Weekly Editors Picks is a functional column of Odaily Planet Daily. In addition to covering a large amount of real-time information every week, Planet Daily also publishes a lot of high-quality in-depth analysis content, but they may be hidden in the information flow and hot news, and pass you by.

Therefore, every Saturday, our editorial department will select some high-quality articles that are worth spending time reading and collecting from the content published in the past 7 days, and bring new inspiration to you in the crypto world from the perspectives of data analysis, industry judgment, and opinion output.

Now, come and read with us:

Investment and Entrepreneurship

The first crypto president, a look at Trump’s cryptographic landscape

The article introduces two new U.S. crypto regulators: SEC Acting Chairman Mark Uyeda and CFTC Acting Chief of Staff Harry Jung.

Also recommended: Dialogue with Mr. Mai: A Hardcore Meme Gold Digging Course - Practical Tips for Degen Players | Friends of OKX, Issue 6 .

Airdrop Opportunities and Interaction Guide

Jupiter airdrops another surprise, what does this reveal to us about maintaining premium accounts?

How to maintain a batch of boutique accounts efficiently and at low cost? First, when participating in popular projects on the chain, it is recommended to trade in multiple wallets. Secondly, it is a strategy to increase the transaction volume of wallets and form LPs for popular projects. Finally, the strategy seems simple, but it is not easy to maintain the boutique small account as planned.

In addition, in the first quarter of this year, many top-tier projects have participated in TGE. While maintaining a number of high-quality accounts, you still need to regularly participate in these high-financing, high-profile un-coined projects. The key to these projects is not the number, but the quality. Un-coined projects worth participating in include Story, Berachain, Nillion, Initia, pump.fun, and OpenSea.

Meme

Reviewing the top 10 profitable addresses, how to capture TRUMPs early buying signals?

An introduction to on-chain monitoring ideas and tools.

ZachXBT and $3.9M worth of Meme Coins: The Dragon Slayer Becomes the Dragon?

ZachXBT was “issued” and airdropped with Meme coins, followed by a series of operations. In summary:

Instead of blocking the project, he increased liquidity, allowing others to trade;

The 10% withdrawal helped him gain financially, but many felt he deserved it;

The re-increase of liquidity showed no sign of struggle.

AI + government efficiency department? What stories are the new batch of meme speedruns telling?

AI applications have been weak for a long time, and DeFAI remains the main line.

Also recommended: A Guide for Newbies: A Step-by-Step Guide to On-Chain Meme Trading , Hot money pours in, liquidity soars, and a detailed explanation of how GMGN can help you make millions of dollars in the exploding market , and Trumps issuance of currency has allowed the Chinese to make hundreds of millions, and the American crypto community has split .

Ethereum and Scaling

Leading projects collectively force the palace, but the Ethereum Foundation remains unmoved

Founder of Synthetix and Infinex: EF should require L2 to repurchase ETH with revenue.

Curve founder: EF should abandon L2 strategy immediately.

Aave founder proposed 12 measures to save EF.

Former head of growth at Ethena: EF should focus on DeFi.

Wintermute founder analyzes Ethereum’s potential death spiral.

Insufficient Blob Space, Is Ethereum L2 on the Verge of Collapse?

This article discusses the problem of insufficient Blob space faced by Ethereum L2. As the L2 chain grows, multiple L2s compete for limited Blob storage, causing fees to soar and user costs to increase. Even if the number of blobs is increased to 6 through the Pectra upgrade, the problem can only be temporarily alleviated and cannot be fundamentally solved. Solutions include short-term Pectra upgrades, mid-term PeerDAS implementations, and long-term DA expansions, but it is still uncertain whether these solutions can be put in place in time.

With the wealth effect seriously lost, can Ethereum survive the midlife crisis?

New and old money no longer prefer Ethereum; L2 splits liquidity, and voices of doubt arise one after another; the dual-turbo power of DeFi and NFT is exhausted; Ethereums wealth effect is gone, and Solana takes over; the Ethereum Foundation sells coins and the team is bloated.

Injecting 50,000 ETH, the Ethereum Foundation is participating in DeFi for the first time

The Ethereum Foundation and Vitalik Buterin announced two major decisions in recent days: one is to allocate 50,000 ETH (about 150 million US dollars) for participation in the Ethereum DeFi ecosystem, and the other is to make major changes to the leadership structure for nearly a year.

