Original - Odaily

Author - Loopy

On October 24, Bitcoin strongly exceeded $35,000 overnight, hitting its highest level since May 2022.

Although we cannot conclusively judge from a historical perspective whether the bull market has already struck, what can be perceived is that the temperature and enthusiasm of the market are getting higher and higher.

Along with this, there is also peoples pursuit of high-quality innovative assets. Compared with Bitcoin, which is stable and iterates slowly, some small-market currencies in new tracks and innovative fields are more likely to gain the favor of investors in a bull market.

How to capture more high-quality assets has become a topic of greatest concern to investors today.

For ordinary investors, when selecting from a large number of assets in a complex market, the probability of making the wrong choice is greater. Choosing a CEX platform with screening capabilities as an investment channel is a safer choice.

Interpretation of top-level CEX data, early bull or a big rebound?

The current encryption market is standing at a very critical historical moment. The market is eagerly anticipating the adoption of the Bitcoin spot ETF, and sentiment is gradually picking up, looking like a thriving bull market. In the past three days, Bitcoin has continued to rise, with an increase of 16.73%, and transactions are quite active.

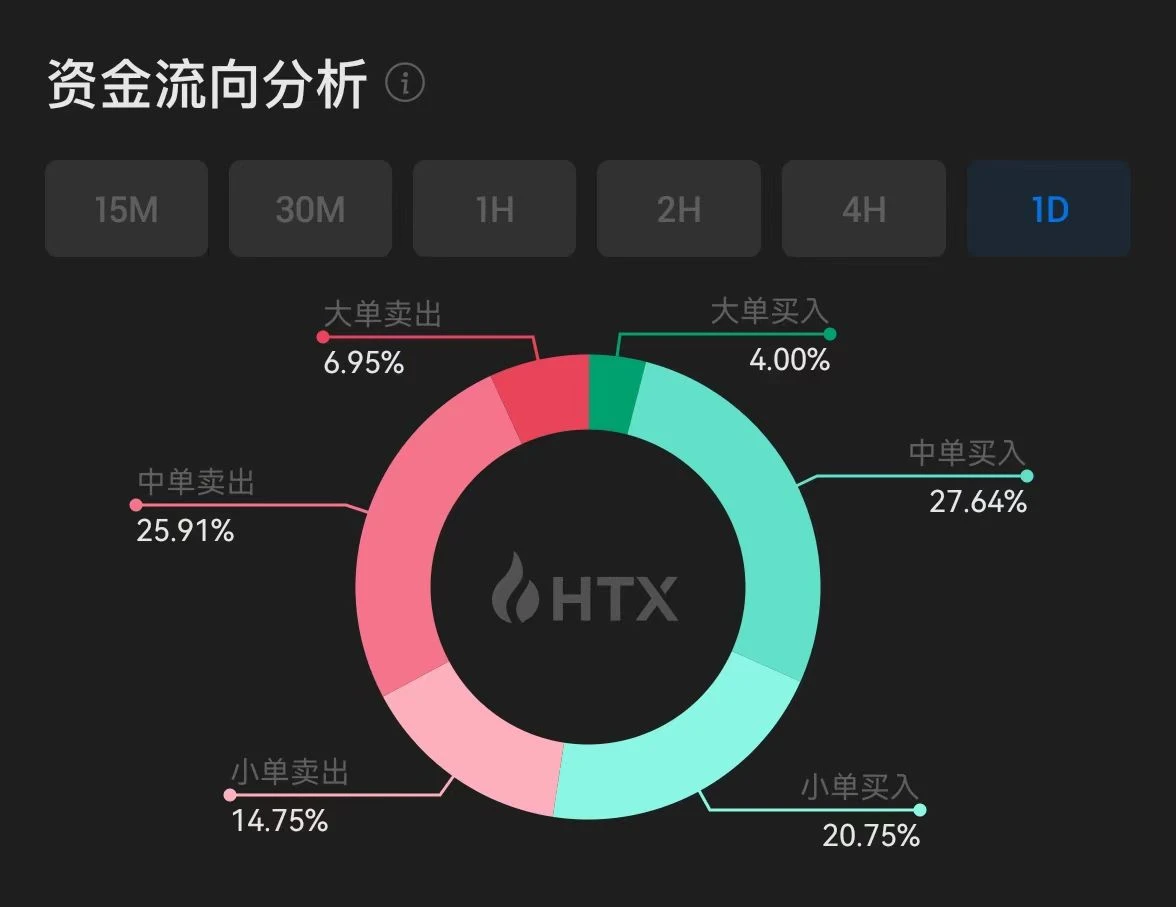

Screenshot from Huobi HTX data at 16:00 on October 26

And if you want to better feel the market temperature, CEX is naturally the more frontline trading frontline. Take Huobi HTX, which has just completed its brand upgrade, as an example. As an old exchange, the data of Huobi HTX is generally recovering.

