Original author: Ignas

Original compilation: Luffy, Foresight News

After reading numerous discussions on

This isn’t just Ethereum vs. Solana, it’s how we scale blockchain for mass adoption. Jumping right to the conclusion, I believe nothing is settled yet and these questions are not as simple as they seem. Thats great because were still in the early days.

The dilemma here is not just technical, but also related to cultural values.

What’s the point of non-Ethereum L1?

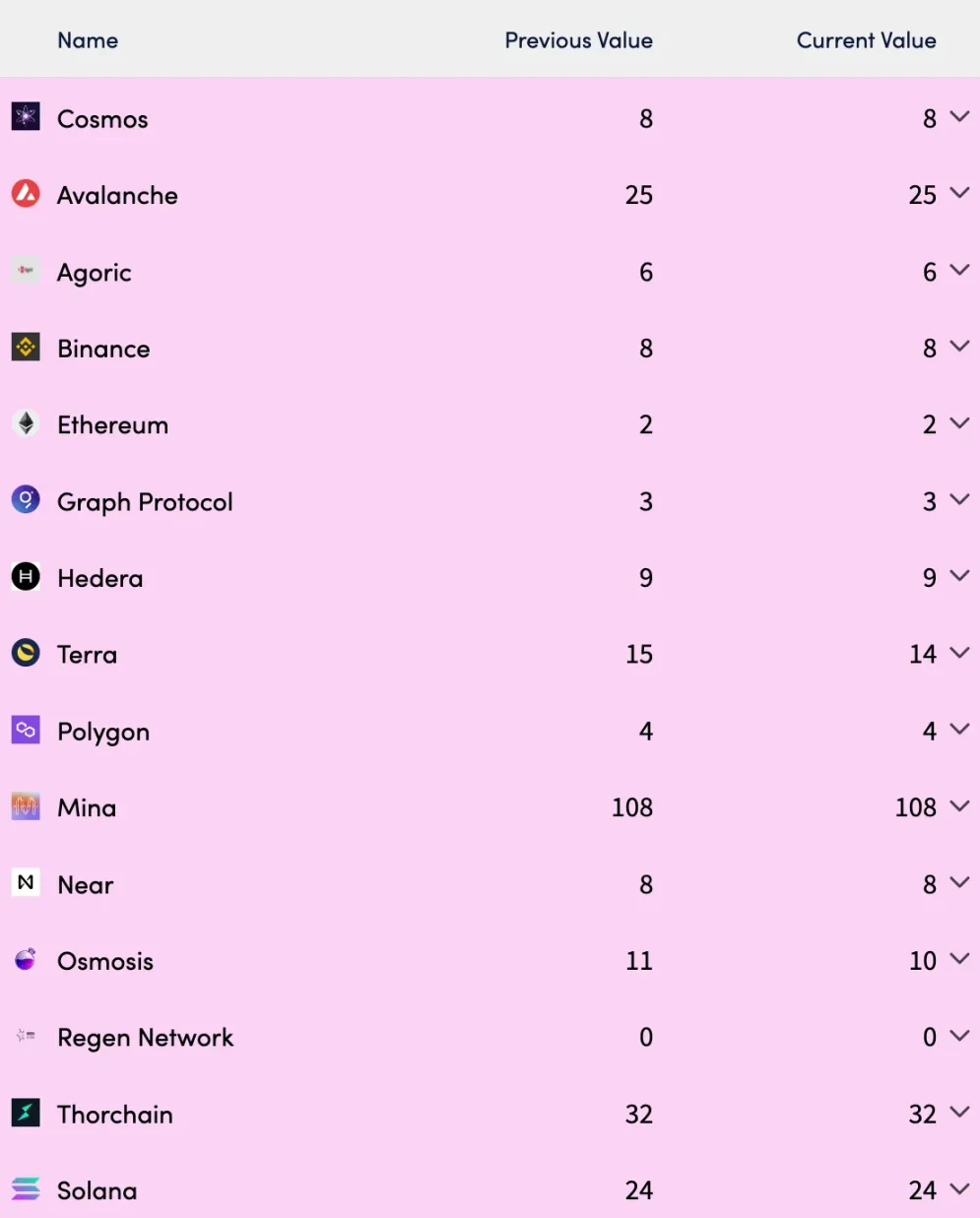

To understand the context of the Ethereum vs. Solana debate, I want to briefly review the other major L1s and their value propositions. This will help us build an L1 picture in terms of scaling solutions.

