Original - Odaily

Author - Loopy Lu

As the final “judgment” day for the Bitcoin spot ETF on January 10 approaches, cryptocurrency market sentiment continues to heat up. From last night to this morning, there were a number of major developments in the Bitcoin spot ETF. BTC also experienced another sharp rise.

Currently, there are less than 24 hours until the ETF has final results. When ETFs are passed, the market consensus is that there will be huge fluctuations, whether up or down. Bitcoin spot ETF is just a step away.

In the face of huge fluctuations, how should retail investors operate? How to profit before potentially huge moves are coming? Odaily organizes potential operations as follows:

fancy open lever

Contract and leverage trading are the easiest to operate, the most basic, and the options with the highest return rate (or loss rate). In the face of the upcoming market fluctuations, whether you are long or short, if the direction is correct, there is the potential for high returns.

Currently, all mainstream CEXs provide currency-based contracts, U-based contracts, spot leverage, leveraged tokens and other leverage methods. In addition, you can also lend stablecoins through DeFi lending to perform on-chain leverage operations.

Odaily reminds investors that increasing leverage is an extremely high-risk trading method in the crypto market.

On January 7, V God posted an article on the X platform. He provided his own investment advice:Do not use more than twice the leverage. Please do not.

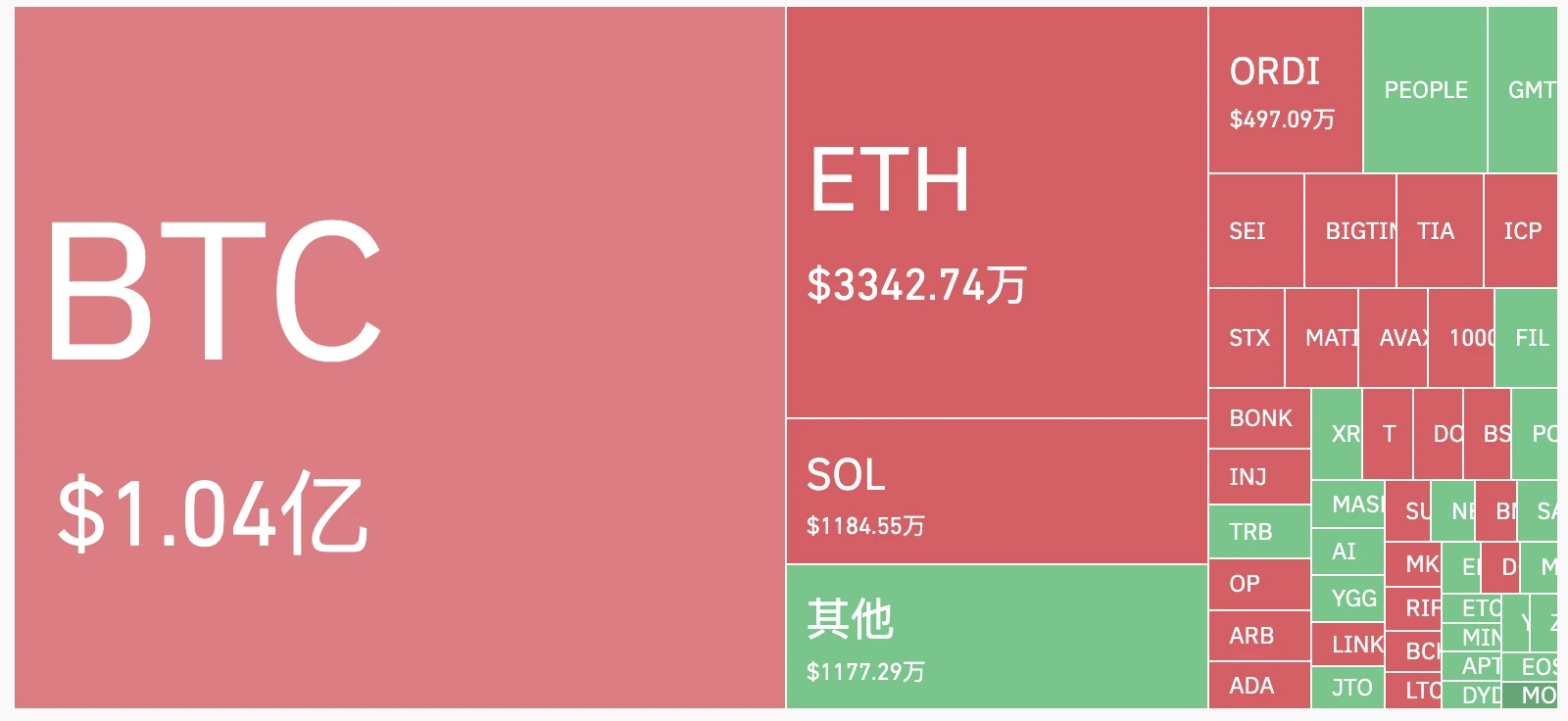