As of October 2023, the number of annual registered users of Huobi HTX has exceeded 4 million. The number of monthly trading users on the platform reaches 220,000, and user stickiness remains relatively stable. It is worth noting that the average daily trading volume of Huobi HTX has remained stable and rising as a whole - since the beginning of the year, the average daily trading volume per person has increased by 63%. These data demonstrate that Huobi HTX has made significant progress in terms of market share, user attraction, and user activity.

Observing mainstream currency data, it can also be clearly seen that the market is continuing to recover. Taking the past week (October 14th to 21st) as an example, the weekly BTC trading volume of the Huobi HTX platform has reached 353% of the last week of 2022, and this data is currency-based trading volume. If measured in US dollars The pricing is higher.

It is not difficult to see from the front-line trading data that the market is currently recovering. As the market recovers, Huobi HTX is also rising with the completion of the brand upgrade.

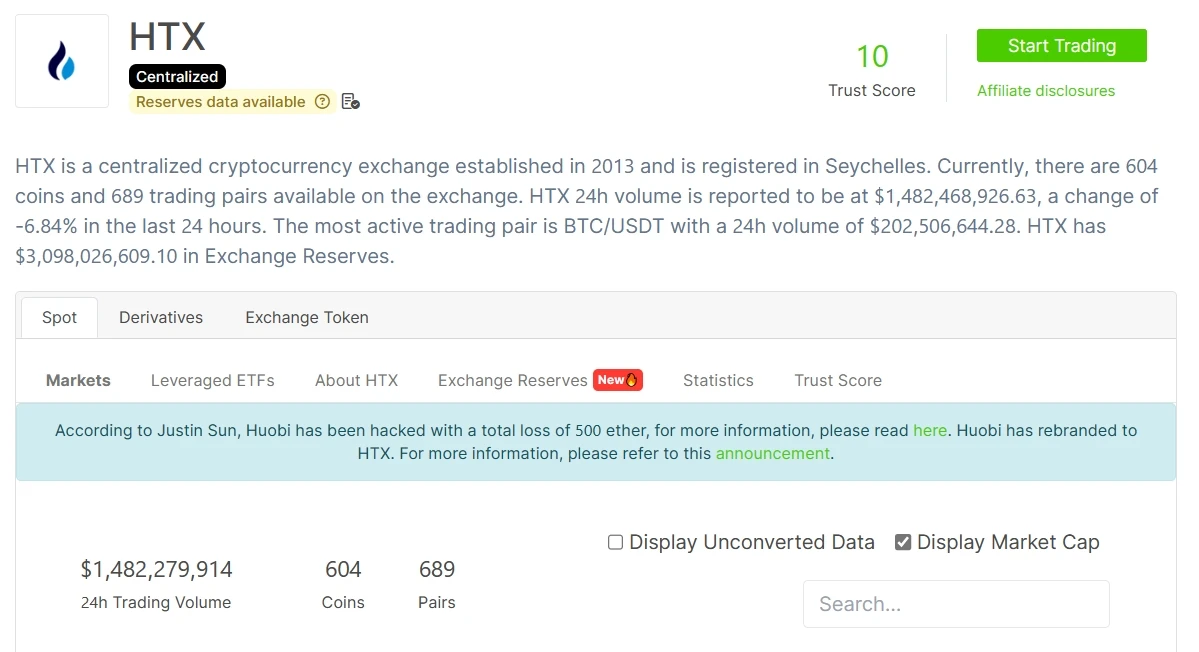

Coingecko data shows that the current 24-hour trading volume of Huobi HTX reaches 1, 482, 279, 914 $. As an old trading platform, Huobi HTX’s comprehensive strength is still strong, and the data of top exchanges also represents the current market’s judgment on the direction to a certain extent.

In this highly competitive and cyclical industry, any trading platform that can traverse bull and bear markets has its advantages. From Huobi in the old era to the new Huobi HTX era, how can Huobi HTX open a new chapter in its global layout and bring more surprises to the market?

The bull market is coming, how does Huobi HTX capture high-quality assets?

Although we don’t know when the bull market will arrive, new tracks and new hot spots are constantly emerging. How should investors capture more market opportunities? Huobi HTX’s exploration provides an example for the market.

In mid-July 2022, the market environment at that time was quite similar to now. BTC has just exceeded $30,000, market sentiment is high, and investors are quickly searching for innovations in the market.

The Telegram BOT sector quickly became popular under this special opportunity and became the focus of the encryption market. (Note: Odaily also noticed the surge in this popular sector and published multiple articles for analysis and reporting.)

Perhaps the rise was too violent and hot spots turned red too fast. Not only retail investors, but also most practitioners had no time to react to the rise of this sector. With its keen market sense, Huobi HTX took the lead in completing the currency listing, seizing the opportunity and taking the leading role among CEXs.

On July 20, Huobi HTX exclusively launched Alpha, UNIBOT, the leader in the BOT sector. Unibot is a project that provides fast and easy-to-use trading tools and real-time monitoring through Telegram bots, allowing users to trade and manage cryptocurrency within the Telegram application.