Recently, I did 6 AMAs, focusing on L1 and zkSync, and discussing the role of L1 in the L2 era.

The main question discussed is what is the point of alt-L1 when Ethereum’s L2 can scale Ethereum with fast transactions and lower fees.

Unsurprisingly, the biggest area of disagreement is whether Ethereum has won the L1 game. Polygons Sanket and zkSyncs Alex believe Ethereum has largely won the L1 game, but the Solana, Avalanche and BNB Chain teams disagree.

NEAR’s position is nuanced: Ethereum will continue to dominate, but other Layer 1 solutions will thrive in areas where Ethereum does not excel. NEARs value proposition is less clear, but their recent partnership with Polygon to scale Ethereum on a data availability layer is consistent with the sentiment above.

Bankless stated in their podcast that NEAR is migrating to an Ethereum Layer 2 solution, but this is not accurate. NEAR exists as a monolithic blockchain and also helps Ethereum achieve scalability through NEARs data availability and storage capabilities.

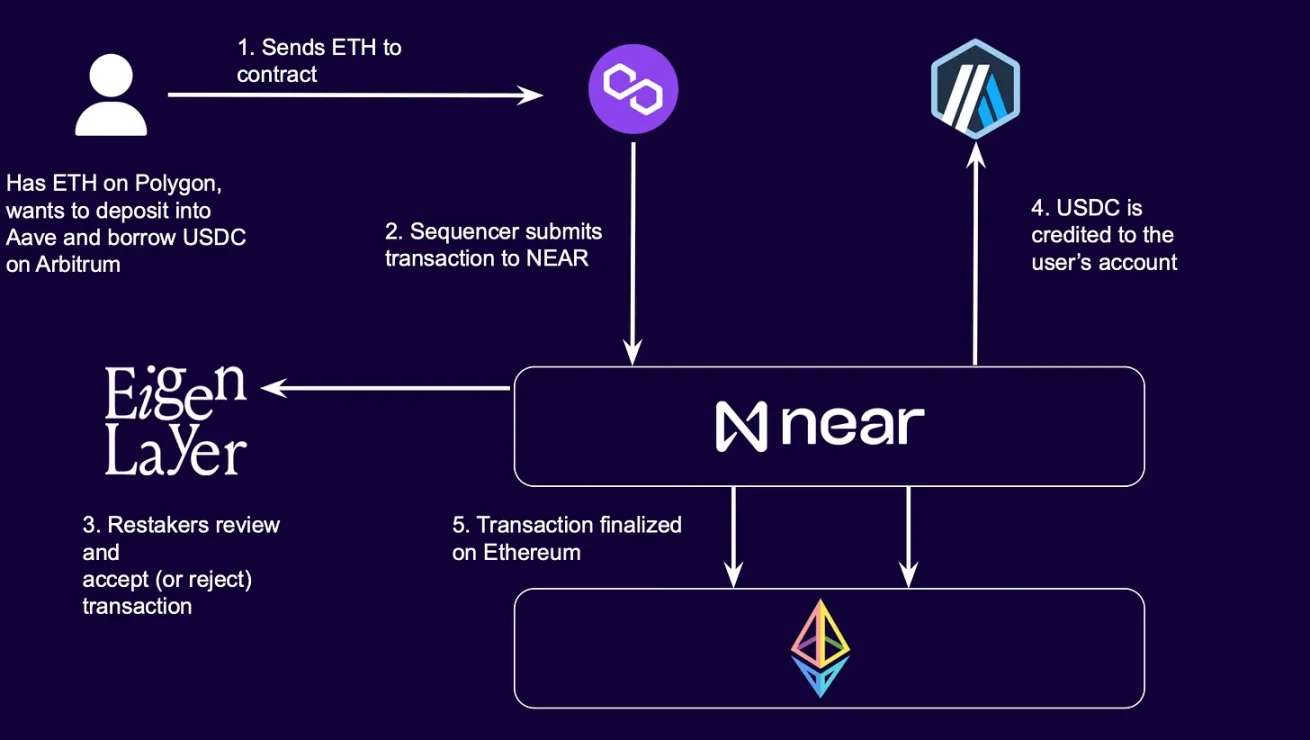

In fact, NEAR can also provide fast finality to L2, where Arbitrum settles on NEAR and then to Ethereum, while providing Ethereum + Eigenlayer-level security guarantees and a decentralized orderer to L2.