Amid yesterday’s violent market fluctuations, Coinglass data showed that the crypto market’s 24-hour liquidation volume reached $208 million. BTC liquidation exceeded $100 million. In the past 24 hours, a total of 60,036 people were liquidated, and the largest single liquidation order was worth US$9.4389 million.

Go long volatility

Although it is currently difficult for the market to judge the specific direction of BTC after the ETF results are announced, the market unanimously predicts that the market will fluctuate violently after the announcement.

Therefore, going long BTC volatility becomes a good option.

In the FTX era, FTX was pioneering in providing the market with a simple option of volatility tokens. Currently FTX has collapsed and there are no competitors with similar products on the market that have clear advantages.

But we still found several interesting options from the DeFi market:

Crypto Volatility Index(CVI)

CVI (Crypto Volatility Index) is the Crypto Volatility Index, which is both the name of an index and the name of the DeFi project. The CVI Index is designed to track the volatility of the entire crypto market, with the greater the market volatility, the higher the index value. We can use an approximate but inappropriate metaphor to understand – the index is the IV of the entire crypto market.

Simply put, the project provides users with CVI tokens whose price is linked to the CVI index, with a built-in funding fee that is adjusted daily.

If users predict that volatility will increase in the future, they can buy the token and sell it after the volatility increases. If users predict that volatility will decrease in the future, they can mint the token and charge a funding rate at each adjustment.

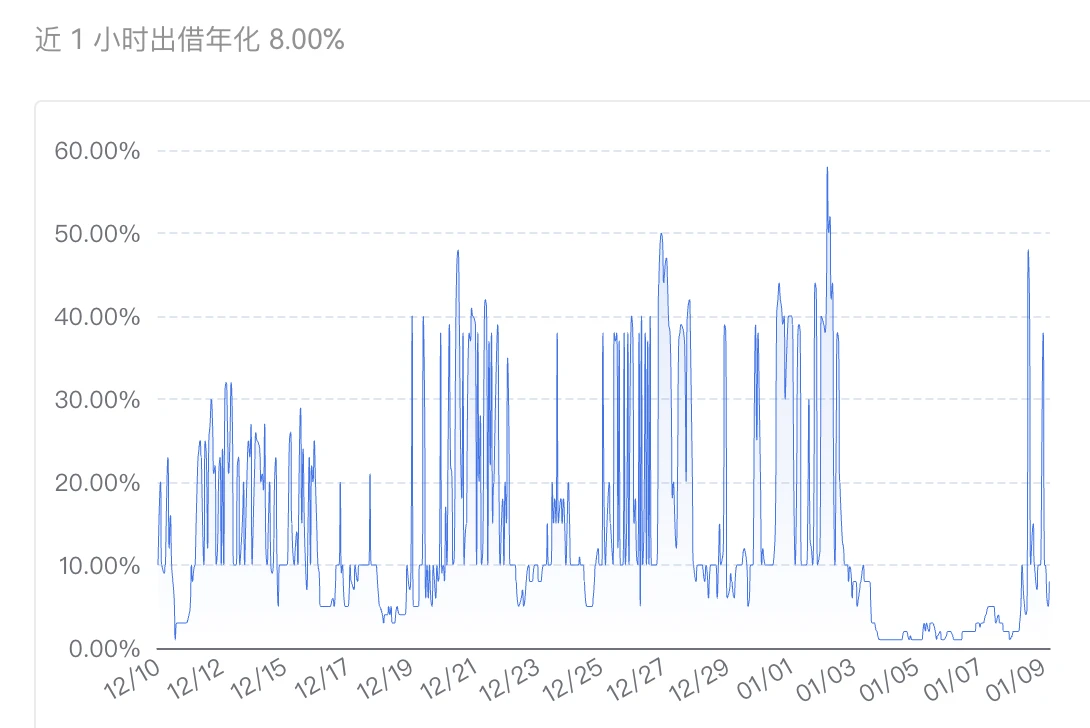

(Today’s hourly trend of CVI index)

