This article comes from:CoinGecko

Compiled by: Odaily Yu YU

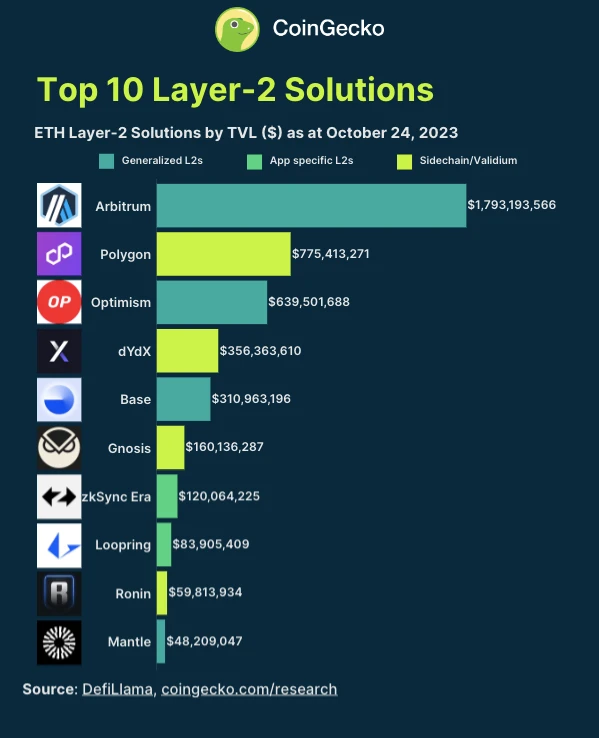

recently,CoinGeckoA report was released to introduce the TVL and market share changes of the top ten Layer 2 expansion solutions this year, as follows:

Based on TVL data from January to October 24, 2023 (excluding liquidity staking and double-counted TVL data)

Arbitrum is the largest L2 solution, with total locked volume (TVL) of over $1.79 billion as of October 2023. Following the airdrop of ARB tokens in March 2023, Arbitrum TVL reached a yearly peak of $2.6 billion in May.

Polygon is the second largest L2 solution with over $770 million in TVL as of October 2023. After the V0.3.1 hard fork upgrade in January 2023, Polygon TVL reached an annual peak of $1.18 billion in February; this upgrade reduced gas fees and solved the chain reorganization problem.

Optimism is the third largest L2 solution, with TVL of nearly $640 million as of October 2023. Optimism TVL hit a yearly peak of $990 million in March.

The combined TVL of Arbitrum, Polygon and Optimism accounted for 73.8% of the total TVL of the top 10 L2 solutions, however in March 2023 this proportion was as high as 86.9%. All this is mainly due to the launch of various new L2 projects, such as Base, zkSync Era, Mantle, ApeX Protocol, Starknet and Linea, and the upstarts grabbing market share from the leaders.

A glance at the market share changes of the top 10 L2 solutions

The total TVL of the top 10 L2 solutions peaked at $5.3 billion during the year in May 2023, but fell to $4.3 billion in October 2023. Total TVL for the top 10 L2 solutions increased 45% compared to January 1, 2023 ($3 billion).

Arbitrum is the largest L2 solution

Arbitrum TVL was close to $1.8 billion in October 2023, accounting for 41.2% of the top 10 L2 solutions market share. Arbitrum TVL reached its peak during the year in May 2023, but its market share peaked as early as March, accounting for 47.2% of the top 10 L2 solutions.

The ARB token airdrop in March was an important factor in increasing its market share, triggering market discussions about L2, with many traders and investors bridging liquidity to the Arbitrum chain.

3 “upstarts” account for 11% of the market

Base, zkSync, and Mantle accounted for 11% of the top 10 L2 solution market share in October 2023. All three L2 solutions are launching this year, with zkSync Era in March 2023 and Base and Mantle in July 2023.

Base is the fastest growing L2 solution, with TVL reaching US$300 million in October 2023, accounting for 7.2% of the top 10 L2 solution market share. After its launch in July 2023, Base is now among the top five L2 solutions. The success of Base can be attributed to the support of Coinbase and the rise of SocialFi applications such as friend.tech, which attracted a large number of users to the Base chain.

The second upstart project with outstanding performance is zkSync Era, with a TVL of US$120 million in October 2023 and a market share of 2.8% among the top 10 L2 solutions. Launched in March 2023, the zkSync Era has become the seventh largest L2 solution. zkSync has successfully attracted many people who are interested in airdrops, and they bridge liquidity to the chain in order to obtain airdrops.

Mantle is the third upstart to enter the top 10 L2 solutions. In October 2023, its TVL exceeded US$48 million, and its market share among the top 10 L2 solutions reached 1.1%.This year BitDAO merged with Mantle Network, Mantle relaunched in July. It is reported that the size of BitDAO’s treasury funds is among the largest in the encryption field.

Gnosis supports sDAI, TVL doubles from the beginning of the year

In October 2023, Gnosiss TVL increased to 2.47 times that at the beginning of the year, reaching $160.1 million, with a market share of 3.7% among the top 10 L2 solutions. This compares to Gnosis TVL of $64.9 million in January 2023 and a market share of 1.8%.

This growth is attributed to Gnosis Chain’s support for MakerDAO’s interest-bearing stablecoin sDAI. sDAI represents users’ liquid tokens staked on Spark Protocol in the form of DAI Savings Rate (DSR). Asset tokenization will be an important area for Gnosis, and the Gnosis Chain bridge is the third largest sDAI holder.