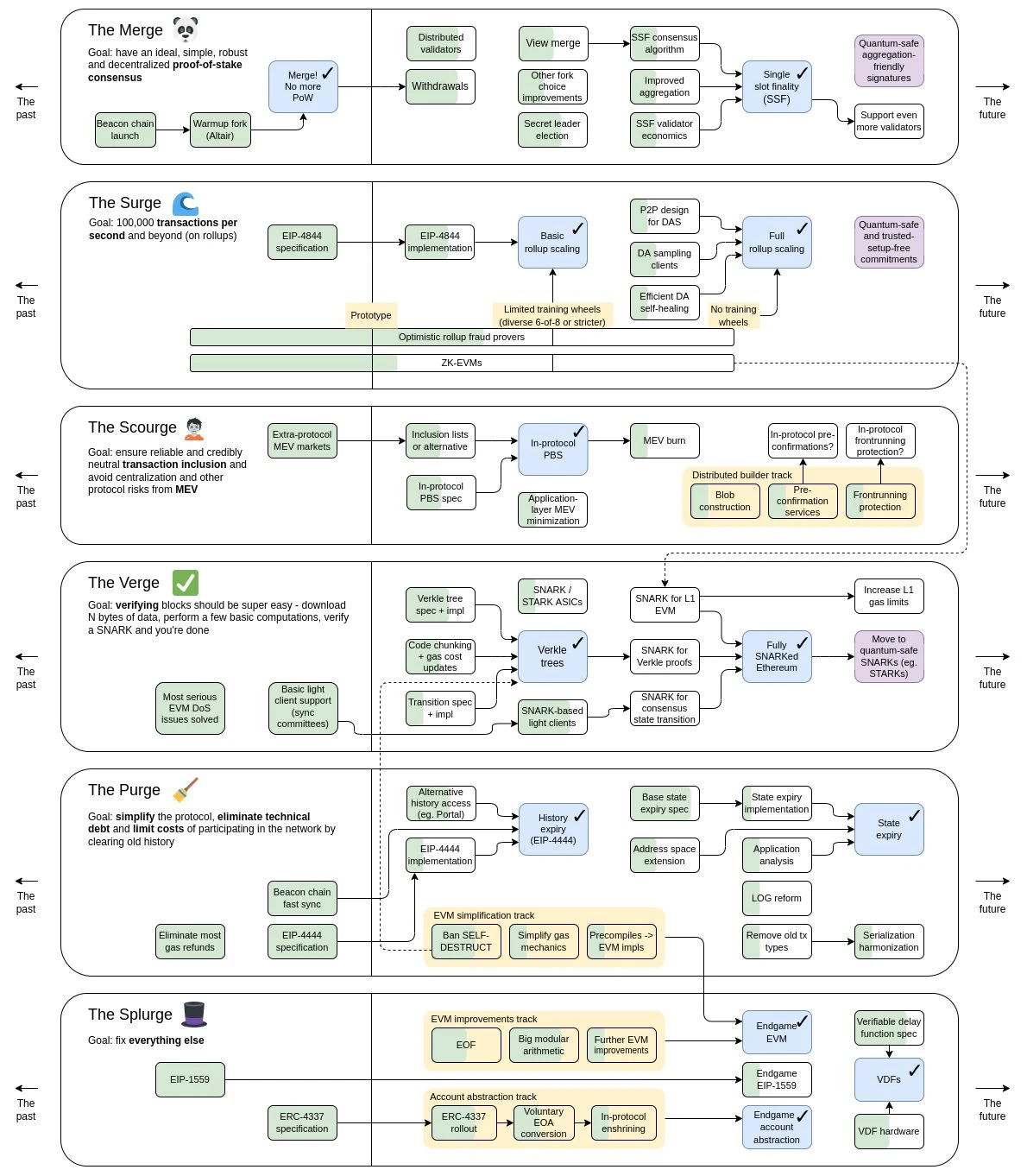

Vitalik Buterin, the founder of Ethereum, outlines the future upgrade route of Ethereum 2.0 in six concise stages: The Merge, The Surge, The Scourge, The Verge, The Purge and The Splurge. Each stage revolves around a specific theme and functional upgrade.