Eigenlayer stakers are re-executing transactions to ensure the orderer is honest

A core proposition of Avalanche’s modular design is that by scalability through subnets, anyone can seamlessly build their own blockchain. Architecturally, Avalanche sits between Cosmos and Polkadot, with P-Chain (for verification), C-Chain (smart contracts), and X-Asset (for sending and receiving funds). You can check out my chat with Luigi, Head of DeFi/DevRel at AvalancheconversationLearn more about how it works.

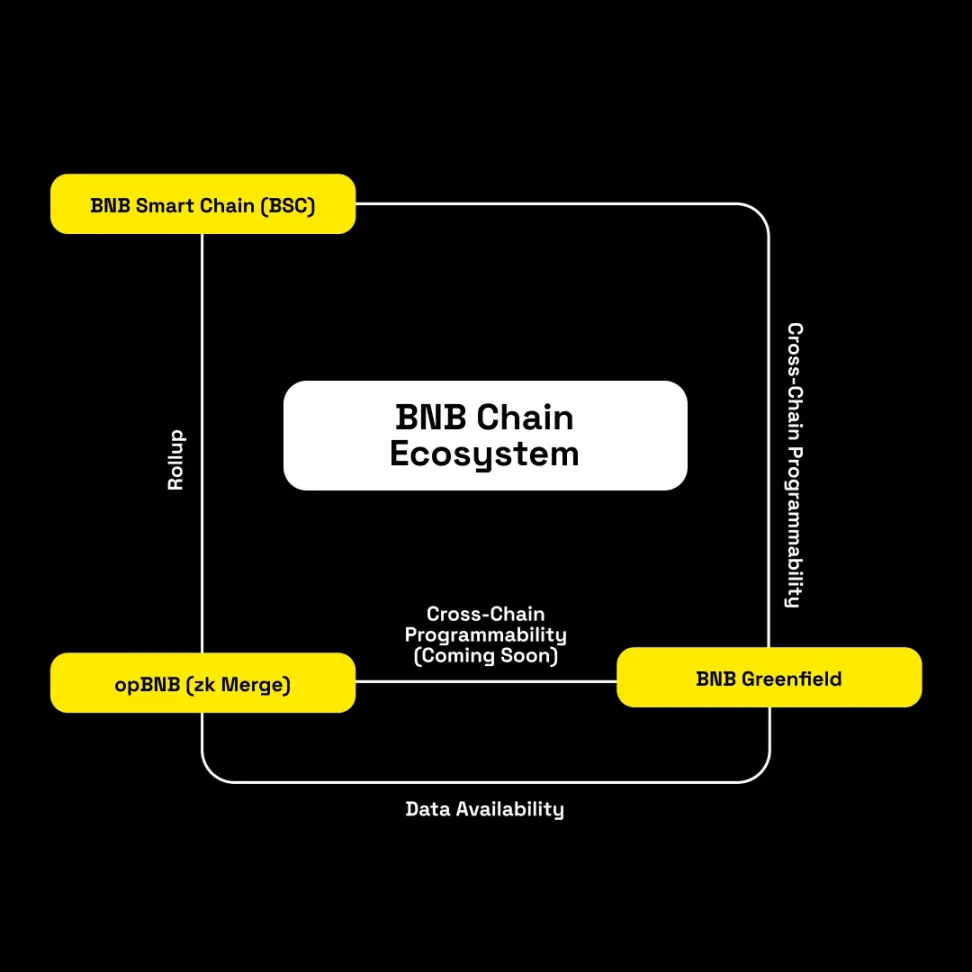

BNB Chain was launched to solve the problem of high gas fees in Ethereum. But even with a gas fee of less than $0.5 (and a compromise on decentralization), BSC is still not cheap enough for many use cases such as high-frequency trading. To solve this problem, they launched opBNB L2 on BSC and Greenfield for data availability.