Volmex

Volmex is another DeFi protocol that offers users volatility trading. Volmex has also launched its own crypto volatility indices, the BVIV Index and EVIV Index. Unlike CVI, which covers the entire crypto market, these two are more precise and specific to tokens, referring to the implied volatility of BTC and the implied volatility of ETH respectively.

On the Volmex platform, users can trade the index, provide liquidity for the index, and perform swap transactions between Bitcoin volatility and Ethereum volatility.

(Today’s hourly trend of Volmex volatility)

Volmex aims to provide users with a simple way to access the volatility of cryptocurrencies, and users can also develop a range of complex trading strategies based on this investment tool.

options trading

Currently, mainstream CEX, Deribit and other centralized platforms, as well as someDeFi ProtocolBoth provide investors with cryptocurrency options markets.

Purchasing call/put options expiring on January 12th is the simplest option trade to go long/short BTC.

However, it should be noted that unlike contracts on CEX, options are forced to settle when the delivery date is reached. Therefore, if the price prediction is wrong, the option will be reset to zero. (For example, when the BTC price is 40,000 US dollars, a call option with a BTC exercise price of 50,000 is purchased. If the BTC price is only 49,999 US dollars at that time, the entire premium of this order will be lost and there will be no profit).

In addition, users can also sell put options and make profits by earning premiums. However, it should be noted that option sellers are a riskier role and theoretically option sellers will bear unlimited risks.

Options products are relatively complex, and it is recommended that investors who are unfamiliar with them should have a thorough understanding before trading. Odaily has published a series ofA Beginners Guide to Options。

Of course, if you only make simple long and short predictions, option tools are overkill. Hedging and combining with other positions (such as spot, contract, options, etc.) and executing some strategies are where options come into play.

How to go long volatility with options?

Constructing a straddle is the simplest way to go long volatility.

For example, when Bitcoin was $40,000, buy both a $40,000 call option and a put option. For investors, this only requires two premium costs. After the price rises/falls significantly and the rise/fall is sufficient to cover the premium cost, profits can begin. The straddle is a simple way to go long on volatility. In theory, it is a combination strategy with limited losses (premium returns to zero) and unlimited returns (no upper limit on price fluctuations).

(Straddle option profit and loss diagram)

Of course, if the same operation is done in reverse - that is, as an option seller - you are shorting volatility, and you can obtain premium income due to the stagnation of market fluctuations.

Practical examples

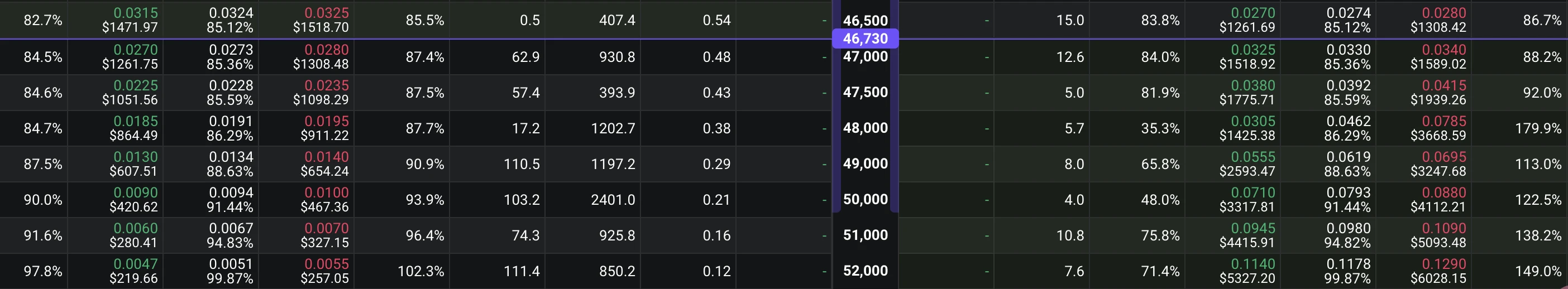

Taking the current market as an example, constructing a basic straddle option portfolio may still be profitable, but it does not seem cost-effective.