1. The Merge

The Merge marks Ethereum’s transition to a PoS system and an important step towards realizing Ethereum’s vision of a highly decentralized, scalable, secure and sustainable network. The Merge unfolds through two key upgrades: Bellatrix and Paris (proposals EIP-3675 and EIP-4399), merging Ethereum’s original execution layer with its newly established PoS consensus layer (Beacon chain), which will be launched in October 2022 Month completed.

The Merge brings some major changes, the most important of which is that full nodes need to run both execution layer and consensus layer clients. Before The Merge, a single client can handle all tasks related to transactions and blocks. After The Merge, the execution layer and consensus layer clients each maintain a peer-to-peer network, and the consensus layer client handles block propagation, certification and punishment. The execution layer client continues to manage transaction execution and state maintenance.

One of the important upgrades to The Merge is Single Slot Finality (SSF). SSF aims to reduce Ethereum’s block finality time to one slot, instead of the current 64 to 95 slots (~15 minutes). To implement SSF, three key challenges must be addressed: developing a precise consensus algorithm, optimizing the signature aggregation process, and determining the best economic method for validator participation. Solutions to these challenges already exist, but they will take longer to implement. Interested friends can follow Vitalik’s articles, which explore these issues.

Secret Leader Election sets up a mechanism to secretly elect proposers. Through random numbers and shuffling, the proposer election is unpredictable, fair and unique, and reduces the possibility of being attacked. sex.

2. The Surge

The Surge is another important content of the Ethereum upgrade. It is to solve the scalability problems that have been plaguing blockchain technology since its birth, so that its performance can eventually reach 100,000 TPS. level, close to the speed of traditional electronic payments (such as visa). This upgrade is achieved through Danksharding (DS, sharding).

Proto-Danksharding (EIP-4844) is the first step of Danksharding and an important step for Deneb-Cancun (i.e. Cancun upgrade). It is also an important step for Ethereum to implement the sharding mechanism and complete the expansion roadmap, which can significantly reduce Layer 2 Rollup transaction and operating costs. By having each shard block directly included in the beacon chain, the shard block no longer contains executed transactions, but only contains large blocks of data, and the specific transaction tasks will be taken care of by the layer 2 rollup protocol.

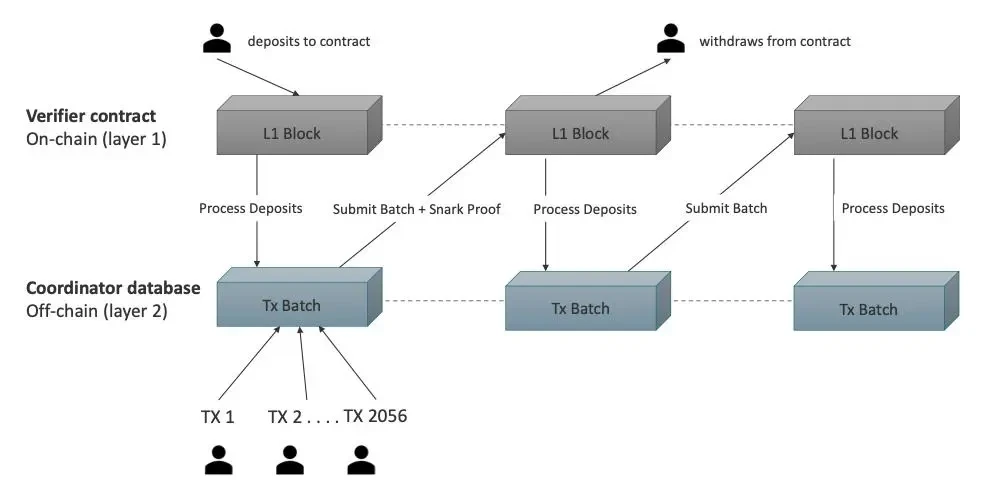

After Layer 2 original transaction data is submitted to the Layer 1 main network, how to verify the correctness of the data, based on different solutions, has given rise to two different rollup routes, namely Optimistic rollups and ZK rollups.