Multi-ecology

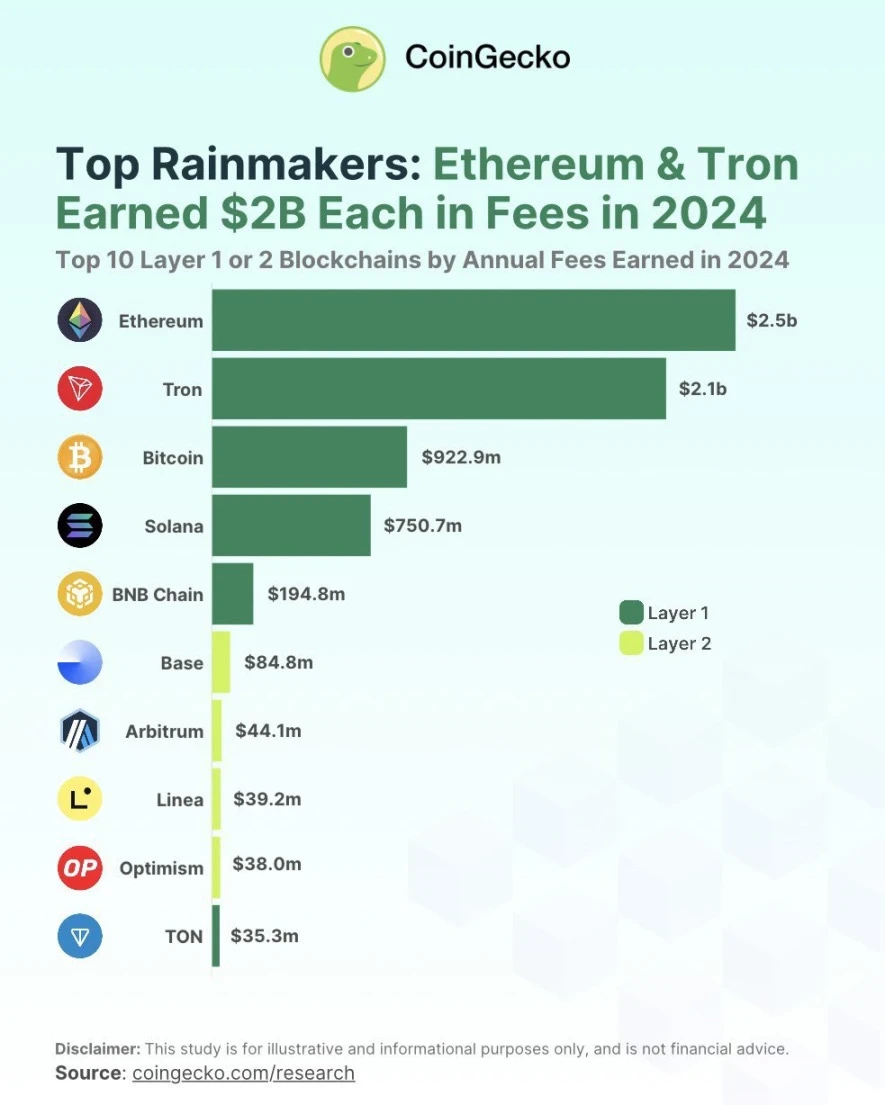

The battle over public chain fees, will Solana achieve an astonishing 30-fold growth in 2024?

Crazy weekend: Crypto’s Solana moment in 10 charts

Solana network DEX trading volume jumped 5.4 times from an average of about $5 billion to $27 billion. TRUMP, MELANIA, and SOL dominate the market. At the same time, market sentiment about ETH turned negative again.

The article introduces a number of projects that have not issued coins or will have a second airdrop: RateX, Fragmetric, Lulo, Meteora, marginfi, Kamino The Vault.

With a huge debt of nearly 200 million US dollars, will THORChain collapse?

Thorchain faces a serious debt problem. Despite the risks, the protocol still has huge business potential, generating more than $30 million in fees each year. Measures such as freezing lending and depositor positions, deleveraging, and tokenizing claims can save the protocol and maintain its core liquidity. At the same time, an economic design committee is established to ensure that the protocol returns to basic principles, improves capital efficiency, and prevents it from falling into debt again.