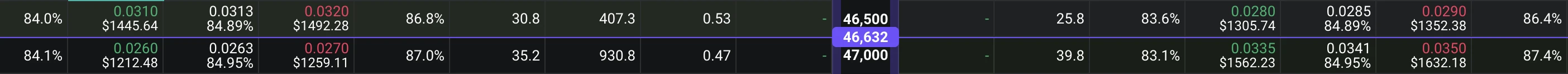

Taking the BTC exercised on January 12 as an example (current price 46632), using BTC-46500-CALL and BTC-47000-PUT to build a combination requires a premium cost of approximately US$3,000, and BTC needs to fluctuate to US$49,932 or 43,362 dollars before you can start making profits.

One-Way Bullish/Down: Spread Strategy

If the user has a one-way directional prediction, he can implement a bull/bear market spread strategy.

Take the bull spread strategy as an example, which involves buying a lower-priced call option and selling a higher-priced call option on the same exercise date. For example, when the BTC price is $40,000, if the market is predicted to be bullish in the future, you can buy a $45,000 call option and sell a $50,000 call option.

The profit space of this strategy is a limited range and cannot achieve theoretical unlimited profit. That is to say, profits can only be made when the BTC price stays between 45,000 and 50,000. (Approximations only, as costs and benefits of royalties need to be calculated)

Practical examples

Compared with only buying a call, the advantage of this strategy is that it reduces the cost of holding a position by acting as a seller. With some modifications, capital efficiency can be further improved.

Also take the current market and BTC exercised on January 12 as an example.

If you buy BTC-48000-CALL and sell BTC-52000-CALL, you will have to pay a cost of about $900 and receive a premium of about $200. The net cost of the strategy is about $700.

When the exercise day comes on January 12, the BTC price stays above about $48,700 and below $52,000 to make a profit. When the price reaches above 52,000, since we act as the option seller, the seller of the option starts to lose money, so continue The rise will cause the gains and losses of the two option orders to be offset at a ratio of 1:1, making it impossible to achieve unlimited gains in profits.

So why is this strategy still being adopted? It should be noted that, as mentioned above,Our cost is only about $700 instead of about $900 for the call option, compared with only a single operation, the combination constructed by this two operations,Capital efficiency increased by a staggering 22%.

Can we improve capital efficiency while breaking the limit of maximum profit?

The answer is yes, with a few tweaks. In the spread strategy we just constructed, due to the operation of buying 1 order, selling 1 order, the Delta value of the portfolio is approximately 0 (not equal to 0), as long as the Delta deviates more to the positive direction.

We can use the same strategy, but buy 3 orders, sell 2 orders, or buy 2 orders, sell 1 order, so as to break the limit of maximum profit and realize a one-way bullish option strategy position.

The above strategies are only some simple and convenient strategies, but option trading risks are huge. Odaily reminds users to identify the risks by yourself and operate with caution.

Options trading is quite mature in the traditional market, and investors can understand and learn more about options through stock options trading.

