Original - Odaily

Author - Loopy Lu

Yesterday, the first day of spot Bitcoin ETF trading started with a bang. The rapidly rising trading volume and drastic changes in the market brought some crypto shock to American investors.

As the next days trading is about to open, we will conduct a brief review of the first days trading. In addition, what is even more interesting is that with the passage of spot Bitcoin ETFs in the United States, other regions may follow suit, and the future of spot Bitcoin ETFs may become a more intense battle.

Currency price trend: Rapid rise and then sharp fall

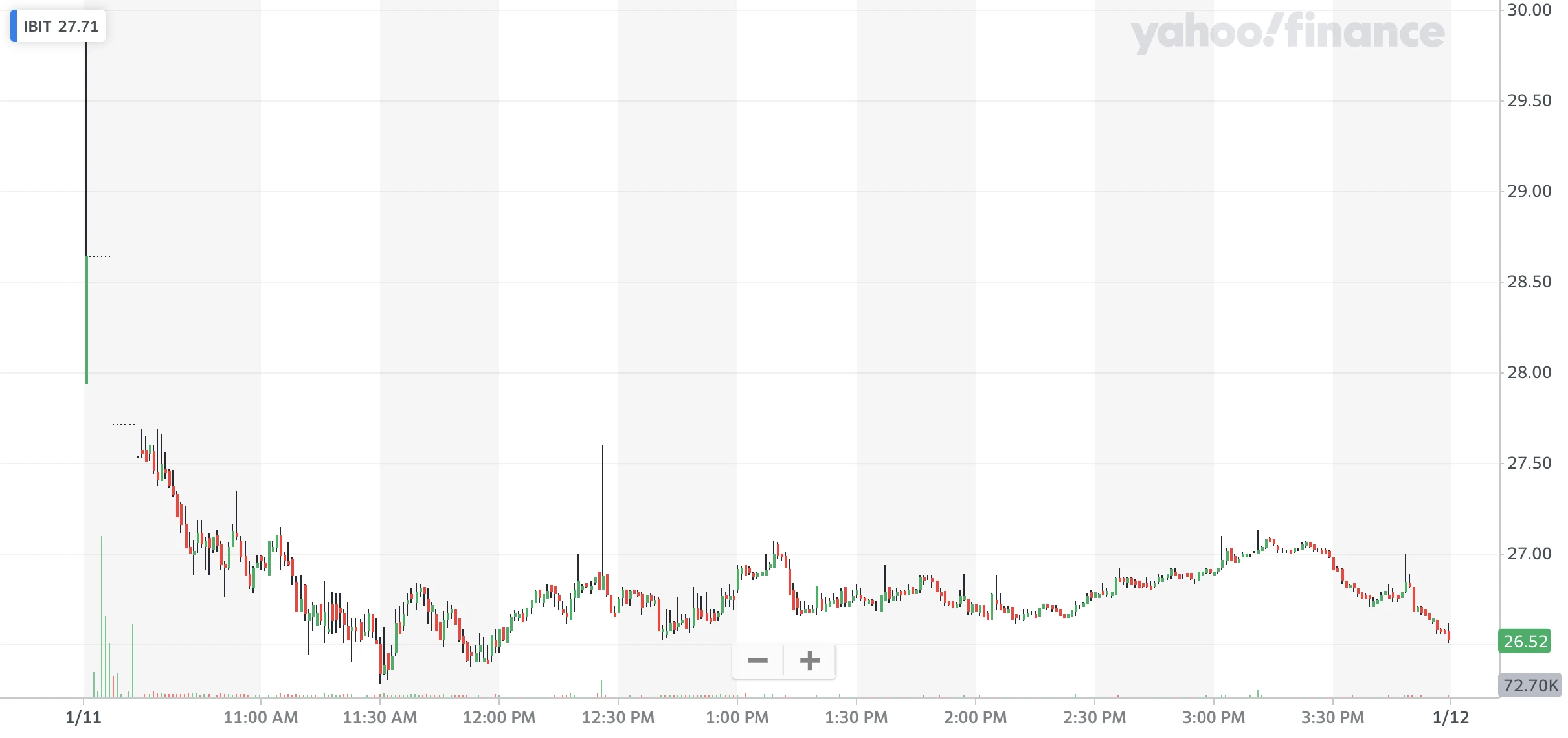

ETF prices rose rapidly in pre-market trading, but during the trading session, they embarked on a volatile downward trend. Taking the most watched Bitcoin ETF issued by BlackRock as an example, IBIT closed at 26.63, down 4.69% on the first day of trading.