For more information, please see my previous article written in collaboration with the BNB core development teamblog post。

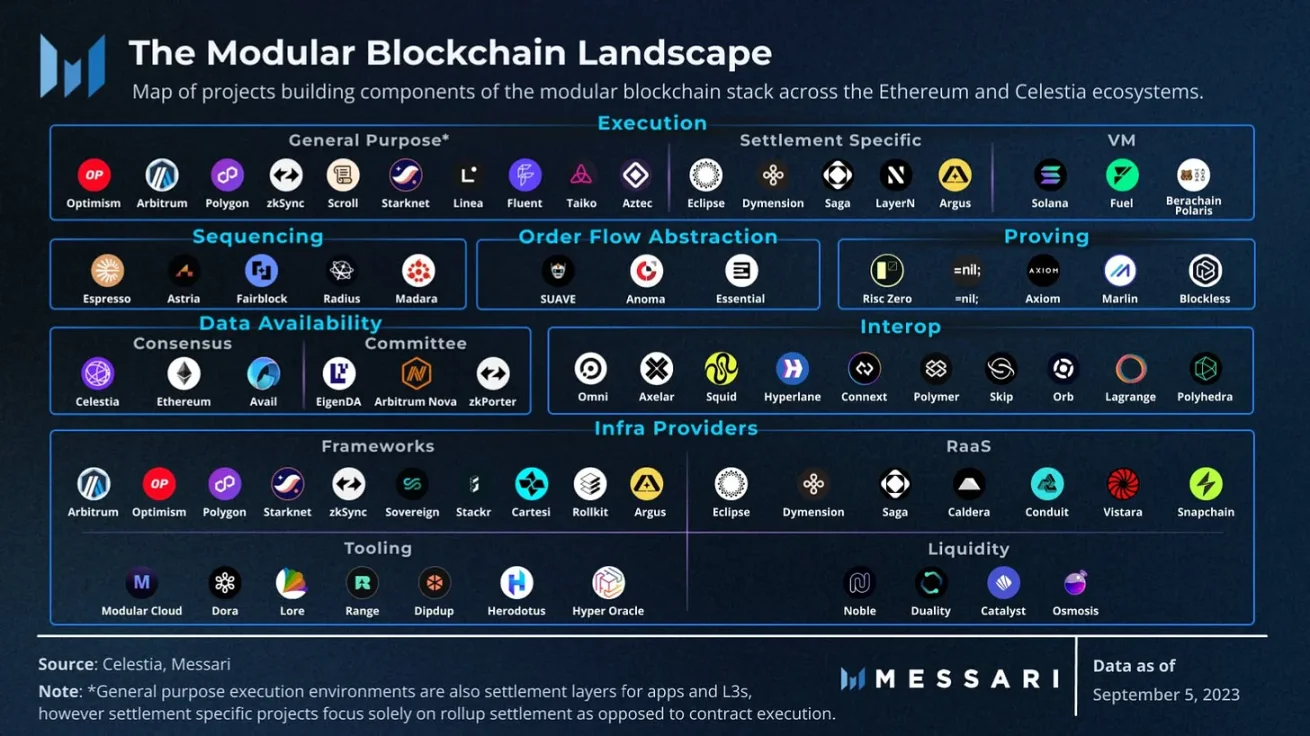

Do these scaling solutions sound complicated? Welcome to the world of modular blockchain. This is at the heart of the Ethereum vs. Solana debate, and its this that I really care about.

The assumption here is that a single blockchain requires a compromise between three key aspects of blockchain technology: security, scalability, and decentralization. Blockchain can only satisfy two of them, and Ethereum focuses on security and decentralization, resulting in high gas fees and slow transaction speeds. Therefore, it requires outsourcing scaling to the execution layer and data availability layer.

See my below for more related contentX thread。

However, the ambitious Solana hopes to solve the trilemma with a single blockchain design. is it possible?