stock trading

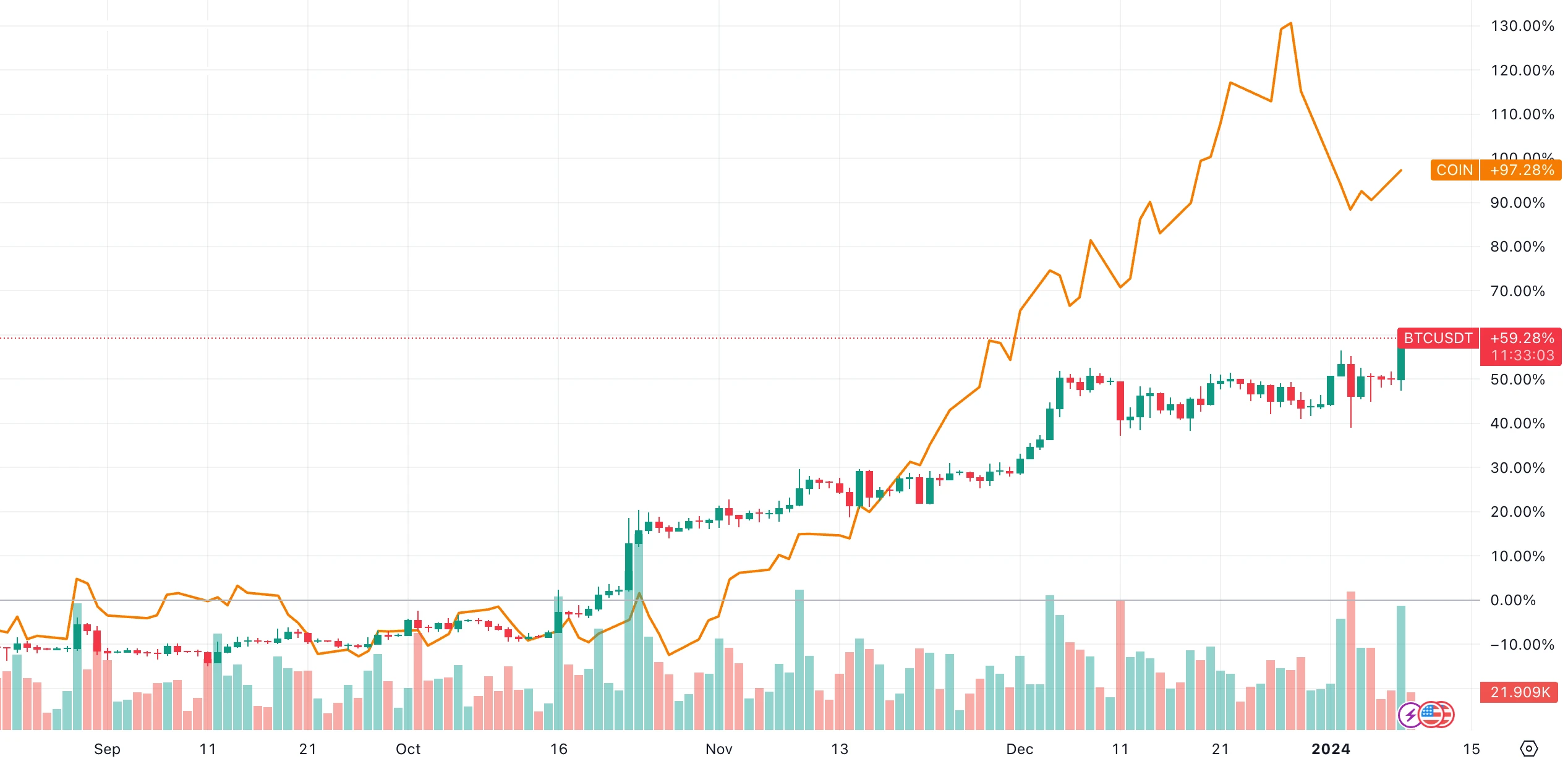

Crypto-concept stocks are another avenue to bet on the crypto market amid the coming high volatility.

The trend of cryptocurrency concept stocks represented by COIN has always been correlated with the cryptocurrency market. The more mature and easy-to-obtain investment tools in the stock market also provide us with more possibilities for betting on the crypto market. Whether you are long, short, or volatility-focused, it is a good choice to find some crypto-sector stocks as targets for your operations.

(Comparison of COIN and BTC trends)

In addition to the leader COIN, there are also a series of crypto mining companies, alternative BTC leveraged tokens MicroStrategy, grayscale GBTC shares and other channels for operation.