After UNIBOT went online, it experienced a sharp rise in a very short period of time, with a maximum increase of 1,500%; UNIBOTs subsequent market performance has always remained stable, without a sudden drop, and the current increase is still more than 300%. This project was also a rare high-quality asset under the market background at that time, which is enough to show the unique vision of Huobi HTX.

Screenshot from Huobi HTX official website data at 16:00 on October 26

In addition, a horizontal comparison found that other CEX platforms were launched significantly later than Huobi HTX: on July 20, Huobi HTX launched UNIBOT; on July 21, Gate.io launched UNIBOT; on July 30, MEXC launched UNIBOT.

For leading Alpha, one minute every night makes a huge difference in price. Huobi HTX can launch UNIBOT immediately. This not only requires the support of the technical teams agile response, but more importantly, the ability to judge the market.

After experiencing many rounds of bull and bear traversals, Huobi HTX undoubtedly has excellent asset discovery capabilities.

For ordinary investors, stripping away redundant information from the complex market and selecting massive assets is a complex and tedious task. The preliminary screening conducted by CEX can, to a certain extent, help investors filter out some inferior projects with significant risks.

More innovations are still happening, Huobi HTX will be a good industry builder

At present, in addition to the BOT track, what other potential tracks deserve our attention? Data from Huobi HTX also reflects the current market temperature to a certain extent.

Layer 1 has always been a dense area for innovation in the crypto industry. From a historical perspective, although the encryption market already has many Layer 1s, every new bull market will have its new rise. Although we cannot predict which Layer 1 will become the new king when the bull market hits, some excellent projects have already shown their prominence in the bear market.

Take Sei as an example. It is a Layer 1 blockchain developed based on the Cosmos SDK. Its core is a trading infrastructure based on the Central Order Book (CLOB). Not only will Sei be able to integrate with dApps on its own chain, but it will also be able to leverage the liquidity of the entire Cosmos ecosystem and create a trading market for its assets on Sei.

This innovative mechanism makes Sei a unique Layer 1, and Huobi HTX also discovered the advantages of this project at the first time.

As the first asset of Huobi HTX, the price of SEI reached a maximum of 0.27 USDT the next day after it went online, an increase of 2600% from the initial price of 0.01 USDT. Currently, SEI remains at 0.11 USDT. Although we don’t know whether Sei can complete the next bull market cycle, judging from its current performance, its assets are undoubtedly an important member of the list of high-quality assets, and it has once again proved that Huobi HTX is a key asset on the potential track. Capturing ability.

In more innovative fields, Huobi HTX still has a keen sense of smell. For example, the WorldCoin project, which has attracted much attention due to its grand vision and well-known founder, its token WLD was also launched on Huobi HTX, and its current increase is as high as 256%.

Another hot topic this year is LSD (liquidity pledged derivatives), the leader of which is the DeFi income protocol Pendle, whose token also achieved a 350% increase as the first asset on Huobi HTX.

Looking back at the high-quality assets listed by Huobi HTX in the past, it is not difficult to find that it has a unique vision in asset discovery. Huobi HTX’s asset listing will enter a new stage, selecting global high-quality and popular assets, launching all-star projects with traffic, popularity, and topics, and deepening cooperation with the mainstream ecosystem.

Conclusion: Huobi HTX will play an important role in the next bull market

At the just past Token 2049 conference, Justin Sun, a member of the Huobi HTX Global Advisory Board, announced that “the Huobi International brand has officially been upgraded to HTX.”

When we look back at history from the present moment, it is not difficult to find this wonderful coincidence. The timing of this conference coincides with a change in market sentiment. It may be the beginning of a bull market for us.

The Huobi HTX brand officially announced at this time exactly carries the vision of Huobi HTX to play a more important role in the next round of bull market. The renaming of Huobi HTX represents the transformation to globalization. Huobi HTX will take building the Yuanverse Financial Freeport as its new mission, and launch a strategic layout of global expansion, ecological prosperity, wealth effects, and safety and compliance under the vision of enabling eight billion people around the world to achieve financial freedom. These changes will ensure that Huobi HTX continues to occupy a dominant position in the new market landscape.

At the same time, on October 25, Huobi HTX won the first place in the “Cryptocurrency Exchange of the Year Award” at Blockchain Life 2023, the top crypto summit, and Sun Yuchen, a member of the Global Advisory Board of Huobi HTX and the founder of TRON, won the “Cryptocurrency Figure of the Year” Honour. After completing the brand upgrade in September this year, Huobi HTX once again appeared at the international encryption event and won important industry awards, highlighting its increasingly solid competitive position in the global encryption market and its commitment to promoting the global development and application of encryption as a giant.

For users, richer businesses also give investors more choices. Huobi HTX closely follows the dynamics of the crypto market and builds a diversified business structure around the core of expanding scale and profit, including PrimeVote, large-amount current financial management, shark fins, etc.

Through superior asset discovery capabilities, market insights, and continuous innovation, Huobi HTX may be able to accomplish its ambitious goals and further expand its market share in the process of globalization.

In the upcoming next bull market, Huobi HTX is working hard to achieve the small goal of returning to the top of the market.