NFT, GameFi, SocialFi

Dialogue with Azuki founder Zagabond: Crypto journey and the dream of ANIME anime universe

The strategy supporting Anime 2.0 involves Full Stack Anime: the strategy aims to create a flywheel effect, with each component driving the growth of the others. By seamlessly integrating blockchain infrastructure, consumer platforms, and IP, Full Stack Anime ensures that the network becomes increasingly valuable and self-sustaining as more users and developers join.

It consists of three parts: blockchain infrastructure, Anime.com, content, and IP.

Web3 AI

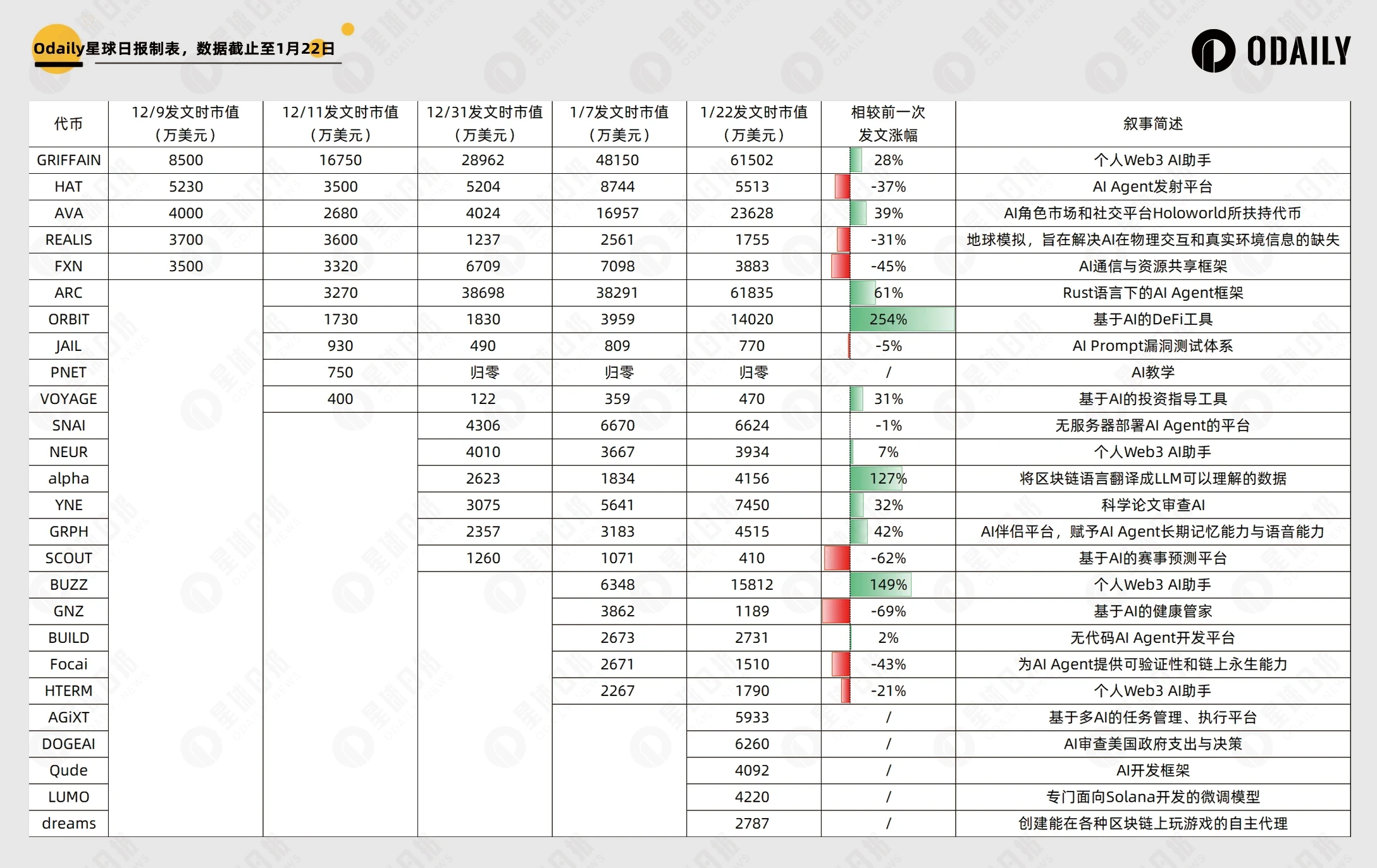

DeFAI is growing wildly. How to identify pie-in-the-sky projects and find the real Alpha?