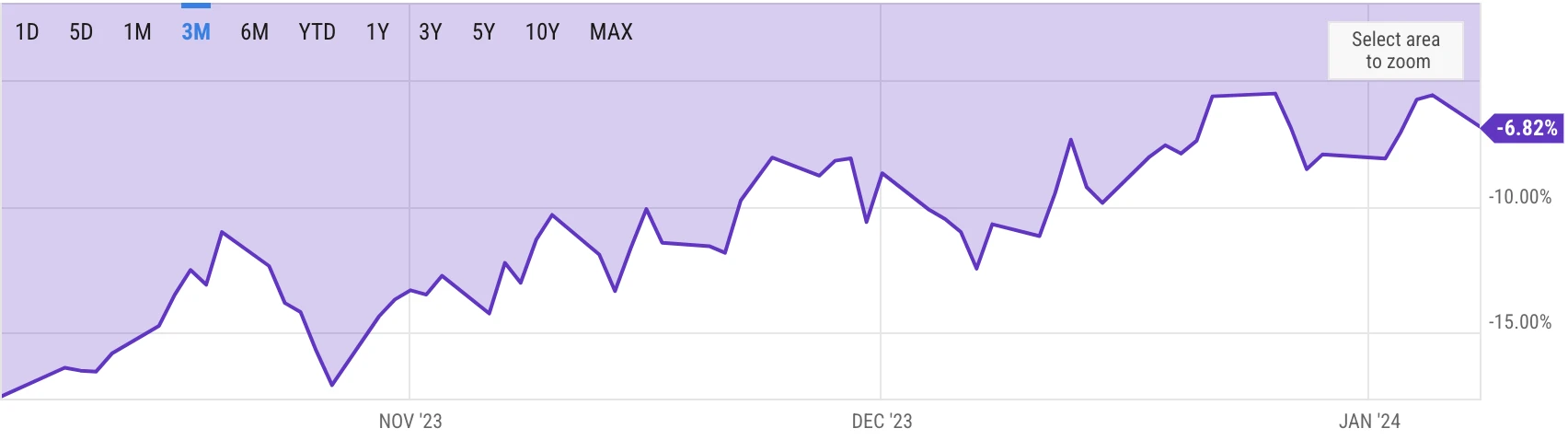

In addition, if GBTC is approved, the price difference between GBTC and BTC is also a potential arbitrage space. GBTC currently has a negative premium of 6.82%.

(Changes in GBTC premium rate in the past 3 months)