1) Optimistic rollups

Optimistic rollups are solutions based on fraud proofs or challenge proofs, which treat the plausibility of data with optimism. The data is considered true and accurate if no one challenges the data and submits proof of fraud within a specified period of time (e.g. one week).

But when someone raises a challenge and points out that a certain transaction is fraudulent, Optimistic rollups need to implement a set of EVM logic in the L1 smart contract to simulate the execution of the transaction, thereby verifying the legitimacy of the data and punishing the fraudster. Reward challengers. Unlike Optimistic rollups, Arbitrium takes a different approach. It does not implement a set of EVM logic, but narrows down the scope of problematic instructions by allowing the challenger to interact with the contract for multiple rounds. Finally, verify the problematic command.

2) ZK rollups

ZK rollups is a solution based on zero-knowledge proof technology. It can be understood that L1 outsources the calculation process of the transaction to L2. At the same time, L1 can verify whether L2 has correctly executed the transaction. This is the charm of zero-knowledge proof. At the same time, because the transaction signature has been verified during the transaction execution process in L2, that is, the zero-knowledge proof part already includes signature verification, so the transaction submitted to L1 does not need to contain a signature, further saving data space. The legality of transactions can be confirmed immediately, and the smaller data size makes ZK rollups considered more in line with the future direction of L2. But the difficulty is how ZK rollups can design a universal circuit system zkEVM to be compatible with all applications.

3. The Scourge

Scourge includes a series of upgrades designed to mitigate the centralization of MEV while maintaining fair and transparent transaction inclusion. MEV is a measure of the additional revenue a miner or validator can earn beyond block rewards and transaction fees, which is achieved by strategically including, excluding, or reordering transactions within a block. An ordinary validator runs standard client software. They have no MEV value capture capability at all, while large validators use modified and optimized software to capture MEV value. This unfairness will lead to the network becoming more and more centralized.

The solution to the above problem is proposer-builder separation (PBS), that is, the proposer is still the protagonist in publishing the block, but only leaves the construction and execution of the block to the creator block builder. In a well-functioning market, competitive creators will bid up to the full value of the MEV they can extract from a block, allowing a decentralized set of validators to capture the majority of MEV rewards. Therefore, PBS can effectively counter the centralizing power of MEV.

Another feature of PBS is the increased cost of censorship. The spirit of blockchain has always been incompatible with centralized censorship, and in the PBS solution, block builders will add as many transactions as possible because there is price competition among builders. If a builder wants to exclude a deal from being reviewed, its potential bid could be completely lower than that of its opponent, and it would not be able to win the auction. In order to win the right to bid and exclude transactions from its review, he needs to invest higher costs, thereby increasing the cost of review.

4. The Verge

The Verge is to implement a minimalist block verification method, that is, download a small amount of data, perform basic calculations, and then complete the verification. To achieve this goal, the existing Merkle Patricia Trie (MPT) needs to be upgraded to Verkle Trie.

Currently, Ethereum implements state data management through MPT. To be sure that the result is correct, you need to prove the entire MPT and then hash it layer by layer for verification. Currently, each full node of Ethereum maintains a complete state tree. Therefore, independent transactions and state verification can be performed, but it also makes the entire verification process very inefficient and cumbersome. Verkle Trie proves that it does not require the participation of sibling nodes. At the same time, the width of the tree can be large and the depth is shallow, which greatly improves the proof efficiency and is expected to be improved by 5-10 times.

