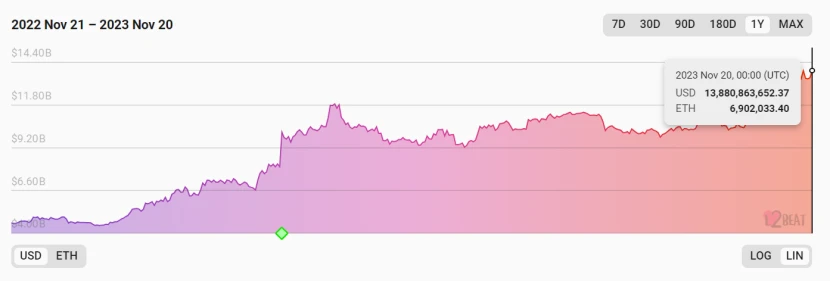

Ethereum L2 TVL hits new high

According to L2 Beat data, on November 20, the total value locked (TVL) on Ethereum L2 reached $13.8 billion, setting a new high. Although L2 still has some challenges in terms of user experience and security, L2 will continue to maintain an overall upward trend.

According to L2 Beat statistics, there are 32 different networks that are eligible for Ethereum L2, including Arbitrum One, Optimism, Base, Polygon zkEVM, Metis, etc. As can be seen from the chart above, L2’s TVL has been declining since April this year until after June 15, when TVL began to turn to positive growth and returned to more than $10 billion. TVL reached nearly $12 billion at the end of October, and investment in L2 applications has since continued to climb, reaching the current $13.8 billion.

During the 2021 bull market, investment in the crypto space was much greater than now, but the current rise in L2 network TVL is more significant than during the bull market. On November 12, 2021, when the total cryptocurrency market capitalization reached an all-time high of $2.82 trillion, the L2 network TVL was just under $6 billion. According to data from CoinMarketCap, the total market value of cryptocurrencies has fallen by about 50%, but L2’s TVL has risen to $13.8 billion. This shows that although the current market is still in a bear market, the L2 ecosystem continues to grow.

Ethereum’s high gas fees during the last bull cycle had a significant impact on the market and users, leading to a desire for better alternatives when demand started to come back. Another reason why the L2 network thrived in the bear market was due to the successful marketing efforts of numerous development teams, which resulted in high user activity and therefore high revenue. L2 networks are deploying capital to attract new users and attract new businesses into DeFi.

L2 faces challenges

Despite this, L2 networks still face challenges in the area of user experience. The Optimistic rollup network requires users to wait 7 days to complete the withdrawal of funds from the official website to L1, which may lead to poor user experience. On the other hand, the Zero-Knowledge Proof Network (ZK Network) can process withdrawals immediately, but is still in the early stages of development and tends to crash more easily than the older L2 network, and has higher fees than the OP system . However, the Metis team is building a hybrid L2 network that gives users the option of using the immediate ZK network or an Optimistic rollup with a seven-day waiting period.

L2 networks also face another serious challenge that is often overlooked: centralization. While L2 solutions are increasingly popular due to increased scalability, they often sacrifice a certain degree of decentralization. Due to the use of centralized orderer nodes at the execution layer that processes transactions, this raises concerns about potential censorship or human intervention. L2 challenges the core principles of decentralization and trustlessness in executing transactions.

In addition to the increase in TVL, the number of L2s continues to increase. Following Coinbase, OKX announced on November 14 that it was creating an L2 network, and there was also news that Kraken was also creating an L2 network. This expansion not only signifies the resilience and adaptability of the blockchain industry, but also reflects the market’s relentless pursuit of improving DeFi efficiency, scalability, and user experience. The L2 ecosystem reaches new heights at TVL, proving its importance and potential in the blockchain and cryptocurrency industry. As the industry grows and innovates, L2 will continue to be a key area for investors, developers and users.

Rediscovering Plasma scaling options

Ethereum co-founder Vitalik Buterin urges Web3 developers to re-explore Plasma scaling solution technology. Plasma aims to increase efficiency by removing most of the data from the main chain and then redistributing the data across a series of sidechains. However, the development of Plasma solutions currently lags behind competitors Arbitrum One and Optimistic rollup due to limitations in enabling smart contract deployment.

Additionally, Plasma requires sacrificing certain aspects of security in order to achieve greater scalability. Vitalik Buterin also admitted that since each side chain of Plasma is independent and responsible for its own security, this makes it more vulnerable to hackers. In contrast, Rollup released information about executing transactions on the main chain All information, so its security is higher than Plasma.

However, Vitalik Buterin claims that proof of effectiveness can help liberate Plasmas limitations, and the results achieved by ZK-EVM this year make it a great opportunity to re-explore Plasmas design space. In fact, Polygon put forward a proposal at the end of June this year to upgrade the POS network to ZKEVM validium. While acknowledging rollup as the gold standard among scaling solutions, Vitalik called for a revisiting of Plasma technology because of its advantages in throughput and cost-effectiveness.

Account abstraction will be incorporated into the Rollup ecosystem

Recently, the Ethereum network is integrating account abstractions (AA accounts) into its rollup ecosystem. The proposal was proposed by Alexander Forshtat of the Ethereum Foundation and is outlined in “Roadmap for the Introduction of Local Account Abstraction: Local Account Abstraction.” The proposal marks Ethereum’s first attempt to incorporate AA accounts into its L2 solution.

Account abstraction is designed to seamlessly integrate user accounts and smart contracts, enhancing the overall functionality and user experience in the Ethereum network. Extending account abstraction to EVM rollup is significant for unifying L1 and L2 environments, creating a more cohesive and efficient ecosystem. This integration is particularly important for Ethereum’s Web3 realm, as it promises to streamline operations and facilitate continued ecosystem development.

To successfully implement AA accounts in rollup, major modifications need to be made in 3 aspects, including changing the entry point address, rewriting the ValidateUserop function, and enhancing the transaction logic. Additionally, Paymaster operations and signature aggregation technology are required. Following the implementation of account abstraction ERC-4337 on Ethereums mainnet, the integration will also create new validation code limits, staking protocols, and reputation systems.

The Ethereum community is showing a lot of interest in this development, as can be seen from the large amount of feedback and contributions on the project’s GitHub page. The authors of the proposal also emphasize the importance of community participation in the standardization process of local account abstractions. This collaborative approach is critical to the adoption and efficiency of AA projects in L1 and L2 networks.

In March 2023, Ethereum demonstrated “account abstraction” ERC-4337 on the mainnet. Account abstraction can facilitate the convenience of wallets on the Ethereum chain, enabling smart contract transactions. This paves the way for a new class of smart contract account Ethereum wallets that are expected to revolutionize the Dapp landscape.

The integration of AA accounts in the Ethereum rollup ecosystem can be said to be a key move that is expected to enhance the scalability and functionality of the Ethereum network. The plan will simplify the interaction between on-chain accounts and smart contracts, providing a more user-friendly and efficient experience. The Ethereum community’s active participation in the development process reflects its importance and its potential impact on the broader blockchain and cryptocurrency space, while also illustrating the network’s commitment to an inclusive and collaborative environment that promotes innovation. As Ethereum continues to grow, its role in shaping the future of blockchain technology and decentralized systems remains undisputed.