CEX products

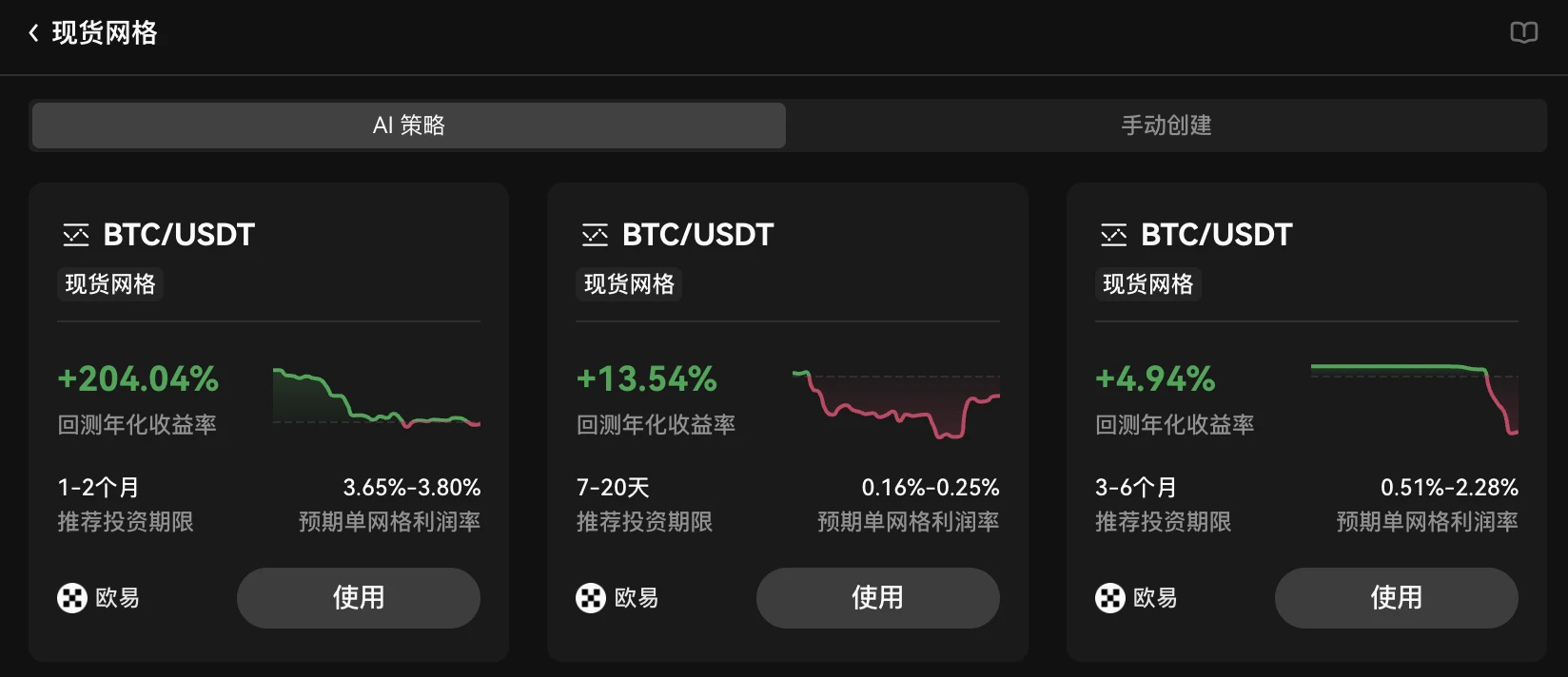

In addition to currency speculation, what other services can CEX provide? Robot products and financial management products are both a good choice.

The grid trading strategy is an extremely fruitful strategy amidst the markets repeated fluctuations.

The grid strategy is a method of profiting from market fluctuations. In a market where the price of the underlying asset is constantly fluctuating, the grid strategy will automatically buy/sell to earn profits every time the market price touches the preset grid line price.

Take OKX as an example, take the default sorting, top ranking, and officially launched grid strategy as an example, all of which have achieved good returns in the previous volatile market.

Financial products are also a good choice.

In recent times, market sentiment has often been in a strong and positive state. Under this circumstance, investors are enthusiastic about increasing leverage, and there is a large demand for loans in various lending products. As a result, loan interest rates remain high.

Correspondingly, it is the high returns that lenders earn.

Taking OKX as an example, the current annualized return rate of OKX stablecoin financial management is 8%. In the past 30 days, this number has surged as high as 58% and has remained above 20% for a long period of time. Under the strong market sentiment, the stablecoin financing of each CEX is a good choice with relatively low risk.

(OKX USDT financial management yield trend)

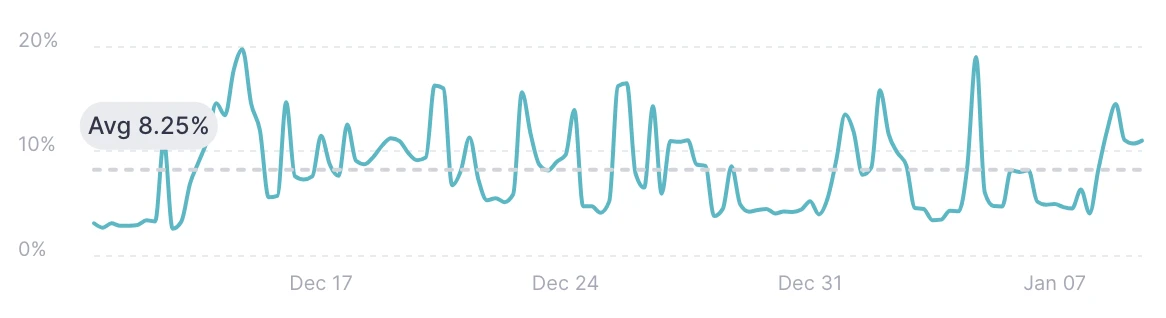

Of course, the demand for lending in the on-chain market is also quite strong. Taking Aave as an example, the average APR of USDC, Polygon market and Optimism market in the past month have exceeded 8%.

(Aave Optimism USDC Interest)

(Aave Polygon USDC Interest)

ETFs are coming, what should I do?

At present, the only factor that affects whether the Bitcoin spot ETF is passed is the attitude of the SEC members who are qualified to vote (a total of 5 people including Gary Gensler) and the results of the vote. No one can know the ultimate outcome of an ETF, and the event is nearly impossible to predict.

For the majority of investors, paying attention to risks and positions is still the best choice.

There are still differences in the markets prediction of the success or failure of ETFs. What will be the final result? Within 24 hours, the results will be known.