The AI Agent narrative originated from InvestmentDAO, and the ecosystem is just starting, but growing:

Infrastructure is emerging: some platforms are launching AI trading agents that handle complex DeFi strategies.

Early experiments: Individual agents are trading, but verifiability of their performance remains a challenge. Few agents transparently share their results - BigTonyXBT is a rare exception.

Lack of TEE adoption: TEEs are still computationally expensive and relatively immature (but there are still efforts to show that the agent is in charge, not the human).

Hot Topics of the Week

In the past week, Trump issued the meme coin TRUMP (list of huge profiteers ); Melania Trump, wife of Trump, launched her personal meme coin MELANIA ; Trump was inaugurated as the President of the United States ; Trump: nearly 80 executive measures of the previous administration will be revoked ; Trump signed the first crypto executive order : banning CBDC, requiring the assessment of strategic national digital asset reserves, and upholding the sovereignty of the US dollar ; Trump: the United States will become the global capital of artificial intelligence and cryptocurrency ; Trump signed an executive order to establish a government efficiency department ; TikTok resumed service in the United States; Trump responded to the issuance of coins: I don’t know if the TRUMP coin is profitable , but I heard it is very successful; Trump pardoned Ross Ulbricht, founder of the dark web Silk Road ; Musk officially took office as the U.S. Government Efficiency Department , and the Chief Diversity Officer Executive Committee became the first department to be cut;

In addition, in terms of policy and macro market, Trump will ask the Federal Reserve to cut interest rates immediately ; Mark Uyeda will take over from Gary Gensler as acting chairman of the SEC ; Hester Peirce will lead the newly established cryptocurrency working group of the US SEC; Massachusetts senators proposed a bill to establish a strategic Bitcoin reserve in the state ; Source: German politicians are preparing for the possibility of Trump announcing a strategic Bitcoin reserve;

In terms of opinions and voices, the founder of Skybridge Capital said: Trumps issuance of Meme coins is not good for the industry , so stop deceiving yourself; Bitcoin Magazine criticized TRUMP: Trump likes cryptocurrency as long as it can be used to make money ; U.S. Congressman Maxine Waters: TRUMP represents the worst side of Crypto and damages legitimate projects in the cryptocurrency industry; U.S. congressmen: Worried that foreign individuals and governments will use TRUMP or MELANIA to influence President Trump and his family; Arthur Hayes: Trump proves that Meme coins are the best fan interaction tool ; CZ: FOMO has just begun ; Vitalik: Support ETH to contact funds, institutions and countries , and is willing to discuss ETH from an asset perspective; Consensys founder: Ethereum will disclose a number of high-value plans that will make you dizzy; VItalik: The decision-making power of the Ethereum Foundation team is in my hands , please stop creating an environment that is harmful to talents; Vitaliks new article: We should continue to adhere to the L2 expansion route, but L2 needs to fulfill its promises, such as contributing a certain amount of income to support ETH ; Multicoin co-founder: Since 2017 Lost confidence in Ethereum since 2000, and the situation has remained almost unchanged for 7 years; Jupiter: Ensured the smooth launch of TRUMP by working closely with the Meteora team;

In terms of institutions, large companies and leading projects, Solana encountered stress testing ; Solayer pre-sale subscription phase ended , with nearly 5 times oversubscription; Jupiter: All systems are under extreme load , and the team is working hard to restore normal services as soon as possible; Tron DAO is the largest purchaser of Trump family project token WLFI ; Telegram and TON Foundation reached a new cooperation, Telegram will stop supporting blockchains and cryptocurrencies other than TON ; Jupiter DAO opened Jupuary airdrop application ; Lido co-founder Konstantin Lomashuk created the Second Foundation for Ethereum ; Virtuals ecological repurchase plan has been launched , and GAME, CONVO, and AIXBT are currently ranked in the top three in repurchase strength; ANIME is open for airdrop application ; Solana core developer Cantelopepeel resigned , saying that he will create a new generation of L1 designed for performance; the founder issued a coin to speed up, and Musks short video Vine made a comeback ;

According to statistics, Moonshot once became the most popular financial application in the US Apple App Store and ranked among the top 5 free applications ... Well, it was another week that witnessed history.

Attached is a portal to the “Weekly Editor’s Picks” series.

See you next time~