Defend Solana

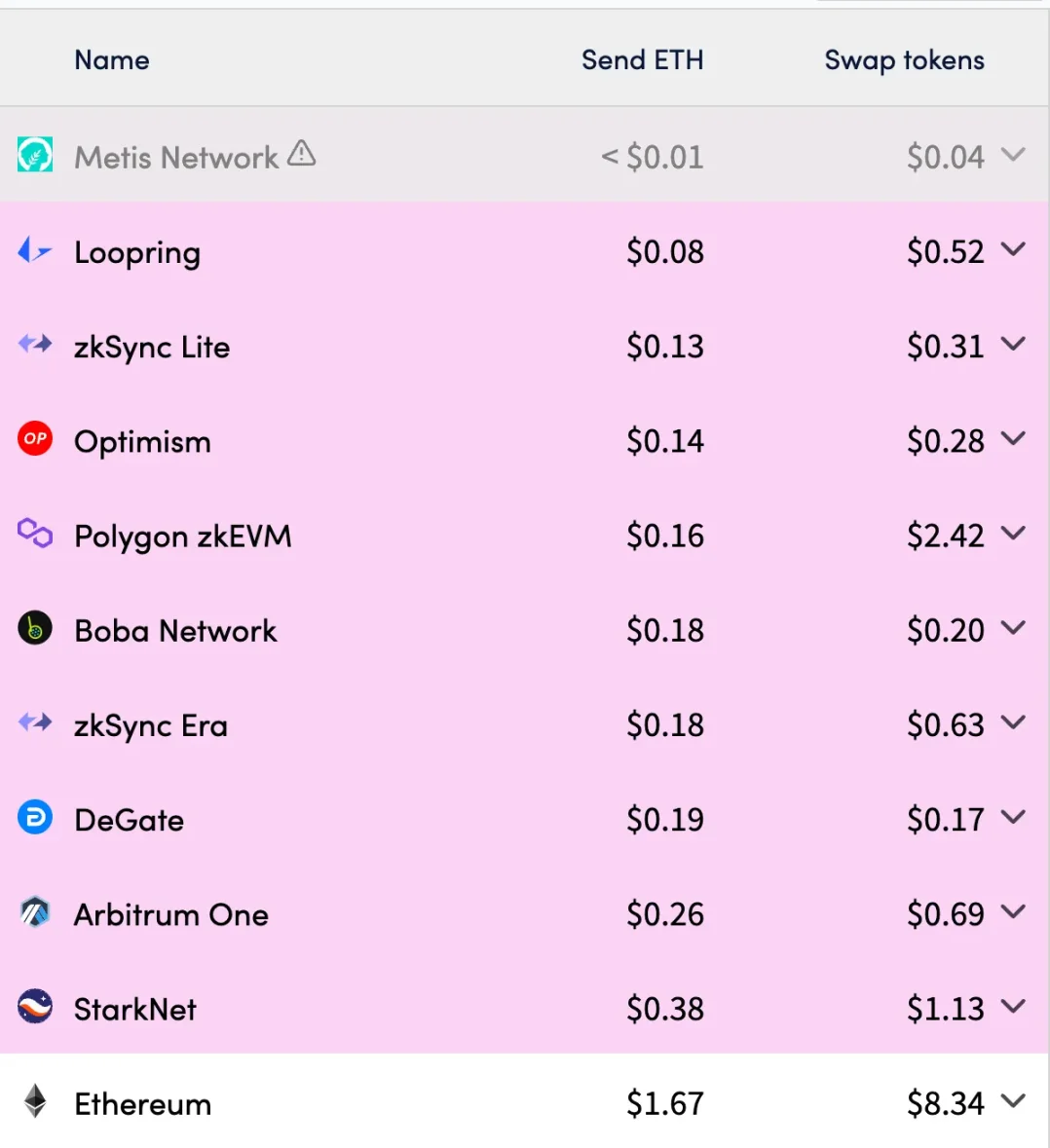

Solana’s vision is to bring together all the advantages of cheap and fast transactions, fast finalization and low latency. Effectively, this eliminates the need for cumbersome cross-chain bridges at a fraction of the cost of the best current Layer 2 solutions.

A single Swap transaction on Arbitrum costs about $0.69 in gas (at the time of writing), which is still not satisfactory... We need L3!

L2 Gas Fee

Now, all of these advantages require powerful hardware, which makes running validators expensive. In fact, Lido has even withdrawn from stSOL staking due to high development costs.

Additionally, there was criticism over the SOL token allocation, with 48% allocated to insiders and venture capitalists. Finally, Solana lacks a second production client (only one blockchain software client exists in Solana, meaning that breaking the blockchain only requires modifying one program).

Due to the above features, the Ethereum community (note that most of my portfolio is in ETH) claims that Solana is not as decentralized as Ethereum. This is a sensitive topic, but my current thoughts are as follows:

Ethereum L2 is also not truly decentralized (sequencer centralization);

Hardware prices will continue to fall, which will benefit Solana in the long run;

Solana will launch Firedancer, the second validator for the decentralized network;

One could argue that the future of Ethereum scaling lies in the hands of the venture capitalists funding L2, the DA protocol, and more.

Im playing devils advocate here.

In fact, according to the Satoshi coefficient, Solana scores higher than Ethereum. It represents how many entities are required to control 33% of the pledge share of the blockchain, reflecting the decentralization and security of the blockchain. Higher values mean the network is more resilient against manipulation. Solana scored 22, while Ethereum scored only 2.

However, decentralization is a spectrum, and if you really care about decentralization, you should buy and hold Bitcoin. This is insurance against Ethereum, fiat currencies, or other black swan events.