5. The Purge

The Purge stands for Purge and is designed to enable simpler protocols and more lightweight nodes by clearing the burden of historical data storage. In the Ethereum 1.0 era, each node needs to retain the historical data of all blocks. After the 2.0 upgrade, block verification introduced finality and checkpoint. The beacon chain data synchronization does not need to start from the founding block, which greatly improves the data synchronization speed. . With the introduction of EIP-4444, the client will no longer save historical data from one year ago, and expired data will be archived. If you want to retrieve archived data, there are special read and write rules.

6. The Splurge

The Splurge means showing off and represents a moment of glory. This series includes upgrades in all miscellaneous categories, including account abstraction, multidimensional EIP-1559, and verifiable delay functions. Among them, account abstraction will greatly reduce the threshold for using the wallet. It abstracts all accounts into one kind of account, a contract account. The wallet can be upgraded to a contract wallet, creating a smart contract for each user to manage the users assets and on-chain interactions. Contract wallets can define more business logic, such as security limits, multi-signing, gas payment, etc. In the future, there will also be corresponding wallet templates for users to choose from, making it easier to configure contract wallets.

5. Follow-up Impact and Prospects

The impact of the Ethereum 2.0 upgrade on the market is positive. First of all, the upgrade will improve the transaction performance and scalability of Ethereum. By introducing sharding technology and an improved consensus mechanism, the network throughput and transaction confirmation speed will be greatly improved, which will greatly improve the availability and competitiveness of the Ethereum network, attracting More developers and businesses join the Ethereum ecosystem. Secondly, Ethereum 2.0 will also improve security and stability. By introducing the beacon chain and Casper mechanism, as well as token staking, the reliance on energy is reduced while improving the security and overall stability of the network. Once again, the Ethereum 2.0 upgrade will bring more innovations and features. By adjusting revenue distribution, reducing node burdens, lowering node thresholds, and introducing sharding technology, Ethereum will be able to support more complex smart contracts and decentralized applications. Additionally, with the integration of Layer 2 solutions, Ethereum will be able to handle more transaction data and better meet market demands. This will provide developers and enterprises with more opportunities to create more valuable applications and services.

However, the implementation of the Ethereum 2.0 upgrade also faces some potential risks and challenges. First of all, since the upgrade requires major changes to the network, there will be inconsistencies in the versions of different nodes, which will further lead to problems such as unwillingness to upgrade or being unable to upgrade. Secondly, the impact of the upgrade on the Ethereum ecosystem is uncertain. For applications already in the Ethereum ecosystem, the upgrade may cause a series of compatibility issues. Finally, the upgrade schedule is also uncertain, and technical difficulties and delays in the upgrade may affect the upgrade process.

The upgrade of Ethereum from 1.0 to 2.0 is an important milestone in the Ethereum ecosystem, but its development will never stop. With a clear roadmap, the development team is advancing the implementation of various module upgrades to unleash the full potential of Ethereum and realize the ideal decentralized network. Expect to see a more robust and efficient Ethereum ecosystem in the near future. The vigorous development of layer 2 will also continuously inject new impetus into the Ethereum ecosystem, enabling more applications (including games) and data to be uploaded to the chain. In the future series of articles, we will analyze the public chain projects of the two Layer 2 tracks in depth from the perspective of Optimistic Rollups and ZK Rollups, so stay tuned!

Disclaimer:

The information in this material is derived from public information or other information that we believe to be reasonable and reliable. Guatian Laboratory does not make any express or implied guarantee for its accuracy, adequacy, completeness and appropriateness of use.

The information, introduction, data, etc. in this material are for readers’ reference only. Under no circumstances should any content in this material be considered as any solicitation or recommendation and does not constitute investment advice. Various risks that investment-related project assets may face (including but not limited to: investment risk, management risk, legal risk, tax risk, liquidity risk, credit risk, policy risk, economic cycle risk, interest rate risk, operational risk, force majeure factors The resulting risks, etc.) shall be borne by the investors themselves. Guatian Laboratory and/or its associated personnel do not assume any legal responsibility for any consequences caused by relying on or using this material.

Without the written consent of Guatian Laboratory, no institution or individual may copy, disseminate or modify the content of this material in any form.