We can see this trend more clearly in the BTC market due to the inconsistency in ETF trading sessions. Before the U.S. stock market opened, BTC rose rapidly. It briefly topped $49,000.

After the U.S. stock market opened, the price of BTC has been falling. Coinglass data shows that in the past 24 hours, BTC positions were liquidated with US$83.8 million in long orders, US$47.63 million in short orders, and US$36.17 million in short orders.

Huge trading volume and high market sentiment

Coinciding with the rapid decline in price has been a surprising performance by the Bitcoin ETF in terms of trading volume. In just half an hour of trading opening, total trading volume across BlackRock, Fidelity and Grayscale products exceeded $1 billion.

Let’s first look at the largest GBTC. The world’s largest Bitcoin ETF was created overnight after Grayscale received approval to convert its Bitcoin Trust into an ETF. The fund manages more than $28 billion in assets. blockworksdataIt shows that GBTC trading volume exceeds $2.27 billion. GBTC became the spot Bitcoin ETF product with the largest first-day trading volume.

Second only to GBTC, the much-watched “old money” BlackRock ranks second. BlackRock’s IBIT products generated $998 million in trading volume.

Fidelitys FBTC received a trading volume of US$685 million, Arks ARKB led by Mutou Sister received a trading volume of US$278 million, and Bitwises BITB received a trading volume of US$121 million. The transaction volume of the remaining products has not exceeded 100 million.

Data from blockworks showed that all 11 of the first batch of approved ETFs had a combined first-day trading volume of $6.473 billion.

So far, the trading volume of the spot Bitcoin ETF far exceeds the trading volume of the Bitcoin futures ETF product BITO launched in October 2021.

For various ETF products, management fees range from 0.2% to 1.5%, and many companies also offer certain preferential policies. Valkyrie, for example, dropped fees again after trading began and waived fees for the first three months.

The future: Can the battle for ETFs begin?

VettaFi strategist Todd Rosenbluth believes that trading volume in new ETF products is relatively strong. But for the field of spot Bitcoin ETFs, the trading volume on the first day is not that important. He emphasized that this will be a long-term competition that goes beyond single-day trading.

Although the spot Bitcoin ETF has been approved, traditional finance’s attitude towards Bitcoin is still vague, and negative voices often occur.

Take Gary Gensler, the “Enemy of Encryption” who approved this ETF as an example. He stated that these approvals were not an endorsement of Bitcoin and described Bitcoin as a “speculative, volatile asset.” (For specific attitudes, please refer to SEC Chairman Approves Spot BTC ETF Statement – Full Text》)

In addition, many traditional financial institutions have issued warnings about the high-risk nature of Bitcoin. The Vanguard Group, the largest mutual fund provider, publicly stated to the media that it has no plans to offer a new spot Bitcoin ETF on its platform.

Interestingly, the approval of a spot Bitcoin ETF in the United States may trigger a battle for Bitcoin trading. Currently, 11 ETFs trade on the New York Stock Exchange, Nasdaq, and Chicago Board Options Exchange. Other regions may also participate in the competition for future assets.

Du Jun, CEO of Xinhuo Technology, believes that Hong Kong is the next important potential market to approve the listing and trading of Bitcoin spot ETFs after the United States. In December last year, the Hong Kong Securities and Futures Commission issued a Circular on SFC-authorized funds to invest in virtual assets and stated that it was ready to accept applications for authorization of virtual asset spot ETFs. Victory Securities, a licensed virtual asset brokerage in Hong Kong, its executive director Chen Peiquan also revealed to the media that according to his understanding, although Hong Kong fund companies have not submitted applications, they have been working intensively.Preparatory work, it is expected that as soon as the first quarter of this year, many fund companies will express their willingness to apply, and even successfully apply.

In the long run, the adoption of spot ETFs will release the entire investment market. After passing, with compliant channels, financial advisors and institutions can compliantly recommend Bitcoin products to their customers.

Prior to this, the market value of cryptocurrency exceeded one trillion US dollars, which was mainly based on independent retail investors. Professional investors need professional products like ETFs to enter the crypto market.

The second trading day of crypto ETFs is approaching, and that era of data cryptocurrencies is only now beginning.