In practice, I think one of the most important attributes of DeFi is self-custody. I hope that neither the Solana Foundation nor the government can seize or freeze my funds. Im actually more confident about holding SOL on Solana than ETH on Coinbases Base (this has nothing to do with price). Unfortunately, high gas fees on Ethereum push people towards L2 where security and decentralization are compromised.

BTC on Bitcoin > ETH on Ethereum > SOL on Solana > ETH on Coinbase

What’s more, discussions about decentralization are dominated by Western countries. However, the success of platforms like Tron and BSC in non-Western countries, and even the success of social network Farcaster in the West, shows that blockchain use cases need to be sufficiently decentralized. Not everyone can afford the $18 swap fee, you know? Ethereum and L2 are currently a rich man’s game.

Regardless... Id like to see a diversification of use cases for blockchain.

While Id be more confident using DeFi on the Ethereum mainnet for lending and staking large sums of money or holding expensive NFTs, Id be happier trading on Solana and using it for small or non-financial transactions.

Solana seems to be a good fit for most GameFi, Metaverse, P2E, derivatives, options, etc. DApps. Thats why Solana launched the Solana Phone equipped with a DApp store. STEPN is a good example, and Im eager to see more consumer-facing applications launched on Solana to validate my point about Solana.

This is why TVL is not a perfect indicator of the Solana ecosystem. Ethereum has the most assets because it is a store of value blockchain. But these assets exist passively in smart contracts that generate revenue, while Solana emphasizes capital velocity—the volume of transactions allocated per dollar of TVL.

With its high scalability and low transaction fees, Solana enables rapid value flow and capital turnover. This speed of capital flow is a testament to the attractiveness of Solanas infrastructure to users and investors.

- Michelle, Solana Foundation DeFi BD

Modular vs. Monolithic Blockchain Future: Why Can’t We Have Both?

To be fair, Solana is not the only monolithic blockchain out there. NEAR and Algorand are two other examples, and Fantom is moving to a monolithic expansion design.

But things get more interesting because NEAR is a monolithic and modular blockchain that provides data availability for Ethereum L2. Algorand has Co-chains for private blockchains.

The above overview of the bipolar framework is too simplistic and I suggest focusing onJustin, who shared a great perspective on the subject. He favors performing sharding or using Rollup to scale.

Others, like Tyler Reynolds, are more convinced that a monolithic blockchain is the right answer.

But as you can see, there are many scaling solutions, and the community is still divided on which one prevails. So, my main point is:

There are many ways to scale a blockchain, each with its own pros and cons. However, I am a pragmatic person who wants to maximize my returns by investing in solutions that are likely to dominate in the near future and have higher upside.

Especially in the current environment, Ethereums transaction fees during busy periods are outrageous, and L2 is not cheap to use, which has a negative impact on the user experience. I hope the Ethereum community will be able to abstract user experience in the near future.

Therefore, I cant ignore the potential advantages of Solanas vision of scaling through a monolithic design. If they succeed in attracting more developers, DApps, and users, the opportunity for growth cannot be ignored.

If you read my blog, you know that I focus on ecosystems with 1) technological innovation; 2) wealth-making opportunities; and 3) compelling stories.

Solana meets all three criteria. It offered a unique vision of expansion that successfully attracted a legion of believers and detractors. Hate is a useful measure of attention because it shows that even skeptics care about Solana.

Finally, Solanas ecosystem was wiped out during the bear market, and even NFT projects like DeGods and yOOts left Solana. Its like a war-torn country currently rebuilding. This provides opportunities because only a few DApps can attract users 1) attention; 2) capital inflows. You can find it at JacobsThis articleto see the project list.

In a world constantly debating Windows vs. Mac, Android vs. iOS, its easy to get caught up in polarizing discussions. But as an investor, the question shouldnt be choosing one or the other. Instead, we can allocate a portion of the portfolio to achieve a comfortable balance that also includes other L1s.

Personally, I think Solanas vision is compelling enough to warrant some configuration. Taking extreme positions goes against my belief in keeping an open mind and constantly reassessing my opinions as new information comes to light.

I also care about the practical approach and I would give Solana a try first rather than dismiss it based solely on the opinions of people who dont like it.

Im very bullish on Ethereum, and probably most people are too. That’s why I even left out the “defending Ethereum” part, because Ethereum’s value proposition is strong. But that doesnt mean I wouldnt consider investing in other Layer 1 solutions.

Disclaimer: The author holds both ETH and SOL.